He can't just gift $10 billion to his people. "It's just business".... He bumps the share price up, they unload all of their shares (puts / calls, etc ) and everyone walks away happy.... TSLA becomes another manufacturer.If Tesla spends $5-10B on share repurchases instead of new factories, investment in product, and building out its supply chain, they're done with this whole "growth stock" story and become just another low-/mid-volume luxury manufacturer. I don't get this relentless pursuit of further share price increases when the stock has already priced in a bunch of miracles that aren't going to happen without boatloads of capital.

Join the Hide community

Get access to live stream, lessons, the post exchange, and chat with other snipers.

Register

Download Gravity Ballistics

Get help to accurately calculate and scope your sniper rifle using real shooting data.

Install the app

How to install the app on iOS

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Stock Market

- Thread starter pmclaine

- Start date

You do realize that Tesla is spending for R&D and Capex in every possible way that they can think of and still cash flowed >$3B and added >$2B in cash. You act as if they are moving slowly because they also have not added billions in debt to finance activities…If Tesla spends $5-10B on share repurchases instead of new factories, investment in product, and building out its supply chain, they're done with this whole "growth stock" story and become just another low-/mid-volume luxury manufacturer. I don't get this relentless pursuit of further share price increases when the stock has already priced in a bunch of miracles that aren't going to happen without boatloads of capital.

In the earnings call, they noted that spending $5B-$10B would have zero impact on R&D plus CAPEx.

Returning shareholder value is the number one goal of a publicly traded company. Using cash or borrowing to do a share repurchase is advantageous right now due to the current stock price and outlook.

Oh, it's obvious what this whole thing is - a way to absorb the shares that Elon musk unload to fund the Twitter deal. Tesla fans can't reconcile that with the growth-to-the-moon narrative, so now we're just making up stuff about why $10B really isn't that important to a company that has only $20B of cash in the bank and $12B of FCF each year, and yet needs about $100B in CapEx just to fulfill the promises that are already priced into the current share price.

You do realize that free cash flow subtracts out capital ex, right?Oh, it's obvious what this whole thing is - a way to absorb the shares that Elon musk unload to fund the Twitter deal. Tesla fans can't reconcile that with the growth-to-the-moon narrative, so now we're just making up stuff about why $10B really isn't that important to a company that has only $20B of cash in the bank and $12B of FCF each year, and yet needs about $100B in CapEx just to fulfill the promises that are already priced into the current share price.

Correct, it off sets dilution… in any form… is beneficial.

The growth to the moon… you are right. 50% CAGR for the expected 4+ years is difficult to imagine. Currently trading at an estimated 50 PE 2022 and 37 PE 2023. Such an expensive stock.

You do realize that Tesla is spending for R&D and Capex in every possible way that they can think of and still cash flowed >$3B and added >$2B in cash. You act as if they are moving slowly because they also have not added billions in debt to finance activities…

I said nothing about going into debt, although selling shares (which even Elon admits are overpriced) to further fund R&D and CapEx would be wise.

You did make a key statement - "in every possible way that they can think of". If that's true, then management isn't cut out for the stated task, and shareholders should run for the doors.

Tesla's already fulfilled its promise of enriching shareholders by making outlandish promises of 50% y-y growth and 10M units/yr seven years from now (7x the current production rate). Now shareholders should obligate the company to follow up on that promise, or else the company should be priced accordingly according to the net present value of the future profits generated by the existing footprint. That'd be a quick 80% haircut to the existing share price.

Colin RuschI said nothing about going into debt, although selling shares (which even Elon admits are overpriced) to further fund R&D and CapEx would be wise.

The operating leverage has been pretty impressive here. And I’m curious about areas where you could invest in an incremental way, whether it’s on the R&D side or on the sales side to accelerate growth or cost reduction, or should we be thinking about this level of spend on a go-forward basis and some significant operating leverage as you scale up from here?

Zachary Kirkhorn

Yes. I mean, our operating leverage has improved quite a bit. It’s the lowest this quarter, I think, ever, and by a decent amount, OpEx as a percentage of revenue. I mean, our forecast is that it will keep reducing. I mean, I think the way to think about it is our total amount of operating expenses will slowly tick up as the company grows. It’s very hard to keep it flat with the rapid growth of the Company, but it’s growing much slower. So some amount of growth there, but the top line of the business is growing so quickly. So, I think there continues to be enormous opportunity to improve the overhead efficiency of the business, and we’re seeing it.

Elon Musk

Yes. Look, we are in the -- at least for now, quite in a good position of -- we’re investing in everything we can think of to possibly invest in, and we’re still generating cash. So, I guess, it gets a pretty good place to be.

Zachary Kirkhorn

Yes. I mean, how many R&D programs are we running in parallel right now?

Elon Musk

People don’t even know old R&D stuff for that. There are some of it, but a bunch of it.

Zachary Kirkhorn

I also don’t think cash is a good gauge of how much R&D you’re doing.

Elon Musk

No. It isn’t because like it’s not like -- it’s not like engineers -- they’re not generic. So it’s just like if you could you spend $5 billion or $10 billion, that will like -- that your actual R&D -- useful product ship will be proportionate to that. It’s just not true. Engineers on -- coming off some assembly line like cookies or something.

Zachary Kirkhorn

Until we get optimistic.

Elon Musk

Get optimistic. Don’t change things. What matters is where are the most brilliant people working? And Tesla remains the -- Tesla and SpaceX are two companies where the smartest engineers want to work.

Zachary Kirkhorn

I mean, like we don’t have to spend billions of dollars to invest in the future and invent the future. Engineers are also cost conscious. And we don’t just burn the money out the window when we’re trying to do R&D. I wouldn’t stop looking at like R&D as a cash investment for...

Elon Musk

I think 1 nickel Tesla is frankly worth an infinite number of dollars. You could have like a -- almost same the number of credit shares and they would not be able to do work 1 nickel of Tesla we can do. You can’t make it up in volume.

So the stock is priced like a growth company, but the leaders are talking the same game as a mature product company in the "harvest" phase. Got it.

I actually agree with much of what Elon is saying here regarding the difficulty of scaling engineering talent, and I admire him for having the courage to say it. It's the investors that are puzzling me at this point. If the company lacks the ability to efficiently deploy capital in pursuit of its growth goals to the point that the best use is a share buy-back, then don't price the company as if it's going to grow infinitely.

I actually agree with much of what Elon is saying here regarding the difficulty of scaling engineering talent, and I admire him for having the courage to say it. It's the investors that are puzzling me at this point. If the company lacks the ability to efficiently deploy capital in pursuit of its growth goals to the point that the best use is a share buy-back, then don't price the company as if it's going to grow infinitely.

From Wall Street Breakfast:

"More investigative journalism from the Wall Street Journal is reporting on how federal officials working on the government response to COVID-19 made some "well-timed financial trades" when markets tanked and rallied at the beginning of the pandemic. In fact, March 2020 was the most active month for trading by officials across the federal government, including the Department of Health and Human Services, while some officials even started trading in January 2020, when the U.S. public was largely unaware of the threat posed by the coronavirus.

Some examples: Then-Transportation Secretary Elaine Chao scooped up more than $600K in two stock funds while her agency was involved in the pandemic response, while her husband, Republican Sen. Mitch McConnell, led negotiations for a market-enhancing stimulus bill. Similarly, a deputy to top health official Anthony Fauci, Hugh Auchincloss, sold off thousands of dollars in stock funds after learning about pandemic risks in January."

"More investigative journalism from the Wall Street Journal is reporting on how federal officials working on the government response to COVID-19 made some "well-timed financial trades" when markets tanked and rallied at the beginning of the pandemic. In fact, March 2020 was the most active month for trading by officials across the federal government, including the Department of Health and Human Services, while some officials even started trading in January 2020, when the U.S. public was largely unaware of the threat posed by the coronavirus.

Some examples: Then-Transportation Secretary Elaine Chao scooped up more than $600K in two stock funds while her agency was involved in the pandemic response, while her husband, Republican Sen. Mitch McConnell, led negotiations for a market-enhancing stimulus bill. Similarly, a deputy to top health official Anthony Fauci, Hugh Auchincloss, sold off thousands of dollars in stock funds after learning about pandemic risks in January."

A question for you guys:

Is lithium going to be "something" or is it just a stepping stone? Asking from an investment point of view.

I have no dog in this fight, just an example:

SIGMA Lithium Corporation (NASDAQ: SGML) (TSXV: SGML), dedicated to powering the next generation of electric vehicles with environmentally sustainable and high-purity lithium, recently provided a corporate update from a transformative second quarter of 2022.

Sigma Lithium ended the quarter with C$123.3 million in cash and cash equivalents as of June 30, 2022, providing sufficient liquidity to advance the Grota do Cirilo Project (the "Project") into production. Phase 1 construction at the Project remains on track with commissioning expected to begin December 2022.

Is lithium going to be "something" or is it just a stepping stone? Asking from an investment point of view.

I have no dog in this fight, just an example:

SIGMA Lithium Corporation (NASDAQ: SGML) (TSXV: SGML), dedicated to powering the next generation of electric vehicles with environmentally sustainable and high-purity lithium, recently provided a corporate update from a transformative second quarter of 2022.

Sigma Lithium ended the quarter with C$123.3 million in cash and cash equivalents as of June 30, 2022, providing sufficient liquidity to advance the Grota do Cirilo Project (the "Project") into production. Phase 1 construction at the Project remains on track with commissioning expected to begin December 2022.

Environmentally sustainable lithium - how its mined isn't sustainable. And it aint coming from here, so there is still the international exposure issue. Especially with the strong dollar.A question for you guys:

Is lithium going to be "something" or is it just a stepping stone? Asking from an investment point of view.

I have no dog in this fight, just an example:

SIGMA Lithium Corporation (NASDAQ: SGML) (TSXV: SGML), dedicated to powering the next generation of electric vehicles with environmentally sustainable and high-purity lithium, recently provided a corporate update from a transformative second quarter of 2022.

Sigma Lithium ended the quarter with C$123.3 million in cash and cash equivalents as of June 30, 2022, providing sufficient liquidity to advance the Grota do Cirilo Project (the "Project") into production. Phase 1 construction at the Project remains on track with commissioning expected to begin December 2022.

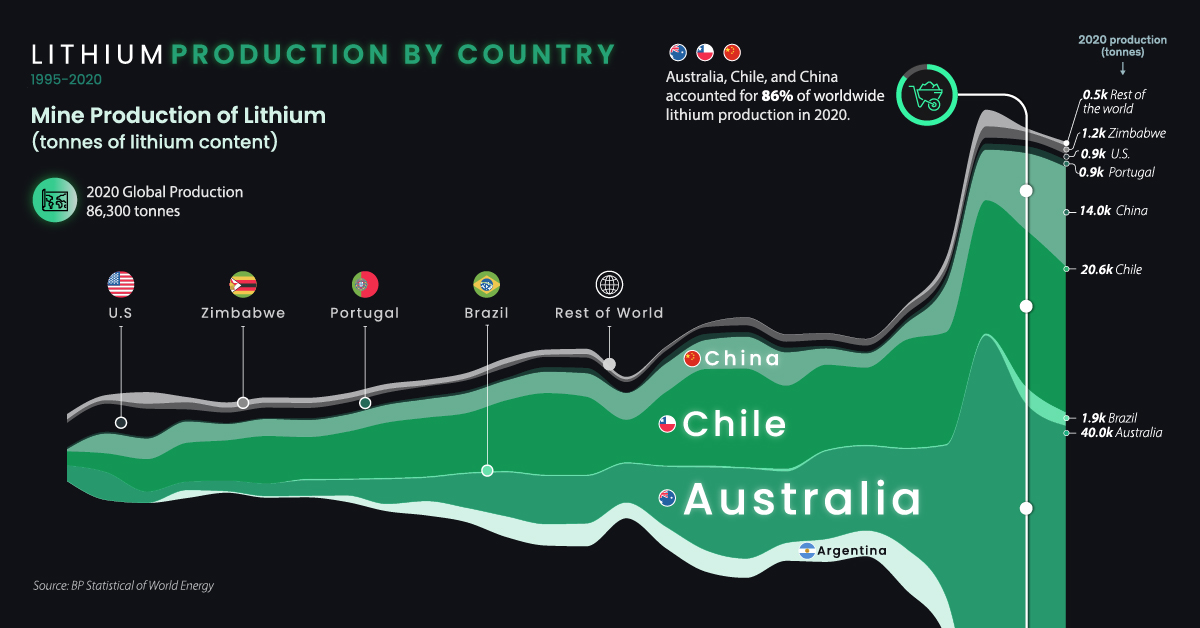

View attachment 7980377

Charted: Lithium Production by Country (1995-2020)

Global lithium production has more than doubled since 2016. This chart visualizes 25 years of lithium production by country.

www.visualcapitalist.com

www.visualcapitalist.com

How is 37x forward PE priced at infinity growth? Also stop acting like Tesla could deploy $100B in capex today with sufficient supply and demand to feed it.So the stock is priced like a growth company, but the leaders are talking the same game as a mature product company in the "harvest" phase. Got it.

I actually agree with much of what Elon is saying here regarding the difficulty of scaling engineering talent, and I admire him for having the courage to say it. It's the investors that are puzzling me at this point. If the company lacks the ability to efficiently deploy capital in pursuit of its growth goals to the point that the best use is a share buy-back, then don't price the company as if it's going to grow infinitely.

I'm trying to follow the different thoughts.

I'll throw some of mine into the Matrix, in no special order:

I'll throw some of mine into the Matrix, in no special order:

- It "feels" like the world is being pushed, not lead towards the EV / Renewables / Sustainable arena while the oil, coal / natural gas arena is getting bashed over the head.... Why ?

- Watching the UK / Liz Truss / Boris Johnson circus as America follows it down the same rabbit hole. When America has bottomed out on this recession will there be a leader / leaders who call "Bull Shit" on all of this Go Green movement and revert America back to oil / natural gas / coal / nuclear ?

- The other thought is will no one do anything and this recession continue for 5+ years ?

What happens to Intel after China invades Taiwan? To be, the recent actions of the Biden adminstration is forcing China's hand to grasp at what they can in this space.

Are you speaking Intel (INTC) or Intel (Intelligence) ?What happens to Intel after China invades Taiwan? To be, the recent actions of the Biden adminstration is forcing China's hand to grasp at what they can in this space.

In either case, nothing is going to happen to either one...

_____________

Taiwan's economy is export-oriented. Exports account for around 70 percent of total GDP and its composition have changed from predominantly agricultural commodities to industrial goods (now 98%) during the past 40 years. Main exports products are: electronics (33.1% of total), information, communication and audio-video products (10.8%), base metals (8.8%), plastics & rubber (7.1%), machinery (7.5 percent). Main exports partners are Mainland China & Hong Kong (40% of total), ASEAN countries (18.3%), USA (12%), Europe (9%) and Japan (7%).

_____________

The main trading partner's of Taiwan is China and Hong Kong. Intel Corp. formally broke ground Sept. 9 on a $20-billion project to build two semiconductor chip manufacturing plants in central Ohio. Company leaders and government officials praised the project as an example of investments to boost domestic chip production after decades of U.S. market share declines.

China will take over Taiwan without firing the first shot... They have been doing that for 3,000 years.

Intel Ohio Fab Breaks Ground, Leading Chip Plant Project Wave

The project will support roughly 7,000 construction jobs, according to Intel.

So.... Does Cathie Wood have a crystal ball or is she simply "Rolling the Dice" while playing with other people's money ? Perhaps she is positioned "Against the Box" and will take profit and cover shorts due to volatility..... IDK

www.marketwatch.com

www.marketwatch.com

Cathie Wood Is Buying Tesla Stock. She’s Been Right About It This Year.

The ARK Innovation ETF has been buying the dip in the EV stock after selling it when shares were between $300 and $350 earlier this year.

Thanks for sharing.... Those are some impressive numbers.... Hopefully you can retire one of these days.

Welcome to the real world and not the make believe world. Standing by for 2023...

100% fact. META takes a 25% hit, Amazon takes a 20% hit, and the market barely budged.

100% fact. META takes a 25% hit, Amazon takes a 20% hit, and the market barely budged.

It was fascinating to see APPL basically stay flat after beating earnings. That's telling.

I think we are in the first inning. The dip under and repeated throw over 30k tells me there isn’t capitulation yet. But I feel like the cattle smell the rain in the storm cloud. Maybe I am wrong and we will go to 40k, but I don’t think so.It was fascinating to see APPL basically stay flat after beating earnings. That's telling.

I think we are in the first inning. The dip under and repeated throw over 30k tells me there isn’t capitulation yet. But I feel like the cattle smell the rain in the storm cloud. Maybe I am wrong and we will go to 40k, but I don’t think so.

Yeah, this doesn't look like capitulation to me:

Get back to me when the PE drops even a touch below the historical norms, or the Fed announces a pivot to QE Forever & Ever. (Unfortunately, I think one of those things is more likely than the other, and it's not the one that makes me believe we're finally going to swallow bitter medicine today in order to feel better tomorrow.)

So now there is a semiconductor and chip glut?

www.zerohedge.com

www.zerohedge.com

TSMC, the world’s largest contract chipmaker, faces reduced orders from four of its largest customers, reflecting slowing global demand. JPMorgan Chase said in a report in early September that AMD, Nvidia, Qualcomm and MediaTek slashed chip orders with TSMC.

Other semiconductor companies are also facing tough conditions. AMD lowered its revenue forecast for the third quarter, citing significant weakening in the PC market. Intel, Nvidia and Micron Technology all issued subdued outlooks.

In the first half of 2022, macroeconomic headwinds and a number of “black swan” factors combined to cause consumer electronics demand to plummet, with smartphones and PCs bearing the brunt. Micron predicted that global PC shipments will decline by 10 per cent to 20 per cent in 2022, while the global smartphone market will decline by less than 10 per cent.

The Semiconductor Shortage Just Quickly Became An Inventory Glut | ZeroHedge

ZeroHedge - On a long enough timeline, the survival rate for everyone drops to zero

Cathie Woods is right. We are heading into large inventory builds that will be sold through distressed channels. However, without employment and wages taking a hit, I don’t see inflation dropping significantly.

As seasons change, I always throw out worn Pocket T shirts and replace them with a few new ones... I usually get about 3 winters out of Long Sleeve Pocket T's.... I buy a heaver weight T... Recently I have been looking at basic Carhartt and LL Bean T's... Plain Jane items like this never change. Today these T's are selling for $30 +/-... Add in shipping and soon a long sleeve pocket T is around $35... A price increase of 20% - 30% from last winter.

Bank of America CEO labels as "Mitigation"..... I label it as "Inflation".

www.cnbc.com

www.cnbc.com

Bank of America CEO labels as "Mitigation"..... I label it as "Inflation".

U.S. economy seeing a 'mitigation' in growth not a slowdown, says Bank of America CEO

Consumers and corporations have strong underlying credit and are not holding back, Brian Moynihan said.

We have a Government running on a champagne budget and a citizenry running on a beer budget. Until the US Government tightens it's belt, inflation will continue. Just one example:Cathie Woods is right. We are heading into large inventory builds that will be sold through distressed channels. However, without employment and wages taking a hit, I don’t see inflation dropping significantly.

As of Oct 21, 2022, the average annual pay for a Federal Employee in the United States is $108,440 a year.

As of Oct 19, 2022, the average annual pay for the Private Sector jobs category in the United States is $81,796 a year. Just in case you need a simple salary calculator, that works out to be approximately $39.33 an hour.

So now there is a semiconductor and chip glut?

Yes, and it was the easiest thing to predict. Everyone in the industry - and I mean everyone - had placed double- and triple-orders with the idea that they'd just cancel a redundant order or broker the parts at a profit when/if they arrived. Do that into the face of sagging demand and now you've got a glut. It's happened before (just not as broadly) which is why the industry was so reluctant to add capacity.

Now watch what happens as this turns into a glut of consumer products just as demand craters. Should be good for bargain hunters or those that just like to watch the world burn.

Are you forecasting a "bottom" ?Intel up 10% after earnings. I’ll have to look at their results later.

INTC - 2 years

I don't know if the bottom is in, but Intel might be one of the first stocks to look at buying once things begin to turn around. The PE is currently around 5.5, which of course is rather low relative to the broader market. But first, the company will need to articulate how it intends to move forward from its PC-centric focus. They've mentioned getting back into the automotive market (Intel made some of the first Flash non-volatile memory chips for GM ECMs back in the 90s), but I've yet to see any solid plans.

Took a vacation day today and am running the roads with my Fiancé. Every single parking lot is packed. Academy, Target, Micheals, Costco, Restaurants, etc.

Trying to spend the cash before it's worthless?Took a vacation day today and am running the roads with my Fiancé. Every single parking lot is packed. Academy, Target, Micheals, Costco, Restaurants, etc.

everyone cashing out on the appreciation on their houses, MAX the bitch out, wait for the crash, buy your neighbors house for cheap, and BK the one you're in.

CA model, max out $$ on CA house, buy additional house in TX, declare BK IN TX (since TX lets you keep 1 house), move to texas with new house and you are above water again. WSJ did an article on this back in 2008 ish

CA model, max out $$ on CA house, buy additional house in TX, declare BK IN TX (since TX lets you keep 1 house), move to texas with new house and you are above water again. WSJ did an article on this back in 2008 ish

If that is the belief, they should be leveraging up and buying tangible assets.Trying to spend the cash before it's worthless?

My Apple calls looking mighty fine. Going to take those idiots shares.

Here is the secret to most of the Big Box stores... Go into the store just about the time the 5 pm, working crowd is arriving at their home. Costco looks like a Ghost town in the evening. Home Depot has people stumbling over each other to help you find things and most any grocery store has a half empty parking lot.Took a vacation day today and am running the roads with my Fiancé. Every single parking lot is packed. Academy, Target, Micheals, Costco, Restaurants, etc.

I think Intel has had their hay day. I was building fabs for them when they moved on to the Ronler Acres Campus.... Over the years they began to bring in Green Card workers from India... As time went on they began to offer the old white folks some pretty good retirement perks to "Early Out".... About that time the Green Cards had been there long enough to start to move into supervision. As different teams got a new Supervisor from India the moral went down. Many instances of a male supervisor from India berating a woman on his team to the point they left at the end of the shift and were crying all the way to the parking lot... That did not go over well with the husband... Connect the dots. Google up some Intel articles and note that the Campus # 1 honcho is from India.... Some of the last lay off's were sent in an inner office email and they basically said.... You can voluntarily take this severance package or you can continue to work and risk getting a lay off with no perks at all.I don't know if the bottom is in, but Intel might be one of the first stocks to look at buying once things begin to turn around. The PE is currently around 5.5, which of course is rather low relative to the broader market. But first, the company will need to articulate how it intends to move forward from its PC-centric focus. They've mentioned getting back into the automotive market (Intel made some of the first Flash non-volatile memory chips for GM ECMs back in the 90s), but I've yet to see any solid plans.

Craig Barrett (ex - CEO Intel) played his cards right when he parted ways with Intel. The end of an era. Moved to Montana and the CB Ranch.

Founded by two really sharp white guys..... 50+ years later operated by people from India...... How's that work out ?

https://www.intel.com/content/www/us/en/history/virtual-vault/articles/intels-founding.html

Triple Creek Ranch | About Us

An oasis of luxury in the Montana wilderness. Triple Creek Ranch is an intimate, luxury ranch resort designed for adults. Situated among the towering pines on the southern side of Trapper Peak, the highest mountain in the Bitterroot Mountain Range of Western Montana, this unforgettable retreat...

you just described damn near every corporate IT environment. IT has been going downhill at a rate that has a formula tied to green cards and language.I think Intel has had their hay day. I was building fabs for them when they moved on to the Ronler Acres Campus.... Over the years they began to bring in Green Card workers from India... As time went on they began to offer the old white folks some pretty good retirement perks to "Early Out".... About that time the Green Cards had been there long enough to start to move into supervision. As different teams got a new Supervisor from India the moral went down. Many instances of a male supervisor from India berating a woman on his team to the point they left at the end of the shift and were crying all the way to the parking lot... That did not go over well with the husband... Connect the dots. Google up some Intel articles and note that the Campus # 1 honcho is from India.... Some of the last lay off's were sent in an inner office email and they basically said.... You can voluntarily take this severance package or you can continue to work and risk getting a lay off with no perks at all.

Craig Barrett (ex - CEO Intel) played his cards right when he parted ways with Intel. The end of an era. Moved to Montana and the CB Ranch.

Founded by two really sharp white guys..... 50+ years later operated by people from India...... How's that work out ?

https://www.intel.com/content/www/us/en/history/virtual-vault/articles/intels-founding.html

Triple Creek Ranch | About Us

An oasis of luxury in the Montana wilderness. Triple Creek Ranch is an intimate, luxury ranch resort designed for adults. Situated among the towering pines on the southern side of Trapper Peak, the highest mountain in the Bitterroot Mountain Range of Western Montana, this unforgettable retreat...www.triplecreekranch.com

Argo AI, an autonomous vehicle startup that burst on the scene in 2017 stacked with a $1 billion investment, is shutting down — its parts being absorbed into its two main backers: Ford and VW, according to people familiar with the matter.

During an all-hands meeting Wednesday, Argo AI employees were told that some people would receive offers from the two automakers, according to multiple sources who asked to not be named. It was unclear how many would be hired into Ford or VW and which companies will get Argo’s technology.

__________________________________________________________________________________________________________________________________________________

Verizon to layoff ~31,000 employees or 22% of its workforce.

__________________________________________________________________________________________________________________________________________________

Meanwhile, General Motors said it was "temporarily" suspending advertising on Twitter as it evaluates the platform's new direction.

During an all-hands meeting Wednesday, Argo AI employees were told that some people would receive offers from the two automakers, according to multiple sources who asked to not be named. It was unclear how many would be hired into Ford or VW and which companies will get Argo’s technology.

__________________________________________________________________________________________________________________________________________________

Verizon to layoff ~31,000 employees or 22% of its workforce.

__________________________________________________________________________________________________________________________________________________

Meanwhile, General Motors said it was "temporarily" suspending advertising on Twitter as it evaluates the platform's new direction.

Well... let's just post it all

Firms that have announced layoffs in October:

High-profile firms that cut staff in September include:

Firms that have announced layoffs in October:

- Nebraska-based e-commerce platform Spreetail has laid off an unspecified number of workers for at least the second time since August, according to one LinkedIn member.

- Mindbody, a Central Coast-based software company, is cutting jobs for the second time in two years.

- Swiss banking giant Credit Suisse is planning to cut about 9,000 positions over the next three years, after reporting a $4 billion net loss in the third quarter, according to The Wall Street Journal.

- Autonomous vehicle startup Argo AI is shutting down operations, impacting roughly 2,000 workers.

- Real-estate platform Zillow cut 300 jobs in its second round of layoffs this year.

- Database management giant Oracle is "quietly" letting go of employees for the second time since August, according to Business Insider.

- Cybersecurity startup Snyk cut 14% of its workforce, about 200 jobs.

- Mental health startup Cerebral laid off 20% of its staff in a major restructuring.

- Dutch technology giant Philips is cutting about 4,000 jobs — 5% of its global workforce — after five consecutive quarters of declining sales.

- Philadelphia-based delivery startup Gopuff let go of as many as 250 workers in its third round of cuts this year, according to Bloomberg.

- Boston internet provider startup Starry announced the layoffs of roughly half its staff, including 175 workers in Massachusetts.

- LinkedIn members are sharing about a second round of layoffs at Sendoso, a direct mail and gifting platform, since the beginning of June.

- LinkedIn members also have shared about being let go at Khoros, an Austin, Texas-based community management platform, and Careerbuilder, a Chicago-based employment website.

- Microsoft, LinkedIn's parent company, let go of about 1,000 employees across multiple divisions, Axios reported.

- News aggregator Flipboard will lay off 21% of its staff (24 employees), according to an exclusive from Axios.

- Computer software company and maker of SurveyMonkey Momentive.ai announced an unspecified number of job cuts in a post on LinkedIn.

- Video game publisher Take-Two is closing its studio in New York City, resulting in 65 layoffs, Bloomberg reported.

- Cloud tech giant Oracle let go of 201 employees in its Redwood City, California, office.

- Customer relationship management platform Salesforce cut an unspecified number of jobs, according to Protocol.

- Weight-loss app Noom laid off employees for the second time this year, cutting about 500 jobs, the majority in coaching.

- Media giant Gannett is cutting costs by having employees take a week of compulsory unpaid leave, offering voluntary buyouts and temporarily suspending 401(k) contribution matches.

- Brex, a corporate spend-management startup, laid off 136 people (11% of its staff), TechCrunch reported. The company was valued at $12.3 billion in January.

- MX employees have taken to LinkedIn to share about the banking software company letting go of an undisclosed number of staff.

- Chipmaking giant Intel is planning thousands of job cuts, Bloomberg reports, as sales of personal computers continue to plummet.

- Warner Brothers Discovery laid off more than 80 employees, and said those were included in 125 open positions that won't be filled.

- General Electric is slashing “hundreds of jobs” at its onshore wind-turbine unit in the U.S., according to anonymous sources.

- Peloton is cutting staff for the fourth time this year, this latest round affecting about 500 employees, or 12% of its workforce.

- JBS Foods is closing the Denver factory of plant-based meat startup Planterra Foods, which will result in about 121 layoffs.

High-profile firms that cut staff in September include:

- San Francisco-based digital document signing platform DocuSign cut 9% of staff, about 670 employees.

- Wells Fargo laid off 36 workers, and has cut more than 400 jobs in its home-mortgage division in central Iowa since April.

- Gap eliminated 500 corporate positions.

- Real-estate brokerage Compass announced its second round of cuts in three months.

- Cloud communications platform Twilio laid off about 850 employees in a cost-cutting move.

- Warner Bros. Discovery let go of about 100 employees, mostly in its ad sales unit.

Thanks for posting.... I guess all those lay offs from the US Government, State and Local Governments must be posted else where.........Well... let's just post it all

Firms that have announced layoffs in October:

- Nebraska-based e-commerce platform Spreetail has laid off an unspecified number of workers for at least the second time since August, according to one LinkedIn member.

- Mindbody, a Central Coast-based software company, is cutting jobs for the second time in two years.

- Swiss banking giant Credit Suisse is planning to cut about 9,000 positions over the next three years, after reporting a $4 billion net loss in the third quarter, according to The Wall Street Journal.

- Autonomous vehicle startup Argo AI is shutting down operations, impacting roughly 2,000 workers.

- Real-estate platform Zillow cut 300 jobs in its second round of layoffs this year.

- Database management giant Oracle is "quietly" letting go of employees for the second time since August, according to Business Insider.

- Cybersecurity startup Snyk cut 14% of its workforce, about 200 jobs.

- Mental health startup Cerebral laid off 20% of its staff in a major restructuring.

- Dutch technology giant Philips is cutting about 4,000 jobs — 5% of its global workforce — after five consecutive quarters of declining sales.

- Philadelphia-based delivery startup Gopuff let go of as many as 250 workers in its third round of cuts this year, according to Bloomberg.

- Boston internet provider startup Starry announced the layoffs of roughly half its staff, including 175 workers in Massachusetts.

- LinkedIn members are sharing about a second round of layoffs at Sendoso, a direct mail and gifting platform, since the beginning of June.

- LinkedIn members also have shared about being let go at Khoros, an Austin, Texas-based community management platform, and Careerbuilder, a Chicago-based employment website.

- Microsoft, LinkedIn's parent company, let go of about 1,000 employees across multiple divisions, Axios reported.

- News aggregator Flipboard will lay off 21% of its staff (24 employees), according to an exclusive from Axios.

- Computer software company and maker of SurveyMonkey Momentive.ai announced an unspecified number of job cuts in a post on LinkedIn.

- Video game publisher Take-Two is closing its studio in New York City, resulting in 65 layoffs, Bloomberg reported.

- Cloud tech giant Oracle let go of 201 employees in its Redwood City, California, office.

- Customer relationship management platform Salesforce cut an unspecified number of jobs, according to Protocol.

- Weight-loss app Noom laid off employees for the second time this year, cutting about 500 jobs, the majority in coaching.

- Media giant Gannett is cutting costs by having employees take a week of compulsory unpaid leave, offering voluntary buyouts and temporarily suspending 401(k) contribution matches.

- Brex, a corporate spend-management startup, laid off 136 people (11% of its staff), TechCrunch reported. The company was valued at $12.3 billion in January.

- MX employees have taken to LinkedIn to share about the banking software company letting go of an undisclosed number of staff.

- Chipmaking giant Intel is planning thousands of job cuts, Bloomberg reports, as sales of personal computers continue to plummet.

- Warner Brothers Discovery laid off more than 80 employees, and said those were included in 125 open positions that won't be filled.

- General Electric is slashing “hundreds of jobs” at its onshore wind-turbine unit in the U.S., according to anonymous sources.

- Peloton is cutting staff for the fourth time this year, this latest round affecting about 500 employees, or 12% of its workforce.

- JBS Foods is closing the Denver factory of plant-based meat startup Planterra Foods, which will result in about 121 layoffs.

High-profile firms that cut staff in September include:

- San Francisco-based digital document signing platform DocuSign cut 9% of staff, about 670 employees.

- Wells Fargo laid off 36 workers, and has cut more than 400 jobs in its home-mortgage division in central Iowa since April.

- Gap eliminated 500 corporate positions.

- Real-estate brokerage Compass announced its second round of cuts in three months.

- Cloud communications platform Twilio laid off about 850 employees in a cost-cutting move.

- Warner Bros. Discovery let go of about 100 employees, mostly in its ad sales unit.

IRS hires 4,000 customer service workers ahead of tax season

WASHINGTON (AP) — The IRS said Thursday it has hired an additional 4,000 customer service representatives who are being trained to answer taxpayer questions during the 2023 tax filing season. It's part of the new hiring made possible when congressional Democrats gave the IRS an $80 billion boost...

Tesla's Ex-AI Lead, Andrej, on why Tesla is focusing on vision-only.

Homo with backward hat really ruined the video.

Similar threads

- Replies

- 13

- Views

- 2K

- Replies

- 0

- Views

- 213

- Replies

- 142

- Views

- 17K