Join the Hide community

Get access to live stream, lessons, the post exchange, and chat with other snipers.

Register

Download Gravity Ballistics

Get help to accurately calculate and scope your sniper rifle using real shooting data.

Install the app

How to install the app on iOS

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

GOLD

- Thread starter Hobo Hilton

- Start date

History repeating. There are always a lot of bag holders.My condolences to all the new bag holders.

Greed is a demon.

So true, and the root of ALL evil not money.Greed is a demon.

If these quotes are accurate........ The numbers don't jive.

www.usmint.gov

www.usmint.gov

Fort Knox Facts

- Amount of present gold holdings: 147.3 million ounces. About half of the Treasury’s stored gold (as well as valuables of other federal agencies) is kept at Fort Knox.

- Highest historic gold holdings: 649.6 million ounces (December 31, 1941).

- The only gold removed has been very small quantities used to test the purity of gold during regularly scheduled audits. Except for these samples, no gold has been transferred to or from the Depository for many years.

- The gold is held as an asset of the United States at book value of $42.22 per ounce.

- Size of a standard gold bar: 7 inches x 3 and 5/8 inches x 1 and 3/4 inches.

- Weight of a standard gold bar: approximately 400 ounces or 27.5 pounds.

- The actual structure and content of the facility is known by only a few, and no one person knows all the procedures to open the vault.

- The first gold arrived at Fort Knox in 1937…by U.S. Mail! View photos of the shipment on the History of the U.S. Mint page.

Fort Knox Bullion Depository | U.S. Mint

The United States Bullion Depository at Fort Knox, Kentucky stores precious metal bullion reserves for the United States.

So, a value of around $300B? That isn't shit. US government deficit spends more than that much money EVERY MONTH.

That is what the rest of the worldwide financial markets are finding out.So, a value of around $300B? That isn't shit. US government deficit spends more than that much money EVERY MONTH.

US Government = Paper tiger

- Amount of present gold holdings: 147.3 million ounces. About half of the Treasury’s stored gold (as well as valuables of other federal agencies) is kept at Fort Knox.

- Highest historic gold holdings: 649.6 million ounces (December 31, 1941).

- The only gold removed has been very small quantities used to test the purity of gold during regularly scheduled audits. Except for these samples, no gold has been transferred to or from the Depository for many years.

It's in a bank in the middle of Beverly Hills under somebody else's name.

Thank you,

MrSmith

Thank you,

MrSmith

650M oz in 1941... Nothing has been added removed "in the last several years..."So basically #502.3 million ounces are missing but none have been added or removed.

After the US dropped off the gold standard, with the exception of nations US holdings.. many countries started repatriation their gold and drained the vault. Or, something like that.

So basically #502.3 million ounces are missing but none have been added or removed. Sounds like solid US gov. accounting. Kind of like the Pentagon audits that show billions of dollars and hardware unaccounted for but nobody knows where it is. Probably the best Ponzi scheme ever imagined!!

- Amount of present gold holdings: 147.3 million ounces. About half of the Treasury’s stored gold (as well as valuables of other federal agencies) is kept at Fort Knox.

- Highest historic gold holdings: 649.6 million ounces (December 31, 1941).

- The only gold removed has been very small quantities used to test the purity of gold during regularly scheduled audits. Except for these samples, no gold has been transferred to or from the Depository for many years.

Nothing has changed since February 22, 1977It's in a bank in the middle of Beverly Hills under somebody else's name.

Thank you,

MrSmith

Pretty sure that's the last time there was an audit.Nothing has changed since February 22, 1977

Every year the gold in Fort Knox is ‘audited’ by checking the official joint seals that were placed on all vault compartments during the continuing audits of U.S.-owned gold from 1974 until 1986, when allegedly 97 % of the (Deep Storage) gold was inspected. However, a Freedom Of Information Act request I’ve submitted in order to obtain all audit reports could not be honored. Seven reports are missing.Pretty sure that's the last time there was an audit.

From at least 1944 the world reserve currency is the US dollar, which was backed by gold until 1971 and supported by gold ever since. There can be no world reserve currency without appropriate gold reserves supporting it, providing essential confidence and credibility. The US official gold reserves are the world’s greatest by far at 8,134 metric tonnes. The fact that 7 audit reports that should grant the existence of these reserves appear to be missing is problematic.

At the congressional hearing of the Gold Transparency Act in 2011 the Inspector General (IG) of the Treasury presented a case ‘all is fine’, but all is not fine. And the problem goes far beyond missing audit reports. In a series of posts we’ll continue to examine all there is to find regarding the audits of US official gold reserves.

Let’s recap what we’ve studied in the previous posts. The US Treasury currently owns 8,134 tonnes of gold of which 7,716 tonnes is stored by the US Mint (4,583 tonnes at Fort Knox, 1,364 tonnes in Denver, 1,682 at West Point) and 418 tonnes at the Federal Reserve Bank Of New York.

Last edited:

Stumbled into a couple of articles at DM. UK stopping minting for other countries, repurpose staff to reclaim gold. They state demand for coins is down worldwide.

www.dailymail.co.uk

www.dailymail.co.uk

This article mentions supplying One customer:

www.dailymail.co.uk

www.dailymail.co.uk

Given the financial crisis world wide saying demand is down is a given. Could this be a smoke screen story, not enough bullion inventory or the opposite the need to stock pile bullion?

Royal Mint to stop making coins for overseas countries after 700 years

The Royal Mint first started making overseas coins in 1325. But from December 2024 the Royal Mint will stop making these overseas coins, and will instead focus on making coins for the UK.

This article mentions supplying One customer:

The Royal Mint aims to sell £100m of coins to AMERICA

Americans are already keen on UK-made coins, and the Mint said it has seen a 118 per cent increase in sales to the US since 2022.

Given the financial crisis world wide saying demand is down is a given. Could this be a smoke screen story, not enough bullion inventory or the opposite the need to stock pile bullion?

Last edited:

Could be several conditions that are rapidly changing. Some of it is just the "cycle". Some of it is the paper gold traders. A lot of the discussion has to do with the "perspective" of both the reporter as well as the reader. I watch the actions of some of the oldest societies in the world. These societies (the people, not the Governments) are steadily stockpiling. Another factor that is skewing the view is attempting to link gold to the purchasing power of the USD. This is nothing more than chasing a mirage. When / if a $1,000 USD will purchase an ounce of gold, America will be moving in the right direction.Stumbled into a couple of articles at DM. UK stopping minting for other countries, repurpose staff to reclaim gold. They state demand for coins is down worldwide.

Royal Mint to stop making coins for overseas countries after 700 years

The Royal Mint first started making overseas coins in 1325. But from December 2024 the Royal Mint will stop making these overseas coins, and will instead focus on making coins for the UK.www.dailymail.co.uk

This article mentions supplying One customer:

The Royal Mint aims to sell £100m of coins to AMERICA

Americans are already keen on UK-made coins, and the Mint said it has seen a 118 per cent increase in sales to the US since 2022.www.dailymail.co.uk

Given the financial crisis world wide saying demand is down is a given. Could this be a smoke screen story, not enough bullion inventory or the opposite the need to stock pile bullion?

Amen.… When / if a $1,000 USD will purchase an ounce of gold, America will be moving in the right direction.

I’ve posted here and in a couple of the other threads that I now have almost 1/3 of my longer term investments in ‘paper’ gold…that is, the fund (PHYS) only holds physical gold, but I of course don’t have physical possession. This is purely a hedge/backstop for me, not what I consider an actual investment intended to create earnings.

I would happily lose half or more of that investment if it meant the dollar was actually getting stronger, because as you point out, America will be heading in the right direction. And coincidentally, my other investments would (theoretically) more than cover any losses in what I call my “Zombie Apocalypse” portfolio.

I’m still buying physical gold and silver (and brass, lead, and copper…LoL) every month too, but that’s slowed down a lot now that I’m down to just my retirement incomes (primarily pension and short term investments). I’m still a year away from being able to tap into my retirement funds, but will likely start converting some of that paper gold to physical gold and silver as soon as possible.

Stumbled into a couple of articles at DM. UK stopping minting for other countries, repurpose staff to reclaim gold. They state demand for coins is down worldwide.

Royal Mint to stop making coins for overseas countries after 700 years

The Royal Mint first started making overseas coins in 1325. But from December 2024 the Royal Mint will stop making these overseas coins, and will instead focus on making coins for the UK.www.dailymail.co.uk

This article mentions supplying One customer:

The Royal Mint aims to sell £100m of coins to AMERICA

Americans are already keen on UK-made coins, and the Mint said it has seen a 118 per cent increase in sales to the US since 2022.www.dailymail.co.uk

Given the financial crisis world wide saying demand is down is a given. Could this be a smoke screen story, not enough bullion inventory or the opposite the need to stock pile bullion?

I read that to say that the demand for gold coins and bullion is so high, they need to ramp up production of their own gold currency; not enough capacity to produce gold currency for other countries outside the empire (commonwealth?…whatever they’re calling the UK/Canada/Australia, etc. these days).

I might be reading too much between the lines, but personally see that as another indicator to buy more gold.

But then again, TBH, I’ve never needed a lot of incentive to sink money into hard assets.

Last edited:

Agreed, but as long as our debt is so high it can never be repaid it's a fantasy that gold will ever be linked to our failed fiat dollar as a form of currency. About 5 seconds of watching the debt clock ticking will make you realize just how screwed we are as a country run by crooks........Could be several conditions that are rapidly changing. Some of it is just the "cycle". Some of it is the paper gold traders. A lot of the discussion has to do with the "perspective" of both the reporter as well as the reader. I watch the actions of some of the oldest societies in the world. These societies (the people, not the Governments) are steadily stockpiling. Another factor that is skewing the view is attempting to link gold to the purchasing power of the USD. This is nothing more than chasing a mirage. When / if a $1,000 USD will purchase an ounce of gold, America will be moving in the right direction.

AgreedI read that to say that the demand for gold coins and bullion is so high, they need to ramp up production of their own gold currency; not enough capacity to produce gold currency for other countries outside the empire (commonwealth?…whatever they’re calling the UK/Canada/Australia, etc. these days).

I might be reading too much between the lines, but personally see that as another indicator to buy more gold.

But then again, TBH, I’ve never needed a lot of incentive to sink money into hard assets.

Agreed, but as long as our debt is so high it can never be repaid it's a fantasy that gold will ever be linked to our failed fiat dollar as a form of currency. About 5 seconds of watching the debt clock ticking will make you realize just how screwed we are as a country run by crooks........

The plan is that it will all be repaid

Just as it always has

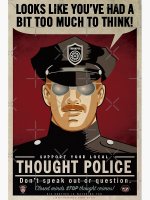

The government will send the Uniform Hangers to take everything that everyone has and turn it over to the bankers.

The plan is complete enslavement and you will be a serf with no ownership of anything.

That's the long game of how the debt is "repaid"...

Reacted with sad face because true…The plan is that it will all be repaid

Just as it always has

The government will send the Uniform Hangers to take everything that everyone has and turn it over to the bankers.

The plan is complete enslavement and you will be a serf with no ownership of anything.

That's the long game of how the debt is "repaid"...

I agree.........Looking into the future, while understanding the "path" (political, financial, cultural, etc) America has been on since 1933..... Very soon, "Something" is going to have to be put in place to back the USD. I follow the US Dollar Index (DXY) but it has nothing to do with the purchasing power of the USD. So, 10 years from now, what will be backing the USD ?Agreed, but as long as our debt is so high it can never be repaid it's a fantasy that gold will ever be linked to our failed fiat dollar as a form of currency. About 5 seconds of watching the debt clock ticking will make you realize just how screwed we are as a country run by crooks........

_________________________

On April 20, 1933, the United States went off the gold standard, a monetary system in which currency is backed by gold, when Congress enacted a joint resolution nullifying the right of creditors to demand payment in gold. The United States had been on a gold standard since 1879, except for an embargo on gold exports during World War I, but bank failures during the Great Depression of the 1930s frightened the public into hoarding gold, making the policy untenable.

somehow I don’t think that plan is going to work but it makes for a great debate!!The plan is that it will all be repaid

Just as it always has

The government will send the Uniform Hangers to take everything that everyone has and turn it over to the bankers.

The plan is complete enslavement and you will be a serf with no ownership of anything.

That's the long game of how the debt is "repaid"...

Gold is getting harder to find as miners struggle to excavate more, World Gold Council says

The gold mining industry is struggling to sustain production growth as deposits of the yellow metal become harder to find, according to the World Gold Council.

“We’ve seen record first quarter mine production in 2024 up 4% year on year. But the bigger picture, I think about mine production is that, effectively, it plateaued around 2016, 2018 and we’ve seen no growth since then,” WGC Chief Market Strategist John Reade said.

Going back to the begging of time and considering all the gold ever mined and processed, how much gets worn out?

The gold used for atomic development contained radioactive properties and medical imaging are the examples of gold gone bad, I’m sure more uses exist that make gold undesirable or damaged beyond being valued. Mining technology continues to advance allowing for better gold yield, is this mineral really worth its value or has man created a system based on 3000 years ago some shiny stuff that was laying on the ground. As hungry stomachs become more common in the future are pollinators and clean water the gold of the future?

and medical imaging are the examples of gold gone bad, I’m sure more uses exist that make gold undesirable or damaged beyond being valued. Mining technology continues to advance allowing for better gold yield, is this mineral really worth its value or has man created a system based on 3000 years ago some shiny stuff that was laying on the ground. As hungry stomachs become more common in the future are pollinators and clean water the gold of the future?

The gold used for atomic development contained radioactive properties

Going back to the begging of time and considering all the gold ever mined and processed, how much gets worn out?

The gold used for atomic development contained radioactive propertiesand medical imaging are the examples of gold gone bad, I’m sure more uses exist that make gold undesirable or damaged beyond being valued. Mining technology continues to advance allowing for better gold yield, is this mineral really worth its value or has man created a system based on 3000 years ago some shiny stuff that was laying on the ground. As hungry stomachs become more common in the future are pollinators and clean water the gold of the future?

1) Clean water

2) ‘Food’ … likely to include long pork for some areas, at least for awhile

3) Prostitution/pimping, to include sexual slavery

4) Ammo…a drink will cost a round of .22LR, a couple 9mm or .45 rounds buys you a gallon, etc.

5) General barter for goods and services…eventually

6) Gold/silver

7) Gemstones

8) ?

9) Nuka Cola bottle caps

What else?

Man will always put value on "something" that makes it convenient and secure for barter.Going back to the begging of time and considering all the gold ever mined and processed, how much gets worn out?

The gold used for atomic development contained radioactive propertiesand medical imaging are the examples of gold gone bad, I’m sure more uses exist that make gold undesirable or damaged beyond being valued. Mining technology continues to advance allowing for better gold yield, is this mineral really worth its value or has man created a system based on 3000 years ago some shiny stuff that was laying on the ground. As hungry stomachs become more common in the future are pollinators and clean water the gold of the future?

“What else,”seems like the ability to mass communication with like minded people is worth its weight in gold, just ask Alex Jones and SteveBannon. Has to be a reason they are both being silenced temporarily. David Bellavia?1) Clean water

2) ‘Food’ … likely to include long pork for some areas, at least for awhile

3) Prostitution/pimping, to include sexual slavery

4) Ammo…a drink will cost a round of .22LR, a couple 9mm or .45 rounds buys you a gallon, etc.

5) General barter for goods and services…eventually

6) Gold/silver

7) Gemstones

8) ?

9) Nuka Cola bottle caps

What else?

Bellavia worked closely with Bannon during Trumps first successful run for President.

Last edited:

“What else,”seems like the ability to mass communication with like minded people is worth its weight in gold, just ask Alex Jones and SteveBannon. Has to be a reason they are both being silenced temporarily. David Bellavia?

Bellavia worked closely with Bannon during Trumps first successful run for President.

I think it goes way beyond that. Information and/or Knowledge = Power

…and there are a whole lot of folks trying their best to keep most people ignorant. It’s been that way for all recorded history, using religion, education, and now technology, to keep the masses ignorant and passive.

(Kitco News) - Gold prices are near steady and silver prices firmer in midday U.S. trading Monday. The precious metals bulls are trying to recover from the very recent surges in the U.S. dollar index and U.S. Treasury yields, following last Friday’s stronger U.S. jobs report. August gold was last up $1.20 at $2,326.50. July silver was last up $0.365 at $29.805.

It’s an extra important U.S. data week, highlighted by inflation readings and the FOMC meeting. Barron’s says in a story today: “After Friday’s jobs shocker, it’s hard to imagine a bigger event than Federal Reserve Chairman Jerome Powell’s press conference on Wednesday for shaping the outlook for investors the rest of this year.” U.S. Treasury yields and the U.S. dollar index spiked higher after the hotter jobs report Friday morning. The FOMC is not expected to take any new monetary policy action this week. The marketplace is putting odds at around 60% that the Fed will make a rate cut before November.

www.kitco.com

www.kitco.com

It’s an extra important U.S. data week, highlighted by inflation readings and the FOMC meeting. Barron’s says in a story today: “After Friday’s jobs shocker, it’s hard to imagine a bigger event than Federal Reserve Chairman Jerome Powell’s press conference on Wednesday for shaping the outlook for investors the rest of this year.” U.S. Treasury yields and the U.S. dollar index spiked higher after the hotter jobs report Friday morning. The FOMC is not expected to take any new monetary policy action this week. The marketplace is putting odds at around 60% that the Fed will make a rate cut before November.

Bulls working to stabilize gold, silver markets

The Kitco News Team brings you the latest news, videos, analysis and opinions regarding Precious Metals, Crypto, Mining, World Markets and Global Economy.

History repeating........

www.kitco.com

www.kitco.com

Four central banks sign new framework to enable responsible gold sourcing from small-scale miners in domestic currency

The Kitco News Team brings you the latest news, videos, analysis and opinions regarding Precious Metals, Crypto, Mining, World Markets and Global Economy.

Picked up some more pieces this week. I’m starting to look like Mr. T.

Picked up some more pieces this week. I’m starting to look like Mr. T.

Fun fact I heard (and possibly not true) but for every 1oz. of physical silver there are 397oz. of "paper" silver leveraged (Is that the right word? Prolly not) against it. Not sure of the ratio for gold but if folks start demanding their metal... Holy shit!

Sold some pieces to remove the last of the indebtedness.Picked up some more pieces this week. I’m starting to look like Mr. T.

the precious metal thing matters a lot. we should be on the gold standard for a bunch of reasons. however, they are just mediums of exchange like cattle,slaves,cowrie shells,wampum whatever. when,not if,the massive crash happens without total societal collapse,holding gold,silver,other things will matter a bunch. if we get a total collapse of civilization,which i suspect will be the case,there will not be enough of a society for a MOE to matter. economics will be based on barter or theft or defense from it.

Smart at the current price level. I still expect to see gold below $2,000 an ounce by end of year.Sold some pieces to remove the last of the indebtedness.

And that's when the spread (premium) between physical and paper will hit an all time record.Smart at the current price level. I still expect to see gold below $2,000 an ounce by end of year.

Smart at the current price level. I still expect to see gold below $2,000 an ounce by end of year.

Only if interest rates drop which is likely as that's what seems to drive the market. What goes up, must come down. Except the Dow it seems which is 25000 points over valued IMO........

Only time will tell like every other equation related to "market" issues.

It would be cool if gold went to $1,400 per ounce so I could start a jewelry store.And that's when the spread (premium) between physical and paper will hit an all time record.

That is how the heavy hitters are going to play those holding paper gold. When the smoke clears the physical will have much more value.Buy hi sell low?

Few buyers for paper and many for physical.

History repeating.

It’s better to do it the other way around.Buy high sell low?

Slice it and dice it... It's still paper.

(Kitco News) – Tether, the company responsible for issuing USDT, the top stablecoin by market cap, continues to expand beyond fait-backed stablecoins with the launch of Alloy by Tether, a new asset-backed token that uses Tether Gold (XAU₮) as collateral.

“Developed by Moon Gold NA, S.A. de C.V. and Moon Gold El Salvador, S.A. de C.V., both of whom are members of the Tether Group, Alloy by Tether aims to redefine stability in the digital economy by combining the strengths of a stable unit of account with the security and reliability of gold,” the company said in a press release.

www.kitco.com

www.kitco.com

Gold meets digital dollars: Tether launches aUSD₮ – a stablecoin with gold backing

(Kitco News) – Tether, the company responsible for issuing USDT, the top stablecoin by market cap, continues to expand beyond fait-backed stablecoins with the launch of Alloy by Tether, a new asset-backed token that uses Tether Gold (XAU₮) as collateral.

“Developed by Moon Gold NA, S.A. de C.V. and Moon Gold El Salvador, S.A. de C.V., both of whom are members of the Tether Group, Alloy by Tether aims to redefine stability in the digital economy by combining the strengths of a stable unit of account with the security and reliability of gold,” the company said in a press release.

Gold meets digital dollars: Tether launches aUSD₮ – a stablecoin with gold backing

The Kitco News Team brings you the latest news, videos, analysis and opinions regarding Precious Metals, Crypto, Mining, World Markets and Global Economy.

Slice it and dice it... It's still paper.

Gold meets digital dollars: Tether launches aUSD₮ – a stablecoin with gold backing

(Kitco News) – Tether, the company responsible for issuing USDT, the top stablecoin by market cap, continues to expand beyond fait-backed stablecoins with the launch of Alloy by Tether, a new asset-backed token that uses Tether Gold (XAU₮) as collateral.

“Developed by Moon Gold NA, S.A. de C.V. and Moon Gold El Salvador, S.A. de C.V., both of whom are members of the Tether Group, Alloy by Tether aims to redefine stability in the digital economy by combining the strengths of a stable unit of account with the security and reliability of gold,” the company said in a press release.

Gold meets digital dollars: Tether launches aUSD₮ – a stablecoin with gold backing

The Kitco News Team brings you the latest news, videos, analysis and opinions regarding Precious Metals, Crypto, Mining, World Markets and Global Economy.www.kitco.com

I'd say this is actually less trustworthy than traditional "paper gold"...

I look at it this way. A "flip of a switch" and paper anything goes away. Going to take a shovel and some sweat to dig up that physical in the back yard. History has proven that time and time again.^^^^^^^Me too, and how is paper gold any different than any other exchange traded commodity? Everyone takes risk but you know the story about "the bird in the hand" just saying.........

I look at it this way. A "flip of a switch" and paper anything goes away. Going to take a shovel and some sweat to dig up that physical in the back yard. History has proven that time and time again.

Holding physical gold as an investment that you are trying to make money on and buy and sell is not a profitable thing to do short term unless you are actually in the gold selling business. That is the same with many things.

I agree. I think what Hobo Hilton is alluding to is that the can't lose his physical gold at the flip of a switch. I laugh at the people I see buying gold as an investment. It's literally just a form of value storage. They have to convert their gold to fiat currency, and rarely ever will they get spot. Then that fiat currency is spent at the current dollar value/strength.Holding physical gold as an investment that you are trying to make money on and buy and sell is not a profitable thing to do short term unless you are actually in the gold selling business. That is the same with many things.

Anyone who think's PMs are anything but transactional items that can be used outside the system are myopic. The only reason I sold was to get out from under a weak dollar and stifling interest rates. I sold no more or no less and used the proceeds before the USDs value dropped (or climbed more). Folks that know me say "Wow! It's like you got a raise!" No, I can just maintain my life style as the dollar weakens and not be beholden to any banking institutions!I agree. I think what Hobo Hilton is alluding to is that the can't lose his physical gold at the flip of a switch. I laugh at the people I see buying gold as an investment. It's literally just a form of value storage. They have to convert their gold to fiat currency, and rarely ever will they get spot. Then that fiat currency is spent at the current dollar value/strength.

Last edited:

Similar threads

- Replies

- 27

- Views

- 2K

- Replies

- 23

- Views

- 1K

- Replies

- 46

- Views

- 2K

- Replies

- 0

- Views

- 224

- Replies

- 45

- Views

- 3K