"Inflation" and "Recession" are melding together in real life........... All we need is "Stagnation" and we will win the Trifecta.May need to move this to the inflation thread. Hard to keep up.

Dallas rent prices seeing some of the highest increases in the U.S., data shows

Data from rent.com shows the average for a two-bedroom in Dallas has jumped up 46% from last year. Other cities like Grapevine and Grand Prairie are seeing even bigger rent increases. Only one North Texas city saw a consistent drop in rent prices.www.fox4news.com

Join the Hide community

Get access to live stream, lessons, the post exchange, and chat with other snipers.

Register

Download Gravity Ballistics

Get help to accurately calculate and scope your sniper rifle using real shooting data.

Install the app

How to install the app on iOS

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Recession - 2022 / 2023 / 2024

- Thread starter Hobo Hilton

- Start date

Thanks. The GFC was so different. The phones just stopped ringing one day, and slowly started coming back, but whole companies were just GONE. This came back sooner and faster, and companies are still there, it's just you can't get stuff.I like a positive opinion. Helps balance the outlook.

Back logs disappear when order's are simply cancelled. Two previous recessions taught people to react with a "hair trigger" much faster than the 1987 oil crash. Home owner's walked away from houses and lost a bundle. In 2008 people listened to financial advisor's tell them to "hold tight" and not cash out... Many of them are still working at 75 years old due to that "hold tight" advice.

Your view and opinion is of the United States. This recession is world wide. We have an administration that is running the money printing presses 7/24/365 while sending that money to foreign countries without any accountability. America can not save the world.

I appreciate your focus on manufacturing. I was sorry when "services" became greater than "industry". A fairly current breakdown is 19.91 percent in industry and 78.74 percent in services. Industry could run at 100% but still have to carry a service industry that is quite a bit larger. It will be interesting to watch the lay off's in the two different sectors.

Interest Rates and the FED Reserve have been politicized. That is the reason Jerome Powell's "Frame Work" would not accommodate the events of the world economy. His frame work was built on historical stats. Mankind has never seen so many Black Swans in such a short period of time. As this recession deepens, there will be more Black Swans.

Again, thank you very much for entering this discussion.

Totally agree with your points on orders. I keep on telling sales and supply chain to measure cancelled and 'refused/never-mind' orders. That is the canary in the coal mine. The problem is that there is such a huge backlog, that outside of a GFC type crash- even with a huge reduction/cxl of orders, manufacturing is going to have to keep going full steam for 3-6 months, and that's without filling the warehouses.

You have COVID lurking out there, with the incentive of it being used to control the next elections. Russia jacking things up, the Chinese locking down and looking at Taiwan. Throw in Monkey Pox

My wife and I went to school forever, work in value-added areas, benefited from previous generations doing the same thing. We drive cars 7 and 8 years old respectively. Not rich by any means, but have some means? And frankly, we can't find ways to spend money (outside of the crazy essentials pricing). Or at least the prices on things like a mountain home or a nice trip give us pause. We live a 1950s or 1980s type lifestyle, and spend a metric ass-load of money to do it.

Something is wrong.

In recent days, however, gold at the BOE traded as much as a dollar an ounce beneath benchmark London prices, according to traders familiar with the matter. Such a big discount usually indicates a big institution like a central bank selling a sizable amount of reserves to raise US dollars or other currencies, one of the traders said.

________________________

Take a moment and let that paragraph sink in. What does it mean ? The Bank of England is 328 years old. Pay attention when they make a move. They have not lasted this long by being foolish, like the Biden administration.

It's coming down to physical gold and food. Pay attention. It will get worse.

www.mining.com

www.mining.com

www.britannica.com

www.britannica.com

________________________

Take a moment and let that paragraph sink in. What does it mean ? The Bank of England is 328 years old. Pay attention when they make a move. They have not lasted this long by being foolish, like the Biden administration.

It's coming down to physical gold and food. Pay attention. It will get worse.

BOE gold trades at rare discount in sign of central bank selling

The Bank of England’s vaults contain 5,676 tonnes of bullion, one of the largest stockpiles in the world.

Bank of England | History, Headquarters, & Facts | Britannica Money

Bank of England, the central bank of the United Kingdom. Its headquarters are in the central financial...

More Subprime Borrowers Are Missing Loan Payments

Consumers with low credit scores are falling behind on payments for car loans, personal loans and credit cards, a sign that the healthiest consumer lending environment on record in the U.S. is coming to an end.The share of subprime credit cards and p

baystatelocal.com

baystatelocal.com

The average amount of personal savings dropped 15% from $73,100 in 2021 to $62,086 in 2022, according to Northwestern Mutual’s recent 2022 Planning & Progress study.

www.cnbc.com

www.cnbc.com

Americans now have an average of $9,000 less in savings than they did last year

The ongoing economic effects of the Covid-19 pandemic have taken a bite out of Americans' savings rates.

Yet, 64% of Americans are living paycheck to paycheck.

www.cnbc.com

www.cnbc.com

As inflation heats up, 64% of Americans are now living paycheck to paycheck

The number of Americans living paycheck to paycheck is climbing, despite rising wages.

Look at all the credit limit increases since January. My theory is it was done to kick the can a little further. Right now those who were living on a shoestring are now using credit to pay for essentials, with the hopes it’ll go back down like 2008.

Sorry homie, it’s not going back down anytime soon. Well, maybe if the Fed’s plan to tame inflation by making everyone broke as fuck works out.

Sorry homie, it’s not going back down anytime soon. Well, maybe if the Fed’s plan to tame inflation by making everyone broke as fuck works out.

Yet, 64% of Americans are living paycheck to paycheck.

As inflation heats up, 64% of Americans are now living paycheck to paycheck

The number of Americans living paycheck to paycheck is climbing, despite rising wages.www.cnbc.com

I'm honestly surprised that number isn't higher.

Appearing the focus for the Deep State is to grease the skids and slide this train wreck into 2023 and actually make 2022 look good on paper.Look at all the credit limit increases since January. My theory is it was done to kick the can a little further. Right now those who were living on a shoestring are now using credit to pay for essentials, with the hopes it’ll go back down like 2008.

Sorry homie, it’s not going back down anytime soon. Well, maybe if the Fed’s plan to tame inflation by making everyone broke as fuck works out.

Re: "Well, you know 2022 was not really that bad".... "We made a lot of great things happen"..... Re-election rhetoric.

CEO outlook dims sharply, with more than half expecting a recession ahead, survey shows

The Conference Board measure of CEO sentiment showed that 57% expect the economy to sustain a "very short, mild recession."

Households are now spending an estimated $5,000 a year on gasoline

U.S. households are now spending the equivalent of $5,000 a year on gasoline, up from $2,800 a year ago, according to Yardeni Research.

Homebuilder sentiment falls to 2-year low on declining demand and rising costs

"Housing leads the business cycle, and housing is slowing," said NAHB Chairman Jerry Konter, a builder and developer.

Weekly mortgage demand from homebuyers tumbles 12%, as higher interest rates take their toll

Higher mortgage interest rates are hitting homebuyer affordability hard, and that is showing up in a sharp drop in mortgage applications.

Ex-Goldman CEO Blankfein says recession possibility is 'very high risk factor'

Former Goldman Sachs CEO Lloyd Blankfein said he believes the economy is at risk of possibly going into a recession.

For those that remember the point in John McCain's 2008 campaign when he wheeled out Phil Gramm to claim that we were "a nation of whiners" suffering from a "mental recession", it kinda feels like we're nearing that same spot in this economic cycle. Admit nothing, deny everything, make counter accusations.

I don't know who Biden's handlers will shove towards the podium in this role, as Larry Summers has already made it clear that he wouldn't fuck this administration's problems with somebody else's dick. The Bernanke has also made it clear that we are likely screwed. Maybe Krugman is available? He seems to follow the party narrative with unblinking dedication. Regardless of the selected puppet, I suspect we'll see something in the next month or two.

I don't know who Biden's handlers will shove towards the podium in this role, as Larry Summers has already made it clear that he wouldn't fuck this administration's problems with somebody else's dick. The Bernanke has also made it clear that we are likely screwed. Maybe Krugman is available? He seems to follow the party narrative with unblinking dedication. Regardless of the selected puppet, I suspect we'll see something in the next month or two.

This was already one year ago but who would have thought that printing $$$ would lead to inflation and eventually recession.Only saving grace is the world wide absorbtion of both USD and Euro due to them being used as world reserve currencies otherwise we would be looking at 3rd world style inflation drive

US money print was off the charts but ECB was just as bad in their decisions as the FED possibly even worse.

US money print was off the charts but ECB was just as bad in their decisions as the FED possibly even worse.

- As of March 2021, COVID costs totaled $5.2 trillion. World War II cost $4.7 trillion (in today’s dollars).

- All-in money printing totaled $13 trillion: $5.2 for COVID + $4.5 for quantitative easing + $3 for infrastructure.

- Mountains of money cause inflation

BlackRock's Monday morning defensive move.... Interesting. A vote of no confidence in the FED Reserve

www.marketwatch.com

www.marketwatch.com

BlackRock just cut developed-market stocks to ‘neutral’. Here’s why.

BlackRock Investment Institute turns neutral on developed-market stocks like those of the U.S. and currently sees no catalyst for a sustained rebound.

What will be the scapegoat when the war ends ?

SEATTLE, April 12 (Reuters) - Boeing Co (BA. N) on Tuesday moved orders for 141 of its airplanes into accounting limbo due to the war in Ukraine and international sanctions against Russia, among other contractual issues, meaning it no longer expects the jets to be delivered.Apr 12, 2022

/cloudfront-us-east-2.images.arcpublishing.com/reuters/FUODPXH2RFLM5ER4BJ634TDV5A.jpg)

www.reuters.com

www.reuters.com

SEATTLE, April 12 (Reuters) - Boeing Co (BA. N) on Tuesday moved orders for 141 of its airplanes into accounting limbo due to the war in Ukraine and international sanctions against Russia, among other contractual issues, meaning it no longer expects the jets to be delivered.Apr 12, 2022

/cloudfront-us-east-2.images.arcpublishing.com/reuters/FUODPXH2RFLM5ER4BJ634TDV5A.jpg)

Boeing says 141 jet orders in limbo amid war in Ukraine

Boeing Co on Tuesday moved orders for 141 of its airplanes into accounting limbo due to the war in Ukraine and international sanctions against Russia, among other contractual issues, meaning it no longer expects the jets to be delivered.

2022 is nothing like 2008.... those that fall into that mindset will suffer the most. JMHO

______________________________________________________________

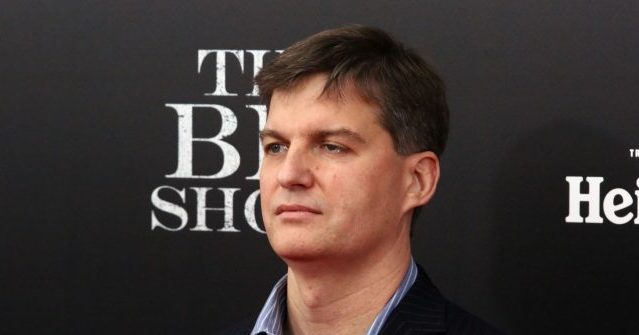

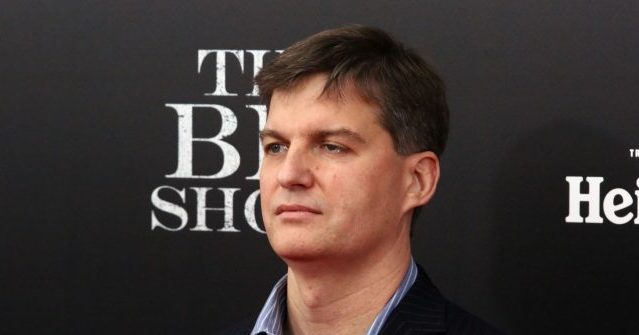

“As I said about 2008, it is like watching a plane crash. It hurts, it is not fun, and I’m not smiling,” Burry tweeted.

Quick recap of 2022 so far:

– energy crisis

– war in Ukraine

– food crisis

– supply chain issues

– surging crime

– bidenflation

– southern border

– massive bird flu

– fentanyl crisis

– stock market crashing

– riots back in season

– baby formula shortage

– drug overdose deaths doubled

And It's Only May

______________________________________________________________

“As I said about 2008, it is like watching a plane crash. It hurts, it is not fun, and I’m not smiling,” Burry tweeted.

Quick recap of 2022 so far:

– energy crisis

– war in Ukraine

– food crisis

– supply chain issues

– surging crime

– bidenflation

– southern border

– massive bird flu

– fentanyl crisis

– stock market crashing

– riots back in season

– baby formula shortage

– drug overdose deaths doubled

And It's Only May

Michael Burry of ‘The Big Short’ Says 2022 Is Like ‘Watching a Plane Crash’

What does Burry see that reminds him of 2008? | Economy

www.breitbart.com

The biggest reason I keep bringing up the comparison to 2008 is because virtually no one foresaw deflation in July 2008 when every commodity price was going to the moon, and then the demand collapse just a few months later absolutely demolished everyone who expected that prices would magically keep climbing forever and forever.

I do think that the globalpolitical environment is far more dangerous this time around, and the Fed is acting even slower than usually which I predict will lead to a sharper "whip crack".

I do think that the globalpolitical environment is far more dangerous this time around, and the Fed is acting even slower than usually which I predict will lead to a sharper "whip crack".

A laughable report:

The numbers: Orders at U.S. factories for long-lasting goods such as machinery and electronics rose a solid 0.4% in April, signaling the economy was still growing at a steady pace in the early spring. Economists polled by the Wall Street Journal had forecast a 0.7% increase.

Nothing more than reporting inflation.

The numbers: Orders at U.S. factories for long-lasting goods such as machinery and electronics rose a solid 0.4% in April, signaling the economy was still growing at a steady pace in the early spring. Economists polled by the Wall Street Journal had forecast a 0.7% increase.

Nothing more than reporting inflation.

Last edited:

Correct, but I’m wondering how supply chain issues will impact this time around?The biggest reason I keep bringing up the comparison to 2008 is because virtually no one foresaw deflation in July 2008 when every commodity price was going to the moon, and then the demand collapse just a few months later absolutely demolished everyone who expected that prices would magically keep climbing forever and forever.

I do think that the globalpolitical environment is far more dangerous this time around, and the Fed is acting even slower than usually which I predict will lead to a sharper "whip crack".

We are currently witnessing the supply chain issues. Big business is shifting to their "Survival Mode". Little effort / resources are being done to improve the supply chain. The "fuel surcharge" being tacked on is nothing more than a band-aid to keep the doors open at the transportation companies. It's become a game of who can last the longest during the recession. We have seen this during past recessions. Deja VuCorrect, but I’m wondering how supply chain issues will impact this time around?

It may not have a huge effect. With the price of gas and other essentials being driven up by diesel costs it may be that there just isn’t enough reserve in the family account to afford much beyond what is needed. If this turns out to be the case then demand will drop, easing the supply chain issues. But it will be very painful.Correct, but I’m wondering how supply chain issues will impact this time around?

Last edited:

| 07:00 | United States | MBA 30-Year Mortgage Rate | - | 5.49% | + | |

|---|---|---|---|---|---|---|

| 07:00 | United States | MBA Mortgage Applications | - | -11.0% |

Lol.

07:00 United States MBA 30-Year Mortgage Rate - 5.49% + 07:00 United States MBA Mortgage Applications - -11.0%

Your best plan is to "Get Ready"

And, today we get a "Definite Maybe" from the FED Reserve......... They are pushing the hard landing into 2023.

Recession is starting to resemble a short squeeze in the market that you can't get out of....

EDIT: The FED can screw up a bread sandwich... They came out with this announcement at about 2 pm (market time). As a result the DOW ran up about 500 points. Pure manipulation. DOW was in the red and the FED gave it a little boost into the green. Put the squeeze on the "shorts" late in the day and will force some of them to hold over night. FED's move will allow the DOW to finish in positive territory so as to break the long down turn.... This is what you get when the FED is trying to save it's ass.... More bull shit.

____________

(Bloomberg) -- Most Federal Reserve officials agreed at their gathering this month that the central bank needed to tighten in half-point steps over the next couple of meetings, continuing an aggressive set of moves that would leave policy makers with flexibility to shift gears later if needed.

www.yahoo.com

www.yahoo.com

Recession is starting to resemble a short squeeze in the market that you can't get out of....

EDIT: The FED can screw up a bread sandwich... They came out with this announcement at about 2 pm (market time). As a result the DOW ran up about 500 points. Pure manipulation. DOW was in the red and the FED gave it a little boost into the green. Put the squeeze on the "shorts" late in the day and will force some of them to hold over night. FED's move will allow the DOW to finish in positive territory so as to break the long down turn.... This is what you get when the FED is trying to save it's ass.... More bull shit.

____________

(Bloomberg) -- Most Federal Reserve officials agreed at their gathering this month that the central bank needed to tighten in half-point steps over the next couple of meetings, continuing an aggressive set of moves that would leave policy makers with flexibility to shift gears later if needed.

Fed Saw Aggressive Hikes Providing Flexibility Later This Year

(Bloomberg) -- Most Federal Reserve officials agreed at their gathering this month that the central bank needed to tighten in half-point steps over the next couple of meetings, continuing an aggressive set of moves that would leave policy makers with flexibility to shift gears later if...

Last edited:

Correct, but I’m wondering how supply chain issues will impact this time around?

It's going to make the whip crack worse, because the most likely outcome is that we muddle through most of the supply chain issues without too many real catastrophes, but companies will still place too many orders because that's what they've been conditioned to do over the past two years. This will lead to a larger-that-usual inventory build, which means a bigger crash when those companies stop ordering things.

The magnitude of the above relative to the effects of Fed tightening is totally unknown, but I'm not sure it really matters at this point.

He doesn't have a choice at this point - supply is more or less fixed. The only lever that will meaningfully decrease gas prices is the one labeled "global economic crash".

Ironic that the photo with this article is of an LNG transport ship bring gas to Japan. No wonder we are paying more here. Keep out resources here until the recession ends.

www.cnbc.com

www.cnbc.com

Natural gas surges above $9, hits the highest since 2008 as inventories stay low

Natural gas prices are at the highest level in nearly 14 years, just as the summer air conditioning season begins.

The "Poor's" in Smallville...

www.cnbc.com

www.cnbc.com

The lack of small-dollar mortgages is preventing Americans from purchasing affordable homes

Families on a more modest income are finding it harder to buy smaller houses with smaller mortgages.

It’s all done on purpose, but you guys know this. Get out of debt and buy food. Don’t know what else to tell you.

Klarna's CEO used a pre-recorded video message to tell employees around 700 of them were being laid off

The Swedish fintech, which is backed by Softbank, has seen its valuation slump from $45.6 billion to $30 billion since the middle of 2021.

Dominoes falling.

Related:

Sure, that's believable

GM delays plans to hire 3,000 salaried workers after intense hiring spree

GM said it has filled 7,000 new salaried jobs this year as it transitions to an electric vehicle software company.

www.freep.com

Some open positions are being delayed in part because we’ve been hiring at such a fast pace," Raynal told the Detroit Free Press on Friday. "We are essentially ahead of schedule with our planned 2022 hiring."

Sure, that's believable

I remember, in previous recessions, people were chasing the big money / benefits jobs.... Some got those jobs, worked a few months and were laid off since they had no seniority and little experience..... Attrition set in and they job hopped themselves into the unemployment job hunting line. Saw it in aerospace, oil patch, nuclear and the auto industry.... Young engineers with 3 - 4 years experience were working an McD's.... The saying during those times was "... went from the penthouse to the outhouse".Related:

GM delays plans to hire 3,000 salaried workers after intense hiring spree

GM said it has filled 7,000 new salaried jobs this year as it transitions to an electric vehicle software company.www.freep.com

Sure, that's believable

Deja Vu

The Clown that is leading the "Clown Show".....

www.cnn.com

www.cnn.com

Biden is 'obsessed' with lowering 'outrageous' gas prices, but presidents don't control prices, says Energy Secretary

Energy Secretary Jennifer Granholm said President Joe Biden is laser-focused on knocking down sky-high gasoline prices, though she concedes that even the most powerful person on the planet has limited influence to do that.

Buy all the canned food bottled water you can things might get spicy

The major corporations are making the same moves now as they did in previous recessions... Insanity

Apple's stock has been sinking for 60 days and they announce they are going to pay employees more.

Here is the plan = Give raises to a core group of people in supervision. Next, each supervisor is told to lay off 50% of his workers. Of course that department is required to continue to put out the same amount of work with half of the people. Insanity.

www.cnbc.com

www.cnbc.com

Apple's stock has been sinking for 60 days and they announce they are going to pay employees more.

Here is the plan = Give raises to a core group of people in supervision. Next, each supervisor is told to lay off 50% of his workers. Of course that department is required to continue to put out the same amount of work with half of the people. Insanity.

Apple says it will raise pay for corporate and retail employees in tight labor market

Apple's move comes after Google, Amazon, and Microsoft have made changes to their compensation structures in recent weeks to pay workers more.

Just hoping we don't venture into crazy town where we lose things we have taken for granted all my life, like indoor plumbing and toiletries. Digging latrines in the suburbs would be a bit dystopian.It’s all done on purpose, but you guys know this. Get out of debt and buy food. Don’t know what else to tell you.

Having basics prepped like our grandparents used to do as a matter of fact is just good common sense and something I should have always done. Camping in the suburbs creates a whole new set of problems though.

Just do what they do in a good number of third world and developing countries: shit in the street. The rain will wash it away. Eventually. And neighborhood pissing walls are a thing, complete with runoff gutters made in concrete.Just hoping we don't venture into crazy town where we lose things we have taken for granted all my life, like indoor plumbing and toiletries. Digging latrines in the suburbs would be a bit dystopian.

Ever been to Chicago, SF or any other city with a large homeless population? Its like Nancy Pelosi's favorite perfume, judging from her hometown.Can’t we shit in the streets in America?

Most Americans don't have more than a 1,000 dollars in their savings.The average amount of personal savings dropped 15% from $73,100 in 2021 to $62,086 in 2022, according to Northwestern Mutual’s recent 2022 Planning & Progress study.

Americans now have an average of $9,000 less in savings than they did last year

The ongoing economic effects of the Covid-19 pandemic have taken a bite out of Americans' savings rates.www.cnbc.com

This study must of looked at their 401Ks as savings.. and the drop, called it a loss.

American savings statistics for 2020 show that nearly 70% of Americans have less than $1,000 stashed away in their bank accounts.

link

department is required to continue to put out the same amount of work with half of the peoplThe major corporations are making the same moves now as they did in previous recessions... Insanity

Apple's stock has been sinking for 60 days and they announce they are going to pay employees more.

Here is the plan = Give raises to a core group of people in supervision. Next, each supervisor is told to lay off 50% of his workers. Of course that department is required to continue to put out the same amount of work with half of the people. Insanity.

Apple says it will raise pay for corporate and retail employees in tight labor market

Apple's move comes after Google, Amazon, and Microsoft have made changes to their compensation structures in recent weeks to pay workers more.www.cnbc.com

don't bosses call that working smarter not harder? Then again it's the bosses that are dumping// I mean DELEGATING the work out.

“In tough times, value retail can be part of the solution to help families stretch their dollars to meet their evolving needs,” he said.

www.cnbc.com

www.cnbc.com

3 takeaways from Dollar General, Dollar Tree earnings that sent stocks soaring

Dollar Tree and Dollar General boosted their outlook for the year, noting that shoppers squeezed by inflation will seek cheaper prices.

I've always said, a great economic indicator is when Dollar stores disappear and people quit shopping at Walmart. When Nordstroms and Macie's are packed with everyday people; then you know the economy is kicking butt.“In tough times, value retail can be part of the solution to help families stretch their dollars to meet their evolving needs,” he said.

3 takeaways from Dollar General, Dollar Tree earnings that sent stocks soaring

Dollar Tree and Dollar General boosted their outlook for the year, noting that shoppers squeezed by inflation will seek cheaper prices.www.cnbc.com

When I see articles about how great dollar stores are, it's just the 1% telling the poor to get used it.

Next, articles on how rolling blackouts are great for the environment. Learning how to live with less. How cockroaches are high in protein and soylent green comes in apple flavor.

The uber rick at Devos talking about carbon foot prints. LOL please...

You are "The Man On Main Street".... So far from Wall Street that they can not see you. Out of sight, out of mind. From Washington, DC they can not see you, either. I think this recession will bring those people down to where we are seeing eye to eye. Maybe even in a grocery store and both are looking at the last can of beans on the shelf. Going to be quite an awakening.I've always said, a great economic indicator is when Dollar stores disappear and people quit shopping at Walmart. When Nordstroms and Macie's are packed with everyday people; then you know the economy is kicking butt.

When I see articles about how great dollar stores are, it's just the 1% telling the poor to get used it.

Next, articles on how rolling blackouts are great for the environment. Learning how to live with less. How cockroaches are high in protein and soylent green comes in apple flavor.

The uber rick at Devos talking about carbon foot prints. LOL please...

I was in a second hand store today. Putting about 15 Mason jars of all sizes in my cart. A man about my age eased over to me and quietly said "You're getting ready for it, aren't you".... I replied "Yes Sir, I am"... That certainly broke the ice for a down to earth discussion... Validation at it's best.

Tucker Carlson tonight,05/26/22 .. Rolling blackouts are coming. See above post ^^ Grid operators are calling this

bad news - electricity is going up faster than inflation (yea, we knew that)

Good news - during a black out, you aren't paying for the high energy prices

The book, 1 second after.. a Great read.. and it's free..

bad news - electricity is going up faster than inflation (yea, we knew that)

Good news - during a black out, you aren't paying for the high energy prices

The book, 1 second after.. a Great read.. and it's free..

The legislation would allow lenders to offer installment loans worth up to $1,500 over a three to 12-month term, with an annual interest rate of up to 36% and a monthly “maintenance fee” worth up to 13% of the original loan amount. Loans over $400 could also incur a $50 underwriting fee.

www.theadvocate.com

www.theadvocate.com

Payday lenders want to offer bigger loans. Critics say it's 'designed to trap' low-income families.

Is a $1,500 loan worth it, if it costs you another $1,500 in interest and fees?

Opinion: It's time to prepare for a recession

There is a toxic brew of external economic headwinds, including the war in Ukraine and Covid lockdowns in China, resulting in supply shocks that boost inflation and slow growth.

Similar threads

- Replies

- 84

- Views

- 4K

- Replies

- 26

- Views

- 2K

- Replies

- 39

- Views

- 2K