I would take some government cheese if they wanted to go back to using that program.I want food stamps

Join the Hide community

Get access to live stream, lessons, the post exchange, and chat with other snipers.

Register

Download Gravity Ballistics

Get help to accurately calculate and scope your sniper rifle using real shooting data.

Install the app

How to install the app on iOS

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Recession - 2022 / 2023 / 2024

- Thread starter Hobo Hilton

- Start date

I'm still in the city, but we planted some things as well. Won't keep us going by itself, but will stretch things out a bit. I guess I am doing a victory/survival garden of tomatoes, okra and a few other things to feed the dehydrator and the canning project.I'm in an exponential mode around the homestead. The more bad news I hear about the food supply, the more dirt I turn over. No, I'm not a farmer, I'm a retired welder. Figuring about a 50% crop failure rate into the Matrix... Sunday afternoon's work:

Just plant one squash plant, lol.

During the census when Trump was President the democraps were in a tissy over the illegals not being allowed to fill out the census form.

The illegals do help in getting congressional seats in the house.

The illegals do help in getting congressional seats in the house.

I don't remember hearing how many filled it out. Was it bilingual? I don't remember.Not sure that includes the 25M+ illegal immigrants who are also mostly getting welfare from US taxpayers.

Get a rain barrel. Use it to water your plants when it's dry. Your plants will reward you for not dumping all the city water with it's chemicals in them.

I'm still in the city, but we planted some things as well. Won't keep us going by itself, but will stretch things out a bit. I guess I am doing a victory/survival garden of tomatoes, okra and a few other things to feed the dehydrator and the canning project.

The biggest benefit of your planting is "Knowledge"... You learn what works and what does not work.I'm still in the city, but we planted some things as well. Won't keep us going by itself, but will stretch things out a bit. I guess I am doing a victory/survival garden of tomatoes, okra and a few other things to feed the dehydrator and the canning project.

Knowledge packs light and travels well.

Also, get heirloom seeds. They will not produce the quantities of hybrid seeds but you can save the seeds and use the next year. Do a little research on saving the seeds though. Not all seeds are stored the same way.

I'm still in the city, but we planted some things as well. Won't keep us going by itself, but will stretch things out a bit. I guess I am doing a victory/survival garden of tomatoes, okra and a few other things to feed the dehydrator and the canning project.

Squash did not work well for me the last couple years. Vine borers got me both of the last two years. I inspect daily, baited yellow bowls with dishwashing liquid, and even cut a couple out through the season. One failure point and it cascades into 6 plants done inside a week.Just plant one squash plant, lol.

When a man or a country over uses a strong weapon... Other's will find a way around that weapon...

New York (CNN Business)The US may have the world's most powerful military, but the dollar is its greatest weapon. Now, after nearly 80 years of dollar dominance, the US might be in danger of losing its global reserve currency status.

www.cnn.com

www.cnn.com

New York (CNN Business)The US may have the world's most powerful military, but the dollar is its greatest weapon. Now, after nearly 80 years of dollar dominance, the US might be in danger of losing its global reserve currency status.

Is the US dollar in danger?

The US may have the world's most powerful military, but the dollar is its greatest weapon. Now, after nearly 80 years of dollar dominance, the US might be in danger of losing its global reserve currency status.

When a man or a country over uses a strong weapon... Other's will find a way around that weapon...

New York (CNN Business)The US may have the world's most powerful military, but the dollar is its greatest weapon. Now, after nearly 80 years of dollar dominance, the US might be in danger of losing its global reserve currency status.

Is the US dollar in danger?

The US may have the world's most powerful military, but the dollar is its greatest weapon. Now, after nearly 80 years of dollar dominance, the US might be in danger of losing its global reserve currency status.www.cnn.com

Huh. Rather interesting that this article ran on CNN, of all places. That's noteworthy.

I agree with you. What ever word a person chooses to label the events of the past few years, these are conditions many of us have seen in our past. The speed / momentum in which these events continue to unfold, to me, is staggering. It's like American's wake up every morning to a new and totally different crisis.... Pandemic, war, inflation, food shortages, weather catastrophes, pedophiles. The United States, much less the entire world has never seen times like this.Huh. Rather interesting that this article ran on CNN, of all places. That's noteworthy.

To be fair, I think the pedophile thing is just the gift that keeps giving. A week does not go by without news about them. I guess if we are catching them that is a good thing, but they don't seem to be getting just punishment for ruining people's lives.I agree with you. What ever word a person chooses to label the events of the past few years, these are conditions many of us have seen in our past. The speed / momentum in which these events continue to unfold, to me, is staggering. It's like American's wake up every morning to a new and totally different crisis.... Pandemic, war, inflation, food shortages, weather catastrophes, pedophiles. The United States, much less the entire world has never seen times like this.

I agree with you. What ever word a person chooses to label the events of the past few years, these are conditions many of us have seen in our past. The speed / momentum in which these events continue to unfold, to me, is staggering. It's like American's wake up every morning to a new and totally different crisis.... Pandemic, war, inflation, food shortages, weather catastrophes, pedophiles. The United States, much less the entire world has never seen times like this.

I keep coming back to the Strauss-Howe generational theory as a framework. An order was established by my grandparents' generation coming out of WWII. The next three generations chipped away at that order with various sins, while technological advancement went wild.

What we're seeing now is the necessity for a new framework. It might be an acknowledgement that the world is not flat. It may be a return to hard currencies; not necessarily backed by gold, but maybe some more practical basket of commodities or measure of productivity. We might have to go draw new borders in a variety of places around the globe. There's probably hundreds of things like this to be worked out, when a change in any one of them would seem impossibly massive at this moment.

What's most likely is that we've still got another 10ish years to go, and that my sons' generation will be the ones to bring the crisis to a head. These dumbass Millennials and older Gen Zs think they can keep breaking down the system and that any backlash is going to come from older generations. They're going to be quite surprised when those who are currently in grade school start pushing back against their hedonism and illogic.

I'm reading between the lines of Jamie's letter..... Things / events are going to hit us head on out of a clear blue sky. Prepare.

________________________________

Jamie Dimon, CEO and chairman of the biggest U.S. bank by assets, pointed to a potentially unprecedented combination of risks facing the country in his annual shareholder letter.

www.cnbc.com

www.cnbc.com

________________________________

Jamie Dimon, CEO and chairman of the biggest U.S. bank by assets, pointed to a potentially unprecedented combination of risks facing the country in his annual shareholder letter.

Dimon says confluence of inflation, Ukraine war may 'dramatically increase risks ahead' for U.S.

Jamie Dimon's annual letter to JPMorgan shareholders, read widely in business circles, took a more downcast tone from his missive just last year.

Pay attention to those one little lines. They must be inserted in articles to cover the reporter's ass. An example:

The decline in factory orders in February was led by a 5.3% tumble in transportation equipment.

For those not in the trucking arena, PACCAR is those big ol, shiney Kenworths / Peterbilts running the Interstates. When a recession hits, the last thing companies want is to have equipment sitting around while they pay the monthly note:

bigcharts.marketwatch.com

bigcharts.marketwatch.com

The decline in factory orders in February was led by a 5.3% tumble in transportation equipment.

For those not in the trucking arena, PACCAR is those big ol, shiney Kenworths / Peterbilts running the Interstates. When a recession hits, the last thing companies want is to have equipment sitting around while they pay the monthly note:

Paccar Inc., PCAR Quick Chart - (NAS) PCAR, Paccar Inc. Stock Price - BigCharts.com

PCAR - Paccar Inc. Basic Chart, Quote and financial news from the leading provider and award-winning BigCharts.com.

Last edited:

The chances of any sort of commodity basket based currency supplanting the current order is next to nil. Personally, I think it is a really good idea, but it isn't going to happen, absent an absolute breakdown of the current order, which also isn't likely to happen.I keep coming back to the Strauss-Howe generational theory as a framework. An order was established by my grandparents' generation coming out of WWII. The next three generations chipped away at that order with various sins, while technological advancement went wild.

What we're seeing now is the necessity for a new framework. It might be an acknowledgement that the world is not flat. It may be a return to hard currencies; not necessarily backed by gold, but maybe some more practical basket of commodities or measure of productivity. We might have to go draw new borders in a variety of places around the globe. There's probably hundreds of things like this to be worked out, when a change in any one of them would seem impossibly massive at this moment.

What's most likely is that we've still got another 10ish years to go, and that my sons' generation will be the ones to bring the crisis to a head. These dumbass Millennials and older Gen Zs think they can keep breaking down the system and that any backlash is going to come from older generations. They're going to be quite surprised when those who are currently in grade school start pushing back against their hedonism and illogic.

I've mentioned, to much consternation here, that naive models of history repeating are silly, and rarely come about, mainly because, outside of orthodox Hegelian Marxism, which seems to be the religion of the new right, history itself is not a player on the world stage. It's probably why, as I have pointed out many times on here, everybody else saw singular (inflation) risk for a year, while I was telling you guys it was a high, dual risk situation. In fact, I suggested stagflation about a year ago, or more. That is because each scenario presents a set of choices, and figuring out what is going to happen requires understanding the choices, not a naive adherence to the forces of history.

So, I don't necessarily disagree with your concept of generations constantly fucking things up, but it isn't written in stone, it is done by choice, and most of those choices are made with extremely limited knowledge of their outcomes, or how they would interact with other individual choices being made. In other words, they happen because there is no plan, not because there is one, and we prefer it that way, because plans are worse. Or, to riff on Tolstoy, every good economy is the same, every bad economy is bad in its own individual way.

Worldwide.....

BANGKOK (AP) — Disruptions to supplies of commodities, financial strains and higher prices are among the impacts of the war in Ukraine that will slow economies in Asia in coming months, the World Bank says in a report released Tuesday.

The report forecasts slower growth and rising poverty in the Asia-Pacific region this year as “multiple shocks” compound troubles for people and for businesses.

www.sfgate.com

www.sfgate.com

BANGKOK (AP) — Disruptions to supplies of commodities, financial strains and higher prices are among the impacts of the war in Ukraine that will slow economies in Asia in coming months, the World Bank says in a report released Tuesday.

The report forecasts slower growth and rising poverty in the Asia-Pacific region this year as “multiple shocks” compound troubles for people and for businesses.

World Bank says war shocks to drag on Asian economies

BANGKOK (AP) — Disruptions to supplies of commodities, financial strains and higher...

Validation:

New York (CNN Business)The Federal Reserve's fight against inflation will spark a recession in the United States that begins late next year, Deutsche Bank warned on Tuesday.

The recession call -- the first from a major bank -- reflects growing concern that the Fed will hit the brakes on the economy so hard that it will inadvertently end the recovery that began just two years ago.

www.cnn.com

www.cnn.com

New York (CNN Business)The Federal Reserve's fight against inflation will spark a recession in the United States that begins late next year, Deutsche Bank warned on Tuesday.

The recession call -- the first from a major bank -- reflects growing concern that the Fed will hit the brakes on the economy so hard that it will inadvertently end the recovery that began just two years ago.

Deutsche Bank is the first big bank to forecast a US recession

The Federal Reserve's fight against inflation will spark a recession in the United States that begins late next year, Deutsche Bank warned on Tuesday.

States put unemployment insurance on chopping block

Lawmakers in a handful of states have proposed reducing the duration of unemployment benefits and imposing more stringent work-search requirements.

Is the FED waiting until after the midterms to make any real meaningful move against this massive inflation? Just to blame it on the Republicans?

At this point I see no other reason other than an actual desire for the great reset.

At this point I see no other reason other than an actual desire for the great reset.

I think that is the plan, but I don't think they are going to make it. I think crap will be hitting the fan far prior to midterms. We have already seen rationing overseas. I will be surprised if we aren't noticing major changes by July that they will have no answers for. I'm pretty sure Jen psaki saw the writing on the wall and realized the backpedaling and being asked tough questions was about to get dialed up to 11. She exited stage left at an opportune time.Is the FED waiting until after the midterms to make any real meaningful move against this massive inflation? Just to blame it on the Republicans?

At this point I see no other reason other than an actual desire for the great reset.

JMHO..... Conditions are a bit different with this train wreck. Inflation / recession is world wide. I think we will get to see how minute the FED Reserve actually is on the "Worldwide Scale".... Many of the poorer countries / continents will hardly feel any change in conditions of their daily lives. Other countries are well buffered against financial upheavals. America is vulnerable.Is the FED waiting until after the midterms to make any real meaningful move against this massive inflation? Just to blame it on the Republicans?

At this point I see no other reason other than an actual desire for the great reset.

Jobless claims usually bottom out prior to a recession:

Initial Jobless Claims (1967-2025)

This interactive chart shows initial unemployment claims back to 1967.www.macrotrends.net

View attachment 7834494

Note that I trimmed the right side of the chart because the April 2020 numbers fuck up the Y-axis scale.

So, if history holds true, we're maybe 6-12 months out from the next recession. I don't place much faith in this prediction because of *waves hands at everything*

Your theory is playing out nicely.Jobless claims usually bottom out prior to a recession:

Initial Jobless Claims (1967-2025)

This interactive chart shows initial unemployment claims back to 1967.www.macrotrends.net

View attachment 7834494

Note that I trimmed the right side of the chart because the April 2020 numbers fuck up the Y-axis scale.

So, if history holds true, we're maybe 6-12 months out from the next recession. I don't place much faith in this prediction because of *waves hands at everything*

Weekly jobless claims fell to 166,000 last week, the lowest level since 1968

Initial filings for unemployment dropped to 166,000, well below the Dow Jones estimate of 200,000 and 5,000 below the previous week's total

Out of fuel, dead stick landing, overshot the runway, __________________ (fill in the blank)

www.marketwatch.com

www.marketwatch.com

It's now clear that the Federal Reserve has made a huge monetary-policy error

The central bank took too long to raise interest rates. It's now playing catchup.

Prediction: dead cat bounce. Again.Out of fuel, dead stick landing, overshot the runway, __________________ (fill in the blank)

It's now clear that the Federal Reserve has made a huge monetary-policy error

The central bank took too long to raise interest rates. It's now playing catchup.www.marketwatch.com

I find it fascinating that the Mega Corporations are raising their prices and driving inflation while reporting record profits. I'm wondering how much of this inflation is fueled by Corporate Greed. Not enough competition anymore so they have no/little fear of trying to hold the line on prices.

VooDoo

VooDoo

Every day I look at different situations here in America. I share some of that here just to see if I am over looking anything...I find it fascinating that the Mega Corporations are raising their prices and driving inflation while reporting record profits. I'm wondering how much of this inflation is fueled by Corporate Greed. Not enough competition anymore so they have no/little fear of trying to hold the line on prices.

VooDoo

That little voice in the back of my head keeps saying "This shit just don't add up".... Why?

Just left my eye Dr's office (Cataract) he's around my age. We both shared how we will wake up, wide awake at 2:30 am and can't get back to sleep. I think our brains are attempting to prepare for the unknown. Fors sure, there will be more Black Swans.

The chances of any sort of commodity basket based currency supplanting the current order is next to nil. Personally, I think it is a really good idea, but it isn't going to happen, absent an absolute breakdown of the current order, which also isn't likely to happen.

The chances of a transition in currency order may be next to nil, but they are never zero. In this case the chances are greater than zero, or so say Zoltan Pozsar.

ZeroHedge

ZeroHedge - On a long enough timeline, the survival rate for everyone drops to zero

Ike

The dollar may well be on its way out as a reserve currency. In fact, the chances are very high in the long run. On the other hand, the chances of it being replaced by anything other than another fiat currency are pretty close to zero. The idea that Chinese ascendancy would lead to, of all things, a decentralization of money, is bonkers.

At the young age of 67 I have lived through a couple of screwed up times including the 70's and several recessions. I have been in the commercial construction/development business my whole career and what I am seeing today with commodity prices in our sector of the economy is 2006 deja vu all over again. We recently received a letter from our concrete supplier stating they will start rationing concrete due to a cement shortage and add on top of that a 5$/yard fuel surcharge. Cement plants can't run at capacity because they don't have enough spare parts and natural gas prices are eating their lunch. We are experiencing material price increased across the board being compounded by availability. Been waiting 9 months for a breaker for a load bank and still no firm shipment date.

I am seeing all the same leading indicators I saw in 2006 and luckily we shut down all new development at that time prior to the SHTF. Compound that with the inflationary pressures leave the fed with little or no options to deal with a recession. All of the above have a domino effect and I am not optimistic especially due to the incompetent asshats in DC.

I am seeing all the same leading indicators I saw in 2006 and luckily we shut down all new development at that time prior to the SHTF. Compound that with the inflationary pressures leave the fed with little or no options to deal with a recession. All of the above have a domino effect and I am not optimistic especially due to the incompetent asshats in DC.

I too spent my life in Heavy Industrial Construction. Like you, all of this is deja vu to me. The biggest difference I see is that this time, it is worldwide. With a business like yours, you can't getaway from it even by relocating to a different country... Same conditions there. We are preparing to walk through a landscape filled with bear traps and land mines.At the young age of 67 I have lived through a couple of screwed up times including the 70's and several recessions. I have been in the commercial construction/development business my whole career and what I am seeing today with commodity prices in our sector of the economy is 2006 deja vu all over again. We recently received a letter from our concrete supplier stating they will start rationing concrete due to a cement shortage and add on top of that a 5$/yard fuel surcharge. Cement plants can't run at capacity because they don't have enough spare parts and natural gas prices are eating their lunch. We are experiencing material price increased across the board being compounded by availability. Been waiting 9 months for a breaker for a load bank and still no firm shipment date.

I am seeing all the same leading indicators I saw in 2006 and luckily we shut down all new development at that time prior to the SHTF. Compound that with the inflationary pressures leave the fed with little or no options to deal with a recession. All of the above have a domino effect and I am not optimistic especially due to the incompetent asshats in DC.

Totally agree and have a feeling its going to be worse than 2006. Liquidated all my equity positions a couple of months ago and reallocated to assets that will be somewhat protected from the coming storm. Got burned in 2006 and not letting it happen again.I too spent my life in Heavy Industrial Construction. Like you, all of this is deja vu to me. The biggest difference I see is that this time, it is worldwide. With a business like yours, you can't getaway from it even by relocating to a different country... Same conditions there. We are preparing to walk through a landscape filled with bear traps and land mines.

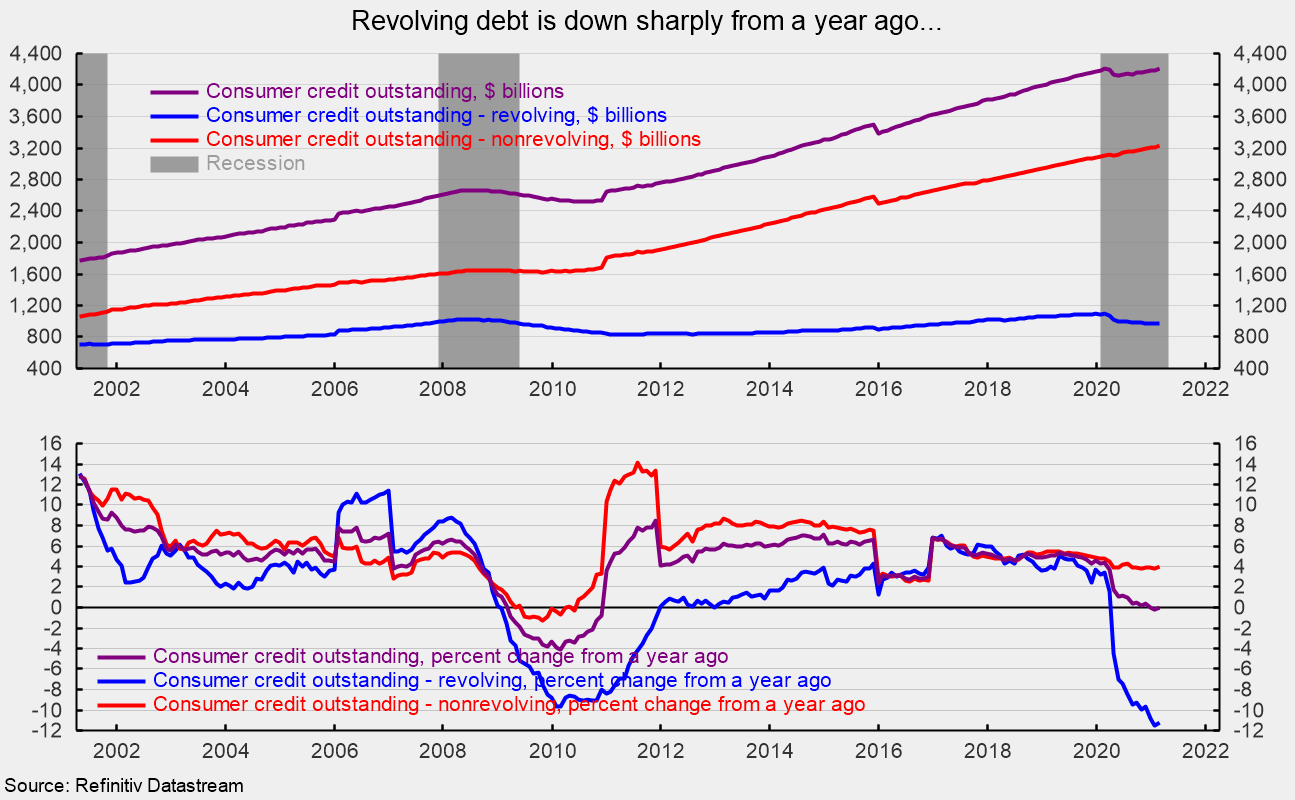

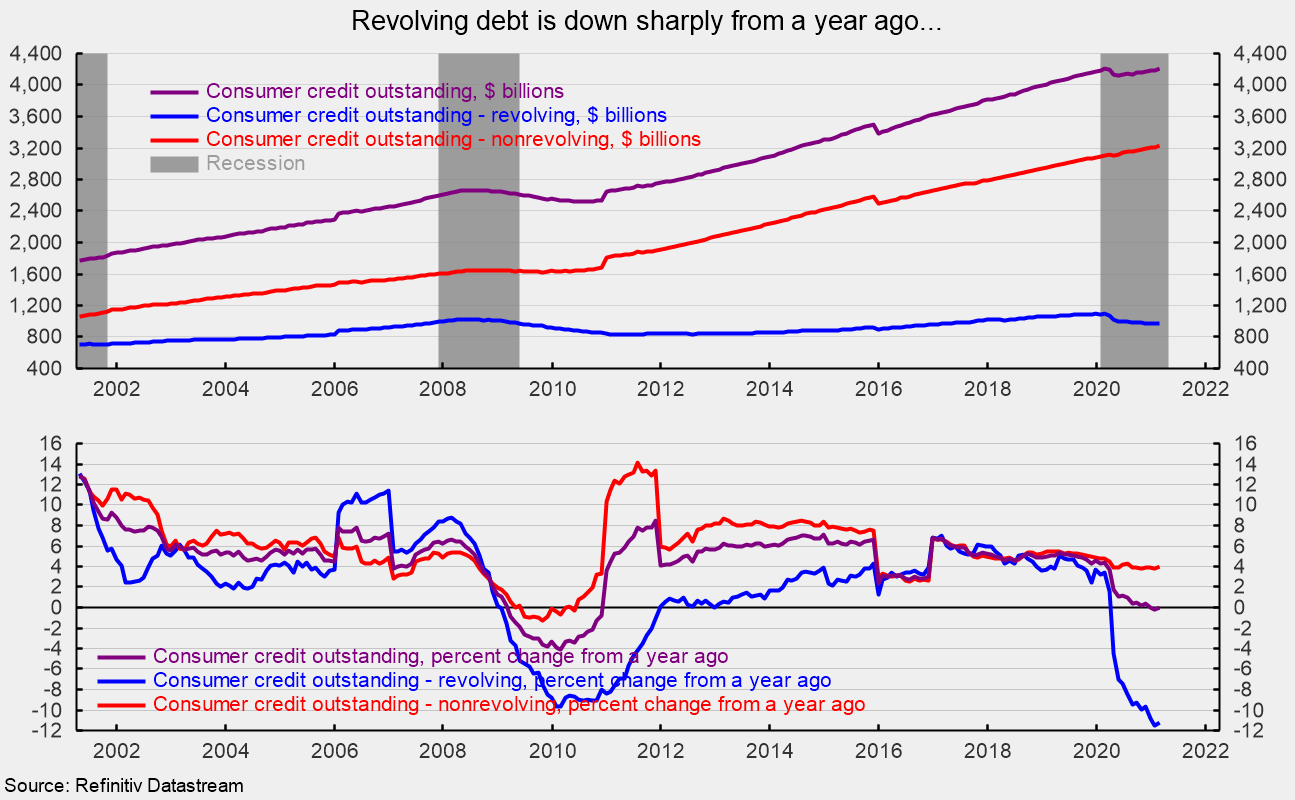

More Deja Vu..... I saw people rack up debts like there was no tomorrow during the Oil Crisis, the S&L Crash and the Great Recession.. The old adage "Don't worry, it will get better"... They had no idea of how many years it would take for things to get better.

seekingalpha.com

seekingalpha.com

Consumer Credit Jumped In February

Total consumer credit outstanding rose $330.9 billion at an annual rate to $4,205.8 billion in February, a 7.9 percent increase from the prior month.

For God's sake. I though my sector, hedge funds, was bad at always fighting the last war, but this is just incredible. Leaving out whether things are good or bad, and how they are likely to be good or bad, the fundamentals of where we are and what problems that causes are not similar to 2006. In fact, if there was going to be a good comparison, it would be 73-74, but even that is imperfect because of the size of the Fed balance sheet right now vs then. But as I was saying a year and a half ago, while everybody was prattling on about non existent hyperinflation, there are serious economic problems, but they are balanced in their severity, as opposed to 2006, and the existing toolkit monetary policy makers have at their disposal is very different right now from then.

Again, and I have said this before... all good economies are basically the same, with regard to their undamentals. But each recession or crash is different, and while it is understandable to think it will look like the last time, it usually will not.

Again, and I have said this before... all good economies are basically the same, with regard to their undamentals. But each recession or crash is different, and while it is understandable to think it will look like the last time, it usually will not.

This "tool kit" you keep bringing up. Maybe you can expound on that.

Housing, inflated prices with purchasers that would not be qualified for the loan if the interest rate was one point higher. Adjustable rate mortgage is just as common now as then.

Gas prices, taking up any excess income

Food prices, this is different. We didn't have inflated food prices then. So that's not good.

Auto prices, many people are upside down in vehicles they can't afford. Cash for clunkers?

National debt, we didn't have $30 trillion in debt then. So that's not good. Fed can't print a couple trillion dollars for shovel ready.

I could go on but I think I made the point that we are in the same position if not worse.

Let's compare 06 to now.For God's sake. I though my sector, hedge funds, was bad at always fighting the last war, but this is just incredible. Leaving out whether things are good or bad, and how they are likely to be good or bad, the fundamentals of where we are and what problems that causes are not similar to 2006. In fact, if there was going to be a good comparison, it would be 73-74, but even that is imperfect because of the size of the Fed balance sheet right now vs then. But as I was saying a year and a half ago, while everybody was prattling on about non existent hyperinflation, there are serious economic problems, but they are balanced in their severity, as opposed to 2006, and the existing toolkit monetary policy makers have at their disposal is very different right now from then.

Again, and I have said this before... all good economies are basically the same, with regard to their undamentals. But each recession or crash is different, and while it is understandable to think it will look like the last time, it usually will not.

Housing, inflated prices with purchasers that would not be qualified for the loan if the interest rate was one point higher. Adjustable rate mortgage is just as common now as then.

Gas prices, taking up any excess income

Food prices, this is different. We didn't have inflated food prices then. So that's not good.

Auto prices, many people are upside down in vehicles they can't afford. Cash for clunkers?

National debt, we didn't have $30 trillion in debt then. So that's not good. Fed can't print a couple trillion dollars for shovel ready.

I could go on but I think I made the point that we are in the same position if not worse.

Choid:For God's sake. I though my sector, hedge funds, was bad at always fighting the last war, but this is just incredible. Leaving out whether things are good or bad, and how they are likely to be good or bad, the fundamentals of where we are and what problems that causes are not similar to 2006. In fact, if there was going to be a good comparison, it would be 73-74, but even that is imperfect because of the size of the Fed balance sheet right now vs then. But as I was saying a year and a half ago, while everybody was prattling on about non existent hyperinflation, there are serious economic problems, but they are balanced in their severity, as opposed to 2006, and the existing toolkit monetary policy makers have at their disposal is very different right now from then.

Again, and I have said this before... all good economies are basically the same, with regard to their undamentals. But each recession or crash is different, and while it is understandable to think it will look like the last time, it usually will not.

I can only speak for what I see in my sector of the economy and in so many ways its a repeat of 2006. In 2006 we saw material prices going crazy and suppliers were only holding prices for 24 to 48 hours. In our business there is no way to manage that kind of risk. I was a Senior VP of Development of an industrial REIT during that time managing 100's of millions in development annually. The CEO asked me what we should do and I told him we need to shut down any new development and sit things out. Two years later I was flying all over the country doing acquisition due diligence on portfolio's which were upside down being and dumped. We bought buildings for a fraction of their replacement cost. The cost inflation and supply chain issues are not sustainable in our sector and there will be an adjustment. By the way I lived through the shit storm which was the 70's. Finished grad school in '81 and things really sucked. Also lived through the S&L crisis when the company I worked for went Chapter 7 and I was out on the street with no job, pregnant wife and just purchased a home. Not good times but what I see now is a real shit storm on the horizon.

So, last part first, I don't think we are necessarily in a better or worse position, but the drivers of the crisis are different, and that makes it a different situation.This "tool kit" you keep bringing up. Maybe you can expound on that.

Let's compare 06 to now.

Housing, inflated prices with purchasers that would not be qualified for the loan if the interest rate was one point higher. Adjustable rate mortgage is just as common now as then.

Gas prices, taking up any excess income

Food prices, this is different. We didn't have inflated food prices then. So that's not good.

Auto prices, many people are upside down in vehicles they can't afford. Cash for clunkers?

National debt, we didn't have $30 trillion in debt then. So that's not good. Fed can't print a couple trillion dollars for shovel ready.

I could go on but I think I made the point that we are in the same position if not worse.

So, the mix of household debt overall is different and household debt to GDP is lower. The mix of prime to subprime mortgages is different, and their spread among financial institutions is as well. It just isn't a similar situation. That isn't to say the situation regarding mortgages is great, because any time you have a recession following a runup in asset prices, be it home prices, or stock prices, as in the tech bubble, the most recent popular asset is going to be punished hardest. But the main difference is that mortgages and home prices are not the drivers of the financial issues, as they were, but just along for the ride.

Gas prices are way more problematic now, and they are sucking up a lot of excess income, as you say. Food prices are problematic as well. Almost inarguably, people misread inflation going into the financial crisis. It was not the main risk factor at the time, especially when compared to the mortgage mix and how it had been collateralized, and fighting the wrong fight, inflation, back then exacerbated the issue. Now there isn't a question but that we have to fight inflation. That, again, is a major difference.

As far as the available tools, I think that, obviously, the Fed cannot fight a slowdown right now. Because of the inflation situation, the debt situation and because they simply do not have any room with the "normal" tools like interest rates. They have plenty of tools to fight inflation, and they are going to, but that is going to lead to other problems, or exacerbate them. Again, that is a major difference. Before the financial crisis, none of these new tools had ever been tried, now they are used up.

So what does that mean? I've been saying on here for 1.5 years now that with the dual risks, the most likely outcome is some sort of compromise low to no growth, mid to high inflation, stagflation scenario. It is one that I think the Fed can manage us into, and it is a pretty dismal outcome, at least compared to the V shaped recoveries we have seen for the last 35 or so years. I think that is much more likely than a significant crisis, assuming that nobody does anything particularly stupid, which is a big assumption.

So that is why I think it is more like 73-74. 1) It was largely instigated by increase social spending which disrupted "normal" demand throughout the economy, 2) it is truly inflationary, unlike the odd spike sector inflation in '06, and 3) it is not centered in one particular asset class that is widely held with tons of leverage by the financial institutions, where small changes meant mass bankruptcy. It is more widespread. More the start of "malaise."

I could definitely be wrong, but that is just how I see the various inputs.

I don't doubt that you are right, or your experience in either of those times. I just don't think that real estate and real estate financing is as central to this downturn as it was in the two times you mentioned.Choid:

I can only speak for what I see in my sector of the economy and in so many ways its a repeat of 2006. In 2006 we saw material prices going crazy and suppliers were only holding prices for 24 to 48 hours. In our business there is no way to manage that kind of risk. I was a Senior VP of Development of an industrial REIT during that time managing 100's of millions in development annually. The CEO asked me what we should do and I told him we need to shut down any new development and sit things out. Two years later I was flying all over the country doing acquisition due diligence on portfolio's which were upside down being and dumped. We bought buildings for a fraction of their replacement cost. The cost inflation and supply chain issues are not sustainable in our sector and there will be an adjustment. By the way I lived through the shit storm which was the 70's. Finished grad school in '81 and things really sucked. Also lived through the S&L crisis when the company I worked for went Chapter 7 and I was out on the street with no job, pregnant wife and just purchased a home. Not good times but what I see now is a real shit storm on the horizon.

DarnYankeeUSMC /ZiaHunter

We are into the 4th month of the year.. I have stated this to other's... Many experts are saying the economy is strong. The way I decipher that statement is "The economy has enough momentum to carry America through the end of the year"... That will be about all the breathing room we get. Careful not to use up many of your resources in order to get to 2023. Complete projects that are underway. Avoid any new, lengthy projects. If you can survive this crash there will be good deals to be found (pennies on the dollar). The history of the last 3 recessions is repeating itself.

I cannot disagree with your premise regarding 73-74 on a macro level although any devaluation in the real estate sector has major impact on the economy as a whole.So, last part first, I don't think we are necessarily in a better or worse position, but the drivers of the crisis are different, and that makes it a different situation.

So, the mix of household debt overall is different and household debt to GDP is lower. The mix of prime to subprime mortgages is different, and their spread among financial institutions is as well. It just isn't a similar situation. That isn't to say the situation regarding mortgages is great, because any time you have a recession following a runup in asset prices, be it home prices, or stock prices, as in the tech bubble, the most recent popular asset is going to be punished hardest. But the main difference is that mortgages and home prices are not the drivers of the financial issues, as they were, but just along for the ride.

Gas prices are way more problematic now, and they are sucking up a lot of excess income, as you say. Food prices are problematic as well. Almost inarguably, people misread inflation going into the financial crisis. It was not the main risk factor at the time, especially when compared to the mortgage mix and how it had been collateralized, and fighting the wrong fight, inflation, back then exacerbated the issue. Now there isn't a question but that we have to fight inflation. That, again, is a major difference.

As far as the available tools, I think that, obviously, the Fed cannot fight a slowdown right now. Because of the inflation situation, the debt situation and because they simply do not have any room with the "normal" tools like interest rates. They have plenty of tools to fight inflation, and they are going to, but that is going to lead to other problems, or exacerbate them. Again, that is a major difference. Before the financial crisis, none of these new tools had ever been tried, now they are used up.

So what does that mean? I've been saying on here for 1.5 years now that with the dual risks, the most likely outcome is some sort of compromise low to no growth, mid to high inflation, stagflation scenario. It is one that I think the Fed can manage us into, and it is a pretty dismal outcome, at least compared to the V shaped recoveries we have seen for the last 35 or so years. I think that is much more likely than a significant crisis, assuming that nobody does anything particularly stupid, which is a big assumption.

So that is why I think it is more like 73-74. 1) It was largely instigated by increase social spending which disrupted "normal" demand throughout the economy, 2) it is truly inflationary, unlike the odd spike sector inflation in '06, and 3) it is not centered in one particular asset class that is widely held with tons of leverage by the financial institutions, where small changes meant mass bankruptcy. It is more widespread. More the start of "malaise."

I could definitely be wrong, but that is just how I see the various inputs.

This "tool kit" you keep bringing up. Maybe you can expound on that.

Let's compare 06 to now.

Housing, inflated prices with purchasers that would not be qualified for the loan if the interest rate was one point higher. Adjustable rate mortgage is just as common now as then.

Gas prices, taking up any excess income

Food prices, this is different. We didn't have inflated food prices then. So that's not good.

Auto prices, many people are upside down in vehicles they can't afford. Cash for clunkers?

National debt, we didn't have $30 trillion in debt then. So that's not good. Fed can't print a couple trillion dollars for shovel ready.

I could go on but I think I made the point that we are in the same position if not worse.

I think the final thing to remember is that 2007-8-9 was particularly awful because of the situation with financial institution balance sheets. My first job in the financial sector was in a bank analysis group, and I can tell you that thirty years later there is no way I would reasonably be able to tell you that I understand bank asset mixes. I am not sure that many people can. That said, the liquidity crunch was a two way street between mortages being in massive trouble, and banks being overlevered with them, and, in most cases, not even really understanding what they owned in each of the securities on their books.Choid:

I can only speak for what I see in my sector of the economy and in so many ways its a repeat of 2006. In 2006 we saw material prices going crazy and suppliers were only holding prices for 24 to 48 hours. In our business there is no way to manage that kind of risk. I was a Senior VP of Development of an industrial REIT during that time managing 100's of millions in development annually. The CEO asked me what we should do and I told him we need to shut down any new development and sit things out. Two years later I was flying all over the country doing acquisition due diligence on portfolio's which were upside down being and dumped. We bought buildings for a fraction of their replacement cost. The cost inflation and supply chain issues are not sustainable in our sector and there will be an adjustment. By the way I lived through the shit storm which was the 70's. Finished grad school in '81 and things really sucked. Also lived through the S&L crisis when the company I worked for went Chapter 7 and I was out on the street with no job, pregnant wife and just purchased a home. Not good times but what I see now is a real shit storm on the horizon.

Now, I cannot tell you that the same thing is not happening now, but I don't believe that it is. If it is, well then we are well and truly fucked. But if you were to say that every crisis has its own very particular identity, the identity of the last one was the interplay between bad mortgage policy, bad mortgage risk management and people fundamentally not even knowing what they owned. It is one of the reasons that there was a lot of money to be made at the end as well, because a lot of those securities weren't quite as bad as they seemed, but when you are highly levered, you cannot stay solvent to find out.

In government contracting, a prevailing wage is defined as the hourly wage, usual benefits and overtime, paid to the majority of workers, laborers, and mechanics within a particular area. This is usually the union wage.Aren't PLAs based on prevailing wage rates set by the comptroller though? In other words, the rates aren't based on law?

I can't imagine that PLAs would supercede minimum wage laws. I don't know anything about this, so I'll take your word for it.

Which can be a benefit to the non-union sector working on a project.

Tools? What are these tools you keep saying that they have?

Now for the rest

You wrote a lot of words to say that the general population is over extended financially. This is not different from the 08 collapse.

You do have one point. The banks are not carrying the same amount of sub prime mortgage's. But every interest rate hike is scaring the shit out of the banks. They are carrying a vast majority of loans that will be worthless after the next couple rate hikes.

So again, with a few minor differences the picture is pretty much the same. Either way, the outcome will be the same or worse.

Now for the rest

You wrote a lot of words to say that the general population is over extended financially. This is not different from the 08 collapse.

You do have one point. The banks are not carrying the same amount of sub prime mortgage's. But every interest rate hike is scaring the shit out of the banks. They are carrying a vast majority of loans that will be worthless after the next couple rate hikes.

So again, with a few minor differences the picture is pretty much the same. Either way, the outcome will be the same or worse.

So, last part first, I don't think we are necessarily in a better or worse position, but the drivers of the crisis are different, and that makes it a different situation.

So, the mix of household debt overall is different and household debt to GDP is lower. The mix of prime to subprime mortgages is different, and their spread among financial institutions is as well. It just isn't a similar situation. That isn't to say the situation regarding mortgages is great, because any time you have a recession following a runup in asset prices, be it home prices, or stock prices, as in the tech bubble, the most recent popular asset is going to be punished hardest. But the main difference is that mortgages and home prices are not the drivers of the financial issues, as they were, but just along for the ride.

Gas prices are way more problematic now, and they are sucking up a lot of excess income, as you say. Food prices are problematic as well. Almost inarguably, people misread inflation going into the financial crisis. It was not the main risk factor at the time, especially when compared to the mortgage mix and how it had been collateralized, and fighting the wrong fight, inflation, back then exacerbated the issue. Now there isn't a question but that we have to fight inflation. That, again, is a major difference.

As far as the available tools, I think that, obviously, the Fed cannot fight a slowdown right now. Because of the inflation situation, the debt situation and because they simply do not have any room with the "normal" tools like interest rates. They have plenty of tools to fight inflation, and they are going to, but that is going to lead to other problems, or exacerbate them. Again, that is a major difference. Before the financial crisis, none of these new tools had ever been tried, now they are used up.

So what does that mean? I've been saying on here for 1.5 years now that with the dual risks, the most likely outcome is some sort of compromise low to no growth, mid to high inflation, stagflation scenario. It is one that I think the Fed can manage us into, and it is a pretty dismal outcome, at least compared to the V shaped recoveries we have seen for the last 35 or so years. I think that is much more likely than a significant crisis, assuming that nobody does anything particularly stupid, which is a big assumption.

So that is why I think it is more like 73-74. 1) It was largely instigated by increase social spending which disrupted "normal" demand throughout the economy, 2) it is truly inflationary, unlike the odd spike sector inflation in '06, and 3) it is not centered in one particular asset class that is widely held with tons of leverage by the financial institutions, where small changes meant mass bankruptcy. It is more widespread. More the start of "malaise."

I could definitely be wrong, but that is just how I see the various inputs.

What I said is that each recession/crisis has its own particular causes and reasons, and those tend to determine their outcomes. Yes, consumers are extended, but that is not particularly unusual for the last many years. What is different is the mix between fixed and revolving credit, and adjustable and fixed rates, along with the particular asset mixes of individuals and financial institutions.Tools? What are these tools you keep saying that they have?

Now for the rest

You wrote a lot of words to say that the general population is over extended financially. This is not different from the 08 collapse.

You do have one point. The banks are not carrying the same amount of sub prime mortgage's. But every interest rate hike is scaring the shit out of the banks. They are carrying a vast majority of loans that will be worthless after the next couple rate hikes.

So again, with a few minor differences the picture is pretty much the same. Either way, the outcome will be the same or worse.

Real estate as a percentage of household net worth is about 40% lower than it was in '06, which means, on the one hand, there is far more diversification, and on the other hand there is likely far more holdings in relatively overpriced speculative stocks, but those are different problems, are financed differently etc.

As far as the banks being scared by every interest hike, well that is of course true. Banks hate rate hikes, but we have had one so far, and mortgage rates are so decoupled from bank interest rates at this point that we are going to have to see what happens.

As far as tool go, what I have said is that if you look at all of the tools the fed has on board, they retain every one used to fight inflation, and retain none used to fight recession. In fact, this is exactly what I was mocked for on here for saying for a year, because everybody was on their retarded hyperinflation kick. The point is that inflation is a problem, but the fed can fight that, what they can't really do is fight a slowdown, and are pretty far from having them, so they are going to have to be moderated in their attack on inflation (this will be a mistake,) which is why I would suggest that what we will see is relatively high inflation, relatively low employment/growth as a base case scenario, which is exactly what I have been saying. And it will be protracted. I don't see that as better than '06, I see it as different.

So again, and for the last time, the differences are that it isn't real estate driven, consumer asset and debt mixes are different, financial asset mixes are different, the Fed balance sheet is different. In other words, the only thing that is the same is that things suck. Our disagreement seems to be whether all sucky economies flame out similarly, or whether they flame out differently.

I think we are on the same idea. You are pointing out the micro and I am looking at the macro level. My view is from running a business for almost 30 years. Or just my view on things. Most of the time I just want the big picture and the fine details are a time consuming thing to get to the big picture. So I will agree that real estate is not the driver.

Again I am going to ask what tools do the feds have other than adjustment to the interest rate and printing of money? I am not in the financial world so when I hear people, not just you, say things like they have many "tools" to use. I would like to know what they are. I have multiple tool boxes that are filled with tools but I also have a tool pouch with a very few tools for diagnosing the problem. Then the big box gets opened. What I hear when someone says that the Fed has the tools and only see a tool pouch it doesn't give me any hope. It looks like the term is used to put hope and faith in the system. Which over the long run has failed miserably multiple times. And everything that was done to avoid the last failures hasn't done anything to prevent the next one. History proves that. It's a ten, or less, year cycle.

I guess we can say that another Great Depression hasn't happened so it's been a success?

Again I am going to ask what tools do the feds have other than adjustment to the interest rate and printing of money? I am not in the financial world so when I hear people, not just you, say things like they have many "tools" to use. I would like to know what they are. I have multiple tool boxes that are filled with tools but I also have a tool pouch with a very few tools for diagnosing the problem. Then the big box gets opened. What I hear when someone says that the Fed has the tools and only see a tool pouch it doesn't give me any hope. It looks like the term is used to put hope and faith in the system. Which over the long run has failed miserably multiple times. And everything that was done to avoid the last failures hasn't done anything to prevent the next one. History proves that. It's a ten, or less, year cycle.

I guess we can say that another Great Depression hasn't happened so it's been a success?

What I said is that each recession/crisis has its own particular causes and reasons, and those tend to determine their outcomes. Yes, consumers are extended, but that is not particularly unusual for the last many years. What is different is the mix between fixed and revolving credit, and adjustable and fixed rates, along with the particular asset mixes of individuals and financial institutions.

Real estate as a percentage of household net worth is about 40% lower than it was in '06, which means, on the one hand, there is far more diversification, and on the other hand there is likely far more holdings in relatively overpriced speculative stocks, but those are different problems, are financed differently etc.

As far as the banks being scared by every interest hike, well that is of course true. Banks hate rate hikes, but we have had one so far, and mortgage rates are so decoupled from bank interest rates at this point that we are going to have to see what happens.

As far as tool go, what I have said is that if you look at all of the tools the fed has on board, they retain every one used to fight inflation, and retain none used to fight recession. In fact, this is exactly what I was mocked for on here for saying for a year, because everybody was on their retarded hyperinflation kick. The point is that inflation is a problem, but the fed can fight that, what they can't really do is fight a slowdown, and are pretty far from having them, so they are going to have to be moderated in their attack on inflation (this will be a mistake,) which is why I would suggest that what we will see is relatively high inflation, relatively low employment/growth as a base case scenario, which is exactly what I have been saying. And it will be protracted. I don't see that as better than '06, I see it as different.

So again, and for the last time, the differences are that it isn't real estate driven, consumer asset and debt mixes are different, financial asset mixes are different, the Fed balance sheet is different. In other words, the only thing that is the same is that things suck. Our disagreement seems to be whether all sucky economies flame out similarly, or whether they flame out differently.

I rented a trailer this morning and hauled some topsoil... I hear people, too. Man running the rental yard has been in the business since the early 70's. We talked about the Oil Recession, the S&L Recession and the Great Recession 2007 +/-..... His words were "Something's got to change"... My reply was "They always do".... I wish I could share better words of wisdom.I think we are on the same idea. You are pointing out the micro and I am looking at the macro level. My view is from running a business for almost 30 years. Or just my view on things. Most of the time I just want the big picture and the fine details are a time consuming thing to get to the big picture. So I will agree that real estate is not the driver.

Again I am going to ask what tools do the feds have other than adjustment to the interest rate and printing of money? I am not in the financial world so when I hear people, not just you, say things like they have many "tools" to use. I would like to know what they are. I have multiple tool boxes that are filled with tools but I also have a tool pouch with a very few tools for diagnosing the problem. Then the big box gets opened. What I hear when someone says that the Fed has the tools and only see a tool pouch it doesn't give me any hope. It looks like the term is used to put hope and faith in the system. Which over the long run has failed miserably multiple times. And everything that was done to avoid the last failures hasn't done anything to prevent the next one. History proves that. It's a ten, or less, year cycle.

I guess we can say that another Great Depression hasn't happened so it's been a success?

Attachments

DarnYankeeUSMC

What I hear when someone says that the Fed has the tools and only see a tool pouch it doesn't give me any hope.______________________________

What I see is an "ON / OFF" switch on a $$$ printing press. That switch should be turned OFF. As other's have pointed out to me, simply raising the interest rate will not solve the inflation issue as long as the $$$ print presses are running 24 hours a day.

JMHO

OK, yeah, I agree that we are pretty much on the same page on the big parts.I think we are on the same idea. You are pointing out the micro and I am looking at the macro level. My view is from running a business for almost 30 years. Or just my view on things. Most of the time I just want the big picture and the fine details are a time consuming thing to get to the big picture. So I will agree that real estate is not the driver.

Again I am going to ask what tools do the feds have other than adjustment to the interest rate and printing of money? I am not in the financial world so when I hear people, not just you, say things like they have many "tools" to use. I would like to know what they are. I have multiple tool boxes that are filled with tools but I also have a tool pouch with a very few tools for diagnosing the problem. Then the big box gets opened. What I hear when someone says that the Fed has the tools and only see a tool pouch it doesn't give me any hope. It looks like the term is used to put hope and faith in the system. Which over the long run has failed miserably multiple times. And everything that was done to avoid the last failures hasn't done anything to prevent the next one. History proves that. It's a ten, or less, year cycle.

I guess we can say that another Great Depression hasn't happened so it's been a success?

As far as the Fed's toolbox, there are the normal ones, basically they move interest rates and sell federal securities. They can also raise margin rates on various securities etc. Those are the ones to suck inflation out of an economy, and they are actually really effective, especially because, as you note so often, we are basically a credit economy, and the more credit makes up the total economy, the more interest rates drive everything. That is to say that obviously if we had a no lending economy, interest rates would be relatively meaningless. Furthermore, changes in interest rates not only change credit cost and availability, but they change asset values as well, since asset values are a function of expected rates. So if a fed chairman does a really good job, say as Greenspan did before he went to shit, they can make small moves to attack individual asset classes. Now, I actually think this is an awful idea because nobody is God, and that kind of foresight doesn't exist, and we saw that as Greenspan's bubble collapsed.

On the inflationary side, there are the opposite moves, plus, apparently the Bernanke playbook of buy everything you want and create as much money as you like. Those are pretty well hashed out by now. I also dislike them, but I will say that Bernanke did a masterful job as far as it went. It was basically a hail mary that got caught in the end zone.

What I mean by we have the tools on one side but not the other is pretty much what you are saying when you mention that, unlike at other times, interest rates are at lows, we still have a Fed with an enormous balance sheet, we have a huge national debt (though there are clearly strains of thought that say this doesn't matter*) and, more than that, we have real, as opposed to flaring, inflation. So basically hands are completely tied on this end.

So, what could the Fed do? Clearly, it would be easy to crash the economy and wring everything out, but that isn't going to happen. I mean, the economy could crash out, but policy makers aren't going to do it on purpose. Also, I think the Fed, and everybody else, understands that in a highly credit based economy, with lots of income and asset inequality, and plenty of anger, there is a limit to the pain that will be acceptable. So I think what they will probably do is try to finesse a scenario where we live at 4-7% inflation and 6-9% unemployment for an extended period of time. I don't know if they can do it, but it is possible. It's also an awful outcome.

*FWIW, Larry Summers, who is a partisan Democrat but smart as hell, and surprisingly honest, has commented a lot on the idea that there is a significant movement on the left to dismiss completely the importance of government debt, and he thinks it is crazy. I think what is clear is that we are a lot further out there on the plank than we ever thought existed, so there is something we probably didn't get right in our previous understanding to allow us to be out here. He also says that the fed probably needs to induce 9% unemployment to crush current inflation, but I think the term of that pain is longer than he does.

Anyway, that's about all I've got.

ETA: I guess my main point is that in a credit economy it is no secret how you stop inflation, and since rates are so minuscule, there should be no difficulty in doing so. What is problematic is that we really don't know what organic demand is like without current Fed policy, but it isn't something that they can address because they are shooting blanks at this point, so I expect them to be slower than they should be in combatting inflation because they will want to see what happens, knowing they can't really hit hard reverse. So stagflation is likely.

Last edited:

Hand writing on the wall

Transport stocks keep falling as analyst says a freight recession is ‘likely inevitable’

Similar threads

- Replies

- 84

- Views

- 4K

- Replies

- 26

- Views

- 2K

- Replies

- 39

- Views

- 2K