Join the Hide community

Get access to live stream, lessons, the post exchange, and chat with other snipers.

Register

Download Gravity Ballistics

Get help to accurately calculate and scope your sniper rifle using real shooting data.

Install the app

How to install the app on iOS

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Stock Market

- Thread starter pmclaine

- Start date

You got to love the markets and how they can make the index funds look good right at the end of the trading day....

Rigged to make the "Index Funds" look like the place to put that spare money.

They run up an unknown like West Rock (WRK), or similar, that no one has heard of to get the averages up.

Or like Nike (NKE) that has down trended since November of 2021 but today a miracle gave it a bump to move the DOW positive.

The deck is stacked

DOW down trending since mid November of 2021

Rigged to make the "Index Funds" look like the place to put that spare money.

They run up an unknown like West Rock (WRK), or similar, that no one has heard of to get the averages up.

Or like Nike (NKE) that has down trended since November of 2021 but today a miracle gave it a bump to move the DOW positive.

The deck is stacked

DOW down trending since mid November of 2021

Last edited:

Parsed from a CNBC story today

Housing starts soared 12% higher from the previous month, far greater than the 0.3% Dow Jones estimate. However, building permits plunged 10%, much worse than the expectation for a 4.4% drop.

Shepherdson said the permits number tells the real story of a housing market mired in a deep slump.

"As a general rule, when starts and permits move in opposite directions, trust the permits numbers, which lead and usually are less noisy," he said. "In short, ignore the headline starts numbers. The collapse in single-family permits is the real story, and it has much further to go."

Housing starts soared 12% higher from the previous month, far greater than the 0.3% Dow Jones estimate. However, building permits plunged 10%, much worse than the expectation for a 4.4% drop.

Shepherdson said the permits number tells the real story of a housing market mired in a deep slump.

"As a general rule, when starts and permits move in opposite directions, trust the permits numbers, which lead and usually are less noisy," he said. "In short, ignore the headline starts numbers. The collapse in single-family permits is the real story, and it has much further to go."

I only see a long down trend in the markets starting in November of 2021.Can you say a possible Black Monday is on the Horizon in the next few days.

Administration is running the recession into 2023 with a plan of "Hope" it gets better.

The hedge funds are doing well.

May not be a Monday but there’s more downside comingCan you say a possible Black Monday is on the Horizon in the next few days.

Can't get inflation down (aka, initiate equitable wealth transfer/distribution) without dipping into the coffers of middle income plebs. It's almost as if there is no connection between "owning nothing" and market behavior

The Government can totally bankrupt the middle income plebs and not dig themselves out of this hole. The only hope is for the Government to stop increasing the USD's it is printing and giving away. But, that is not a politically sound move at this time.Can't get inflation down (aka, initiate equitable wealth transfer/distribution) without dipping into the coffers of middle income plebs. It's almost as if there is no connection between "owning nothing" and market behavior

Q3 earnings will be landslide of lowered guidance, reduced revenues, cash flows, and borrowings. Looking forward to add at lower levels.

Last edited:

I am thinking Q3 will kick off further P/E compression. Q4 & Q1 will lead into low EPS. Further exacerbating equity price corrections.

Looking to add if this plays out... for now I'll continue my weekly ROTH purchases and bi-weekly 401K contributions. I'll build cash in my HSA and won't add to my taxable; which I haven't in a month+.

Looking to add if this plays out... for now I'll continue my weekly ROTH purchases and bi-weekly 401K contributions. I'll build cash in my HSA and won't add to my taxable; which I haven't in a month+.

I am thinking Q3 will kick off further P/E compression. Q4 & Q1 will lead into low EPS. Further exacerbating equity price corrections.

I agree with this assessment.

Hoping to sell covered over-the-market Tesla calls after AI Day lol

The news that Austin has only built 10,000 Model Y cars since opening in April seems scary. That's only two weeks of production at the claimed rate (and only one week of production at the Fremont plant, which one would assume to be considered less sophisticated than the Austin plant). I get that the 4680 bottleneck is likely to blame, but regardless of the cause, that plant is an expensive piece of overhead when running at that rate.

Billions of dollars according to Elon.The news that Austin has only built 10,000 Model Y cars since opening in April seems scary. That's only two weeks of production at the claimed rate (and only one week of production at the Fremont plant, which one would assume to be considered less sophisticated than the Austin plant). I get that the 4680 bottleneck is likely to blame, but regardless of the cause, that plant is an expensive piece of overhead when running at that rate.

Billions of dollars according to Elon.

I don't think he's wrong. And at some point, that will hit the balance sheet. But it's probably a transient issue that gets resolved in a few quarters (like the 4680 ramp), and thus less of a concern than more fundamental issues like the lack of CapEx to support future growth plans, the continued inability to launch FSD (much less robotaxi functionality), and looming supply chain constraints like minerals for batteries and motors.

Their cash and cash equivalents are going to be an interesting number. As well as any potential increase in debt borrowings.I don't think he's wrong. And at some point, that will hit the balance sheet. But it's probably a transient issue that gets resolved in a few quarters (like the 4680 ramp), and thus less of a concern than more fundamental issues like the lack of CapEx to support future growth plans, the continued inability to launch FSD (much less robotaxi functionality), and looming supply chain constraints like minerals for batteries and motors.

Their cash and cash equivalents are going to be an interesting number. As well as any potential increase in debt borrowings.

Yep. And honestly, an increase in debt or an equity offering to support CapEx shouldn't be a major issue to investors. It'll take a huge amount of money to build the 10-20 plants required to support 10M units/yr and build out a supply chain and develop some number of new platforms while refreshing existing product.

The unsaid issue is that until the raw materials for produuction/assembly stop coming from China there will always be threats to and weaknesses in the business model. Its a universal problem.Yep. And honestly, an increase in debt or an equity offering to support CapEx shouldn't be a major issue to investors. It'll take a huge amount of money to build the 10-20 plants required to support 10M units/yr and build out a supply chain and develop some number of new platforms while refreshing existing product.

My Dad raised me with an old saying and reminded me of it frequently.

"Son, nothing is free".

So today, we find out just how much all of the "Free Government Money" is costing us.

www.cnbc.com

www.cnbc.com

"Son, nothing is free".

So today, we find out just how much all of the "Free Government Money" is costing us.

Dow closes 500 points lower after the Fed delivers another aggressive rate hike

Stocks fell in volatile trading Wednesday after the Federal Reserve raised rates by 75 basis points and forecast more sizable rate hikes ahead

Took out some trend lines.My Dad raised me with an old saying and reminded me of it frequently.

"Son, nothing is free".

So today, we find out just how much all of the "Free Government Money" is costing us.

Dow closes 500 points lower after the Fed delivers another aggressive rate hike

Stocks fell in volatile trading Wednesday after the Federal Reserve raised rates by 75 basis points and forecast more sizable rate hikes aheadwww.cnbc.com

I’ll stick a China chart at the bottom.

Unsolicited advice. For the guys wanting to “add on lower” . Wait a bit, you’ll be able to add significantly lower imo. Don’t get fooled by bounces, the old buy dips has let you get away with that for 13 years or so. If you’re under 35 or so, you’ve not seen a bear market. From an earlier post I made, unless your timeline is 5 yrs or more buying these dips could get you waxed.

I think the Asian Markets are better "postured" for the worldwide recession than the American Markets.Took out some trend lines.

I’ll stick a China chart at the bottom.

Unsolicited advice. For the guys wanting to “add on lower” . Wait a bit, you’ll be able to add significantly lower imo. Don’t get fooled by bounces, the old buy dips has let you get away with that for 13 years or so. If you’re under 35 or so, you’ve not seen a bear market. From an earlier post I made, unless your timeline is 5 yrs or more buying these dips could get you waxed.

View attachment 7960924

Those people come from a culture of existing on fish heads and rice for 3,000 years.

Sun Tzu had it all figured out long, long ago.

Last edited:

Agree.I thin

I think the Asian Markets are better "postured" for the worldwide recession than the American Markets.

Those people come from a culture of existing on fish heads and rice for 3,000 years.

Sun Tzu had it all figured out long, long ago.

They take out that low that chart is fugly

Dead cat bounces. They will take money like nobody’s business.Took out some trend lines.

I’ll stick a China chart at the bottom.

Unsolicited advice. For the guys wanting to “add on lower” . Wait a bit, you’ll be able to add significantly lower imo. Don’t get fooled by bounces, the old buy dips has let you get away with that for 13 years or so. If you’re under 35 or so, you’ve not seen a bear market. From an earlier post I made, unless your timeline is 5 yrs or more buying these dips could get you waxed.

View attachment 7960924

Looking back, the financial institutions of the world followed the FED Reserve down this rabbit hole..... Now, the pain of climbing out of this hole will be on the backs of the American, working middle class. The FED Reserve became "politicized" and allowed the political machine to run the printing presses wide open and hand out free money. Now, we pay the price.Japan would benefit greatly with higher rates.

I don’t think it was just making bad calls. This was engineered. The economy needs to crash hard to facilitate the great reset. It is not a fringe theory. Lots of meetings, presentations, and even books written about it.Looking back, the financial institutions of the world followed the FED Reserve down this rabbit hole..... Now, the pain of climbing out of this hole will be on the backs of the American, working middle class. The FED Reserve became "politicized" and allowed the political machine to run the printing presses wide open and hand out free money. Now, we pay the price.

Their cash and cash equivalents are going to be an interesting number. As well as any potential increase in debt borrowings.

Tesla Recalls Another Million-Plus EVs. Investors Care This Time.

Electric-vehicle giant Tesla is recalling vehicles for a glitch in the power windows. It can be fixed with an over-the-air software update, but the stock is...

Japan would benefit greatly with higher rates.

Problems with the yen go back decades, and is complex enough that I'll gladly admit to not fully understanding the issue. What is clear is that Japanese exports (a huge chunk of their economic activity) have traditionally benefited from a weak yen, that this is probably no longer sustainable in the face of commodity and energy inflation, and that Japanese population demographics make the situation impossible to resolve regardless of monetary policy.

In short, they are kinda fucked.

Wish they would stop calling these recalls.

“And none of the million-plus electric vehicles will have to go into the shop. The cars will be fixed by an over-the-air software update.”

“And none of the million-plus electric vehicles will have to go into the shop. The cars will be fixed by an over-the-air software update.”

I don’t think it was just making bad calls. This was engineered. The economy needs to crash hard to facilitate the great reset. It is not a fringe theory. Lots of meetings, presentations, and even books written about it.

Wish they would stop calling these recalls.

“And none of the million-plus electric vehicles will have to go into the shop. The cars will be fixed by an over-the-air software update.”

"Recall" is legally correct since it's an action to correct a safety issue, but it's inconsequential to the market valuation of Tesla and thus not particularly newsworthy.

Recall is associated with traditional automakers where vehicles would have to be brought in for diagnosis. The term doesn't fit OTA updates."Recall" is legally correct since it's an action to correct a safety issue, but it's inconsequential to the market valuation of Tesla and thus not particularly newsworthy.

Except "recall" I think has special NTSB implications which includes that the automaker has to provide the 'fix' for free and the life of the vehicle? As opposed to "service bulletins" which are at the manufacturers discretion.

IT'S OFFICIAL - Right Now 2022 Stands as the Worst Year in US Stock Market History | The Gateway Pundit | by Joe Hoft

Biden’s economy is bad. It’s really bad. As of today, the DOW in 2022 is having its worst year ever!

Fiscal + the Energy Relief Scheme: UK announced energy-protection measures are the highest, as a potential % of GDP, across the developed world. If TTF/Nat Gas prices continue lower, the cost will be materially less than the £150bn touted in press. However, the UK fiscal-position is now essentially tied to the price of wholesale Nat Gas, over which it has no control. If prices continue higher, over this Winter and next, the UK will be locked in to a price-peg that will be financially difficult to sustain, but politically impossible to remove. That could quickly deteriorate in to spiralling borrowing costs, deep consumer-led recession, with GBP likely collateral damage.

WorldwideFiscal + the Energy Relief Scheme: UK announced energy-protection measures are the highest, as a potential % of GDP, across the developed world. If TTF/Nat Gas prices continue lower, the cost will be materially less than the £150bn touted in press. However, the UK fiscal-position is now essentially tied to the price of wholesale Nat Gas, over which it has no control. If prices continue higher, over this Winter and next, the UK will be locked in to a price-peg that will be financially difficult to sustain, but politically impossible to remove. That could quickly deteriorate in to spiralling borrowing costs, deep consumer-led recession, with GBP likely collateral damage.

There is no way out out, no where to run and we are surrounded by millions of people who's only plan is "Hope"....

Amazing how fast it all went down hill.

This planned and engineered process has been obvious for quite a while to those who have not been been blinded by earnestly yearning for comfort and security.

IT'S OFFICIAL - Right Now 2022 Stands as the Worst Year in US Stock Market History | The Gateway Pundit | by Joe Hoft

Biden’s economy is bad. It’s really bad. As of today, the DOW in 2022 is having its worst year ever!www.thegatewaypundit.com

This planned and engineered process has been obvious for quite a while to those who have not been been blinded by earnestly yearning for comfort and security.

Those other people:

IT'S OFFICIAL - Right Now 2022 Stands as the Worst Year in US Stock Market History | The Gateway Pundit | by Joe Hoft

Biden’s economy is bad. It’s really bad. As of today, the DOW in 2022 is having its worst year ever!www.thegatewaypundit.com

This is a pretty stupid article, and completely unnecessary since Biden's economic failures stand on their own accord.

Absolute drops don't matter - percentages do. 1931 remains the worse, and 2008 gets 2nd place on the podium. 2022 is currently in the top 10, and it may very well work its way up the charts.

Down the rabbit hole... Worldwide

www.cnbc.com

www.cnbc.com

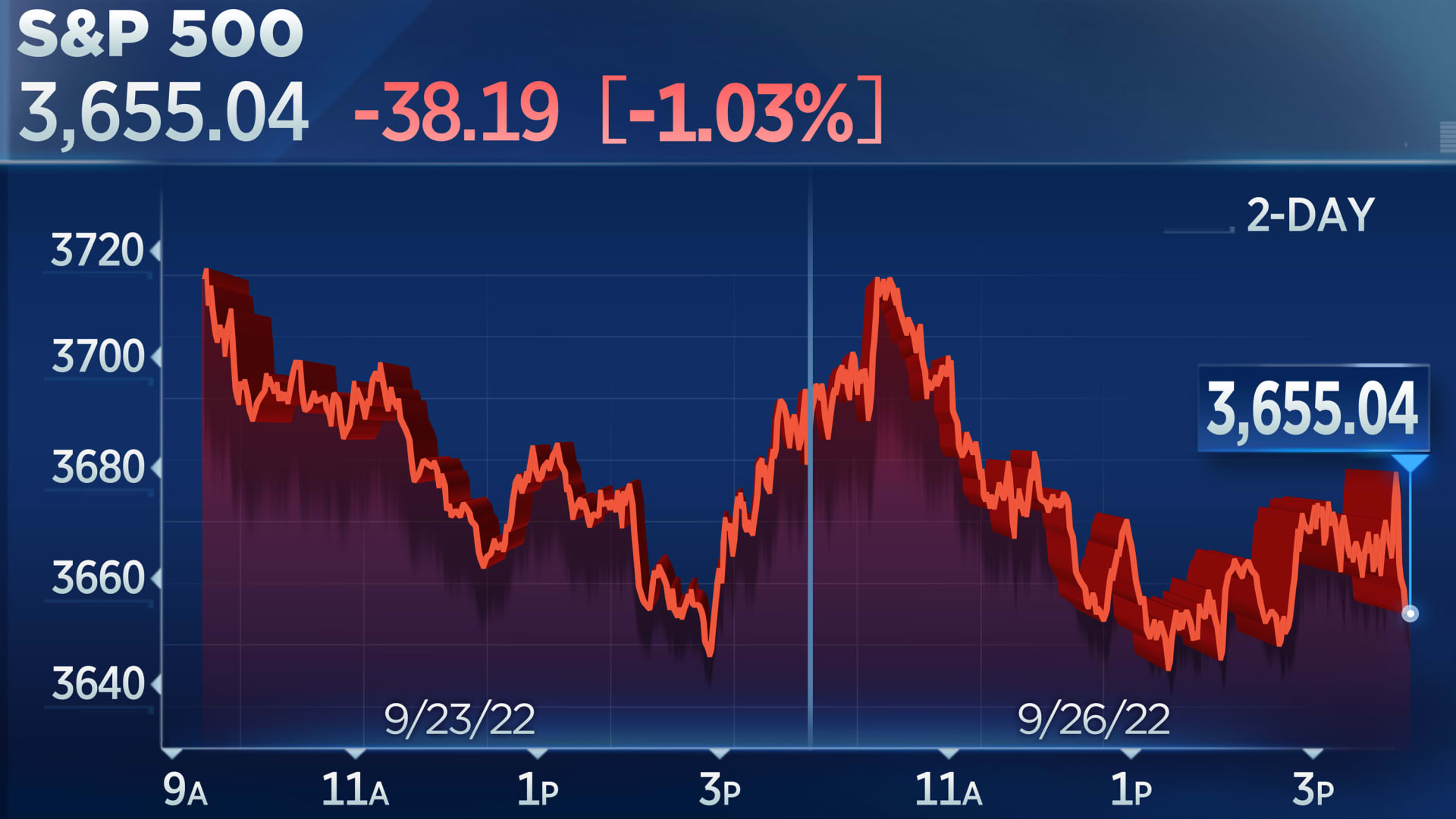

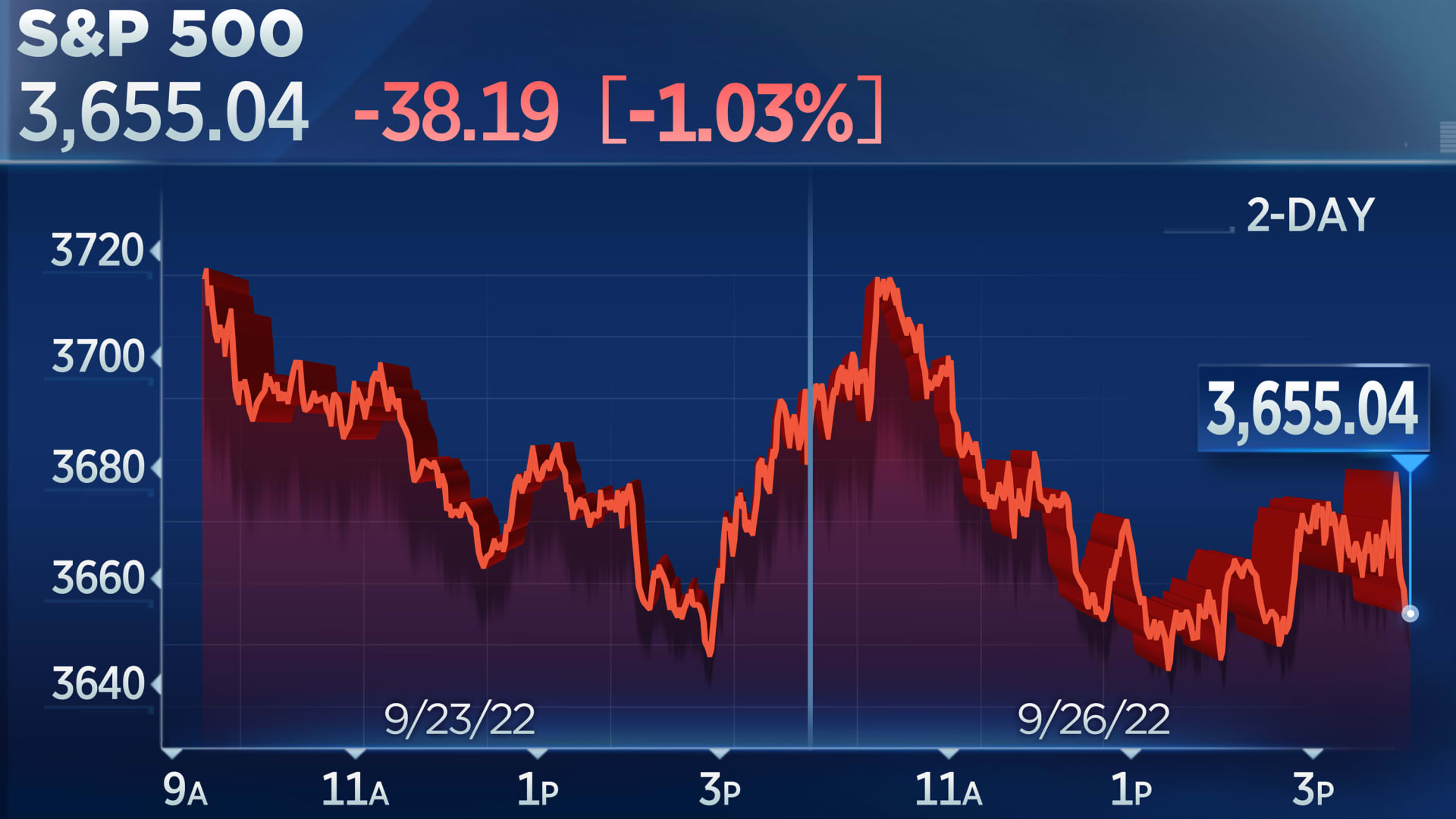

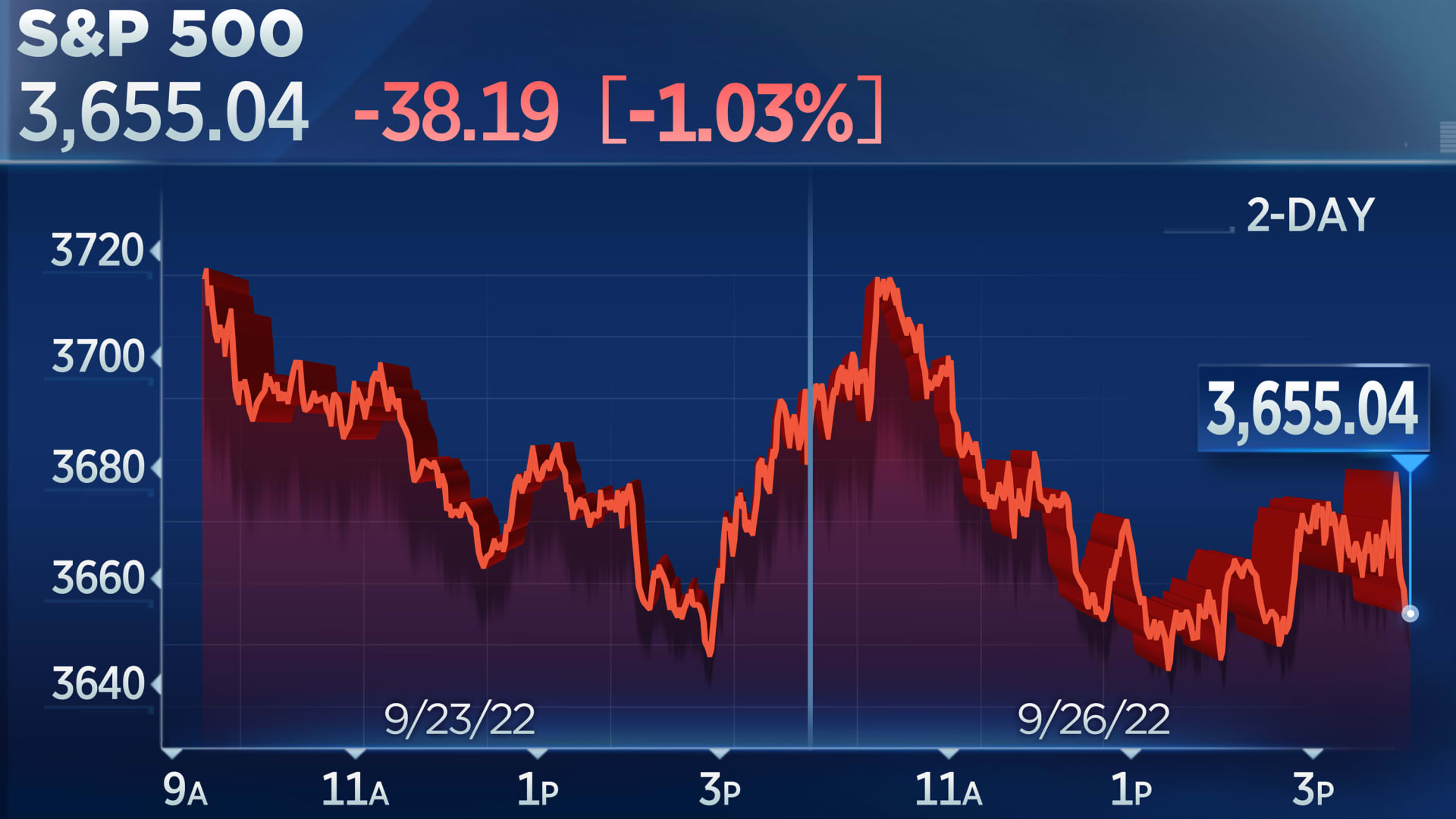

S&P 500 notches new closing low for 2022, Dow falls into bear market as dollar surges

The broader market index broke below its June closing low as interest rates surged and turmoil rocked global currencies.

Black MondayDown the rabbit hole... Worldwide

S&P 500 notches new closing low for 2022, Dow falls into bear market as dollar surges

The broader market index broke below its June closing low as interest rates surged and turmoil rocked global currencies.www.cnbc.com

Lots of talk recently (from the talking heads and the FED Reserve) in regard to the strong US Dollar...

I see a lot of propaganda. To a working middle class bread winner, the strength of the USD means very little.

To an old retired guy on a fixed income, it really means nothing. I'm certainly not taking a few of my USD's and buying an item in a foreign country because my currency will buy a bit more than theirs.

After watching events of the past couple of years, how the USD stacks up against a market basket of currencies from a few other token countries carries no weight at all.

Here is an evening headline "The British pound plunged to a record low on Monday"...... So ?

Open for discussion.

www.cnbc.com

www.cnbc.com

www.macrotrends.net

www.macrotrends.net

I see a lot of propaganda. To a working middle class bread winner, the strength of the USD means very little.

To an old retired guy on a fixed income, it really means nothing. I'm certainly not taking a few of my USD's and buying an item in a foreign country because my currency will buy a bit more than theirs.

After watching events of the past couple of years, how the USD stacks up against a market basket of currencies from a few other token countries carries no weight at all.

Here is an evening headline "The British pound plunged to a record low on Monday"...... So ?

Open for discussion.

Sterling hits record low against the dollar, as Asia-Pacific currencies also weaken

The British pound briefly plunged 4% to a record low against the dollar.

U.S. Dollar Index (2006-2025)

Interactive chart of historical data showing the broad price-adjusted U.S. dollar index published by the Federal Reserve. The index is adjusted for the aggregated home inflation rates of all included currencies. The price adjustment is especially important with our Asian and South American...

Last edited:

Lots of talk recently (from the talking heads and the FED Reserve) in regard to the strong US Dollar...

I see a lot of propaganda. To a working middle class bread winner, the strength of the USD means very little.

To an old retired guy on a fixed income, it really means nothing. I'm certainly not taking a few of my USD's and buying an item in a foreign country because my currency will buy a bit more than theirs.

After watching events of the past couple of years, how the USD stacks up against a market basket of currencies from a few other token countries carries no weight at all.

Here is an evening headline "The British pound plunged to a record low on Monday"...... So ?

Open for discussion.

Sterling hits record low against the dollar, as Asia-Pacific currencies also weaken

The British pound briefly plunged 4% to a record low against the dollar.www.cnbc.com

U.S. Dollar Index (2006-2025)

Interactive chart of historical data showing the broad price-adjusted U.S. dollar index published by the Federal Reserve. The index is adjusted for the aggregated home inflation rates of all included currencies. The price adjustment is especially important with our Asian and South American...www.macrotrends.net

A strong US dollar sounds good in headlines, but kinda sucks once someone comprends what it does to foreign trade balances. Look at the progress Asia made against the US during the 1980s as an example. It might not carry any meaning for a middle-class person at this moment, but it will once there's a shift of another few hundred billion dollars each year.

Similar threads

- Replies

- 13

- Views

- 2K

- Replies

- 0

- Views

- 213

- Replies

- 142

- Views

- 17K