Crude oil prices dropped sharply on Tuesday, with WTI falling by more than 4 percent as traders appear spooked by the consumer price index, which increased by 3.1 percent from November 2022 to November 2023, The Labor Department said on Tuesday. The CPI rose 0.1 percent from October to November, the most recent data showed.

Join the Hide community

Get access to live stream, lessons, the post exchange, and chat with other snipers.

Register

Download Gravity Ballistics

Get help to accurately calculate and scope your sniper rifle using real shooting data.

Install the app

How to install the app on iOS

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Recession - 2022 / 2023 / 2024

- Thread starter Hobo Hilton

- Start date

The FED is hoping for a miracle... In the mean time:

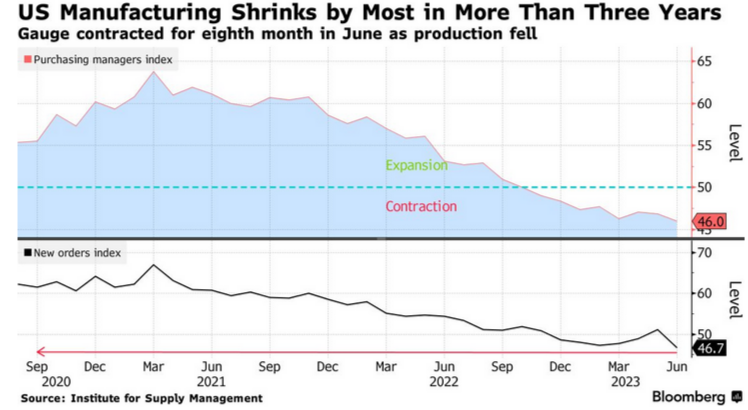

U.S. manufacturing activity has declined for the 13th consecutive month, making this an unusually lengthy downturn. The manufacturing purchasing managers index by the Institute for Supply Management (ISM) clocked in at 46.7 (14th percentile for all months since 1980) in November 2023, marking the 13th straight month the index has dipped below the 50-point threshold since November 2022.

www.cnbc.com

www.cnbc.com

oilprice.com

oilprice.com

U.S. manufacturing activity has declined for the 13th consecutive month, making this an unusually lengthy downturn. The manufacturing purchasing managers index by the Institute for Supply Management (ISM) clocked in at 46.7 (14th percentile for all months since 1980) in November 2023, marking the 13th straight month the index has dipped below the 50-point threshold since November 2022.

Fed holds rates steady, indicates three cuts coming in 2024

The Federal Reserve on Wednesday held its key interest rate steady for the third straight time and set the table for multiple cuts to come in 2024 and beyond.

Oil Demand Will Take a Hit from Yet Another Decline in U.S. Manufacturing | OilPrice.com

U.S. manufacturing activity has declined for the 13th consecutive month, making this an unusually lengthy downturn, but in diesel demand has not followed a similar trajectory

Shows high high priced shit is/was.The FED is hoping for a miracle... In the mean time:

U.S. manufacturing activity has declined for the 13th consecutive month, making this an unusually lengthy downturn. The manufacturing purchasing managers index by the Institute for Supply Management (ISM) clocked in at 46.7 (14th percentile for all months since 1980) in November 2023, marking the 13th straight month the index has dipped below the 50-point threshold since November 2022.

Fed holds rates steady, indicates three cuts coming in 2024

The Federal Reserve on Wednesday held its key interest rate steady for the third straight time and set the table for multiple cuts to come in 2024 and beyond.www.cnbc.com

Oil Demand Will Take a Hit from Yet Another Decline in U.S. Manufacturing | OilPrice.com

U.S. manufacturing activity has declined for the 13th consecutive month, making this an unusually lengthy downturn, but in diesel demand has not followed a similar trajectoryoilprice.com

The FED is hoping for a miracle... In the mean time:

U.S. manufacturing activity has declined for the 13th consecutive month, making this an unusually lengthy downturn. The manufacturing purchasing managers index by the Institute for Supply Management (ISM) clocked in at 46.7 (14th percentile for all months since 1980) in November 2023, marking the 13th straight month the index has dipped below the 50-point threshold since November 2022.

Fed holds rates steady, indicates three cuts coming in 2024

The Federal Reserve on Wednesday held its key interest rate steady for the third straight time and set the table for multiple cuts to come in 2024 and beyond.www.cnbc.com

Oil Demand Will Take a Hit from Yet Another Decline in U.S. Manufacturing | OilPrice.com

U.S. manufacturing activity has declined for the 13th consecutive month, making this an unusually lengthy downturn, but in diesel demand has not followed a similar trajectoryoilprice.com

Stagflation is a very, very bad place to be in. Last time we were in it 'bad' was when Jimmy Carter tanked the economy and Japan was starting to surge (our steel industry and car industry tanked simultaneously) and causing huge (IIRC 12 percent) unemployment... the worst since the Depression. In addition, the OPEC second embargo was whacking energy prices... and war with the USSR was distinctly on the horizon... again stoking consumer fears.

When manufacturing is down, unemployment is up, consumption is down, and inflation is soaring.. you have Stagflation. (Stagnation and inflation.)

It's a bad place to be in.

Oh and unemployment in the US is WAY over 12 percent. Because back then it was... unemployment. Today the number is intentionally kept low because it only counts 'potential workers LOOKING' for jobs. Welfare shit and dirtbags who don't look for jobs aren't included. Nor are the ill, the retired, etc. Back in the day... it was working age population. Now it's all statistically warped for political reasons.

So... yeah. We are in a bad place economically.

Ok, well, back to Israel. May they have a great Christmas killing Hamas!

Sirhr

Don't worry, the Biden Gov will redefine everything. The new definition, will paint all of this as exceptional leadership.Stagflation is a very, very bad place to be in. Last time we were in it 'bad' was when Jimmy Carter tanked the economy and Japan was starting to surge (our steel industry and car industry tanked simultaneously) and causing huge (IIRC 12 percent) unemployment... the worst since the Depression. In addition, the OPEC second embargo was whacking energy prices... and war with the USSR was distinctly on the horizon... again stoking consumer fears.

When manufacturing is down, unemployment is up, consumption is down, and inflation is soaring.. you have Stagflation. (Stagnation and inflation.)

It's a bad place to be in.

Oh and unemployment in the US is WAY over 12 percent. Because back then it was... unemployment. Today the number is intentionally kept low because it only counts 'potential workers LOOKING' for jobs. Welfare shit and dirtbags who don't look for jobs aren't included. Nor are the ill, the retired, etc. Back in the day... it was working age population. Now it's all statistically warped for political reasons.

So... yeah. We are in a bad place economically.

Ok, well, back to Israel. May they have a great Christmas killing Hamas!

Sirhr

Transitional.Don't worry, the Biden Gov will redefine everything. The new definition, will paint all of this as exceptional leadership.

It will get worse before it gets worse.

America consumes more than it produces.

The Institute for Supply Management's manufacturing gauge indicated contraction for a 13th straight month in November.

..... But .....

Retail sales rose 0.3% in November,

The rise in retail sales is nothing more than inflation.

Does anyone think this is sustainable ?

www.wita.org

www.wita.org

www.bloomberg.com

www.bloomberg.com

www.cnbc.com

www.cnbc.com

The Institute for Supply Management's manufacturing gauge indicated contraction for a 13th straight month in November.

..... But .....

Retail sales rose 0.3% in November,

The rise in retail sales is nothing more than inflation.

Does anyone think this is sustainable ?

The U.S. Trade Deficit - WITA

Home Previous Page Documents What is the Trade Deficit? Information Courtesy Congressional Research Service, IF11016 What is the trade deficit? The “trade deficit” generally is used to refer to...

www.wita.org

www.wita.org

US Manufacturing Production Bounces Back, Boosted by Autos

US factory production rebounded in November, reflecting a pickup in activity at carmakers and parts suppliers following the end of the United Auto Workers’ strike.

Retail sales rose 0.3% in November vs. expectations for a decline

Retail sales rose 0.3% in November, stronger than the 0.2% decline in October and better than the Dow Jones estimate for a decrease of 0.1%.

more good news

*I wonder who's going to buy the processing plants? My 2 cents, is China

Alaska’s largest seafood processor announces restructuring of operations, including selling processing plants

*I wonder who's going to buy the processing plants? My 2 cents, is China

US homelessness up 12% to highest reported level as rents soar and coronavirus pandemic aid lapses

WASHINGTON (AP) — The United States experienced a dramatic 12% increase in homelessness to its highest reported level as soaring rents and a decline in coronavirus pandemic assistance combined to put housing out of reach for more Americans, federal officials said Friday.

“But then all of that got kind of masked by the sudden, very rapid influx of new asylum seekers, and that is a crisis for which the city and state were more unprepared to deal with.”

US homelessness up 12% to highest reported level as rents soar and coronavirus pandemic aid lapses

WASHINGTON (AP) — The United States experienced a dramatic 12% increase in homelessness to its highest reported level as soaring rents and a decline in coronavirus pandemic assistance combined to put housing out of reach for more Americans, federal officials said Friday.www.wbrz.com

Open borders = millions of new people with no place to live = Americans bumped out of shelters therefore "homeless".

I agree. To add to the "wedge" being driven within the housing arena, look at these two numbers.“But then all of that got kind of masked by the sudden, very rapid influx of new asylum seekers, and that is a crisis for which the city and state were more unprepared to deal with.”

Open borders = millions of new people with no place to live = Americans bumped out of shelters therefore "homeless".

According to estimates from the National Association of Realtors, 28% of existing home transactions were all-cash sales in December 2022, up from 26.0% in November 2022 and 23.0% in December 2021.

Nearly 40% of homeowners in the country now own their homes outright, marking a record high in mortgage-free ownership as of 2022, Bloomberg reported Friday (Nov. 18).

The burden to finance housing the homeless is on the guy that is still working and has his own house paid for. Moving closer to the great reset.

All goes well in the USA, move along

www.cnbc.com

www.cnbc.com

Japan's Nippon Steel to buy U.S. Steel in a $14.9 billion deal

Japan's Nippon Steel clinched a deal on Monday to buy U.S. Steel for $14.9 billion in cash, prevailing in an auction for the 122-year-old iconic steelmaker.

Japan’s Nippon Steel to buy U.S. Steel in $14.9 billion deal

Seems like a pretty solid indicator that things are going the wrong way for at least the bottom half.

US homelessness up 12% to highest reported level as rents soar and coronavirus pandemic aid lapses

WASHINGTON (AP) — The United States experienced a dramatic 12% increase in homelessness to its highest reported level as soaring rents and a decline in coronavirus pandemic assistance combined to put housing out of reach for more Americans, federal officials said Friday.www.wbrz.com

"That's an 86% crash in the S&P and a 92% crash in the NASDAQ. And crypto, it's going to be 96%. So that is a big deal," the economist added. "And real estate, by the way, is only projected, by me, to go back to its 2012 lows... but that's a 50% crash for the average house, which went down 34% in the last crash, more than the Great Depression, more than any time in history. That is what's going to hurt people the most."

www.foxbusiness.com

www.foxbusiness.com

US economist predicts 2024 will bring 'biggest crash of our lifetime'

As Americans and the markets ready to enter the new year, financial author Harry Dent warns 2024 will bring the "everything bubble" to a burst "of a lifetime."

Government is printing way too much money. All modern examples of these led to massive inflation. Not price crashes.

I don’t see any of that happening. Even if a 50% housing crash happened, most people who bought before 2023 would still have equity or be at break even."That's an 86% crash in the S&P and a 92% crash in the NASDAQ. And crypto, it's going to be 96%. So that is a big deal," the economist added. "And real estate, by the way, is only projected, by me, to go back to its 2012 lows... but that's a 50% crash for the average house, which went down 34% in the last crash, more than the Great Depression, more than any time in history. That is what's going to hurt people the most."

US economist predicts 2024 will bring 'biggest crash of our lifetime'

As Americans and the markets ready to enter the new year, financial author Harry Dent warns 2024 will bring the "everything bubble" to a burst "of a lifetime."www.foxbusiness.com

The Government will be printing additional surplus of money next year. Much of it will go to pay the interest on the National Debt.Government is printing way too much money. All modern examples of these led to massive inflation. Not price crashes.

The USD is well on it's way to becoming worthless.

The only thing that will kill inflation is more inflation.

It will get worse before it get's worse.

I think those that bought roughly a year ago are going to be the ones that are going to really feel it.I don’t see any of that happening. Even if a 50% housing crash happened, most people who bought before 2023 would still have equity or be at break even.

A factor that will lessen the blow on housing is a 28% of recent sales have been "cash sales". Sure, it shows as a loss but it's just on paper.I don’t see any of that happening. Even if a 50% housing crash happened, most people who bought before 2023 would still have equity or be at break even.

The only thing that will tame inflation is more inflation.

When your USD becomes worthless you will look back and ask "Where else should I have put my money" ?

Worldwide

The UK economy shrank by more than expected in October, as higher interest rates squeezed consumers and bad weather swept the country.

The economy fell 0.3% during the month, after growth of 0.2% in September.

Household spending has been dented by rate rises as the Bank of England tries to tackle inflation. It is due to make its next rate decision on Thursday.

www.bbc.com

www.bbc.com

When your USD becomes worthless you will look back and ask "Where else should I have put my money" ?

Worldwide

The UK economy shrank by more than expected in October, as higher interest rates squeezed consumers and bad weather swept the country.

The economy fell 0.3% during the month, after growth of 0.2% in September.

Household spending has been dented by rate rises as the Bank of England tries to tackle inflation. It is due to make its next rate decision on Thursday.

UK economy falls unexpectedly in October as higher rates bite

Higher interest rates and bad weather hold back growth as the economy continues to stagnate.

Make more money = Spend more money

Worldwide

Dec 20 (Reuters) - Uber Technologies (UBER.N) will raise the minimum wage it pays drivers in France as part of a wider agreement between ride-hailing companies and driver representatives in the country, the company said on Wednesday.

Drivers will earn a minimum income 9 euros ($9.85) per trip, up from 7.65 euros they were earning previously, and will have a guaranteed income of 30 euros per hour and 1 euro per kilometer.

The changes in hourly income guarantee and minimum wage per kilometer will be implemented by May next year, while the wage increase in revenue per trip will be in effect from February.

Worldwide

Dec 20 (Reuters) - Uber Technologies (UBER.N) will raise the minimum wage it pays drivers in France as part of a wider agreement between ride-hailing companies and driver representatives in the country, the company said on Wednesday.

Drivers will earn a minimum income 9 euros ($9.85) per trip, up from 7.65 euros they were earning previously, and will have a guaranteed income of 30 euros per hour and 1 euro per kilometer.

The changes in hourly income guarantee and minimum wage per kilometer will be implemented by May next year, while the wage increase in revenue per trip will be in effect from February.

Another one bites the dust.

Dec 21 (Reuters) - High-speed freight transportation company Hyperloop One will shut down, having failed to win any contract to build a working hyperloop, Bloomberg News reported on Thursday citing people familiar with the matter.

The Los-Angeles-based firm, which completed the world's first passenger ride on a super high-speed levitating pod system in 2020, will sell off its remaining assets, while the employment for its remaining employees will end on Dec. 31 this year, according to the report.

Dec 21 (Reuters) - High-speed freight transportation company Hyperloop One will shut down, having failed to win any contract to build a working hyperloop, Bloomberg News reported on Thursday citing people familiar with the matter.

The Los-Angeles-based firm, which completed the world's first passenger ride on a super high-speed levitating pod system in 2020, will sell off its remaining assets, while the employment for its remaining employees will end on Dec. 31 this year, according to the report.

US Dollar Index..... 3 months of steady decline. It can only be propped up for just so long.

Worldwide

Worldwide

I read the fed wants the dollar to drop to keep the rest of the world from massive inflation and oil/energy costs in USD. May also explain Japan's sudden pivot from announced rate hikes a few weeks back.

All of these "maneuvers" have been implemented during past recessions. Paul Volcker was the only one who had success by raising the interest rate above the inflation rate. This mess is so politicized there may never be a happy ending.I read the fed wants the dollar to drop to keep the rest of the world from massive inflation and oil/energy costs in USD. May also explain Japan's sudden pivot from announced rate hikes a few weeks back.

Previously the national debt has never been this high.

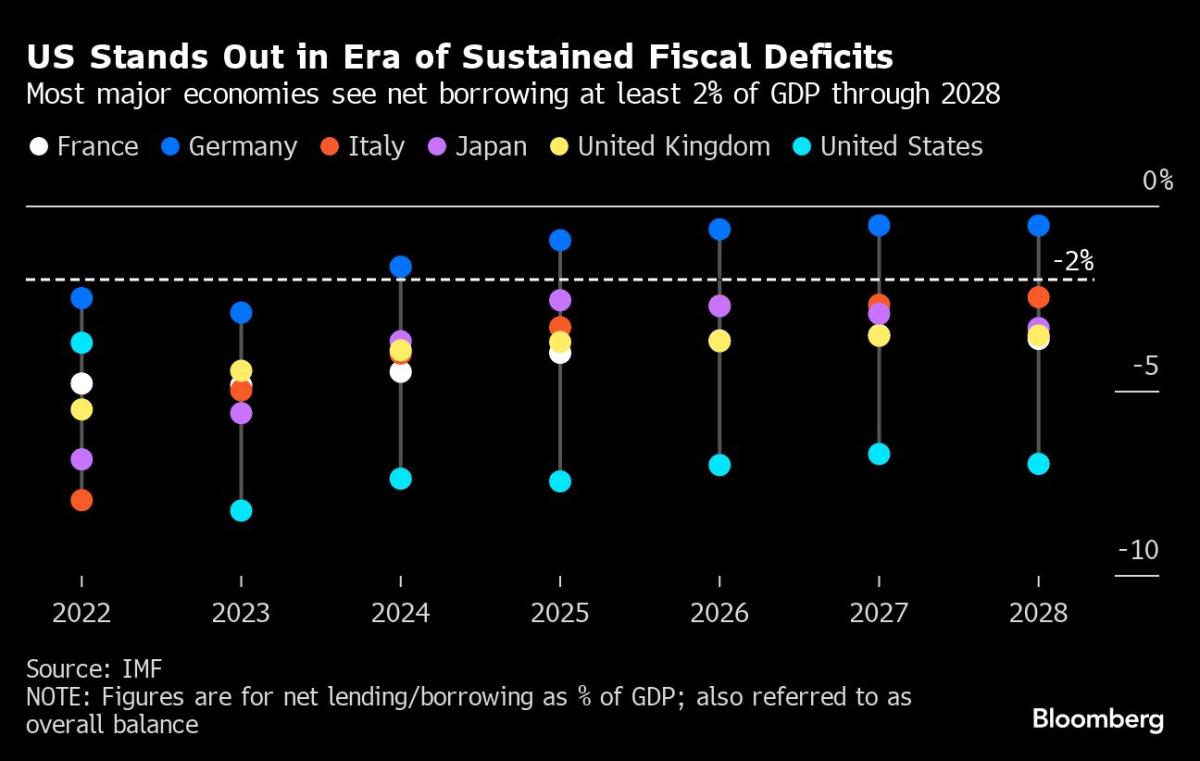

The U.S. government on Friday posted a $1.695 trillion budget deficit in fiscal 2023, a 23% jump from the prior year as revenues fell and outlays for Social Security, Medicare and record-high interest costs on the federal debt rose.

The Treasury Department said the deficit was the largest since a COVID-fueled $2.78 trillion gap in 2021. It marks a major return to ballooning deficits after back-to-back declines during President Joe Biden’s first two years in office.

Biden Rescue Operation Could Tank The Economy

From Peter Reagan at Birch Gold Group For the last two years, Federal Reserve Chairman Jerome Powell has been maintaining a moderate stance on raising rates to combat a historic wave of red-hot inf…

www.theburningplatform.com

"Since 2009, this has been 100% artificial, unprecedented money printing and deficits; $27 trillion over 15 years, to be exact. This is off the charts, 100% artificial, which means we're in a dangerous state," Harry Dent told Fox News Digital. "I think 2024 is going to be the biggest single crash year we'll see in our lifetimes."

"I'm the guy that's praying for a crash while everybody else is not. We need to get back down to normal, and we need to send a message to central banks," he continued. "This should be a lesson I don't think we'll ever revisit. I don't think we'll ever see a bubble for any of our lifetimes again."

www.foxbusiness.com

www.foxbusiness.com

"I'm the guy that's praying for a crash while everybody else is not. We need to get back down to normal, and we need to send a message to central banks," he continued. "This should be a lesson I don't think we'll ever revisit. I don't think we'll ever see a bubble for any of our lifetimes again."

US economist predicts 2024 will bring 'biggest crash of our lifetime'

As Americans and the markets ready to enter the new year, financial author Harry Dent warns 2024 will bring the "everything bubble" to a burst "of a lifetime."

Have a healthy cash reserve.With all this gloom & financial doom for 2024 how do American working families prepare to survive?

Or is it falling dominos once it starts they all tumble over.

If the fed tries to stave off a massive crash they will accelerate money printing leading to massive inflation and destruction of those cash reserves. They claim their policy is 2% inflation, but that will go out the window when the economy is crashing. Market will then melt up even in a recession.

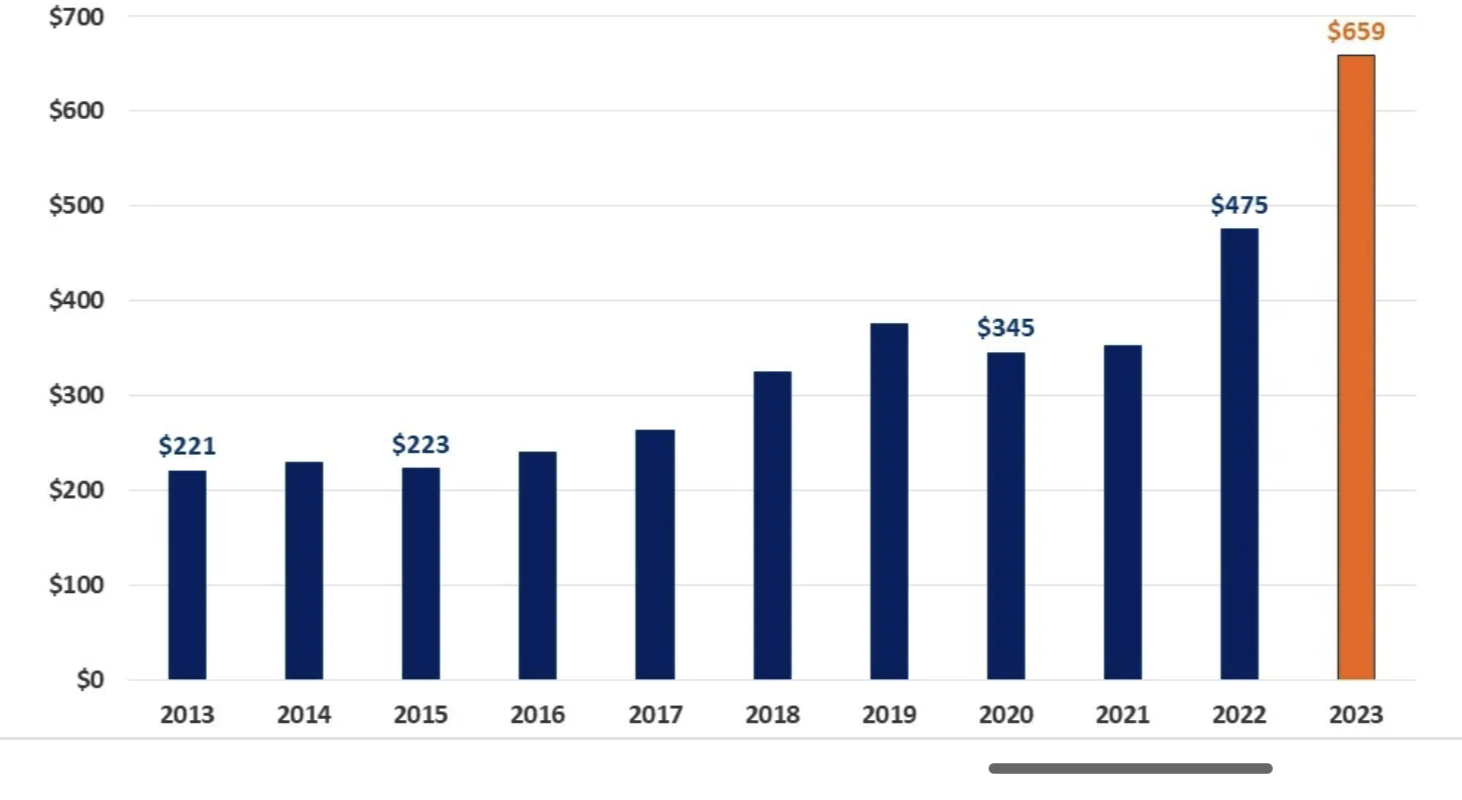

Even if somehow we don't have a hard landing, massive money printing is still a near certainty for the foreseeable future. Revenues are down, debt spending is up, interest payments are skyrocketing, and old gov debt has to roll over at current interest rates. Here are annual interest payments on gov debt.

Pay off your house or at least your car so you'll have somewhere to live.

Invest in primers, powder, silver and gold.

I'm trying to play all sides now. My predictions have been wrong for two years so WTF do I know.

Even if somehow we don't have a hard landing, massive money printing is still a near certainty for the foreseeable future. Revenues are down, debt spending is up, interest payments are skyrocketing, and old gov debt has to roll over at current interest rates. Here are annual interest payments on gov debt.

Pay off your house or at least your car so you'll have somewhere to live.

Invest in primers, powder, silver and gold.

I'm trying to play all sides now. My predictions have been wrong for two years so WTF do I know.

That is an excellent question. There is no "scripted answer". We are all plotting a journey down an unknown path.With all this gloom & financial doom for 2024 how do American working families prepare to survive?

Or is it falling dominos once it starts they all tumble over.

Long ago when the label "survivalist" first came on the scene some of the author's did unscientific surveys of people, in general. About 80% of the population never considered survival, 10% were considering the concept and 10% were actually moving to retreats and making preparations. I don't think the numbers have changed much over the past 50 years. The challenges to survival have grown exponentially.

A few things I have discovered along the way. "We" can't save them all.

The majority live in denial of a collapse. Denial is a warm and fuzzy place. Best leave them there and go on about your business.

I mention "Regional" frequently. Study your region. If you can't do anything else, situate yourself to where you can survive longer than 50% of those around you. Law's of nature / survival of the Fittest. Along that path you will meet the fittest and hopefully find some common ground.

Yes, and lots of beansHave a healthy cash reserve.

A portion of my "investing" is in myself. I had shoulder surgery 2 weeks ago. All well planned out. Waited 6 months for the best surgeon, got my ducks in order on my homestead, paid some bills in advance (just in case) and will rehab during this winter. My plan is to be healthy when it comes time to plant my spring garden. Those of you waiting for the perfect time to get medical procedures taken care may be waiting too long. We will see a time when eyes, joints, teeth, stomach and other body parts will not be so easy to get tuned up. People die from an ingrown toenail after wading through waste water. Take care of what you can control.If the fed tries to stave off a massive crash they will accelerate money printing leading to massive inflation and destruction of those cash reserves. They claim their policy is 2% inflation, but that will go out the window when the economy is crashing. Market will then melt up even in a recession.

Even if somehow we don't have a hard landing, massive money printing is still a near certainty for the foreseeable future. Revenues are down, debt spending is up, interest payments are skyrocketing, and old gov debt has to roll over at current interest rates. Here are annual interest payments on gov debt.

View attachment 8304062

Pay off your house or at least your car so you'll have somewhere to live.

Invest in primers, powder, silver and gold.

I'm trying to play all sides now. My predictions have been wrong for two years so WTF do I know.

Last edited:

It’s been a rough year for some household-name US retailers and businesses. As the economy emerged out of the Covid-19 pandemic, companies faced a laundry list of problems arising from high costs, supply shortages and growing competition.

As a result, several big names filed for bankruptcy in 2023.

As a result, several big names filed for bankruptcy in 2023.

14 straight months of shrinking manufacturing is what the Government is saying. Realistically, manufacturing has shrunk for the past 3 years.

One more nail in the coffin.

The numbers: A closely-watched index that measures U.S. manufacturing activity rose 0.7 percentage point to 47.4 in December, according to the Institute for Supply Management on Wednesday.

Economists surveyed by the Wall Street Journal had forecast the index to rise to 47.2%.

Any number below 50% reflects a shrinking economy. Manufacturing has contracted for 14 straight months.

Key details: The key new orders index fell 1.2 percentage points lower to 47.1 in December.

Production rose 1.8 points to 50.3 from the prior month. Employment picked up slightly but remained below 50% threshold.

Prices fell 4.7 percentage points to 45.2%. Inventories were down 0.5 percentage point to 44.3 in December. `

www.morningstar.com

www.morningstar.com

One more nail in the coffin.

The numbers: A closely-watched index that measures U.S. manufacturing activity rose 0.7 percentage point to 47.4 in December, according to the Institute for Supply Management on Wednesday.

Economists surveyed by the Wall Street Journal had forecast the index to rise to 47.2%.

Any number below 50% reflects a shrinking economy. Manufacturing has contracted for 14 straight months.

Key details: The key new orders index fell 1.2 percentage points lower to 47.1 in December.

Production rose 1.8 points to 50.3 from the prior month. Employment picked up slightly but remained below 50% threshold.

Prices fell 4.7 percentage points to 45.2%. Inventories were down 0.5 percentage point to 44.3 in December. `

U.S. manufacturing sector shrinks for 14th straight month in December

Some double talk for the morning...

Even when the manufacturing index is down for the past 14 months and the report comes in "above the consensus" the DXY jumps up.

A situation where the financial world is saying "Well... it could have been worse"... It is worse.

Both the US Government and Wall Street are totally disconnected from the Man on Main Street.

www.fxstreet.com

www.fxstreet.com

Even when the manufacturing index is down for the past 14 months and the report comes in "above the consensus" the DXY jumps up.

A situation where the financial world is saying "Well... it could have been worse"... It is worse.

Both the US Government and Wall Street are totally disconnected from the Man on Main Street.

US Dollar jumps as ISM PMIs beat expectations, FOMC minutes

The US Dollar (USD) Index trades with noteworthy gains at 102.60, having successfully reclaimed the 20-day Simple Moving Average (SMA).

Feb 1, 2022.

"My hope is when 2023 rolls in all of you guy's can say - Look, Hobo was wrong.

Let's watch it unfold."

Ok.

Better edit thread title for new year. Don't get me wrong, I'm not disagreeing that things are fucked here, there, and pretty much everywhere. But your fascination with the condition of the world is bordering on mental illness. Aside from the occasional recently woke new member, people here generally get it. So, I'm not sure if you just like preaching to the choir because no one else will listen to your sermons or if this is your version of gambling and you think if you keep doubling down, you'll finally win and then you can finally have the "I told you so" moment that you appear to desperately need.

"My hope is when 2023 rolls in all of you guy's can say - Look, Hobo was wrong.

Let's watch it unfold."

Ok.

Better edit thread title for new year. Don't get me wrong, I'm not disagreeing that things are fucked here, there, and pretty much everywhere. But your fascination with the condition of the world is bordering on mental illness. Aside from the occasional recently woke new member, people here generally get it. So, I'm not sure if you just like preaching to the choir because no one else will listen to your sermons or if this is your version of gambling and you think if you keep doubling down, you'll finally win and then you can finally have the "I told you so" moment that you appear to desperately need.

BlackRock layoffs coming as firm matures, ESG pullback and Bitcoin ETF approval

Money management firm BlackRock plans to announce layoffs of about 3 percent of its global workforce in the coming days, totaling about 600 employees.

False alarm. Everything is fine.

So, which is it ?

1 -

Altogether, card balances now total $1.08 trillion, according to the latest quarterly report from the Federal Reserve Bank of New York, a new record.

“Over the past two years, Americans’ credit card balances have skyrocketed 40%,” said Ted Rossman, senior industry analyst at Bankrate.

“While Americans are managing their credit card debt pretty well, all things considered, we are seeing pockets of trouble at the household level,” Rossman said.

2 -

A sharp drop in mortgage interest rates in December may have kickstarted this year’s spring housing market early. Rates are about a full percentage point lower than they were in October, and consumers expect they will fall even more.

Every day, 24 hours a day we are bombarded with useless, conflicting information. More and more it is difficult to separate fact from fiction. All the while the important things are buried down in the rabbit hole.

www.cnbc.com

www.cnbc.com

www.cnbc.com

www.cnbc.com

1 -

Altogether, card balances now total $1.08 trillion, according to the latest quarterly report from the Federal Reserve Bank of New York, a new record.

“Over the past two years, Americans’ credit card balances have skyrocketed 40%,” said Ted Rossman, senior industry analyst at Bankrate.

“While Americans are managing their credit card debt pretty well, all things considered, we are seeing pockets of trouble at the household level,” Rossman said.

2 -

A sharp drop in mortgage interest rates in December may have kickstarted this year’s spring housing market early. Rates are about a full percentage point lower than they were in October, and consumers expect they will fall even more.

Every day, 24 hours a day we are bombarded with useless, conflicting information. More and more it is difficult to separate fact from fiction. All the while the important things are buried down in the rabbit hole.

56 million Americans have been in credit card debt for at least a year. ‘We are seeing pockets of trouble,’ expert says

More Americans carry credit card debt from month to month as living expenses stay high, according to a new report by Bankrate.

Mortgage rate decline pulls buyers back into the housing market

The spring housing market may be getting underway a little early this year.

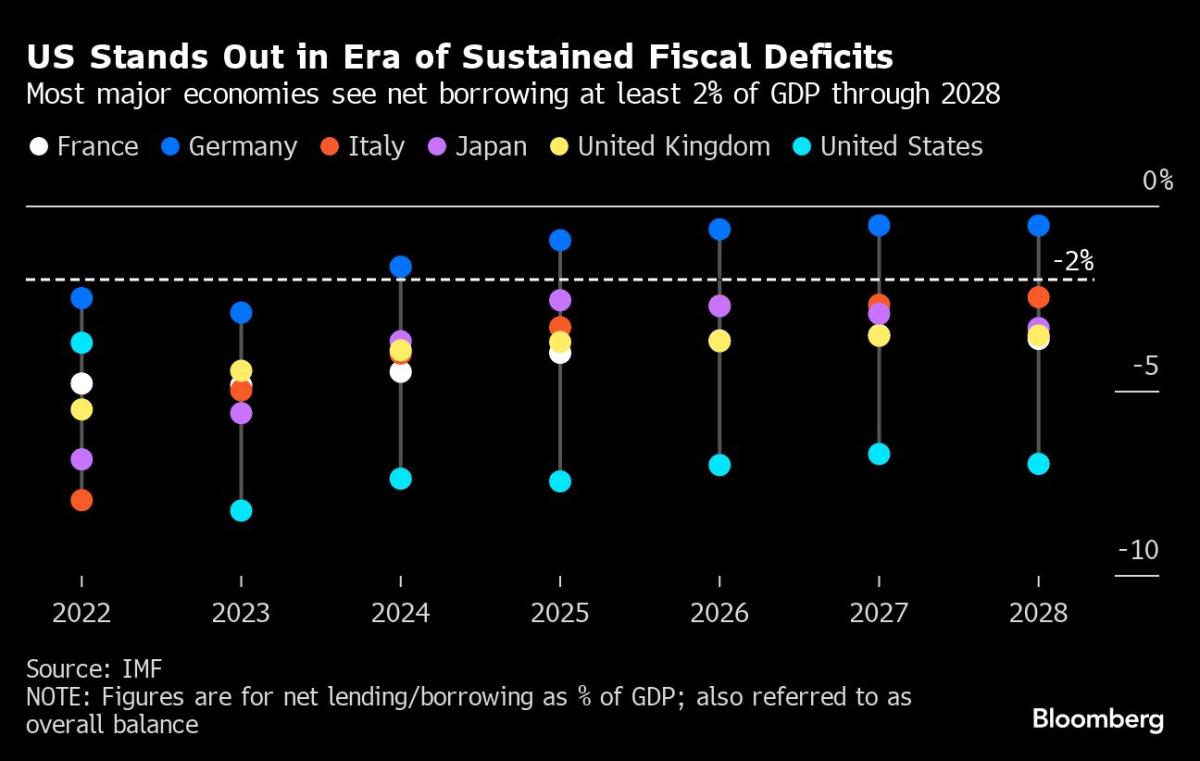

Over the next several weeks, governments from the US, UK and the eurozone will start flooding the market with bonds at a clip rarely seen before. Saddled with the kind of bloated deficits that were once unthinkable, these countries — along with Japan — will sell a net $2.1 trillion of new bonds to finance their 2024 spending plans, a 7% increase from last year, according to estimates from Bloomberg Intelligence.

ca.finance.yahoo.com

ca.finance.yahoo.com

The Bond Market Rally Is Overlooking a Soaring $2 Trillion Debt Problem

(Bloomberg) -- Right around the start of November, two words suddenly disappeared from the chatter in the bond market: debt supply. As bond prices surged across the developed world day after day, sending yields tumbling and handing investors some much-needed profits, the angst about soaring...

Let this headline sink in:

The propaganda is restless... Again, the consumer is paying full retail + inflation.... The middle man is passing it on.

www.cnbc.com

www.cnbc.com

Wholesale prices unexpectedly fell 0.1% in December in positive inflation sign

Repeatedly, over the past month, there have always been articles showing the wholesale price on an item dropped. After reading the article and getting to the last paragraph there is a line saying "The fall in wholesale prices did not reach the retail market and the US consumers".The propaganda is restless... Again, the consumer is paying full retail + inflation.... The middle man is passing it on.

Wholesale prices unexpectedly fell 0.1% in December in positive inflation sign

The producer price index fell 0.1% for the month and ended 2023 up 1% from a year ago, the Labor Department reported Friday.

JP Morgan said the same thing in 2006... Prior to the Great Recession. Guard your money.

___________

PMorgan Chase Financial Chief Jeremy Barnum sees a 'significantly higher probability' of a soft landing for the U.S. economy

The U.S. consumer continues to show signs of health, signaling a soft landing for the economy, as the U.S.'s biggest banks shared a glimpse into their collective crystal ball on Friday.

"The way we see it, the consumer is fine," said JPMorgan Chase & Co. Financial Chief Jeremy Barnum. "I think it's uncontroversial that the economic outlook has evolved to include a significantly higher probability of a soft landing. That's, I think, the consensus at this point."

JPMorgan Chase (JPM) weighed in with its outlook as part of its stronger-than-expected earnings update Friday, citing a "resilient" economy.

www.morningstar.com

www.morningstar.com

___________

PMorgan Chase Financial Chief Jeremy Barnum sees a 'significantly higher probability' of a soft landing for the U.S. economy

The U.S. consumer continues to show signs of health, signaling a soft landing for the economy, as the U.S.'s biggest banks shared a glimpse into their collective crystal ball on Friday.

"The way we see it, the consumer is fine," said JPMorgan Chase & Co. Financial Chief Jeremy Barnum. "I think it's uncontroversial that the economic outlook has evolved to include a significantly higher probability of a soft landing. That's, I think, the consensus at this point."

JPMorgan Chase (JPM) weighed in with its outlook as part of its stronger-than-expected earnings update Friday, citing a "resilient" economy.

'The consumer is fine,' says a key JPMorgan exec

I think 2023 proved beyond a shadow of a doubt that the entire stock market is controlled like a puppet on a string

Whomever the powers are that pull the string, are not ready for it to crash yet, but it will and at their command...

Whomever the powers are that pull the string, are not ready for it to crash yet, but it will and at their command...

Buy the S&P 500 with every paycheck you get for life.I think 2023 proved beyond a shadow of a doubt that the entire stock market is controlled like a puppet on a string

Whomever the powers are that pull the string, are not ready for it to crash yet, but it will and at their command...

Last edited:

Citigroup plans to cut 20,000 jobs - about 10% of its global staff - over the next two years, as it pushes to streamline operations.

The reductions are part of a sweeping reorganisation announced by boss Jane Fraser last year.

The UK-born executive, who took the helm in 2021, said 2024 would be a "turning point" for the firm.

Citi has already sold off some of its overseas operations and moved to list its Mexican unit as a standalone firm.

www.bbc.com

www.bbc.com

The reductions are part of a sweeping reorganisation announced by boss Jane Fraser last year.

The UK-born executive, who took the helm in 2021, said 2024 would be a "turning point" for the firm.

Citi has already sold off some of its overseas operations and moved to list its Mexican unit as a standalone firm.

Citigroup plans 20,000 job cuts over two years

The reductions are part of a sweeping reorganisation, and equal about 10% of the bank's global workforce.

“We have a debt problem globally. We have the highest levels of debt in a non-war period in modern history, and it’s at the corporate, household, sovereign, sub-sovereign [levels],” Adams said.

"I think those who are looking for six rate cuts are smoking some substance," Cooperman expressed, arguing that we would be "lucky" to see three reductions.

www.foxbusiness.com

www.foxbusiness.com

Billionaire investor warns over impending financial crisis: 'Nobody' knows when it will hit

Omega Family Office CEO Leon Cooperman discusses why the country's troublesome debt will contribute to the country heading towards a financial crisis

Attention Walmart shoppers, observing a price bump across my shopping excursions since the first of the year on everything. Interesting YT video on socks & undies being behind glass, not in NCF. (sand paper-wire wheels etc) ring doorbell for service. Funny lady in the store looks in my buggy/cart hands me whatever I ask for behind the lockup and sends me on my way the young grunch looking guy makes me pay in automotive, things just don’t make sense to me at times.

Similar threads

- Replies

- 84

- Views

- 4K

- Replies

- 26

- Views

- 2K

- Replies

- 39

- Views

- 2K