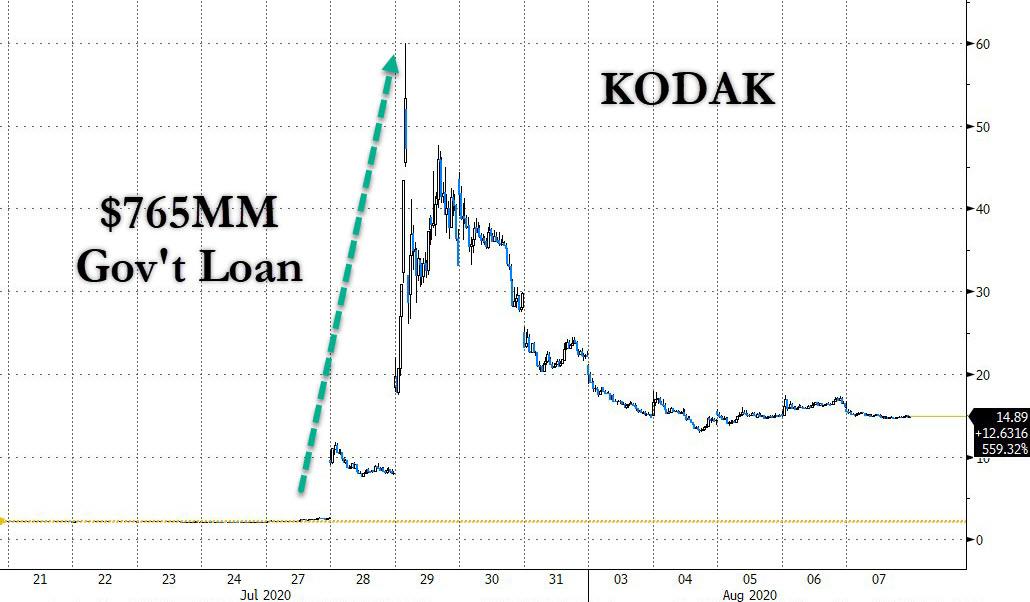

KODK - Eastman Kodak, Trump said the gubmint was going to turn them from an old film processing relic to a new pharmaceutical company.

Shares up 450% as of now.

Shares up 450% as of now.

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

Tell us about the best or most memorable shot you’ve ever taken. Contest ends June 13th and remember: subscribe for a better chance of winning!

Join contest Subscribeand people look at me like I am crazy when I say the government picks the winners

What if Trump tried to get big pharma to invest and they said eff you. You are costing us money. They probably figured they had him defeated. Boom hey Kodak do you want to help. This is national security infrastructure China unleashes Covid and they control 75% of pharma ingredients. Oh yeah that is just great for us.

They could do some really bad shit. We are at war it's not kinetic yet but it could be soon. WWII it was quite common for the Govt to take over businesses. I think he did the right thing. So did Kodak. The problem with Americans they have been slow to see this change in warfare. There is not a city in the rust belt that has not been attacked by China, with the help of our leaders. JMHO

Nothing is moving back without some incentive. This has been discussed here in many threads. And who is to blame?

Us.

Not even things that are critical to our survival.

I like the idea that there are only absolutes - 0s or 1s. But, I live in the analog world and know absolutes can only reflect reality to a certain degree.

If it were so absolute....

Might as well have 90% of our armaments made in china too...

And where is the SEC???

Wise words. Although there are two sides, one you have no chance it's good, the other you have a chance it's good. So you have to pick a side, like it or not. I choose the one where I have a chance.Hi,

How about this as a novel idea for Trump....

Lead from the front and bring ALL his business operations and manufacturing to the USA?

Lead from the front and revoke all H1B1 Visas currently authorized for Trump Inc and all its' subsidiaries?

He keeps demanding what other businesses need to do but.......

The guy has done good for my industry in regards to regulations pertaining to International business development and such but I am not naïve enough to think everything he does is good!!

Sincerely,

Theis

Capitalism and the free market are dead for the most part and have been for some time. In the USI love the idea of bringing drug manufacturing back to the US, but I'm more than just a bit squeamish about having the federal government play kingmaker. That doesn't strike me as being particularly capitalistic.

Hi,

How about this as a novel idea for Trump....

Lead from the front and bring ALL his business operations and manufacturing to the USA?

Lead from the front and revoke all H1B1 Visas currently authorized for Trump Inc and all its' subsidiaries?

He keeps demanding what other businesses need to do but.......

The guy has done good for my industry in regards to regulations pertaining to International business development and such but I am not naïve enough to think everything he does is good!!

Sincerely,

Theis

That’s not how that works.Just remember... For every man that makes a Dollar in the Market, another man looses a Dollar.

Hobo

And where is the SEC???

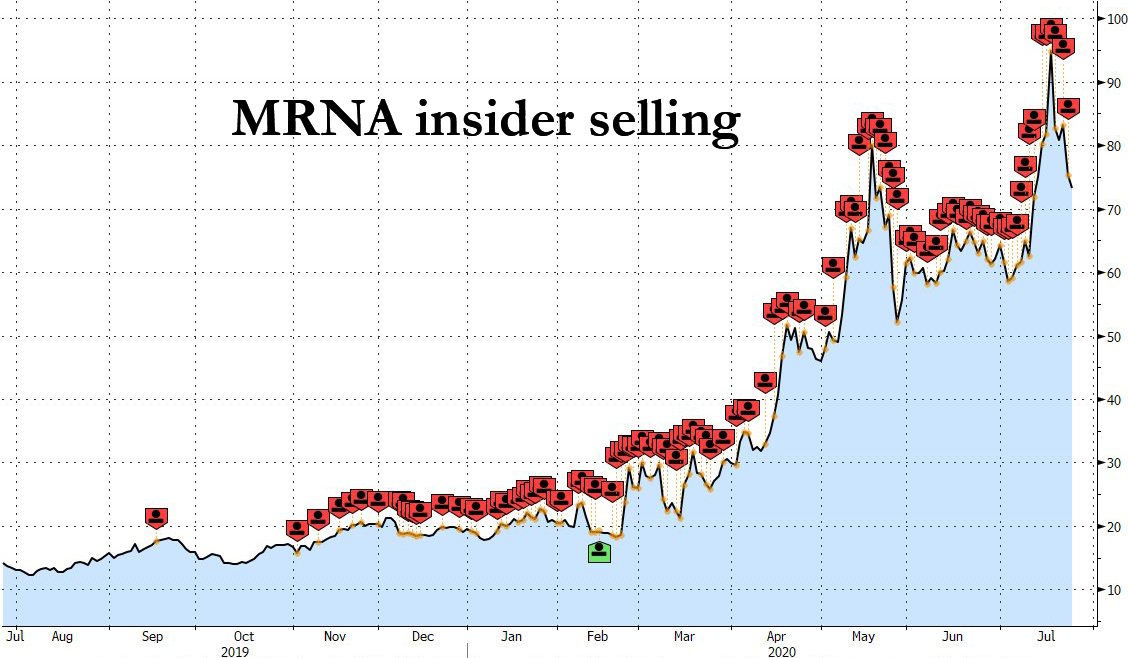

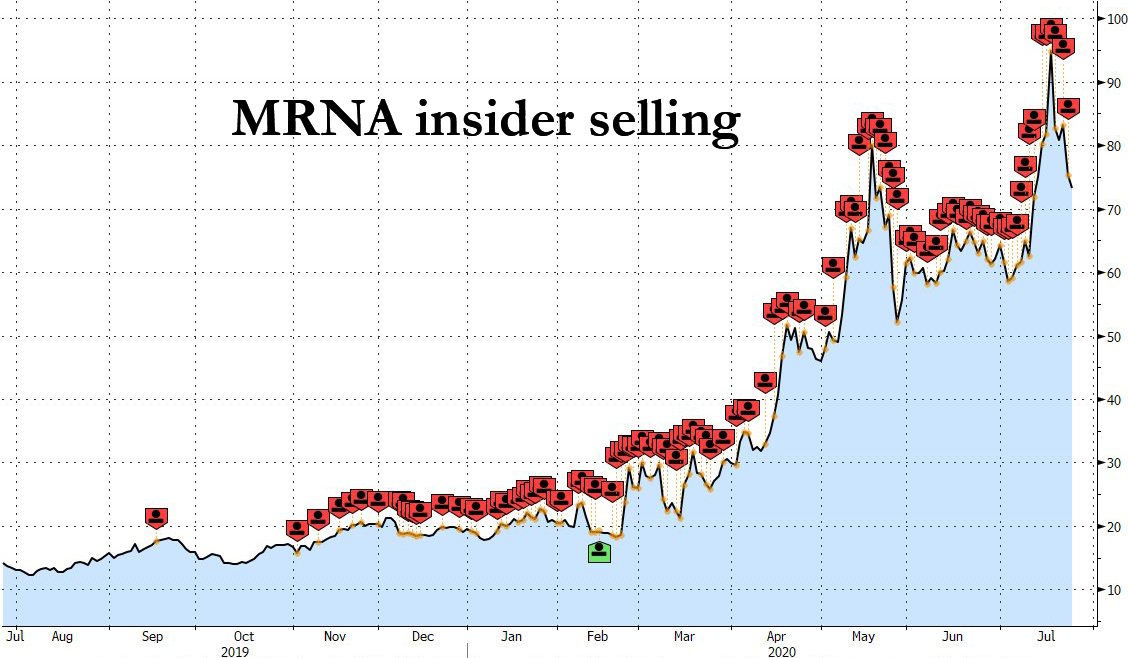

You are joking right if SEC would be doing its job Musk be sitting behind bars and Tesla would be a nothing burger, thesedays even the most obvious pump and dumps by insiders don't get investigated (most recent are the ''vacine fraudsters' insiders made cca 200mio just on these pump and dump trades and the dumb fucking Robinhood traders never learn allways pile in like flys to a turd, insider trading has become new normal. I could list you a list of obvious insider trades pages long just from the past 3-4 months.

Moderna doesn't even have a product yet just pumping the stock with SM posts and tweets ,note they are just selling ,lets just say maybe they know vaccine they are touting might not pan out and stock will crash soon after.

Rule of law doesn't exist newer has, never will its just an illusion to keep the plebs inline

These days only the most inept fraudsters get caught like this guy .That is before Munchin writes of the PPP loans

https://www.justice.gov/opa/pr/flor...-lamborghini-sports-car-charged-miami-federal

From Market Watch:I got in at $24, I forgot about and missed the opening. Also, trading was odd, was getting errors trying to buy market, so just set a limit and it processed.

Like a rock..........From Market Watch:

Bearish short sellers—in Wall Street parlance—got their faces ripped off by Eastman Kodak stock over the past two days. It sounds brutal, but it’s common Street-jargon. It also appears to be a fair description for what just happened to the bears. The short squeeze has been epic.

_____

Just short it at $30 , ride it down to $15 and double your money......

Hobo

But the person who loses a dollar gains whatever product or service they purchased. The free market is a positive sum game. Your religion of the state is the real definition of negative sum game you’re talking aboutJust remember... For every man that makes a Dollar in the Market, another man looses a Dollar.

Hobo

A fundamental aspect of Communism is when the Government owns/controls the means of production. A fundamental aspect of Socialism is when The People/Workers own and control the means of Production. Capitalism is an economic and political system in which a country's trade and industry are controlled by private owners for profit, rather than by the state.

Which of the above three true statements most parallels what Trump is doing with Kodak? I'm just saying that this is not Capitalism.

VooDoo

From Market Watch:

Bearish short sellers—in Wall Street parlance—got their faces ripped off by Eastman Kodak stock over the past two days. It sounds brutal, but it’s common Street-jargon. It also appears to be a fair description for what just happened to the bears. The short squeeze has been epic.

_____

Just short it at $30 , ride it down to $15 and double your money......

Hobo

Shares of Eastman Kodak Co. KODK, -30.71% plummeted 45% in active premarket trading Monday, after reports the U.S. International Development Finance Corp. is withholding its planned $765 million loan after the deal came under regulatory scrutiny. The stock had rocketed 13-fold in two days, after it was announced on July 28 that the IDFC would provide Kodak a the loan to help produce the ingredients to maker generic drugs. Under question how Kodak controlled the disclosure of the loan, as the stock soared 25% in active trading the day before the news was reported, amid active stock option trading. Kodak disclosed on Friday that it appointed a special committee to oversee and internal review of recent activity by the company and related parties in connection with the announcement of the potential government loan. As of Friday's close of $14.88, the stock had pulled back 55% since July 29.That’s not how that works.

Not sure if sarcasm

Is that fundamentally any different than how they’re dealing with Trump already?i gotta tell you, it sounds great what you suggest. here’s the problem....the SECOND trump said or did ANYTHING regarding his businesses, they’d be be all over his ass for using his office to benefit his business....whether it was legit or not. i think if he so much as made a phone call to suggest the lawn was looking shaggy at a golf course, they’d accuse him of something super evil and try to hang him for it.