Where did this chart come from?

Join the Hide community

Get access to live stream, lessons, the post exchange, and chat with other snipers.

Register

Download Gravity Ballistics

Get help to accurately calculate and scope your sniper rifle using real shooting data.

Install the app

How to install the app on iOS

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Stock Market

- Thread starter pmclaine

- Start date

Covered half my oil short.

My DRIP and SCO are both up significantly since purchase. Will hold those until oil hits $100 and cover the rest of my crude short at $100 as well.

My DRIP and SCO are both up significantly since purchase. Will hold those until oil hits $100 and cover the rest of my crude short at $100 as well.

Traditional shorts.Are you doing traditional shorts or buying puts?

I’m not a fan of options.

99% of all my positions are built on actual shares or contracts.

Nice bump on EMPH........Mortgage rates are currently at 6.25%-6.75%... and we aren't even close to stopping. Affordability is getting crushed, forcing more buyers into the smaller housing segments. Soon enough, all homes will start adjusting down to meet demand. Mortgage rates are likely to hit 8%+ by EOY.

Biden Waives Solar Import Tariffs for Two Years

Why. It’s worse than tulip maniaI’ll probably buy BTC under $10K.

Because it’s volatile... small risk for potential reward. Probably just put $1,000 in or so.Why. It’s worse than tulip mania

BREAKING: Run on the Banks in China - Long Lines in Henan, Shanghai, and Dandong | The Gateway Pundit | by Joe Hoft

People are reportedly lining up for hours in China to obtain money from their bank accounts in China. The large cities of Henan, Shanghai, and Dandong are three cities where the lines are long.

BREAKING: Run on the Banks in China - Long Lines in Henan, Shanghai, and Dandong | The Gateway Pundit | by Joe Hoft

People are reportedly lining up for hours in China to obtain money from their bank accounts in China. The large cities of Henan, Shanghai, and Dandong are three cities where the lines are long.www.thegatewaypundit.com

From my grandfather's diary.

Time traveler looks as if written with a ball point pen.View attachment 7895357

From my grandfather's diary.

Another diary from that era. Times were tough.Time traveler looks as if written with a ball point pen.

Probably a fountain pen. I saved the diary from my father's things. A year's worth of entries, with entries about hitch hiking to town to try to find work, his 1st wife, his dog, weather, etc.Time traveler looks as if written with a ball point pen.

Europe is up about 1%, Asia appears down a bit, Japan seems to be consolidating and figuring how to balance the import / export ratio. Oil people have not missed a lick (worldwide) and the Brent oil is going to get more expensive as Germany starts up their coal fired power plants....Market is pretty stable today

Won't be long before Elon figures out he can make cars where the energy cost is lowest and just ship them worldwide... I'm sure the thought of him "Circling his wagon's" has crossed his mind..... Rest up today because the Deep State will cram 5 days of chaos into the last 4 days of the week.

Market is pretty stable today

Tesla Cars Won’t Be Allowed Near China Leadership Meeting: Report

Tesla cars are equipped with several external cameras. Elon Musk, Tesla's CEO, has said the cars don't spy in China or anywhere else.

Likely related to military/government meetings or testing. China has done this previously as they cannot access Tesla's camera data.

Tesla Cars Won’t Be Allowed Near China Leadership Meeting: Report

Tesla cars are equipped with several external cameras. Elon Musk, Tesla's CEO, has said the cars don't spy in China or anywhere else.www.marketwatch.com

Impressive...... The Chinese can hack any system in the world, but not a Tesla camera.Likely related to military/government meetings or testing. China has done this previously as they cannot access Tesla's camera data.

More so, the data transmission.Impressive...... The Chinese can hack any system in the world, but not a Tesla camera.

Time traveler looks as if written with a ball point pen.

Nah, Look how the settled ink wrote dark than evened out.

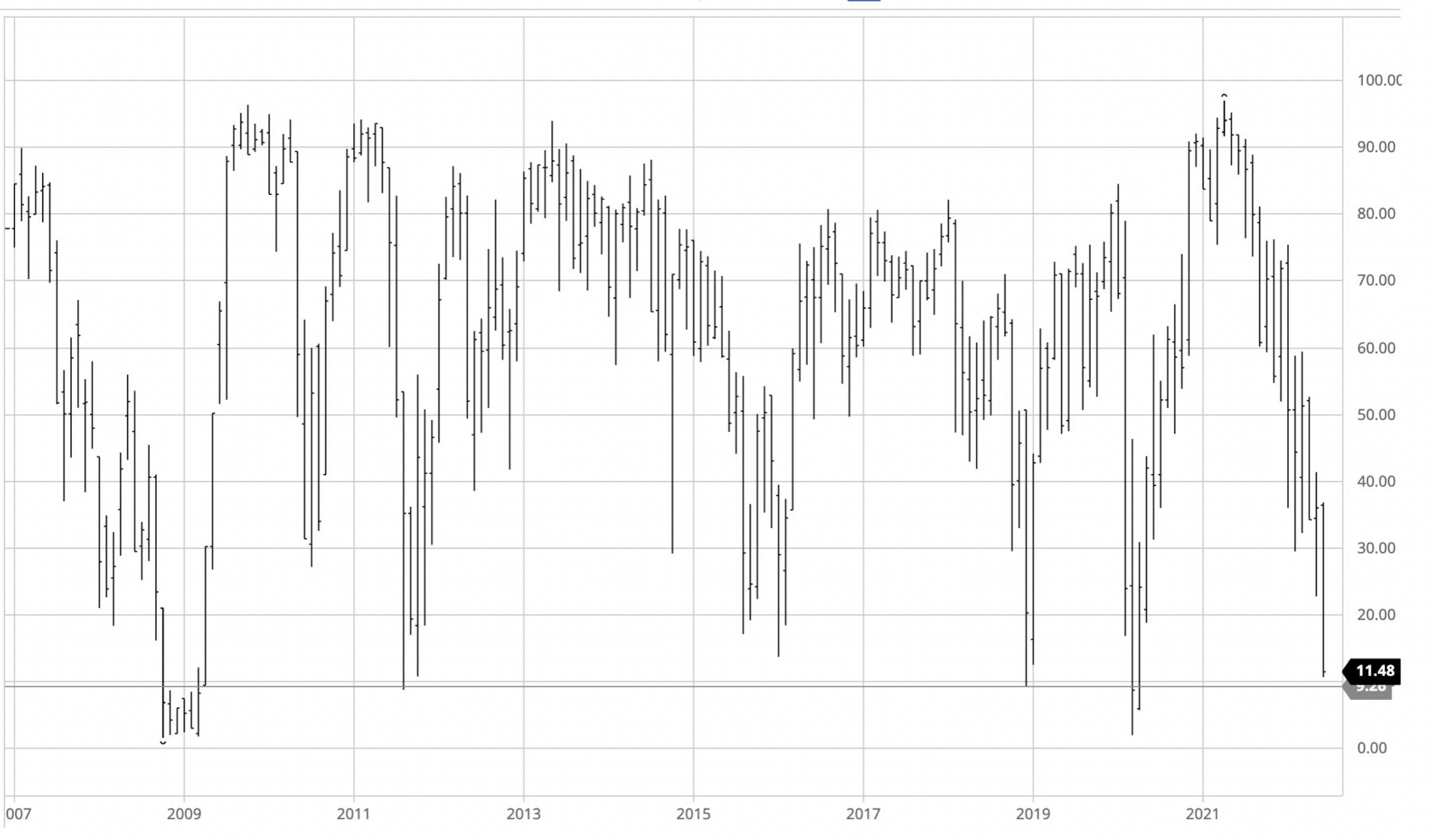

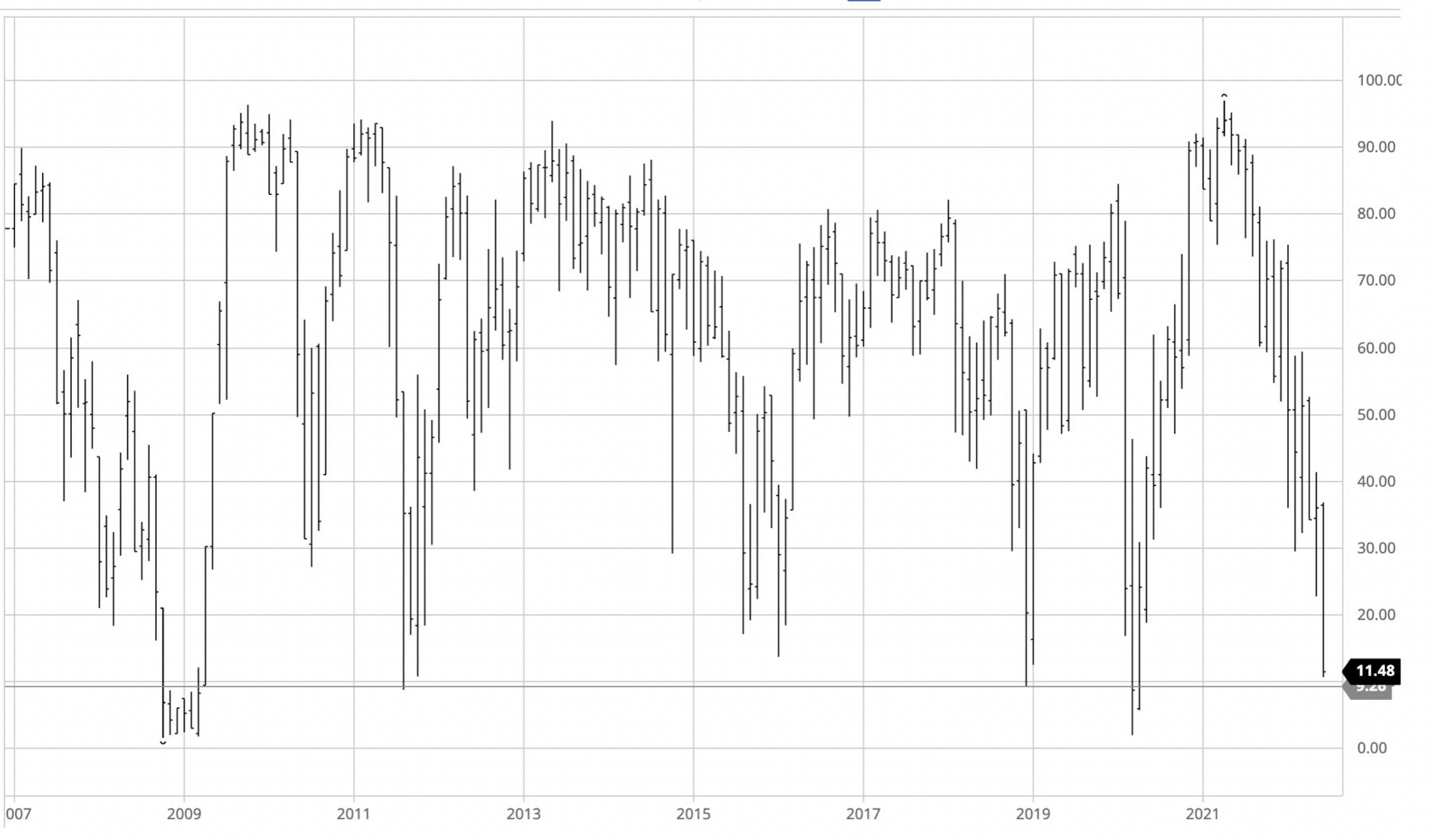

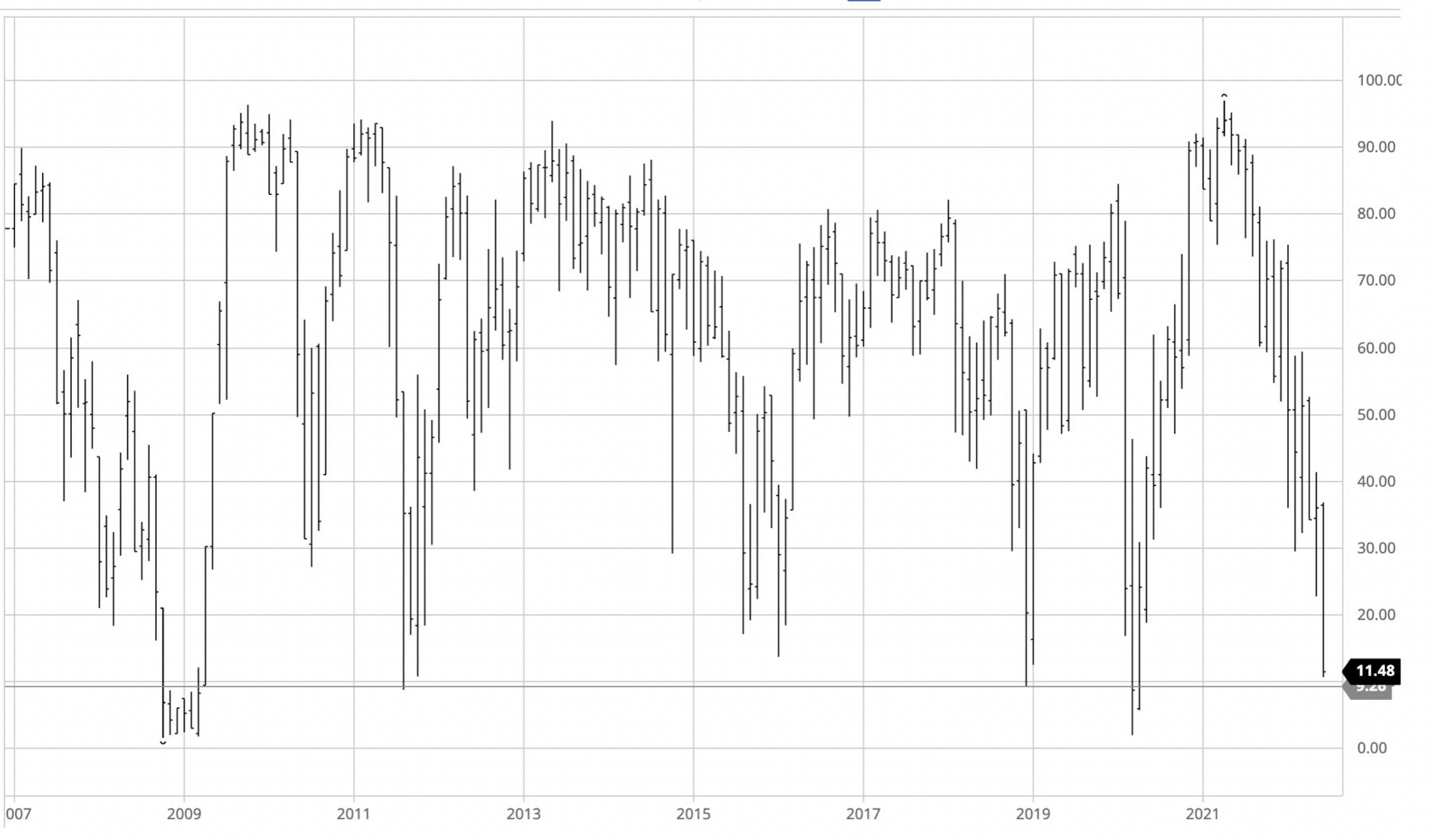

The Challenging Middle - The Big Picture

Percentage of S&P 500 Stocks Above Their 200-Day Moving Average We now enter the most challenging part of the bear market: The tedious middle. This is the portion of the bear cycle where we’ve fallen far and long enough to have scared off the BTFD crowd. There is an excess of bears. More...

Looks like we're getting a nice bounce this morning - take advantage of it.

Whatcha takin gains on?

The Challenging Middle - The Big Picture

Percentage of S&P 500 Stocks Above Their 200-Day Moving Average We now enter the most challenging part of the bear market: The tedious middle. This is the portion of the bear cycle where we’ve fallen far and long enough to have scared off the BTFD crowd. There is an excess of bears. More...ritholtz.com

Looks like we're getting a nice bounce this morning - take advantage of it.

The only advantage I see is being able to unload a looser before the next step down.

The Challenging Middle - The Big Picture

Percentage of S&P 500 Stocks Above Their 200-Day Moving Average We now enter the most challenging part of the bear market: The tedious middle. This is the portion of the bear cycle where we’ve fallen far and long enough to have scared off the BTFD crowd. There is an excess of bears. More...ritholtz.com

Looks like we're getting a nice bounce this morning - take advantage of it.

I'm not seeing any changes politically, inflation, supply chain, climate / weather, virus to warrant any changes. A dribble of propaganda saying this is the bottom and things are improving. Perhaps there is a plateau developing due to the sheeple accepting conditions as the new normal.

I really doubt we are done. I am pessimistic at best of what the Fed says. I really think we need them disbanded. These "experts" have been calling it wrong my entire life.

The only advantage I see is being able to unload a looser before the next step down.

I'm not seeing any changes politically, inflation, supply chain, climate / weather, virus to warrant any changes. A dribble of propaganda saying this is the bottom and things are improving. Perhaps there is a plateau developing due to the sheeple accepting conditions as the new normal.

Tesla Model Y & Model 3 have been named the “most American-made” vehicles in the US by Cars.com. This includes both EVs and ICE vehicles.

Model Y overtook Model 3 for 2022 to be #1.

GM is not even in the top 10.

Model Y overtook Model 3 for 2022 to be #1.

GM is not even in the top 10.

I have been pondering what you said about the housing market. The mega investment funds (Blackrock, etc) have been buying up realestate, REIT's, etc. It appears that they are moving to corner the housing market. Reminds me of the Hunt Brother's back in the early 80's. In that case, big banks stepped in to rescue the brokerage firms. If the plan to corner the housing market fails, this will be too big of a risk for any / all of the banks to save...... Feds ended up taking over all those vacant properties in the late 80's and early 90's and formed the Resolution Trust Corp. Just some thoughts.True, true. I think that one of the biggest risks to investors is that market signals have become mere noise compared to the far more powerful effect of Fed easing, so it has become difficult or impossible to determine the actual value of anything.

There will be much bitching about the Fed crashing the stock market, housing market, auto sales, employment, etc. over the next several months, but that's simply because people aren't accustomed to observing the weak signals produced by anything closer to a properly-functioning free market (and yes, I fully acknowledge that we're still far, far away from that ideal - but removing ZIRP gets us much closer).

Silver Thursday - Wikipedia

More so, the data transmission.

Raw material costs for electric vehicles have doubled during the pandemic

Raw material costs for electric vehicles more than doubled during the coronavirus pandemic, according to a new report Wednesday by AlixPartners.

www.cnbc.com

www.cnbc.com

Raw material costs for electric vehicles have doubled during the pandemic

Raw material costs for electric vehicles more than doubled during the coronavirus pandemic, according to a new report Wednesday by AlixPartners.

I don’t know. This is why I am not using the housing market as an indicator.I have been pondering what you said about the housing market. The mega investment funds (Blackrock, etc) have been buying up realestate, REIT's, etc. It appears that they are moving to corner the housing market. Reminds me of the Hunt Brother's back in the early 80's. In that case, big banks stepped in to rescue the brokerage firms. If the plan to corner the housing market fails, this will be too big of a risk for any / all of the banks to save...... Feds ended up taking over all those vacant properties in the late 80's and early 90's and formed the Resolution Trust Corp. Just some thoughts.

Silver Thursday - Wikipedia

en.wikipedia.org

I believe what the institutions are after is the rent in perpetuity.

Tesla Model Y & Model 3 have been named the “most American-made” vehicles in the US by Cars.com. This includes both EVs and ICE vehicles.

Model Y overtook Model 3 for 2022 to be #1.

GM is not even in the top 10.

Not surprised at this result. Tesla's level of vertical integration gives them a big advantage over the legacy automakers. The amount of offshoring of supplied components by the "domestic" manufacturers over the past two decades has gone largely unnoticed, especially by the patrons of those companies.

I see that the Silverado and Sierra come in at #93 and #94 (out of 95 total) on this list. Yikes.

I'm seeing and hearing a few somewhat minor comments about Dow Chemical. A member of the Dow 30 Group... Starting to sound like the US Government or other forces are trying to either put Dow out of business or force them to move their operation out of the United States.

Dow stock sinks toward 17-month low after Credit Suisse recommends selling

Dow again recognized among the 50 most community-minded companies in the U.S.... ???

Dow stock sinks toward 17-month low after Credit Suisse recommends selling

Dow again recognized among the 50 most community-minded companies in the U.S.... ???

Umicore down 14% after investor day; time to dive in. Might be a good time to restart this position.

www.umicore.com

www.umicore.com

“Umicore 2030 - RISE”, designed to accelerate value creative growth

Chief Executive Officer Mathias Miedreich, along with his Management Board colleagues, will unveil Umicore’s new strategy “Umicore 2030 - RISE”.

Price is down due to market conditions. A good day to short Umicore.Umicore down 14% after investor day; time to dive in. Might be a good time to restart this position.

“Umicore 2030 - RISE”, designed to accelerate value creative growth

Chief Executive Officer Mathias Miedreich, along with his Management Board colleagues, will unveil Umicore’s new strategy “Umicore 2030 - RISE”.www.umicore.com

The last line in the prospectus:

Assuming a gradual PGM price normalization scenario and stable average 2021 battery metal prices

What are PGM?

The PGMs are a family of six transitional metal elements that, structurally and chemically, are very similar. They are: platinum, palladium, rhodium, iridium, ruthenium and osmium. Aside from being the densest known materials, platinum group metals are also highly durable and offer long lifecycles.

Platinum to tank towards $730 on a break under 2021 lows at $905/$897 – Credit Suisse

Platinum is back below its 200-day and 200-week averages to leave the spotlight firmly on the lows of the past year at $905/$897. A break below here w

Tesla Model Y & Model 3 have been named the “most American-made” vehicles in the US by Cars.com. This includes both EVs and ICE vehicles.

Model Y overtook Model 3 for 2022 to be #1.

GM is not even in the top 10.

Elon Musk says he's worried about keeping Tesla out of bankruptcy

Tesla faces billions of dollars in losses from its new plants, supply chain problems and Covid lockdowns — enough for CEO Elon Musk to mention the possibility of bankruptcy in a recent interview.

Elon Musk says he's worried about keeping Tesla out of bankruptcy

Tesla faces billions of dollars in losses from its new plants, supply chain problems and Covid lockdowns — enough for CEO Elon Musk to mention the possibility of bankruptcy in a recent interview.www.cnn.com

Only 10-20 more of those facilities to go between now and 2030 if the 10 million unit/year prophecy is to come true. How many of those are under construction at the moment?

Hyperbole. Tesla was sitting on ~16B cash and virtual no debt. Still on track to hit 1.5M deliveries this year.

Elon Musk says he's worried about keeping Tesla out of bankruptcy

Tesla faces billions of dollars in losses from its new plants, supply chain problems and Covid lockdowns — enough for CEO Elon Musk to mention the possibility of bankruptcy in a recent interview.www.cnn.com

I don't think that Tesla will go bankrupt any time soon, so I agree that it's hyperbole. Musk is just doing that whole "anchoring" bullshit - set the bar really low (or high, depending upon which side of the table you're on) with an unreasonable number, and then you've basically established a new baseline for what's considered "reasonable" later.

In this case, I suspect he knows that the next few quarters won't be great - Austin and Berlin are taking longer than expected to ramp, Shanghai is going down for a while to improve throughput, etc. And we also don't yet know how Tesla's sales will hold up to a recession. It's not unusual for luxury cars to be the first to dip and also the first to recover, but it's not at all clear that Tesla will follow the same pattern.

In this case, I suspect he knows that the next few quarters won't be great - Austin and Berlin are taking longer than expected to ramp, Shanghai is going down for a while to improve throughput, etc. And we also don't yet know how Tesla's sales will hold up to a recession. It's not unusual for luxury cars to be the first to dip and also the first to recover, but it's not at all clear that Tesla will follow the same pattern.

Smith & Wesson’s Stock Price Up By 11% Following Record Year

Smith & Wesson’s stock price is up 11% today as the gun manufacturer records its best fiscal year in its 169-year history.

Smith & Wesson has surpassed the $1 billion mark in terms of revenue, and it is celebrating it by giving full-time employees $1,200 bonuses for and part-timers $600.

Proves there are still some old world values around. Throw a bone to the workers, make a few $$$ for the stock holders without reinventing the wheel...Smith & Wesson has surpassed the $1 billion mark in terms of revenue, and it is celebrating it by giving full-time employees $1,200 bonuses for and part-timers $600.

$1B is pretty small in today's world... I thought they were much larger.Proves there are still some old world values around. Throw a bone to the workers, make a few $$$ for the stock holders without reinventing the wheel...

Small enough to fly under most radar's until the Deep State wants to take away guns. A S&W in your safe is more valuable than money in the bank.$1B is pretty small in today's world... I thought they were much larger.

Shifting topics:

Appearing this plateau is forming... Interesting

A good example is a chart showing ABNB

Last edited:

Wahina, ammo, water, food, and soap will all skyrocket in value when moneys collapse around the world.

Flying EV being developed in China.I’ll probably buy BTC under $10K.

Two killed as Nio electric car falls from third floor office in Shanghai

Pictures show a gaping hole in the side of car maker Nio's Shanghai HQ, and a smashed vehicle below.

I'm in the chemical biz. Dow already has many offshore facilities, they are the largest chemical producer in the world. Dow is a monster (called Do it Our Way in my biz) I don't see them closing any US operations.I'm seeing and hearing a few somewhat minor comments about Dow Chemical. A member of the Dow 30 Group... Starting to sound like the US Government or other forces are trying to either put Dow out of business or force them to move their operation out of the United States.

Dow stock sinks toward 17-month low after Credit Suisse recommends selling

Dow again recognized among the 50 most community-minded companies in the U.S.... ???

Why the decline in stock price ?I'm in the chemical biz. Dow already has many offshore facilities, they are the largest chemical producer in the world. Dow is a monster (called Do it Our Way in my biz) I don't see them closing any US operations.

Similar threads

- Replies

- 13

- Views

- 2K

- Replies

- 0

- Views

- 220

- Replies

- 142

- Views

- 17K