Join the Hide community

Get access to live stream, lessons, the post exchange, and chat with other snipers.

Register

Download Gravity Ballistics

Get help to accurately calculate and scope your sniper rifle using real shooting data.

Install the app

How to install the app on iOS

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

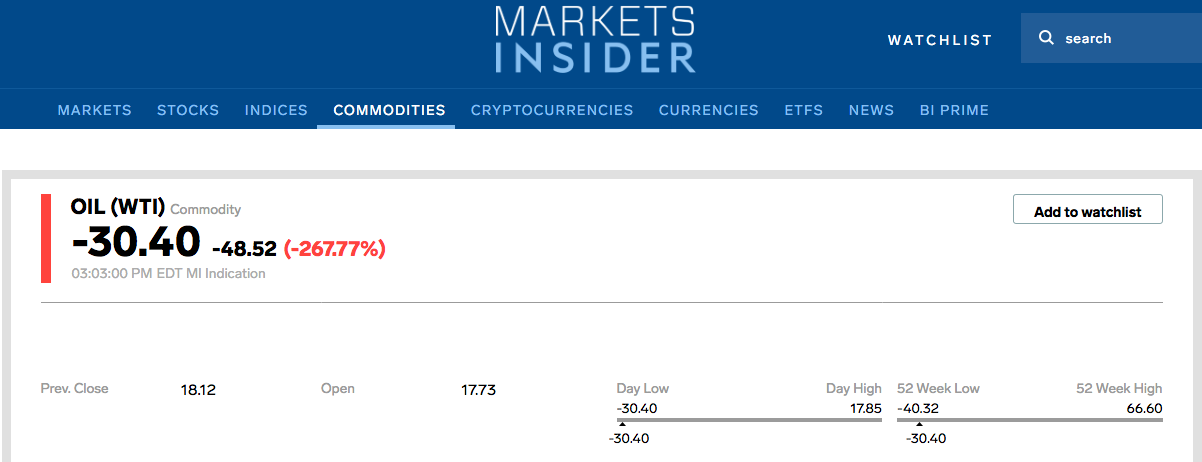

Oil Prices ?????????

- Thread starter Sgt47

- Start date

She’s going down boys.

Money is worthless

Goddammit, just realized my brokerage account doesn't trade NYMEX.

I was about to buy some negative oil lol

Help me out here. If money were worthless, wouldn't that mean that it would cost millions of dollars to buy a barrel of oil. If each individual dollar is worthless, it would take millions of them to equal the value of a barrel of oil.She’s going down boys.

Money is worthless

This looks to me like the opposite extreme as far as money and oil are concerned.

It looks more like oil is worthless, although we know that oil isn't really without worth when we want to fire up the old tractor.

Help me out here. If money were worthless, wouldn't that mean that it would cost millions of dollars to buy a barrel of oil. If each individual dollar is worthless, it would take millions of them to equal the value of a barrel of oil.

This looks to me like the opposite extreme as far as money and oil are concerned.

It looks more like oil is worthless, although we know that oil isn't really without worth when we want to fire up the old tractor.

And its temporary.

I don't know exactly what happened, but from reading, it has to do with the flood of oil on the market from OPEC and Russia, the constantly dropping price and now people who had bought oil thinking it was 'on sale' slated for physical delivery of said oil and they do not want to take delivery because it is way over current cost.

It's basically someone buying a McMansion because there was a slight drop in the real estate market, then realizing the bubble burst and its now worth 1/4 of what they paid for it and are now refusing to pay their mortgage.

If I believed in gambling I would do some investing right about now.

But I don’t So back under the mattress it goes. My retirement hasn’t been interrupted by all this mess

It'll come back. It has to. Oil isn't something that is just going away.

Today is the last day for trading futures for the current block; here we are.

After that it'll slowly come back, and the downside will be that everyone stops producing any, so by the time they let the supply catch up with demand we'll end up at 120$/barrel for a while.

The only precaution I took today was to take the profit end off of stocks I have and to put in future buy orders at lower prices today.

Just called my local fuel distributor. Told them to go ahead and send me 500 gallons of premium fuel.

Told them I'd send them a bill for my troubles.

Told them I'd send them a bill for my troubles.

Last edited:

I'm not sure where you got that, but WTI never went below the $1.90s. Right now it's trading at $2.03. And it averages around $4.00.

I just heard on the radio it hit a penny a barrel then negotiate.

I’m rushing out to buy me a GIANT SUV with a GIANT GAS motor tonight!

Don't get too exicted.

Prepare for all sorts of the typical 'oh we shut a refinery down for maintenance' bullshit where the price goes up overnight due to it, yet when it opens back up the price doesn't move.

It went negative for a while. Its negative $18 and some change now. Swinging wildly.I'm not sure where you got that, but WTI never went below the $1.90s. Right now it's trading at $2.03. And it averages around $4.00.

-$18.20 a bbl at the time of this post. Down almost 200% today at this time. WTF!!

and Yet gas is still above 2.00 per gallon that's kinda funny

poor opec .. all that oil and no one can really use it with the quarantine in place

poor opec .. all that oil and no one can really use it with the quarantine in place

More than poor OPEC. One of the largest sectors of the US economy is failing right now. Thousands and thousands of layoffs already. Maybe 100,000s of layoffs and more everyday.and Yet gas is still above 2.00 per gallon that's kinda funny

poor opec .. all that oil and no one can really use it with the quarantine in place

7 million Americans earn a living in the energy sector. Not all oil and gas but many. Choose your words wisely please.

Last edited:

May contracts.

markets.businessinsider.com

markets.businessinsider.com

I'm putting on my tinfoil for a moment and thinking this has Sorros written all over it.

Crude Oil Price Today | WTI OIL PRICE CHART | OIL PRICE PER BARREL | Markets Insider

Oil Price: Get all information on the Price of Oil including News, Charts and Realtime Quotes.

I'm putting on my tinfoil for a moment and thinking this has Sorros written all over it.

Also obligatory fuck all this shit and the idiots perpetuating it. Convinced they won't be satisfied until everyone is ruined.

Thought it was about "flattening the curve" not "prevent anyone anywhere ever from ever getting sick ever, no matter the price".

Thought it was about "flattening the curve" not "prevent anyone anywhere ever from ever getting sick ever, no matter the price".

Oil prices have put thousands out of work and likely to break many big companies. The virus may go away this year but oil is going to be down for at least two years as all reserves world wide are overflowing today.

Yep. Better than negatives but damn. It dropped today like a rock because there is nowhere to go with oil. If the world doesn’t go back to some kind of normalcy, I bet those futures will be on the optimistic side.

The over supply is a problem for oil prices and the June contract could drift lower as such.

Understand that today’s insane drop was via paper traders getting their ass handed to them by futures expiration.

A long squeeze took place as traders had to close or roll to the June contract. The ETF, USO, owned 25% of the outstanding May oil futures and ETFs and smaller futures traders don’t take physical delivery so they are forced to close.

The over supply situation has been known for a while and will continue to be an issue until demand catches up.

Understand that today’s insane drop was via paper traders getting their ass handed to them by futures expiration.

A long squeeze took place as traders had to close or roll to the June contract. The ETF, USO, owned 25% of the outstanding May oil futures and ETFs and smaller futures traders don’t take physical delivery so they are forced to close.

The over supply situation has been known for a while and will continue to be an issue until demand catches up.

Be curious to see what happens short and long term.

I recall some analysts speculating about negative oil prices, many were doubtful including myself. Though I knew it was going to get a lot worse before it got better.

I doubt it will be negative for a sustained period, but the prices will be depressed for a while. I don't feel too bad for the oil & gas companies - they are their own worst enemies and make some very unsustainable decisions in order to appease their shareholders. But I do feel bad for the individual employees, many of whom are going to lose their jobs.

The world relies on the commodity of oil, it's not going away any time soon. Almost every product in some fashion requires a product derived from O&G to be produced and delivered to the end user. But I do think O&G companies are going to bleed for a while, and having to make some big changes to survive depressed market prices. There will definitely be more then a few bankruptcies with the amount of over leveraged O&G companies out there.

I hope that Trump doesn't bail out the O&G companies.

I recall some analysts speculating about negative oil prices, many were doubtful including myself. Though I knew it was going to get a lot worse before it got better.

I doubt it will be negative for a sustained period, but the prices will be depressed for a while. I don't feel too bad for the oil & gas companies - they are their own worst enemies and make some very unsustainable decisions in order to appease their shareholders. But I do feel bad for the individual employees, many of whom are going to lose their jobs.

The world relies on the commodity of oil, it's not going away any time soon. Almost every product in some fashion requires a product derived from O&G to be produced and delivered to the end user. But I do think O&G companies are going to bleed for a while, and having to make some big changes to survive depressed market prices. There will definitely be more then a few bankruptcies with the amount of over leveraged O&G companies out there.

I hope that Trump doesn't bail out the O&G companies.

You need to look at this as long ball now.

I'm not experienced with futures, but are they like stocks where it has a market price, or is it more of something where you are just betting that the price will be above/below whatever the contract price for said time period is?

If its like stock and you can hold it as long as you want, I'd seriously consider buying a ton of it and holding it for a year. I wonder if the negative price would force you to margin the difference to 0.

Remember that there are many many more small independent oil companies out there. Exxon, BP, Chevron, etc that you are referring to are the big boys. Those small independents are dropping like flies. Same for the service companies that work for them. Eventually there will only be the big boys. That is something we dont want.Be curious to see what happens short and long term.

I recall some analysts speculating about negative oil prices, many were doubtful including myself. Though I knew it was going to get a lot worse before it got better.

I doubt it will be negative for a sustained period, but the prices will be depressed for a while. I don't feel too bad for the oil & gas companies - they are their own worst enemies and make some very unsustainable decisions in order to appease their shareholders. But I do feel bad for the individual employees, many of whom are going to lose their jobs.

The world relies on the commodity of oil, it's not going away any time soon. Almost every product in some fashion requires a product derived from O&G to be produced and delivered to the end user. But I do think O&G companies are going to bleed for a while, and having to make some big changes to survive depressed market prices. There will definitely be more then a few bankruptcies with the amount of over leveraged O&G companies out there.

I hope that Trump doesn't bail out the O&G companies.

The situation is bad for oil companies, no doubt. The supply problem is bad for them.

Point being, I wouldn’t pay attention to today’s price. See my above post as to why. June contract is more reflective and currently at 21.34. Now it could go lower naturally due to supply/demand and whatever OPEC says next.

Point being, I wouldn’t pay attention to today’s price. See my above post as to why. June contract is more reflective and currently at 21.34. Now it could go lower naturally due to supply/demand and whatever OPEC says next.

Does that mean they will pay me to fiilup my truck. I think not. The low price will not help anyone . Other than OPEC

Remember that there are many many more small independent oil companies out there. Exxon, BP, Chevron, etc that you are referring to are the big boys. Those small independents are dropping like flies. Same for the service companies that work for them. Eventually there will only be the big boys. That is something we dont want.

I agree with that. Small, private companies are who I wish would stick around. Some have really good balance sheets, others are extremely overleveraged with debt.

If Exxon, Chevron, etc get a big bailout, I would absolutely be pissed.

I'm on your side. When I used to work for one of those big companies, our management was trying to get some of the smaller vendors we used to give us huge price cuts. Like 20+%. Just so that the division I worked at could be competitive with another internal division in Texas. Give me a fucking break, we are going to make these small service companies essentially pay to be on our location??? That pissed me of. Our company that was still making $4 billion profit per quarter wanted to make the little guys bleed, how rich.

The games that this big oil companies play really drive me nuts, as someone who used to be on the inside.

Be curious to see what happens short and long term.

I recall some analysts speculating about negative oil prices, many were doubtful including myself. Though I knew it was going to get a lot worse before it got better.

I doubt it will be negative for a sustained period, but the prices will be depressed for a while. I don't feel too bad for the oil & gas companies - they are their own worst enemies and make some very unsustainable decisions in order to appease their shareholders. But I do feel bad for the individual employees, many of whom are going to lose their jobs.

The world relies on the commodity of oil, it's not going away any time soon. Almost every product in some fashion requires a product derived from O&G to be produced and delivered to the end user. But I do think O&G companies are going to bleed for a while, and having to make some big changes to survive depressed market prices. There will definitely be more then a few bankruptcies with the amount of over leveraged O&G companies out there.

I hope that Trump doesn't bail out the O&G companies.

you realize that by not bailing out the american O&G companies you then increase the leverage that the saudis and OPEC already has right? We have gone to war over this shit in the past and you think the best idea is to give them even more power? Now I agree there were some small US companies back when oil was 100+/bbl that should have never existed but if the big boys (Exxon, Shell, chevron, etc) start to crumble you’ll soon see a new world order. Energy controls a hell of a lot more than what you pay to fill your truck at the pump.

The big companies in Any industry boast billions in quarterly profits. Where is that money to run on. The small guys dont have it.you realize that by not bailing out the american O&G companies you then increase the leverage that the saudis and OPEC already has right? We have gone to war over this shit in the past and you think the best idea is to give them even more power? Now I agree there were some small US companies back when oil was 100+/bbl that should have never existed but if the big boys (Exxon, Shell, chevron, etc) start to crumble you’ll soon see a new world order. Energy controls a hell of a lot more than what you pay to fill your truck at the pump.

you realize that by not bailing out the american O&G companies you then increase the leverage that the saudis and OPEC already has right? We have gone to war over this shit in the past and you think the best idea is to give them even more power? Now I agree there were some small US companies back when oil was 100+/bbl that should have never existed but if the big boys (Exxon, Shell, chevron, etc) start to crumble you’ll soon see a new world order. Energy controls a hell of a lot more than what you pay to fill your truck at the pump.

What I believe needs to be done is that the US creates their own internal oil market. Each company has a quota, and it's all based on creating a stabilized internal oil market around $50-60/bbl. If you choose to produce more then your quota, then you are stick selling that on the external international markets, at whatever prices those may be. There's enough reserves in the US to be completely self dependent on oil & gas, which as you say is a very strategic commodity. We can completely remove OPEC and other external factors if we so choose.

I don't believe in bailouts. Bailouts continue to enforce and enable the horrible and unsustainable practices that a lot of these oil & gas companies have been engaged in for years.

A bailout isn't really going to fix shit. It's placing a bandaid on a sucking chest wound.

I understand your sentiment about bailouts but I think they may be because of how they were used in the past. For example, with the big auto manufacturers they just bought back their stock for pennies and fattened the pockets of the execs which is completely bullshit and they should be in jail for it. However a bail out as I see it is to strategically boost a micro economy for various reasons (in this case national security and foreign interest/relations) I think more controls needs to be put in place on how the money is used etc. For example I don’t think it should be used to pay dividend.

We also really haven’t seen anything like this in our lives. Sure man made things like the housing market collapse or even acute disasters like 9/11 but I can’t recall at least in my lifetime anything that has brought the entire world to a screeching halt. In my mind it’s times like these that bailouts serve their more ethical purpose.

We also really haven’t seen anything like this in our lives. Sure man made things like the housing market collapse or even acute disasters like 9/11 but I can’t recall at least in my lifetime anything that has brought the entire world to a screeching halt. In my mind it’s times like these that bailouts serve their more ethical purpose.

There are so many different grades of oil that I am not sure the US can have its own internal market or function independently

I don’t feel bad one bit for O&G operators. Their decisions over the last 10-15yrs determine how bad they are off right now.

I don’t feel bad at all for service companies as when the getting is good they clean shop.

I feel bad for the drilling contractors. They way operators are forcing them to function is not sustainable.

At this point everyone is just “maintaining” and trying to save their market share. Operators are going to service providers and drilling contractors and saying reduce personnel and cost or we will find someone else. At this point drilling contractors and service companies are just doing what they need to do to survive this market.

The stupidity of Oil and Gas management at a corporate level is absolutely mind boggling at this point in time.

I could go on a rant for days but I am going to go back to letting it all roll off my back.

I don’t feel bad one bit for O&G operators. Their decisions over the last 10-15yrs determine how bad they are off right now.

I don’t feel bad at all for service companies as when the getting is good they clean shop.

I feel bad for the drilling contractors. They way operators are forcing them to function is not sustainable.

At this point everyone is just “maintaining” and trying to save their market share. Operators are going to service providers and drilling contractors and saying reduce personnel and cost or we will find someone else. At this point drilling contractors and service companies are just doing what they need to do to survive this market.

The stupidity of Oil and Gas management at a corporate level is absolutely mind boggling at this point in time.

I could go on a rant for days but I am going to go back to letting it all roll off my back.

There are so many different grades of oil that I am not sure the US can have its own internal market or function independently

I don’t feel bad one bit for O&G operators. Their decisions over the last 10-15yrs determine how bad they are off right now.

I don’t feel bad at all for service companies as when the getting is good they clean shop.

I feel bad for the drilling contractors. They way operators are forcing them to function is not sustainable.

At this point everyone is just “maintaining” and trying to save their market share. Operators are going to service providers and drilling contractors and saying reduce personnel and cost or we will find someone else. At this point drilling contractors and service companies are just doing what they need to do to survive this market.

The stupidity of Oil and Gas management at a corporate level is absolutely mind boggling at this point in time.

I could go on a rant for days but I am going to go back to letting it all roll off my back.

Agreed. Oil & gas companies have been orchestrating their demise through years of horrible and greedy decisions. A bailout will just reinforce and enable these poor decisions. They are their own worst enemies.

If you want to treat O&G like a strategic asset, then we need to start treating it as such. If you think companies that are beholden to shareholders are acting within the best interest of the country, you are in for a rude awakening. They are doing everything but.

If we want to treat O&G like a strategic asset, then we better start acting like it.

Last edited:

When I finished grad school in '81 I went to work in Midland, TX in since the rest of the economy was in the tank following Carter's Presidency. It was a high rolling place and the money was just flowing. Then oil prices started to slide in late '83 and completely tanked by '86 due to oversupply. The collapse of oil prices as well as the Tax Reform Act of '86 were the major contributor's to the S&L crisis for those of us old enough to live through it. Many people in the oil gas business went bankrupt but also created a window of opportunity for fortunes to be made. A gentleman I knew in Midland started buying production at pennies on the dollar at the bottom of the market and subsequently sold them for a fortune years later. Oil is a pure commodity and being such behaves economically as one. Wells will be idled and some even plugged. Service companies will be devastated and small towns in the oil patch will become empty. New Mexico where 30% of its revenue is generated by royalties will be in dire straits especially since the idiots in Santa Fe have been spending money like shit through a goose.

Does that mean they will pay me to fiilup my truck. I think not. The low price will not help anyone . Other than OPEC

OPEC is not helped by low prices. We're looking at a minor to moderate economy disturbance in the US*; countries like Saudi Arabia are going to burst at the seams if this keeps up.

*At least in the short term. In the long term, the death of the petrodollar could mean the fall of our empire.

Brent is already on the June contract.I'm wondering why is it only WTI????? Brent is still up and all the others I could find quotes on. Somebody just trying to put the US companies out of business?

Because it wasnt actual oil per barrel.

It was paper trades. Meaning futures contracts that expire tomorrow. Someone had way too many and the buyers knew someone had too many so they made them pay them to take them....

It was paper trades. Meaning futures contracts that expire tomorrow. Someone had way too many and the buyers knew someone had too many so they made them pay them to take them....

Somebody just trying to put the US companies out of business?

You're kidding right...

Everything the Swamp tried failed...while we were looking at Russian collusion, the socialists were colluding with Xi...their plan to boot Trump is working like clockwork...

Sheep are sheep...and now they will get sheared...big time

The problem is storage. No space left to put WTI. May contracts expire, so June will be back to ~$20, but demand wanes and the storage problem won't go away soon. I expect the June futures to drop over the next few weeks. This will be like the tulips and Hunt brothers.

Unless someone has found a big mine of Dilithium Crystals oil is a temp problem. We had a glut now we have a COVID glut.

Where do you think the price of oil goes when the world economy turns back on. Let’s see, low production, high demand, equals oil up up up.

Crisis Market change is why you don’t want go Too far out on a limb in any business.

Where do you think the price of oil goes when the world economy turns back on. Let’s see, low production, high demand, equals oil up up up.

Crisis Market change is why you don’t want go Too far out on a limb in any business.

WTI crude is still in negatives as of now.New contract at around $15 and down 25%.

View attachment 7304527

Death Cert; cause of death, COVID.

So the prices trading right now are still for May? I thought yesterday was the last day for may.That is the old contract K/May, this is the M/June contract.

edit: i see MAY expires today. I bet June will fall as well soon enough unfortunately.

Last edited:

I thought we were energy independent? Why did we have Saudi oil arriving in the US? Im sure my definition of (energy Independent) is not what it actually means...

oilprice.com

oilprice.com

Flood Of Saudi Oil To Hit U.S. Shores As Prices Hit $10 | OilPrice.com

The highest number of Saudi oil shipments in years are making their way to the United States this month, threatening to make an already dire situation in the U.S. oil industry even worse

Maybe some long term futures calls?

How about BP? Low 20s, dividend yield 11% plus. Get paid to wait on it.

How about BP? Low 20s, dividend yield 11% plus. Get paid to wait on it.

If oil is worthless now (Its really not) then its not worth putting in a tanker or hauling to a refinery. Less refining equal less fuel on the market and the price will go back up with demand that is mote than the supply. Just wait. We will all get fucked on the back end of this thing.

Last edited:

Arabian oil is light and sweet and easy to refine. Each refinery is tuned the the type of oil they are buying... this can be adjusted and retuned to new crudes but the stuff that arrives this week has already been under contract and so it makes sense to use what is on the way and then use that time to figure out the next refinery move. My bet is that US refineries will likely be adjusting to only use US based grades of crude going forward. And that's when the wars will start. Because we have enough supply to be self sufficient, we'll be ok and can hopefully stay out of the shit show that will be Iran/Iraq/Russia/Saudi Arabia.I thought we were energy independent? Why did we have Saudi oil arriving in the US? Im sure my definition of (energy Independent) is not what it actually means...

Flood Of Saudi Oil To Hit U.S. Shores As Prices Hit $10 | OilPrice.com

The highest number of Saudi oil shipments in years are making their way to the United States this month, threatening to make an already dire situation in the U.S. oil industry even worseoilprice.com

The best way to make money in oil right now is storage... there's panic storage buying going on that will translate into 100% utilization of assets and awesome profits over the next few quarters for tank farms, super tankers, and pipelines.

Similar threads

- Replies

- 28

- Views

- 1K