It takes a lot of money to live a sort of decent life these days.yeah my head hurts looking at interns that are just about to graduate and want $70k/year to start ANY job.

Again, big name colleges, not people from schools you never heard of, but still $70k to start is insane, I can't offer that for an entry level job. Most graduates are like ok thanks and moving on until they get the $70k they are looking for

Must be nice to have parents paying your bills until you find the perfect job...

Join the Hide community

Get access to live stream, lessons, the post exchange, and chat with other snipers.

Register

Download Gravity Ballistics

Get help to accurately calculate and scope your sniper rifle using real shooting data.

Install the app

How to install the app on iOS

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Inflation.......... ?

- Thread starter Hobo Hilton

- Start date

I told my kids that when my wife and I were growing up, we were told to "go to school so you could get a good job so you could earn a good living", and that this doesn’t apply anymore if we’re talking about college degrees in many cases.

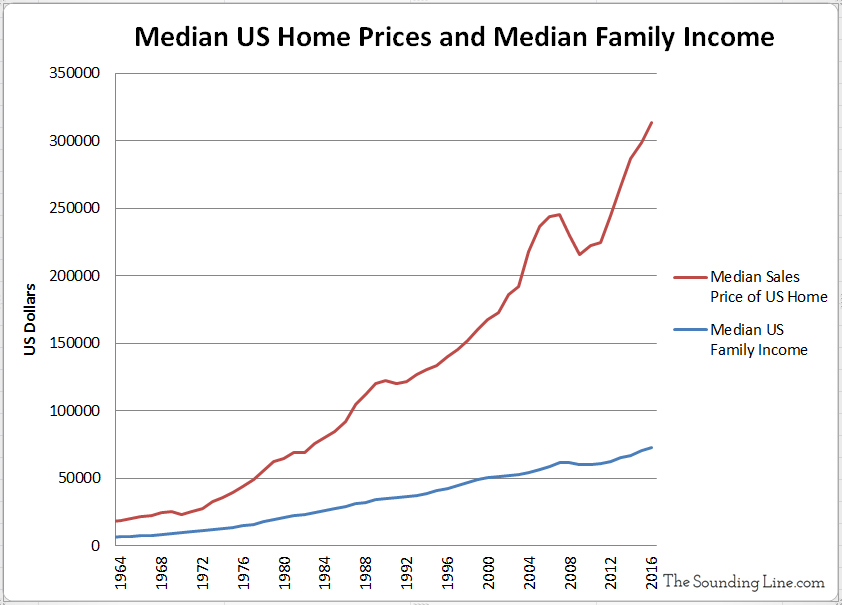

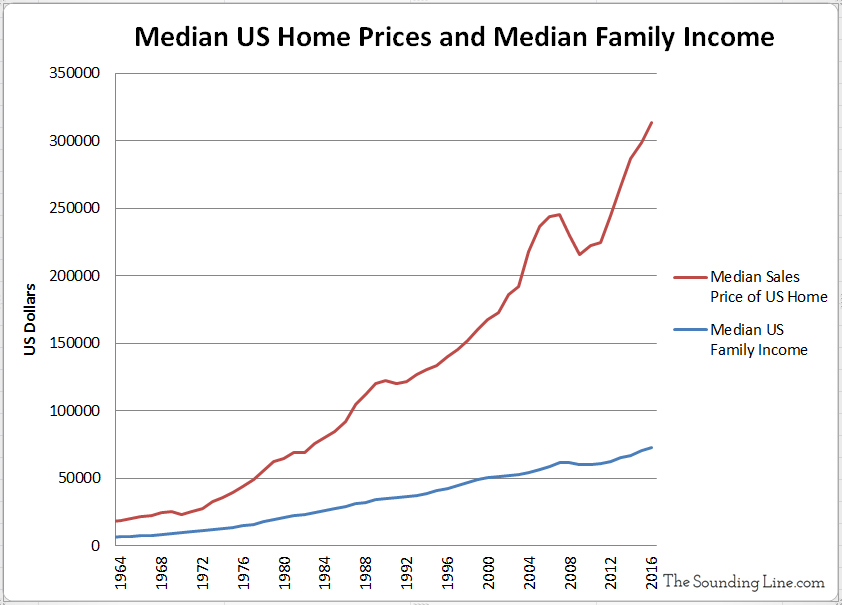

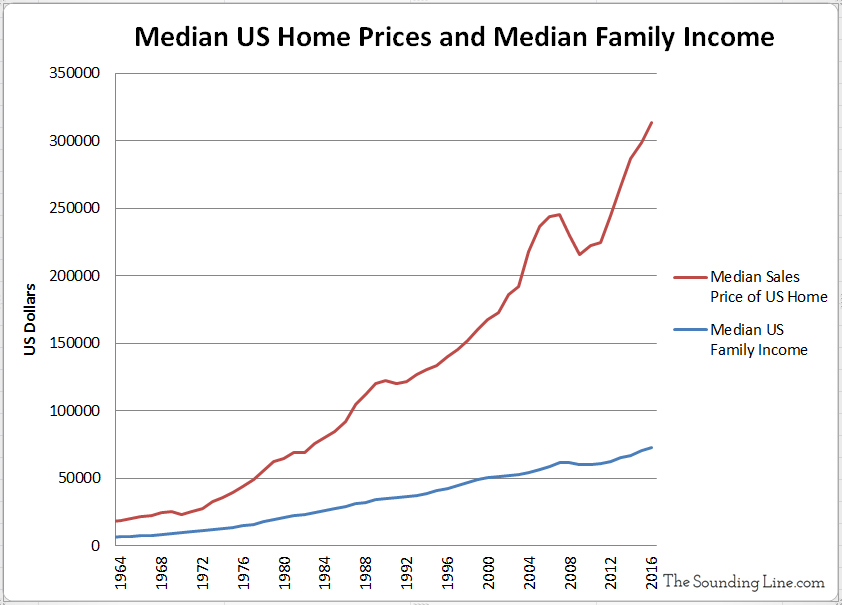

I told them if they want to be able to afford basic things, they will need to be in business for themselves and set their own terms, especially if we’re talking about being able to afford a home. Median household income to home sale price ratio is way outside of the norm.

Even pre-Wuhanflu, I knew guys pulling in awesome cash every year who couldn’t qualify for anything other than a town home. There are programmers who make $130k that are struggling. I also think the younger generation who is coming into their own now grew up with a lot of silver spoon in their mouths across the common consumables, electronics, clothing, and comforts without realizing those are nice-to-halves, not need-to-haves.

As the Baby Boomer collapse from the market continues (not buying new cars, homes, appliances, electronics much anymore), prices for those things increase. Compound that with re-shoring and the price increases from limited Chinese labor after 35 years of One-Child infanticide, and the recipe is baked-into the cake for things to cost more.

I told them if they want to be able to afford basic things, they will need to be in business for themselves and set their own terms, especially if we’re talking about being able to afford a home. Median household income to home sale price ratio is way outside of the norm.

Even pre-Wuhanflu, I knew guys pulling in awesome cash every year who couldn’t qualify for anything other than a town home. There are programmers who make $130k that are struggling. I also think the younger generation who is coming into their own now grew up with a lot of silver spoon in their mouths across the common consumables, electronics, clothing, and comforts without realizing those are nice-to-halves, not need-to-haves.

As the Baby Boomer collapse from the market continues (not buying new cars, homes, appliances, electronics much anymore), prices for those things increase. Compound that with re-shoring and the price increases from limited Chinese labor after 35 years of One-Child infanticide, and the recipe is baked-into the cake for things to cost more.

Last edited:

I told my kids that when my wife and I were growing up, we were told to "go to school so you could get a good job so you could earn a good living", and that this doesn’t apply anymore if we’re talking about college degrees in many cases.

I told them if they want to be able to afford basic things, they will need to be in business for themselves and set their own terms, especially if we’re talking about being able to afford a home. Median household income to home sale price ratio is way outside of the norm.

Even pre-Wuhanflu, I knew guys pulling in awesome cash every year who couldn’t qualify for anything other than a town home. There are programmers who make $130k that are struggling. I also think the younger generation who is coming into their own now grew up with a lot of silver spoon in their mouths across the common consumables, electronics, clothing, and comforts without realizing those are nice-to-halves, not need-to-haves.

As the Baby Boomer collapse from the market continues (not buying new cars, homes, appliances, electronics much anymore), prices for those things increases. Compound that with re-shoring and the price increases from limited Chinese labor after 35 years of One-Child infanticide, and the recipe is baked-into the cake for things to cost more.

The simple truth is that the "go to college for any degree, get any degree, this is the path to a great salary and stable work" mantra has been exposed as a sham and it is ringing hollow for most young people.

Most young people need to hear, "95% of society shouldn't go to college under any circumstances, quickly determine if your chosen career path requires college and if you're in that 5% that should be going to college, if you are and you believe your career path is viable, then consider going. If not, then do something else that makes sense and is workable."

I've talked to people who went to college because, "I had no other idea what to do with my life, it seemed to be the thing to do" or "to find myself," or "to learn." Those are expensive ways to putz around or to find yourself. If you are infatuated with history and philosophy but don't see a path to being a professor, don't get a degree in either, go become an electrician, a gunsmith, a rancher, a welder, a programmer, and then get a philosophy degree later for your own personal satisfaction if you want to do that.

Typically when societies have average age for first marriage reach the levels that have been reached in the West, and when house prices exceed household income by these levels, revolutions and civil wars are the result. Historically young people do not tolerate these sorts of hurdles being put in place to prevent or hinder their reproductive plans and goals. The elites know this, which is why they are promoting "childlessness by choice" and trying to encourage young people to not want families. They know that if they don't do something to stem the tide, that masses of young people will burn their society down.

All of this +1.I told my kids that when my wife and I were growing up, we were told to "go to school so you could get a good job so you could earn a good living", and that this doesn’t apply anymore if we’re talking about college degrees in many cases.

I told them if they want to be able to afford basic things, they will need to be in business for themselves and set their own terms, especially if we’re talking about being able to afford a home. Median household income to home sale price ratio is way outside of the norm.

Even pre-Wuhanflu, I knew guys pulling in awesome cash every year who couldn’t qualify for anything other than a town home. There are programmers who make $130k that are struggling. I also think the younger generation who is coming into their own now grew up with a lot of silver spoon in their mouths across the common consumables, electronics, clothing, and comforts without realizing those are nice-to-halves, not need-to-haves.

As the Baby Boomer collapse from the market continues (not buying new cars, homes, appliances, electronics much anymore), prices for those things increases. Compound that with re-shoring and the price increases from limited Chinese labor after 35 years of One-Child infanticide, and the recipe is baked-into the cake for things to cost more.

-LD

It takes a lot of money to live a sort of decent life these days.

So college grads start out on top? I have a 10 year employee that isn't making 70k...

I am not going into hard numbers, but my first real job, I struggled to pay bills and eat and have a car. I did without a lot of things, including eating real food (50 cent box of mac and cheese is all it was some nights)

Kids today refuse to do without anything, and yes, life is rough when you have a $1600 iphone bill and a $100 plus a month for a data plan, and you want to drive a Tesla all the day after you graduate college.

So college grads start out on top? I have a 10 year employee that isn't making 70k...

I am not going into hard numbers, but my first real job, I struggled to pay bills and eat and have a car. I did without a lot of things, including eating real food (50 cent box of mac and cheese is all it was some nights)

Kids today refuse to do without anything, and yes, life is rough when you have a $1600 iphone bill and a $100 plus a month for a data plan, and you want to drive a Tesla all the day after you graduate college.

I can appreciate both sides of the "kids don't want to work" situation.

My father's first serious job in the 1970s was working as a general technician in a chemical factory. He was paid $8 per hour. Mind you this was the mid 1970s.

I can assure you, when a typical Boomer articulates, "I made $8 per hour with my first job, you should be glad to make $8 per hour, that is a fine minimum wage for this era" they are failing to realize that $8 from 1975 is no less than $35 today.

My father has *never* had that attitude, and considers himself quite lucky to have come of age when he did, and he laments the sad state of affairs faced by most kids these days.

There are very few jobs that start out paying a general technician $35+ per hour that can be obtained by an 18 year old whose main skills are being scientifically/electronically/mechanically inclined, reliable, and willing to show up. If you want $35 per hour in a chemical factory, to start, good luck...

A lot of kids don't want to work, but it is also a matter of, "a lot of kids don't want to work shit jobs for shit wages that don't even provide enough to support a basic subsistence or dignified lifestyle."

Money has lost about 80% of its purchasing power since the 1970s. Wages have definitely not kept up with inflation.

Measuring Worth - Results

Your results

See the results in a table format.

In 2023, the relative values of $8.00 from 1975 ranges from $35.20 to $130.00.

A simple Purchasing Power Calculator would say the relative value is $45.30. This answer is obtained by multiplying $8 by the percentage increase in the CPI from 1975 to 2023.

This may not be the best answer.

The best measure of the relative value over time depends on if you are interested in comparing the cost or value of a Commodity , Income or Wealth , or a Project.

If you want to compare the value of a $8.00 Commodity in 1975 there are three choices. In 2023 the relative:

real price of that commodity is $45.30

labor value of that commodity is $49.10 (using the unskilled wage) or $47.50 (using production worker compensation)

income value of that commodity is $83.70

economic share of that commodity is $130.00

The sad thing to watch was to see the roughly 50% of millennials do the right thing, paying their bills, holding down well-paying jobs for 10-20 years, building excellent credit, and showing up to a broker only to be told they can’t qualify for a simple 3bed 1.5 bath house built in the freaking 1960s or 70s with a fake garage built from an original car port, even with a $20-$40k downpayment in cash they’ve been saving for "the right moment".

It’s easy for me to think, “Glad I’m not in that boat.”, but what about my kids? I have 5 kids, 2 of them adults in their mid-20s, and 3 much younger kids. American ideals were founded on leaving a legacy of freedom and prosperity for their children. Something went off the rails terribly and we need to right that ship.

It’s easy for me to think, “Glad I’m not in that boat.”, but what about my kids? I have 5 kids, 2 of them adults in their mid-20s, and 3 much younger kids. American ideals were founded on leaving a legacy of freedom and prosperity for their children. Something went off the rails terribly and we need to right that ship.

The sad thing to watch was to see the roughly 50% of millennials do the right thing, paying their bills, holding down well-paying jobs for 10-20 years, building excellent credit, and showing up to a broker only to be told they can’t qualify for a simple 3bed 1.5 bath house built in the freaking 1960s or 70s with a fake garage built from an original car port, even with a $20-$40k downpayment in cash they’ve been saving for "the right moment".

It’s easy for me to think, “Glad I’m not in that boat.”, but what about my kids? I have 5 kids, 2 of them adults in their mid-20s, and 3 much younger kids. American ideals were founded on leaving a legacy of freedom and prosperity for their children. Something went off the rails terribly and we need to right that ship.

I paid off my law school loans within 12 months of becoming licensed, which took a colossal amount of work. Also, there were a dozen other things I would have rather done with the money.

Then a while down the road there begins to be serious political rumblings and talk of "student loan forgiveness."

At that point I shrug and then ask myself, "well gee, I guess my reward for paying off my loans is that I now get to help pay off the loans of those who didn't pay off their own loans, isn't that great?"

The reward for doing the right thing is to get to shoulder additional burdens to carry extra weight from those who didn't do the right thing.

At some point a lot of people are just going to say, "hey, there's no reward for playing by the rules or working hard, so we're just done playing that game."

Would you mind if I asked your age sir?So college grads start out on top? I have a 10 year employee that isn't making 70k...

I am not going into hard numbers, but my first real job, I struggled to pay bills and eat and have a car. I did without a lot of things, including eating real food (50 cent box of mac and cheese is all it was some nights)

Kids today refuse to do without anything, and yes, life is rough when you have a $1600 iphone bill and a $100 plus a month for a data plan, and you want to drive a Tesla all the day after you graduate college.

None of this situation is your fault personally but even if the employee had a $70K salary would that be enough to afford a "middle-class" lifestyle? By that I mean a modest home (which again through no fault of your own) doesn't seem to be built anymore nationally, a 'newish' car, and groceries/insurance/whatever else?

I'm not trying to cast stones at you nor dismiss your own experiences but rather question whether a family in your AO could afford these basic/American life requirements on a $70K salary considering it'd take them a decade (per your own admission) to even work up to that point. Something broke over the past 5 years (in my opinion) and we're either destined for an upcoming reset or we will have advanced our culture back into feudalism with no end in sight.

Once again, no fault of your own but my father came from a small Irish coal mining town. I remember several decades ago driving through his hometown for certain holidays and my father pointing out which house the gas station attendant lived in, or bartender, or seamstress, or pizza shop employee (etc. etc.) lived in. I'd only suggest we're now at a precipice where all of those type of workers can no longer afford even rent on their 9-5 job (which if we're being honest they are working much odder hours than that with less stability) and even the well trained/educated professional working group who are in the top... let's say 80% of incomes can't afford an average house in their AO.

Something has to give as I see it, one way or another, but as I say in other posts, that's just one opinion.

-LD

Last edited:

And the VERY SERIOUS question is what other game will they be playing? If it doesn't contribute to GDP its a big problem. OnlyFans, theft, drug smuggling/manufacture, welfare, sitting in mom's basement, etc. Nobody is thinking about the macro-ramifications of pulling out of the "system". I'm not saying it isn't broken, what I am saying is that everyone is dependent on it, which is evidenced by their expectations and desires in their lives. Unless they are Buddhist monks.I paid off my law school loans within 12 months of becoming licensed, which took a colossal amount of work. Also, there were a dozen other things I would have rather done with the money.

Then a while down the road there begins to be serious political rumblings and talk of "student loan forgiveness."

At that point I shrug and then ask myself, "well gee, I guess my reward for paying off my loans is that I now get to help pay off the loans of those who didn't pay off their own loans, isn't that great?"

The reward for doing the right thing is to get to shoulder additional burdens to carry extra weight from those who didn't do the right thing.

At some point a lot of people are just going to say, "hey, there's no reward for playing by the rules or working hard, so we're just done playing that game."

This is not FAFO territory, this is a country stability issue, and those seeds are being sown.

Cool story and all, but I didn’t say they should start at the top. I said it’s expensive to live these days. If $70,000 was the top for a field then I wouldn’t want to be in that field anyway.So college grads start out on top? I have a 10 year employee that isn't making 70k...

I am not going into hard numbers, but my first real job, I struggled to pay bills and eat and have a car. I did without a lot of things, including eating real food (50 cent box of mac and cheese is all it was some nights)

Kids today refuse to do without anything, and yes, life is rough when you have a $1600 iphone bill and a $100 plus a month for a data plan, and you want to drive a Tesla all the day after you graduate college.

It’s expensive to live these days. Even small town USA is expensive to live in. 30k is barely making the necessities in a small town, let alone any medium to large city. You won’t even make it on 30k in a rural area.

50k would be the minimum start to a decent level life. That might be enough to afford a modest 2/1 house, 6 year old car, groceries, utilities, etc in a small town.

And the VERY SERIOUS question is what other game will they be playing? If it doesn't contribute to GDP its a big problem. OnlyFans, theft, drug smuggling/manufacture, welfare, sitting in mom's basement, etc. Nobody is thinking about the macro-ramifications of pulling out of the "system". I'm not saying it isn't broken, what I am saying is that everyone is dependent on it, which is evidenced by their expectations and desires in their lives. Unless they are Buddhist monks.

This is not FAFO territory, this is a country stability issue, and those seeds are being sown.

I cannot in good conscience tell any young person to "work hard and participate in the system of this society, put in your dues and you'll get to advance in life and receive a reward" because I don't believe anything awaits young people except crippling austerity, debt, conscription, war, and being priced out of the housing market, being unable to start a family, and essentially being priced out of life. I cannot sell them on the American Dream (TM, copyright, patent pending) because the American Dream is basically a dystopian nightmare for most people.

I increasingly believe the world is at a point where there is so much bad blood, tension, and ongoing disputes, and the country is at a point with too much bad blood, tension, disputes, polarization, that we just need 5-10 years of a world war to air it all out, let it out, and allow some countries, administrations, governments, regimes, to fall by the wayside and fade into history.

The post-WW2 attempt to establish a neo-liberal world order based on "rules" which would outlaw war and prevent major international war, was simply misguided humanist globalism.

Humans have a nature that is marked by conflict and defined by struggle. It has been 79 years since a major western war, that being World War Two. The West has grown fat, decadent, docile, and complacent, and addicted to the idea of "endless quantity of life for the sake of life and sensory indulgences, living as long as possible to indulge more things."

Human civilization [perhaps even humanity itself] will not survive long without a world war. This is reflected in the horrifically low birth rates, every single Western nation is below replacement level. Almost all Asian nations [except Afghanistan and Pakistan] are below replacement level. South Korea recently hit a fertility rate of 0.68 and demographers have them on track to wind up with a population by 2100 that is 40% of what it presently stands at.

Somehow people reproduced [rampantly and rapidly] during the Mongol Conquests, the Thirty Years War, the Napoleonic Wars, the First World War, the Second World War. Endless prolonged peace has allowed people to become docile, tame, and demoralized.

People need challenge, they need struggle, they need unifying events to help define their culture and civilization. Each generation needs some sort of struggle, ideally a struggle against an external force.

The USA needs either a civil war or a revolution and the world needs a world war, so that at the end of those tunnels we can sort out a lot of stuff and reboot certain things. The level of institutional structural damage done to Western nations and the third world underclasses imported into the heartlands of Western nations has been so severe that there is no peaceful way to gather at polling places and "vote" the nations out from under the problems. In some nations, such as France, the people will likely continue voting up until the day France is finally turned into a caliphate and there is no more voting. "If we just vote harder this time, it will all work out!" It won't work out.

Last edited:

Maybe they should become home builders.I told my kids that when my wife and I were growing up, we were told to "go to school so you could get a good job so you could earn a good living", and that this doesn’t apply anymore if we’re talking about college degrees in many cases.

I told them if they want to be able to afford basic things, they will need to be in business for themselves and set their own terms, especially if we’re talking about being able to afford a home. Median household income to home sale price ratio is way outside of the norm.

Even pre-Wuhanflu, I knew guys pulling in awesome cash every year who couldn’t qualify for anything other than a town home. There are programmers who make $130k that are struggling. I also think the younger generation who is coming into their own now grew up with a lot of silver spoon in their mouths across the common consumables, electronics, clothing, and comforts without realizing those are nice-to-halves, not need-to-haves.

As the Baby Boomer collapse from the market continues (not buying new cars, homes, appliances, electronics much anymore), prices for those things increase. Compound that with re-shoring and the price increases from limited Chinese labor after 35 years of One-Child infanticide, and the recipe is baked-into the cake for things to cost more.

So what do you do about it?The sad thing to watch was to see the roughly 50% of millennials do the right thing, paying their bills, holding down well-paying jobs for 10-20 years, building excellent credit, and showing up to a broker only to be told they can’t qualify for a simple 3bed 1.5 bath house built in the freaking 1960s or 70s with a fake garage built from an original car port, even with a $20-$40k downpayment in cash they’ve been saving for "the right moment".

It’s easy for me to think, “Glad I’m not in that boat.”, but what about my kids? I have 5 kids, 2 of them adults in their mid-20s, and 3 much younger kids. American ideals were founded on leaving a legacy of freedom and prosperity for their children. Something went off the rails terribly and we need to right that ship.

What do you advocate?

Are you complaining when they build more housing near you?

Because we are 3.2 million homes short of meeting demand.

If 5 million homes went up in the next two years, you would see the cost of housing drop like a rock (because you would then have a surplus of homes again).

I cannot in good conscience tell any young person to "work hard and participate in the system of this society, put in your dues and you'll get to advance in life and receive a reward" because I don't believe anything awaits young people except crippling austerity, debt, conscription, war, and being priced out of the housing market, being unable to start a family, and essentially being priced out of life. I cannot sell them on the American Dream (TM, copyright, patent pending) because the American Dream is basically a dystopian nightmare for most people.

That is somewhat my point. If one doesn't participate, those things are guaranteed. If one does participate, those things may very well still be guaranteed on some level. But what I do know is that a person that does not work (and struggle) is left devoid of personal worth. It is that lack of personal worth that causes everything to collapse. Especially men. If there is nothing earned, there is nothing to fight for. If there is nothing to fight for there is no country. It's over.

Self-worth is what is on the sacrificial altar. If that goes it is all gone.

My county adopted an ordinance for a minimum square footage that would make it illegal to build the house I live in right now and raised or am raising four kids.

And on the local Facebook page for the nearby town, every body is screaming bloody murder every time a new development goes in. "They are ruining our beautiful little town!"

And the beautiful little town has experienced a huge increase in median home prices, too. Gee, I can't see any connection to opposing new housing, adopting minimum square footage requirements and then the prices shooting through the roof.

No, not connected. It's "the system" or Democrats or the New World Order or George Soros or companies that buy and rent homes . . . LOL

No, it can't be my neighbors.

Can it?

And on the local Facebook page for the nearby town, every body is screaming bloody murder every time a new development goes in. "They are ruining our beautiful little town!"

And the beautiful little town has experienced a huge increase in median home prices, too. Gee, I can't see any connection to opposing new housing, adopting minimum square footage requirements and then the prices shooting through the roof.

No, not connected. It's "the system" or Democrats or the New World Order or George Soros or companies that buy and rent homes . . . LOL

No, it can't be my neighbors.

Can it?

It pains me to say this but there's a significant amount of truth if everything you just said. Good post.I cannot in good conscience tell any young person to "work hard and participate in the system of this society, put in your dues and you'll get to advance in life and receive a reward" because I don't believe anything awaits young people except crippling austerity, debt, conscription, war, and being priced out of the housing market, being unable to start a family, and essentially being priced out of life. I cannot sell them on the American Dream (TM, copyright, patent pending) because the American Dream is basically a dystopian nightmare for most people.

I increasingly believe the world is at a point where there is so much bad blood, tension, and ongoing disputes, and the country is at a point with too much bad blood, tension, disputes, polarization, that we just need 5-10 years of a world war to air it all out, let it out, and allow some countries, administrations, governments, regimes, to fall by the wayside and fade into history.

The post-WW2 attempt to establish a neo-liberal world order based on "rules" which would outlaw war and prevent major international war, was simply misguided humanist globalism.

Humans have a nature that is marked by conflict and defined by struggle. It has been 79 years since a major western war, that being World War Two. The West has grown fat, decadent, docile, and complacent, and addicted to the idea of "endless quantity of life for the sake of life and sensory indulgences, living as long as possible to indulge more things."

Human civilization [perhaps even humanity itself] will not survive long without a world war. This is reflected in the horrifically low birth rates, every single Western nation is below replacement level. Almost all Asian nations [except Afghanistan and Pakistan] are below replacement level. South Korea recently hit a fertility rate of 0.68 and demographers have them on track to wind up with a population by 2100 that is 40% of what it presently stands at.

Somehow people reproduced [rampantly and rapidly] during the Mongol Conquests, the Thirty Years War, the Napoleonic Wars, the First World War, the Second World War. Endless prolonged peace has allowed people to become docile, tame, and demoralized.

People need challenge, they need struggle, they need unifying events to help define their culture and civilization. Each generation needs some sort of struggle, ideally a struggle against an external force.

The USA needs either a civil war or a revolution and the world needs a world war, so that at the end of those tunnels we can sort out a lot of stuff and reboot certain things. The level of institutional structural damage done to Western nations and the third world underclasses imported into the heartlands of Western nations has been so severe that there is no peaceful way to gather at polling places and "vote" the nations out from under the problems. In some nations, such as France, the people will likely continue voting up until the day France is finally turned into a caliphate and there is no more voting. "If we just vote harder this time, it will all work out!" It won't work out.

-LD

That is somewhat my point. If one doesn't participate, those things are guaranteed. If one does participate, those things may very well still be guaranteed on some level. But what I do know is that a person that does not work (and struggle) is left devoid of personal worth. It is that lack of personal worth that causes everything to collapse. Especially men. If there is nothing earned, there is nothing to fight for. If there is nothing to fight for there is no country. It's over.

Self-worth is what is on the sacrificial altar. If that goes it is all gone.

If 500 young men, aged 18-22 came to me and asked, "what should we do to get ahead in life?" I would probably tell them, "either find a way to become independent self-sufficient homesteaders, or get yourselves in shape, train individually and as a group, and each of you report back to me in 18 months with an AR-15 and a basic kit, and I'll provide the ship that is going to take us to Iceland, and we'll go full Viking conquest mode on that mostly unarmed country which lacks a standing army. You put me in charge and keep me in power and I'll start writing laws to grant you land and women once we secure the island. I'll come up with the legal basis to justify our conquest and to enshrine our new system. I will also be the first one off the ship when the invasion begins, and if it fails and we are captured, you can all denounce me as a cult leader and say that you were young, naive, and were swindled by me."

Basically, "we're going to become Germanic barbarians and carve out our piece of the decaying civilization."

I know, I've given that too much thought, more thought that anybody should. I must say, the topic came up when I was talking to a military officer friend of mine and we were discussing NATO and how Iceland is a NATO member which lacks a standing army of any sort and doesn't have anything other than a small national police force. The idea was, "what would happen if a group of international mercenary or adventure seekers just stormed into Iceland to take over? Would NATO respond? Could NATO effectively respond in that remote of an area?"

In all seriousness though, expect to see barbarian conquests in formerly civilized areas, expect to see cartels carving out their own kingdoms, expect to see decaying civilizations cede authority to encroaching tribes who are pressing their advantage. I am somewhat surprised that a few thousand Jihadis have not landed in Iceland to claim the place in the name of Allah.

Let's not lose sight of the fact that all of the kings of the 400s-600s were basically just Germanic chieftains (or their heirs) who led their various tribes to rampage over the decaying ruins of the Western Roman Empire, carved out holdings, made some of their subordinates dukes, others earls, some counts, many barons and knights, and distributed land while reserving the right to adjudicate disputes between those nobles.

Deflation is much worse. No one would be able to pay off debts because there would be a massive decrease in economic activity. Defaults would skyrocket, unemployment would go to the moon and businesses everywhere would close. Deflation is a monster none of us want to see.We need deflation.

Deflation is much worse. No one would be able to pay off debts because there would be a massive decrease in economic activity. Defaults would skyrocket, unemployment would go to the moon and businesses everywhere would close. Deflation is a monster none of us want to see.

Short of a massive war, we need a solid Biblical solution, perhaps a debt forgiveness Jubilee and a reset/reversion combined with the discontinuing of all fiat paper currencies and the unveiling of a gold/silver based currency.

Well, the banks aren't going to forgive debt, so a massive war is what we will get - and a conversion to CBDCs with a haircut for all cash balances. That's pretty much easy to call at this point.Short of a massive war, we need a solid Biblical solution, perhaps a debt forgiveness Jubilee and a reset/reversion combined with the discontinuing of all fiat paper currencies and the unveiling of a gold/silver based currency.

Well, the banks aren't going to forgive debt, so a massive war is what we will get - and a conversion to CBDCs with a haircut for all cash balances. That's pretty much easy to call at this point.

It may very well turn out to be a war they didn't expect or want, and the result may be out of their control.

I was more talking of WW3. Seems to be where we are headed if cooler heads don't prevail worldwide.It may very well turn out to be a war they didn't expect or want, and the result may be out of their control.

The Biblical word for that is "suffering".We need deflation.

It will arrive in many sizes, shapes and forms.

I am not sure where this went off course to deserve the cool story commentCool story and all, but I didn’t say they should start at the top. I said it’s expensive to live these days. If $70,000 was the top for a field then I wouldn’t want to be in that field anyway.

It’s expensive to live these days. Even small town USA is expensive to live in. 30k is barely making the necessities in a small town, let alone any medium to large city. You won’t even make it on 30k in a rural area.

50k would be the minimum start to a decent level life. That might be enough to afford a modest 2/1 house, 6 year old car, groceries, utilities, etc in a small town.

yes $50k to start right out of college is reasonable these days. $70k is not

I see you agree, way cool story

paid off my student loans instead of spending it and now they are forgiving deadbeats and people who overpaid. how the fk is that my problem to shoulder?????

Inflation has gotten so high hookers cant make bank. Discretionary income and all...

paid off my student loans instead of spending it and now they are forgiving deadbeats and people who overpaid. how the fk is that my problem to shoulder?????

No malarky here.

-LD

like paying child support for a kid you never fathered to a woman you never screwed.paid off my student loans instead of spending it and now they are forgiving deadbeats and people who overpaid. how the fk is that my problem to shoulder?????

Fed's Williams doesn't see urgent need to cut interest rates

Paying more and getting less. The trend continues.

Mortgage rates are now at the highest level of the year, and could still climb

Dropped my car off for warranty work.

Dealer no longer has full time shuttle drivers, it's Uber based now.

Driver said he's getting paid less and less due to Uber fees.

His mortgage payment went up $200/month from ins and taxes. He wasn't happy.

Dealer no longer has full time shuttle drivers, it's Uber based now.

Driver said he's getting paid less and less due to Uber fees.

His mortgage payment went up $200/month from ins and taxes. He wasn't happy.

A sign of the times. Impossible to ignore. It's everywhere.Dropped my car off for warranty work.

Dealer no longer has full time shuttle drivers, it's Uber based now.

Driver said he's getting paid less and less due to Uber fees.

His mortgage payment went up $200/month from ins and taxes. He wasn't happy.

I do think trying to buy food from Whole Paycheck and then complaining about the price lands a little flat. Everyone knows they are higher than everyone else from the jump.

must import more 'newcomers' to vote for biden.. 91 million votes, most ever, most popular.. the usa loves him. cheer or face the firing squad comradeDropped my car off for warranty work.

Dealer no longer has full time shuttle drivers, it's Uber based now.

Driver said he's getting paid less and less due to Uber fees.

His mortgage payment went up $200/month from ins and taxes. He wasn't happy.

When I can get a good understanding of "people", it will be time to write a book and make a million dollars.hope all these people upset by this vote R in November

Doubtful very many will change from D to R.

Doing that would be an acknowledgement they have been supporting a party that is destroying America.

People will continue to do the same thing over and over, expecting a different outcome.

"Market conditions for homebuyers remain challenging with few homes listed and costs for ownership still climbing," said Ben Ayers, Nationwide senior economist. "Despite strong fundamentals for demand from demographics and a strong labor market, many first-time buyers are being shut out of the market by elevated financing rates and rising prices."

www.foxbusiness.com

www.foxbusiness.com

The cost of buying a house hit another record high as mortgage rates spike again

Buying a house just became even more expensive for would-bve homebuyers as mortgage rates shot above 7% for the first time this year, according to Redfin.

Well, I sure the hell am not voting for any Dhope all these people upset by this vote R in November

But, honestly, the stuff being discussed in this thread is not going to be changed by voting R or D

If you vote D, then Interest rates need to be high until inflation cools off.

If you vote R, then Interest rates need to be high until inflation cools off.

Lowering interest rates, lowering mortgage rates, will just increase inflation.

Federal spending does not appear to be affected by voting R or D, either.

Note the biggest jump you see there was during the Trump administration. The next biggest jump was during the Bush administration. Also, be aware the last five years on that chart are merely projections, not actuals.

Federal budget receipts and outlays U.S. 2028 | Statista

In 2022, the total receipts of the United States government added up to approximately 4.9 trillion U.S.

I just do not see voting R as the solution we would hope. They tell us they are for smaller government, but I see nothing smaller on that chart, going all the way back to the beginning of this century. It just keeps going up no matter who is in office, Congress or the White House.

If I didn't know better, I would think the politicians of both parties are playing us for fools . . .

But, no, that can't be right.

Can it?

Right before our very eyes.............Well, I sure the hell am not voting for any D

But, honestly, the stuff being discussed in this thread is not going to be changed by voting R or D

If you vote D, then Interest rates need to be high until inflation cools off.

If you vote R, then Interest rates need to be high until inflation cools off.

Lowering interest rates, lowering mortgage rates, will just increase inflation.

Federal spending does not appear to be affected by voting R or D, either.

Note the biggest jump you see there was during the Trump administration. The next biggest jump was during the Bush administration. Also, be aware the last five years on that chart are merely projections, not actuals.

Federal budget receipts and outlays U.S. 2028 | Statista

In 2022, the total receipts of the United States government added up to approximately 4.9 trillion U.S.www.statista.com

View attachment 8400038

I just do not see voting R as the solution we would hope. They tell us they are for smaller government, but I see nothing smaller on that chart, going all the way back to the beginning of this century. It just keeps going up no matter who is in office, Congress or the White House.

If I didn't know better, I would think the politicians of both parties are playing us for fools . . .

But, no, that can't be right.

Can it?

A friend asked me to keep a look out for a couple of rain barrels. I ran across 2 this morning at my local Habitat for Humanity store. I glanced at the price tag and read it as $3.00. When I went to check out I told the checker I'd take the two, non-food quality barrels. He replied "Oh, they are marked $30 and not $3"..... Hmmmm.. Prior to the pandemic those were $3 - $5 each. Now the price is 10 times what they were.

A $USD$ just does not buy much these days.

uh no....... I'm taking them at the price that is clearly marked on the Price TAGView attachment 8400118

A friend asked me to keep a look out for a couple of rain barrels. I ran across 2 this morning at my local Habitat for Humanity store. I glanced at the price tag and read it as $3.00. When I went to check out I told the checker I'd take the two, non-food quality barrels. He replied "Oh, they are marked $30 and not $3"..... Hmmmm.. Prior to the pandemic those were $3 - $5 each. Now the price is 10 times what they were.

A $USD$ just does not buy much these days.

I went back and checked it. Kind of faded but it was $30. Too rich for my blood.uh no....... I'm taking them at the price that is clearly marked on the Price TAG

The average 30-year fixed-rate mortgage was 7.10% for the week ending April 18, according to Freddie Mac's latest Primary Mortgage Market Survey. That's an increase from the previous week when it averaged 6.88%. A year ago, the 30-year fixed-rate mortgage averaged 6.39%.

The average rate for a 15-year mortgage was 6.39%, up from 6.16% last week and up from 5.76% last year.

www.foxbusiness.com

www.foxbusiness.com

The average rate for a 15-year mortgage was 6.39%, up from 6.16% last week and up from 5.76% last year.

Mortgage rates sail past 7% as market moves into critical spring homebuying season

The average 30-year fixed-rate mortgage was 7.10% for the week ending April 18, according to Freddie Mac's latest Primary Mortgage Market Survey.

Make more, spend more, make more, spend more. Fanning the fires of inflation.

Delta Air Lines gives staff another 5% raise, hikes starting wages to $19 an hour

The "Strong US Dollar" myth.

I am holding some USD's. A USD purchases much less today than it did 4 years ago.

What the rest of the world is over looking is the USD is now backed by nothing more than debt (https://www.usdebtclock.org/ ).

The USD's held by other countries "seemingly" increases in value due to nothing more than inflation.

Eventually the rest of the world will figure out they are holding a lot of "Snake oil" that has become worthless.

___________

The dollar is at its highest since November against other major currencies, poised for a fourth straight month of gains .

Its latest rally, following stronger-than-expected March inflation numbers that pushed back U.S. rate cut bets even further, highlights how sensitive currency markets are to relative interest rate changes.

"We track investor flows, and the dollar buying since the CPI release has been strong," said Tim Graf, head of macro strategy for Europe at State Street Global Markets.

I am holding some USD's. A USD purchases much less today than it did 4 years ago.

What the rest of the world is over looking is the USD is now backed by nothing more than debt (https://www.usdebtclock.org/ ).

The USD's held by other countries "seemingly" increases in value due to nothing more than inflation.

Eventually the rest of the world will figure out they are holding a lot of "Snake oil" that has become worthless.

___________

Where king dollar is causing pain the most

LONDON, April 23 (Reuters) - A dollar surge propelled by a strong economy, sticky inflation and geopolitical tensions have unnerved policymakers from Tokyo to Beijing and Stockholm.The dollar is at its highest since November against other major currencies, poised for a fourth straight month of gains .

Its latest rally, following stronger-than-expected March inflation numbers that pushed back U.S. rate cut bets even further, highlights how sensitive currency markets are to relative interest rate changes.

"We track investor flows, and the dollar buying since the CPI release has been strong," said Tim Graf, head of macro strategy for Europe at State Street Global Markets.

A 20% down payment on $766,550 = $153,310

Monthly payment

$4,179

Mortgage rates rose for the third straight week last week, hitting the highest level since November. As a result, mortgage application demand dropped 2.7% compared with the previous week, according to the Mortgage Bankers Association’s seasonally adjusted index.

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($766,550 or less) increased to 7.24% from 7.13%, with points increasing to 0.66 from 0.65 (including the origination fee) for loans with a 20% down payment.

Monthly payment

$4,179

Mortgage rates rose for the third straight week last week, hitting the highest level since November. As a result, mortgage application demand dropped 2.7% compared with the previous week, according to the Mortgage Bankers Association’s seasonally adjusted index.

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($766,550 or less) increased to 7.24% from 7.13%, with points increasing to 0.66 from 0.65 (including the origination fee) for loans with a 20% down payment.

A 20% down payment on $766,550 = $153,310

Monthly payment

$4,179

Mortgage rates rose for the third straight week last week, hitting the highest level since November. As a result, mortgage application demand dropped 2.7% compared with the previous week, according to the Mortgage Bankers Association’s seasonally adjusted index.

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($766,550 or less) increased to 7.24% from 7.13%, with points increasing to 0.66 from 0.65 (including the origination fee) for loans with a 20% down payment.

It is starting to have an effect.

Sales declined 8.2% in the American west. Home prices still went up, but they are not selling as many at that price.

The reality is, though, that we need more housing to be built.

Similar threads

- Replies

- 32

- Views

- 1K

- Replies

- 109

- Views

- 4K

- Replies

- 61

- Views

- 2K