WTF. So on the way home I heard on the radio, they were announcing that the feds claimed, in some kind of conference regarding inflation and whatnot, that the average American or American family has $75,000 sitting in savings. I call bullshit on this and would love to know where they are getting their numbers. The avg American likely lives paycheck to paycheck. They were saying this as if this was some justification for pulling some of this economical/financial voodoo that they are doing. You know the same group that talks about transitory inflation. I feel like I do better than a lot of people and work/save my ass off and I don’t even quite have $75k sitting around in an account waiting to do whatever I want. On the other hand, if their statement is true then I’m behind the curve here. I mean seriously, wtf?

Join the Hide community

Get access to live stream, lessons, the post exchange, and chat with other snipers.

Register

Download Gravity Ballistics

Get help to accurately calculate and scope your sniper rifle using real shooting data.

Install the app

How to install the app on iOS

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

WTF Avg. American has $75k in savings...

- Thread starter SilentStalkr

- Start date

WTF. So on the way home I heard on the radio, they were announcing that the feds claimed, in some kind of conference regarding inflation and whatnot, that the average American or American family has $75,000 sitting in savings. I call bullshit on this and would love to know where they are getting their numbers. The avg American likely lives paycheck to paycheck. They were saying this as if this was some justification for pulling some of this economical/financial voodoo that they are doing. You know the same group that talks about transitory inflation. I feel like I do better than a lot of people and work/save my ass off and I don’t even quite have $75k sitting around in an account waiting to do whatever I want. On the other hand, if their statement is true then I’m behind the curve here. I mean seriously, wtf?

They added their income and savings into the mix. It bumped the numbers up nicely

Zuckerbergberg, Musk, and Gates make up for a lot of broke poors.

Yeah… that’s bullshit.

Maybe $75k net worth. But that’s about to drop with the housing market.

Maybe $75k net worth. But that’s about to drop with the housing market.

You forget 401k can be considered savings since you can withdraw from it.

Yeah, see I don’t consider 401k savings. And from what I heard, it sounded like they meant pure liquid cash sitting around in a literal savings account. And ivory gonna have shoot if we don’t get these fools out of office. I’m literally worth 38% of what I was this time last year.You forget 401k can be considered savings since you can withdraw from it.

Average versus median  corrected thanks to the catch of @buffalowinter .

corrected thanks to the catch of @buffalowinter .

Read an article about this. They also counted money within individual investment accounts in this as well.

But for real, look into the median and you will see how the ultra rich are skewing the avg.

Read an article about this. They also counted money within individual investment accounts in this as well.

But for real, look into the median and you will see how the ultra rich are skewing the avg.

Last edited:

I thought statistically they were the same? I also think you’d have to be a fucking moron to put the Uber rich into any pool called avg. this is why most Americans hate these people. I’d say you need to separate them out, ofherwise, yeah the Uber rich gonna side the shit out of some results and the little guy getting screwed, again. At some point people can’t be squeezed anymore.Average versus mean.

Read an article about this. They also counted money within individual investment accounts in this as well.

But for real, look into the mean and you will see how the ultra rich are skewing the avg.

Get.

The.

Fuck.

Out.

$750 maybe.

What are they calculating this off of; the average amount of equity people have in their overpriced, overinflated McMansions? We'll see how much they actually have in savings here in the next 12-18 months as all of those McMansions they bought lose 50% of their 'value'.

The.

Fuck.

Out.

$750 maybe.

What are they calculating this off of; the average amount of equity people have in their overpriced, overinflated McMansions? We'll see how much they actually have in savings here in the next 12-18 months as all of those McMansions they bought lose 50% of their 'value'.

I thought statistically they were the same? I also think you’d have to be a fucking moron to put the Uber rich into any pool called avg. this is why most Americans hate these people. I’d say you need to separate them out, ofherwise, yeah the Uber rich gonna side the shit out of some results and the little guy getting screwed, again. At some point people can’t be squeezed anymore.

Average is the sum divided by the number of objects.

4 people

1st has 96 dollars in savings

2nd has 2 dollars in savings

3rd has 1 dollar in savings

4th has 1 dollar in savings.

Avg = 100/4 = 25.

Median is 50 percent is above and 50 percent are below. So in the above example, the median is basically 1 dollar. Which is a better reflection of reality? Both are valid measures, but avg can be very skewed by outliers which is why you want various deviation metrics alongside averages.

Eta - The median savings is said to be around 4-5k, which is, 50% of the US population has less than 4-5k and 50% have more than 4-5k total in savings.

Again, average tells very little w/o knowing the various deviations. Think about it in terms of velocity for your handloads.

Last edited:

That's $70k more than I do.

Two years ago it would have been $74k more.

Yeah, rackin' it up baby. Another 63 years and I can retire.

Two years ago it would have been $74k more.

Yeah, rackin' it up baby. Another 63 years and I can retire.

Does that include a 401K?

The craziest financial decision I ever saw was a 62 year old engineer that I worked with. He had just bought a house on a 30 year note, and already had poor health. I guess the bank will get the house if he passed so they didn't care.

The craziest financial decision I ever saw was a 62 year old engineer that I worked with. He had just bought a house on a 30 year note, and already had poor health. I guess the bank will get the house if he passed so they didn't care.

We're all in good company....

www.cnbc.com

www.cnbc.com

As inflation heats up, 64% of Americans are now living paycheck to paycheck

The number of Americans living paycheck to paycheck is climbing, despite rising wages.

Does that include a 401K?

The craziest financial decision I ever saw was a 62 year old engineer that I worked with. He had just bought a house on a 30 year note, and already had poor health. I guess the bank will get the house if he passed so they didn't care.

The article I saw did not include 401k but did include individual investment accounts.

if most had to give 8k cash, most couldn’t.

But midterms, so crank the BS meter to 1000%

But midterms, so crank the BS meter to 1000%

But 2/3 of all baby formula paid for by some government program

Why are babies needing formula?

I don’t think anyone as a baby, no one in my bloodline used that shit, heck I feel bad enough feeding my dog out of a bag/can

if most had to give 8k cash, most couldn’t.

But midterms, so crank the BS meter to 1000%

This is exactly the motive. But people aren't going to buy it.

By the way, it gets much much worse when you start looking at the percentiles for savings. Once you get to around the 34th percentile range the savings are basically nil. Meaning, 34% of Americans have NO savings.

I heard this stat too. I definitely feel they are including retirement savings.You forget 401k can be considered savings since you can withdraw from it.

i.e. by the tax payerBut 2/3 of all baby formula paid for by some government program

They must have included the big guys 10 percent.

Only two people who demand 10% before of your gross.

The church and biden

You're confusing median and mean. Mean and average are the same thing. Median is the point where 50% is above and 50% belowAverage is the sum divided by the number of objects.

4 people

1st has 96 dollars in savings

2nd has 2 dollars in savings

3rd has 1 dollar in savings

4th has 1 dollar in savings.

Avg = 100/4 = 25.

Mean is 50 percent is above and 50 percent are below. So in the above example, the mean is basically 1 dollar. Which is a better reflection of reality? Both are valid measures, but avg can be very skewed by outliers which is why you want various deviation metrics alongside averages.

Eta - The mean savings is said to be around 4-5k, which is, 50% of the US population has less than 4-5k and 50% have more than 4-5k total in savings.

Again, average tells very little w/o knowing the various deviations. Think about it in terms of velocity for your handloads.

median-

denoting or relating to a value or quantity lying at the midpoint of a frequency distribution of observed values or quantities, such that there is an equal probability of falling above or below it.

"the median duration of this treatment was four months"

mean or average-

Average and mean are used interchangeably. In Statistics, instead of the term “average”, the term “mean” is used. Average can simply be defined as a quantity or a rate which usually fall under the centre of the data.

You're confusing median and mean. Mean and average are the same thing. Median is the point where 50% is above and 50% below

median-

denoting or relating to a value or quantity lying at the midpoint of a frequency distribution of observed values or quantities, such that there is an equal probability of falling above or below it.

"the median duration of this treatment was four months"

mean or average-

Average and mean are used interchangeably. In Statistics, instead of the term “average”, the term “mean” is used. Average can simply be defined as a quantity or a rate which usually fall under the centre of the data.

Good catch, sorry, yes..median...been a long fkn day. the rest of the points stand as shown.

Here’s exactly how much money is in the average savings account in America (and psst: it's a lot more than you might guess)

Plus how to boost your savings, and where to put it.

Northwestern Mutual’s 2022 Planning & Progress Study revealed that the average amount of personal savings (not including investments) was $62,086 in 2022 (down from $73,100 in 2021).

And according to data from the 2019 Survey of Consumer Finances by the US Federal Reserve, the most recent year for which they polled participants, Americans have a weighted average savings account balance of $41,600 which includes checking, savings, money market and prepaid debit cards, while the median was only $5,300.

So yeah, there's certainly a sharp difference between mean and median with this statistic.

Here’s exactly how much money is in the average savings account in America (and psst: it's a lot more than you might guess)

Plus how to boost your savings, and where to put it.www.marketwatch.com

Yup and the savings went up 2020 and 2021 due to covid spending, which is now the most significant factor with inflation. Got to bleed that money back out lol...

Measures of central tendency - only on the Hide! You're forgetting mode.

The mode in this conversation is probably $0.00.

I wouldn't be surprised if the Average American™ has $70,000 in credit card debt.

The mode in this conversation is probably $0.00.

But yet, here you are. Slumming it?

But yet, here you are. Slumming it?

Er, my comment was intended as a slam on America at large, and not any members of this board. I'm working under the assumption that Hide members are basically Lake Wobegon residents from a financial standpoint.

Keep in mind that most of that 64% was already close to check to check.We're all in good company....

As inflation heats up, 64% of Americans are now living paycheck to paycheck

The number of Americans living paycheck to paycheck is climbing, despite rising wages.www.cnbc.com

Americans have always been piss poor savers. Look up the stats on employee participation is sponsored 401K plans. The company match is free money and exceeds the return from any stock index.

Average is the sum divided by the number of objects.

4 people

1st has 96 dollars in savings

2nd has 2 dollars in savings

3rd has 1 dollar in savings

4th has 1 dollar in savings.

Avg = 100/4 = 25.

Median is 50 percent is above and 50 percent are below. So in the above example, the median is basically 1 dollar. Which is a better reflection of reality? Both are valid measures, but avg can be very skewed by outliers which is why you want various deviation metrics alongside averages.

Eta - The median savings is said to be around 4-5k, which is, 50% of the US population has less than 4-5k and 50% have more than 4-5k total in savings.

Again, average tells very little w/o knowing the various deviations. Think about it in terms of velocity for your handloads.

Whoops. My bad, I misread median for mean!

Yea, 75K liquid in a savings account is a good thing, but how much do you have stashed away? I did a google search, How much do the average retires have invested, the numbers are crazy .............here is one from the montley fool.........

www.fool.com

www.fool.com

Mom and I worked a long time, and invested a lot of money, these numbers make me feel real good, despite the current market..........

Average Retirement Savings in 2025: How Do You Compare? | The Motley Fool

What's the average retirement savings? We dug into the statistics to find out the average retirement savings by age, income, race, and more.

Mom and I worked a long time, and invested a lot of money, these numbers make me feel real good, despite the current market..........

Exactly!By the way, it gets much much worse when you start looking at the percentiles for savings. Once you get to around the 34th percentile range the savings are basically nil. Meaning, 34% of Americans have NO savings.

The church doesn’t require it. I think Old Testament said 10% but that all went out the window when Jesus came. We are not held to the old law. With that said, it is suggested as a guide but is by no means required. Taxes however, yeah, totally different story. And I’d be jumping for joy if they only took 10% from me. The current rate of everything coming out of my check is like 47%!!! This does include some 401k, local taxes, social security and all that mess. So 10% goes straight to retirement. So it’s really 37% but you get what I’m saying, still too damn much.Only two people who demand 10% before of your gross.

The church and biden

Exactly!the "average" american......

which "average" did they use?

are they taking the mean?.....in which case, would the presence of billionaires like Musk and Bezos not artificially inflate that average?

if you take 9 people who all have $2,500 in savings.....and you have one person who has a $1,000,000......your "average" person in that group will have $102,250

Had a pretty good sum in the market till the current regime got in power. Now I’m literally worth 38% of what I was a year ago. All retirement funds are down, drastically. And I got around $72,000 in liquid cash, spread in several different accounts if one must know, but I’m not sure I’d consider me the average saver. I’m super frugal and actually feel bad even when buying stuff I want.Yea, 75K liquid in a savings account is a good thing, but how much do you have stashed away? I did a google search, How much do the average retires have invested, the numbers are crazy .............here is one from the montley fool.........

Average Retirement Savings in 2025: How Do You Compare? | The Motley Fool

What's the average retirement savings? We dug into the statistics to find out the average retirement savings by age, income, race, and more.www.fool.com

Mom and I worked a long time, and invested a lot of money, these numbers make me feel real good, despite the current market..........

Its much easier to save when the gov and its goons don’t have their hands in your pocket and a gun to your head.Keep in mind that most of that 64% was already close to check to check.

Americans have always been piss poor savers. Look up the stats on employee participation is sponsored 401K plans. The company match is free money and exceeds the return from any stock index.

I pay more in income tax, social security, medicare, and property tax than I used to gross in my early 20s. That doesn’t include sales tax, phone tax, fuel tax, and every other tax. If I had half that money back I would be set although the politicians wouldn’t have been able to pay off their corporate donors, set up their citizen army with nice pensions for their blind loyalty, and create a permanent welfare class to degrade society evermore.

Exactly. We are all taxed to death. I read somewhere the other day that in two income families, generally speaking whoever was making the less of the two was pretty much working, just to pay taxes. Yes, they were saying by the time you added up all their taxes that one of the families entire income went straight to the man in some way. That’s insane but I could see it. You got income tax, city and local taxes, occupational tax in some places, social security, Medicare crap, property tax, sales tax, fuel tax, phone and internet fees and taxes and on and on and on. I could totally see it adding up to someone’s yearly income. Fucking crazy! Yet, apparently the gov wants more, hence the reason they keep pointing out that Americans have $11 trillion in savings in some way.Its much easier to save when the gov and its goons don’t have their hands in your pocket and a gun to your head.

I pay more in income tax, social security, medicare, and property tax than I used to gross in my early 20s. That doesn’t include sales tax, phone tax, fuel tax, and every other tax. If I had half that money back I would be set although the politicians wouldn’t have been able to pay off their corporate donors, set up their citizen army with nice pensions for their blind loyalty, and create a permanent welfare class to degrade society evermore.

seeing as how I RTFA

"Americans have a weighted average savings account balance of $41,600 which includes checking, savings, money market and prepaid debit cards, while the median was only $5,300. "

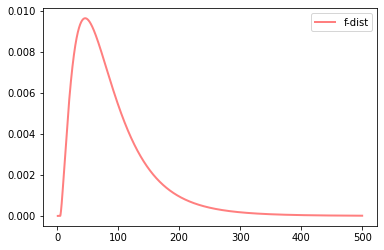

Income distribution roughly looks like this (all the peeps on the right hand "tail" pull up the average, which is why you see the HUGE difference between mean and median).

Yes this is income (by thousands) and not savings, but they probably follow the same curve. (This data is totally pulled outta my ass and is just to show something other than a "normal" or gaussian distribution.)

How to lie with statistics!

"Americans have a weighted average savings account balance of $41,600 which includes checking, savings, money market and prepaid debit cards, while the median was only $5,300. "

Income distribution roughly looks like this (all the peeps on the right hand "tail" pull up the average, which is why you see the HUGE difference between mean and median).

Yes this is income (by thousands) and not savings, but they probably follow the same curve. (This data is totally pulled outta my ass and is just to show something other than a "normal" or gaussian distribution.)

How to lie with statistics!

Here are the 97 taxes in the US tax code:

- Air Transportation Taxes

- Biodiesel Fuel Taxes

- Building Permit Taxes

- Business Registration Fees

- Capital Gains Taxes

- Cigarette Taxes

- Court Fines

- Disposal Fees

- Dog License Taxes

- Drivers License Fees

- Employer Health Insurance Mandate Tax

- Employer Medicare Taxes

- Employer Social Security Taxes

- Environmental Fees

- Estate Taxes

- Excise Taxes On Comprehensive Health Insurance Plans

- Federal Corporate Taxes

- Federal Income Taxes

- Federal Unemployment Taxes

- Fishing License Taxes

- Flush Taxes

- Food And Beverage License Fees

- Franchise Business Taxes

- Garbage Taxes

- Gasoline Taxes

- Gift Taxes

- Gun Ownership Permits

- Hazardous Material Disposal Fees

- Highway Access Fees

- Hotel Taxes (these are becoming quite large in some areas)

- Hunting License Taxes

- Import Taxes

- Individual Health Insurance Mandate Taxes

- Inheritance Taxes

- Insect Control Hazardous Materials Licenses

- Inspection Fees

- Insurance Premium Taxes

- Interstate User Diesel Fuel Taxes

- Inventory Taxes

- IRA Early Withdrawal Taxes

- IRS Interest Charges

- IRS Penalties

- Library Taxes

- License Plate Fees

- Liquor Taxes

- Local Corporate Taxes

- Local Income Taxes

- Local School Taxes

- Local Unemployment Taxes

- Luxury Taxes

- Marriage License Taxes

- Medicare Taxes

- Medicare Tax Surcharge On High Earning Americans Under Obamacare

- Obamacare Individual Mandate Excise Tax

- Obamacare Surtax On Investment Income

- Parking Meters

- Passport Fees

- Professional Licenses And Fees (another form of taxation)

- Property Taxes

- Real Estate Taxes

- Recreational Vehicle Taxes

- Registration Fees For New Businesses

- Toll Booth Taxes

- Sales Taxes

- Self-Employment Taxes

- Sewer & Water Taxes

- School Taxes

- Septic Permit Taxes

- Service Charge Taxes

- Social Security Taxes

- Special Assessments For Road Repairs Or Construction

- Sports Stadium Taxes

- State Corporate Taxes

- State Income Taxes

- State Park Entrance Fees

- State Unemployment Taxes (SUTA)

- Tanning Taxes

- Telephone 911 Service Taxes

- Telephone Federal Excise Taxes

- Telephone Federal Universal Service Fee Taxes

- Telephone Minimum Usage Surcharge Taxes

- Telephone State And Local Taxes

- Telephone Universal Access Taxes

- The Alternative Minimum Tax

- Tire Recycling Fees

- Tire Taxes

- Tolls

- Traffic Fines

- Use Taxes

- Utility Taxes

- Vehicle Registration Taxes

- Waste Management Taxes

- Water Rights Fees

- Watercraft Registration & Licensing Fees

- Well Permit Fees

- Workers Compensation Taxes

- Zoning Permit Fees

Sure but too many people convince themselves that they cannot afford to save money. We do pay a lot in taxes but that is an excuse to not save. A 401K is also a great tax break but most people never consider that.Its much easier to save when the gov and its goons don’t have their hands in your pocket and a gun to your head.

I pay more in income tax, social security, medicare, and property tax than I used to gross in my early 20s. That doesn’t include sales tax, phone tax, fuel tax, and every other tax. If I had half that money back I would be set although the politicians wouldn’t have been able to pay off their corporate donors, set up their citizen army with nice pensions for their blind loyalty, and create a permanent welfare class to degrade society evermore.

All my savings is in steel, aluminum, brass, lead, and even a little plastic.

I'll work till I die. Every old guy I see dead is sitting around without purpose. Give me a pile of money and I'll still need to be badgered out of the house by something.

I'll work till I die. Every old guy I see dead is sitting around without purpose. Give me a pile of money and I'll still need to be badgered out of the house by something.

Sure but too many people convince themselves that they cannot afford to save money. We do pay a lot in taxes but that is an excuse to not save. A 401K is also a great tax break but most people never consider that.

I had one employer with a great 401k. They matched 50% of your contribution up to 15% of your gross. 7.5% extra gross wage for free.

Next one I didn't bother, just started investing myself. They said they matched 5%. Turns out that was 5% of the first 1% of your contribution, so basically nothing.

But I make more money in the trades than everyone I know with a college degree, and I had about 50k less debt to start my life.

Do you notice there is no longer a “tea tax”? Maybe the early Americans were onto somethingHere are the 97 taxes in the US tax code:

- Air Transportation Taxes

- Biodiesel Fuel Taxes

- Building Permit Taxes

- Business Registration Fees

- Capital Gains Taxes

- Cigarette Taxes

- Court Fines

- Disposal Fees

- Dog License Taxes

- Drivers License Fees

- Employer Health Insurance Mandate Tax

- Employer Medicare Taxes

- Employer Social Security Taxes

- Environmental Fees

- Estate Taxes

- Excise Taxes On Comprehensive Health Insurance Plans

- Federal Corporate Taxes

- Federal Income Taxes

- Federal Unemployment Taxes

- Fishing License Taxes

- Flush Taxes

- Food And Beverage License Fees

- Franchise Business Taxes

- Garbage Taxes

- Gasoline Taxes

- Gift Taxes

- Gun Ownership Permits

- Hazardous Material Disposal Fees

- Highway Access Fees

- Hotel Taxes (these are becoming quite large in some areas)

- Hunting License Taxes

- Import Taxes

- Individual Health Insurance Mandate Taxes

- Inheritance Taxes

- Insect Control Hazardous Materials Licenses

- Inspection Fees

- Insurance Premium Taxes

- Interstate User Diesel Fuel Taxes

- Inventory Taxes

- IRA Early Withdrawal Taxes

- IRS Interest Charges

- IRS Penalties

- Library Taxes

- License Plate Fees

- Liquor Taxes

- Local Corporate Taxes

- Local Income Taxes

- Local School Taxes

- Local Unemployment Taxes

- Luxury Taxes

- Marriage License Taxes

- Medicare Taxes

- Medicare Tax Surcharge On High Earning Americans Under Obamacare

- Obamacare Individual Mandate Excise Tax

- Obamacare Surtax On Investment Income

- Parking Meters

- Passport Fees

- Professional Licenses And Fees (another form of taxation)

- Property Taxes

- Real Estate Taxes

- Recreational Vehicle Taxes

- Registration Fees For New Businesses

- Toll Booth Taxes

- Sales Taxes

- Self-Employment Taxes

- Sewer & Water Taxes

- School Taxes

- Septic Permit Taxes

- Service Charge Taxes

- Social Security Taxes

- Special Assessments For Road Repairs Or Construction

- Sports Stadium Taxes

- State Corporate Taxes

- State Income Taxes

- State Park Entrance Fees

- State Unemployment Taxes (SUTA)

- Tanning Taxes

- Telephone 911 Service Taxes

- Telephone Federal Excise Taxes

- Telephone Federal Universal Service Fee Taxes

- Telephone Minimum Usage Surcharge Taxes

- Telephone State And Local Taxes

- Telephone Universal Access Taxes

- The Alternative Minimum Tax

- Tire Recycling Fees

- Tire Taxes

- Tolls

- Traffic Fines

- Use Taxes

- Utility Taxes

- Vehicle Registration Taxes

- Waste Management Taxes

- Water Rights Fees

- Watercraft Registration & Licensing Fees

- Well Permit Fees

- Workers Compensation Taxes

- Zoning Permit Fees

the market lost $3 trillion recently...

so they are probably giving total invested in the market, divided by number of families...

this would not represent the "avg american"...

so they are probably giving total invested in the market, divided by number of families...

this would not represent the "avg american"...

Trust your lying eyes not their lying statistics. Many of us have acquaintances from various levels of the financial ladder. Being that is generally the case, you will have some sense of who and how many have what. There will always be outliers. There are those that have great wealth and appear to have little. There are those that appear to have everything but their everything is actually a mound of debt.

$75,000. in savings is utter BS. The only number that counts is your/their balance sheet. That number only counts if it is after all taxes, liquidation costs, fees, penalties, market variations, projected market variations, etc., etc. Right now, I believe I'm going to be worth less tomorrow than I am today and I believe that will continue for a relatively short period of time.

The people that derived the number in the title of this post have no interest in conveying the truth to us. There only intent is to present a world that favors their image. You know it, I know it and they know it.

Trust your gut and trust your dog.

$75,000. in savings is utter BS. The only number that counts is your/their balance sheet. That number only counts if it is after all taxes, liquidation costs, fees, penalties, market variations, projected market variations, etc., etc. Right now, I believe I'm going to be worth less tomorrow than I am today and I believe that will continue for a relatively short period of time.

The people that derived the number in the title of this post have no interest in conveying the truth to us. There only intent is to present a world that favors their image. You know it, I know it and they know it.

Trust your gut and trust your dog.

Similar threads

- Replies

- 118

- Views

- 4K

- Replies

- 22

- Views

- 2K