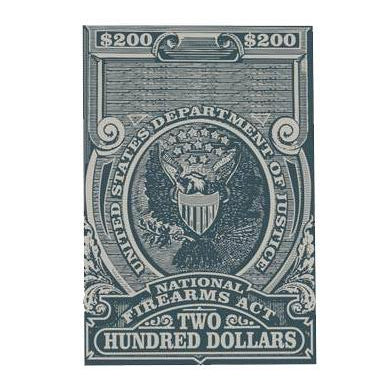

I had a trust drawn up a little over 10 years ago. I haven't put anything on it since 41F went in to effect but I'm about to file for a Thunderbeast 338 Ultra SR.

I got all the trust paperwork together and realized that the trust was done before one of the trustees legally changed their name.

So the current legal name of the trustee isn't what's listed on the trust, but I have the court order and all the other paperwork documenting that the old legal name refers to the same person as the new legal name.

I'm interested to hear anyone else's experience with this particular situation and how they handled it.

I got all the trust paperwork together and realized that the trust was done before one of the trustees legally changed their name.

So the current legal name of the trustee isn't what's listed on the trust, but I have the court order and all the other paperwork documenting that the old legal name refers to the same person as the new legal name.

I'm interested to hear anyone else's experience with this particular situation and how they handled it.