Tesla Model Y delivery dates extend by 3 months within hours of order books opening in Australia.

Join the Hide community

Get access to live stream, lessons, the post exchange, and chat with other snipers.

Register

Download Gravity Ballistics

Get help to accurately calculate and scope your sniper rifle using real shooting data.

Install the app

How to install the app on iOS

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Stock Market

- Thread starter pmclaine

- Start date

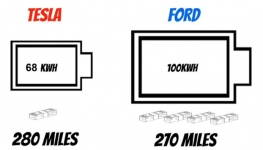

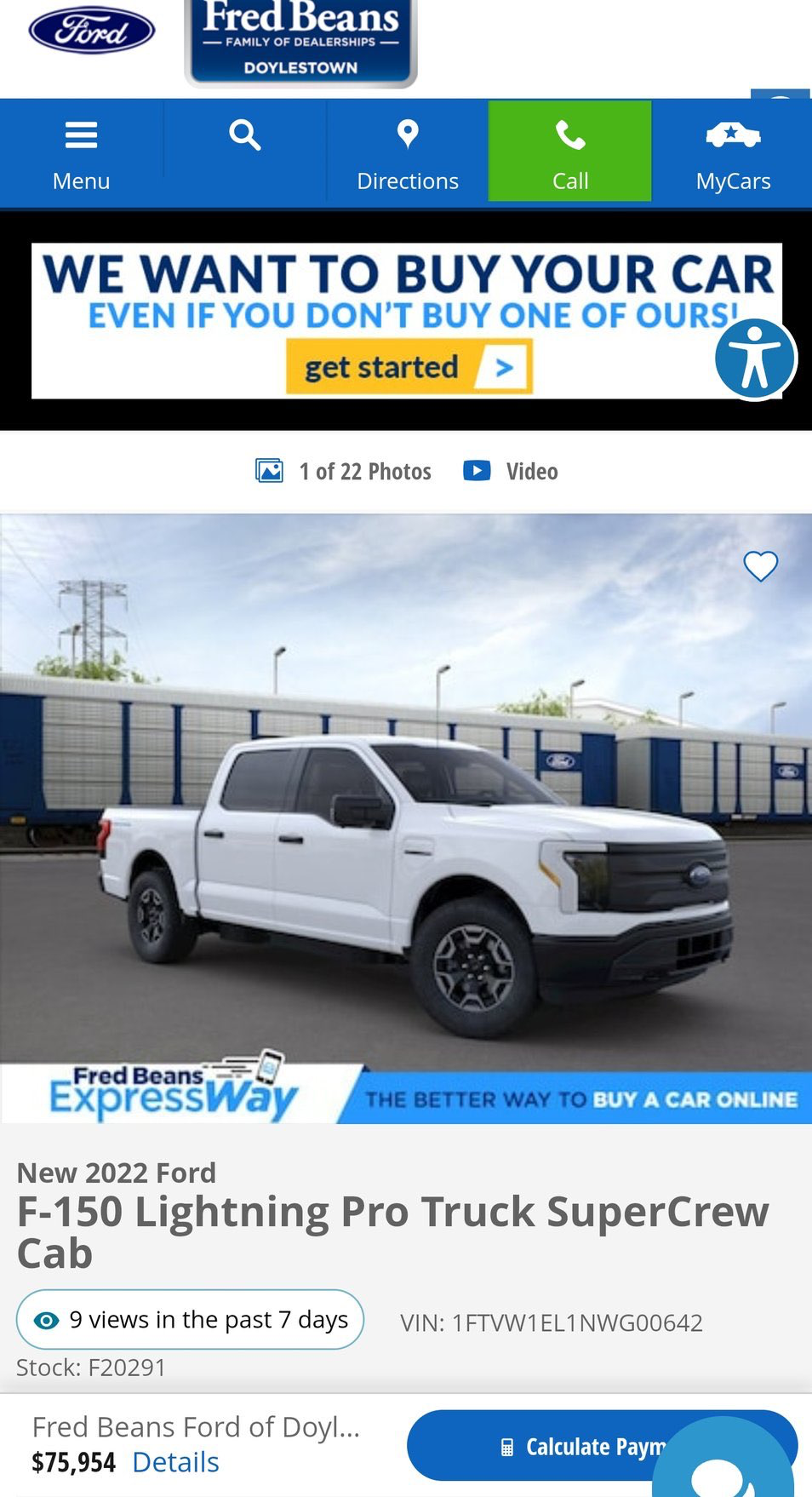

Here is the $40K Lighting marked up $36K. I have said it before, the dealership model will be their downfall.

Send it to Ford. They are very interested in these things.Here is the $40K Lighting marked up $36K. I have said it before, the dealership model will be their downfall.

View attachment 7889676

Asian markets down over 2%...Crude short doing well tonight.

Looks like everything is down except VIX and 10-year bond rates, which now sit roughly at Oct/Nov 2018 levels. It may be instructive to look at stock index levels in that same period, as this could indicate where we are headed absent some sort of rationalization as to why earning expectations would be better today than roughly four years ago. (And if you can rationalize that position, please share your work with the class.)

THe EV sector is going start clearing house. Few will be left standing.

EV maker Electric Last Mile Solutions files for bankruptcy.

U.S. commercial EV maker Electric Last Mile Solutions Inc (ELMS) said on Sunday it is planning to file for Chapter 7 bankruptcy, after a review of its products & commercialization plans.

EV maker Electric Last Mile Solutions files for bankruptcy.

U.S. commercial EV maker Electric Last Mile Solutions Inc (ELMS) said on Sunday it is planning to file for Chapter 7 bankruptcy, after a review of its products & commercialization plans.

THe EV sector is going start clearing house. Few will be left standing.

EV maker Electric Last Mile Solutions files for bankruptcy.

U.S. commercial EV maker Electric Last Mile Solutions Inc (ELMS) said on Sunday it is planning to file for Chapter 7 bankruptcy, after a review of its products & commercialization plans.

With "digital strategy" presentations like this, they deserve to be out of business:

I'm not happy to see them fail, however; the product was good (Class 1-3 urban delivery is a great use case for electrified vehicles), and it would have been nice to see the old AM General Mishawaka plant returned to service.

Now, let's do Nikola.

Hedging is dumb when you can get 20% interest rates on these crypto exchanges. It's free money bro, no risk, guaranteed returns. Just be like me and take out loans on gains to get more gains. Lambos every day.

Lol. This has to be sarcasm.Hedging is dumb when you can get 20% interest rates on these crypto exchanges. It's free money bro, no risk, guaranteed returns. Just be like me and take out loans on gains to get more gains. Lambos every day.

Hedging is dumb when you can get 20% interest rates on these crypto exchanges. It's free money bro, no risk, guaranteed returns. Just be like me and take out loans on gains to get more gains. Lambos every day.

Link to your YouTube channel so I can like and subscribe, please.

lol

www.cnn.com

www.cnn.com

Rebranded McDonald's restaurants are unveiled in Russia | CNN

The golden arches and Big Mac may have gone, but Russians saw 15 McDonald's restaurants reopen on Sunday under new branding and ownership, according to its owner Alexander Nikolaevich Govor.

Makes me think about the movie “Coming to America”lol

Rebranded McDonald's restaurants are unveiled in Russia | CNN

The golden arches and Big Mac may have gone, but Russians saw 15 McDonald's restaurants reopen on Sunday under new branding and ownership, according to its owner Alexander Nikolaevich Govor.www.cnn.com

Currently regretting my decision to move only partially to cash.

Mama said there would be day's like this. Those who have played the Market have been there... More than once.Getting my ass handed to me today. Purchased in ROTH (auto) and added to Tesla and Intel in taxable.

Part of the cycle... I am all about share accumulation.Mama said there would be day's like this. Those who have played the Market have been there... More than once.

My Dad had a saying....... "A man can go broke taking advantage of good deals"............Part of the cycle... I am all about share accumulation.

The worst financial decisions are made on days like today.

Those ideas are incubated in environments of political panic.... Getting re-elected is still Priority # 1...... Even on days like this.GM, Ford, Chrysler-parent Stellantis and Toyota North America on Monday urged Congress to lift a cap on the $7,500 electric vehicle tax credit, citing higher costs to produce zero-emission vehicles, according to a letter seen by Reuters.

Historically, buying at the top of the S&P has always paid off. I am not concerned... as I have said if we have issues long-term; the market is the least of my concern. I rather buy when others are panic selling and sell when others are FOMO.My Dad had a saying....... "A man can go broke taking advantage of good deals"............

The worst financial decisions are made on days like today.

The inflation we see today, drives the earnings of tomorrow.

hmm, i took my pitiful savings out of the market last monday (the 6th).

perhaps this was a good decision?

got laid off and thinking about moving to someplace cheaper...

perhaps this was a good decision?

got laid off and thinking about moving to someplace cheaper...

Historically, buying at the top of the S&P has always paid off. I am not concerned... as I have said if we have issues long-term; the market is the least of my concern. I rather buy when others are panic selling and sell when others are FOMO.

The inflation we see today, drives the earnings of tomorrow.

BlackRock isn’t buying the dip as volatility climbs in sinking stock market

BlackRock isn’t wading into the sinking stock market to buy the dip, as the S&P 500 trades in bear-market territory Monday. What else Wall Street is thinking...

Now do Buffet who is targeting individual stocks like myself.

BlackRock isn’t buying the dip as volatility climbs in sinking stock market

BlackRock isn’t wading into the sinking stock market to buy the dip, as the S&P 500 trades in bear-market territory Monday. What else Wall Street is thinking...www.marketwatch.com

u r screwed down tu five fiffyGetting my ass handed to me today. Purchased in ROTH (auto) and added to Tesla and Intel in taxable.

Added more to my oil short today. Hoping to short it up to the $150’s and and up with an average in the mid $130’s.

I believe europe and ukraine will capitulate by winter, and America will be broke AF by then too. I believe demand destruction will happen faster than expected.

Starting to scale into shorts on other commodities as well. America is a HUGE consumer, and with America’s demand down, I believe most commodities will follow the same path as lumber.

I believe europe and ukraine will capitulate by winter, and America will be broke AF by then too. I believe demand destruction will happen faster than expected.

Starting to scale into shorts on other commodities as well. America is a HUGE consumer, and with America’s demand down, I believe most commodities will follow the same path as lumber.

People laughed when I said this a number of months ago.Currently regretting my decision to move only partially to cash.

I am laughing my ass off at all the geniuses.

Last Mile should have gone under a while ago. They never had a chance to scale and are a laughing stock in the EV space.THe EV sector is going start clearing house. Few will be left standing.

EV maker Electric Last Mile Solutions files for bankruptcy.

U.S. commercial EV maker Electric Last Mile Solutions Inc (ELMS) said on Sunday it is planning to file for Chapter 7 bankruptcy, after a review of its products & commercialization plans.

The whole transportation sector will be a shell of itself soon enough

I went to cash back in December. It wasn't genius, it was fear and luck.People laughed when I said this a number of months ago.

I am laughing my ass off at all the geniuses.

It was a little like that for me as well. It took a bit of nerve as well.I went to cash back in December. It wasn't genius, it was fear and luck.

My view is that it doesn't take a genius to understand the ridiculously low probability of successfully restarting a global economy after a complete shutdown.

Especially when an utterly corrupt and brainless administration like Biden's is in charge.

Now do Buffet who is targeting individual stocks like myself.

Berkshire Hathaway Portfolio Tracker

I sold most of the SQQQ calls I had on Friday, should have held them. Bought some TSLA, BYDDF, and LEU today. we have to see a face ripping short squeeze soon

Blackrock:

We’re not buying the stock dip because valuations haven’t really improved, there’s a risk of Fed overtightening, and margins challenge corporate earnings.

We’re not buying the stock dip because valuations haven’t really improved, there’s a risk of Fed overtightening, and margins challenge corporate earnings.

Weekly market commentary | BlackRock Investment Institute

Stay tuned for insights on hot topics and latest trends in the financial market via the Weekly commentary by the BlackRock Investment Institute.

www.blackrock.com

I know the stock markets and other markets keep plummeting... Do not panic my people, this only mean one thing... Here is another opportunity to save some more investment money, when the markets are back on another bull run, you'll have some money to catch the big ride. Cheers !

Correct me if I am wrong but PE valuations have dropped as of a % more in QQQ today than the dot com burst.Blackrock:

We’re not buying the stock dip because valuations haven’t really improved, there’s a risk of Fed overtightening, and margins challenge corporate earnings.

Weekly market commentary | BlackRock Investment Institute

Stay tuned for insights on hot topics and latest trends in the financial market via the Weekly commentary by the BlackRock Investment Institute.www.blackrock.com

Correct me if I am wrong but PE valuations have dropped as of a % more in QQQ today than the dot com burst.

If so, it's simply a reflection of how overvalued the market was at the Nov 2021 peak. Remember that the dot-com bubble was fueled by "normal" over-exuberance, and not several trillion of excess printing.

The base economy circa 2000 was actually pretty damn good:

- We had a surplus in federal spending (artificially inflated by Boomers making SS payments into the general fund, but still better than the trillion-dollar yearly deficits of the last 10+ years)

- Unemployment was low

- Productivity was high as the PC and Internet fully infiltrated office and manufacturing plants (added substantially by "lean" production principles such as TPS and quality systems like ISO9001)

- The outsourcing trend had only begun, so there was huge upside available in supply chain optimization

- Commodity prices were low

Looking back, it was an entirely different era.

Strange times..... Things are not as they seem...Correct me if I am wrong but PE valuations have dropped as of a % more in QQQ today than the dot com burst.

Blackrock:

We’re not buying the stock dip because valuations haven’t really improved, there’s a risk of Fed overtightening, and margins challenge corporate earnings.

Weekly market commentary | BlackRock Investment Institute

Stay tuned for insights on hot topics and latest trends in the financial market via the Weekly commentary by the BlackRock Investment Institute.www.blackrock.com

So we're not yet at Warren Buffett's "blood in the streets" moment. If the Fed continues to tighten, then we'll eventually get to the point where certain individual stocks have been monkey-hammered into becoming must-buys because they will either hold up better in a recession than their peers (Wal-Mart feels like a good example), because they have low debt load and thus won't suffer from margin erosion due to debt service costs, or because their book value is so much higher than their market cap that they become an attractive target for acquisition and break-up/spin-off/wind-down.

If the Fed caves to political pressure and relents on the hikes, then it's an entirely different market that will ultimate value companies which will thrive in persistent inflation (probably not "hyperinflation" popular in dystopian fiction, but rather persistent 8-10% yearly inflation for the next half-decade). In this case, debt service costs potentially become negligible and pricing power is the entire game. It seems like that would favor certain commodity and energy stocks.

These are two entirely different scenarios.

Strange times..... Things are not as they seem...

True, true. I think that one of the biggest risks to investors is that market signals have become mere noise compared to the far more powerful effect of Fed easing, so it has become difficult or impossible to determine the actual value of anything.

There will be much bitching about the Fed crashing the stock market, housing market, auto sales, employment, etc. over the next several months, but that's simply because people aren't accustomed to observing the weak signals produced by anything closer to a properly-functioning free market (and yes, I fully acknowledge that we're still far, far away from that ideal - but removing ZIRP gets us much closer).

LOL.... FedEx creating their own "Dead Cat Bounce".... Can't pull that trick too often or the player's will bite them in the ass.

www.cnbc.com

www.cnbc.com

FedEx adds two directors to board in agreement with D.E. Shaw

U.S. delivery firm FedEx on Tuesday raised its quarterly dividend by more than 50%.

Similar threads

- Replies

- 13

- Views

- 2K

- Replies

- 0

- Views

- 213

- Replies

- 142

- Views

- 17K