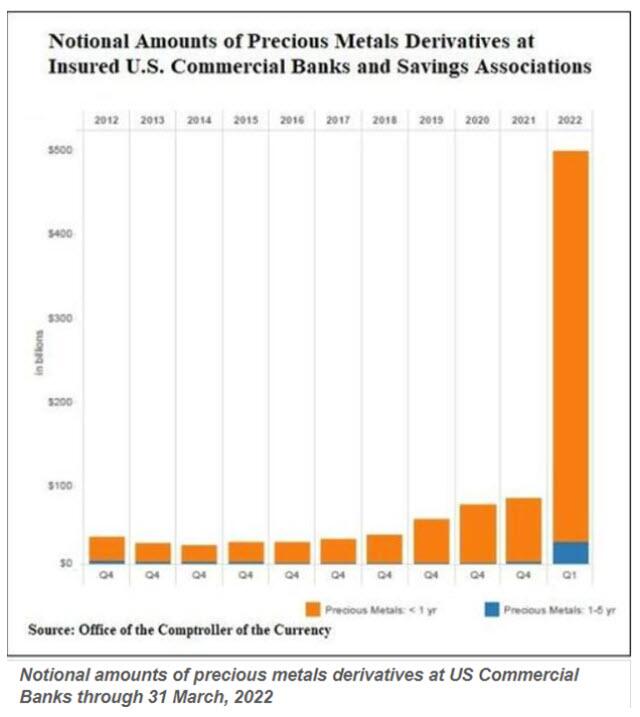

What the hell is going on with gold/silver prices today? What's messing with me is that typically when you have high inflation the price of gold goes up as well. Today however gold is currently down nearly 2%, silver down 5%. I know that a bunch of y'alls are way smarter than me, any insight to help me wrap my little mind around why? My 2nd quarter investment account statement came out and we were down 11.88% for q2, and we lost 3% in the first quarter, but the economy is "doing well" according to Pedo Pete. If it's doing well, why am I losing double digit percentages on a up economy?

Branden

Branden