Compared to paper dollars put into any representative index fund over that time. And that is including two really brutal bear markets.Compared to paper dollars?

- Thread starter Hobo Hilton

- Start date

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

I think I will carry a bit of each.

Ever played a super bowl board? The market has been a good way for me to donate money to other people's winning.Compared to paper dollars put into any representative index fund over that time. And that is including two really brutal bear markets.

Diversification is good, and gold can be a good contrarian asset, but people shouldn't take 1980s bromides as investment advice.I think I will carry a bit of each.

Ever played a super bowl board? The market has been a good way for me to donate money to other people's winning.

It's become more of a "buy more ammo" than advice

Diversification is good, and gold can be a good contrarian asset, but people shouldn't take 1980s bromides as investment advice.

I can't wait to see the Fed start printing thousand dollar bills again.

What happened to the trillion dollar coin?

You have totally missed the point.And let's not forget that the price of gold was about $600 in 1980, while the S&P was at about $100.

But if you want to compare gold to putting money under your mattress, yes, it has been excellent.

Investing in gold and silver only is obvious foolish, just as letting cash sit in the bank losing value daily. Gold and silver in hand provide a hedge against that loss, and they also provide security, not to mention certain other tax "benefits ". However, I wasn't speaking about investment strategy in normal context either. Just as I said a while ago (when there was so much "oh its just transitory "), inflation is absolutely going to continue and with the current lot we have in govt, you can be assured of it. The economy is also in very sketchy territory, so turning sitting cash into gold and silver makes a ton of sense.Diversification is good, and gold can be a good contrarian asset, but people shouldn't take 1980s bromides as investment advice.

I haven't missed the point. Gold isn't a very good hedge against inflation, and the only reason it sometimes does well in inflationary environments is that people think it should be. It was historically a good hedge against inflation when people still pretended that money was backed by assets, but unarguably, useful commodity futures are a better hedge against inflation, that is unless inflation is already priced into them. As long as gold has no tangible relation to money, and likely never will, and isn't particularly useful as compared to 99% of other commodities, I don't understand the argument for it other than the historical one, or as @DarnYankeeUSMC said, "in bad times, buy more ammo."You have totally missed the point.

As far as transitory, hyper etc, I wrote what my expectations were for inflation and recession in the Porta John back a year ago, and I stand by them 100%. In fact, I think it would be hard to have given a better call than I did. (Pats back.)

Biden also wants to set your tax rate on total wealth, not income. Most his wealth from fleecing taxpayers is hidden in shell companies and offshore accounts.

Pretty sure Biden, and the rest of the Democrats, are an "AND" on this issue, not an "OR."Biden also wants to set your tax rate on total wealth, not income. Most his wealth from fleecing taxpayers is hidden in shell companies and offshore accounts.

Still have someI can't wait to see the Fed start printing thousand dollar bills again.

I'm not poor. I'm a trillionaire.

link

In Zimbabwe, one Zimbabwe Dollar used to buy one loaf of bread and you would probably get some change back.

link

In Zimbabwe, one Zimbabwe Dollar used to buy one loaf of bread and you would probably get some change back.

100 Trillion Zimbabwe Dollar = 1014 dollars (back in 2006) link

The price of bread was Z$550,000,000 in the regular market at one point, when bread was even available; except for a trip to another country, the black market was the only place to buy almost all goods, and bread might cost as much as Z$10,000,000,000.Just FWIW, and I usually do not give any advice, but it sounds like a lot of your net worth is in your business, which is relatively economically sensitive, so I hope you take that into account when you are looking at your asset mix, because a business owner should be looking at owning other businesses (stocks) differently than a salaried employee as far as diversification. It's one thing, and good general advice, to say that people should concentrate on investing in what they know, but that can be overdone especially when you already own a business in a sector that you, presumably, understand pretty well.I think I will carry a bit of each.

Ever played a super bowl board? The market has been a good way for me to donate money to other people's winning.

Yeah and when the government shuts down trading ect.... and things are truly a mess, are you going to take those futures and by food for your kids with it, or do anything at all with it?I haven't missed the point. Gold isn't a very good hedge against inflation, and the only reason it sometimes does well in inflationary environments is that people think it should be. It was historically a good hedge against inflation when people still pretended that money was backed by assets, but unarguably, useful commodity futures are a better hedge against inflation, that is unless inflation is already priced into them. As long as gold has no tangible relation to money, and likely never will, and isn't particularly useful as compared to 99% of other commodities, I don't understand the argument for it other than the historical one, or as @DarnYankeeUSMC said, "in bad times, buy more ammo."

As far as transitory, hyper etc, I wrote what my expectations were for inflation and recession in the Porta John back a year ago, and I stand by them 100%. In fact, I think it would be hard to have given a better call than I did. (Pats back.)

When uncertainty comes, even big dogs want a certain percentage of their assets in gold and silver that they hold in their hands. This reduces the effect of the paper manipulation in the gold and silver markets and the price goes up. It's absolutely guaranteed. Then you sell half it when appropriate, and buy other hard assets when their price is down.... such as land for example. There is zero doubt gold and silver will go up during this oncoming recession or depression. The HUGR premium on delivered gold and silver show 2 things. 1- major manipulation in pricing by way of paper gold and silver. 2- people are already running to it.

Upfront - The link below is to a Paper written in November of 1992. Probably by a Graduate Student in International Finance at Princeton University. The writer compiles some history and current events from the time it was Written... The Pure Economics are historical and, to this day, have not changed. Brush up on trading in the Black Market's and gather the currency that will be needed. They are here now and more will be here in the future.

_______________

2 The Scope and Nature of Parallel Currency Markets

Due to the often illegal—albeit perhaps officially tolerated—nature of

transactions in parallel markets, information on their functioning is

neither readily available nor very reliable. Magnitudes mentioned here

should therefore be treated with caution. The major qualitative features

of parallel markets are well documented, however, suggesting that

common features are to be found in a variety of institutional settings.

This section discusses the ways in which parallel markets emerge, the

nature of transactions conducted in those markets, and their welfare

implications.

Emergence of Parallel Markets

Parallel markets generally develop in conditions of excess demand for a

commodity subject to legal restrictions on sale, official price ceilings, or

both. 2 In a large majority of developing countries, transactions in

foreign exchange are subject to both kinds of restrictions (see the IMF’s

Annual Report on Exchange Restrictions). Typically, the exchange rate

is officially pegged by the central bank, and only a small group of

intermediaries is permitted to engage in currency transactions. Purchases

of foreign currencies by domestic agents are, in principle, restricted to

uses judged by the authorities to be “essential” for economic develop-

ment, such as imports of capital goods. As a consequence, some of the

supply of foreign exchange is diverted and sold illegally, at a market

price higher than the official price, to satisfy the excess demand. The

amount by which the parallel-market exchange rate exceeds the official

rate, the “parallel-market premium,” will depend upon a host of fac-

tors—in particular, the penalty structure and the volume of resources

devoted to apprehension and prosecution of violators

_______________

2 The Scope and Nature of Parallel Currency Markets

Due to the often illegal—albeit perhaps officially tolerated—nature of

transactions in parallel markets, information on their functioning is

neither readily available nor very reliable. Magnitudes mentioned here

should therefore be treated with caution. The major qualitative features

of parallel markets are well documented, however, suggesting that

common features are to be found in a variety of institutional settings.

This section discusses the ways in which parallel markets emerge, the

nature of transactions conducted in those markets, and their welfare

implications.

Emergence of Parallel Markets

Parallel markets generally develop in conditions of excess demand for a

commodity subject to legal restrictions on sale, official price ceilings, or

both. 2 In a large majority of developing countries, transactions in

foreign exchange are subject to both kinds of restrictions (see the IMF’s

Annual Report on Exchange Restrictions). Typically, the exchange rate

is officially pegged by the central bank, and only a small group of

intermediaries is permitted to engage in currency transactions. Purchases

of foreign currencies by domestic agents are, in principle, restricted to

uses judged by the authorities to be “essential” for economic develop-

ment, such as imports of capital goods. As a consequence, some of the

supply of foreign exchange is diverted and sold illegally, at a market

price higher than the official price, to satisfy the excess demand. The

amount by which the parallel-market exchange rate exceeds the official

rate, the “parallel-market premium,” will depend upon a host of fac-

tors—in particular, the penalty structure and the volume of resources

devoted to apprehension and prosecution of violators

Tell me about the number of times the government has confiscated all private gold.Yeah and when the government shuts down trading ect.... and things are truly a mess, are you going to take those futures and by food for your kids with it, or do anything at all with it?

When uncertainty comes, even big dogs want a certain percentage of their assets in gold and silver that they hold in their hands. This reduces the effect of the paper manipulation in the gold and silver markets and the price goes up. It's absolutely guaranteed. Then you sell half it when appropriate, and buy other hard assets when their price is down.... such as land for example. There is zero doubt gold and silver will go up during this oncoming recession or depression. The HUGR premium on delivered gold and silver show 2 things. 1- major manipulation in pricing by way of paper gold and silver. 2- people are already running to it.

I hope you do well with your guaranteed plan. They are always the best.

Look, what I am telling you is that since the beginning of this thread, gold is up 10%, so is the S&P. And this has been the period where inflation expectations have crystallized. So either you think that these prices move in reaction, rather than expectation, which is not true, or you think that gold is a great inflation hedge, and that we are still far underpricing inflation. That may be true, or it may be one of two more likely scenarios 1) most of those expectations have been fully priced in for a long time, and 2) people realize that as gold gets further from its historical place as a monetary asset, it becomes a worse inflation hedge.

Last edited:

Oh they will no doubt try it among anything else. They are going to have to take the people money more than they already do. Of course..... they can't take what you don't have...... how would they know what you have or don't have?Tell me about the number of times the government has confiscated all private gold.

I hope you do well with your guaranteed plan. They are always the best.

As I said, part of a plan. Not the whole plan. There is no plan that's a good one where all eggs are in one basket, but thank you, I will do well. Really anyone who had any kind of real plan will do exceedingly better than 99% of the other regular people just by having some kind of plan.Tell me about the number of times the government has confiscated all private gold.

I hope you do well with your guaranteed plan. They are always the best.

Look, what I am telling you is that since the beginning of this thread, gold is up 10%, so is the S&P. And this has been the period where inflation expectations have crystallized. So either you think that these prices move in reaction, rather than expectation, which is not true, or you think that gold is a great inflation hedge, and that we are still far underpricing inflation. That may be true, or it may be one of two more likely scenarios 1) most of those expectations have been fully priced in for a long time, and 2) people realize that as gold gets further from its historical place as a monetary asset, it becomes a worse inflation hedge.

There's lots of other commodities and assets that people can save up for uncertain times as well as market opportunities, but if you lose 20% of your cash value, you can then only use 80% of what you saved to take advantage of those opportunities when the time comes.

I actually absolutely agree with the bolded, as long as they stick to it.As I said, part of a plan. Not the whole plan. There is no plan that's a good one where all eggs are in one basket, but thank you, I will do well. Really anyone who had any kind of real plan will do exceedingly better than 99% of the other regular people just by having some kind of plan.

There's lots of other commodities and assets that people can save up for uncertain times as well as market opportunities, but if you lose 20% of your cash value, you can then only use 80% of what you saved to take advantage of those opportunities when the time comes.

Along the same lines you are speaking of.... For a young couple, around 30 years old, debt free, good money managers, good work ethics with good heads on their shoulders.... the coming recession could be their "Goose that Laid the Golden Egg". Historically, the end of the recession will be signaled by a Dead Cat Bounce in the markets. For the young couple I described this will be their once in a lifetime opportunity to gather possessions and wealth like never before.As I said, part of a plan. Not the whole plan. There is no plan that's a good one where all eggs are in one basket, but thank you, I will do well. Really anyone who had any kind of real plan will do exceedingly better than 99% of the other regular people just by having some kind of plan.

There's lots of other commodities and assets that people can save up for uncertain times as well as market opportunities, but if you lose 20% of your cash value, you can then only use 80% of what you saved to take advantage of those opportunities when the time comes.

I know some folks who were young and ambitious when the Resolution Trust Corp was bundling abandoned houses and selling them for a nickle on the dollar after the S&L crash (1991 +/-).... I joked with them about becoming Slum Lords. They retired before their 50th birthday.

:max_bytes(150000):strip_icc()/treasury-secretary-steven-mnuchin-speaks-at-meeting-of-the-financial-stability-oversight-council-1052294660-c88600b7e56f471aafbe7eb9771bc382.jpg)

Resolution Trust Corporation (RTC): What It Was and How It Worked

The Resolution Trust Corporation was a temporary federal agency created to resolve the savings and loan crisis of the 1980s.

Lots of chatter / complaints here about how much prices have inflated.

Either buy the item now or do without........ That mind game of "the prices will come down" is Government propaganda.

Prepare yourself to do without.

Either buy the item now or do without........ That mind game of "the prices will come down" is Government propaganda.

Prepare yourself to do without.

and for those items the government doesn't like, prepare for additional regulations to drive the price up even higher.

Don't forget, Hillary back in the 1990's wanted to make it illegal to have ANY lead in the home. She wanted the EPA to move forward with regulations that would make it illegal to have lead in your house (aka bullets with lead cores)

Don't think that idea has gone away.

While guns are protected by the constitution (in theory), ammunition is NOT.

Don't forget, Hillary back in the 1990's wanted to make it illegal to have ANY lead in the home. She wanted the EPA to move forward with regulations that would make it illegal to have lead in your house (aka bullets with lead cores)

Don't think that idea has gone away.

While guns are protected by the constitution (in theory), ammunition is NOT.

https://www.thegatewaypundit.com/20...fordability-due-unprecedented-rent-increases/

The program’s key pieces are: The county will pay up to $3,000 a month to people behind on their monthly rent payments by up to a year; if your landlord raises the rent between 1% and 20%, the county will assist by covering up to 20% of your monthly payment for three months; and for tenants hit with rent hikes of more than 20%, the county will pay a portion of that increase.

Wonderful....... I missed the part of who is paying for this project.

Up 112% in 12 months

08:32:00 AM

MI Indication

tradingeconomics.com

tradingeconomics.com

OatsCommodity

8.07+0.23+2.93%08:32:00 AM

MI Indication

Oat - 2023 Data - 1979-2022 Historical - 2024 Forecast - Price - Quote - Chart

Oat increased 22.71 USd/BU or 6.18% since the beginning of 2023, according to trading on a contract for difference (CFD) that tracks the benchmark market for this commodity. Historically, Oat reached an all time high of 811 in April of 2022.

(Natural News) Since its inception in 1990, the U.N. Food and Agriculture Organization’ (FAO) Food Price Index has never been higher than it was in February, compliments of endless money printing and many decades of corrupt monetary policy.

www.naturalnews.com

www.naturalnews.com

Food inflation has now reached 12.6% PER MONTH, corporate media blames Putin, not money printing – NaturalNews.com

Since its inception in 1990, the U.N. Food and Agriculture Organization’ (FAO) Food Price Index has never been higher than it was in February, compliments of endless money printing and many decades of corrupt monetary policy. The corporate-controlled media, however, is blaming Vladimir Putin as...

White House says it expects inflation to be 'extraordinarily elevated' in new report

The Biden administration is bracing for the Labor Department's consumer price index report to show that inflation is "extraordinarily elevated."

Dear sweet baby Jesus can we get lumber under $600 per 1,000 bf? If so I’m definitely adding more.

vancouversun.com

vancouversun.com

Lumber prices plummet as inflation kills home reno projects

Lumber futures fell as much as 8.4 per cent to $870 a 1,000 board feet in Chicago on Monday.

Ethanol is bad. Destroys the O Rings and seals in engine fuel systems. In the long run it is way more expensive than crude oil. Government subsidies are astronomical. One more move in the wrong direction:

/cloudfront-us-east-2.images.arcpublishing.com/reuters/S3LZTJAGBFI4TIHHHR3ADTKY6Q.jpg)

www.reuters.com

www.reuters.com

/cloudfront-us-east-2.images.arcpublishing.com/reuters/S3LZTJAGBFI4TIHHHR3ADTKY6Q.jpg)

Biden taps ethanol to help lower fuel prices as consumer inflation surges

The measure will allow Americans to keep buying E15, a gasoline that uses a 15% ethanol blend, from June 1 to Sept. 15.

$400 / ton Wheat will seem like a bargain later this year.

07:01:00 AM

MI Indication

WheatCommodity

394.50+14.00+3.68%07:01:00 AM

MI Indication

Ethanol is bad. Destroys the O Rings and seals in engine fuel systems. In the long run it is way more expensive than crude oil. Government subsidies are astronomical. One more move in the wrong direction:

/cloudfront-us-east-2.images.arcpublishing.com/reuters/S3LZTJAGBFI4TIHHHR3ADTKY6Q.jpg)

Biden taps ethanol to help lower fuel prices as consumer inflation surges

The measure will allow Americans to keep buying E15, a gasoline that uses a 15% ethanol blend, from June 1 to Sept. 15.www.reuters.com

The auto industry solved the ethanol problem long ago. Other industries have not followed their lead, despite the fact that ethanol blends aren't going away (it's mandated by law - passed by a Republican Congress and signed by GW Bush, natch). Really, people, do your customers a favor by getting with the times and ditch the outdated nitrile rubber o-rings in favor of Viton. A bit of stainless steel here and there doesn't hurt, either.

It's still a shitty fuel source for a number of big reasons - actually creates more carbon emissions, leads to food inflation, uses a shit-ton of fresh water, etc. We'd do well to phase it out, but now would be an unpleasant time to start. Might be forced to do so regardless if there's really a grain shortage this season. Woulda been much nicer to make that transition 2-3 years ago.

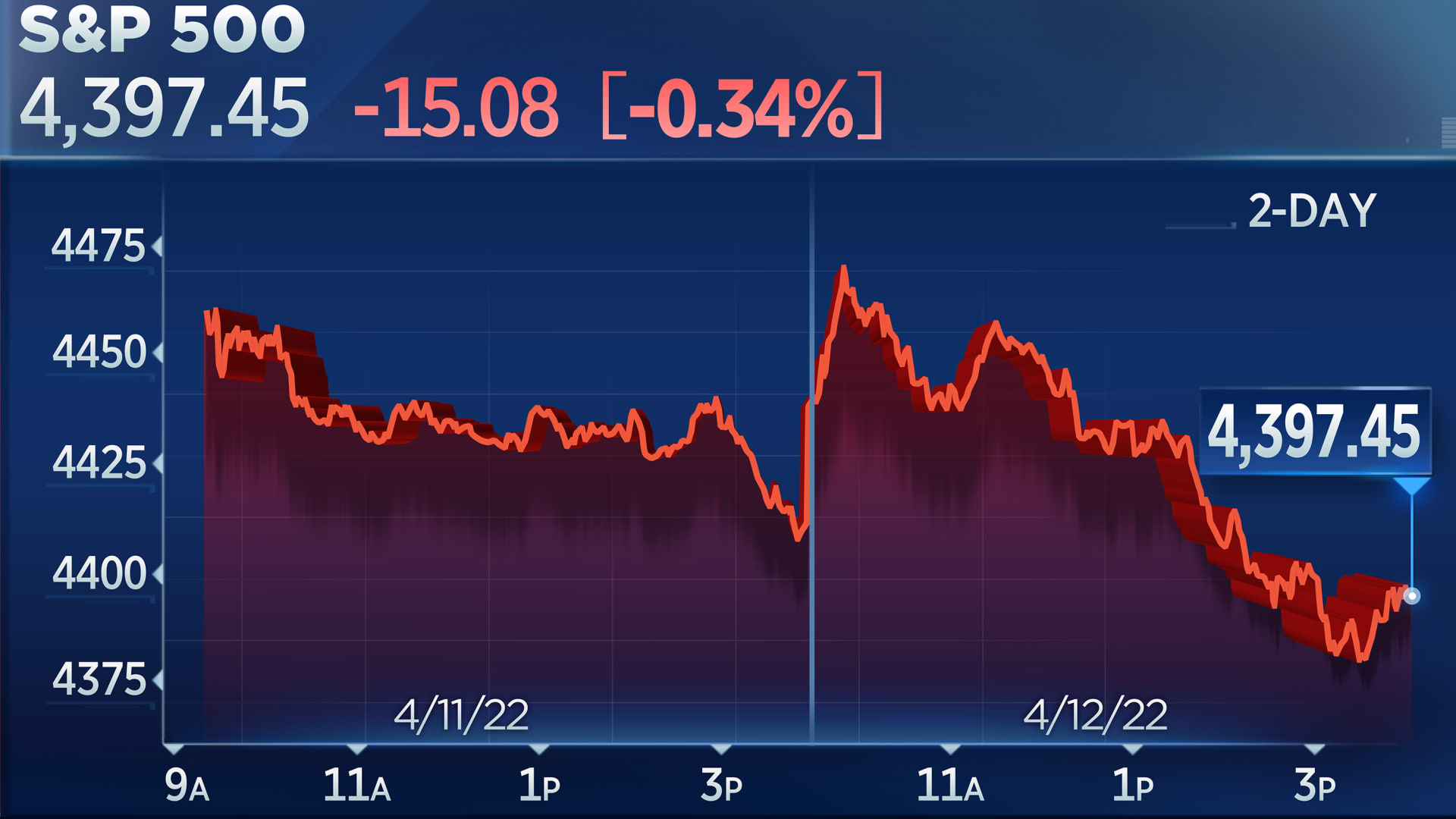

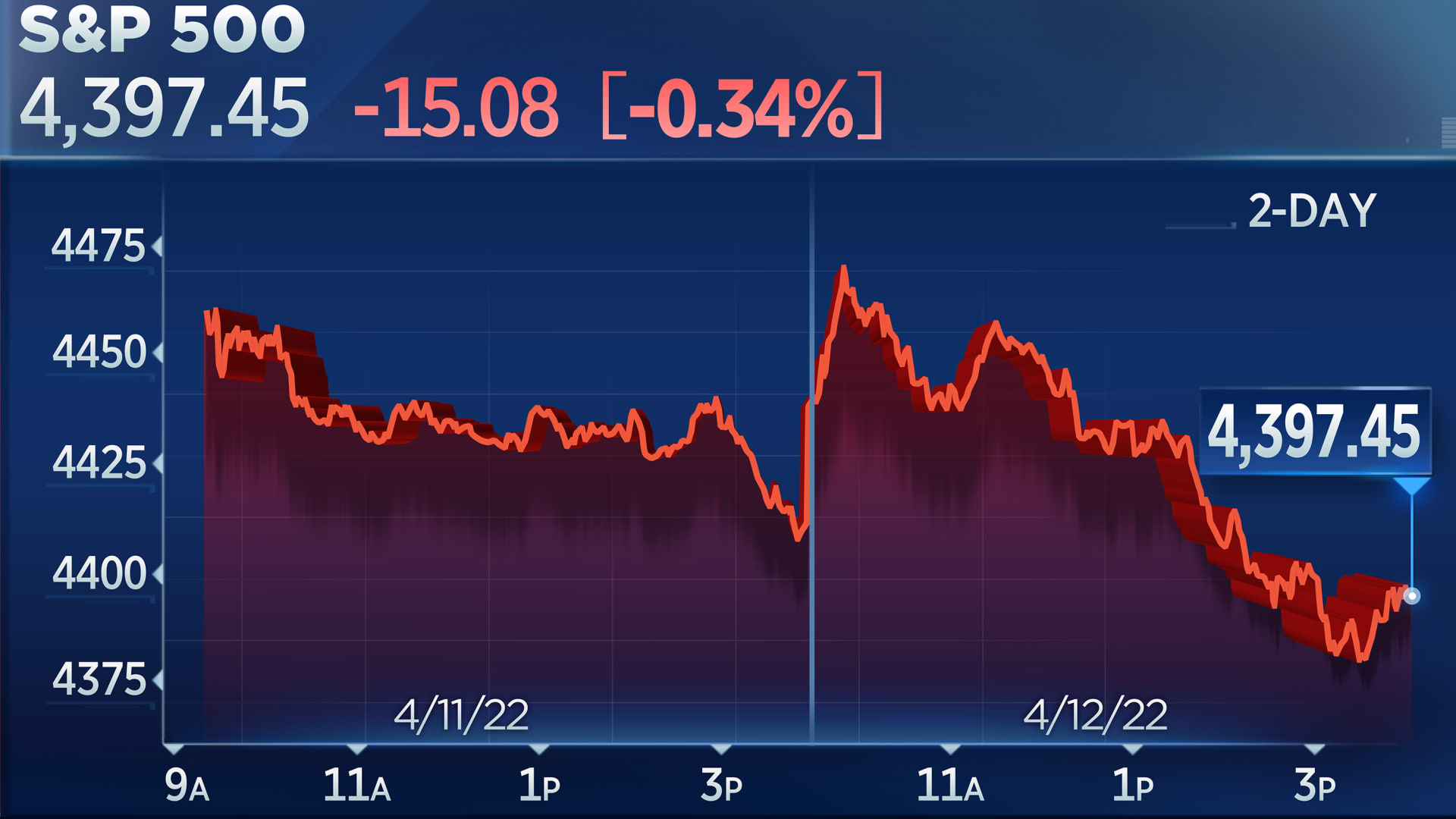

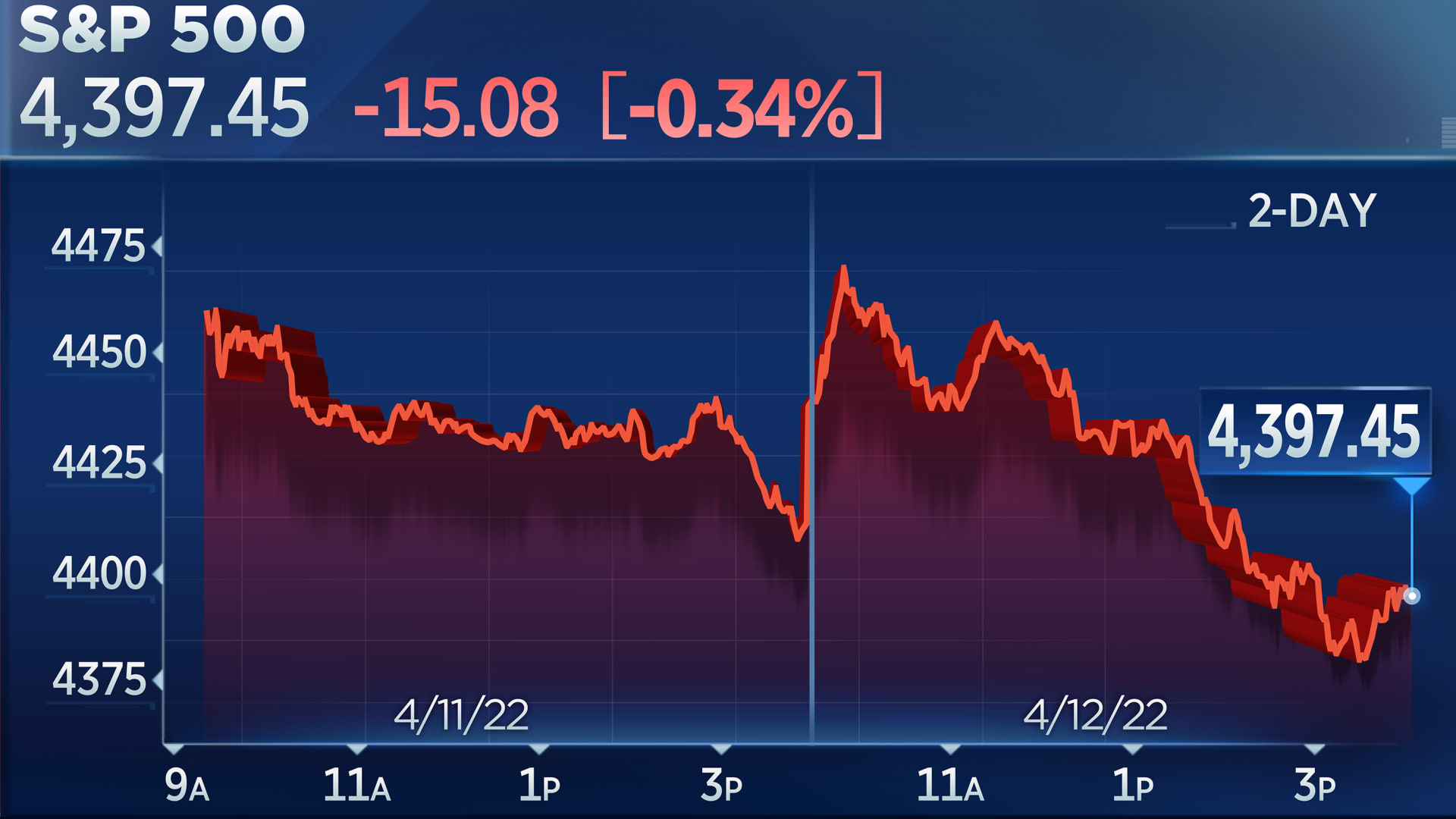

Consumer prices rose 8.5% in March, slightly hotter than expected and the highest since 1981

The consumer price index for March was expected to increase 8.4% from a year ago, according to Dow Jones estimates.

Hope, hope, hope

Hope is not a plan.

www.cnbc.com

www.cnbc.com

Hope is not a plan.

S&P 500, Nasdaq fall for a third day, reversing earlier gains, after report shows highest inflation since '81

The recent spike in U.S. inflation has helped increase expectations of tighter monetary policy from the Federal Reserve.

inflation is not stopping. The gov has manipulated the real inflation number to keep it low, to prevent having to give COLA's to everybody.Hope, hope, hope

Hope is not a plan.

S&P 500, Nasdaq fall for a third day, reversing earlier gains, after report shows highest inflation since '81

The recent spike in U.S. inflation has helped increase expectations of tighter monetary policy from the Federal Reserve.www.cnbc.com

You want to know what inflation is, just check McDonalds. Real numbers. over 25%. Follow the Sausage Egg McMuffin. 2 for 4.50, it use to be 2 for 2.

Starting to get to a point, when you see primers under a 100 for 1K; and you think, this is a great deal LOL

edit - side note. I feel sorry for the swallows trying to build a house above my door way. Nothing but crappy mud, that won't stick. They are still at it, on day 4. I hope they succeed. No bugs when you have swallows flying around.

Frisco burger value meal at Hardee’s is $10.99.

Government is manipulating two really big numbers... 1) Removing medical debt from consumer's Credit Reporting and 2) Forgiving Student debt. This will lower a person's debt to income ration and allow them to get more credit card debt.inflation is not stopping. The gov has manipulated the real inflation number to keep it low, to prevent having to give COLA's to everybody.

You want to know what inflation is, just check McDonalds. Real numbers. over 25%. Follow the Sausage Egg McMuffin. 2 for 4.50, it use to be 2 for 2.

Starting to get to a point, when you see primers under a 100 for 1K; and you think, this is a great deal LOL

edit - side note. I feel sorry for the swallows trying to build a house above my door way. Nothing but crappy mud, that won't stick. They are still at it, on day 4. I hope they succeed. No bugs when you have swallows flying around.

Smoke and Mirrors

Got my shipment of bandsaw blades in. Was really the last thing I needed for the big machines, which I won’t be able to use in the apocalypse anyway, lol.

I’m so glad I’ve been on a buying binge. I feel very comfortable now with what I have on hand. Now I can wait for deals. I can continue doing what I want to do now for quite awhile without having to replenish anything. Hopefully by that time we may be beyond our current shit show.

Food security is good. Clothes, linens, shoes, hygiene supplies, batteries and all the other day to day shit you don’t think about.

Would still love to see lumber hit below $600 per 1,000 bf.

I’m so glad I’ve been on a buying binge. I feel very comfortable now with what I have on hand. Now I can wait for deals. I can continue doing what I want to do now for quite awhile without having to replenish anything. Hopefully by that time we may be beyond our current shit show.

Food security is good. Clothes, linens, shoes, hygiene supplies, batteries and all the other day to day shit you don’t think about.

Would still love to see lumber hit below $600 per 1,000 bf.

If you have been mulling over / procrastinating / hesitating buying a big ticket item, today is the day to go down and buy it (if it's still there).

There was bad news in the financials this morning (inflation, interest rates, inflation)... The stage is set today for you to negotiate the selling price.

Jet ski, snow machine, Bad Boy mower, etc will be lower priced today than when that next transport truck unload the same machines.

If you can't pay CASH today, disregard this message.

There was bad news in the financials this morning (inflation, interest rates, inflation)... The stage is set today for you to negotiate the selling price.

Jet ski, snow machine, Bad Boy mower, etc will be lower priced today than when that next transport truck unload the same machines.

If you can't pay CASH today, disregard this message.

Prices are increasing fast. I see this forcing people to pivot towards quality made items, and maintaining vs buying throw away items or replacing.If you have been mulling over / procrastinating / hesitating buying a big ticket item, today is the day to go down and buy it (if it's still there).

There was bad news in the financials this morning (inflation, interest rates, inflation)... The stage is set today for you to negotiate the selling price.

Jet ski, snow machine, Bad Boy mower, etc will be lower priced today than when that next transport truck unload the same machines.

If you can't pay CASH today, disregard this message.

The Snake Oil salesman selling that Chinese junk is yelling "It's got a warranty".... Careful, don't get a paper cut when you wipe your ass with that warranty.Prices are increasing fast. I see this forcing people to pivot towards quality made items, and maintaining vs buying throw away items or replacing.

It took Lael a few hours to put some sort of positive spin on the worst inflation in a decade.... Snake Oil Salesman... "CORE" ! ! ! ! !

Brainard said that “core” inflationary pressure moderated in March by more than she had expected. The Fed views “core” inflation readings, which exclude food and energy prices, as a better guide to future inflation than the overall headline data

www.bloomberg.com

www.bloomberg.com

Brainard said that “core” inflationary pressure moderated in March by more than she had expected. The Fed views “core” inflation readings, which exclude food and energy prices, as a better guide to future inflation than the overall headline data

Don’t Expect Clairvoyance From the Federal Reserve

The balance of future supply and demand is unknowable, and so is the right path for interest rates.

Last edited:

I occasionally follow another guy with a blog site.. I'm in no way plugging him or his site. But, he is thinking along the same lines that you and I are thinking. Here is a real life person looking into the future like many are doing. Not even Survivalist actions.Prices are increasing fast. I see this forcing people to pivot towards quality made items, and maintaining vs buying throw away items or replacing.

State of the author in early April

It's been several weeks since I updated readers on the progress (or lack thereof) in my writing. Briefly, there hasn't been much, because...

There is really no point in waiting. The pace of price increases is pretty damn fast. Add to that the availability issue.I occasionally follow another guy with a blog site.. I'm in no way plugging him or his site. But, he is thinking along the same lines that you and I are thinking. Here is a real life person looking into the future like many are doing. Not even Survivalist actions.

State of the author in early April

It's been several weeks since I updated readers on the progress (or lack thereof) in my writing. Briefly, there hasn't been much, because...bayourenaissanceman.blogspot.com

You and I have kicked some numbers around.... appears to me that 50% of Americans have a grasp on inflation and shortages. All we have to do is outlive the 50% without a clue. It will be a better world then.There is really no point in waiting. The pace of price increases is pretty damn fast. Add to that the availability issue.

Similar threads

- Replies

- 10

- Views

- 359

- Replies

- 2

- Views

- 118

- Replies

- 25

- Views

- 845