Join the Hide community

Get access to live stream, lessons, the post exchange, and chat with other snipers.

Register

Download Gravity Ballistics

Get help to accurately calculate and scope your sniper rifle using real shooting data.

Install the app

How to install the app on iOS

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

PortaJohn

- Thread starter Lowlight

- Start date

-

- Tags

- sniper's hide

Sharks know how to party.

www.foxnews.com

www.foxnews.com

Sharks test positive for cocaine off Brazil's coast | Fox News

Study, published in the journal ScienceDirect, is first to test cocaine in free-ranging sharks

Canadian 'Skinny Dipping Club' Lets Kids In For Free & Says Erections 'Are Natural'

A Canadian gym hosts a regular “skinny dipping club” for people who like getting naked - including young children.

It's rare to encounter someone so easily and deeply offended by the most trivial things, but here we are - straight to name-calling over a very mild difference of opinion.Moot to you.

What is is with retards on this site who don't have an answer or constructive input or an entertaining joke who are drawn to questions they don't even fucking understand with a burning desire to pontificate about how meaningless the question is to them personally?

I'd have more respect for you if you tried to make a joke out of it ... even a lame joke.

You asked if they would include tips in total income for calculation of SS benefits. He said they'd gladly trade the tax break for the illusion of SS benefits, and I said it's a moot point because there aren't going to be any SS benefits by the time they retire. And that set you off to go calling people retards and turds...?

Well, that's more than it usually takes around these here parts. . .It's rare to encounter someone so easily and deeply offended by the most trivial things, but here we are - straight to name-calling over a very mild difference of opinion.

You asked if they would include tips in total income for calculation of SS benefits. He said they'd gladly trade the tax break for the illusion of SS benefits, and I said it's a moot point because there aren't going to be any SS benefits by the time they retire. And that set you off to go calling people retards and turds...?

Of all the retard companies that fall apart going woke, I will enjoy watching this one the most.

Alex Soros and Abadin afraid of losing their clout.

Harley is in deep trouble as the under 35 are not buying Harleys. Going woke will not sit well with their current customers!Of all the retard companies that fall apart going woke, I will enjoy watching this one the most.

These fucking liberal cowards cannot even stand up and take the responsibility of their actions.

In chorus as usual..gaslighting again

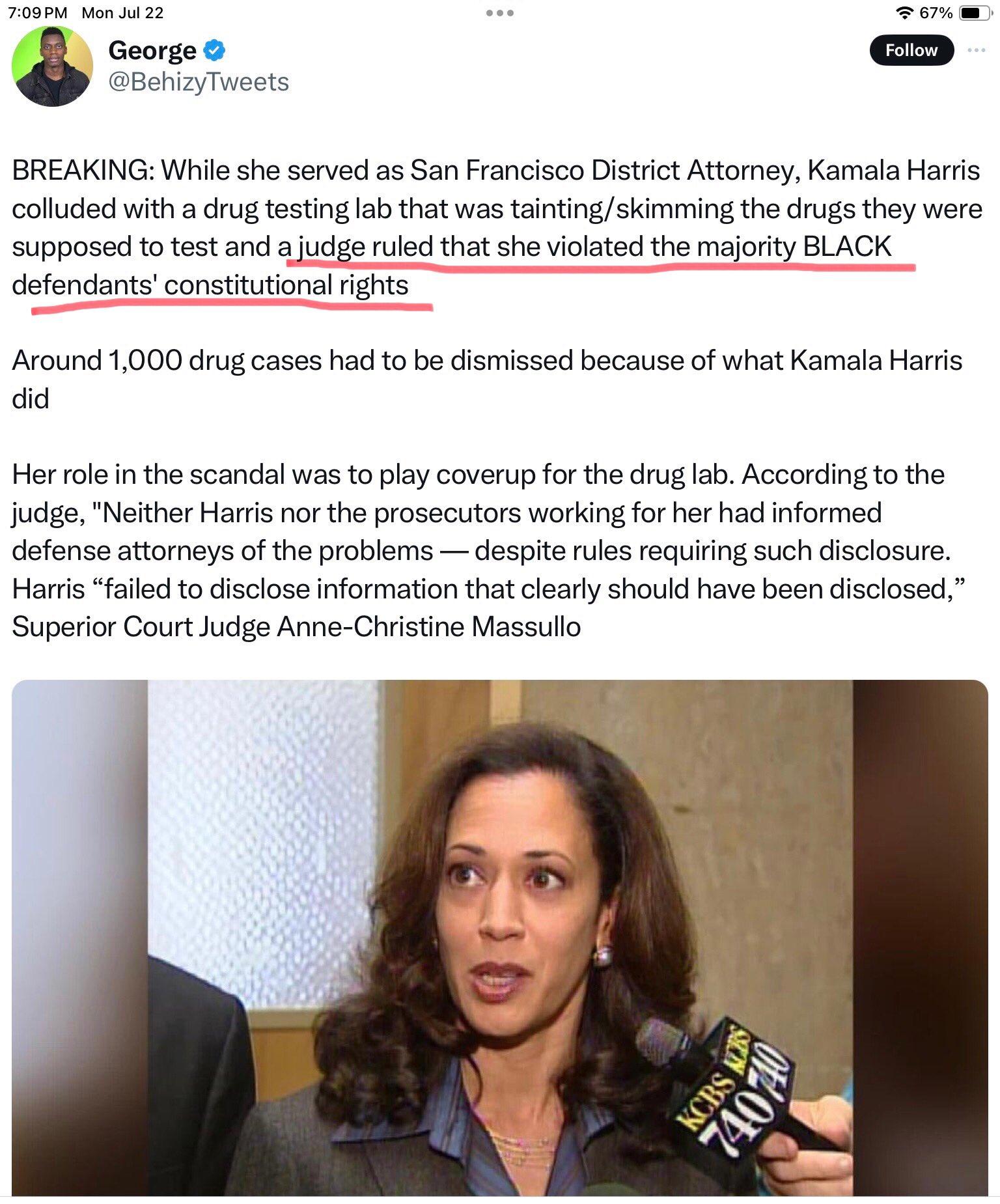

She also can't keep a staff. I think the average time she can keep a staffer is six months. How many Chiefs of Staff has she had? That's usually a position that follows a politician through their career. She can't find anyone who trusts her and whom she can trust.

what....everyone working tip jobs would gladly exchange tax free wages in exchange for paying SS tax and its inclusion in your calculation later in life

some people work 30 years for 1,000 a month in SS; other come across the border and get 2500 without ever paying a penny into the pot.

People wonder why the pot is going empty. Thanks Joe and VP

Hate Crime?

“He was down on the floor, and this kid just came and just stomped on him and on his head,” the victim’s mother, Eva Guingab, told ABC 7.

“You could clearly see the size of his shoe on his face. My son suffered a concussion for the first time he played basketball.”

“He was down on the floor, and this kid just came and just stomped on him and on his head,” the victim’s mother, Eva Guingab, told ABC 7.

“You could clearly see the size of his shoe on his face. My son suffered a concussion for the first time he played basketball.”

Anyone know why? soft coup? Getting ready to mourn?

edited - thanks to friends and grammar police

edited - thanks to friends and grammar police

Last edited:

Anyone know why? soft coupe? Getting ready to mourn?

“Coup”

This would be a soft coupe

Last edited:

Anyone know why? soft coup? Getting ready to mourn?

edited - thanks to friends and grammar police

most likely because bibi is going to be there and they expect hamas supporters.

Last edited:

These fucking liberal cowards cannot even stand up and take the responsibility of their actions.

MI still has NOT released pictures of the murderer.......

Of course not and they may not eitherMI still has NOT released pictures of the murderer.......

Dunno either, however there could likely be many ways to workaround not taxing tips.Don't know the details.

Under his policy will it still be reported income just not taxed?

What you make influences what you get from social security later, assuming it's still around.

Currently, tips reported to the employer (ex tip on a meal paid by credit card) are reported to the IRS by the employer. They have income tax & SS+Medicare withheld.

Tips could still be reported & have SS+Medicare withheld but NOT income tax. No change to SS in New scheme.

Or they could feasibly not have anything withheld. If that ends up the case, then it COULD change SS in new scheme.

Also & important are tips NOT reported to employer (ie cash tips). The employee is supposed to file those. Perhaps some do. More likely most report "some". We ALWAYS tip cash, even paying when with CC...

--Noteable: never worked a tip job, so there's that.

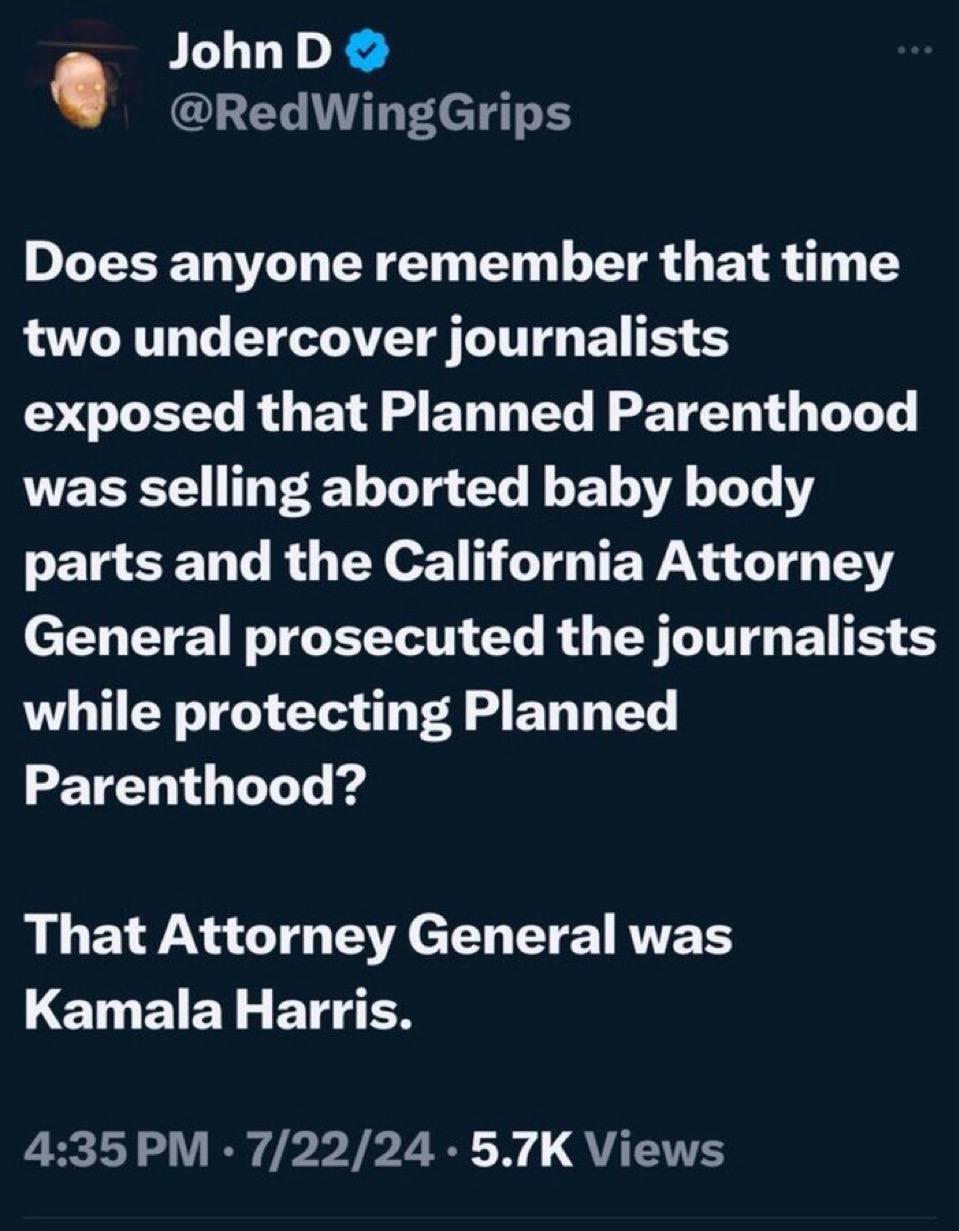

California's Kamala Harris becomes first Indian-American US senator

Harris was backed by President Barack Obama, Vice President Joe Biden and other top Democrats.

California's Kamala Harris becomes first Indian-American US senator

Associated Press

Nov 8, 2016, 11:20 PM CST

Texas woman Janet Mello looks devastated after being sentenced for scamming more than $100m from the US Army

100 Million from US taxpayer, US Army, and money meant for kids......sentenced to 15 years in jail.

Texas woman who scammed the US Army out of more than $100M sentenced

Janet Yamanaka Mello created a shell company in 2016 before splashing out on multiple McMansions, 82 supercars, motorcycles and flashy designer jewelry during the brazen six-year scam.

California's Kamala Harris becomes first Indian-American US senator

Harris was backed by President Barack Obama, Vice President Joe Biden and other top Democrats.www.businessinsider.com

California's Kamala Harris becomes first Indian-American US senator

Associated Press

Nov 8, 2016, 11:20 PM CST

Similar threads

- Replies

- 1

- Views

- 577