Our world is changing, rapidly. Most people don't connect the dots or pay attention to the changes. When the shelves are empty or their plastic card stops working they will wake up. Snug up.Attention Walmart shoppers, observing a price bump across my shopping excursions since the first of the year on everything. Interesting YT video on socks & undies being behind glass, not in NCF. (sand paper-wire wheels etc) ring doorbell for service. Funny lady in the store looks in my buggy/cart hands me whatever I ask for behind the lockup and sends me on my way the young grunch looking guy makes me pay in automotive, things just don’t make sense to me at times.

Join the Hide community

Get access to live stream, lessons, the post exchange, and chat with other snipers.

Register

Download Gravity Ballistics

Get help to accurately calculate and scope your sniper rifle using real shooting data.

Install the app

How to install the app on iOS

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Recession - 2022 / 2023 / 2024

- Thread starter Hobo Hilton

- Start date

Worldwide

www.bbc.com

www.bbc.com

Retail sales fall at sharpest rate since Covid

Sales during December tumbled by 3.2% as shoppers stocked up earlier on Black Friday discounts.

2% inflation is a "bad number".

2% inflation rate is a number "pulled out of thin air".

2% inflation is a Government propaganda tool.

2% inflation rate makes the buying power of your USD less and less, year after year.

2% inflation is something you should start to question.

www.cnbc.com

www.cnbc.com

2% inflation rate is a number "pulled out of thin air".

2% inflation is a Government propaganda tool.

2% inflation rate makes the buying power of your USD less and less, year after year.

2% inflation is something you should start to question.

No 'economic collapse': Top Citi strategist says healthier economic growth is coming

The global economy does not need a "collapse" in order to bring inflation back to target and return to sustainable growth, according to Citi's Steven Wieting.

I question any inflation at all, ever.2% inflation is a "bad number".

2% inflation rate is a number "pulled out of thin air".

2% inflation is a Government propaganda tool.

2% inflation rate makes the buying power of your USD less and less, year after year.

2% inflation is something you should start to question.

No 'economic collapse': Top Citi strategist says healthier economic growth is coming

The global economy does not need a "collapse" in order to bring inflation back to target and return to sustainable growth, according to Citi's Steven Wieting.www.cnbc.com

Janet Yellen is taking her "Political Puppet Show" on the road. Who will believe her ?

The Biden administration is dispatching U.S. Treasury Secretary Janet Yellen to Chicago and Milwaukee this week as part of a stepped-up domestic travel schedule to sell Americans on the benefits of President Joe Biden’s economic policies.

Yellen will make the case in remarks to the Economic Club of Chicago on Thursday that the pandemic recovery was faster, fairer and more transformative than previous economic recoveries, the Treasury said late on Sunday.

www.cnbc.com

www.cnbc.com

The Biden administration is dispatching U.S. Treasury Secretary Janet Yellen to Chicago and Milwaukee this week as part of a stepped-up domestic travel schedule to sell Americans on the benefits of President Joe Biden’s economic policies.

Yellen will make the case in remarks to the Economic Club of Chicago on Thursday that the pandemic recovery was faster, fairer and more transformative than previous economic recoveries, the Treasury said late on Sunday.

Yellen to step up campaign touting Biden's economic record

The Biden administration is dispatching U.S. Treasury Secretary Janet Yellen to sell Americans on the benefits of President Joe Biden's economic policies.

Worldwide

www.cnbc.com

www.cnbc.com

Tech layoffs balloon in January as Wall Street rally lifts Alphabet, Meta, Microsoft to records

So far in January, some 23,670 workers have been laid off, the most in any month since March, according to the website Layoffs.fyi.

Levi Strauss plans to cut at least 10% of its global corporate workforce in restructuring

Levi's announced the layoffs as the apparel retailer reported fourth-quarter earnings.

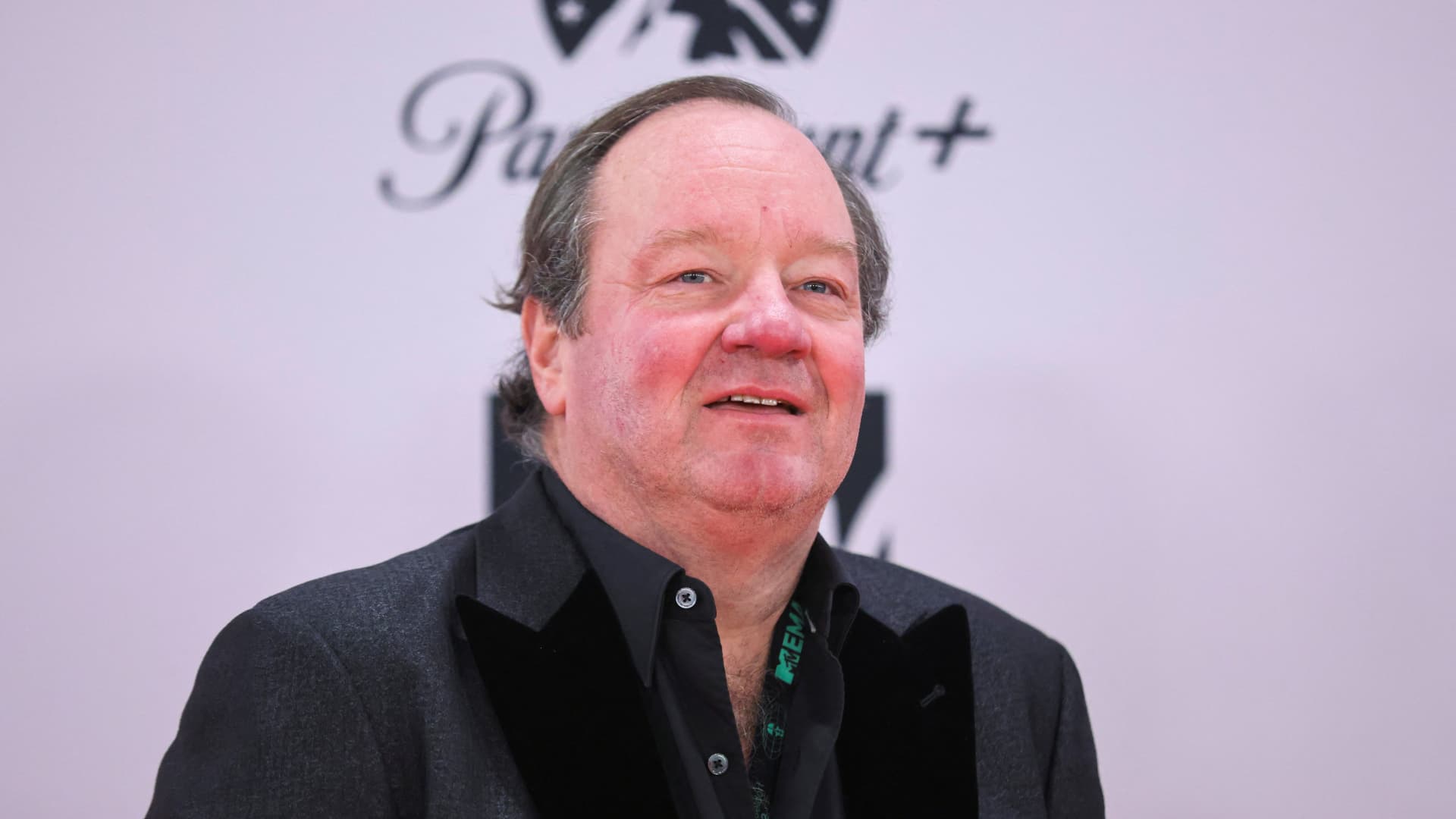

Paramount CEO announces layoffs as cost pressures, take-private talks build

Paramount Global announced layoffs, as the company tries to cut costs while it faces acquisition interest.

Evergrande shares halted after Hong Kong court orders liquidation

Shares of China Evergrande plunged over 20% in early trading on Monday before being halted.

Wayfair shares surge after home goods retailer announces 1,650 job cuts, 13% of workforce

Digital home goods retailer Wayfair is cutting 13% of its global workforce as it looks to trim down its structure, cut layers of management and reduce costs.

Macy's to cut more than 2,300 jobs, about 3.5% of its workforce, and close five stores

The legacy department store Macy's is aiming to trim costs and turn around slowing sales.

Layoffs at Corporate offices = automation and AI. All those "spreadsheet" jobs that can be done remote = outsourced to India or AI. Will be interesting to see how many people will be bragging about working from home in their pajamas soon.

Levi Strauss plans to cut at least 10% of its global corporate workforce in restructuring

Levi's announced the layoffs as the apparel retailer reported fourth-quarter earnings.www.cnbc.com

Paramount CEO announces layoffs as cost pressures, take-private talks build

Paramount Global announced layoffs, as the company tries to cut costs while it faces acquisition interest.www.cnbc.com

Evergrande shares halted after Hong Kong court orders liquidation

Shares of China Evergrande plunged over 20% in early trading on Monday before being halted.www.cnbc.com

Wayfair shares surge after home goods retailer announces 1,650 job cuts, 13% of workforce

Digital home goods retailer Wayfair is cutting 13% of its global workforce as it looks to trim down its structure, cut layers of management and reduce costs.www.cnbc.com

Macy's to cut more than 2,300 jobs, about 3.5% of its workforce, and close five stores

The legacy department store Macy's is aiming to trim costs and turn around slowing sales.www.cnbc.com

The only thing America has increased production on are "excuses".Layoffs at Corporate offices = automation and AI. All those "spreadsheet" jobs that can be done remote = outsourced to India or AI. Will be interesting to see how many people will be bragging about working from home in their pajamas soon.

Running a country on "excuses" is also unsustainable.

Coming from the heavy industrial construction world, an "excuse" would result in a quick trip to the exit gate with a pink slip.

Follow the money.. Rather the "lack of money".

www.foxbusiness.com

www.foxbusiness.com

US economy set to 'slow noticeably' as consumer spending loses steam: 'Last hurrah'

Consumer spending is set to slow precipitously in 2024 as the job market softens and the economy continues to cool, according to Wells Fargo analysts.

2% compounded yearly for 10 years is a net 21.9% increase.2% inflation is a "bad number".

2% inflation rate is a number "pulled out of thin air".

2% inflation is a Government propaganda tool.

2% inflation rate makes the buying power of your USD less and less, year after year.

2% inflation is something you should start to question.

No 'economic collapse': Top Citi strategist says healthier economic growth is coming

The global economy does not need a "collapse" in order to bring inflation back to target and return to sustainable growth, according to Citi's Steven Wieting.www.cnbc.com

2% compounded yearly for 20 years is a net 48.6% increase.

Any inflation at all erodes the value of your dollars.

Today's Snake Oil salesman... Ken Griffin

However, Griffin noted that the current level of federal spending has created an economy that “feels really good right now,” but could come at a cost. “This government spending has got to get in check. It’s creating [a] bit of euphoria right now, but it will come with a hangover,” said Griffin.

www.cnbc.com

www.cnbc.com

However, Griffin noted that the current level of federal spending has created an economy that “feels really good right now,” but could come at a cost. “This government spending has got to get in check. It’s creating [a] bit of euphoria right now, but it will come with a hangover,” said Griffin.

Citadel's Ken Griffin says the economy looks 'pretty damn good right now'

Citadel CEO Ken Griffin believes the U.S. economy is in a better position than it was last fall, but warns that high fiscal spending could pose risks.

Anybody says economy is fine - ask them how much would it cost to feed a family of 4 at "Five Guys"?

The more I talk to people, the more I just shake my head.Anybody says economy is fine - ask them how much would it cost to feed a family of 4 at "Five Guys"?

I remember back during the "Great Recession" the news people would run these two stories, side by side.

"You are drowning in debt.... but... pay off your credit cards"... !

Deja Vu

"You are drowning in debt.... but... pay off your credit cards"... !

Deja Vu

Credit card delinquencies surged in 2023, indicating 'financial stress,' New York Fed says

Debt that has transitioned into "serious delinquency," or 90 days or more past due, increased across the board during the year,

Decade of Debt

The world is looking at a debt crisis that will span the next 10 years and it’s not going to end well, economist Arthur Laffer has warned, with global borrowings hitting a record of $307.4 trillion last September.

Both high-income countries as well as emerging markets have seen a substantial rise in their debt piles, which has grown by a $100 trillion from a decade ago, fueled in part by a high interest rate environment.

“I predict that the next 10 years will be the Decade of Debt. Debt globally is coming to a head. It will not end well,” Laffer, who is President at investment and wealth advisory Laffer Tengler Investments, told CNBC.

As a share of the global gross domestic product, debt has risen to 336%. This compares to an average debt-to-GDP ratio of 110% in 2012 for advanced economies, and 35% for emerging economies. It was 334% in the fourth quarter of 2022, according to the most recent global debt monitor report by the Institute of International Finance.

www.cnbc.com

www.cnbc.com

The world is looking at a debt crisis that will span the next 10 years and it’s not going to end well, economist Arthur Laffer has warned, with global borrowings hitting a record of $307.4 trillion last September.

Both high-income countries as well as emerging markets have seen a substantial rise in their debt piles, which has grown by a $100 trillion from a decade ago, fueled in part by a high interest rate environment.

“I predict that the next 10 years will be the Decade of Debt. Debt globally is coming to a head. It will not end well,” Laffer, who is President at investment and wealth advisory Laffer Tengler Investments, told CNBC.

As a share of the global gross domestic product, debt has risen to 336%. This compares to an average debt-to-GDP ratio of 110% in 2012 for advanced economies, and 35% for emerging economies. It was 334% in the fourth quarter of 2022, according to the most recent global debt monitor report by the Institute of International Finance.

‘A slow fiscal death’ awaits some countries in this 'decade of debt,' says economist Art Laffer

The world is looking at a debt crisis that will span the next 10 years and it's not going to end well, economist Arthur Laffer has warned.

Feb 9 (Reuters) - Network giant Cisco is planning to restructure its business which will include laying off thousands of employees, as it seeks to focus on high-growth areas, according to three sources familiar with the matter.

The San Jose, California-based company has a total employee count of 84,900 as of fiscal 2023, according to its website.

The company is still deciding on the total number of employees to be affected by the layoffs, one person said.

The San Jose, California-based company has a total employee count of 84,900 as of fiscal 2023, according to its website.

The company is still deciding on the total number of employees to be affected by the layoffs, one person said.

MEXICO CITY, Feb 9 (Reuters) - Ratings agency Moody's on Friday downgraded its rating for Mexico's state-owned oil firm Pemex (PEMX.UL) by two notches to B3 from B1 previously, citing poorer credit quality.

Moody's, which has a negative outlook for the firm, said it assumed the company was receiving high government support, and that this support could be jeopardized by a 2024 deterioration of Mexico's fiscal conditions.

Pemex is among the world's most indebted oil companies, with financial liabilities exceeding $100 billion.

The agency said it expected a considerably higher fiscal deficit in Mexico on the back of high borrowing costs, social spending and emblematic government projects.

Moody's, which has a negative outlook for the firm, said it assumed the company was receiving high government support, and that this support could be jeopardized by a 2024 deterioration of Mexico's fiscal conditions.

Pemex is among the world's most indebted oil companies, with financial liabilities exceeding $100 billion.

The agency said it expected a considerably higher fiscal deficit in Mexico on the back of high borrowing costs, social spending and emblematic government projects.

MEXICO CITY, Feb 9 (Reuters) - Mexico's government has ordered the expropriation of a hydrogen plant at a Pemex oil refinery that was sold to French company Air Liquide during the previous administration, after officials ordered a temporary occupation of the facility last December.

The expropriation announcement from Mexico's energy ministry was published in the government's official gazette late on Thursday, citing risks to motor fuels production at the Tula refinery, owned and operated by state-run Pemex, due to the third-party supply of hydrogen.

Oil refineries use hydrogen to reduce the sulfur content in petroleum products, especially diesel.

The government's announcement also cited the need to ensure Mexico's "energy sovereignty" via the expropriation of the privately-operated facility.

The expropriation announcement from Mexico's energy ministry was published in the government's official gazette late on Thursday, citing risks to motor fuels production at the Tula refinery, owned and operated by state-run Pemex, due to the third-party supply of hydrogen.

Oil refineries use hydrogen to reduce the sulfur content in petroleum products, especially diesel.

The government's announcement also cited the need to ensure Mexico's "energy sovereignty" via the expropriation of the privately-operated facility.

When the credit card is maxed out, there won't be a new rifle under the tree next Christmas.

2% inflation is a propaganda tool.. Don't step in that bear trap.

Never trust the "Government Numbers".

www.cnbc.com

www.cnbc.com

2% inflation is a propaganda tool.. Don't step in that bear trap.

Never trust the "Government Numbers".

Prices rose more than expected in January as inflation won't go away

The consumer price index was expected to show a 0.2% increase in January, according to economists surveyed by Dow Jones.

Former Home Depot CEO sounds alarm on 'tremendous shift' in labor market

The U.S. economy may be riding out an inflation and job layoff wave, according to former Chrysler and Home Depot CEO Bob Nardelli, who shifted blame away from corporate America.

Cisco says it's cutting 5% of global workforce, amounting to over 4,000 jobs

Cisco announced plans to cut 5% of its workforce on Wednesday, the latest tech company to downsize this year.

Japan is no longer the world's third-largest economy as it slips into recession

Japan's 2023 nominal GDP came in at 591.48 trillion yen, or $4.2 trillion, while Germany's stood at 4.12 trillion euros, or $4.46 trillion.

Interest on national debt could threaten U.S. economic stability, CBO director tells House panel

The leader of the nonpartisan Congressional Budget Office alerted House members of the rising national deficit and interest costs on the national debt.

LONDON, Feb 15 (Reuters) - Britain's economy fell into a recession in the second half of 2023, a tough backdrop ahead of this year's expected election for Prime Minister Rishi Sunak who has promised to boost growth.

Gross domestic product (GDP) contracted by 0.3% in the three months to December, having shrunk by 0.1% between July and September, official data showed.

The fourth-quarter contraction was deeper than all economists' estimates in a Reuters poll, which had pointed to a 0.1% decline.

Sterling weakened against the dollar and the euro. Investors added to their bets on the Bank of England (BoE) cutting interest rates this year and businesses called for more help from the government in a budget plan due on March 6.

Thursday's data means Britain joins Japan among the Group of Seven advanced economies in a recession, although it is likely to be short-lived and shallow by historical standards. Canada has yet to report GDP data for the fourth quarter.

Gross domestic product (GDP) contracted by 0.3% in the three months to December, having shrunk by 0.1% between July and September, official data showed.

The fourth-quarter contraction was deeper than all economists' estimates in a Reuters poll, which had pointed to a 0.1% decline.

Sterling weakened against the dollar and the euro. Investors added to their bets on the Bank of England (BoE) cutting interest rates this year and businesses called for more help from the government in a budget plan due on March 6.

Thursday's data means Britain joins Japan among the Group of Seven advanced economies in a recession, although it is likely to be short-lived and shallow by historical standards. Canada has yet to report GDP data for the fourth quarter.

Inflation is working.

www.cnbc.com

www.cnbc.com

Retail sales tumbled 0.8% in January, much more than expected

Sales declined 0.8%, down from a 0.4% gain in December and worse than the estimate for a 0.3% drop.

The world economy is in trouble. Not only are there clear indications of a substantial slowdown in a number of the world’s key economies, there are also growing signs that we could be on the cusp of a worldwide wave of commercial property loan defaults. Those defaults could put great strain on the global financial system and trigger a meaningful global economic recession.

The good news is that those developments should bring in their wake lower inflation in general, and lower international energy and food prices in particular. That should help both the Federal Reserve and the European Central Bank achieve their inflation targets, which should encourage those central banks to not delay the start of an interest rate cutting cycle that would provide much needed support to a weakening world economy and a challenged financial system.

The good news is that those developments should bring in their wake lower inflation in general, and lower international energy and food prices in particular. That should help both the Federal Reserve and the European Central Bank achieve their inflation targets, which should encourage those central banks to not delay the start of an interest rate cutting cycle that would provide much needed support to a weakening world economy and a challenged financial system.

The FED Reserve will continue to sit on their hands....

More Inflation will tame inflation.

"We will need to resist the temptation to act quickly when patience is needed, and be prepared to respond agilely as the economy evolves," Daly said in a speech at the National Association for Business Economics conference in Washington, D.C.

www.morningstar.com

www.morningstar.com

More Inflation will tame inflation.

"We will need to resist the temptation to act quickly when patience is needed, and be prepared to respond agilely as the economy evolves," Daly said in a speech at the National Association for Business Economics conference in Washington, D.C.

Fed's Daly says patience is needed to finish the job on inflation

These 19 Airlines Shut Down Operations In 2023

As airlines still deal with the fall out from the pandemic, these are the 19 airlines that shut down operations in 2023.

Americans renting the roof over their heads do not buy durable goods....

WASHINGTON, Feb 27 (Reuters) - Orders for long-lasting U.S. manufactured goods fell by the most in nearly four years in January amid a sharp drop in bookings for commercial aircraft, while the outlook for business investment on equipment was mixed.

The report from the Commerce Department on Tuesday added to a series of data this month, including retail sales, housing starts and manufacturing production in suggesting the economy lost momentum at the start of the year.

WASHINGTON, Feb 27 (Reuters) - Orders for long-lasting U.S. manufactured goods fell by the most in nearly four years in January amid a sharp drop in bookings for commercial aircraft, while the outlook for business investment on equipment was mixed.

The report from the Commerce Department on Tuesday added to a series of data this month, including retail sales, housing starts and manufacturing production in suggesting the economy lost momentum at the start of the year.

The recession has been squeezing out the "Middle Men".... Another one falls.

Thrasio and other Amazon aggregators raised billions of dollars from investors looking to cash in on the third-party seller rollup craze. Aggregators bought up promising products and storefronts on Amazon, to use their data and operational expertise to turbocharge sales. But the hype began to fizzle last year as the pandemic ended, e-commerce growth slowed, and economic uncertainty increased.

www.cnbc.com

www.cnbc.com

Thrasio and other Amazon aggregators raised billions of dollars from investors looking to cash in on the third-party seller rollup craze. Aggregators bought up promising products and storefronts on Amazon, to use their data and operational expertise to turbocharge sales. But the hype began to fizzle last year as the pandemic ended, e-commerce growth slowed, and economic uncertainty increased.

Top Amazon aggregator Thrasio files for bankruptcy

Aggregators like Thrasio raised billions of dollars from investors looking to cash in on the third-party seller rollup craze.

"Who Could Be Next": Top Canadian Pension Fund Sells Manhattan Office Tower For $1, Sparking Firesale Panic | ZeroHedge

ZeroHedge - On a long enough timeline, the survival rate for everyone drops to zero

The Snake Oil Salesmen and those that publish the AI forecast are busy at work this morning. The arguements can be made both ways. How are things in your world ?

www.conference-board.org

www.conference-board.org

US Consumer Confidence

A monthly survey of US consumer attitudes, spending plans, and expectations for inflation, stock prices, and interest rates

The reporter is attempting to put some positive spin on the situation. The numbers don't lie.

WASHINGTON, March 1 (Reuters) - U.S. manufacturing slumped further in February, with a measure of factory employment falling to a seven-month low amid layoffs, but there were signs activity was on the cusp of rebounding.

The survey from the Institute for Supply Management on Friday showed customer inventories declining for a third straight month, which the ISM considered as positive for future new orders and production growth. Comments from manufacturers were also upbeat, with some saying "demand has finally picked up," and others noting they were "experiencing increased sales."

"We see some encouraging signs of life in manufacturing," said Shannon Grein, an economist at Wells Fargo in Charlotte, North Carolina.

The ISM said its manufacturing PMI fell to 47.8 last month from 49.1 in January. It was the 16th straight month the PMI remained below 50, which indicates contraction in manufacturing. That is the longest such stretch since the period from August 2000 to January 2002.

WASHINGTON, March 1 (Reuters) - U.S. manufacturing slumped further in February, with a measure of factory employment falling to a seven-month low amid layoffs, but there were signs activity was on the cusp of rebounding.

The survey from the Institute for Supply Management on Friday showed customer inventories declining for a third straight month, which the ISM considered as positive for future new orders and production growth. Comments from manufacturers were also upbeat, with some saying "demand has finally picked up," and others noting they were "experiencing increased sales."

"We see some encouraging signs of life in manufacturing," said Shannon Grein, an economist at Wells Fargo in Charlotte, North Carolina.

The ISM said its manufacturing PMI fell to 47.8 last month from 49.1 in January. It was the 16th straight month the PMI remained below 50, which indicates contraction in manufacturing. That is the longest such stretch since the period from August 2000 to January 2002.

I've been watching this thread since it started and thus far it's been rather one-sided and I get it, I really do. But it's also pushed back into the 3rd year of these projections and there's always been a 'you can't time the market' sentiment amongst the financial folks that study this... if we push this thread far enough into the future, it eventually will be right but are there any bulls that have been following this and have a contrary opinion? I'm not calling anyone out but would appreciate a contrary opinion to the assessments here to balance things out at least.

-LD

-LD

Welcome to the discussion. I'd certainly like to hear your perspective and opinions.I've been watching this thread since it started and thus far it's been rather one-sided and I get it, I really do. But it's also pushed back into the 3rd year of these projections and there's always been a 'you can't time the market' sentiment amongst the financial folks that study this... if we push this thread far enough into the future, it eventually will be right but are there any bulls that have been following this and have a contrary opinion? I'm not calling anyone out but would appreciate a contrary opinion to the assessments here to balance things out at least.

-LD

Hobo

Appreciate the invite sir! As an example- this year I bought several thousand shares of Rite-Aid (to be fair they've been trading as penny stocks for quite some time but I've seen this story before with Rite-Aid about 10 years or so ago (of course any successes that I could use to illustrate it would mean exiting at the right time which... that adds some other complications for sure...

-LD

-LD

Do I think a recession is coming- yes I do. Wasn't it last year that we hit all of the thresholds to declare a recession but then the definition changed... I think we did. So, and this may be a demographic conversation, but if you were under 40, what's the recommendation for the group think here as far as putting all their retirement savings in bonds or to keep buying stocks? Wish I had an answer for the group but I don't. I'd say that history suggests that the 'always be buying' strategy with regards to retirement accounts is likely in our best interest but everything's a gamble too and past performance is no guarantee of future returns.

-LD

-LD

As a humble request- what would this group recommend to prepare investors for the inevitable recession? Consumer Stables? Not intended as a challenge but just wanted to inject some other thoughts to this thread if nobody minds. Last question- for our 'seasoned' investors that contribute to the conversation, how many times have you seen in your investing experience when everything looked dire like it does today only to be surprised that the market reacted differently? If nothing else just trying to solicit some contrary opinions for this.

-LD

-LD

Last edited:

The Personal "Recession" of 2024. Go woke, go broke. Faggots.

www.foxnews.com

www.foxnews.com

University of Florida fires all DEI employees in compliance with state law

The University of Florida is terminating all DEI positions and administrative appointments in compliance with state law, according to a memo it sent Friday.

I can’t see the future, but we should have been in a recession 2 years ago.I've been watching this thread since it started and thus far it's been rather one-sided and I get it, I really do. But it's also pushed back into the 3rd year of these projections and there's always been a 'you can't time the market' sentiment amongst the financial folks that study this... if we push this thread far enough into the future, it eventually will be right but are there any bulls that have been following this and have a contrary opinion? I'm not calling anyone out but would appreciate a contrary opinion to the assessments here to balance things out at least.

-LD

However, I don’t fight the trend either, and the trend in S&P 500 has been to go up. Forever. I DCA quality stonks at every opportunity.

I started to tag you and S3th when I made my request to LuckyDuck to enter this discussion.I can’t see the future, but we should have been in a recession 2 years ago.

However, I don’t fight the trend either, and the trend in S&P 500 has been to go up. Forever. I DCA quality stonks at every opportunity.

You and I were thinking the recession would take form 2 years ago.

So... Why did it not start 2 years ago ?

The media hasn't been instructed to light the fuse to spook investors to the exits just yet.

If the economic data we've been seeing for the past 2-3 years was happening during a republican controlled presidency, all you would hear on the TV and radio would be doom and gloom.

interesting as i live close to gainesville and worked at their hospital 20yr. they were "woke" "DEI" waaay before those concepts were identified. the amount of mindless political correctness was pervasive 30years ago. glad ron is back being governor and trying to clean out the augean stable.The Personal "Recession" of 2024. Go woke, go broke. Faggots.

University of Florida fires all DEI employees in compliance with state law

The University of Florida is terminating all DEI positions and administrative appointments in compliance with state law, according to a memo it sent Friday.www.foxnews.com

I dabbled in Rite Aid back in 1998 - 99.... Few timed their exit correctly. A lot of propaganda to "stick with it"... Almost another Enron.Appreciate the invite sir! As an example- this year I bought several thousand shares of Rite-Aid (to be fair they've been trading as penny stocks for quite some time but I've seen this story before with Rite-Aid about 10 years or so ago (of course any successes that I could use to illustrate it would mean exiting at the right time which... that adds some other complications for sure...

-LD

US is deficit spending at around 10% of GDP!

They are pumping it up.

Buffet actually called it last summer.

They are pumping it up.

Buffet actually called it last summer.

I will address the '"always be buying' strategy with regards to retirement accounts." With a foot note below.Do I think a recession is coming- yes I do. Wasn't it last year that we hit all of the thresholds to declare a recession but then the definition changed... I think we did. So, and this may be a demographic conversation, but if you were under 40, what's the recommendation for the group think here as far as putting all their retirement savings in bonds or to keep buying stocks? Wish I had an answer for the group but I don't. I'd say that history suggests that the 'always be buying' strategy with regards to retirement accounts is likely in our best interest but everything's a gamble too and past performance is no guarantee of future returns.

-LD

I had both IRA's and SEP-IRA's for the self employed. When they were first implemented the programs were great. When the politicians started to notice how much money was being stored in IRA's the elected officials / Congress changed the rules.... More than one time over a few years. Soon they had gutted the benefits of the IRA's. Those that bailed paid severe penalties. All of this is from my memory of the situation.

When America was being settled, the US Government made many "treaties" with the Indians. The Indians now say the treaties were always good for the Government. When the treaty was no longer good for the Government... The Government broke the treaty. Nothing has changed. Careful putting your money where the Government can track it and change the rules. JMHO

1974

Background on IRAs Deductible IRAs were first introduced in the United States in 1974 as a tax- preferred savings vehicle for those without pensions. From 1982-1986, all working taxpayers up to age 70.5 were eligible for tax-deductible contributions to an IRA.

Similar threads

- Replies

- 84

- Views

- 4K

- Replies

- 26

- Views

- 2K

- Replies

- 39

- Views

- 2K