Liking it nowMSFT at $389 was a nice price

- Thread starter pmclaine

- Start date

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

I am bullish on MSFT... the integration of CoPilot is amazing and further builds Microsoft's moat.Liking it now

Something for you "Traders".

Starting on May 28, 2024, the settlement period for most securities traded on U.S. exchanges or over the counter will shorten from two business days (T+2) to one business day (T+1). For most investors, this event may have little or no impact.

Starting on May 28, 2024, the settlement period for most securities traded on U.S. exchanges or over the counter will shorten from two business days (T+2) to one business day (T+1). For most investors, this event may have little or no impact.

"capitalists will sell you the rope, you will use to hang them" - Stalin

I'm bullish on MSFT, but, the AI they are developing will be used against Americans

I'm bullish on MSFT, but, the AI they are developing will be used against Americans

Red Flag

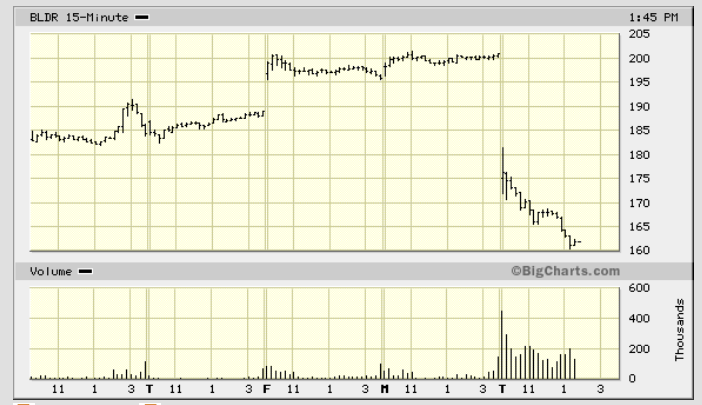

BLDR Builders FirstSource Inc. (NYS)

www.bldr.com

www.bldr.com

BLDR Builders FirstSource Inc. (NYS)

Building Supplies & Materials | Builders FirstSource

Welcome to Builders FirstSource, the nation’s largest supplier of building products, components and services. Find a store near you or request a quote online!

Exclusive: In Tesla Autopilot probe, US prosecutors focus on securities, wire fraud

Elon Musk’s startup Neuralink on Wednesday said part of its brain implant malfunctioned after it put the system in a human patient for the first time.

Neuralink has built a brain-computer interface, or a BCI, that could eventually help patients with paralysis control external technology using only their minds. The company’s system, called the Link, records neural signals using 1,024 electrodes across 64 “threads” that are thinner than a human hair, according to its website.

Neuralink has built a brain-computer interface, or a BCI, that could eventually help patients with paralysis control external technology using only their minds. The company’s system, called the Link, records neural signals using 1,024 electrodes across 64 “threads” that are thinner than a human hair, according to its website.

Bearish on $TSLA in the short term. Sold cover calls w/ $162.50 strike - currently up 30%. Worst case I roll them out to September at a strike above $200 to breakeven lol.

Tesla stock is no longer about cars, market, etc. - it is now about Elon and his leaning to the Right. Tesla will be punished for the sins of Elon.

Man risks losing finger in viral Tesla Cybertruck 'frunk' sensor test video

Tesla Cybertruck's front trunk, better known as a frunk, was tested by an owner for its sensitivity to detecting objects in a now-viral video taken last week.

Another Tesla owner is an attention whore? Say it ain’t so, Joe…

Man risks losing finger in viral Tesla Cybertruck 'frunk' sensor test video

Tesla Cybertruck's front trunk, better known as a frunk, was tested by an owner for its sensitivity to detecting objects in a now-viral video taken last week.www.foxbusiness.com

Something also tells me he’s gluten free and does CrossFit.

Rolled back half of their earnings bump so far, I’d say good move.Bearish on $TSLA in the short term. Sold cover calls w/ $162.50 strike - currently up 30%. Worst case I roll them out to September at a strike above $200 to breakeven lol.

Rolled back half of their earnings bump so far, I’d say good move.

Their financing offering on the MY vs. further discounts is a great move. Could see stock on up on this change haha

forgot /s

It's not just the Koreans.

Intel has gone the way of many worldwide Corporate companies. Rather than clean house on managers / workers and re-tool existing plants, they just build another plant. Getting to the point of making more money building a plant than actually producing a product.

Intel Corp’s stock INTC, -0.80% was up by 0.9% in premarket trading on Monday after The Wall Street Journal reported it’s in talks with Apollo Global Management Inc. APO, -0.12% to line up $11 billion for construction of a new chip plant in Ireland. The deal could be finalized within weeks after Apollo outpaced rival firms such as Stonepeak and KKR & Co Inc. KKR, +1.06% for the deal, the report said. Apollo’s High Grade Capital Solutions unit is leading the deal for Apollo. The new plant is part of Intel’s plan to meet increased demand for chips. The potential deal with Apollo comes after Brookfield Asset Management Ltd. BAM, -0.63% inked a $30 billion deal with Intel in 2022 for a chip-making plant in Chandler, Ariz. Intel was to have a controlling stake in the Arizona plant

Intel Corp’s stock INTC, -0.80% was up by 0.9% in premarket trading on Monday after The Wall Street Journal reported it’s in talks with Apollo Global Management Inc. APO, -0.12% to line up $11 billion for construction of a new chip plant in Ireland. The deal could be finalized within weeks after Apollo outpaced rival firms such as Stonepeak and KKR & Co Inc. KKR, +1.06% for the deal, the report said. Apollo’s High Grade Capital Solutions unit is leading the deal for Apollo. The new plant is part of Intel’s plan to meet increased demand for chips. The potential deal with Apollo comes after Brookfield Asset Management Ltd. BAM, -0.63% inked a $30 billion deal with Intel in 2022 for a chip-making plant in Chandler, Ariz. Intel was to have a controlling stake in the Arizona plant

Wife’s company (family owned) just announced layoffs for the first time in 30 years. Luckily she is to be given a new role in the organization but it's starting to hit home.

Wallstreet Breakfast:

Are U.S. consumers finally tightening the purse strings? That's the main question on the minds of investors as major retailers kick off their quarterly earnings reports this week, starting with Home Depot (HD). The home improvement chain's Q1 results came in below Street expectations, hurt by a delayed start to spring, continued softness in certain larger discretionary projects, and higher mortgage rates.

Dig deeper: Retailer earnings come at a time when consumer sentiment is weakening, amid expectations of stickier inflation for some time to come and a tempered outlook for income growth. Investing Group Leader Bret Jensen believes stagflation is an increasingly likely economic scenario. "Right now, I believe the average American consumer has a better handle on the U.S. economy than the average investor and a better take on the true level of inflation than governmental statistics."

Scott Feiler, consumer sector specialist at Goldman Sachs, said the consumer spending concerns have been driven by updates by bellwethers in the sector, and the notable slowdown seen in April - one of the worst months of the retail quarter. Companies like Wayfair (W) and Whirlpool (WHR) have already warned that consumers are cutting back spending on big-ticket items, while fast-food chains such as McDonald's (MCD) and Starbucks (SBUX) have observed pickier and more value-minded customers. "Consumer cracks are emerging," especially among lower incomes, warned Bank of America analyst Savita Subramanian.

Are U.S. consumers finally tightening the purse strings? That's the main question on the minds of investors as major retailers kick off their quarterly earnings reports this week, starting with Home Depot (HD). The home improvement chain's Q1 results came in below Street expectations, hurt by a delayed start to spring, continued softness in certain larger discretionary projects, and higher mortgage rates.

Dig deeper: Retailer earnings come at a time when consumer sentiment is weakening, amid expectations of stickier inflation for some time to come and a tempered outlook for income growth. Investing Group Leader Bret Jensen believes stagflation is an increasingly likely economic scenario. "Right now, I believe the average American consumer has a better handle on the U.S. economy than the average investor and a better take on the true level of inflation than governmental statistics."

Scott Feiler, consumer sector specialist at Goldman Sachs, said the consumer spending concerns have been driven by updates by bellwethers in the sector, and the notable slowdown seen in April - one of the worst months of the retail quarter. Companies like Wayfair (W) and Whirlpool (WHR) have already warned that consumers are cutting back spending on big-ticket items, while fast-food chains such as McDonald's (MCD) and Starbucks (SBUX) have observed pickier and more value-minded customers. "Consumer cracks are emerging," especially among lower incomes, warned Bank of America analyst Savita Subramanian.

Jerome Powell's plan is working. We need more inflation to lick inflation.Wallstreet Breakfast:

Are U.S. consumers finally tightening the purse strings? That's the main question on the minds of investors as major retailers kick off their quarterly earnings reports this week, starting with Home Depot (HD). The home improvement chain's Q1 results came in below Street expectations, hurt by a delayed start to spring, continued softness in certain larger discretionary projects, and higher mortgage rates.

Dig deeper: Retailer earnings come at a time when consumer sentiment is weakening, amid expectations of stickier inflation for some time to come and a tempered outlook for income growth. Investing Group Leader Bret Jensen believes stagflation is an increasingly likely economic scenario. "Right now, I believe the average American consumer has a better handle on the U.S. economy than the average investor and a better take on the true level of inflation than governmental statistics."

Scott Feiler, consumer sector specialist at Goldman Sachs, said the consumer spending concerns have been driven by updates by bellwethers in the sector, and the notable slowdown seen in April - one of the worst months of the retail quarter. Companies like Wayfair (W) and Whirlpool (WHR) have already warned that consumers are cutting back spending on big-ticket items, while fast-food chains such as McDonald's (MCD) and Starbucks (SBUX) have observed pickier and more value-minded customers. "Consumer cracks are emerging," especially among lower incomes, warned Bank of America analyst Savita Subramanian.

I guess the auto pilot on the "Flying Tesla" must have malfunctioned.Tesla stock is no longer about cars, market, etc. - it is now about Elon and his leaning to the Right. Tesla will be punished for the sins of Elon.

___________________________________________________________________

3 killed, 3 injured in California after speeding Tesla flies into power pole and building, knocks out power

Crash knocked out power to more than 500 homes, businesses in Pasadena, CaliforniaA driver and two passengers were killed in a crash that also left three other passengers seriously injured when their Tesla Model 3 struck a curb and went airborne, smashing into a power pole and building in Pasadena, California, early Saturday, authorities said.

The fatal single-vehicle crash happened around 2:30 a.m. as the Tesla carrying six people was traveling at a high speed in a 35-mph zone, Lt. Anthony Russo of the Pasadena Police Department told FOX11 Los Angeles.

Russo said it appears the driver "failed to negotiate a slight curve," causing the car to strike the curb. The car flew through the air, hit the pole, and then crashed through a wall of the building.

3 killed, 3 injured in California after speeding Tesla flies into power pole and building, knocks out power

Three people are dead and three others seriously injured after a speeding car struck a curb and crashed into a power pole and building in California.

The longer the can is kicked down the road..... The faster the middle class disappears.Wait until March 11th. I fully expect the FED to kick the can down the road but it could be interesting for some banks.

All part of the plan.

I'm going to go way out on a limb here and predict that in a 35MPH zone, a Tesla traveling at a high rate of speed was not on FSD.2:30 a.m. as the Tesla carrying six people was traveling at a high speed in a 35-mph zone

Got to sell a lot of chicken and pizza to stash $2 Billion. The YUM share price has been increasing year after year for 5 years.

Is YUM shoring up the stock price in anticipation of a major down turn in the market ?

KFC and Pizza Hut parent company Yum Brands said its board had approved a new $2 billion share buyback program over the next two years.

The Louisville, Ky.-based company, which also oversees Taco Bell and Habit Burger Grill restaurants, said the share repurchase authorization allowed for up to $2 billion in shares to be bought between July 1, 2024, and Dec. 31, 2026.

The company’s prior buyback program expires on June 30. That authorization, announced in September 2022, was also for $2 billion.

Yum also declared its regular dividend of 67 cents a share.

Is YUM shoring up the stock price in anticipation of a major down turn in the market ?

KFC and Pizza Hut parent company Yum Brands said its board had approved a new $2 billion share buyback program over the next two years.

The Louisville, Ky.-based company, which also oversees Taco Bell and Habit Burger Grill restaurants, said the share repurchase authorization allowed for up to $2 billion in shares to be bought between July 1, 2024, and Dec. 31, 2026.

The company’s prior buyback program expires on June 30. That authorization, announced in September 2022, was also for $2 billion.

Yum also declared its regular dividend of 67 cents a share.

Jiffy Lube kills another one.

DOW @ 40,000

Does anyone even raise an eyebrow when a headline like this appears ? Since the inception of the Dow there has been a continuous shuffle of loosing stocks being replaced by high fliers.

The Dow is up about 15% for the past 6 months. I see this as a good indicator of inflation. Inflation up 15% Dow up 15%... Just a wash.

Does anyone even raise an eyebrow when a headline like this appears ? Since the inception of the Dow there has been a continuous shuffle of loosing stocks being replaced by high fliers.

The Dow is up about 15% for the past 6 months. I see this as a good indicator of inflation. Inflation up 15% Dow up 15%... Just a wash.

CNBC Daily Open: Dow briefly tops 40,000 for the first time, meme stocks down but not out

Last edited:

Wall Street is completely disconnected from the rest of America. I do not believe or trust the "market". Still investing but this is manipulated.DOW @ 40,000

Does anyone even raise an eyebrow when a headline like this appears ? Since the inception of the Dow there has been a continuous shuffle of loosing stocks being replaced by high fliers.

The Dow is up about 15% for the past 6 months. I see this as a good indicator of inflation. Inflation up 15% Dow up 15%... Just a wash.

View attachment 8420033

CNBC Daily Open: Dow briefly tops 40,000 for the first time, meme stocks down but not out

This is not normal wear and tear, this is a colossal fuck up by both the oil change joint and the driver for ignoring the light that 100% guaranteed came on.

I change my own oil. Problem solved, problem staying solved.

Try again.

100% accurate!This is not normal wear and tear, this is a colossal fuck up by both the oil change joint and the driver for ignoring the light that 100% guaranteed came on.

I change my own oil. Problem solved, problem staying solved.

Try again.

This is not normal wear and tear, this is a colossal fuck up by both the oil change joint and the driver for ignoring the light that 100% guaranteed came on.

I change my own oil. Problem solved, problem staying solved.

Try again.

Ahh, you missed the point.

Replacement cost for engines and transmissions aren't cheap. Same as replacement cost for an EV. The benefit is that EV battery failure rates are so very low and the technology is only going to get better. The longer you own an EV, the cheaper it becomes vs. an ICE counterpart. Your engines and transmissions aren't getting better.

Up front = I am not an expert at anything.This is not normal wear and tear, this is a colossal fuck up by both the oil change joint and the driver for ignoring the light that 100% guaranteed came on.

I change my own oil. Problem solved, problem staying solved.

Try again.

What I have found is the more "I can do for myself, the better off I am". And it is getting worse by the day.

I take a black Sharpie with me when grocery shopping and write the price on each item. When the checker runs it through the scanner and the price comes up more than the listed price, I tell her to put it back, I don't want it. I watch my own money better than anyone else.

I maintain my own mechanical stuff. I have the service manuals and can find needed info on the Internet. Plus, I learn by doing.

I have oil, grease, coolant additives here in my shop.

Watching a man's equipment is like watching his money. No one else can do as through of a job.

Post up some photos of EV's with 300k miles.Ahh, you missed the point.

Replacement cost for engines and transmissions aren't cheap. Same as replacement cost for an EV. The benefit is that EV battery failure rates are so very low and the technology is only going to get better. The longer you own an EV, the cheaper it becomes vs. an ICE counterpart. Your engines and transmissions aren't getting better.

2016 Toyota Corolla with close to 500,000 miles is another example why Toyota is the reliability king - Alt Car news

This 2016 Toyota Corolla with close to half a million miles is a prime example why people choose Toyotas without batting an eye.

How about a 2010 Yaris with 411K miles? It's sitting in the parking lot and the keys are in my pocket. Only failures aside from consumables were a rear wheel bearing and an alternator.Post up some photos of EV's with 300k miles.

2016 Toyota Corolla with close to 500,000 miles is another example why Toyota is the reliability king - Alt Car news

This 2016 Toyota Corolla with close to half a million miles is a prime example why people choose Toyotas without batting an eye.tiremeetsroad.com

Post up some photos of EV's with 300k miles.

2016 Toyota Corolla with close to 500,000 miles is another example why Toyota is the reliability king - Alt Car news

This 2016 Toyota Corolla with close to half a million miles is a prime example why people choose Toyotas without batting an eye.tiremeetsroad.com

Google is right there. There is a 2014 model S that makes the news every year that has over 1.5M km on it. The latest battery supposedly has over 1M on it.

At this point, it is just a game of numbers. The difference is battery technology will continue to progress while ICE dies.

Life is a game of numbers.... With a little luck mixed in.Google is right there. There is a 2014 model S that makes the news every year that has over 1.5M km on it. The latest battery supposedly has over 1M on it.

At this point, it is just a game of numbers. The difference is battery technology will continue to progress while ICE dies.

ICE engines and transmissions are improving, and have consistently over the entirety of their existence and will continue down the road. Engineers are always coming up with new ways to squeeze power and efficiency out of every drop of gas or diesel.Ahh, you missed the point.

Replacement cost for engines and transmissions aren't cheap. Same as replacement cost for an EV. The benefit is that EV battery failure rates are so very low and the technology is only going to get better. The longer you own an EV, the cheaper it becomes vs. an ICE counterpart. Your engines and transmissions aren't getting better.

Most V6 engines blow the V8s of three decades ago out of the water in HP and torque, and last two to three times as long. Some V6 engines even meet or beat old big block numbers. Used to be if you wanted more than four gears you had a stick shift, now 10sp autos are becoming the new norm.

But sure, you’re going to say they’re making no improvements in ICE vehicles. It’s just that we’re not buying your perpetual bullshit gaslighting.

ICE engines and transmissions are improving, and have consistently over the entirety of their existence and will continue down the road. Engineers are always coming up with new ways to squeeze power and efficiency out of every drop of gas or diesel.

Most V6 engines blow the V8s of three decades ago out of the water in HP and torque, and last two to three times as long. Some V6 engines even meet or beat old big block numbers. Used to be if you wanted more than four gears you had a stick shift, now 10sp autos are becoming the new norm.

But sure, you’re going to say they’re making no improvements in ICE vehicles. It’s just that we’re not buying your perpetual bullshit gaslighting.

Toyota Tacoma

MPG Efficiency (2014-2024):

• 2014-2023: The base 2.7-liter four-cylinder engine typically delivered around 19-21 MPG city and 23-24 MPG highway. The 3.5-liter V6 managed about 18-19 MPG city and 22-24 MPG highway

2014-2023: The 2.7-liter engine produced 159 HP and 180 lb-ft of torque. The 3.5-liter V6 offered 278 HP and 265 lb-ft of torque

Honda Civic

MPG Efficiency (2014-2024):

• 2014-2021:

• 2.0L I4 (158 HP): Typically 30-32 MPG city / 38-42 MPG highway.

• 1.5L Turbo I4 (174-180 HP): Around 32-33 MPG city / 42-43 MPG highway.

Horsepower and Torque:

• 2014-2021:

• 2.0L I4: 158 HP and 138 lb-ft of torque.

• 1.5L Turbo I4: 174-180 HP and 162-177 lb-ft of torque.

Damn, those engineers are squeezing prunes. ICE < Turbo < Hybrid < BEV. Where are we at it in 2024 with the typical ICE manufacturer? Its just a matter of time until the three fold.

You're even looking at the latest generation of Tacomas. Again, your gaslighting bullshit is getting old.Toyota Tacoma

MPG Efficiency (2014-2024):

• 2014-2023: The base 2.7-liter four-cylinder engine typically delivered around 19-21 MPG city and 23-24 MPG highway. The 3.5-liter V6 managed about 18-19 MPG city and 22-24 MPG highway

2014-2023: The 2.7-liter engine produced 159 HP and 180 lb-ft of torque. The 3.5-liter V6 offered 278 HP and 265 lb-ft of torque

Honda Civic

MPG Efficiency (2014-2024):

• 2014-2021:

• 2.0L I4 (158 HP): Typically 30-32 MPG city / 38-42 MPG highway.

• 1.5L Turbo I4 (174-180 HP): Around 32-33 MPG city / 42-43 MPG highway.

Horsepower and Torque:

• 2014-2021:

• 2.0L I4: 158 HP and 138 lb-ft of torque.

• 1.5L Turbo I4: 174-180 HP and 162-177 lb-ft of torque.

Damn, those engineers are squeezing prunes. ICE < Turbo < Hybrid < BEV. Where are we at it in 2024 with the typical ICE manufacturer? Its just a matter of time until the three fold.

You're even looking at the latest generation of Tacomas. Again, your gaslighting bullshit is getting old.

10 years of data is gaslighting?

2024 is a new model.10 years of data is gaslighting?

And the 14-15 were different engines too.

2024 is a new model.

And the 14-15 were different engines too.

So again, wheres the engineers squeezing power and efficiency if the beginning and ending are pretty much the exact same outcome?

The standard ICE vehicle is maxed out on this hence the transition to Turbos and Hybrids. All roads lead to BEV.

Similar threads

- Replies

- 7

- Views

- 645

- Replies

- 49

- Views

- 3K

- Replies

- 115

- Views

- 6K