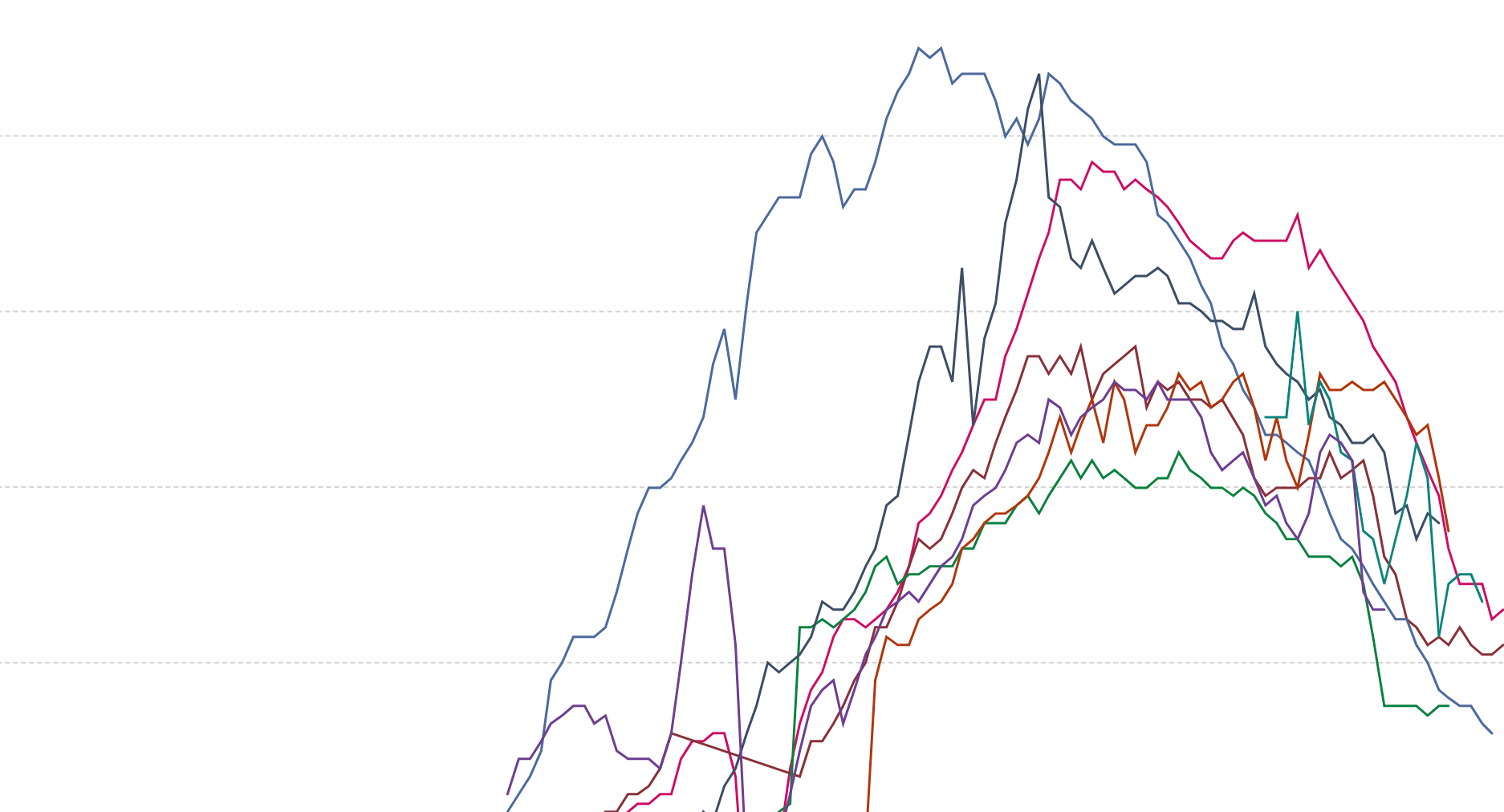

Im feeling optimistic.

My thoughts are that the market has needed a correction.

Id rather see a correction related to unrelated fears rather than to some sort of actual economic issue.

Granted fears of Corona virus are creating actual market problems in supply chains and purchase orders but Im thinking once Corona virus is revealed as a nothing burger shit is going to spin up very fast.

Co workers laments about his 401K got me thinking about this.

Who cares?

Unless people start dropping dead in the streets or if he decides to retire tomorrow nothing to see and good opportunities

My thoughts are that the market has needed a correction.

Id rather see a correction related to unrelated fears rather than to some sort of actual economic issue.

Granted fears of Corona virus are creating actual market problems in supply chains and purchase orders but Im thinking once Corona virus is revealed as a nothing burger shit is going to spin up very fast.

Co workers laments about his 401K got me thinking about this.

Who cares?

Unless people start dropping dead in the streets or if he decides to retire tomorrow nothing to see and good opportunities