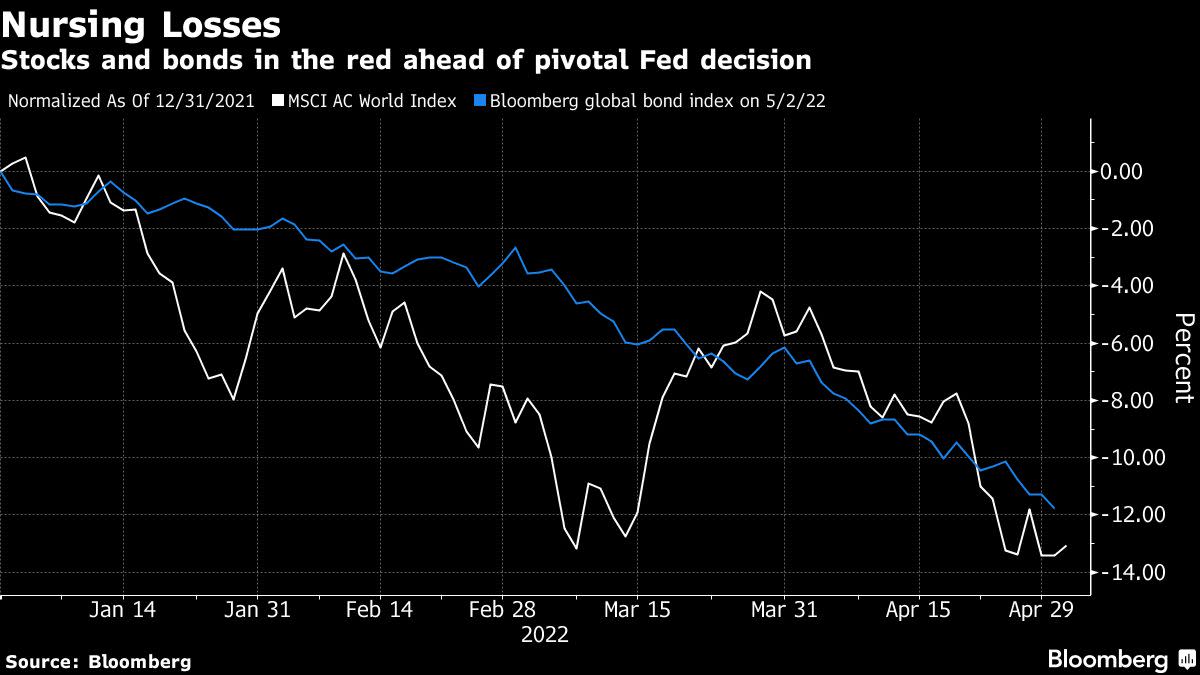

So if GDP shrank before the Fed started raising rates, what are the odds of a so-called "soft landing" once we start seeing these 50-75 bps monthly hikes?

Larry Summers claimed a couple of weeks ago that the odds of a "hard landing" where something like "better than half, maybe two-thirds or more". That now seems a bit too optimistic.

All that said, the stock markets are up almost 1% as of this post, which means that we're still operating under the "bad news is bullish" rubric. This probably won't end well.

Larry Summers claimed a couple of weeks ago that the odds of a "hard landing" where something like "better than half, maybe two-thirds or more". That now seems a bit too optimistic.

All that said, the stock markets are up almost 1% as of this post, which means that we're still operating under the "bad news is bullish" rubric. This probably won't end well.