Here's a good high level explanation of those labor numbers, regarding part time and full time. It also brings in the effect of the illegal population on those numbers. It is not as good as they say. By a long shot. Combine this with the ISM and you get a good idea of what is going on in the economy vs what they are telling you.

Join the Hide community

Get access to live stream, lessons, the post exchange, and chat with other snipers.

Register

Download Gravity Ballistics

Get help to accurately calculate and scope your sniper rifle using real shooting data.

Install the app

How to install the app on iOS

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Inflation.......... ?

- Thread starter Hobo Hilton

- Start date

Bowman is starting to sound like Hobo........ Raise interest to 20% and kill inflation....

Fed Governor Bowman says additional rate hike could be needed if inflation stays high

99 Cents Only Stores Closing

Another company biting the dust.Inflation may not fall for months.

Now that March’s shockingly strong official jobs report is in hand, traders are expecting five more months of consumer-price index reports to show no further progress being made on the annual headline rate of U.S. inflation.That rate is seen as likely to come in between 3.2% and 3.4%, starting with next Wednesday’s data for March and stretching through the August release of July’s CPI figures to extend the current nine-month streak of readings at or above 3%. Although the Federal Reserve prefers to focus on core readings from another gauge known as the personal-consumption-expenditures index, or PCE, the CPI numbers matter because of their influence on household expectations.

Despite the expected lack of progress in the Federal Reserve’s efforts to bring inflation sustainably back to its 2% target and the risk that inflation might go higher from here, “we still may not have any major asset-price depreciation,” said trader Gang Hu of New York hedge fund WinShore Capital Partners.

Hu has made a string of prescient calls in the past few years that make his views worth paying attention to. In February of 2023, he said inflation could easily take more than a year to decline by enough for the Fed to cut rates, which has turned out to be the case. In early July of the same year, Hu said markets were caught in a “self-defeating feedback loop” on inflation that made it likely the Fed would need to keep raising rates from levels of 5%-5.25%. Less than three weeks later, the Fed delivered another quarter-point increase, lifting its fed-funds rate target to 5.25%-5.5%, where it has remained since.

The Fed does not use CPI for its 2% inflation target. I do not know why media (Marketwatch, above) always talks about CPI in its articles about the Fed, inflation, and interest rates.

The Fed uses PCE, which is more like 2.5%, which explains why the Fed is holding rates steady instead of raising them. The Fed is not so far off its target as the media portrays by using the CPI number.

The Fed uses PCE, which is more like 2.5%, which explains why the Fed is holding rates steady instead of raising them. The Fed is not so far off its target as the media portrays by using the CPI number.

Are you saying you have faith in the FED and they are going to get America out of this mess ?The Fed does not use CPI for its 2% inflation target. I do not know why media (Marketwatch, above) always talks about CPI in its articles about the Fed, inflation, and interest rates.

The Fed uses PCE, which is more like 2.5%, which explains why the Fed is holding rates steady instead of raising them. The Fed is not so far off its target as the media portrays by using the CPI number.

I want to hear their plan to reduce the national debt.

I said only what I said, which does not resemble in any way what you are asking.Are you saying you have faith in the FED and they are going to get America out of this mess ?

I want to hear their plan to reduce the national debt.

I am merely commenting on the media constantly writing articles citing CPI inflation and then mentioning the Fed and interest rates. The Fed does not use CPI for inflation. It uses PCE. So writing:

That rate is seen as likely to come in between 3.2% and 3.4%, starting with next Wednesday’s data for March and stretching through the August release of July’s CPI figures to extend the current nine-month streak of readings at or above 3%

It is completely useless information. In fact, it is worse than useless, because it is misleading. If you are sitting here thinking, wow, we are a point and a half (1.5%) above the Fed's target rate, you are probably wondering why the Fed is holding steady. Why are they not raising rates?

Here is why: The Fed uses PCE, which is 2.5%.

So the Fed, when it is analyzing the inflation situation, is thinking, inflation is not only coming down, but is only one half of a point (0.5%) above our target.

Do you see how different those two things are?

Nevertheless, every article I read about "what is the Fed going to do?" cites CPI.

This has nothing to do with "faith" in anybody and more to do with a huge public misconception driven by misleading financial reporting. That is all.

And it may be unintentional, that is, all of these reporters are just that ignorant, but if you are reporting on financial matters, you ought to at least have a grasp of the very basic issues. The actual measure of inflation being utilized for what you are reporting about seems to be one of those fundamental things that should be in your base of knowledge as a financial reporter.

It's not in the best interest of the reporter to publish bad news. 2% inflation is excessive. Look at where that got us, over the long term.I said only what I said, which does not resemble in any way what you are asking.

I am merely commenting on the media constantly writing articles citing CPI inflation and then mentioning the Fed and interest rates. The Fed does not use CPI for inflation. It uses PCE. So writing:

It is completely useless information. In fact, it is worse than useless, because it is misleading. If you are sitting here thinking, wow, we are a point and a half (1.5%) above the Fed's target rate, you are probably wondering why the Fed is holding steady. Why are they not raising rates?

Here is why: The Fed uses PCE, which is 2.5%.

So the Fed, when it is analyzing the inflation situation, is thinking, inflation is not only coming down, but is only one half of a point (0.5%) above our target.

Do you see how different those two things are?

Nevertheless, every article I read about "what is the Fed going to do?" cites CPI.

This has nothing to do with "faith" in anybody and more to do with a huge public misconception driven by misleading financial reporting. That is all.

And it may be unintentional, that is, all of these reporters are just that ignorant, but if you are reporting on financial matters, you ought to at least have a grasp of the very basic issues. The actual measure of inflation being utilized for what you are reporting about seems to be one of those fundamental things that should be in your base of knowledge as a financial reporter.

Staving Off Revolution

If the leadership chooses happy-story PR and toothless reforms for show in the hopes it will all blow over, these subterfuges have the poten...

Last edited:

Great Leader says everything is great with the economy.

Sailing seas depends on the helmsman, but ignoring inflation requires Joe Biden thought.

Sailing seas depends on the helmsman, but ignoring inflation requires Joe Biden thought.

"What’s Wrong With the Economy? It’s You, Not the Data

Many Americans believe that the economy and their finances are worse than they really are"

Who still follows corporate media in 2024?

These are presstitute brothels of disinformation, and always have been.

There never were "good ‘ol days" of journalism. They have always been mostly low-paid shills for corporations that own the media companies, who use “news” to advertise for themselves. Sensationalist headlines laced with stupid ads for their garbage products, nothing more.

Look at the commercials, which are always from the top 10-15 industries in the US/World.

These are presstitute brothels of disinformation, and always have been.

There never were "good ‘ol days" of journalism. They have always been mostly low-paid shills for corporations that own the media companies, who use “news” to advertise for themselves. Sensationalist headlines laced with stupid ads for their garbage products, nothing more.

Look at the commercials, which are always from the top 10-15 industries in the US/World.

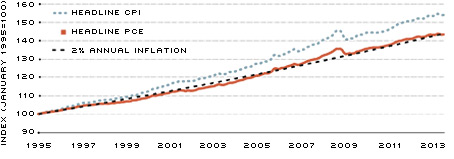

Even aligned by year, it's consistently visibly lower. Your a mouse, and it's their wheel.Between the two headline indexes, the CPI tends to show more inflation than the PCE. From January 1995 to May 2013, the average rate of inflation was 2.4 percent when measured by headline CPI and 2.0 percent when measured by headline PCE. Hence, after setting both indexes equal to 100 in 1995, the CPI was more than 7 percent higher than the PCE in May 2013.

so as prices go up; people start to consume less (aka - consume only those essential items).Even aligned by year, it's consistently visibly lower. Your a mouse, and it's their wheel.

LOL on the 2% annual inflation.

from link below =

here are two common measures of inflation in the US today: the Consumer Price Index (CPI) released by the Bureau of Labor Statistics and the Personal Consumption Expenditures price index (PCE) issued by the Bureau of Economic Analysis. The CPI probably gets more press, in that it is used to adjust social security payments and is also the reference rate for some financial contracts, such as Treasury Inflation Protected Securities (TIPS) and inflation swaps. The Federal Reserve, however, states its goal for inflation in terms of the PCE.

et 20140417 pce and cpi inflation difference

There are two common measures of inflation in the US today: the Consumer Price Index (CPI) and the Personal Consumption Expenditures price index (PCE). The two measures, though following broadly similar trends, are certainly not identical.

One would ask how PCE is perfectly pegged at 2%?

Because they manipulate the measurement to maintain the illusion.

Because they manipulate the measurement to maintain the illusion.

You mean like hedonistic adjustments? Something like that perhaps?One would ask how PCE is perfectly pegged at 2%?

Because they manipulate the measurement to maintain the illusion.

Anything larger than 2 and the girls start getting excited.You mean like hedonistic adjustments? Something like that perhaps?

WASHINGTON, April 9 (Reuters) - U.S. small-business confidence slipped to the lowest level in more than 11 years in March amid rising concerns about inflation, according to a survey on Tuesday.

The National Federation of Independent Business (NFIB) said its Small Business Optimism Index fell 0.9 point to 88.5 last month, the lowest level since December 2012. It was the 27th straight month the index was below the 50-year average of 98.

Twenty-five percent of owners reported inflation was their single most important problem in operating their business, reflecting higher input and labor costs, up 2 points from February. The share of businesses raising average selling prices rose 7 points from the prior month.

That aligns with a pick-up in consumer prices in the first two months of the year. Price increases were prevalent in the finance, retail, construction, wholesale and transportation sectors. There was also an increase in the share of businesses raising compensation even as demand for labor is cooling.

The National Federation of Independent Business (NFIB) said its Small Business Optimism Index fell 0.9 point to 88.5 last month, the lowest level since December 2012. It was the 27th straight month the index was below the 50-year average of 98.

Twenty-five percent of owners reported inflation was their single most important problem in operating their business, reflecting higher input and labor costs, up 2 points from February. The share of businesses raising average selling prices rose 7 points from the prior month.

That aligns with a pick-up in consumer prices in the first two months of the year. Price increases were prevalent in the finance, retail, construction, wholesale and transportation sectors. There was also an increase in the share of businesses raising compensation even as demand for labor is cooling.

A crucial report Wednesday is expected to show little progress against inflation

How It Started ... How It's Going: Inflation-adjusted hourly wages lower today than when Biden took office

Inflation has mostly outpaced wage growth in the United States since President Biden assumed office, although in the last year wages have grown faster as inflation has slowed.

Leaving this here. It can't get bumpy if you never leave the ground

Spirit Airlines revealed on Monday that it would be furloughing roughly 260 pilots and deferring the delivery of aircraft from Q2 2025 through 2026 until at least 2030 to save money after a rough fiscal year.

Spirit Airlines revealed on Monday that it would be furloughing roughly 260 pilots and deferring the delivery of aircraft from Q2 2025 through 2026 until at least 2030 to save money after a rough fiscal year.

Airline Is Furloughing 260 Pilots Amid Cost Concerns, Aircraft Delays

The airline estimates that the furloughs will help increase the company's liquidity value by $340 million through 2026. Aircraft deliveries scheduled for 2027 through 2029 will proceed as planned.Spirit needs a magician.Leaving this here. It can't get bumpy if you never leave the ground

Spirit Airlines revealed on Monday that it would be furloughing roughly 260 pilots and deferring the delivery of aircraft from Q2 2025 through 2026 until at least 2030 to save money after a rough fiscal year.

Airline Is Furloughing 260 Pilots Amid Cost Concerns, Aircraft Delays

The airline estimates that the furloughs will help increase the company's liquidity value by $340 million through 2026. Aircraft deliveries scheduled for 2027 through 2029 will proceed as planned.

The boss of one of the world's biggest banks has warned US interest rates could climb to 8%.

Jamie Dimon, the head of JPMorgan Chase, said his bank has prepared for interest rates to jump because of "persistent inflationary pressures".

Central banks around the world have been busy raising rates in a bid to dampen rising prices.

But with US inflation gradually easing, the overwhelming expectation is for the Federal Reserve to cut rates this year.

Markets are pricing in two quarter-point rate cuts in 2024.

www.bbc.com

www.bbc.com

Jamie Dimon, the head of JPMorgan Chase, said his bank has prepared for interest rates to jump because of "persistent inflationary pressures".

Central banks around the world have been busy raising rates in a bid to dampen rising prices.

But with US inflation gradually easing, the overwhelming expectation is for the Federal Reserve to cut rates this year.

Markets are pricing in two quarter-point rate cuts in 2024.

Jamie Dimon: Bank boss warns US interest rates could rise to 8%

Jamie Dimon, the boss of JPMorgan Chase, said the bank is preparing for both rate cuts and rises.

Consumer prices rose 3.5% from a year ago in March, more than expected

LOL... BS, we know it.Consumer prices rose 3.5% from a year ago in March, more than expected

ask the gov official. If 50% of your purchases are in fuel, what would your inflation be?

Costco selling as much as $200 million in gold bars monthly, Wells Fargo estimates

Correct. Fuel is relatively inelastic. Studies have shown that when gas prices are high people will forego certain car usage, but by and large they have to get to work, etc so there is a base below which the usage cannot go at an individual level. The results are that other items are not purchased or purchased on credit - as long as it lasts or the consumer becomes reluctant to pile more debt on themselves and especially with the high interest rates on the cards.LOL... BS, we know it.

ask the gov official. If 50% of your purchases are in fuel, what would your inflation be?

The end result is that other essential goods purchases start to move down in preference - off-brand items, alternatives, etc. This ends up having a disinflation effect over the course of months as fewer purchases are made and the stores have to bring prices down to sustain demand. But that is a rocky road as some retailers fight it all the way and some even go under, mainly because they themselves can only go down so far or are unwilling to go down further. We are seeing this now. "Disinflation" and "prices coming down" in no way means prices are anywhere near where they were previously, they aren't. The consumer knows what's up, they can see it plainly every day and are not fooled by these ridiculous numbers that are massaged before being published. Economists slice and dice the data, but the average Joe already knows what the real story is.

In this environment there is a real challenge in being in a business that caters to non-essential middle class consumer items or purchases that can be put off (cars, etc). I know some disagree, but layoffs are indeed here and increasing across the board. This will magnify the effect.

"Disinflation" and "prices coming down"Correct. Fuel is relatively inelastic. Studies have shown that when gas prices are high people will forego certain car usage, but by and large they have to get to work, etc so there is a base below which the usage cannot go at an individual level. The results are that other items are not purchased or purchased on credit - as long as it lasts or the consumer becomes reluctant to pile more debt on themselves and especially with the high interest rates on the cards.

The end result is that other essential goods purchases start to move down in preference - off-brand items, alternatives, etc. This ends up having a disinflation effect over the course of months as fewer purchases are made and the stores have to bring prices down to sustain demand. But that is a rocky road as some retailers fight it all the way and some even go under, mainly because they themselves can only go down so far or are unwilling to go down further. We are seeing this now. "Disinflation" and "prices coming down" in no way means prices are anywhere near where they were previously, they aren't. The consumer knows what's up, they can see it plainly every day and are not fooled by these ridiculous numbers that are massaged before being published. Economists slice and dice the data, but the average Joe already knows what the real story is.

In this environment there is a real challenge in being in a business that caters to non-essential middle class consumer items or purchases that can be put off (cars, etc). I know some disagree, but layoffs are indeed here and increasing across the board. This will magnify the effect.

Hikiing prices up a 100% and then dropping them 50%, isn't a sign of Disinflation or prices coming down in my opinion. That's just gov propaganda to use on the masses of sheep that can't do math. We can start to use the phrase 'new normal' or 'climate change' if it makes the people feel better.

Destroying domestic drilling and giving the middle east 500million to keep drilling, only makes sense if you hate America.

Lots of reasons why, but printing a shit load of money is probably the main one.

US Reaches New Milestone With Massive Federal Debt

Interest on the federal debt exceeded defense spending in the first half of fiscal year 2024 as government spending piles up and interest rates remain high.

Yup, totally my point. Saying inflation is "coming down" is absolutely not the same thing as prices heading down in the aggregate. Everything is still inflating, and they must think the citizens cant figure this out."Disinflation" and "prices coming down"

Hikiing prices up a 100% and then dropping them 50%, isn't a sign of Disinflation or prices coming down in my opinion. That's just gov propaganda to use on the masses of sheep that can't do math. We can start to use the phrase 'new normal' or 'climate change' if it makes the people feel better.

Destroying domestic drilling and giving the middle east 500million to keep drilling, only makes sense if you hate America.

Lots of reasons why, but printing a shit load of money is probably the main one.

US Reaches New Milestone With Massive Federal Debt

Interest on the federal debt exceeded defense spending in the first half of fiscal year 2024 as government spending piles up and interest rates remain high.dailycaller.com

"Obviously, This Is Very Bad News For Biden": Wall Street Reacts To Today's Red Hot Inflation Print | ZeroHedge

ZeroHedge - On a long enough timeline, the survival rate for everyone drops to zero

Consumer Prices Print Hotter Than Expected, Led By Surge In Energy & Shelter Costs | ZeroHedge

ZeroHedge - On a long enough timeline, the survival rate for everyone drops to zero

So, I was pissed about my insurance going from $3500 to $5500 this year so shopped around a bit.

Got quotes today for $7500 and $9500. Broker I was talking to say all insurance companies are doing this.

At least I can drop it if I want, and just might... but people with mortgages are fucked with no options.

But, the impact will be delayed until their annual payment resets with the mortgage payment escrow. Not only will they have to have current increase, they'll have to make up any shortages back to insurance payment month. This will really fuck a lot of people.

This isn't just cost increases.. not fucking possible. Wouldn't be surprised if the WEF is behind this shit in their 3030 agenda.

Got quotes today for $7500 and $9500. Broker I was talking to say all insurance companies are doing this.

At least I can drop it if I want, and just might... but people with mortgages are fucked with no options.

But, the impact will be delayed until their annual payment resets with the mortgage payment escrow. Not only will they have to have current increase, they'll have to make up any shortages back to insurance payment month. This will really fuck a lot of people.

This isn't just cost increases.. not fucking possible. Wouldn't be surprised if the WEF is behind this shit in their 3030 agenda.

The FED Reserve have painted themselves in a corner.

The ‘supercore’ inflation measure shows Fed may have a real problem on its hands

new study published by Northwestern Mutual found the "magic number" that Americans believe they need in order to retire comfortably hit $1.46 million this year, the highest level on record.

Is this in Florida?So, I was pissed about my insurance going from $3500 to $5500 this year so shopped around a bit.

Got quotes today for $7500 and $9500. Broker I was talking to say all insurance companies are doing this.

At least I can drop it if I want, and just might... but people with mortgages are fucked with no options.

But, the impact will be delayed until their annual payment resets with the mortgage payment escrow. Not only will they have to have current increase, they'll have to make up any shortages back to insurance payment month. This will really fuck a lot of people.

This isn't just cost increases.. not fucking possible. Wouldn't be surprised if the WEF is behind this shit in their 3030 agenda.

0.4% X 12 months = 4.8%

Annual inflation is much, much higher than that. The Government is feeding us unrealistic numbers from the beginning.

Reality says inflation is closer to 20% annually. The markets of the world are doubting the US Government's numbers.

WASHINGTON (AP) — Consumer inflation remained persistently high last month, boosted by gas, rents, auto insurance and other items, the government said Wednesday in a report that will likely give pause to the Federal Reserve as it considers how often — or even whether — to cut interest rates this year.

Prices outside the volatile food and energy categories rose 0.4% from February to March, the same accelerated pace as in the previous month. Measured from a year earlier, these core prices are up 3.8%, unchanged from the year-over-year rise in February. The Fed closely tracks core prices because they tend to provide a good read of where inflation is headed.

apnews.com

apnews.com

Annual inflation is much, much higher than that. The Government is feeding us unrealistic numbers from the beginning.

Reality says inflation is closer to 20% annually. The markets of the world are doubting the US Government's numbers.

WASHINGTON (AP) — Consumer inflation remained persistently high last month, boosted by gas, rents, auto insurance and other items, the government said Wednesday in a report that will likely give pause to the Federal Reserve as it considers how often — or even whether — to cut interest rates this year.

Prices outside the volatile food and energy categories rose 0.4% from February to March, the same accelerated pace as in the previous month. Measured from a year earlier, these core prices are up 3.8%, unchanged from the year-over-year rise in February. The Fed closely tracks core prices because they tend to provide a good read of where inflation is headed.

Higher gas and rents keep US inflation elevated, likely delaying Fed rate cuts

Prices outside the volatile food and energy categories rose 0.4% from February to March, the same accelerated pace as in the previous month.

new study published by Northwestern Mutual found the "magic number" that Americans believe they need in order to retire comfortably hit $1.46 million this year, the highest level on record.

Using the 4% rule, that would generate $58,400 annually with no fear of running out before dying.

Along with social security, at $3000 for one and $2500 for the other, that is another $66,000 in income.

So $124,400

With no debt (inc. a paid off house) should be very comfortable, indeed.

WALLSTREET BREAKFAST this AM: "These markets seem to be pricing in at a 70% to 80% chance of a soft landing - modest growth along with declining inflation and interest rates," JPMorgan CEO Jamie Dimon said in his annual letter to shareholders on Monday. "I believe the odds are a lot lower than that." Dimon also pointed to "huge fiscal spending, the trillions needed each year for the green economy, the remilitarization of the world, and the restructuring of global trade" as contributors to inflation. "Therefore, we are prepared for a very broad range of interest rates, from 2% to 8% or even more, with equally wide-ranging economic outcomes."

Dimon is interesting to follow. Similar to listening to a paid "Financial Advisor". Maybe he will make you some money, maybe not. No one can tell us what the future will hold. Why ? Because the world financial system is in uncharted waters. Many interesting phrases are starting to show up recently. This week it was "the market is not following the metrics"... Really difficult to pin down a "metric". My metric is different than your metric.WALLSTREET BREAKFAST this AM: "These markets seem to be pricing in at a 70% to 80% chance of a soft landing - modest growth along with declining inflation and interest rates," JPMorgan CEO Jamie Dimon said in his annual letter to shareholders on Monday. "I believe the odds are a lot lower than that." Dimon also pointed to "huge fiscal spending, the trillions needed each year for the green economy, the remilitarization of the world, and the restructuring of global trade" as contributors to inflation. "Therefore, we are prepared for a very broad range of interest rates, from 2% to 8% or even more, with equally wide-ranging economic outcomes."

Regardless, Dimon is well hedged.

you have to pay taxes on that 124.000... Medicare isn't free if you are making that much money.. I'm not of age, but I know, the more you make, the more they take..Using the 4% rule, that would generate $58,400 annually with no fear of running out before dying.

Along with social security, at $3000 for one and $2500 for the other, that is another $66,000 in income.

So $124,400

With no debt (inc. a paid off house) should be very comfortable, indeed.

This will only make inflation higher, not much considering. However, everything adds up. I don't understand how these idiots don't fucking get it.

you have to pay taxes on that 124.000... Medicare isn't free if you are making that much money.. I'm not of age, but I know, the more you make, the more they take..

Well, sure. You have to pay taxes on income. We all know that.

But if you are married, then the first $29,200 is taxed at 0% (standard deduction for 2024). So, basically, the first 30 Grand is tax free.

You pay tax on only 85% of the social security payments (nobody pays on more than 85%, no matter what income).

Amounts you take from an HSA to reimburse yourself for medical expenses are not taxed.

Roth - IRA withdrawals are not taxed, either.

Money withdrawn from regular taxable accounts is taxed only at the long term capital gains rate, not at income tax rates. Capital gains tax brackets are 0%, 15%, and 20%. But, get this, the first bracket is $94,050. After that it is 15% on capital gains up until $583,751 . . . so our hypothetical $1.6 million portfolio is never going to see 20% capital gains tax no matter how much of it is in a regular, taxable account.

Medicare is $175 to $371 per month, very easily manageable on $124,400 a year.

Insanity

This will only make inflation higher, not much considering. However, everything adds up. I don't understand how these idiots don't fucking get it.

This will only make inflation higher, not much considering. However, everything adds up. I don't understand how these idiots don't fucking get it.

Insanity

It is not insanity. It is vote buying, pure and simple.

Vote for me and get what amounts to tens of thousands of dollars of improvement in your net worth, overnight, and for nothing in return but your support at the voting booth.

How else do you interpret this?

"That’s on top of a pledge Biden and Vice President Kamala Harris made to voters in the swing states of Wisconsin and Pennsylvania earlier this week to cancel up to $20,000 in accrued interest for more than 25 million debtors who went to college."

I mean, going to swing states and telling them, we are going to cancel $20k of accrued interest? This is even more vote buying. I mean, you are not going to get $20k in interest forgiven if you elect that other guy. Right? Vote for us. They hope that will buy them enough votes to pick up those states.

Spoils systemIt is not insanity. It is vote buying, pure and simple.

Vote for me and get what amounts to tens of thousands of dollars of improvement in your net worth, overnight, and for nothing in return but your support at the voting booth.

How else do you interpret this?

"That’s on top of a pledge Biden and Vice President Kamala Harris made to voters in the swing states of Wisconsin and Pennsylvania earlier this week to cancel up to $20,000 in accrued interest for more than 25 million debtors who went to college."

I mean, going to swing states and telling them, we are going to cancel $20k of accrued interest? This is even more vote buying. I mean, you are not going to get $20k in interest forgiven if you elect that other guy. Right? Vote for us. They hope that will buy them enough votes to pick up those states.

Trump needs to come out and say...

"If I get elected, every voting aged American will get a 10,000 dollar hardship grant", due to the previous Administrations mismanagement of funds.

Be nice to keep some of those Trillions here at home, instead of sending it off the middle east or some other country that hates us.

"If I get elected, every voting aged American will get a 10,000 dollar hardship grant", due to the previous Administrations mismanagement of funds.

Be nice to keep some of those Trillions here at home, instead of sending it off the middle east or some other country that hates us.

You mean folks with less than a 720 credit score actually try to take out mortgages rather than paying down some debt and making payments on time to get a 720 or higher?

Why?

I guess I just do not understand the financial decisions people make.

Why?

I guess I just do not understand the financial decisions people make.

Trump needs to come out and say...

"If I get elected, every voting aged American will get a 10,000 dollar hardship grant", due to the previous Administrations mismanagement of funds.

Be nice to keep some of those Trillions here at home, instead of sending it off the middle east or some other country that hates us.

That's what they have been doing for decades now except it's low/no interest loans from the federal reserve to investment groups, banks, special interests etc. So they might as well just switch gears and start at the bottom instead of pouring billions into the top only for nickels and dimes to roll out the bottom.

Dave Ramsey Is a little off. Get a 30 year, pay it as if it were a 15. You end up paying more against principal each month and over time it makes a material difference in the real interest you pay on the loan. Also it gives cushion - if something goes sideways financially you aren’t locked in to the 15 year amount so you can flex back to the 30 year monthly amount instead of potentially getting into mortgage trouble. And make sure there is no clause against prepayment.Current average for a 15 year is 6.38%

Dave Ramsey says never do a 30 year.

Getting out of debt as fast as possible is Always the best option.

Last edited:

Similar threads

- Replies

- 32

- Views

- 1K

- Replies

- 109

- Views

- 4K

- Replies

- 61

- Views

- 2K