Hahaha the dog is 14. She's been around since my 20 year old was 6. Kind of amazing really.3 babies?

Join the Hide community

Get access to live stream, lessons, the post exchange, and chat with other snipers.

Register

Download Gravity Ballistics

Get help to accurately calculate and scope your sniper rifle using real shooting data.

Install the app

How to install the app on iOS

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Maggie’s What's Your View II

- Thread starter 1J04

- Start date

This evenings view......

Same shot a few days ago...

Same shot a few days ago...

Change of scenery today. Wind has kicked up, blowing smoke from eastern Washington to the normally wet side. Gusting to 20+ earlier and just now the power has gone out. Prayers for all who are suffering from a lot worse than just smoke and a lack of electricity!

OSHA violation! Ladders should extend at least 3 feet over the roof line. Also they are required to be tied off. I'm a squealin like a stuck pig on you.My 2 Son's got the 1st coat of Sealer down on the Sheet Metal after cleaning the hell outta the Roof and treating it. Then they hauled ass to Tillamook for the night before coming back today for round 2 of coating. Sent these 2 pics of their trip.

View attachment 7418244View attachment 7418245View attachment 7418246View attachment 7418247View attachment 7418248

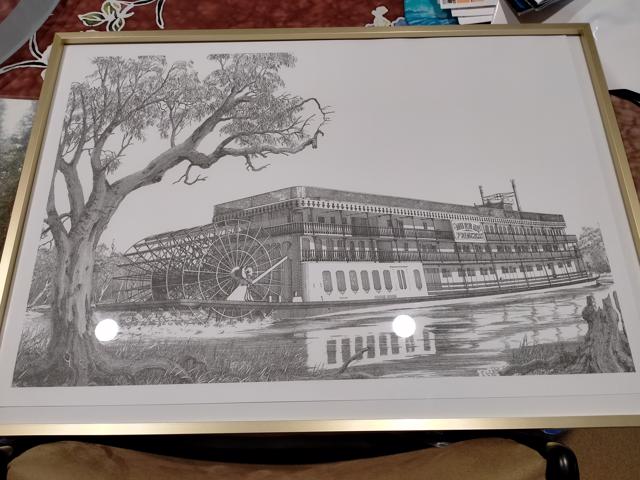

Souvenir print of our recent cruise boat, should have waited till I hung it before taking a pic. The white circles are the down lights.

Cleaning this up. Back to "work" tomorrow.

E

E

Cough cough....

Worst I've seen in 60+ years. Next few days will be interesting.

Worst I've seen in 60+ years. Next few days will be interesting.

Looks like filling it up with Evaporust might be a good idea.

The Best Rust Remover | Quick & Easy with CRC's Evapo-Rust®

CRC's Evapo-Rust® Heavy Duty Rust Remover will remove rust to bare metal in minutes without scrubbing. It is also biodegradable and reusable!

Looks like Colorado this past weekend. Ash on everything.Cough cough....

View attachment 7419089

Worst I've seen in 60+ years. Next few days will be interesting.

Looks like filling it up with Evaporust might be a good idea.

The Best Rust Remover | Quick & Easy with CRC's Evapo-Rust®

CRC's Evapo-Rust® Heavy Duty Rust Remover will remove rust to bare metal in minutes without scrubbing. It is also biodegradable and reusable!evapo-rust.com

Probably best. The owner did not store this bike properly and now here I am.

E

Change of scenery today. Wind has kicked up, blowing smoke from eastern Washington to the normally wet side. Gusting to 20+ earlier and just now the power has gone out. Prayers for all who are suffering from a lot worse than just smoke and a lack of electricity!View attachment 7418816

I was up till midnight lastnight trying to maintain my maintenance BAC level. It was so damn warm out and a helluva East/Northeast wind that kept up till this morning. Geezus it was pretty out, but ya, seen the exact same sunset due to smoke.

OSHA violation! Ladders should extend at least 3 feet over the roof line. Also they are required to be tied off. I'm a squealin like a stuck pig on you.Also calling the DNR on you holding squirrel hostages.

OSHA Smosha. They're still young and invincible.

My latest acquisition finally came to fruition:

Last edited:

Reminds me of the regulations when I used to make my own bio-diesel.Need to be real careful, even for personal use our government expects us to pay excise....

Is it illegal to distil alcohol in Australia?

NO! It is NOT illegal to distil alcohol in Australia. Distilling is like driving, it's perfect legal so long as you have a license.

People presume the license has to do with safety, that the government wants to make sure we're distilling spirits safely. This could not be further from the truth. The license is actually issued by the Australian Tax Office (ATO). It's completely free, and the catch? You have to pay tax on the alcohol you produce, even if it's for personal consumption in your own home. This is because of a law passed in 1901 where the government at the time decided it was OK for beer, cider and wine to be produced tax free at home for personal use, but spirits were not. Crazy right? But hey, the law is the law and taxes are important.

This tax is built into every bottle of spirits you buy so it's not a special tax on home made spirits. If you do the calculations, you'll find your favourite spirits cost up to 90% less when you take the tax off. Based on the February 2018 excise rate of $83.84 (it goes up every 6 months) a 700mL bottles of 40% alcohol has $23.48 of excise attached to it. If that bottle costs $30, there is also $3 GST. Total tax is $26.48 which means the distiller, distributor and retailer share the remaining $3.52. That's how much that bottle of liquor actually costs.

There are a couple things to go over here. This first is permission for your still. If you buy a still 5L or under, you don't need permission from the ATO to buy it. We also don't need permission from the ATO to sell it. That's why we only sell one still, the Air Still, which is 5L. If you intend on using the Air Still to distil water, make essential oils, herbal tinctures or anything else that is not for drinking, you don't need a license from the ATO. Go for gold. If you use the Air Still to produce alcohol for drinking, you need an excise manufactures license from the ATO and you need to pay tax on that alcohol.

But 5L is pretty small right? As our mothers always said, if you're going to do something, do it properly. That's why we sell 25L boilers and condensers that can be attached to each other to make a still, like the Turbo 500. Because these two things are not attached when you purchase them, you don't need permission to buy them and we don't need permission to sell them. You will however need permission to "manufacture" a still before attaching a condenser to a boiler over 5L. You will need this permission even if you're not using the still to produce drinking alcohol. If you're going to use the still to produce drinking alcohol, you need an excise manufactures license from the ATO and you need to pay tax on that alcohol.

There is some good news. From 1st July 2017, you can claim a refund of 60% of the excise duty you have paid on spirits you have distilled. The maximum refund you can claim is $30,000 per financial year and it must be made within 12 months of paying the excise duty.

In summary:

The most important thing is, don't be scared! The ATO are really friendly and helpful. Make sure you buy the right equipment and use the right ingredients to ensure you're distilling safely. Using our equipment and distilling yeasts, you'll only be producing safe to drink ethanol, rather than poisonous methanol.

- Want a still over 5L? You'll need to Get Permission

- Planning to produce alcohol to drink? You need an Excise Manufacturer License

- Want to claim 60% of your excise back? Here's information on the Refund Scheme

Last edited:

Bullshit, you where playing with your squirrels.I was up till midnight lastnight trying to maintain my maintenance BAC level. It was so damn warm out and a helluva East/Northeast wind that kept up till this morning. Geezus it was pretty out, but ya, seen the exact same sunset due to smoke.

Bullshit, you where playing with your squirrels.

correct answer is drinkin and playin with his squirrels.

Do you think he makes them “battle” over “the nuts”?

I think he likes the "nuts".correct answer is drinkin and playin with his squirrels.

Do you think he makes them “battle” over “the nuts”?

Barn Barrel Bourbon orWork finally gave up arguing and bought me the Turbo T 500 fractionating still kit, picked it up today. Looks like the new workbench Pam bought me last week is going to become "moonshine central". 2 gallons of Bourbon a week should keep me going. Anyone got any ideas for labels for Barney's Bourbon??? Squirrels need not apply.....

Barn Burners Bourbon

Had to walk down today to see the impacts on the 695 yard target. This corn has been hammered by 3 different wind events and 1 hail event. From my firing position I can see the general shape of the target and that’s about it. Running the 20” 308 today.

There is a TON of damage in Iowa! Lots of fields that have taken a beatingHad to walk down today to see the impacts on the 695 yard target. This corn has been hammered by 3 different wind events and 1 hail event. From my firing position I can see the general shape of the target and that’s about it. Running the 20” 308 today.

View attachment 7419671View attachment 7419672

Got confirmation today that I will be retiring effective Oct 14. Management want us to close the doors and walk away that day then think they can sell the place as a going concern when they just got rid of the only people in the country who know how to make it work. Their excuse for closing us is a downturn in profitability but the numbers are against them. We know how well we are going and with a little investment we could do much better. We actually made an offer to buy the company but they did not want to talk to us. Our parent company, Fletcher Building based in New Zealand are in the top 10 companies for tax avoidance in Australia / New Zealand. A tax write off must exceed any possible actual sale.

Normally they make a big deal of long service awards but I was sworn to secrecy about the still they bought for me last week. Next week we are expected to fill out a company wide survey about how well we think they are doing, I have both Gatling door guns armed and ready plus a few cluster bombs for back up.

Normally they make a big deal of long service awards but I was sworn to secrecy about the still they bought for me last week. Next week we are expected to fill out a company wide survey about how well we think they are doing, I have both Gatling door guns armed and ready plus a few cluster bombs for back up.

1J to wife...honey are you feeling squirrely tonite?

Dude,you are so fucked.

I thought this would have burnt itself out by now.

But NO it continues.

I'm almost 60 and I'd say this is by far the worse/best one I've ever seen.

Candygram for Mongo. Check yer front porch when you get home tonight

Hope he includes me. I need all the help I can get

The Ridge is GONE!

Temp has dropped dramatically and we're being choked out by all this damn smoke. What's next 2020! Geezus.

Temp has dropped dramatically and we're being choked out by all this damn smoke. What's next 2020! Geezus.

Last edited:

Dude,you are so fucked.

I thought this would have burnt itself out by now.

But NO it continues.

I'm almost 60 and I'd say this is by far the worse/best one I've ever seen.

You're not wrong Brother!

Candygram for Mongo. Check yer front porch when you get home tonight

Uh Oh!

Pretty crappy pics but cool views thanks to the low cloud ceiling last night.

Video!!!

We wanna see the sexy dance!!

Maybe a little singing too.

We wanna see the sexy dance!!

Maybe a little singing too.

Double dog dare you to wear that into any/all businesses that require a mask for entry! Doesn’t look like you can see out of it - even better! Even a blind squirrel busts a nut every once in a while. Or is it ‘finds’?

Video of others reactions would be priceless!

go down and get those piles going, nobody will noticeThe Ridge is GONE!

Temp has dropped dramatically and we're being choked out by all this damn smoke. What's next 2020! Geezus.

View attachment 7421465

Video!!!

We wanna see the sexy dance!!

Maybe a little singing too.

we want to hear the song marilyn monroe sang

Will send it over Brian.

cover it in fish juice please. And ship it slowly.

cover it in fish juice please. And ship it slowly.

As the west burns, it won’t stop here. Day 4 now. We received 4” during the derecho. Then 27 days without a drop. Now 6-8” in 4 days. I’ll be glad to box this up and ship overnight to @1J04 , @Mooseknuckles , @Steel head , etc... I had exactly 12 minutes to shoot this afternoon. Between #5 and 6, it opened up again.

Boy we could use 4 days of good rain like that. Hopefully we get some here Monday or Tuesday. I seen humidity levels down to 20%. That is scary low for this area.As the west burns, it won’t stop here. Day 4 now. We received 4” during the derecho. Then 27 days without a drop. Now 6-8” in 4 days. I’ll be glad to box this up and ship overnight to @1J04 , @Mooseknuckles , @Steel head , etc... I had exactly 12 minutes to shoot this afternoon. Between #5 and 6, it opened up again.

View attachment 7421831

I’ve always wanted to fly into there but being pt 91 it’ll never happen unless I’m in the back. Very cool pics!Pretty crappy pics but cool views thanks to the low cloud ceiling last night.

View attachment 7421454View attachment 7421459

Similar threads

- Replies

- 20

- Views

- 1K

- Replies

- 22

- Views

- 1K