If you can't put you hands on your money now an are in debt, someone else is controlling your life,....no matter how you try an spin it.

nypost.com

nypost.com

www.wsj.com

www.wsj.com

finance.yahoo.com

finance.yahoo.com

Bankruptcy filings rising across the country and it could get worse

Bankruptcies are back — flashing warnings that more Americans are knee-deep in debt in big cities like New York. While total bankruptcy petitions nationwide by consumers and businesses are still we…

Investors Ponder Negative Bond Yields in the U.S.

A steep slide in U.S. government-bond yields last week wrong-footed investors and left some pondering what was once unthinkable: whether interest rates in America could one day turn negative.

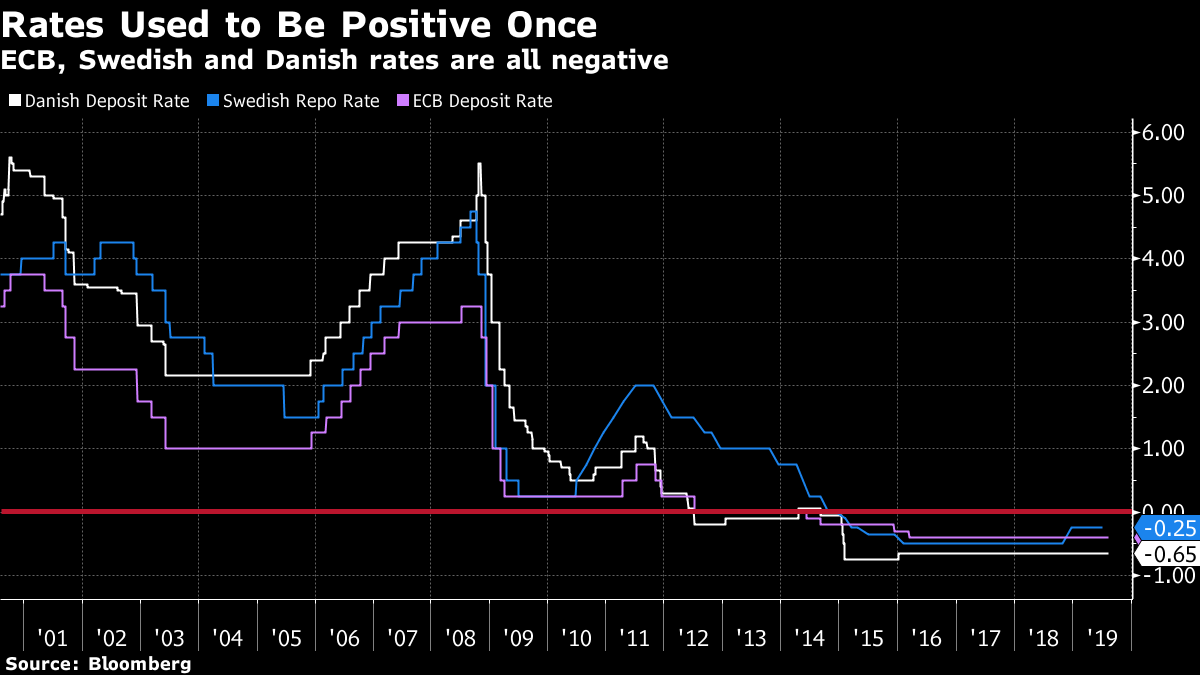

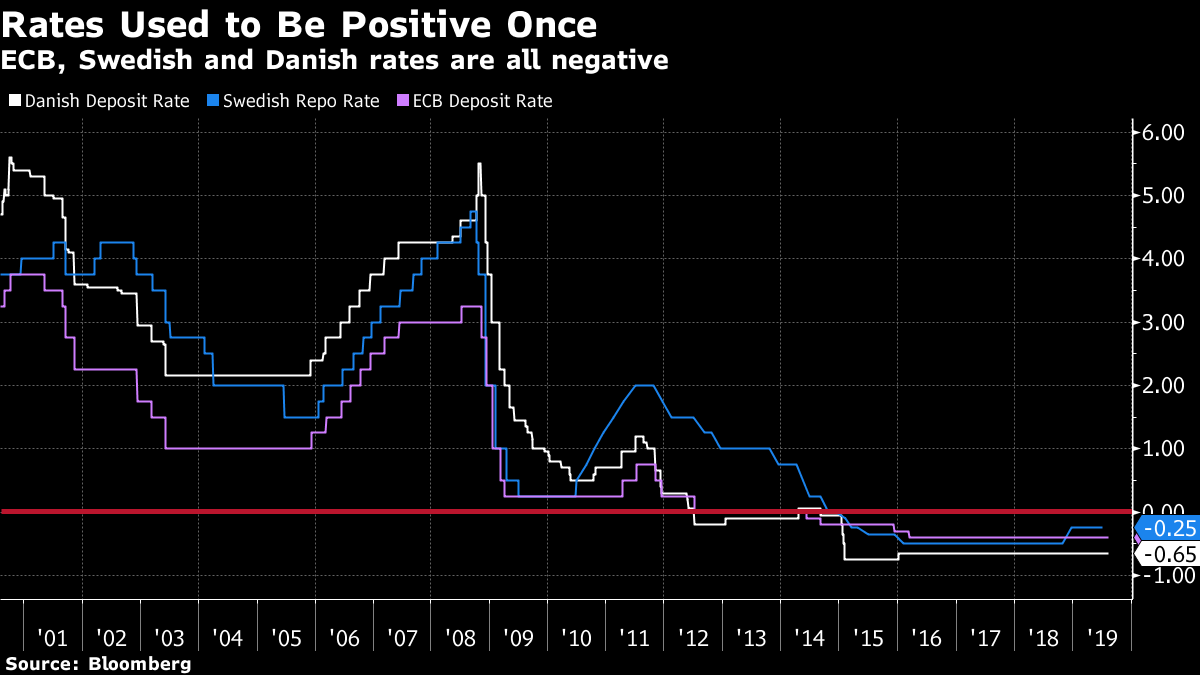

Depositors Are Next as Nordic Banks Buckle Under Negative Rates

(Bloomberg) -- Ever since negative interest rates became a thing, banks have been too afraid to pass them on to retail depositors. That may be about to change.In Scandinavia, where sub-zero rates have been the norm longer than most other places, the finance industry has undergone several drastic...