So how do we, those of us aware and willing, protect what we have now, before it's too late?

Join the Hide community

Get access to live stream, lessons, the post exchange, and chat with other snipers.

Register

Download Gravity Ballistics

Get help to accurately calculate and scope your sniper rifle using real shooting data.

Install the app

How to install the app on iOS

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Inflation.......... ?

- Thread starter Hobo Hilton

- Start date

So, there are a lot of issues with this analysis. First, of course, is the assumption of a strong correlation, over any term, between tax rates and tax revenue. It isn't negative, it is just unpredictable. Likewise, spending cuts, which are clearly necessary long term, are going to have negative effects on tax revenue.

The real harsh truth isn't the conspiracy you mention, but it is that we are flying way more blind than we ever thought. Most predictive models have not fared well over the last 20 years or so about the relationships between debt, spending and inflation, or about tax rates, spending and economic activity. That is scary in and of itself, but it doesn't lead to a crazy belief that we are headed to so master slave world.

When you stop being dazzled by the brilliance of people being all fancy pants trying to hide things with big words and fancy numbers, you can see things for what they really are.

Do the numbers yourself and come back.

What was the total amount the US Treasury received in tax revenue 2020 from all sources combined?

(then repeat for say the previous 4 years or if you want fun, year by year for 10 years).

What was the total expenditure of the US government in all forms including guarantee payments, interest payments and everything for all expenses combined?

(then repeat for say the previous 4 years, or if you want fun, year by year for 10 years).

How much is the shortfall?

What percentage of the entire amount of government spending would need to be cut to just equal the amount taken in that same year in taxes?

Come back with those numbers then we can proceed.

I think the point is that nobody is really sure. If you asked me fifteen years ago, telling me our fiscal policies would be what they have been, I would have told you one thing, but I would have been wrong, because nothing that has happened has followed any models I was taught in college or grad school. Not as far as returns on government spending (ARRA,) not in terms of trade deficits or regular deficits or monetary policy. That is the biggest problem.So how do we, those of us aware and willing, protect what we have now, before it's too late?

What people are doing in this thread is that they are overlaying what they have always believed to be true onto this world, but that hasn't worked, so rather than admitting that we are in a bit of a conundrum, they double down and say either, "it will happen" or "it has happened and they are lying" or "this is part of the NWO plan." The first may be true, the second seems true to people in some businesses, but inflation in a lot of materials areas has continued to be mitigated by disinflation or deflation in other areas, along with gains in productivity. The third is crazy talk.

If I were to guess, the big disinflationary trends will probably wane a bit, putting us in a higher inflation zone, but not in something terrifyingly high. That said, the turn in spending policy toward the most ideologically driven we have seen in a generation, at least, puts into doubt the idea that the equilibrium of inflationary and disinflationary forces will maintain, given that they have been established through one regime of spending power while a lot of the new fiscal policy aims to distribute spending power differently.

Just be careful.

I'm not sure how that disagrees with anything I have said. What I did say is that the relationships we have all taken for granted are being, and should be being, questioned. My personal preference is for almost no spending at all, but my preferences don't set reality, and sometimes don't conform to reality at all. If you don't like big words, that is too bad. You need to understand the words that describe a subject.When you stop being dazzled by the brilliance of people being all fancy pants trying to hide things with big words and fancy numbers, you can see things for what they really are.

Do the numbers yourself and come back.

What was the total amount the US Treasury received in tax revenue 2020 from all sources combined?

(then repeat for say the previous 4 years or if you want fun, year by year for 10 years).

What was the total expenditure of the US government in all forms including guarantee payments, interest payments and everything for all expenses combined?

(then repeat for say the previous 4 years, or if you want fun, year by year for 10 years).

How much is the shortfall?

What percentage of the entire amount of government spending would need to be cut to just equal the amount taken in that same year in taxes?

Come back with those numbers then we can proceed.

Really not sure what there is to proceed with when talking to somebody who thinks that everything is a conspiracy to turn you into slaves for the oligarchs. But the general answer to your very simplistic argument, is to ask whether you believe tax rates and spending decisions influence behavior. If your answer is yes, then your simple answer isn't worth spit. If your answer is no, well, you are nuts.

Last edited:

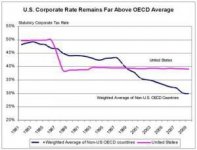

That's really only true on a big news headline level. Corporate tax rate shifts accounted for almost the entirety of the onshoring and repatriation during the last four years. They are the most effective tax cut out there. The "corporations don't really pay" headlines are generally not as truthy as people believe.

It's more common than you think, even for "small" corporations. Things like the R&D tax credit are very powerful tools for those businesses which can take advantage. I'm not saying this is wrong or bad, just simply that headline rates are deceptive.

History also shows the weak link between statutory and actual tax rates:

That being said, a cut like that passed in 2017 made a huge difference simply due to its magnitude - whether a company was able to take advantage of various provisions or not, they almost certainly were going to see a smaller bill as a result of this headline cut.

I am not in favor of higher headline rates, and debating the pros and cons of such aren't nearly as interesting as Yellen's wishes to harmonize rates across the first world. Such a move doesn't work without similar harmonization of exemptions, and that potentially has a larger impact than simply raising the headline rate.

I'm not sure how that disagrees with anything I have said. What I did say is that the relationships we have all taken for granted are being, and should be being, questioned. My personal preference is for almost no spending at all, but my preferences don't set reality, and sometimes don't conform to reality at all. If you don't like big words, that is too bad. You need to understand the words that describe a subject.

Really not sure what there is to proceed with when talking to somebody who thinks that everything is a conspiracy to turn you into slaves for the oligarchs. But the general answer to your very simplistic argument, is to ask whether you believe tax rates and spending decisions influence behavior. If your answer is yes, then your simple answer isn't worth spit. If your answer is no, well, you are nuts.

The part I was specifically discussing was:

"End the day you have a massive hole that multiple admins dug and spending $$ at unprecedented rates. Do you really think another tax break will fix that?"

My argument is that do whatever you want and say whatever you want, but the "massive hole" is not only impossible to fill up, but it's also impossible to stop digging deeper.

Tax policy, spending policy, trade policy, war policy, corporate and consumer confidence, consumer demand and many other things all have an effect on how much revenue overall the government receives.

BUT, it still doesn't change the fact that there is a giant hole that is only getting dug deeper. Quibble about how fast you dig it deeper fine.

Who knows how long it can last? It could last a very long time, it could come to an abrupt crash.

History is filled with examples of governments that hit the wall one day when they could no longer print enough money or borrow enough money to keep going and they were already getting as much tax money as they could.

Ill just leave this here. This is the mindset they have.There is pretty much no way that debt will ever get paid back, you couldn't raise taxes high enough even if you took all of everybody's money.

There will never be the political will to make the drastic spending cuts that would be needed to stop borrowing more. Getting the budget low enough to start paying off the debt is a fantasy.

The harsh truth is it's just a matter of how long before it all blows up and the people loose everything, the global elites grab everything the people thought they had and then let the people start over, working as slaves that own nothing to pay for what they used to have.

If Deficits Don’t Matter, Why Bother with Taxes? - LewRockwell

On March 18, Joe Wiesenthal of Bloomberg Markets had MMT economist Stephanie Kelton on the show. If you’re not familiar with modern monetary theory, they think governments should print more money because deficits aren’t a big deal. At one point in the show, Wiesenthal asked, “If we don’t need to...

Well, there are a couple of issues. Things like R&D tax credit, though debatable, aren't really what you are talking about when you talk about corporations finding loopholes to avoid taxes. Corporations will work to avoid taxes as much as they can, but that work to avoid them is not costless to the companies, and comes at a relatively high cost to society. It is almost literally burnt money.It's more common than you think, even for "small" corporations. Things like the R&D tax credit are very powerful tools for those businesses which can take advantage. I'm not saying this is wrong or bad, just simply that headline rates are deceptive.

History also shows the weak link between statutory and actual tax rates:

View attachment 7597955

That being said, a cut like that passed in 2017 made a huge difference simply due to its magnitude - whether a company was able to take advantage of various provisions or not, they almost certainly were going to see a smaller bill as a result of this headline cut.

I am not in favor of higher headline rates, and debating the pros and cons of such aren't nearly as interesting as Yellen's wishes to harmonize rates across the first world. Such a move doesn't work without similar harmonization of exemptions, and that potentially has a larger impact than simply raising the headline rate.

As to the chart, that is an average, and is going reflect the distribution of earnings, meaning that small corporations are not that well represented. But what is interesting is that the effective US rate looks a lot like the statutory average of OECD rates over time, which is not surprising, and kind of shows what I am getting at. US corporations are happy to pay taxes in the US as long as they are not higher than elsewhere, because it is better PR, and it is far cheaper transactionally to do it. The amount of taxes paid in the US is going to be the amount they can pay at a "reasonable rate" and over that they will pay the cost of offshoring for the benefit, hence the reshoring when statutory rates went down. This is assuming, and I think it is a fair assumption, that it is easier to pay taxes on more of your income at the statutory rate than to exploit credits and loopholes.

Attachments

Look, I agree with you. Everything I believe in my heart and mind agrees with you. All of my training agrees with you. I think it is correct both from an economic and moral standpoint. My problem is that things aren't working out as we think they should. So the question becomes are we wrong, or is it about to happen, or are the statistics a lie? I don't know, I would put my money on two, then one, then three.The part I was specifically discussing was:

"End the day you have a massive hole that multiple admins dug and spending $$ at unprecedented rates. Do you really think another tax break will fix that?"

My argument is that do whatever you want and say whatever you want, but the "massive hole" is not only impossible to fill up, but it's also impossible to stop digging deeper.

Tax policy, spending policy, trade policy, war policy, corporate and consumer confidence, consumer demand and many other things all have an effect on how much revenue overall the government receives.

BUT, it still doesn't change the fact that there is a giant hole that is only getting dug deeper. Quibble about how fast you dig it deeper fine.

Who knows how long it can last? It could last a very long time, it could come to an abrupt crash.

History is filled with examples of governments that hit the wall one day when they could no longer print enough money or borrow enough money to keep going and they were already getting as much tax money as they could.

Like i mentioned it pointless harmonising rates as long as you have a plethora of loophooles and mayor tax dodging is not going trough 'first world' but a dozen or so tax havens that will not be harmonizing anything. End of the day that has nothing to do with competitivnes of the countrys economy but it just making the playing field even more tailored to big corporations vs millions of small businesses that have to play ball and pay their taxes.

Its not R&D tax deductions as much as its offshore entites holding IP and billing said IP to the entities actually doing the bussines.

Its not R&D tax deductions as much as its offshore entites holding IP and billing said IP to the entities actually doing the bussines.

Last edited:

Thinking it’s time to sell some stuff while people have Covid bucks, and before the taxes kick in and the mass layoffs start.

Without reading the entire thread, I would like to add a thought. The United States is a failed state if we continue to base our economy on cooking each other hamburgers. The corporate tax rate combined with the a very healthy tort industry has put people in the United States who make things in a somewhat uncompetitive situation. (to put it mildly). The exportation of our technology continues to contribute to this manufacturing deficit as well.

I grew up up in a family that had a small business that made products and knowing many who also owned and operated small businesses (that made things or provided services to people who made things) and kinda know how the tax structure hurts. Corporate Tax reduction was a major boost in profitability as well as better securing our nation.

I suppose the point is...There is only so much gold in Ft. Knox to give away and jsut how long do people think the red chinese are willing to supply us with hamburger meat to keep us happy flipping burgers at McDonalds?

(If all of this has been said please forgive) Oh yes, I know that I used people a lot when talking about corporations, but in the end, it is people who run small incorporated businesses as well as the profitability of large corporates, are the ones getting hurt)

I grew up up in a family that had a small business that made products and knowing many who also owned and operated small businesses (that made things or provided services to people who made things) and kinda know how the tax structure hurts. Corporate Tax reduction was a major boost in profitability as well as better securing our nation.

I suppose the point is...There is only so much gold in Ft. Knox to give away and jsut how long do people think the red chinese are willing to supply us with hamburger meat to keep us happy flipping burgers at McDonalds?

(If all of this has been said please forgive) Oh yes, I know that I used people a lot when talking about corporations, but in the end, it is people who run small incorporated businesses as well as the profitability of large corporates, are the ones getting hurt)

Without reading the entire thread, I would like to add a thought. The United States is a failed state if we continue to base our economy on cooking each other hamburgers. The corporate tax rate combined with the a very healthy tort industry has put people in the United States who make things in a somewhat uncompetitive situation. (to put it mildly). The exportation of our technology continues to contribute to this manufacturing deficit as well.

I grew up up in a family that had a small business that made products and knowing many who also owned and operated small businesses (that made things or provided services to people who made things) and kinda know how the tax structure hurts. Corporate Tax reduction was a major boost in profitability as well as better securing our nation.

I suppose the point is...There is only so much gold in Ft. Knox to give away and jsut how long do people think the red chinese are willing to supply us with hamburger meat to keep us happy flipping burgers at McDonalds?

(If all of this has been said please forgive) Oh yes, I know that I used people a lot when talking about corporations, but in the end, it is people who run small incorporated businesses as well as the profitability of large corporates, are the ones getting hurt)

We don’t need china other than for cheap crap which has to get replaced more often. Food, tech, energy, IP, they are more of a drain than anything

Frankly I’d be cool just shutting them off, call it reparations for covid, give US companies 6mo to pull out of china and use the US, or really any non communist country, heck I’d even rather them give the business to Russia, at least their values are slightly more inline with ours, cancel all “debt” to china that should free up some monopoly fiat cash, and carry on.

Tell all the countries that we fund/protect to pick aside, and ask them how the Wuhan flu worked out for them while you’re at it. Strike while the iron is hot.

Pretty excited: just bought my first sheet of $43 OSB, $65 sheet of ply wood, and some $3.61/gal non-ethanol gas. 3-4% inflation my ass. Unless you're talking this year alone .

.

Pretty excited: just bought my first sheet of $43 OSB, $65 sheet of ply wood, and some $3.61/gal non-ethanol gas. 3-4% inflation my ass. Unless you're talking this year alone.

3.61?

You behind enemy lines?

So, this is the self selection problem I talked of before. The CPI numbers are based on what urban consumers are paying for goods. Not what contractors are paying for materials. Because you are talking urban consumer, changes in gas prices are minimized. It isn't a lie, it just isn't you. I mean I could say I paid 10k for my first flat screen TV in 1999 (true) and the last one I bought was a couple of hundred bucks. Same with computers and lots of other products and services that make up the standard urban consumer's basket of goods. No everybody gets to be average, but the CPI is striving for some average understanding of inflation. It is imperfect, but noting that things that wouldn't be in a CPI basket, like OSB, doesn't really say much about the things that are.Pretty excited: just bought my first sheet of $43 OSB, $65 sheet of ply wood, and some $3.61/gal non-ethanol gas. 3-4% inflation my ass. Unless you're talking this year alone.

https://www.bls.gov/charts/consumer-price-index/consumer-price-index-by-category.htm. There you go. Building materials are literally not on there, and not much accounted for even in the sub categories.

So, this is the self selection problem I talked of before. The CPI numbers are based on what urban consumers are paying for goods. Not what contractors are paying for materials. Because you are talking urban consumer, changes in gas prices are minimized. It isn't a lie, it just isn't you. I mean I could say I paid 10k for my first flat screen TV in 1999 (true) and the last one I bought was a couple of hundred bucks. Same with computers and lots of other products and services that make up the standard urban consumer's basket of goods. No everybody gets to be average, but the CPI is striving for some average understanding of inflation. It is imperfect, but noting that things that wouldn't be in a CPI basket, like OSB, doesn't really say much about the things that are.

https://www.bls.gov/charts/consumer-price-index/consumer-price-index-by-category.htm. There you go. Building materials are literally not on there, and not much accounted for even in the sub categories.

Building materials are up, I really don’t care what a .gov site, kinda like the .gov sites that say double bag your face with masks, has to say.

Nobody disputes that building materials are up. They just don't make up much of what is the day to day costs for the urban consumer. As far as not caring about information, that is your choice. Being willfully uninformed is a sure way to make sure you continue to think you are correct.Building materials are up, I really don’t care what a .gov site, kinda like the .gov sites that say double bag your face with masks, has to say.

Nobody disputes that building materials are up. They just don't make up much of what is the day to day costs for the urban consumer. As far as not caring about information, that is your choice. Being willfully uninformed is a sure way to make sure you continue to think you are correct.

I wonder how many on this board are “urban”, it also didn’t take much to get the “contractor” rates, lots of places I bought from the biggest discount was for cash.

It’s also not being “uninformed” anymore than not watching commercials makes you uniformed about what you need to buy, taking that crap as gospel I’d say is more being misinformed, I’m pretty dumb, I go off crazy shit like what I can see with my own two eyes over what websites tell me, I’m probably doomed... wait just two weeks

What is being uninformed is saying xxx has gone up, the government is lying about inflation, when you don't take into account that the government is talking about a different basket of goods, and then when that is pointed out, to reply that the government is lying anyway, because of masks. But you do you.I wonder how many on this board are “urban”, it also didn’t take much to get the “contractor” rates, lots of places I bought from the biggest discount was for cash.

It’s also not being “uninformed” anymore than not watching commercials makes you uniformed about what you need to buy, taking that crap as gospel I’d say is more being misinformed, I’m pretty dumb, I go off crazy shit like what I can see with my own two eyes over what websites tell me, I’m probably doomed... wait just two weeks

What is being uninformed is saying xxx has gone up, the government is lying about inflation, when you don't take into account that the government is talking about a different basket of goods, and then when that is pointed out, to reply that the government is lying anyway, because of masks. But you do you.

Government knows best

I can’t wait for 100yrs in the future, maybe we’ll have stained glass windows depicting the DMV lady too lol

Look, prices are going up, probably a mix of Covid bucks, inflation, the mini housing bubble, lack of supply due to the illegal lockdowns, etc. You are 100% right on me not trusting gov, I’m not saying it’s a big conspiracy as much as they are both crooked and incompetent.

Inflation is going to go up, based on the printing of money and growth of government, I’m not saying hyper inflation where we have bucks of cash for bread, but it’s going to be higher than it was, that’s just using logic and math, print a shit ton of money and that’s what’s going to happen. But hey a .gov site says that’s all nothing to see here, and gov has that great track record of honesty and competence huh

I can only say to this what I said above. I agree with the analysis from a fundamental point of view. I also know that I made this same assumption in '08 with all of the bailouts and then ARRA, and in fact I was wrong, at least for the time being. That either points to things going to shit in the future, or our basic understanding of drivers of inflation being wrong. I can't say which one it will be, and I wish I could.Government knows best

I can’t wait for 100yrs in the future, maybe we’ll have stained glass windows depicting the DMV lady too lol

Look, prices are going up, probably a mix of Covid bucks, inflation, the mini housing bubble, lack of supply due to the illegal lockdowns, etc. You are 100% right on me not trusting gov, I’m not saying it’s a big conspiracy as much as they are both crooked and incompetent.

Inflation is going to go up, based on the printing of money and growth of government, I’m not saying hyper inflation where we have bucks of cash for bread, but it’s going to be higher than it was, that’s just using logic and math, print a shit ton of money and that’s what’s going to happen. But hey a .gov site says that’s all nothing to see here, and gov has that great track record of honesty and competence huh

The focus on urban consumers is not for nothing. The US population is 80% urban, and the economy is still extremely consumer focused. But again, I agree with your analysis, but we are 13 years into this, plus the 6 years of forever war before '08, and really we haven't seen inflation to date. Maybe it will come now, but after being wrong for this long, I simply don't have the hubris to say I am right.

What you are experiencing is both correct and unavoidable. More money supply leads to higher prices. Its inflationary in terms of prices but deflationary in terms of the value of each dollar in the economy - it buys less. This is one way you get higher prices without real economic activity.Government knows best

I can’t wait for 100yrs in the future, maybe we’ll have stained glass windows depicting the DMV lady too lol

Look, prices are going up, probably a mix of Covid bucks, inflation, the mini housing bubble, lack of supply due to the illegal lockdowns, etc. You are 100% right on me not trusting gov, I’m not saying it’s a big conspiracy as much as they are both crooked and incompetent.

Inflation is going to go up, based on the printing of money and growth of government, I’m not saying hyper inflation where we have bucks of cash for bread, but it’s going to be higher than it was, that’s just using logic and math, print a shit ton of money and that’s what’s going to happen. But hey a .gov site says that’s all nothing to see here, and gov has that great track record of honesty and competence huh

There is also the issue of the way the gov calculates the CPI - that is not a pristine number as it is messed with - you have equivalency calculations that push the product inflation number lower than it actually is. This has been known for some time and scores of articles have been written about it. These are "quality adjustments". Never mind those major expenditures in every family that aren't considered part of the CPI.

Here is a brief article to get you going down the path of truth. If you want to dig deeper the internet awaits. BLUF: you are being told a story that isn't accurate.

Your Cost of Living Is Soaring (Fed Chairman Powell STILL Not Concerned About Inflation!)

The disparity between wage growth and the cost of living, as a factor of inflation, is enormously underreported. Market analyst Sean McCloskey breaks down the incongruity...

This one is more detailed. Spend time here for info that tell you what you already know.

There are consequences to loose monetary policy.

Again, even your links show that the linkage between money supply and purchasing power is broken. When you look at the "killer graph" in the last article, it shows purchasing power has declined at a 2% compounded rate for 12 years, which is pretty close to the top line inflation rate, which you say is a lie, and is totally decoupled from expectations given a strong linkage between money supply and purchasing power. It basically shows the opposite of inflation. This is exactly what I have been saying. We all expect it given monetary and fiscal policy, but nobody can actually show it happening other than from anecdote. What your graphs show is the opposite of consequences.What you are experiencing is both correct and unavoidable. More money supply leads to higher prices. Its inflationary in terms of prices but deflationary in terms of the value of each dollar in the economy - it buys less. This is one way you get higher prices without real economic activity.

There is also the issue of the way the gov calculates the CPI - that is not a pristine number as it is messed with - you have equivalency calculations that push the product inflation number lower than it actually is. This has been known for some time and scores of articles have been written about it. These are "quality adjustments". Never mind those major expenditures in every family that aren't considered part of the CPI.

Here is a brief article to get you going down the path of truth. If you want to dig deeper the internet awaits. BLUF: you are being told a story that isn't accurate.

Your Cost of Living Is Soaring (Fed Chairman Powell STILL Not Concerned About Inflation!)

The disparity between wage growth and the cost of living, as a factor of inflation, is enormously underreported. Market analyst Sean McCloskey breaks down the incongruity...www.energyandcapital.com

This one is more detailed. Spend time here for info that tell you what you already know.

There are consequences to loose monetary policy.

And quality adjustments do matter. They can be played with, but the readings are more reasonable with them than without.

Grocery prices have risen a significant amount over the past year.

You tend to notice when you buy the exact same stuff every week for years.

You tend to notice when you buy the exact same stuff every week for years.

A lot of that had to do with running specials and closeouts, and having general markdowns from increased inventory. I would think of the 1500 one as a snapshot in time but not reflective of general prices over the last few years. I know what you mean though, as we just bought a new fridge.Its definitely here. Last December I was looking at a refridgerator for under $1500. That same one can't be touched now for under $2600, and many decent ones under $3000 simply sold out in this area.

Grocery prices have risen a significant amount over the past year.

You tend to notice when you buy the exact same stuff every week for years.

I'd expect them to get a good bit worse. Food is hyper influenced by fuel prices, unless you live in very particular areas. That is an expect, though, and not a guarantee. One issue is going to be how much Covid has changed American's eating habits long term with regard to going out vs staying in for meals.

Well, obama restructured the calculations for inflation first thing in office from the 1970's model and included two items that shouldn't be included, the price of fuel, and the average home prices, neither of which should be in the model if you understand that it's based primarily off commodities, grain, beef, etc.. If you look at inflation rate starting at the beginning of his term it went negative,,,due to the shift in calculation..... hmmmm.

as for current inflation, it's the way they are going to manage wealth redistribution by allowing inflation to destroy the middle class...

Oh and yeah price of groceries has doubled almost in the past five years... but since january I'd say 25% hike roughly...

as for current inflation, it's the way they are going to manage wealth redistribution by allowing inflation to destroy the middle class...

Oh and yeah price of groceries has doubled almost in the past five years... but since january I'd say 25% hike roughly...

Its definitely here. Last December I was looking at a refridgerator for under $1500. That same one can't be touched now for under $2600, and many decent ones under $3000 simply sold out in this area.

I think some of that is also Covid bucks and the weird shit that happens when you outlaw work, less fridges/ammo/etc gets made.

Shit...I just paid $14,000 for my refrigeratorIts definitely here. Last December I was looking at a refridgerator for under $1500. That same one can't be touched now for under $2600, and many decent ones under $3000 simply sold out in this area.

Jeep is popular here, I have no idea why.

Must be the image people want to portray.

A BT50, D-MAX, Hilux, LandRover will piss all over those Jeeps for 4x4 performance and reliability.

Must be the image people want to portray.

A BT50, D-MAX, Hilux, LandRover will piss all over those Jeeps for 4x4 performance and reliability.

Because everyone just got their money from the govt.....Its definitely here. Last December I was looking at a refridgerator for under $1500. That same one can't be touched now for under $2600, and many decent ones under $3000 simply sold out in this area.

Of course prices will go up. Spending/paying 1.9 billion instead of letting people go back to work.....

Doc

Generally speaking corporations do a better job of allocating capital than the government, so I’d rather see them continue to keep corporate tax low.

I remember wondering why the general public thought healthcare prices would decline with the advent of Obamacare. They did not, as expected, but the public was easily bullshitted into it under the premise of helping to lower costs “for some” they simply left out the bad part.

The same folks are now selling the idea of ‘pay their share’ so that they can steal that money and hand it out to pet projects and their buddies that run them.

The public will fall for it again becuase they have spent all this time selling them the idea that the wealthy are to blame for wealth inequality. It is and always has been those making the rules, not those playing the game within that set of rules.

The end effect will be an increase in prices for the consumer and who will they blame...the corporations of course.

We have, the in the very recent past, many examples of this kind of policy making and it’s effect on pricing, both in the more moderate form (70’s USA) and in the more extreme forms such as post war Germany, after both wars. We’re even provided with examples of how this spending is resolved, such as with the introduction of the Deutschmark and with Regan’s Fed.

I remember wondering why the general public thought healthcare prices would decline with the advent of Obamacare. They did not, as expected, but the public was easily bullshitted into it under the premise of helping to lower costs “for some” they simply left out the bad part.

The same folks are now selling the idea of ‘pay their share’ so that they can steal that money and hand it out to pet projects and their buddies that run them.

The public will fall for it again becuase they have spent all this time selling them the idea that the wealthy are to blame for wealth inequality. It is and always has been those making the rules, not those playing the game within that set of rules.

The end effect will be an increase in prices for the consumer and who will they blame...the corporations of course.

We have, the in the very recent past, many examples of this kind of policy making and it’s effect on pricing, both in the more moderate form (70’s USA) and in the more extreme forms such as post war Germany, after both wars. We’re even provided with examples of how this spending is resolved, such as with the introduction of the Deutschmark and with Regan’s Fed.

Last edited:

Here in the Great State of Komifornia new building cost are around $225 sq. ft., State mandate requires Title 24 energy codes and wildland fire codes. That means out of any CITY limits you need fire sprinklers, non combustible siding , soffits, decks, tempered windows, self sealing vents etc. and on the energy side one needs to produce 100% of your calculated energy for the year with renewable resource (solar ), heat pump heating, heat pump water heater, low flow fixtures, led lighting, occupancy sensor switch's, humidity sensing fans in baths, The required circuit list is now a mile long, its all combo arc/ground plug on neutral breakers at $55 bucks a pop, the list goes on. These FUCKS cant understand why the housing cost are so high so they tax us to make AFFORDABLE housing for the all the illegal Border Hoppers.lumber is definitely up much more than that and certain components are certainly up much more than 20% individually

it's a back of the napkin at the bar very rough way but cost per square foot of a basic new home without premium finishes in my area is $125 a square foot and going higher every day to build where it was around $100 last year

.

Last edited:

So, this is the self selection problem I talked of before. The CPI numbers are based on what urban consumers are paying for goods. Not what contractors are paying for materials. Because you are talking urban consumer, changes in gas prices are minimized. It isn't a lie, it just isn't you. I mean I could say I paid 10k for my first flat screen TV in 1999 (true) and the last one I bought was a couple of hundred bucks. Same with computers and lots of other products and services that make up the standard urban consumer's basket of goods. No everybody gets to be average, but the CPI is striving for some average understanding of inflation. It is imperfect, but noting that things that wouldn't be in a CPI basket, like OSB, doesn't really say much about the things that are.

https://www.bls.gov/charts/consumer-price-index/consumer-price-index-by-category.htm. There you go. Building materials are literally not on there, and not much accounted for even in the sub categories.

As I'm sure that you are aware, there are some valid criticisms of the CPI; some about the items that CPI includes and does not include, and some about the timeliness of the data. Since the loudest voices tend to be from those that start from a position that inflation is either over-stated or under-stated and then work backwards (John Williams's "Shadow Stats" being perhaps one of the better-known), it's been easy to ignore the criticism. But it's probably also correct to state that the CPI is a poor reflection of what any one consumer (or even a fairly large group) might be experiencing at any given moment, and that limitation hasn't always been made clear by proponents of the statistic - which, in turn, leads to more criticism.

What I do think is a fair claim is that there are some significant dislocations taken place at the moment that should, at the least, cause even a dispassionate observer to raise an eyebrow. From my narrow vantage points as a consumer and professional, it looks like a lot of shit is broken, and not all of that can land on the usual boogymen such as Covid, BLM riots, Biden, et al.

Now, back to trying to figure out how not to shut down car assembly lines for want of a $0.25 integrated circuit...

In 2013 I bought a new stripped Jeep Wrangler (roll up windows, auto, freedom top) for 26K. Last week I traded it (83K miles) for 18K = 1K depreciation/yr. Lots of dollars chasing too few goods.Used prices are also inflated. I bought a new truck last week. My trade in was two years old and had 35,000 miles on it. They gave me $2,000 less than what I paid out the door for it brand new.

Sure, I don't think anybody thinks CPI is a clean statistic, and it shouldn't be used as an overall perfect gauge of inflation. My point is that it is important, when dismissing it, to make sure you are doing it for the right reasons. Saying it doesn't make sense because OSB costs are high neglects the fact that building materials are a vanishingly small part of CPI, if there at all. They would basically be in the cost of upkeep for landlords section. In other words, CPI doesn't measure things it doesn't measure. It measures a basket of goods and services that an average urban consumer might buy. So if your argument is CPI is a lie, I drove 45 miles into town to get copper pipe, you are on the wrong track. There are other stats for that.As I'm sure that you are aware, there are some valid criticisms of the CPI; some about the items that CPI includes and does not include, and some about the timeliness of the data. Since the loudest voices tend to be from those that start from a position that inflation is either over-stated or under-stated and then work backwards (John Williams's "Shadow Stats" being perhaps one of the better-known), it's been easy to ignore the criticism. But it's probably also correct to state that the CPI is a poor reflection of what any one consumer (or even a fairly large group) might be experiencing at any given moment, and that limitation hasn't always been made clear by proponents of the statistic - which, in turn, leads to more criticism.

What I do think is a fair claim is that there are some significant dislocations taken place at the moment that should, at the least, cause even a dispassionate observer to raise an eyebrow. From my narrow vantage points as a consumer and professional, it looks like a lot of shit is broken, and not all of that can land on the usual boogymen such as Covid, BLM riots, Biden, et al.

Now, back to trying to figure out how not to shut down car assembly lines for want of a $0.25 integrated circuit...

That said, it isn't perfect, and even absent willful manipulation, it is extremely hard to figure out a way to substitute goods over time. Compounding that is the fact that the goods that are changing fastest in quality are also the ones that tend to drive disinflationary trends. That leads to problems in calculation, but also weird conspiracy assumptions. So yeah, there are problems with CPI, but again the main point is that even with those problems, consumer prices and money supply have become very delinked, at least much more than we would have assumed to be the case. That's not an argument on the margins. If there were as strong a link as expected, it wouldn't be 2 or 3 dollar gas, but 12 or 15 after this many years. So I am not going to dismiss issues with CPI, but I don't need it to be perfect, or even very good, to know that spending power is definitely decreasing in the 2-4% range per year rather than the 7-8% just by going to any grocery store or gas station. Remember, we are almost 20 years into this, so compounding would show an enormous difference.

There are definitely a lot of economic dislocations right now, though you, Mr. Uniparty, can complain about all of them but Biden/Democrats

One of the other contributing factors in the suspicion of this metric is how social security payments and other program payments are tied to it. If the published CPI stays low then the payments are minimized.As I'm sure that you are aware, there are some valid criticisms of the CPI; some about the items that CPI includes and does not include, and some about the timeliness of the data. Since the loudest voices tend to be from those that start from a position that inflation is either over-stated or under-stated and then work backwards (John Williams's "Shadow Stats" being perhaps one of the better-known), it's been easy to ignore the criticism. But it's probably also correct to state that the CPI is a poor reflection of what any one consumer (or even a fairly large group) might be experiencing at any given moment, and that limitation hasn't always been made clear by proponents of the statistic - which, in turn, leads to more criticism.

What I do think is a fair claim is that there are some significant dislocations taken place at the moment that should, at the least, cause even a dispassionate observer to raise an eyebrow. From my narrow vantage points as a consumer and professional, it looks like a lot of shit is broken, and not all of that can land on the usual boogymen such as Covid, BLM riots, Biden, et al.

Now, back to trying to figure out how not to shut down car assembly lines for want of a $0.25 integrated circuit...

Pretty excited: just bought my first sheet of $43 OSB, $65 sheet of ply wood, and some $3.61/gal non-ethanol gas. 3-4% inflation my ass. Unless you're talking this year alone.

Sounds like Washington state.

We had a portion of the house remodeled last summer. I see the contractor regularly, we are neighbors. He said, this year that work would be 50-65% more money. The front door and sidelights have increased 85%. The decking 50%, the steal beams at least 50%, OSB, 30% on flooring, his labor costs have gone up 50% as the minimum wage climbs, state employer taxes climb and you cannot hire people for less than welfare and stim checks. If you drug test................................no one will apply.

If you wait two weeks, he has to rebid the materials and he is not surprised they cost more. He is buying as much as possible as quickly as possible and warning customers to expect a bill for additional costs on materials, especially changes.

As I'm sure that you are aware, there are some valid criticisms of the CPI; some about the items that CPI includes and does not include, and some about the timeliness of the data. Since the loudest voices tend to be from those that start from a position that inflation is either over-stated or under-stated and then work backwards (John Williams's "Shadow Stats" being perhaps one of the better-known), it's been easy to ignore the criticism. But it's probably also correct to state that the CPI is a poor reflection of what any one consumer (or even a fairly large group) might be experiencing at any given moment, and that limitation hasn't always been made clear by proponents of the statistic - which, in turn, leads to more criticism.

What I do think is a fair claim is that there are some significant dislocations taken place at the moment that should, at the least, cause even a dispassionate observer to raise an eyebrow. From my narrow vantage points as a consumer and professional, it looks like a lot of shit is broken, and not all of that can land on the usual boogymen such as Covid, BLM riots, Biden, et al.

Now, back to trying to figure out how not to shut down car assembly lines for want of a $0.25 integrated circuit...

The cost of food, fuel and power which are not properly represented (if at all in the CPI) are a very large part of the budget for people most affected by inflation and especially those on retirement payments.

It's easy to take those out and say "what inflation?" which is why the government likes to do it that way.

Food, power and fuel are all represented in the CPI. Food is the largest component, other than housing, at about 16%, and transportation, which includes fuel, is about the same. Utilities are part of housing, and about 5% of the total.The cost of food, fuel and power which are not properly represented (if at all in the CPI) are a very large part of the budget for people most affected by inflation and especially those on retirement payments.

It's easy to take those out and say "what inflation?" which is why the government likes to do it that way.

Be double damn sure you share this info with any liberal friends you have! Ask them how you get a "liberal" discount for these and any other items, then see how long they take to realize they have to pay the same prices and they are getting porked also.Pretty excited: just bought my first sheet of $43 OSB, $65 sheet of ply wood, and some $3.61/gal non-ethanol gas. 3-4% inflation my ass. Unless you're talking this year alone.

Rub their noses in it til they have scabs!

One of the other contributing factors in the suspicion of this metric is how social security payments and other program payments are tied to it. If the published CPI stays low then the payments are minimized.

Bingo. I was going to mention this in my previous reply but did not for reasons of focus and brevity (an unusual decision for me). If there is motivation to be found for fuckery in the calculations, this stands out as a large factor.

As my investment manager said several years as when we were talking about Social Security and its effective non-existence for us young people - "the government will never be brave enough to legislate away Social Security benefits, but it will use inflation to manage these costs to the point that they don't matter."

I truly hope everyone that reads your comment understands the implications for their personal futures as well as their aging relatives. The government acts like there is a safety net, but it isn't really there to any meaningful degree. This is especially true with the vast amount of money printed in the last few years. One way the politicians control the spending on social programs is to tie it to a number that has been artificially lowered while prices increase via money supply at a higher rate than the CPI. You can add more people to the dependency that way as well - increase the rolls by giving money away, but also increase the money supply AND keep the CPI low. The non-thinking population loses everything while they think they are winning by taking the handout. Welfare plantation. This keeps the democrat voters high and keeps the "Us vs. Them" victim theme going as well since they can scrape by on the social programs (just enough to not bitch too loudly) but never enough to live comfortably and be able to feel and think independently.Bingo. I was going to mention this in my previous reply but did not for reasons of focus and brevity (an unusual decision for me). If there is motivation to be found for fuckery in the calculations, this stands out as a large factor.

As my investment manager said several years as when we were talking about Social Security and its effective non-existence for us young people - "the government will never be brave enough to legislate away Social Security benefits, but it will use inflation to manage these costs to the point that they don't matter."

Last edited:

Very simple and dead accurate explanation of the shit coming to you in the nearest future:

Very simple and dead accurate explanation of the shit coming to you in the nearest future:

Question. If Milton Friedman were still alive, would he be as sure of what was coming as you seem to be, or would he be trying to assess why, after arguably 20 years of this, it hasn't come yet? Having spent a little time with him in his later years, I can assure you the answer would be the second.

Just watch the video if you have time. He spelled it all as it is. World history and stuff, more than enough examples. Nothing to guess here. This thing was known for 200+ years, when paper money became common.Question. If Milton Friedman were still alive, would he be as sure of what was coming as you seem to be, or would he be trying to assess why, after arguably 20 years of this, it hasn't come yet? Having spent a little time with him in his later years, I can assure you the answer would be the second.

Everything else is a wishful thinking, including that U.S. somehow is an exception. It is not.

Last edited:

I understand, and I have seen it. My point is that people as smart and curious as Milton Friedman don't reject new data in order to hold to their beliefs. People treat social science as though it were prophesy at their own peril. Now, I am not saying that what he predicts won't happen, just that it hasn't been going the way he predicted, which requires examination of the theory.Just watch the video if you have time. He spelled it all as it is. World history and stuff, more than enough examples. Noting to guess here. This thing was known for 200+ years, when paper money become common.

Everything else is a wishful thinking, including that U.S. somehow is an exception. It is not.

I'd say the exact same thing to strong Keynesians. The multiplier on ARRA was so low, both simply and in comparison to projections, that it is necessary to reexamine the framework and see if it still makes sense. Some have. Others haven't. Same with any social science "law," or frankly any scientific law. Per Popper this road of discovery is a series of conjectures and refutations, and the refutations are as important to the process of refining knowledge as the successes are, perhaps more.

Similar threads

- Replies

- 32

- Views

- 1K

- Replies

- 109

- Views

- 4K

- Replies

- 61

- Views

- 2K