The link is to an "Opinion" article. All valid considerations. The one thing the American's can't seem to accept if the FED Reserve is now just one more fish in a big ocean. Hundreds of opinions on what the FED should do. Probably the best thing for middle class American's is for the FED to simply disappear.... Poof ! .... Wake up tomorrow morning the there is no FED Reserve. Allow the World Markets to get the human race out of this mess.

JMHO

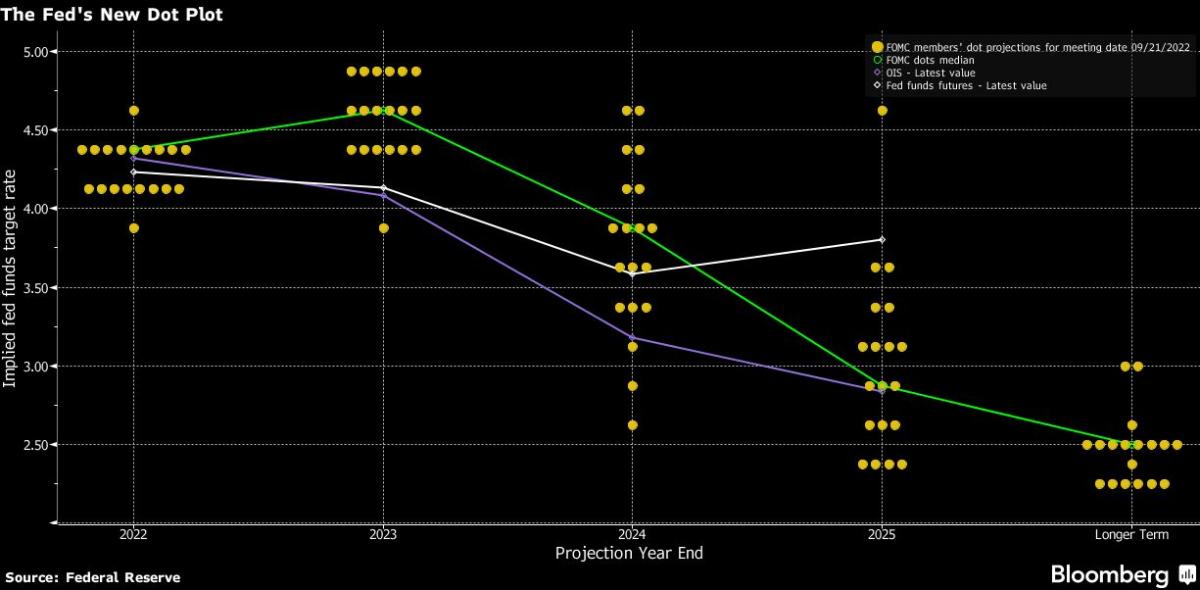

The Federal Reserve is in an impossible position, and now has yet another complicating factor

The Fed wants to avoid the perception of politics playing a role in its policy. So how does it handle two rate decisions before the November elections?www.marketwatch.com

There was a crazy old guy who ran for president a few times on a platform that included "End The Fed", but too many Republicans didn't like him because he didn't want to spy on Americans or bomb enough foreign countries or reduce taxes in precisely the right way to keep rich people happy. So we didn't get this guy as president, despite the fact that hindsight has proven correct virtually every one of his core positions. What a wasted opportunity.

/cloudfront-us-east-2.images.arcpublishing.com/reuters/UQD2XXYAVRPUTO2FRENGT2AEPU.jpg)

/cloudfront-us-east-2.images.arcpublishing.com/reuters/YRYLTA2P7JLGBJV4WO6YE7FYCU.jpg)

/cloudfront-us-east-2.images.arcpublishing.com/reuters/W3KZYKPSBNMCHA2RESU4UUR55Y.jpg)

/cloudfront-us-east-2.images.arcpublishing.com/reuters/BV233UCYPROEFOLFD5SKJCN4CQ.jpg)