My buddies wife is a Ped/Med, children's doctor. They buy 150G in drugs at a wack, all on a CC, points for Airline Upgrades to Hawaii. Working the system.

- Thread starter Hobo Hilton

- Start date

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

The FED Reserve is going to have to bring some more printing presses on line.

www.cnbc.com

www.cnbc.com

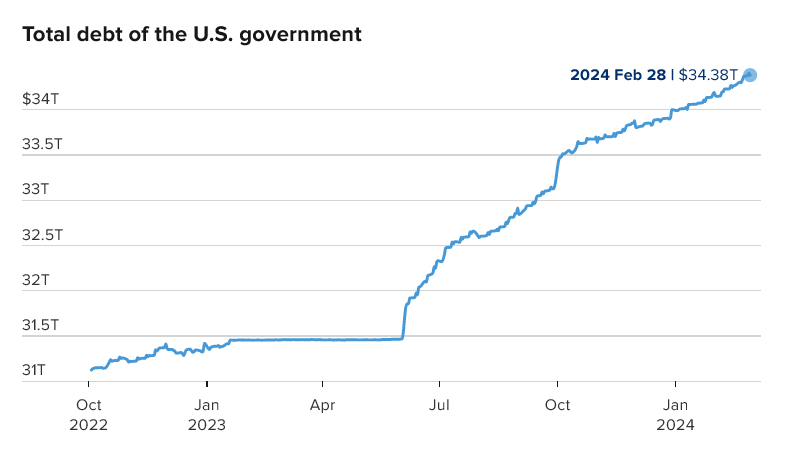

The U.S. national debt is rising by $1 trillion about every 100 days

The nation's debt now stands at nearly $34.4 trillion.

Last edited:

Laughing,... looks like the cookie is about to crumble for a few.The FED Reserve is going to have to bring some more printing presses on line.

View attachment 8362053

The U.S. national debt is rising by $1 trillion about every 100 days

The nation's debt now stands at nearly $34.4 trillion.www.cnbc.com

How ironic that in a different thread the tax man came to take someone’s castle from them for back taxes, yet these same politicians keep writing checks for money they don’t have either, is this how it’s supposed to work?The FED Reserve is going to have to bring some more printing presses on line.

View attachment 8362053

The U.S. national debt is rising by $1 trillion about every 100 days

The nation's debt now stands at nearly $34.4 trillion.www.cnbc.com

How ironic that in a different thread the tax man came to take someone’s castle from them for back taxes, yet these same politicians keep writing checks for money they don’t have either, is this how it’s supposed to work?

Your Guide to Gibbs’ Rules

Jethro Gibbs - Rule #39: There is no such thing as a coincidence.The Deep State has sped up the implementation of their plan. You will own nothing.

Adapt

Consumers as a whole are falling deeper in debt, and that has cost them.

Cardholders coughed up a record-high $130 billion in credit card interest and fees in 2022, according to the latest tally from the Consumer Financial Protection Bureau. That was before credit card APRs moved even higher as the Federal Reserve continued raising its benchmark interest rate to tame inflation.

www.cnbc.com

www.cnbc.com

Cardholders coughed up a record-high $130 billion in credit card interest and fees in 2022, according to the latest tally from the Consumer Financial Protection Bureau. That was before credit card APRs moved even higher as the Federal Reserve continued raising its benchmark interest rate to tame inflation.

As late, missed payments rise, credit card borrowers face 'consequences' for falling behind, CFPB says

The CFPB finalized a rule to ban excessive credit card late fees, after finding that cardholders paid a record $130 billion in interest and fees.

Did some reading on the subject matter, it seems real-time America is a chapter of this commie-philosophy. The parallels they describe with events are almost to perfect a fit. If you blow the spot up and ruin the deepest state planners efforts they will not be happy. Thanks for the insightful info.Cloward-Piven

All part of the plan.

Help me with the math.

Biden proposes reducing the federal deficit by $3 trillion over the next 10 years by taxing the wealthiest companies and households.

Without adding any new debt, just the Net interest costs soared to $659 billion in fiscal year 2023, which ended September 30, according to the Treasury Department. That’s up $184 billion, or 39%, from the previous year and is nearly double what it was in fiscal year 2020.

www.cnbc.com

www.cnbc.com

Biden proposes reducing the federal deficit by $3 trillion over the next 10 years by taxing the wealthiest companies and households.

Without adding any new debt, just the Net interest costs soared to $659 billion in fiscal year 2023, which ended September 30, according to the Treasury Department. That’s up $184 billion, or 39%, from the previous year and is nearly double what it was in fiscal year 2020.

Treasury chief Yellen defends Biden budget against Republican senators' fears of tax increases

President Joe Biden is committed to not raising taxes on Americans earning less than $400,000, Treasury Secretary Janet Yellen told senators at a hearing.

Most Americans, including the Potato in Chief, think deficit reduction equals debt reduction. It's why when asked about the debt, he claims he's reduced the debt by $3T when we all know it's gone nowhere but up, but the libs clap and cheer because they are fucking stupid. Literally and completely, FUCKING STUPID.Help me with the math.

Biden proposes reducing the federal deficit by $3 trillion over the next 10 years by taxing the wealthiest companies and households.

Without adding any new debt, just the Net interest costs soared to $659 billion in fiscal year 2023, which ended September 30, according to the Treasury Department. That’s up $184 billion, or 39%, from the previous year and is nearly double what it was in fiscal year 2020.

Treasury chief Yellen defends Biden budget against Republican senators' fears of tax increases

President Joe Biden is committed to not raising taxes on Americans earning less than $400,000, Treasury Secretary Janet Yellen told senators at a hearing.www.cnbc.com

If you gave Yellen $100 and asked her to go grocery shopping for you, she'd come back with a sack of onions, three new employees to carry it and a credit card charge in your name due to the People's Bank of China. It's exactly how she runs the US Government's economy.

Behind a Pay Wall so I copied.

________

Larry Fink is worried about what he calls the U.S.’s “snowballing debt.” He’s not alone, with Washington number crunchers seeing it hit a record in as little as five years.

In his annual letter to BlackRock Inc. investors, the chairman and chief executive of the investment-management company said: “More leaders should pay attention to America’s snowballing debt.

“There’s a bad scenario where the American economy starts looking like Japan’s in the late 1990s and early 2000s, when debt exceeded [gross domestic product] and led to periods of austerity and stagnation.”

Fink’s concerns echo those of a recent analysis by the nonpartisan Congressional Budget Office, which projected that debt held by the public would reach its highest level ever in 2029, at 107% when measured as a percentage of the economy. By 2054, it would reach 166% of the economy, the CBO said in its March 20 estimate.

The BlackRock chief and the CBO both warned of the risks of servicing that debt. Under the CBO’s scenario, the cost of interest payments on the debt will double by 2054, to 6.3% of GDP. Add in rising costs for programs like Social Security, and there are “significant risks to the fiscal and economic outlook,” the agency said.

The CBO’s report was released before President Joe Biden signed into law a $1.2 trillion package of spending bills on March 23, ending the threat of a government shutdown.

Combined with a separate package, discretionary spending for the budget year will come to about $1.66 trillion. But, as the Associated Press noted, that does not include programs such as Social Security and Medicare, or financing the country’s rising debt.

The spending package largely tracks with an agreement that then-Speaker Kevin McCarthy of California worked out with the White House in May 2023, which restricted spending for two years and suspended the debt ceiling into January 2025 so the federal government could continue paying its bills.

In his letter, Fink said a debt crisis is not inevitable. He said the issue can’t only be solved through tax hikes and spending cuts, and called for “pro-growth policies” such as infrastructure investments, especially in the energy sector.

________

BlackRock’s Larry Fink is worried about ‘snowballing’ U.S. debt. Here’s how soon it could hit a record.

Larry Fink is worried about what he calls the U.S.’s “snowballing debt.” He’s not alone, with Washington number crunchers seeing it hit a record in as little as five years.

In his annual letter to BlackRock Inc. investors, the chairman and chief executive of the investment-management company said: “More leaders should pay attention to America’s snowballing debt.

“There’s a bad scenario where the American economy starts looking like Japan’s in the late 1990s and early 2000s, when debt exceeded [gross domestic product] and led to periods of austerity and stagnation.”

Fink’s concerns echo those of a recent analysis by the nonpartisan Congressional Budget Office, which projected that debt held by the public would reach its highest level ever in 2029, at 107% when measured as a percentage of the economy. By 2054, it would reach 166% of the economy, the CBO said in its March 20 estimate.

The BlackRock chief and the CBO both warned of the risks of servicing that debt. Under the CBO’s scenario, the cost of interest payments on the debt will double by 2054, to 6.3% of GDP. Add in rising costs for programs like Social Security, and there are “significant risks to the fiscal and economic outlook,” the agency said.

The CBO’s report was released before President Joe Biden signed into law a $1.2 trillion package of spending bills on March 23, ending the threat of a government shutdown.

Combined with a separate package, discretionary spending for the budget year will come to about $1.66 trillion. But, as the Associated Press noted, that does not include programs such as Social Security and Medicare, or financing the country’s rising debt.

The spending package largely tracks with an agreement that then-Speaker Kevin McCarthy of California worked out with the White House in May 2023, which restricted spending for two years and suspended the debt ceiling into January 2025 so the federal government could continue paying its bills.

In his letter, Fink said a debt crisis is not inevitable. He said the issue can’t only be solved through tax hikes and spending cuts, and called for “pro-growth policies” such as infrastructure investments, especially in the energy sector.

First of all... total government debt(*) is already at 121% Softball article using "held by public" to reduce the numbers.Fink’s concerns echo those of a recent analysis by the nonpartisan Congressional Budget Office, which projected that debt held by the public would reach its highest level ever in 2029, at 107% when measured as a percentage of the economy. By 2054, it would reach 166% of the economy, the CBO said in its March 20 estimate.

(*) This doesn't include unfunded liabilities which is WAY higher.

Probably not wanting to create panic in the streets. His article is a "word to the wise"... the Wall Street insiders already knew what he publicized. His message is to those who had a plan of "Hope". For those people, best they shift to their Plan B.First of all... total government debt(*) is already at 121% Softball article using "held by public" to reduce the numbers.

View attachment 8382920

(*) This doesn't include unfunded liabilities which is WAY higher.

None of us were alive for the gold confiscation act of 1933 but some of us might live long enough to see what comes next after the Dollar is played out.

Bring it on. The sooner the better. If "this" goes on much longer there won't be a country to save.None of us were alive for the gold confiscation act of 1933 but some of us might live long enough to see what comes next after the Dollar is played out.

I like the fuck outta this guy. Speakin truth!!For starters, stop buying faggot coffee. Lets look at that one product the faggot generation loves to buy. Two or three cups a day, $7-9 dollars a cup for shitty coffee and three shots of pure corn syrup and artificial flavoring. That is $15-30 dollars a day. Only work days? Probably not. So five days a week, 4.3 weeks a month. $330 to 650 a month on fucking coffee. $7700 dollars a year for coffee. Buy a fucking candy bar already.

Eating lunch out for $18-25 dollars a day. An easy $5,000 a year and then some. And how many apps on your phone are billing your credit cards monthly? Yeah, you can bitch about "boomers" but they are not fucking broke, living at home at 30 and grubbing off relatives for money like the generation of fucking failures they raised.

As far as the $3,000 Apple faggot phone, that is all yours. My buddy Ralph is a computer geek and he loves Apple's crap products. When his laptop died last year he went to the Apple store to ask the manbun guy with gages in his ears for help. The Apple fag says, "You old guys hang on to computers for far too long, this one is obsolete." Ralph looked a bit upset and said, "It's less than two years old!!!" The kid says, "YEAH! time for a new one."

I paid my bills and went without until I did not have to do that any longer. Yeah, we got Pizza at the kids place on payday Friday so the kids could play a few bucks in games and we could all eat a cardboard pizza and bitch about our lives. Maybe a movie every couple of months and a big weekend involved the kids running around in the yard, a few beers and burgers or hotdogs on the grill. I knew going into adulthood the first house was not going to be 5,000 sq. ft. with a pool and tennis court and the first car was not a BMW.

It might be harder but people are dumber and that is a bigger problem.

"America’s fiscal outlook is more dangerous and daunting than ever, threatening our economy and the next generation," said Michael Peterson, the CEO of the Peter G. Peterson Foundation that advocates for reducing the federal deficit. "This is not the future any of us want, and it’s no way to run a great nation like ours."

That is because as interest rates rise, the federal government's borrowing costs on its debt will also increase. In fact, interest payments on the national debt are projected to be the fastest-growing part of the federal budget over the next three decades, according to the CRFB.

www.foxbusiness.com

www.foxbusiness.com

That is because as interest rates rise, the federal government's borrowing costs on its debt will also increase. In fact, interest payments on the national debt are projected to be the fastest-growing part of the federal budget over the next three decades, according to the CRFB.

National Debt Tracker: American taxpayers (you) are now on the hook for $34,606,167,915,025.93 as of 5/29/24

The U.S. national debt is climbing at a rapid pace, on track to double over the next three decades amid a rush of spending by President Biden and Congress.

Average consumer carries $6,218 in credit card debt, as more borrowers are falling behind on their payments

Last edited:

Soaring debt and deficits causing worry about threats to the economy and markets

Government debt that has swelled nearly 50% since the early days of the Covid pandemic is generating elevated levels of worry both on Wall Street and in Washington.The federal IOU is now at $34.5 trillion, or about $11 trillion higher than where it stood in March 2020. As a portion of the total U.S. economy, it is now more than 120%.

The sky fell a long time ago, most are just to dumb to realize it, yet. They are not called golden handcuffs for nothing. Living w/o them is a skill most do not possess.

Rising US debt burden spooks some bond investors ahead of election

NEW YORK, May 24 (Reuters) - Investors are bracing for a flood of U.S. government debt issuance that over time could dwarf an expected rally in bonds, as they see no end in sight for large fiscal deficits ahead of this year's presidential election.While bond markets so far this year have been driven mostly by bets on how deeply the Federal Reserve will be able to cut interest rates, fiscal concerns are expected to become more prominent as the Nov. 5 election nears. Analysts and investors say a reduction in deficit spending does not appear to be a policy priority for President Joe Biden and Republican challenger Donald Trump. Both candidates' teams dispute this notion.

Inflation and Debt destroyed the Roman Empire - study it, that is our fate.

Without a doubt..... Unless there are gigantic changes in rapid succession.Inflation and Debt destroyed the Roman Empire - study it, that is our fate.

The higher the National Debt goes, the less buying power the United States Dollar (USD) will have.

It's not inflation, it's the lack of buying power. The "value" of a USD is at an all time low.

When a working man can not afford a house, there is something wrong.

___________________

www.bbc.com

www.bbc.com

It's not inflation, it's the lack of buying power. The "value" of a USD is at an all time low.

When a working man can not afford a house, there is something wrong.

___________________

Priced out of homeownership - 'It makes me want to throw up'

Trying to buy a house is 'playing a game you can't win'

The US housing market has changed dramatically since the pandemic - an issue looming over the election.

Central Banks keep sucking the wealth out of everything, politicians legislate for them to legally lie and cheat, while reading and gaining basic information it appears Alan Greenspan is the kingpin of the current Ponzi scheme that keeps repeating in America. He got this ball rolling with the help of politicians and the FTC and it just keeps snowballing, add in some Ben Bernacke and credit reporting companies saying AAA when stuff is junk. A system has been designed to fleece the wealth from working Americans and return it to the wealthy with the help of Congress.

Was it that, or wants vs needs?Inflation and Debt destroyed the Roman Empire - study it, that is our fate.

The more wants and look at me shit a person inks their name to, the more debt they incur. Without debt, you can tell the boss to F/O anytime you want. There is a direct correlation between debt & freedom.

The powers to be want all to be deep in debt, as its much easier to peacefully control them, that way. Allow them to easily self enslave with ink for wants, and they become lock steppers via their own hand. The covid scam proved that in spades.

Its all on full display 24/7 if you just look around.

The Shoppers of Walmart have run up a lot of debt:

In a government filing Friday, Capital One said there are approximately $8.5 billion in loans in the existing Walmart credit card portfolio.

In a government filing Friday, Capital One said there are approximately $8.5 billion in loans in the existing Walmart credit card portfolio.

Walmart has ended its partnership with Capital One. Here’s what it means for cardholders

If credit cards were ended across the board, so would a lot of B/S in this country. I'd like to see a full and complete margin call on all debt,.

Fed needs to force a major increase to banks reserve requirements which would effectively cut out a lot of loans. Fed needs to kill the switch as the CC debt, imho, is a major issue that is loomingIf credit cards were ended across the board, so would a lot of B/S in this country. I'd like to see a full and complete margin call on all debt,.

Over the past year+ many of the Walmart’s I have been in have created a separate area not associated with the customer service area for money orders, billpay and other financial support services. Separating from Capital One may allow them a means to cut out the middleman or collaboration with a banker, think Cabela’s for a time they owned their credit card operations.

The new "Pay Latter" or "4 Payments" scam, they are not in the "unsecured credit data that is published", close to 1 trillion of credit that is not accounted for on the books. What could go wrong.

As a kid in the 60's working at a gas station in the afternoon for extra High school credit, I ask what is this credit card thing about, to the owner. He was an old country boy from Ar. and replied,... just another way too allow people to willingly enslave their selves. I never understood that until the late 70's. One day while visiting that old employer he showed me a list of people who had pickup orders on their cards. I ask him to explain how people could get so far behind in payments. He said people do not treat C/C's like real money, and will spend card money on wants & look at me shit in a heart beat, vs green backs. Guess that old hick knew people better than most.The new "Pay Latter" or "4 Payments" scam, they are not in the "unsecured credit data that is published", close to 1 trillion of credit that is not accounted for on the books. What could go wrong.

I told my kids that in order to enjoy a bare bones middle class lifestyle with home ownership, they will have to be business owners earning 2-3x the current median household income, not job/debt slave workers.

The more I observe "The FED" the more it just looks like all the other 3 letter Government agencies.Fed needs to force a major increase to banks reserve requirements which would effectively cut out a lot of loans. Fed needs to kill the switch as the CC debt, imho, is a major issue that is looming

That was the plan announced in December. Increase capital reserve requirements to 16%, but last week the Fed backed off of that and conceded to major banks that are sueing the Fed. They have indicated that they will back that increase down to 8%.Fed needs to force a major increase to banks reserve requirements which would effectively cut out a lot of loans. Fed needs to kill the switch as the CC debt, imho, is a major issue that is looming

Couldn’t sleep the other night and I ended up watching this on hbo

Maybe info is dated but it is presented in good order, you look at it in real-time today and realize things are still the same. Really makes you question W.

FILM REVIEW: 'Inside Job' scrutinizes the economic crisis of 2008

Care to find out why this country is in economic do-do? "Inside Job" provides answers.

www.metrowestdailynews.com

Maybe info is dated but it is presented in good order, you look at it in real-time today and realize things are still the same. Really makes you question W.

There is the option to buy now, pay later over 4 payments for a $9 can of pomade online, lol.The new "Pay Latter" or "4 Payments" scam, they are not in the "unsecured credit data that is published", close to 1 trillion of credit that is not accounted for on the books. What could go wrong.

The debt trap is closing.

37% of Americans paid a late fee in the last 12 months, report finds

This year is the first time I have,.... Ever,... had to pay a late fee, and it was due to the fuck sticks in the BHM USPS hub. That is the fucked up'est place in Alabama. Your packages are almost always sent some where else in the state before getting to you. They fuck the mail up so bad most people around here now drive to pay power, water, gas, phone/internet bills. No one around here trusts them at all to the point we have quit allowing packages to be sent via usps.The debt trap is closing.

37% of Americans paid a late fee in the last 12 months, report finds

Fuck all those DEI cock sucking fagots, and the motherfucking horse they rode in on.

I'd tell what I really think, but I like the neighbor hood dogs,...

TLDR. Pinch pennies or be in debt. I manage to do both as a resident making a whopping 56k a year while working 100+ hours a week (falsifying work hours FTW ayooo) and blame all of you for my debt due to an addiction in firearms that happened some odd 15 years ago which I refuse to take responsibility for

In reality it's a mess but dental school also cost me 330K and that is one of the cheapest in the nation lmao. Idk how i would afford a home in todays market if I didn't have the wife. I don't think there is really a correct answer. Don't get me wrong people are more stupid this day in age, as mentioned iphones, coffee, all this mess. But i mean we meal prep and have our ramen days and I'm still spending well over 50% of my monthly earnings on mortgage, insurance, internet, groceries, etc. Everything is just at astronomical prices from top to bottom right now. Housing market is stupid right now.

In reality it's a mess but dental school also cost me 330K and that is one of the cheapest in the nation lmao. Idk how i would afford a home in todays market if I didn't have the wife. I don't think there is really a correct answer. Don't get me wrong people are more stupid this day in age, as mentioned iphones, coffee, all this mess. But i mean we meal prep and have our ramen days and I'm still spending well over 50% of my monthly earnings on mortgage, insurance, internet, groceries, etc. Everything is just at astronomical prices from top to bottom right now. Housing market is stupid right now.

Copied from “Puke Bonds” thread 02/2009

Please inform if this has been posted previously...

The financial crisis explained in simple terms:

Heidi is the proprietor of a bar in Berlin. In order to

increase sales, she decides to allow her loyal customers - most of whom

are unemployed alcoholics - to drink now but pay later. She keeps track

of the drinks consumed on a ledger (thereby granting the customers

loans).

Word gets around and as a result increasing numbers of

customers flood into Heidi's bar.

Taking advantage of her customers' freedom from

immediate payment constraints, Heidi increases her prices for wine and

beer, the most-consumed beverages. Her sales volume increases massively.

A young and dynamic customer service consultant at the

local bank recognizes these customer debts as valuable future assets and

increases Heidi's borrowing limit.

He sees no reason for undue concern since he has the

debts of the alcoholics as collateral.

At the bank's corporate headquarters, expert bankers

transform these customer assets into DRINKBONDS, ALKBONDS and PUKEBONDS.

These securities are then traded on markets worldwide. No one really

understands what these abbreviations mean and how the securities are

guaranteed. Nevertheless, as their prices continuously climb, the

securities become top-selling items.

One day, although the prices are still climbing, a risk

manager (subsequently of course fired due his negativity) of the bank

decides that slowly the time has come to demand payment of the debts

incurred by the drinkers at Heidi's bar.

However they cannot pay back the debts.

Heidi cannot fulfill her loan obligations and claims

bankruptcy.

DRINKBOND and ALKBOND drop in price by 95 %. PUKEBOND

performs better, stabilizing in price after dropping by 80 %.

The suppliers of Heidi's bar, having granted her

generous payment due dates and having invested in the securities are

faced with a new situation. Her wine supplier claims bankruptcy, her

beer supplier is taken over by a competitor.

The bank is saved by the Government following dramatic

round-the-clock consultations by leaders from the governing political

parties.

The funds required for this purpose are obtained by a

tax levied on the non-drinkers.

Finally an explanation I understand .....

Please inform if this has been posted previously...

The financial crisis explained in simple terms:

Heidi is the proprietor of a bar in Berlin. In order to

increase sales, she decides to allow her loyal customers - most of whom

are unemployed alcoholics - to drink now but pay later. She keeps track

of the drinks consumed on a ledger (thereby granting the customers

loans).

Word gets around and as a result increasing numbers of

customers flood into Heidi's bar.

Taking advantage of her customers' freedom from

immediate payment constraints, Heidi increases her prices for wine and

beer, the most-consumed beverages. Her sales volume increases massively.

A young and dynamic customer service consultant at the

local bank recognizes these customer debts as valuable future assets and

increases Heidi's borrowing limit.

He sees no reason for undue concern since he has the

debts of the alcoholics as collateral.

At the bank's corporate headquarters, expert bankers

transform these customer assets into DRINKBONDS, ALKBONDS and PUKEBONDS.

These securities are then traded on markets worldwide. No one really

understands what these abbreviations mean and how the securities are

guaranteed. Nevertheless, as their prices continuously climb, the

securities become top-selling items.

One day, although the prices are still climbing, a risk

manager (subsequently of course fired due his negativity) of the bank

decides that slowly the time has come to demand payment of the debts

incurred by the drinkers at Heidi's bar.

However they cannot pay back the debts.

Heidi cannot fulfill her loan obligations and claims

bankruptcy.

DRINKBOND and ALKBOND drop in price by 95 %. PUKEBOND

performs better, stabilizing in price after dropping by 80 %.

The suppliers of Heidi's bar, having granted her

generous payment due dates and having invested in the securities are

faced with a new situation. Her wine supplier claims bankruptcy, her

beer supplier is taken over by a competitor.

The bank is saved by the Government following dramatic

round-the-clock consultations by leaders from the governing political

parties.

The funds required for this purpose are obtained by a

tax levied on the non-drinkers.

Finally an explanation I understand .....

That’s a good summary of 2008 TARP bail-outs. The main difference would be that Heidi was ordered to open the tab by the local government and her bank was told to back her loans by the State, while many other bars and patrons were actually working and paying, while Heidi’s customers were in and out of jail, didn’t have bank accounts, and used the local pawn shop to cash their checks when they were doing intermittent work.

Once it all came crashing down, the workers and banks with solid payment histories were left with the bills and the wineries never caught up to pre-crisis production rates. Now wine and beer costs more for everyone. Wine and beer would be analogous to homes in this case.

Once it all came crashing down, the workers and banks with solid payment histories were left with the bills and the wineries never caught up to pre-crisis production rates. Now wine and beer costs more for everyone. Wine and beer would be analogous to homes in this case.

Not having a mortgage or car payments is a wonderful feeling. My wife and I did not bring any debts into our marriage, so there wasn’t any financial baggage. I have never bought a new car, but I learned the hard way to really be educated about what you’re buying before ever thinking about walking onto a car lot.

Same for real estate. We’re conditioned to just blindly walk in like cattle to the realtor’s and bank’s slaughter.

When it came time for me to buy my first home, I bought the points down from whatever it was by a quarter point, and then the broker told me I couldn’t buy them down any further. They were at 7% at the time and I bought down to 6.75%.

My wife and I are teaching our kids early how to deal with these things. I don’t want my kids to ever have to walk into deals without the information they'll need.

Same for real estate. We’re conditioned to just blindly walk in like cattle to the realtor’s and bank’s slaughter.

When it came time for me to buy my first home, I bought the points down from whatever it was by a quarter point, and then the broker told me I couldn’t buy them down any further. They were at 7% at the time and I bought down to 6.75%.

My wife and I are teaching our kids early how to deal with these things. I don’t want my kids to ever have to walk into deals without the information they'll need.

Similar threads

- Replies

- 24

- Views

- 795

- Replies

- 32

- Views

- 3K