In 1980, we did not have a shortfall of 3.2 million housing units, interest rates on mortgages were 14%, would go up over 16% for two years after that, and did

not go below 10% until the 1990s.

The average home in 1980 also had countertops and cabinets that are far different from the fancy granite countertop kitchens today, and carpet and vinyl floors.

I am not taking issue with anything you wrote. I am just pointing out some more variables to consider.

A decade of mortgage rates at 13-17% would dampen housing prices a lot even now.

Still, the bottom line is that the housing supply has never recovered from the Great Recession, when homebuilding almost stopped. There was a surplus that turned into a deficit by 2010 that kept going on a downward supply curve.

Check out where we are now on supply.

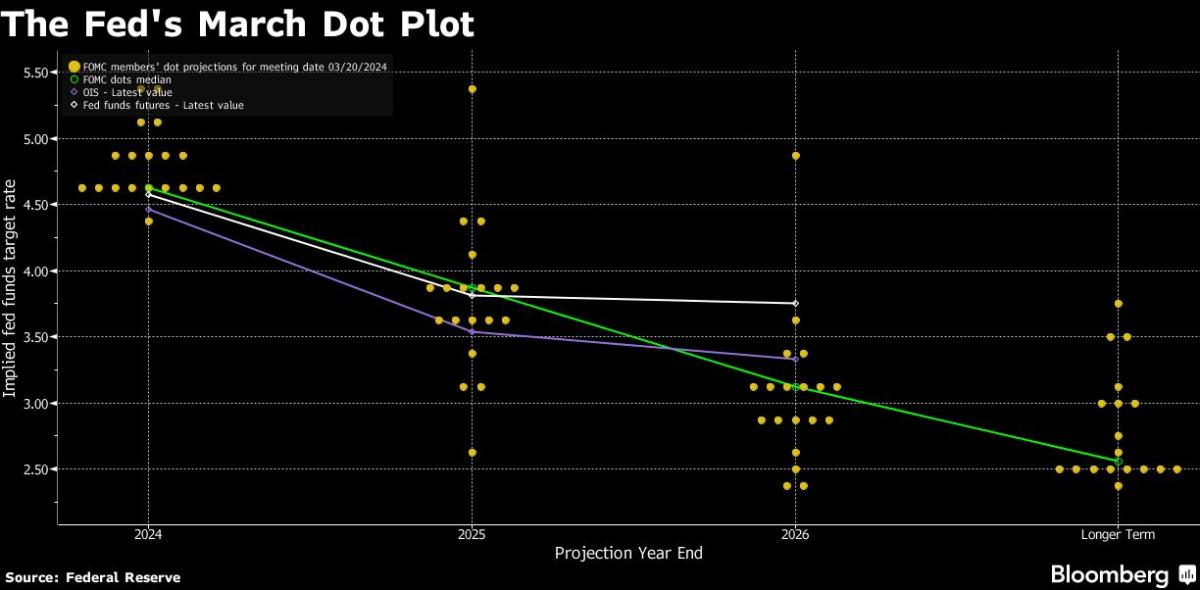

View attachment 8408201

Supply and demand = price.

Demand keeps rising. Housing construction is not keeping pace with demand. Until we build more housing, that price is not coming down.

And nobody wants more housing. They certainly do not want more affordable housing.

It would not even be legal for me to build my home where I live if I were building it today (not enough square footage to meet the new local requirements).