@Hobo Hilton started this tread 54 weeks ago. The prediction was spot-on.

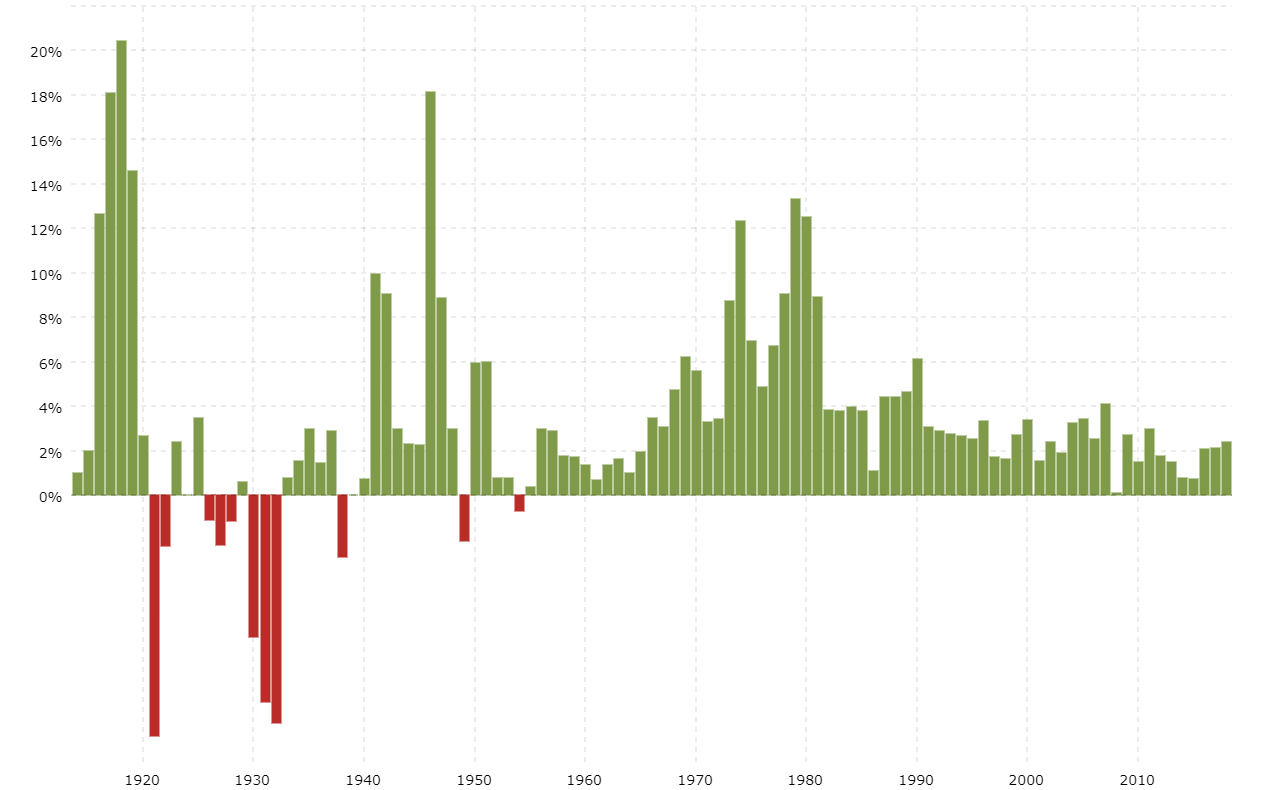

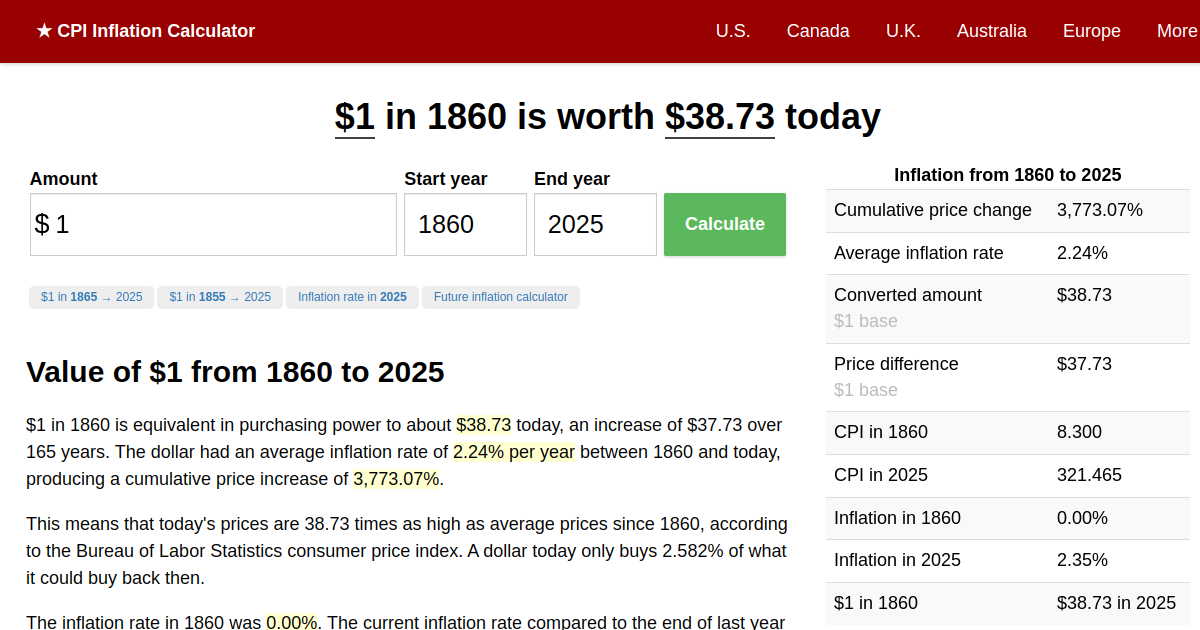

With PPI at 11.2 this morning, plus ongoing supply chain issues, demand is increasing while supplies are shrinking on almost everything. The fed is shrinking the monetary supply, increasing prime interest rates, and devaluing the dollar.

My point being....this is only going to get worse. Get ready!

Thank you for the credit...

... For the sake of my children and Grand children, I had hoped to be wrong.

This will be the 3rd or 4th recession of my lifetime. Propaganda (inflation, shortages, monetary, etc) has been worse going into this one. Partially because it is worldwide.

Historically recessions bring out the "Flim Flam men", Snake Oil Salesmen and a dramatic increase of people buying Lotto tickets. When people become desperate they grasp at straw's.

Credit cards and Buy Now Pay Later (BNPL) will be the other bear traps. If I could wave my Magic Wand I would destroy every credit card in America. Soon the financial headlines will tell stories of people buying their weekly groceries with a credit card because some politician said "Things are getting better"...

Recently here on the board and in the financials the talk has been that this recession will take hold in 2023. I tend to agree because both Big Business and the FED Reserve are making moves to avoid an immediate crash. Call it "Tapping the Brake Pedal"..

The one thing desperately needed is to stop the $$$ printing presses. Every week this Administration is throwing Billions of $$$ at COVID, Ukraine, Global Warming, Solar Power, etc. Free money is what got us into this mess.

Pay off your credit cards

Have a 6 month supply of food and water

Plant some sort of garden, even in 5 gallon buckets. Build your knowledge of growing something.

Get to know your neighbors. Good, bad or indifferent to know where they stand when things get worse.

Everyone here has enough weapons and ammo.. You could starve to death 3 or 4 times over before the shooting starts.

Pray