Taxation. Beware of this one.Again I am going to ask what tools do the feds have other than adjustment to the interest rate and printing of money?

Join the Hide community

Get access to live stream, lessons, the post exchange, and chat with other snipers.

Register

Download Gravity Ballistics

Get help to accurately calculate and scope your sniper rifle using real shooting data.

Install the app

How to install the app on iOS

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

-

1 WEEK LEFT: This Target Haunts Me Contest

Tell us about the one that got away, the flier that ruined your group, the zero that drifted, the shot you still see when you close your eyes. Winner will receive a free scope!

Join contest

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Recession - 2022 / 2023 / 2024

- Thread starter Hobo Hilton

- Start date

Been rebuilding a privacy fence for a buddy this week. He almost passed out at the cost of lumber, and that’s just the pickets and backer rails. Have to build them all custom because the person who put it in didn’t put the posts at 8 ft.I rented a trailer this morning and hauled some topsoil... I hear people, too. Man running the rental yard has been in the business since the early 70's. We talked about the Oil Recession, the S&L Recession and the Great Recession 2007 +/-..... His words were "Something's got to change"... My reply was "They always do".... I wish I could share better words of wisdom.

Got some 9’ 10” panels, some 8’ 7” panels, a 10’ 4” panel etc. Thank God for nail guns as I’d hate to build these on the ground and then raise them in place.

Pro-tip: Don’t let retards put up your privacy fence.

Taxation isn't a current tool against any issue. That isn't to say that it can't be used punitively, but increasing taxes on people who actually pay them would have almost zero effect on marginal demand, and increasing taxes on corporations is even less of a potent tool. There is a time during the business cycle when it is useful, but this is not that time.

Raise taxes on gas and find out. Create a tax per mile like Biden has been proposing this year. It would have the effect they desire. Thnk outside of the box, they certainly are.Taxation isn't a current tool against any issue. That isn't to say that it can't be used punitively, but increasing taxes on people who actually pay them would have almost zero effect on marginal demand, and increasing taxes on corporations is even less of a potent tool. There is a time during the business cycle when it is useful, but this is not that time.

All I said is that it would not be a tool to manage the current issues in the business cycle. I don't think I said you couldn't change behavior through taxation.Raise taxes on gas and find out. Create a tax per mile like Biden has been proposing this year. It would have the effect they desire. Thnk outside of the box, they certainly are.

Taxation can be used to sponge up extra funds in the economy if levied against both mandatory and highly transacted activities by all economic classes. Its not a perfect answer obviously, but when used in conjunction with higher interest rates it may allow for rates to not be raised so much that it completely screws up everything. Its a finesse thing all the way around to be sure.All I said is that it would not be a tool to manage the current issues in the business cycle. I don't think I said you couldn't change behavior through taxation.

It has to be remembered that economics is a subset of psychology. The issue with taxation and interest rates is that you can assume that you know what people will do, but it isn't 100% correct. Humans are unruly and tend to ignore economic models, pursue alternatives and generally kick back at those things that they don't like.

If you think the goal of the government is to crash the economy and destroy lives, then you are correct. And as I said above, it certainly could be used punitively. If you think their goal is to somehow manage their way out of a stagflationary environment, then it is not a very good tool. If you still mistakenly believe we are in hyperinflation, I don't know what to tell you.Taxation can be used to sponge up extra funds in the economy if levied against both mandatory and highly transacted activities by all economic classes.

In other words, there is nothing that would both lower employment and increase the general price level as efficiently as a forced increase in fuel costs. It is the prime driver of stagflation. If you think that this is the goal of the government, then that is what you think. I do not think that. But that is way outside the context of the discussion I was having with @DarnYankeeUSMC

Last edited:

Raise taxes on gas and find out. Create a tax per mile like Biden has been proposing this year. It would have the effect they desire. Thnk outside of the box, they certainly are.

I look forward to this. Drive it off the cliff. Guess we have to get to the bottom before we can start building back, but I plan on gathering myself and surviving the impact.

I did not say we were in a hyperinflationary environment. You are assuming things.If you think the goal of the government is to crash the economy and destroy lives, then you are correct. And as I said above, it certainly could be used punitively. If you think their goal is to somehow manage their way out of a stagflationary environment, then it is not a very good tool. If you still mistakenly believe we are in hyperinflation, I don't know what to tell you.

If you think that taxation is only a punitive tool you are thinking myopically. And if you think interest rates are the only thing that can be used to curb demand up and down the supply chain right into your very home, you are wrong.

You are, again, taking my statement out of context. There is no doubt that taxation can change behavior (change demand,) but given the current environment, it is not a tool in the toolbox, thus using it would be a punitive measure. But we certainly don't disagree that at times in a business cycle, particularly ones that aren't exclusively credit driven, it can be a tool.I did not say we were in a hyperinflationary environment. You are assuming things.

If you think that taxation is only a punitive tool you are thinking myopically. And if you think interest rates are the only thing that can be used to curb demand up and down the supply chain right into your very home, you are wrong.

In the current situation, raising prices most specifically on the two biggest drivers of inflation, oil and food, would be madness, not policy.

And excuse me if I misremembered you as one of the hyperinflation crew.

I snipped some of your post to reply..they will probably do is try to finesse a scenario where we live at 4-7% inflation and 6-9% unemployment.

in a credit economy it is no secret how you stop inflation, and since rates are so minuscule, there should be no difficulty in doing so. What is problematic is that we really don't know what organic demand is like without current Fed policy, but it isn't something that they can address because they are shooting blanks at this point, so I expect them to be slower than they should be in combatting inflation because they will want to see what happens, knowing they can't really hit hard reverse. So stagflation is likely.

We know that the unemployment rate is bogus. Many have dropped from those numbers into the abiss. Employers are having a hard time filling positions and the welfare ranks have swollen.

What you described 7% inflation and 8% unemployment will sink the ship when you add in a federal interest rate of 4%.

Opinion: The 'interest rate comet' is about to slam into the U.S. economy

Americans will soon realize that the interest on our national debt is costing taxpayers a frightening percentage of our national income and wealth.

The big turd that no one wants to deal with is the debt.

As for ignoring the debt. I think you were referring to Keynesian policy? If so they blew that up in the last 15 years. It's not a bad thing if it's short term and paid back. What they have done is way outside of the realm of ever being paid back.

Like I said, I am not a financial wizard. Just someone that knows how to run a successful business. I think that's where Trump failed. Maybe he thought that his short term economic policy was Keynesian but once the real unemployment rate and a sound business foundation was established it would be time to pay the piper but on a more stable foundation. Then the WuFlu and politics stabbed him in the back and the printing press went on double time.

Keynesians actually think debt matters a lot. The difference between actual Keynesians and political Keynesians is that the former believe strongly in pretty strictly managing booms in order to repay the debts from busts, but political Keynesians don't have the same ethic. That said, the new strain is more MMT, which has really taken hold in left wing academic circles, and it is based on the literal idea that as long as a government controls the currency, it can do what it likes with it with basically no repercussions. It is pretty fucking stupid, but attractive to politicians and ideologues.I snipped some of your post to reply..

We know that the unemployment rate is bogus. Many have dropped from those numbers into the abiss. Employers are having a hard time filling positions and the welfare ranks have swollen.

What you described 7% inflation and 8% unemployment will sink the ship when you add in a federal interest rate of 4%.

It's an opinion but I agree with it and I am pretty sure that I am not the only one.

Opinion: The 'interest rate comet' is about to slam into the U.S. economy

Americans will soon realize that the interest on our national debt is costing taxpayers a frightening percentage of our national income and wealth.www.cnbc.com

The big turd that no one wants to deal with is the debt.

As for ignoring the debt. I think you were referring to Keynesian policy? If so they blew that up in the last 15 years. It's not a bad thing if it's short term and paid back. What they have done is way outside of the realm of ever being paid back.

Like I said, I am not a financial wizard. Just someone that knows how to run a successful business. I think that's where Trump failed. Maybe he thought that his short term economic policy was Keynesian but once the real unemployment rate and a sound business foundation was established it would be time to pay the piper but on a more stable foundation. Then the WuFlu and politics stabbed him in the back and the printing press went on double time.

Regarding Keynesianism, it was pretty much considered dead when I was in grad school, which was the early '90s. Killed by the '70s and by the neo Classical economists. We really didn't take it seriously, or at least we didn't at the lower levels before I departed. It had a resurgence after '08, but most honest accountings would say that it has been a total flop. Still, it's a mistake not to understand it because it is so influential now.

Regarding the unempolyment rate, I was using it as a metric, not as a reality. Even if it is bogus, which it is in a lot of ways, 8% means something different from 3%, and it is a difference we can all understand.

As for that opinion piece, I don't disagree with it, but I'd prefer not to find out.

Look, I think that at the base, I agree with you nearly 100% as to what economic policy, debt, etc should look like, if I were King, if I had my druthers, hell, if it was still 1999 and we were in that position, but I am trying, best I can, to understand what I think is likely to happen given that people are using a framework with which I disagree, making decisions I don't like etc. Trying to analyze the most likely outcomes.

Yes, I confused the two. Modern money theory and Keynesian.

The numbers don't lie. Someone posted the other day that there's 127 million people currently employed out of the 335 million citizens. Take away the 35 million government employees that just recycle tax dollars and you only have 92 million. Then remove the lower income that don't pay taxes. That doesn't leave too many actual tax payers along with corporate taxes. Which are paid by anyone that purchased their products.

I don't think anyone wants to see what is at the end of that opinion piece. But I am realistic and what I see right now is a train wreck.Keynesians actually think debt matters a lot. The difference between actual Keynesians and political Keynesians is that the former believe strongly in pretty strictly managing booms in order to repay the debts from busts, but political Keynesians don't have the same ethic. That said, the new strain is more MMT, which has really taken hold in left wing academic circles, and it is based on the literal idea that as long as a government controls the currency, it can do what it likes with it with basically no repercussions. It is pretty fucking stupid, but attractive to politicians and ideologues.

Regarding Keynesianism, it was pretty much considered dead when I was in grad school, which was the early '90s. Killed by the '70s and by the neo Classical economists. We really didn't take it seriously, or at least we didn't at the lower levels before I departed. It had a resurgence after '08, but most honest accountings would say that it has been a total flop. Still, it's a mistake not to understand it because it is so influential now.

Regarding the unempolyment rate, I was using it as a metric, not as a reality. Even if it is bogus, which it is in a lot of ways, 8% means something different from 3%, and it is a difference we can all understand.

As for that opinion piece, I don't disagree with it, but I'd prefer not to find out.

Look, I think that at the base, I agree with you nearly 100% as to what economic policy, debt, etc should look like, if I were King, if I had my druthers, hell, if it was still 1999 and we were in that position, but I am trying, best I can, to understand what I think is likely to happen given that people are using a framework with which I disagree, making decisions I don't like etc. Trying to analyze the most likely outcomes.

The numbers don't lie. Someone posted the other day that there's 127 million people currently employed out of the 335 million citizens. Take away the 35 million government employees that just recycle tax dollars and you only have 92 million. Then remove the lower income that don't pay taxes. That doesn't leave too many actual tax payers along with corporate taxes. Which are paid by anyone that purchased their products.

Tools? What are these tools you keep saying that they have?

One tool or rather trick that the banks use to hide falling values of their mortgage, bond and high-yield cooperate bond portfolios is to shift those assets from their usual short term holdings to long term holdings. They're basically saying that they intend to hold the shifted assets until maturity so they don't take the hit for loss of market value.

It's when those assets become nonperforming that the real problems come.

I agree with you completely. What's nuts is that as of 1999 we had gotten ourselves into pretty damn good shape, oddly enough thanks in part to some of the worst political actors out there. But now we are where we are, and I don't think there is a reasonable way of getting back to where we think we ought to be.Yes, I confused the two. Modern money theory and Keynesian.

I don't think anyone wants to see what is at the end of that opinion piece. But I am realistic and what I see right now is a train wreck.

The numbers don't lie. Someone posted the other day that there's 127 million people currently employed out of the 335 million citizens. Take away the 35 million government employees that just recycle tax dollars and you only have 92 million. Then remove the lower income that don't pay taxes. That doesn't leave too many actual tax payers along with corporate taxes. Which are paid by anyone that purchased their products.

What started the housing boom? Low interest rates and good employment. How many of those notes were down at the 4% level? Or ARM loans? When do the banks start losing money on those low interest rate loans? The Fed raising the interest rate will cause all those fixed rate mortgage's to be worthless and the ARM loans will be adjusted. Adjusted to what interest rate? The Fed is saying that they may raise the rate five times this year. Will the banks take that into consideration to cover their ass? With inflation and gas prices that are currently taking a chunk out of disposable income will it be just like 07? Too big to fail has been played out because the government has spent us into this mess.

They can shuffle shit but it's still shit and there's not an accountant that can't see itOne tool or rather trick that the banks use to hide falling values of their mortgage, bond and high-yield cooperate bond portfolios is to shift those assets from their usual short term holdings to long term holdings. They're basically saying that they intend to hold the shifted assets until maturity so they don't take the hit for loss of market value.

It's when those assets become nonperforming that the real problems come.

One more tool the FED is using is to "Reverse Exemptions" on businesses. The previous administration passed out many exemptions to businesses in order to get the economy jump started as the pandemic wound down. Basically this force businesses to pay more taxes.

One example:

ncga.com

ncga.com

One example:

Biofuel & Ag Leaders Respond to EPA Decision to Reverse Refinery Exemptions, Decry Lack of Real Market Impact

Top farm and biofuel leaders responded to the U.S. Environmental Protection Agency’s (EPA)decision to reverse 31 controversial small refinery exemptions (SREs)granted in August 2019 and expressed disappointment with EPA’s decision to allow refineries with previously-granted SREs...

The Fed and the EPA are not related.One more tool the FED is using is to "Reverse Exemptions" on businesses. The previous administration passed out many exemptions to businesses in order to get the economy jump started as the pandemic wound down. Basically this force businesses to pay more taxes.

One example:

Biofuel & Ag Leaders Respond to EPA Decision to Reverse Refinery Exemptions, Decry Lack of Real Market Impact

Top farm and biofuel leaders responded to the U.S. Environmental Protection Agency’s (EPA)decision to reverse 31 controversial small refinery exemptions (SREs)granted in August 2019 and expressed disappointment with EPA’s decision to allow refineries with previously-granted SREs...ncga.com

Damage Control:

NEW YORK, April 8 (Reuters) – A U.S. recession is not imminent despite the inversion of a part of the U.S. Treasury yield curve which has been “artificially pressured” by some investors, BlackRock Inc (BLK.N), the world’s largest asset manager, said in a note on Friday.

Link below to a current chart for BLK. Five down months with a dead cat bounce. Would you buy Blackrock today?

bigcharts.marketwatch.com

bigcharts.marketwatch.com

NEW YORK, April 8 (Reuters) – A U.S. recession is not imminent despite the inversion of a part of the U.S. Treasury yield curve which has been “artificially pressured” by some investors, BlackRock Inc (BLK.N), the world’s largest asset manager, said in a note on Friday.

Link below to a current chart for BLK. Five down months with a dead cat bounce. Would you buy Blackrock today?

BlackRock Inc., BLK Quick Chart - (NYS) BLK, BlackRock Inc. Stock Price - BigCharts.com

BLK - BlackRock Inc. Basic Chart, Quote and financial news from the leading provider and award-winning BigCharts.com.

Supplies are dwindling but, for the most part, most Prepper related items are still available. The day will come when a person won't be able to get an item at any price. Think hard about passing on an item because the price inflated recently.. FED is looking into 2023.

Narrator: Almost assuredly that day will not come in any of our lifetimes.

80 percent of the currency, currently in circulation was printed in the last 18 or so months. I would love to come back here in 2023 and say you were wrong, but a ressesion might not happen until 2023. There's just too much money in circulation. The federal reserve, will be rasing interest rates 4 times in 2022 and 3 times in 2023. People will have to slow down spending, they won't be able to afford anything.My hope is when 2023 rolls in all of you guy's can say - Look, Hobo was wrong.

Let's watch it unfold.

We can call it a plan for a soft landing or simply kicking the can down the road....... If and that's a big "IF" the recession takes hold in 2023 that will be a blessing. It will give some folks an opportunity to get ready. The inflation of prices is stifling some people from preparing. Many are just trying to put food on the table and pay the utility bills.80 percent of the currency, currently in circulation was printed in the last 18 or so months. I would love to come back here in 2023 and say you were wrong, but a ressesion might not happen until 2023. There's just too much money in circulation. The federal reserve, will be rasing interest rates 4 times in 2022 and 3 times in 2023. People will have to slow down spending, they won't be able to afford anything.

The biggest US banks are set to report their largest slowdown in funding banking income in years subsequent week, because the dealmaking engine that helped propel Wall Road to report income final 12 months sputters.

www.techstations.in

www.techstations.in

US banks set for giant hit to revenues as dealmaking dries up - Tech Stations

The biggest US banks are set to report their largest slowdown in funding banking income in years subsequent week, because the dealmaking engine that helped propel Wall Road to report income final 12 months sputters. Banks began the 12 months braced for a slowdown in dealmaking exercise following...

www.techstations.in

www.techstations.in

White House is re-writing the definition of "debt".

White House says:

One-in-three adults in the United States have medical debt. It is now the largest source of debt in collections—more than credit cards, utilities, and auto loans combined.

____________

Sleepy Joe's answer to this is to Reduce the role that medical debt plays in determining whether Americans can access credit –

With the looming recession he wants to remove medical debt from a person's credit report so they can run up more charge card debt. How thoughtful.

www.whitehouse.gov

www.whitehouse.gov

:max_bytes(150000):strip_icc()/GettyImages-1389164135-7be8cc87f8664afda9ab64a685193ce4.jpg)

www.investopedia.com

www.investopedia.com

Understanding Debt

The most common forms of debt are loans, including mortgages, auto loans, personal loans, and credit card debt. Under the terms of a loan, the borrower is required to repay the balance of the loan by a certain date, typically several years in the future

____________________________White House says:

One-in-three adults in the United States have medical debt. It is now the largest source of debt in collections—more than credit cards, utilities, and auto loans combined.

____________

Sleepy Joe's answer to this is to Reduce the role that medical debt plays in determining whether Americans can access credit –

With the looming recession he wants to remove medical debt from a person's credit report so they can run up more charge card debt. How thoughtful.

FACT SHEET: The Biden Administration Announces New Actions to Lessen the Burden of Medical Debt and Increase Consumer Protection | The White House

Vice President Kamala Harris to announce reforms across four areas to ease the burden of medical debt, giving more American families the opportunity

:max_bytes(150000):strip_icc()/GettyImages-1389164135-7be8cc87f8664afda9ab64a685193ce4.jpg)

Debt: What It Is, How It Works, Types, and Ways to Pay Back

Debt is something, usually money, owed by one party to another. Debt is used by many individuals and companies to make large purchases they could not afford under other circumstances. Debt must be paid back, typically with interest.

At any time now I would expect Jerome Powell to make his exit (health issue, spend time with family, pursue other employment, etc). The way things are shaping up, Lael Brainard will have this fiasco dumped in her lap. She will be the fall guy. The FED Governors know interest rates must advance expeditiously.

/cloudfront-us-east-2.images.arcpublishing.com/reuters/RP2JVDZ2DJOX7I6QZ4N5DX25XY.jpg)

www.reuters.com

www.reuters.com

/cloudfront-us-east-2.images.arcpublishing.com/reuters/RP2JVDZ2DJOX7I6QZ4N5DX25XY.jpg)

Fed's Evans: half-point hikes likely, shouldn't go too far

Chicago Federal Reserve Bank President Charles Evans on Monday signaled he would not necessarily oppose getting interest rates up to a neutral setting of 2.25% to 2.5% by the end of the year, a pace that would require a couple of 50 basis-point rate hikes at upcoming Fed meetings.

What started the housing boom? Low interest rates and good employment. How many of those notes were down at the 4% level? Or ARM loans? When do the banks start losing money on those low interest rate loans? The Fed raising the interest rate will cause all those fixed rate mortgage's to be worthless and the ARM loans will be adjusted. Adjusted to what interest rate? The Fed is saying that they may raise the rate five times this year. Will the banks take that into consideration to cover their ass? With inflation and gas prices that are currently taking a chunk out of disposable income will it be just like 07? Too big to fail has been played out because the government has spent us into this mess.

They can shuffle shit but it's still shit and there's not an accountant that can't see it

You make a lot of valid points that I will add to:

"What started the housing boom? Low interest rates and good employment."

This situation added fuel to the fire. The main culprit was bank deregulation allowing speculation on derivatives backed by sub-prime mortgages. Through in credit default swaps on those bundled mortgages and it's trouble. If everyone is able to continue to pay their mortgage, then no problem, but when economic conditions reverse you get the GFC. There is a chance that we are headed that way again now (meaning high unemployment, high interest rates and add to that high inflation).

"When do the banks start losing money on those low interest rate loans?"

The answer is when the loans become none performing. When people or business stop paying the bill, the banks start losing money other than to lost opportunity and inflation.

"The Fed raising the interest rate will cause all those fixed rate mortgage's to be worthless"

No, as interest rates rise the value of a mortgage on the secondary market drops, but it will never become worthless. Not even in foreclosure. Don't get me wrong, someone is losing money if the loans become none performing, but a simple increase in interest rates doesn't start the banks losing money.

"The Fed is saying that they may raise the rate five times this year. Will the banks take that into consideration to cover their ass"

Yes, banks have to meet stress test requirements to show that they have enough capital to manage going through an "economic shock". It's another reason they move the low interest rate loans and bonds to the hold maturity line if rates increase. I am hearing some reports that the FED won't be able to increase much past 1% before it will have to halt, but we shall see.

"With inflation and gas prices that are currently taking a chunk out of disposable income will it be just like 07?"

It may be worse than the GFC. Once interest rates rise enough >the economy slows >unemployment starts to rise then mortgages start to become none performing way faster than in 07' due to high inflation and high gas prices that were not part of the mix in 07'. The real action will be in the high-yield corporate debt market. Look at the FED chart below and see what happened during the GFC.

ICE BofA US High Yield Index Effective Yield

View data of the effective yield of an index of non-investment grade publically issued corporate debt in the U.S.

fred.stlouisfed.org

As for your last statement;

"They can shuffle shit but it's still shit"

Truer words have never been spoken.

From JW Rawles site:

At Zero Hedge: FOMC Minutes Signal Bigger, Faster-Than-Expected QT, Multiple 50bps Hikes. JWR’s Comment: It looks like the Fed’s leadership is fast-tracking a recession.

www.zerohedge.com

www.zerohedge.com

At Zero Hedge: FOMC Minutes Signal Bigger, Faster-Than-Expected QT, Multiple 50bps Hikes. JWR’s Comment: It looks like the Fed’s leadership is fast-tracking a recession.

ZeroHedge

ZeroHedge - On a long enough timeline, the survival rate for everyone drops to zero

"The real action will be in the high-yield corporate debt market." - This right here. Gird thy loins. Who had shitty business models but got people to buy their debt anyway? We will soon find out.You make a lot of valid points that I will add to:

"What started the housing boom? Low interest rates and good employment."

This situation added fuel to the fire. The main culprit was bank deregulation allowing speculation on derivatives backed by sub-prime mortgages. Through in credit default swaps on those bundled mortgages and it's trouble. If everyone is able to continue to pay their mortgage, then no problem, but when economic conditions reverse you get the GFC. There is a chance that we are headed that way again now (meaning high unemployment, high interest rates and add to that high inflation).

"When do the banks start losing money on those low interest rate loans?"

The answer is when the loans become none performing. When people or business stop paying the bill, the banks start losing money other than to lost opportunity and inflation.

"The Fed raising the interest rate will cause all those fixed rate mortgage's to be worthless"

No, as interest rates rise the value of a mortgage on the secondary market drops, but it will never become worthless. Not even in foreclosure. Don't get me wrong, someone is losing money if the loans become none performing, but a simple increase in interest rates doesn't start the banks losing money.

"The Fed is saying that they may raise the rate five times this year. Will the banks take that into consideration to cover their ass"

Yes, banks have to meet stress test requirements to show that they have enough capital to manage going through an "economic shock". It's another reason they move the low interest rate loans and bonds to the hold maturity line if rates increase. I am hearing some reports that the FED won't be able to increase much past 1% before it will have to halt, but we shall see.

"With inflation and gas prices that are currently taking a chunk out of disposable income will it be just like 07?"

It may be worse than the GFC. Once interest rates rise enough >the economy slows >unemployment starts to rise then mortgages start to become none performing way faster than in 07' due to high inflation and high gas prices that were not part of the mix in 07'. The real action will be in the high-yield corporate debt market. Look at the FED chart below and see what happened during the GFC.

ICE BofA US High Yield Index Effective Yield

View data of the effective yield of an index of non-investment grade publically issued corporate debt in the U.S.fred.stlouisfed.org

As for your last statement;

"They can shuffle shit but it's still shit"

Truer words have never been spoken.

Talk about creating a problem with a fix.

They know that it takes several quarters to realize the impact of a rate change but they are going to keep raising it anyway. Does that make sense?

They know that it takes several quarters to realize the impact of a rate change but they are going to keep raising it anyway. Does that make sense?

From JW Rawles site:

At Zero Hedge: FOMC Minutes Signal Bigger, Faster-Than-Expected QT, Multiple 50bps Hikes. JWR’s Comment: It looks like the Fed’s leadership is fast-tracking a recession.

ZeroHedge

ZeroHedge - On a long enough timeline, the survival rate for everyone drops to zerowww.zerohedge.com

Some don’t like them but the Elliott Wave guys firmly believe that the Fed always moves too late and overshoots the correct action, primarily due their backward looking nature.Talk about creating a problem with a fix.

They know that it takes several quarters to realize the impact of a rate change but they are going to keep raising it anyway. Does that make sense?

That's pretty much a fundamental position of any Fed criticism. And given my (relatively) short time as a wage-earner, taxpayer, homeowner, and investor, it's a solid argument to make.Some don’t like them but the Elliott Wave guys firmly believe that the Fed always moves too late and overshoots the correct action, primarily due their backward looking nature.

The counterargument is that any other monetary system is less stable and produces bigger oscillations. But for someone who's lived through 50 years of Fed-induced pain via inflation and then more Fed-induced pain via recessions, the political reality is that support will grow for alternatives - crypto, commodity basket indexing, gold standard, tulip bulbs, whatever. I think most rational individuals (i.e. not AOC or Paul Krugman) would cross MMT off the list of alternatives, but that still leaves dozens of other bad ideas for our favorite congresscritters to propose.

I don't even think that settling on a target rate is going to be the toughest job for the Fed (although it's pretty tough). Simultaneously, liquidity needs to be withdrawn, and I think this has more impact than rates and yet works with even more phase delay (lag).

Also note this probably needs to be coordinated with other central banks.

My only contribution to this thread now is that 'This is not the same as The '70's/ The '80's/ The '90's/ 2008/Blah, Blah, Blah. All the old worn and true transcripts are now obsolete. All the classic texts about Economics 101/202/505 and how Money runs are obsolete. In My Opinion, there is little/no precedent for what works now, how it goes, where it goes, or how it fails/corrects/or is mitigated. People literally execute multimillion $ stock trades via the fucking *PhOnE!*...literally billions of dollars trades hands (or Rubles or Pesos or whatever) untraced and not tracked. The US/World Stock Markets do not (and have not for some time) reflect the health of a US/Global economy - Stock prices reflect the "Mood" of the folks able to invest...be that panic, greed, or impatience. Countries print money and call it good - the Gold Standard is no more. Digital currency or a "no money" System looms on the horizon.

There is no precedent for what comes next or where this goes. The Classic Text Books on Economics and Such are obsolete. The Future of Money is ahead now - not behind. What happened in 1976, 1876, 1776, in terms of Economics is obsolete and no longer needed information. IMO/YMMV.

VooDoo

There is no precedent for what comes next or where this goes. The Classic Text Books on Economics and Such are obsolete. The Future of Money is ahead now - not behind. What happened in 1976, 1876, 1776, in terms of Economics is obsolete and no longer needed information. IMO/YMMV.

VooDoo

I think it must be coordinated with other central banks to some degree as they hold some of our currency and debt. At a minimum those impacts need to be considered as the roll-on effects will be real and ultimately boomerang back to us. Part of the curse/benefits of a reserve currency.That's pretty much a fundamental position of any Fed criticism. And given my (relatively) short time as a wage-earner, taxpayer, homeowner, and investor, it's a solid argument to make.

The counterargument is that any other monetary system is less stable and produces bigger oscillations. But for someone who's lived through 50 years of Fed-induced pain via inflation and then more Fed-induced pain via recessions, the political reality is that support will grow for alternatives - crypto, commodity basket indexing, gold standard, tulip bulbs, whatever. I think most rational individuals (i.e. not AOC or Paul Krugman) would cross MMT off the list of alternatives, but that still leaves dozens of other bad ideas for our favorite congresscritters to propose.

I don't even think that settling on a target rate is going to be the toughest job for the Fed (although it's pretty tough). Simultaneously, liquidity needs to be withdrawn, and I think this has more impact than rates and yet works with even more phase delay (lag).

Also note this probably needs to be coordinated with other central banks.

The ultimate question: what options are available sponge up the excess liquidity and which ones are truly up for consideration? Alternatively, which ones would not necessarily remove it from existing per se, but remove it from use (increasing bank reserve requirements, etc). There are options, many we haven't considered. And for some reason I cannot get the digital dollar separated from this as a solution in my mind. Still working through that, but I feel like it would be something similar to an exchange rate of x physical dollars for x-y amount of digital dollars and the physical gets phased out for a debt reset. But then Russia kind of jacked that up with going back to the gold standard. Unbacked digital dollars vs a gold backed Ruble? I dunno.

I agree. I have mentioned here that split second financial decisions are made while viewing historic charts, theories and "we always did it this way" thinking. The FED Reserve and Congress remind me of a man racing through a forest at night while looking backwards. The American people are the one's suffering.My only contribution to this thread now is that 'This is not the same as The '70's/ The '80's/ The '90's/ 2008/Blah, Blah, Blah. All the old worn and true transcripts are now obsolete. All the classic texts about Economics 101/202/505 and how Money runs are obsolete. In My Opinion, there is little/no precedent for what works now, how it goes, where it goes, or how it fails/corrects/or is mitigated. People literally execute multimillion $ stock trades via the fucking *PhOnE!*...literally billions of dollars trades hands (or Rubles or Pesos or whatever) untraced and not tracked. The US/World Stock Markets do not (and have not for some time) reflect the health of a US/Global economy - Stock prices reflect the "Mood" of the folks able to invest...be that panic, greed, or impatience. Countries print money and call it good - the Gold Standard is no more. Digital currency or a "no money" System looms on the horizon.

There is no precedent for what comes next or where this goes. The Classic Text Books on Economics and Such are obsolete. The Future of Money is ahead now - not behind. What happened in 1976, 1876, 1776, in terms of Economics is obsolete and no longer needed information. IMO/YMMV.

VooDoo

All I have been telling friends and family is to "Plot Your Own Course" because each person / family understand their resources and priorities.

Put some kind of plan together. Obviously it will be better than the Government's plan for you and your family. Hope is not a plan.

I don't think there is any way to possibly argue that the business cycle has been anything but less severe over the past hundredish years (post GD) than in any other time in history, and at the same time, growth in technology, shared prosperity, etc, has been greater than in any other period. In fact, I think if you gave people perfect foresight into a century of economics, with all of its warts and troubles, nearly everybody, from every other time, would have chosen the past century. Any, as you say, rational individual.That's pretty much a fundamental position of any Fed criticism. And given my (relatively) short time as a wage-earner, taxpayer, homeowner, and investor, it's a solid argument to make.

The counterargument is that any other monetary system is less stable and produces bigger oscillations. But for someone who's lived through 50 years of Fed-induced pain via inflation and then more Fed-induced pain via recessions, the political reality is that support will grow for alternatives - crypto, commodity basket indexing, gold standard, tulip bulbs, whatever. I think most rational individuals (i.e. not AOC or Paul Krugman) would cross MMT off the list of alternatives, but that still leaves dozens of other bad ideas for our favorite congresscritters to propose.

I don't even think that settling on a target rate is going to be the toughest job for the Fed (although it's pretty tough). Simultaneously, liquidity needs to be withdrawn, and I think this has more impact than rates and yet works with even more phase delay (lag).

Also note this probably needs to be coordinated with other central banks.

Of course, past is prologue, and that might not last, but people, especially those out of power in politics, have been forecasting doom that entire time, and have become poor doing so. As I have said, I think we are in for a slow drain for a good long while, but I don't think the smart money is on collapse, in fact, we know it isn't because we watch it every day. It maybe that the self styled Viking Soothsayers of the world, the Hobo Hiltons, will finally be right, but it isn't a bet I would be willing to make.

As far as asset based commodities, they really aren't a great solution in most ways. Basket indexing is interesting, but in many ways it violates nearly every assumed characteristic of money, and while gold is the old standard, it really isn't the "gold standard" for money in any other way that that it does have the characteristics of money: divisibility, portability, durability, consistency etc. Otherwise, there is no reason that gold is money other than that gold was money. That said, I think that observation of the populace would tell you that hard money is less demanded now than ever, except in some rather extreme circles. That doesn't mean those circles are wrong, I think that hard money is probably second best to rule based money, but nearly everybody is demanding, in some words or another, worse money than better.

As far as draining liquidity from the system, it probably isn't that difficult, and it certainly is going to have to be coordinated, but it would be a lot easier than adding liquidity at this point, so, as I have said, they will likely proceed with extreme caution, and go too slow so as to not create something that spirals. They might not be able to do it, but it is hardly impossible.

World Markets Are Falling Again With Echoes of the 2018 Rout

(Bloomberg) -- The feel-good days for global markets at the end of March are firmly over.Most Read from BloombergUkraine Update: Austria Chancellor to Meet Putin; New War FrontUkraine Update: More Than 10,000 Died in Mariupol, Mayor SaysCovid Could Be Surging in the U.S. Right Now and We Might...

Some don’t like them but the Elliott Wave guys firmly believe that the Fed always moves too late and overshoots the correct action, primarily due their backward looking nature.

I like the guys at EW, but I find the thinking of the above statement to be, well, awkward and excusatory.

During the extended period of time that they looked at to determine that the Fed is always late to take action and takes actions over what is necessary, there have been dozens of different people as Fed chair and dozens more as board members. Yet they all make the same errors.

A group who is backward looking by nature that can't see that their past actions have always been late and have been overreactions, isn't looking backwards. EW's reasoning for why the Fed is always late is faulty.

Doing something over and over and expecting a different result is no longer defined as insanity, it's policy.

Ike

Mixing Politics and Economics is painful for the people on Main Street.I like the guys at EW, but I find the thinking of the above statement to be, well, awkward and excusatory.

During the extended period of time that they looked at to determine that the Fed is always late to take action and takes actions over what is necessary, there have been dozens of different people as Fed chair and dozens more as board members. Yet they all make the same errors.

A group who is backward looking by nature that can't see that their past actions have always been late and have been overreactions, isn't looking backwards. EW's reasoning for why the Fed is always late is faulty.

Doing something over and over and expecting a different result is no longer defined as insanity, it's policy.

Ike

As the trading winds down today, we have $100 oil and $400 wheat... Regardless of what Biden and the FED Reserve are saying.

Comforting words this morning from the FED Reserve:

“If you take account of [forward guidance], we don’t look so bad. Not all hope is lost. That is the basic gist of this story,” Bullard said in a speech at the University of Missouri.

The FED's plan is hope. Best put together your own financial survival plan today. The FED's plan does not have your best interest in mind.

www.cnbc.com

www.cnbc.com

“If you take account of [forward guidance], we don’t look so bad. Not all hope is lost. That is the basic gist of this story,” Bullard said in a speech at the University of Missouri.

The FED's plan is hope. Best put together your own financial survival plan today. The FED's plan does not have your best interest in mind.

Fed's Bullard says interest rate policy is 'behind the curve,' but it's making progress

The Fed needs to raise rates substantially to control inflation but may not be as "behind the curve" as it appears, St. Louis Fed President James Bullard said.

I'm chuckling. US Market's are up nicely today. The thing driving them today is "Consumer discretionary spending".Been rebuilding a privacy fence for a buddy this week. He almost passed out at the cost of lumber, and that’s just the pickets and backer rails. Have to build them all custom because the person who put it in didn’t put the posts at 8 ft.

Got some 9’ 10” panels, some 8’ 7” panels, a 10’ 4” panel etc. Thank God for nail guns as I’d hate to build these on the ground and then raise them in place.

Pro-tip: Don’t let retards put up your privacy fence.

Consumer discretionary is a term for classifying goods and services that are considered non-essential by consumers, but desirable if their available income is sufficient to purchase them.

The only thing that drives markets is a delta between old expectations and new expectations. CNBC loves to tell you it is this or that, and people love to talk their book, but repricing is nothing other than discounting new information, most notably today JPM and PPI, and comparing it to expectations.

I'm chuckling. US Market's are up nicely today. The thing driving them today is "Consumer discretionary spending".

Consumer discretionary is a term for classifying goods and services that are considered non-essential by consumers, but desirable if their available income is sufficient to purchase them.

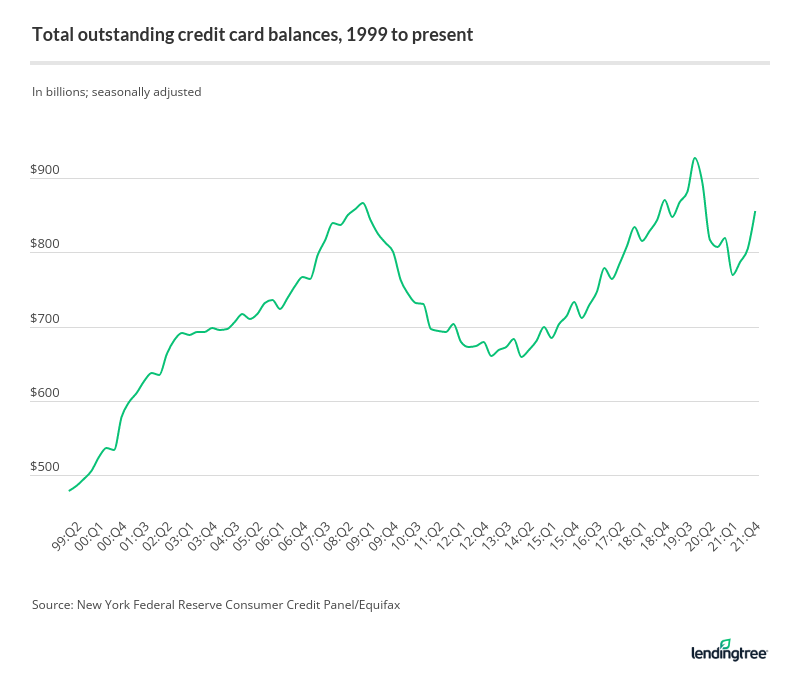

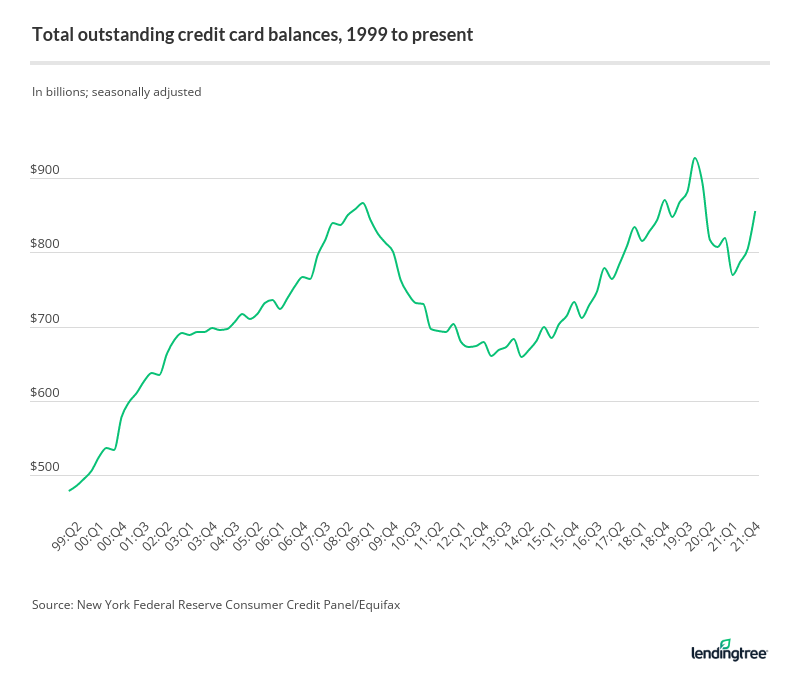

US consumer debt jumped by $40 billion in February

Americans got into a lot more debt in February as rampant inflation kept up the pressure, the Federal Reserve's consumer credit report showed Thursday.

Discretionary spending.... Indeed.Americans got into a lot more debt in February as rampant inflation kept up the pressure, the Federal Reserve's consumer credit report showed Thursday.

Debt levels jumped by nearly $42 billion to a total of almost $4.5 trillion. That's an annual increase of 11.3%, seasonally adjusted, far outperforming economists' expectations and setting a new high. In January, total credit had grown only 2.4%

This "Flash in the Pan" will come to a screeching halt when remaining spending is focused at the grocery store and gas station. History repeating

US consumer debt jumped by $40 billion in February

Americans got into a lot more debt in February as rampant inflation kept up the pressure, the Federal Reserve's consumer credit report showed Thursday.www.cnn.com

Discretionary spending.... Indeed.

Last edited:

Mr. Dimon said that risk remains remote but has grown following Russia's invasion of Ukraine and as inflation has hit its highest level in 40 years. “Those are very powerful forces, and those things are going to collide at one point,” Mr. Dimon said. “No one knows what's going to turn out.”

www.wsj.com

www.wsj.com

JPMorgan CEO Jamie Dimon Says ‘Powerful Forces’ Threaten U.S. Economy

While the bank CEO said the U.S. economy is growing, the company socked away funds to prepare for higher defaults in case of a recession, and its first-quarter profit fell 42%.

I wouldn't be leaving too much cash in a bank right now.

War and inflation set to drag on corporate profits despite rising revenues - News07trends

The most important US corporations are anticipated to put up a slowdown in earnings progress after they reveal their first-quarter ends in the approaching weeks as raging inflation and the warfare in Ukraine weigh on income. Earnings bulletins from corporations listed on the S&P 500 index are...

www.universalpersonality.com

www.universalpersonality.com

History repeating... The Bear Trap is set

2025 Credit Card Debt Statistics | LendingTree

Americans’ total credit card balance is $1.182 trillion as of the first quarter of 2025, according to the latest Federal Reserve data.

www.lendingtree.com

Similar threads

- Replies

- 26

- Views

- 1K

- Replies

- 1

- Views

- 140

- Replies

- 39

- Views

- 2K

- Replies

- 0

- Views

- 164