Well I make multiple trips like that every year hunting and competing. I hear a lot about "technology advances" - there will not be a US surge to EV until AFTER that charging technology is available on a "no kidding" basis. The "gladly pay you tomorrow for my burger today" promise of EVs is turning off a lot of potential customers.TIL everyone needs a vehicle to travel for a once-in-a-blue-moon hunting trip across 1,500 miles. Also, charging times are going to change significantly as technology advances. Also, I recommend flying

Join the Hide community

Get access to live stream, lessons, the post exchange, and chat with other snipers.

Register

Download Gravity Ballistics

Get help to accurately calculate and scope your sniper rifle using real shooting data.

Install the app

How to install the app on iOS

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Stock Market

- Thread starter pmclaine

- Start date

There is already demand that exceeds production in America. And it isn't going to stop anytime soon.Well I make multiple trips like that every year hunting and competing. I hear a lot about "technology advances" - there will not be a US surge to EV until AFTER that charging technology is available on a "no kidding" basis. The "gladly pay you tomorrow for my burger today" promise of EVs is turning off a lot of potential customers.

Well, demand exceeds production right now for ALL types of vehicles so in a way you are right. But I will just let you win the internet todayThere is already demand that exceeds production in America. And it isn't going to stop anytime soon.

It's not just EV's. It's health, religion, food, transportation, education, etc. The Deep State is forcing square pegs in round holes. Just look around at your family, job, Doctor, grocery store.....I did not see that in the article - I saw not enough demand to justify EV production. The US is not Europe, Japan, South Korea, etc. Just look at a map and do simple math and see that MANY US citizens will not be well served by EV - I have a hunting trip coming up in Wyoming, we will drive non-stop (multiple drivers) from Georgia to Wyoming - EVs are not doing that trip for a long time. If I lived in Europe or Japan then maybe it will work.

Attachments

Appears the automotive world is winding down.

American Car Shoppers Are Least Likely to Buy an Electric Vehicle

www.bloomberg.com

“Just 29% of US buyers plan to go electric with their next car.”

Aka not enough EV production to meet demand.

/cloudfront-us-east-2.images.arcpublishing.com/reuters/TUEWOXRW25M63HA6W3B4K5R5Z4.jpg)

Toyota to cut global production plan by 100,000 in June

Toyota Motor Corp will cut its global production plan by about 100,000 to roughly 850,000 vehicles in June due to the semiconductor shortage, it said on Tuesday.

The risk that the Fed's rate hikes will trigger a recession led BlackRock to downgrade US stocks on Monday.

technewstube.com

technewstube.com

BlackRock downgrades US stocks as the world's largest asset manager sees growing risk that the Fed's rate hikes will trigger a recession

The Federal Reserve, led by Jerome Powell, raised interest rates earlier this month. Samuel Corum/Getty Images The risk that the Fed's rate hikes will trigger a recession led…

$TSLA -2.5% to $658 pre-mkt as tech stocks tumbled (SPX -1.2% NDX -1.7%) after SNAP pre-announced that 2Q Revs/EBITDA will be below April 21 guidance due to deteriorating macro conditions. $GOOGL (-4%) will present at same JPM tech conf tomorrow (8am ET). 10yrTY-4.8bp to 2.81%.

Is any investor falling for this type of hype ? Similar to winning a metal at the Special Olympics. Loosing 33% is still loosing 33%... The Market "Sales Pitch" is starting to sound more and more like a Used Car lot salesman.

15 stocks that have fallen at least 33% but by these measures are still standouts in their sectors

15 stocks that have fallen at least 33% but by these measures are still standouts in their sectors

*US Apr New Home Sales -16.6% To 591K; Consensus 750K

*US Apr New Home Sales Supply At 9.0 Months

*US Apr New Home Sales Supply At 9.0 Months

A heavy hit for one day.

From the NASDAQ 100

Percent Change:

-10.10%

From the NASDAQ 100

Percent Change:

-10.10%

| DXCM DexCom Inc. (NAS) Delayed quote data | 5/24/2022 11:41 AM | ||||

| hide quote | detailed quote | options chain | chart help | ||

| Last: 291.20 | Change: | Open: 296.33 | High: 306.48 | Low: 289.68 | Volume: 811,254 |

| Percent Change: -10.10% | Yield: n/a | P/E Ratio: 140.622 | 52 Week Range: 289.68 to 659.4518 |

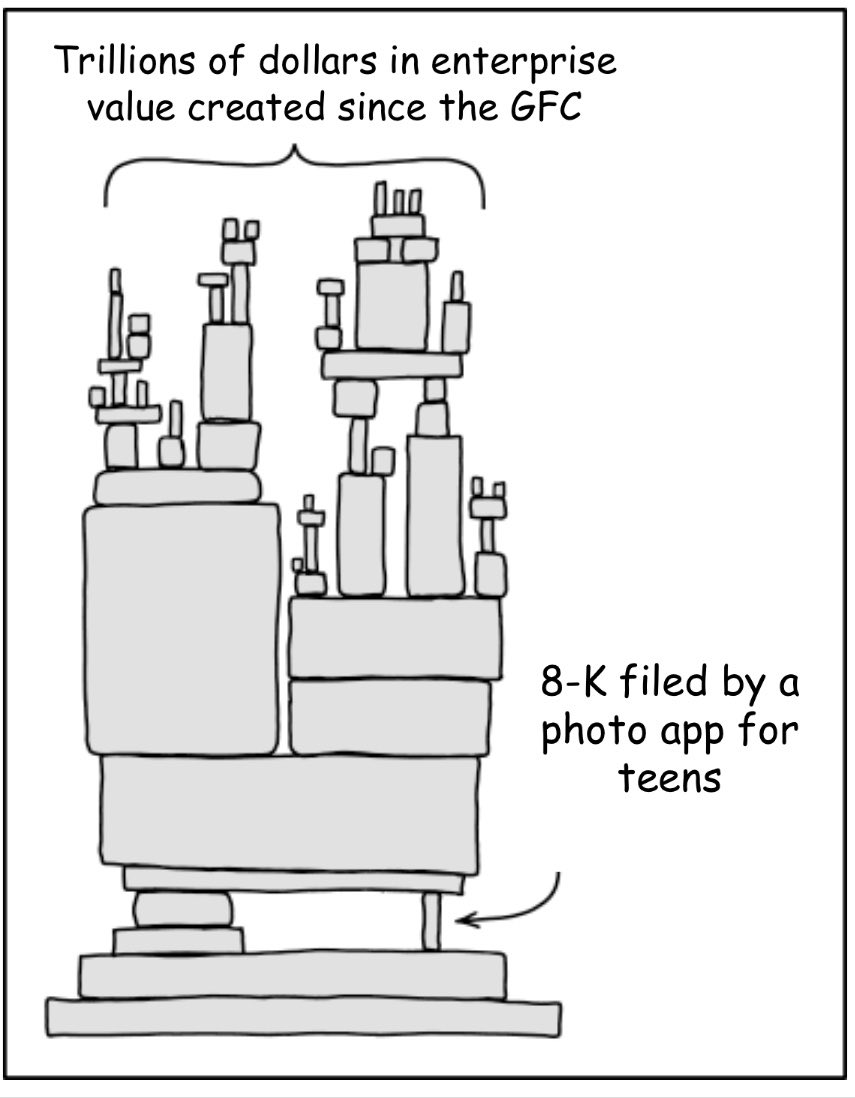

Now we're blaming supply chain problems for the failure of a shitty company to monetize their teenybopper app:

Perhaps they are not directly saying their product is missing due to supply chains in of itself but that supply chain disruptions are impacting their ability to grow in new markets where consumers cannot access their product due to low/limited supply of devices.

Additionally, could also refer to less ad revenue if companies cannot get their product to inventory.

Additionally, could also refer to less ad revenue if companies cannot get their product to inventory.

Last edited:

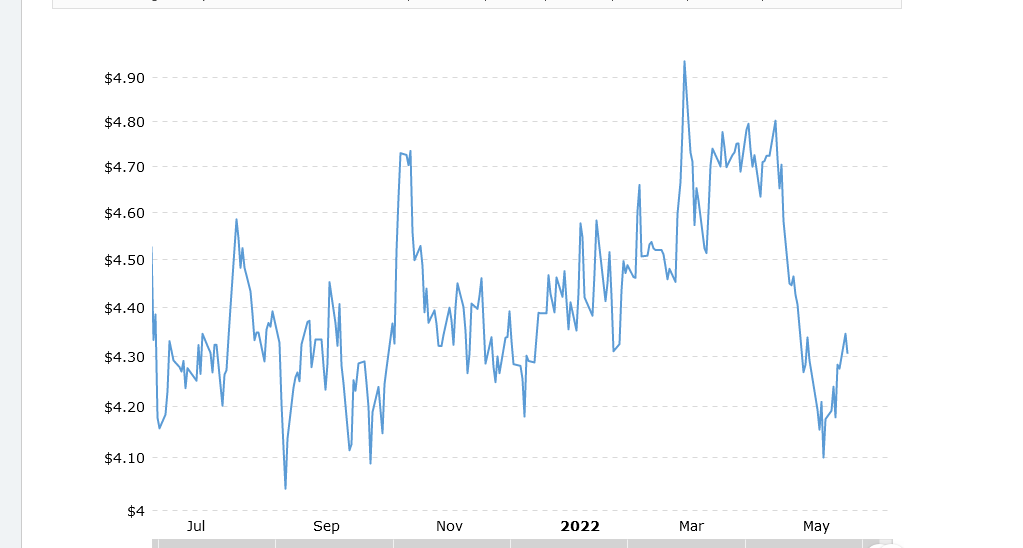

Probably one of the most stable commodities is copper (below). Looking far ahead, it appears that there will be a consistent demand for copper.

Perhaps they are not directly saying their product is missing due to supply chains in of itself but that supply chain disruptions are impacting their ability to grow in new markets where consumers cannot access their product due to low/limited supply of devices.

Additionally, could also refer to less ad revenue if companies cannot get their product to inventory.

Perhaps they are indeed saying that. It'd be complete horseshit if that's what they are indeed claiming.

What was the reason given for this?

Most likely cash balances built up over the last two years are being extinguished due to environmental factors. (Inflation, market down turn, loss of job, etc)What was the reason given for this?

I don’t believe the FED as reported why.

In order to solve a problem, the problem must first be identified.Most likely cash balances built up over the last two years are being extinguished due to environmental factors. (Inflation, market down turn, loss of job, etc)

I don’t believe the FED as reported why.

Being the FED is a major part of the problem... It is doubtful they will implicate themselves.

Search else where for answers to your questions... Start locally and branch out from there. Talk to the man on the street. As you tour around your AO, do a head count of how many people are actually working a job. Then count the number of people who appear to just be hanging out.

Stop the flow of free money (food, education, day care, healthcare, transportation, etc)... Let the slackers start to miss a few meals and you will see more people working a real job.

Tough love.

JMHO

Probably one of the most stable commodities is copper (below). Looking far ahead, it appears that there will be a consistent demand for copper.

View attachment 7877277

Other than the dip in early 2007, this looks somewhat like copper prices from mid-2006 to mid-2008. So I would be rather hesitant to make any predictions.

I agree, some what.. For now, I'm just watching the miners... A lot of time, resources and money tied up until the commodity is sold at the market. If they hold their cost inline, a big stock of physical copper in a year or two could be worth a lot more. Another IDK, we will see.Other than the dip in early 2007, this looks somewhat like copper prices from mid-2006 to mid-2008. So I would be rather hesitant to make any predictions.

Maybe I'm just looking for that light at the end of the tunnel... LOL

$TSLA catalysts 5/25

1/ Shanghai full reopen June

2/ Stock split announce June

3/ TWTR deal closes Aug

4/ TSLA AGM / AI Day 2 Aug

5/ S&P upgrades debt Aug

6/ New gigas (UK, East US) 4Q

7/ FSD beta release 4Q

8/ Cytruck launch FY’23

9/ M-$25K/Robotaxi FY’24

$1,500 PT 6-12 mo

new $TWTR 13D, eliminating the remaining $6.25B margin loan, and increasing his equity commitment by the same $6.25B. This increases odds the deal gets done (TWTR +6% AH), and reduces TSLA overhang risk since declining TSLA doesn’t require Elon to sell more $TSLA.

1/ Shanghai full reopen June

2/ Stock split announce June

3/ TWTR deal closes Aug

4/ TSLA AGM / AI Day 2 Aug

5/ S&P upgrades debt Aug

6/ New gigas (UK, East US) 4Q

7/ FSD beta release 4Q

8/ Cytruck launch FY’23

9/ M-$25K/Robotaxi FY’24

$1,500 PT 6-12 mo

new $TWTR 13D, eliminating the remaining $6.25B margin loan, and increasing his equity commitment by the same $6.25B. This increases odds the deal gets done (TWTR +6% AH), and reduces TSLA overhang risk since declining TSLA doesn’t require Elon to sell more $TSLA.

(C) Citigroup

(Nvda) Nvidia

Both look interesting to me on sell offs

(Snow) Snowflake -( More risk but more reward as well )

Kinda hard to know where this one will land. It’s currently dipped below the ipo price. It’s moving the right direction though.

I know 2 of the above are also Brookshire Hathaway picks.

Opinions

(Nvda) Nvidia

Both look interesting to me on sell offs

(Snow) Snowflake -( More risk but more reward as well )

Kinda hard to know where this one will land. It’s currently dipped below the ipo price. It’s moving the right direction though.

I know 2 of the above are also Brookshire Hathaway picks.

Opinions

I put C along side AXP (American Express), DFS (Discover)and MA (Mastercard) it appears they have all run flat for a couple of weeks. Without a doubt, people are starting to put groceries and fuel on credit cards. Lots of bear traps in making that move.. Deja Vu. There is an opportunity to make some money holding them long for a couple of months. After a couple of month's I'd set my "Stop Out" really tight and take some profit. But, the future is unknown.(C) Citigroup

(Nvda) Nvidia

Both look interesting to me on sell offs

(Snow) Snowflake -( More risk but more reward as well )

Kinda hard to know where this one will land. It’s currently dipped below the ipo price. It’s moving the right direction though.

I know 2 of the above are also Brookshire Hathaway picks.

Opinions

I bought some Vroom. It might go bankrupt, who knows, but the possible reward is worth the GAMBLE.

Hobo-

Take a look at their (C) financials and value

They might be better compared to US Bank and Bank of America.

Take a look at their (C) financials and value

They might be better compared to US Bank and Bank of America.

Last edited:

I did. Tight trailing stop applied. Investor day is today, so maybe it’ll get it moving back where it needs to be.Take a look at their financials and value

My apologies. That was to hobo.I did. Tight trailing stop applied. Investor day is today, so maybe it’ll get it moving back where it needs to be.

Yep.... Seems like those "in the business" of the markets are down to comparing apples to oranges... Sort of clouds up the crystal ball..Hobo-

Take a look at their (C) financials and value

They might be better compared to US Bank and Bank of America.

As we speak:

10:24:00 AM

NYMEX

I'm hearing echo's of Bigfatcock from earlier this year when he forecasted events linked to the "price of gasoline"... Europe and US markets popped up this morning. Scanning the stories, there is nothing encouraging... The one point of light was that Dollar General had good news.....

Dollar General on Thursday raised its fiscal-year financial forecasts, unlike many other retailers, and beat analysts’ estimates for its fiscal first quarter....

Dollar General ! ! .... I shop there and Dollar Tree cause I'm one of the poors... The discount store shoppers are not going to get us out of this recession.

2022 is starting to have the feeling of a dead stick landing in a little Cessna 140... The end of the runway is at 1/1/2023. JMHO

Oil (WTI)Commodity

113.78+3.04+2.75%10:24:00 AM

NYMEX

I'm hearing echo's of Bigfatcock from earlier this year when he forecasted events linked to the "price of gasoline"... Europe and US markets popped up this morning. Scanning the stories, there is nothing encouraging... The one point of light was that Dollar General had good news.....

Dollar General on Thursday raised its fiscal-year financial forecasts, unlike many other retailers, and beat analysts’ estimates for its fiscal first quarter....

Dollar General ! ! .... I shop there and Dollar Tree cause I'm one of the poors... The discount store shoppers are not going to get us out of this recession.

2022 is starting to have the feeling of a dead stick landing in a little Cessna 140... The end of the runway is at 1/1/2023. JMHO

Average % of American’s household income spent on mortgage is 34%; up from 24%.

I am just "timing" the market - not supposed to do that but I am looking for the bottom or closer to the bottom. I quit putting money into the overpriced market quite a while back.

Gas and food prices are things people can’t escape. A big reason spending was high (aside from stimulus) in 2020 is that you could fill up a Silverado for $30-$40. Now it costs you over $100, and your grocery bill is up 40%.As we speak:

Oil (WTI)Commodity

113.78+3.04+2.75%

10:24:00 AM

NYMEX

I'm hearing echo's of Bigfatcock from earlier this year when he forecasted events linked to the "price of gasoline"... Europe and US markets popped up this morning. Scanning the stories, there is nothing encouraging... The one point of light was that Dollar General had good news.....

Dollar General on Thursday raised its fiscal-year financial forecasts, unlike many other retailers, and beat analysts’ estimates for its fiscal first quarter....

Dollar General ! ! .... I shop there and Dollar Tree cause I'm one of the poors... The discount store shoppers are not going to get us out of this recession.

2022 is starting to have the feeling of a dead stick landing in a little Cessna 140... The end of the runway is at 1/1/2023. JMHO

Oh, and your rent is now up 25%

We are a consumer economy. When the majority of people are broke as fuck, they can’t consume.

Remember when gas crashed in 2020 and the Democrats wanted to add $1 to the fuel tax? Glad that didn’t happen.

Sure would have been cool if they let Trump by $3,000,000,000 for the SPR when it dropped, but orange man bad. No worries, Kennedy school of arts got a smooth $25,000,00.

Yes, I’m old enough to remember 2020.

Last edited:

You can take the rest of the year off... No bottom in sight... Long glide pattern.I am just "timing" the market - not supposed to do that but I am looking for the bottom or closer to the bottom. I quit putting money into the overpriced market quite a while back.

Stock Market propaganda. Headlines like this get the non-english speaking foreigners to sink their money into the US Markets.

www.cnbc.com

www.cnbc.com

Dow rises for a fifth straight day, S&P 500 and Nasdaq on pace to snap 7-week losing streaks

Stocks rallied Thursday, as Wall Street rebounded from a long string of weekly declines.

Promising looking day on the market... Jump on in and buy stocks that have bottomed out. FED says inflation is tapering off and there will be no need to raise interest rates. Sarcasm.

https://www.marketwatch.com/story/c...of-inflation-11653655888?mod=newsviewer_click

https://www.marketwatch.com/story/c...of-inflation-11653655888?mod=newsviewer_click

For some reason I don't believe them. In fact, I think 180 degrees from where they are on anything is the safe position, like taking Jim Cramer's financial advice.Promising looking day on the market... Jump on in and buy stocks that have bottomed out. FED says inflation is tapering off and there will be no need to raise interest rates. Sarcasm.

https://www.marketwatch.com/story/c...of-inflation-11653655888?mod=newsviewer_click

Hard one to call. I think shortages will keep prices elevated, even with demand destruction.

Every trend (up or down) will always pause / take a break.. This is how the market makers play the game... It is all about movement.

Visualize sitting in your beach chair, next to a beautiful woman with a cooler full of cold ones. You got there early and set up the perfect distance from the water... Great conversation, great condiments, rubbin' in some lotion while listening to the waves lappin on the beach... In a couple of hours you decide to take a dip in the ocean. To your surprise the water is now 50 yards away from your beach chairs. But, you heard the waves breaking all morning. Well, while you were distracted the tide went out. The tide of a booming economy is going out, don't be distracted by the lapping of the waves (yesterday and today in the market)... While you may feel like you are positioned in the right place, this recession is just getting started. A year from now, the tide will start to come back in, very slowly.

Selling out of VTI and moving those funds into QQQ Tuesday.

You bastard! Let me stock up on beer before you crash my VTI any more than it is!

If you don't mind me asking, could I ask why you're making this decision (my beer buying aside)? Thanks in advance.

These ETFs are held in my Rollover and Roth accounts; thus long-term focus. I believe technology will lead the way in recovery and outperform VTI/VOO over the next 30+ years.You bastard! Let me stock up on beer before you crash my VTI any more than it is!

If you don't mind me asking, could I ask why you're making this decision (my beer buying aside)? Thanks in advance.

Also VTI is down like 10% vs. QQQ 30% or so.

Thank you.

Given your rationale, why not go for something like ARKK? It's down a lot more and is tech-related.

Given your rationale, why not go for something like ARKK? It's down a lot more and is tech-related.

I don't think that is a bad move; however, ARKK is much more focused on next-gen innovation. ARKK might very well outperform VTI/QQQ going forward.Thank you.

Given your rationale, why not go for something like ARKK? It's down a lot more and is tech-related.

I think I'm going to go with just getting started.

Both funds caught a little bump up so that might be a good time to move.Selling out of VTI and moving those funds into QQQ Tuesday.

Extrapolating that chart suggests that prices will continue to rise at an abnormally high rate for at least several months - just not as abnormally high as the past few months.

Similar threads

- Replies

- 13

- Views

- 1K

- Replies

- 141

- Views

- 14K