Ok, let's say I purchase a suppressor through my PD. When I left the department, would I just go about the transfer as I would through a local gun store? Example I pay for the suppressor for the department, once I decide to leave the department how do I take it with me when I go?

Join the Hide community

Get access to live stream, lessons, the post exchange, and chat with other snipers.

Register

Download Gravity Ballistics

Get help to accurately calculate and scope your sniper rifle using real shooting data.

Install the app

How to install the app on iOS

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

-

The Shot You’ll Never Forget Giveaway - Enter To Win A Barrel From Rifle Barrel Blanks!

Tell us about the best or most memorable shot you’ve ever taken. Contest ends June 13th and remember: subscribe for a better chance of winning!

Join contest Subscribe

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Suppressors Acquiring a suppressor through department ?

- Thread starter cwatson308

- Start date

Re: Acquiring a suppressor through department ?

You would have to fill out the transfer form, get it signed off by the Chief, get the fingerprint cards, get photographs, pay the $200 tax and wait six months for the stamp to come back.

You would have to fill out the transfer form, get it signed off by the Chief, get the fingerprint cards, get photographs, pay the $200 tax and wait six months for the stamp to come back.

Re: Acquiring a suppressor through department ?

In my experience most PD's won't transfer anything directly to an officer, they transfer it tax free to an SOT and then that SOT transfers it to you.

They do the same with Title1 and Title2 weapons.

Its a budgeting issue and liability is my understanding.

In my experience most PD's won't transfer anything directly to an officer, they transfer it tax free to an SOT and then that SOT transfers it to you.

They do the same with Title1 and Title2 weapons.

Its a budgeting issue and liability is my understanding.

Re: Acquiring a suppressor through department ?

<div class="ubbcode-block"><div class="ubbcode-header">Originally Posted By: Phylodog</div><div class="ubbcode-body">You would have to fill out the transfer form, get it signed off by the Chief, get the fingerprint cards, get photographs, pay the $200 tax and wait six months for the stamp to come back. </div></div>

Any transfer of Title II items to and from government entities are tax exempt. In this case, if the agency allows it, they would complete an ATF Form 5 and submit it to ATF.

Otherwise they could transfer the item to a SOT tax exempt and then the transfer from the SOT to a future owner would be a tax paid transfer.

<div class="ubbcode-block"><div class="ubbcode-header">Originally Posted By: Phylodog</div><div class="ubbcode-body">You would have to fill out the transfer form, get it signed off by the Chief, get the fingerprint cards, get photographs, pay the $200 tax and wait six months for the stamp to come back. </div></div>

Any transfer of Title II items to and from government entities are tax exempt. In this case, if the agency allows it, they would complete an ATF Form 5 and submit it to ATF.

Otherwise they could transfer the item to a SOT tax exempt and then the transfer from the SOT to a future owner would be a tax paid transfer.

Re: Acquiring a suppressor through department ?

<div class="ubbcode-block"><div class="ubbcode-header">Originally Posted By: rbdub474</div><div class="ubbcode-body">

Any transfer of Title II items to and from government entities are tax exempt. In this case, if the agency allows it, they would complete an ATF Form 5 and submit it to ATF.

Otherwise they could transfer the item to a SOT tax exempt and then the transfer from the SOT to a future owner would be a tax paid transfer. </div></div>

That's what I was saying. He might get it tax free initially but it would belong to the department. If he wants to own it there is no getting around the tax.

<div class="ubbcode-block"><div class="ubbcode-header">Originally Posted By: rbdub474</div><div class="ubbcode-body">

Any transfer of Title II items to and from government entities are tax exempt. In this case, if the agency allows it, they would complete an ATF Form 5 and submit it to ATF.

Otherwise they could transfer the item to a SOT tax exempt and then the transfer from the SOT to a future owner would be a tax paid transfer. </div></div>

That's what I was saying. He might get it tax free initially but it would belong to the department. If he wants to own it there is no getting around the tax.

Re: Acquiring a suppressor through department ?

<div class="ubbcode-block"><div class="ubbcode-header">Originally Posted By: Phylodog</div><div class="ubbcode-body"><div class="ubbcode-block"><div class="ubbcode-header">Originally Posted By: rbdub474</div><div class="ubbcode-body">

Any transfer of Title II items to and from government entities are tax exempt. In this case, if the agency allows it, they would complete an ATF Form 5 and submit it to ATF.

Otherwise they could transfer the item to a SOT tax exempt and then the transfer from the SOT to a future owner would be a tax paid transfer. </div></div>

That's what I was saying. He might get it tax free initially but it would belong to the department. If he wants to own it there is no getting around the tax. </div></div>

If the department transfers directly to him, it would be tax free again. Any government transfers are tax free, whether acquiring or disposing of Title II items.

The actual wording on the ATF Form 5 for Tax Exempt Transfer is "Firearm is being transferred to or from a Government Entity".

We have helped agencies sell off everything from old Rem 870 SBSs and outdated suppressors to transferable Thompson SMGs. They were all transferred to the individual tax free on a Form 5 direct from the selling agency.

Now, again this is only relevant if the agency is willing to sell direct to an individual.

<div class="ubbcode-block"><div class="ubbcode-header">Originally Posted By: Phylodog</div><div class="ubbcode-body"><div class="ubbcode-block"><div class="ubbcode-header">Originally Posted By: rbdub474</div><div class="ubbcode-body">

Any transfer of Title II items to and from government entities are tax exempt. In this case, if the agency allows it, they would complete an ATF Form 5 and submit it to ATF.

Otherwise they could transfer the item to a SOT tax exempt and then the transfer from the SOT to a future owner would be a tax paid transfer. </div></div>

That's what I was saying. He might get it tax free initially but it would belong to the department. If he wants to own it there is no getting around the tax. </div></div>

If the department transfers directly to him, it would be tax free again. Any government transfers are tax free, whether acquiring or disposing of Title II items.

The actual wording on the ATF Form 5 for Tax Exempt Transfer is "Firearm is being transferred to or from a Government Entity".

We have helped agencies sell off everything from old Rem 870 SBSs and outdated suppressors to transferable Thompson SMGs. They were all transferred to the individual tax free on a Form 5 direct from the selling agency.

Now, again this is only relevant if the agency is willing to sell direct to an individual.

Re: Acquiring a suppressor through department ?

First I've heard of that. Seems like someone might consider that an attempt at tax evasion. I could see it if they were transferred to a dealer but seems fishy to an individual.

First I've heard of that. Seems like someone might consider that an attempt at tax evasion. I could see it if they were transferred to a dealer but seems fishy to an individual.

Re: Acquiring a suppressor through department ?

<div class="ubbcode-block"><div class="ubbcode-header">Originally Posted By: Phylodog</div><div class="ubbcode-body">First I've heard of that. Seems like someone might consider that an attempt at tax evasion. I could see it if they were transferred to a dealer but seems fishy to an individual. </div></div>

It has been the same process for a long time now.

How is it fishy? An agency acquires an item and uses it until they don't need it, or want to acquire something else. They then sell the item off. Why should it matter if it goes to an individual or SOT? Unless the initial purchase and subsequent transfer were done with the intent to avoid the transfer tax, I don't see an issue.

One example was an agency had a pristine Thompson SMG they bought from the factory in 1938. They sold it in 2011 to an individual to fund the purchase of M4s for their agency. I don't see any attempt at tax evasion.

I'm not trying to be an ass, I just don't see the difference between a transfer to an individual or a SOT.

<div class="ubbcode-block"><div class="ubbcode-header">Originally Posted By: Phylodog</div><div class="ubbcode-body">First I've heard of that. Seems like someone might consider that an attempt at tax evasion. I could see it if they were transferred to a dealer but seems fishy to an individual. </div></div>

It has been the same process for a long time now.

How is it fishy? An agency acquires an item and uses it until they don't need it, or want to acquire something else. They then sell the item off. Why should it matter if it goes to an individual or SOT? Unless the initial purchase and subsequent transfer were done with the intent to avoid the transfer tax, I don't see an issue.

One example was an agency had a pristine Thompson SMG they bought from the factory in 1938. They sold it in 2011 to an individual to fund the purchase of M4s for their agency. I don't see any attempt at tax evasion.

I'm not trying to be an ass, I just don't see the difference between a transfer to an individual or a SOT.

Re: Acquiring a suppressor through department ?

it doesn't matter between the two, if it is not going to a .gov entity or a SOT its a $200 stamp.

Most depts. that I know won't deal with a Form4 transfer, too much time and hassle for most departments.

Some may do it but I am not aware of what departments.

it doesn't matter between the two, if it is not going to a .gov entity or a SOT its a $200 stamp.

Most depts. that I know won't deal with a Form4 transfer, too much time and hassle for most departments.

Some may do it but I am not aware of what departments.

Re: Acquiring a suppressor through department ?

<div class="ubbcode-block"><div class="ubbcode-header">Originally Posted By: StalkingRhino</div><div class="ubbcode-body">it doesn't matter between the two, if it is not going to a .gov entity or a SOT its a $200 stamp.

Most depts. that I know won't deal with a Form4 transfer, too much time and hassle for most departments.

Some may do it but I am not aware of what departments. </div></div>

If it's coming from a Gov't entity, it's also tax free. No transfer from a dept will be on a Form 4, they will be on a Form 5.

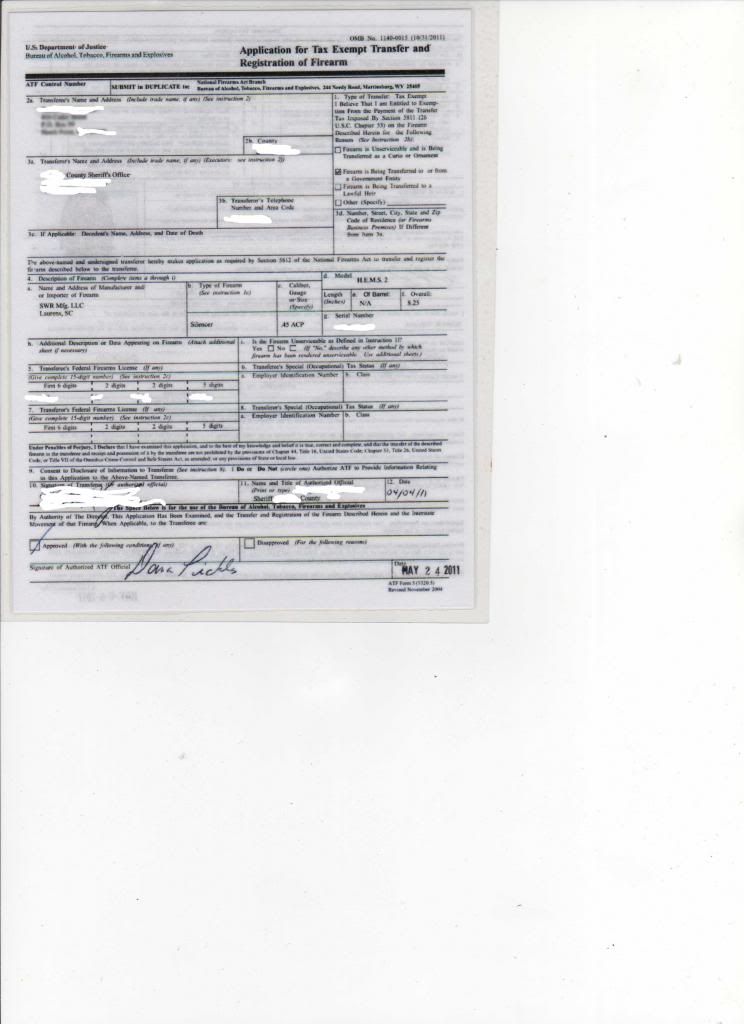

Here is a redacted copy of an approved Form 5 for a suppressor from a LE agency to an individual last year. The transferor is responsible for the transfer tax, hence the reason it is tax exempt when the transferor is a Gov't entity.

<div class="ubbcode-block"><div class="ubbcode-header">Originally Posted By: StalkingRhino</div><div class="ubbcode-body">it doesn't matter between the two, if it is not going to a .gov entity or a SOT its a $200 stamp.

Most depts. that I know won't deal with a Form4 transfer, too much time and hassle for most departments.

Some may do it but I am not aware of what departments. </div></div>

If it's coming from a Gov't entity, it's also tax free. No transfer from a dept will be on a Form 4, they will be on a Form 5.

Here is a redacted copy of an approved Form 5 for a suppressor from a LE agency to an individual last year. The transferor is responsible for the transfer tax, hence the reason it is tax exempt when the transferor is a Gov't entity.

Re: Acquiring a suppressor through department ?

<div class="ubbcode-block"><div class="ubbcode-header">Originally Posted By: rbdub474</div><div class="ubbcode-body"> The transferor is responsible for the transfer tax </div></div>

Learn something new every day I guess. I've bought close to 10 NFA items and paid the tax as the transferee each time.

<div class="ubbcode-block"><div class="ubbcode-header">Originally Posted By: rbdub474</div><div class="ubbcode-body"> The transferor is responsible for the transfer tax </div></div>

Learn something new every day I guess. I've bought close to 10 NFA items and paid the tax as the transferee each time.

Re: Acquiring a suppressor through department ?

<div class="ubbcode-block"><div class="ubbcode-header">Originally Posted By: Phylodog</div><div class="ubbcode-body"><div class="ubbcode-block"><div class="ubbcode-header">Originally Posted By: rbdub474</div><div class="ubbcode-body"> The transferor is responsible for the transfer tax </div></div>

Learn something new every day I guess. I've bought close to 10 NFA items and paid the tax as the transferee each time. </div></div>

That is the general practice across the board as far as I know, but the way the law is written, the transferor is technically responsible for payment of the tax. I guess it is just one of those things that just happened over time where the transferee started paying.

<div class="ubbcode-block"><div class="ubbcode-header">Originally Posted By: Phylodog</div><div class="ubbcode-body"><div class="ubbcode-block"><div class="ubbcode-header">Originally Posted By: rbdub474</div><div class="ubbcode-body"> The transferor is responsible for the transfer tax </div></div>

Learn something new every day I guess. I've bought close to 10 NFA items and paid the tax as the transferee each time. </div></div>

That is the general practice across the board as far as I know, but the way the law is written, the transferor is technically responsible for payment of the tax. I guess it is just one of those things that just happened over time where the transferee started paying.

Re: Acquiring a suppressor through department ?

Only thing im trying to avoid is the wait time. Plan being is useing my money to buy the suppressor for the department through the department. Then upon leaving or at a later date transfer it into my name. If im in the department then i would be able to use the suppressor during the transfer into my name period. Im not to sure how or if this route would work.

Only thing im trying to avoid is the wait time. Plan being is useing my money to buy the suppressor for the department through the department. Then upon leaving or at a later date transfer it into my name. If im in the department then i would be able to use the suppressor during the transfer into my name period. Im not to sure how or if this route would work.

Re: Acquiring a suppressor through department ?

<div class="ubbcode-block"><div class="ubbcode-header">Originally Posted By: cwatson308</div><div class="ubbcode-body">Only thing im trying to avoid is the wait time. Plan being is useing my money to buy the suppressor for the department through the department. Then upon leaving or at a later date transfer it into my name. If im in the department then i would be able to use the suppressor during the transfer into my name period. Im not to sure how or if this route would work. </div></div>

If you buy it through the Dept and then it is immediately transferred to you that is clearly tax evasion.

The ATF watches for abuse like this.

The Form5 is for Dept use, not to make the Dept your SOT.

<div class="ubbcode-block"><div class="ubbcode-header">Originally Posted By: cwatson308</div><div class="ubbcode-body">Only thing im trying to avoid is the wait time. Plan being is useing my money to buy the suppressor for the department through the department. Then upon leaving or at a later date transfer it into my name. If im in the department then i would be able to use the suppressor during the transfer into my name period. Im not to sure how or if this route would work. </div></div>

If you buy it through the Dept and then it is immediately transferred to you that is clearly tax evasion.

The ATF watches for abuse like this.

The Form5 is for Dept use, not to make the Dept your SOT.

Re: Acquiring a suppressor through department ?

I agree with Stalkingrhino. Just do a form5 to your dept, then turn around have them issue it to you, use it for work, while you're doing a form4, pay the 200$ tax and don't try to find a way around the tax, you'll get caught, if not right away then eventually. It's not worth loosing the suppressor over.

xdeano

I agree with Stalkingrhino. Just do a form5 to your dept, then turn around have them issue it to you, use it for work, while you're doing a form4, pay the 200$ tax and don't try to find a way around the tax, you'll get caught, if not right away then eventually. It's not worth loosing the suppressor over.

xdeano

Re: Acquiring a suppressor through department ?

<div class="ubbcode-block"><div class="ubbcode-header">Originally Posted By: xdeano</div><div class="ubbcode-body">I agree with Stalkingrhino. Just do a form5 to your dept, then turn around have them issue it to you, use it for work, while you're doing a form4, pay the 200$ tax and don't try to find a way around the tax, you'll get caught, if not right away then eventually. It's not worth loosing the suppressor over.

xdeano </div></div>

Or your freedom(tax evasion is a felnoy), job, retirement, career. To try and save $200.

If you are that desperate to save the $200 you probably shouldn't be shooting your gun the can would go on.

<div class="ubbcode-block"><div class="ubbcode-header">Originally Posted By: xdeano</div><div class="ubbcode-body">I agree with Stalkingrhino. Just do a form5 to your dept, then turn around have them issue it to you, use it for work, while you're doing a form4, pay the 200$ tax and don't try to find a way around the tax, you'll get caught, if not right away then eventually. It's not worth loosing the suppressor over.

xdeano </div></div>

Or your freedom(tax evasion is a felnoy), job, retirement, career. To try and save $200.

If you are that desperate to save the $200 you probably shouldn't be shooting your gun the can would go on.

Re: Acquiring a suppressor through department ?

Again not trying to avoid the tax. That's not what the question is and or about. I am a sniper in our county so I will use it for work. That being said the transfer into my name would have to be done through a tax stamp and the form 4. Like I said before i am just trying to avoid wait time. If I can purchase one for the department and use it while I'm in the department, then once we acquire the suppressor pay the 200.00 tax stamp and send the form 4 in. Then that means I can run the suppressor during my 6month wait time. Now is that clear enough. Read back on the last posts and see if you can find anything that hints toward tax evasion.

Again not trying to avoid the tax. That's not what the question is and or about. I am a sniper in our county so I will use it for work. That being said the transfer into my name would have to be done through a tax stamp and the form 4. Like I said before i am just trying to avoid wait time. If I can purchase one for the department and use it while I'm in the department, then once we acquire the suppressor pay the 200.00 tax stamp and send the form 4 in. Then that means I can run the suppressor during my 6month wait time. Now is that clear enough. Read back on the last posts and see if you can find anything that hints toward tax evasion.

Similar threads

- Replies

- 175

- Views

- 6K

- Replies

- 19

- Views

- 843

- Replies

- 14

- Views

- 2K

- Replies

- 11

- Views

- 2K

- Replies

- 37

- Views

- 2K