Appears OPEC is calling Biden's bluff..........

____________________________________

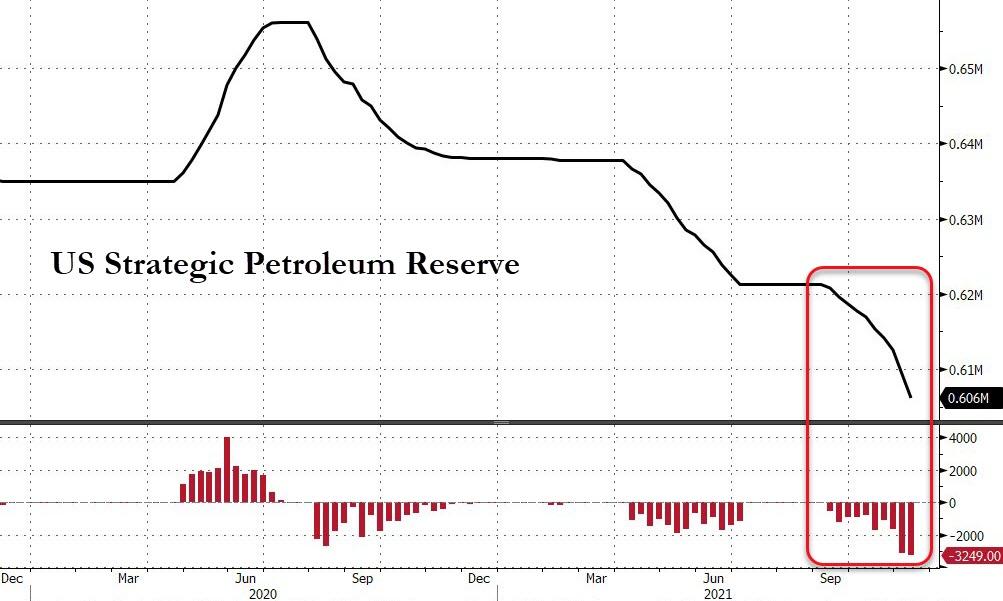

Top oil producers Saudi Arabia and Russia are considering pausing their planned efforts to ramp up oil production, according to The Wall Street Journal, after the U.S. and other energy-consuming countries said they would tap their national strategic petroleum reserves in an attempt to bring down gasoline prices.

www.foxbusiness.com

www.foxbusiness.com

____________________________________

Top oil producers Saudi Arabia and Russia are considering pausing their planned efforts to ramp up oil production, according to The Wall Street Journal, after the U.S. and other energy-consuming countries said they would tap their national strategic petroleum reserves in an attempt to bring down gasoline prices.

OPEC considers pausing oil production increase after Biden releases more crude

Top oil producers Saudi Arabia and Russia are considering pausing their planned efforts to ramp up oil production, according to The Wall Street Journal, after the U.S. and other energy-consuming countries said they would tap their national strategic petroleum reserves in an attempt to bring down...