Counterpoint: look at how many people on this board have looked at incoming policy and decided that preparing for bad times is the best strategy. Not saying it is a perfect representation of the country, but still, it is livestream of why fiscal policy doesn't create growth.Not sure many will get this...

Ive bolded what I find amusing. You are assuming most people in this country have a brain. Most don’t.

Join the Hide community

Get access to live stream, lessons, the post exchange, and chat with other snipers.

Register

Download Gravity Ballistics

Get help to accurately calculate and scope your sniper rifle using real shooting data.

Install the app

How to install the app on iOS

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Inflation.......... ?

- Thread starter Hobo Hilton

- Start date

BINGO! Fractional reserve system. Its a great multiplier in the economy in good times but there are definite weaknesses to it that are rough when they come about. The issue is that people think a bank is savings, while the bank utilizes the cash as funds to invest in order to make them cash on the loaning out of depositors money. Why people choose to not understand this is beyond me. If anyone thinks they are not an input resource to the bank and viewed as such they are sadly mistaken and ignorant of what actually happens with their money. The Fed will then control risk taking and commerce in the economy by utilizing interest rates and dollars "printed".And I agree the entire concept of the Keynesian multiplier was flawed from the beginning especially his arbitrary distinction between savings and investments.

I think the way he separated the two is flawed because savings held in banks represent investments when banks make business loans based on those savings deposited with the banks.

However, I do wonder about how much real innovation would have come about as quickly as it did during the last century if this fractional reserves and monetary inflation were not utilized. Not much I don't think because a lack of funds in the economy do not encourage risk taking due to limited resources for investment - i.e., fiscal conservatism by both governments and individuals. That being said, the abuses of these tools has been rampant in the extreme, especially since the 80's. There has been a ton of waste along with the innovation; I would argue that waste took most of the money.

But hell, where would we be without the Pets.com sock puppet? The world would be a darker place for sure.

I think this sums it up pretty well. And it is hard to argue that we have had less economic stability with this system than we had before. But, there are risk compromises and people need to not be blind to those. The main problem is that the more you rely on single individuals to crunch all market inputs and set policy, the further you get from a market that is responsive to pricing signals.BINGO! Fractional reserve system. Its a great multiplier in the economy in good times but there are definite weaknesses to it that are rough when they come about. The issue is that people think a bank is savings, while the bank utilizes the cash as funds to invest in order to make them cash on the loaning out of depositors money. Why people choose to not understand this is beyond me. If anyone thinks they are not an input resource to the bank and viewed as such they are sadly mistaken and ignorant of what actually happens with their money. The Fed will then control risk taking and commerce in the economy by utilizing interest rates and dollars "printed".

However, I do wonder about how much real innovation would have come about as quickly as it did during the last century if this fractional reserves and monetary inflation were not utilized. Not much I don't think because a lack of funds in the economy do not encourage risk taking due to limited resources for investment - i.e., fiscal conservatism by both governments and individuals. That being said, the abuses of these tools has been rampant in the extreme, especially since the 80's. There has been a ton of waste along with the innovation; I would argue that waste took most of the money.

But hell, where would we be without the Pets.com sock puppet? The world would be a darker place for sure.

I’m going to post this here. I think everyone can determine the macroeconomic implications of what is being said. A commodities super cycle may be great for investors (maybe), but I’ll argue that the inflationary effects upon goods in general will be negative. If he is correct.

This increase in prices makes rentals increase as well. And that has follow on effects. The school bus is stopping longer and at more hotels than it used to on my way to work. I pay attention to this because it is an indication of how low skilled labor may be affected locally.What I see coming down the pike especially in the residential construction market and it’s already happening to some degree is demand staying high because inventory is at low levels as long as interest rates stay low but margins are going to get squeezed at the contractor level because of input inflation whether in labor inflation or building materials or even dirt prices. I think there’s a little room left to move up price wise but not much price wise.

I’m probably younger than most here but the amount of BFR built for rent from large corporations is just at extremely high levels and people are actually living in the homes.

It’s a little different than in 2005 with all the exotic mortgage products where people were buying multiple homes just to sell a year later and the contractors were making at least $100k on any house they could throw together. Now actual people are living in the new homes being built but margins are getting crunched big time with the input inflation.

Importing Chinese for slave labor?Something is going to have to give in the low skilled labor market if people want prices to come down.

When you’re competing with .gov paying people what come out to about $20 an hour to sit on their asses at home on the couch and you have e verify for all of these payroll services construction companies use for payroll so it’s hard to pay “immigrants” lol cash, you’re not going to see what people would consider affordable housing coming on to the market.

I think this isn't necessarily right. As you see shifting consumption, different industries will have more or less pricing power. With current policies, for instance, Nike is going to have more pricing power than some other brands, given shifting demographics in spending power.This increase in prices makes rentals increase as well. And that has follow on effects. The school bus is stopping longer and at more hotels than it used to on my way to work. I pay attention to this because it is an indication of how low skilled labor may be affected locally.

Blaming old people for your mistakes is laughable.

Old people were forced out of thier jobs by the young all over America accross the employment sector.

So we sit living on a fix income listening to dysfunctional disgruntled people blaming us for thier problems that they deem everyone but themselves are responsible for.

Wake the fuck up and deal with it.

Old people were forced out of thier jobs by the young all over America accross the employment sector.

So we sit living on a fix income listening to dysfunctional disgruntled people blaming us for thier problems that they deem everyone but themselves are responsible for.

Wake the fuck up and deal with it.

Who is blaming old people?Blaming old people for your mistakes is laughable.

Old people were forced out of thier jobs by the young all over America accross the employment sector.

So we sit living on a fix income listening to dysfunctional disgruntled people blaming us for thier problems that they deem everyone but themselves are responsible for.

Wake the fuck up and deal with it.

The Producer Price Index rose 0.6% from March, according to the U.S. Bureau of Labor Statistics. Year over year, the PPI spiked 6.2%, the largest increase since the agency started tracking the data in 2010.

Economists polled by FactSet were expecting a 0.3% monthly increase in April and 3.8% year over year.

www.cnbc.com

www.cnbc.com

Economists polled by FactSet were expecting a 0.3% monthly increase in April and 3.8% year over year.

Another inflation gauge comes in hot with producer prices jumping 6.2% in April from a year ago

The PPI spiked 6.2% for the 12 months ended in April, the largest increase since the Bureau of Labor Statistics started tracking the data in 2010.

Given commodity prices one year ago, I don't think this is the big news you think it is. Hell, being a week old, it isn't even actually news, no matter how much bold print. Which can be seen by market action Thurs and Fri.The Producer Price Index rose 0.6% from March, according to the U.S. Bureau of Labor Statistics. Year over year, the PPI spiked 6.2%, the largest increase since the agency started tracking the data in 2010.

Economists polled by FactSet were expecting a 0.3% monthly increase in April and 3.8% year over year.

Another inflation gauge comes in hot with producer prices jumping 6.2% in April from a year ago

The PPI spiked 6.2% for the 12 months ended in April, the largest increase since the Bureau of Labor Statistics started tracking the data in 2010.www.cnbc.com

A bit of satire......... You keep on goin' to work so you can pay for those motel rooms for people who aren't workin'.......This increase in prices makes rentals increase as well. And that has follow on effects. The school bus is stopping longer and at more hotels than it used to on my way to work. I pay attention to this because it is an indication of how low skilled labor may be affected locally.

I'm curious as to where they are findin' all this optimism

Oil prices post highest finish in over 2 years on demand optimism

Maybe because nobody ever has experienced confirmation bias to the level you display it in this thread.I'm curious as to where they are findin' all this optimism

Oil prices post highest finish in over 2 years on demand optimism

It assumes that you know it is commodity traders they are talking about. It means that the traders are optimistic that demand is increasing for oil and therefore are pushing prices higher in the market as they anticipate that the refineries will be willing to pay a higher amount for it per barrel. This goes back to my previous point: while it may be good for the trading market it sucks for main street.

It would be very surprising if demand for oil went down after all the lockdowns, decreases in air traffic etc. Even the levels of last year assumed increased demand, or they would have been at zero. But still, the issue the markets are dealing with isn't as simple as whether there will be more demand or not. It is more a constant reweighing of what looks like a high, but balanced, risk situation. You wouldn't know it from this thread, which is inflation myopic, but the risks to the economy right now are quite balanced between various scenarios. Which is actually pretty normal. What is abnormal is the level of risk in each direction. As market participants cycle through each risk scenario, we see a different basket of pricing, depending on what the dominant belief is.It assumes that you know it is commodity traders they are talking about. It means that the traders are optimistic that demand is increasing for oil and therefore are pushing prices higher in the market as they anticipate that the refineries will be willing to pay a higher amount for it per barrel. This goes back to my previous point: while it may be good for the trading market it sucks for main street.

I don't know the difference between Wall Street and Main Street. I have spent my entire life connected to Wall Street. I am not sure there actually is a difference, when all the chips are cashed at the end, but there can be a very big difference if you look at it at a given point in time, especially if you are forced to cash in on that date. Ben Graham still said it best, that in the short term the market is a voting machine, and in the long term a weighing machine. Or, as he liked to quote from Horace, many will fall that are now in favor, many will be restored that now are fallen. Or something close to that.

More often than not, they are the same companies. Also more often than not, they trade at premiums. So you trade business risk for pricing risk.This has already been mostly if not completely covered above.

But, if we’re starting to see names like Buffet and Ackman give interviews acknowledging inflation then it seems like the next step from a planning or investing perspective would be trying to figure out which businesses have the most pricing power or which businesses have values that wouldn’t be as affected by an interest rate increase if the fed decides they want to pump the brakes.

I am in the process of selling my 2019 Ram for more than I paid for it new, after driving it for a year and a half. To the same dealer that sold it to me. Tell me something isn’t really fugged up. I’ll laugh at you. OSB is FIVE Times what it was when I built my last place in 2016. Most other stuff I buy has doubled in the last few years. This is just the beginning.

What are you replacing it with?I am in the process of selling my 2019 Ram for more than I paid for it new, after driving it for a year and a half. To the same dealer that sold it to me. Tell me something isn’t really fugged up. I’ll laugh at you. OSB is FIVE Times what it was when I built my last place in 2016. Most other stuff I buy has doubled in the last few years. This is just the beginning.

Chipotle trades at 98x earnings, Agilent at 50x etc. There isn't a cheap stock in that group. But that wasn't really my point. My main point being that companies with really good pricing power are generally really good companies. Great brand, well run, etc. Good, solid investments. But they do trade at a premium to other similar companies, because of these qualities. As such, you get businesses that are not likely to fall apart, but if you are looking at inflation, what you are looking at investment wise is an increase in the discount rate you are applying, so high multiple, good companies, are quite vulnerable from a pricing perspective. That kind of risk is shorter term, for sure, but it is not riskless.I guess that really depends on timing price wise.

Pershing Swuare who absolutely killed it in 2020 has the following on their most recent 13F filing (https://sec.report/Document/0001172...FAwMkZkWW1GNEZrdWtIYjFRZEF3czB1MmdtV2dOX1FyMw.):

Agilent Technologies

Chipotle

Dominos

Howard Hughes

Lowe’s

Hilton

Don’t see any of the high flyer tech companies trading at high multiples of earnings.

FWIW, it is worth recognizing that Ackman makes big bets and has huge wins, sometimes, but he is very, very inconsistent in his stock picking, and I would be wary of coat tailing him, among all well known investors. He is also a total shit, but that is beside the point.

Don't take this as investment advice, etc, etc.

This is not a sarcastic remark... In America's future, the market that will do the best is the "Black Market"... Those with the most experience operating in the Black Market environment have come to America from third world countries... American Universaties don't offer a 4 year degree in Black Market Management. Look around your neighborhood and pay attention to the marketer's... If they are not in your neighborhood then prepare to travel to their area to get fresh produce, meat and canned goods.....This has already been mostly if not completely covered above.

But, if we’re starting to see names like Buffet and Ackman give interviews acknowledging inflation then it seems like the next step from a planning or investing perspective would be trying to figure out which businesses have the most pricing power or which businesses have values that wouldn’t be as affected by an interest rate increase if the fed decides they want to pump the brakes.

Skill sets.. Hmmm.The point about timing I was making is look at how Pershing basically traded out Starbucks when it got a little pricy for Dominoes while it was down some. And, I think you're spot on for trading one type of risk for a different type of risk. But, that is exactly what the interesting part to me is seeing which types of risk the fund managers are taking on given a certain set of perceived future economic conditions.

I think that's a fair point if you have a certain outlook. My thinking is probably a littler different in the sense that I would think the people that did well in the normal markets would do well in the "black markets" also. I don't necessarily understand why the skill sets would be that different.

Several years ago I resided in a community with a large population of Latino's. I was riding with the local LEO's on the graveyard shift and they enlightened me. I was banking next to a small strip mall that contained a Mexican market. Conversed with a young Latino teller at the bank about tamales. She said the market had home made tamales on Tuesday and Thursday. When I would go in at lunch time they were sold out. The Latino teller said "You have to get there early". Even that did not work. If I got there around 11 am, there would usually be a few available for me to buy. The bottom line was that the market operator was selling to his "regular customer's" and anything left over would go to the Gringo's around noon. I started to pay closer attention to the market. I never saw the Cisco truck making a delivery. It was always old beat up pickup's with fresh corn, peaches, etc backing up to the front door.... Many of the canned goods were from Mexico. Nothing in the market had a price tag on it. While waiting in line to check out I would notice a person in front of me would pay $1 for an item and the same item would cost me $1.50.... While in Garden Grove, CA I noticed the same thing going on in Little Saigon.

Just sayin'

Yes, asset inflation is the real story. Consumer inflation is noise in comparison.i think most agree there is asset inflation setting in now

with that said, the people that should be the most pissed about all of this are people that didn't choose to allocate their resources in the stock market or real estate

it doesn't take a phd to realize when you pump a shit load of money into the economy, prices go up

and that's not just consumer prices, consumer price inflation is what everyone is hyper focused on but you also get asset inflation

so, what if we get this situation where there is asset inflation to a higher degree than consumer inflation

the fed seems like they only care about consumer inflation as well so whatever interest rate adjustments the feds make seem like they will be tied to consumer inflation

so this is a huge gain for those that are asset owners

just another case of the .gov picking winners and losers

everything i do is tied to real estate in one way or the other but i think if people thought about this more they would be more pissed off than happy about the stimulus

That last comment is true - until that high priced asset cannot be sold. That's a major risk of price inflation - illiquidity. It hasn't been mentioned on this thread yet, but it is the harbinger of deflation. IMO this is one of the reasons they have been pumping the dollars. Not the only reason, but its definitely in the mix. We saw this with the early 2000s housing bubble. Illiquidity is a bad deal as it speaks to the top of a asset pricing cycle; you don't want to buy at this point or be a bank holding a lot of notes with property valued at this peak. The only way out of this is to get more money into the hands of people who would buy the assets, effectively reducing the cost with out reducing the price. Boom - monetary inflation.i think most agree there is asset inflation setting in now

with that said, the people that should be the most pissed about all of this are people that didn't choose to allocate their resources in the stock market or real estate

it doesn't take a phd to realize when you pump a shit load of money into the economy, prices go up

and that's not just consumer prices, consumer price inflation is what everyone is hyper focused on but you also get asset inflation

so, what if we get this situation where there is asset inflation to a higher degree than consumer inflation

the fed seems like they only care about consumer inflation as well so whatever interest rate adjustments the feds make seem like they will be tied to consumer inflation

so this is a huge gain for those that are asset owners

just another case of the .gov picking winners and losers

everything i do is tied to real estate in one way or the other but i think if people thought about this more they would be more pissed off than happy about the stimulus if they aren't in the real estate or finance industries or a industry that benefits from high asset prices or owned a lot of assets prior to the stimulus

My premise the whole time has been that this game has not been about Covid or anything else. Pumping dollars and keeping rates low has everything to do with keeping assets on balance sheets inflated so that institutions remain solvent. If this is true the the mess we are in is dire.

Yes, asset inflation is the real story. Consumer inflation is noise in comparison.

Your statement is true for those with sufficient assets and enough income to be largely unaffected by consumer inflation (if I have $5M in my retirement and income of $500k/year, upward swings in the market are indeed more impactful than paying an extra 10% at the grocery store or 30% at the pump). But there is a large section of the population - like, at least half the US - for whom the opposite is true.

This is the difference between Wall Street and Main Street as you mentioned earlier.

It's true no matter who you are. Nearly all of the monetary inflation to date has chased assets, which I have mentioned more than a few times in this thread. Whether it matters or not to you is a different story... I'd imagine over 98% of the US does not fit the 5m/500k number.Your statement is true for those with sufficient assets and enough income to be largely unaffected by consumer inflation (if I have $5M in my retirement and income of $500k/year, upward swings in the market are indeed more impactful than paying an extra 10% at the grocery store or 30% at the pump). But there is a large section of the population - like, at least half the US - for whom the opposite is true.

This is the difference between Wall Street and Main Street as you mentioned earlier.

It's true no matter who you are. Nearly all of the monetary inflation to date has chased assets, which I have mentioned more than a few times in this thread. Whether it matters or not to you is a different story... I'd imagine over 98% of the US does not fit the 5m/500k number.

I picked a number that shouldn't cause an disagreement, and what happens?

I wasn't disagreeing with you. I swear.I picked a number that shouldn't cause an disagreement, and what happens?Pick whatever threshold you want for wealth and income - it's going to vary according to cost of living, of course. In some areas, one might do fine with $1M assets and $100k/hr. That would put someone in the ~85th percentile for income and ~90th percentile for wealth. Leaves a whole bunch of people in worse shape. Eventually, that could lead to political policy changes that may disfavor the wealthy. It's yet another factor that will box in the Fed.

There is no doubt that you are right about what you are saying, and I don't dispute it, or even that the pain felt by the "average" person is more important or more severe on a life to life basis than whatever is happening to the investor. We are not in disagreement.

I think where we disagree, if only a little, is that I think the story of the recent inflation is that it has been predominately in the asset markets, not the goods or labor markets. That is, in my opinion, true regardless of the human toll. It is just the way the money has gone. That's it.

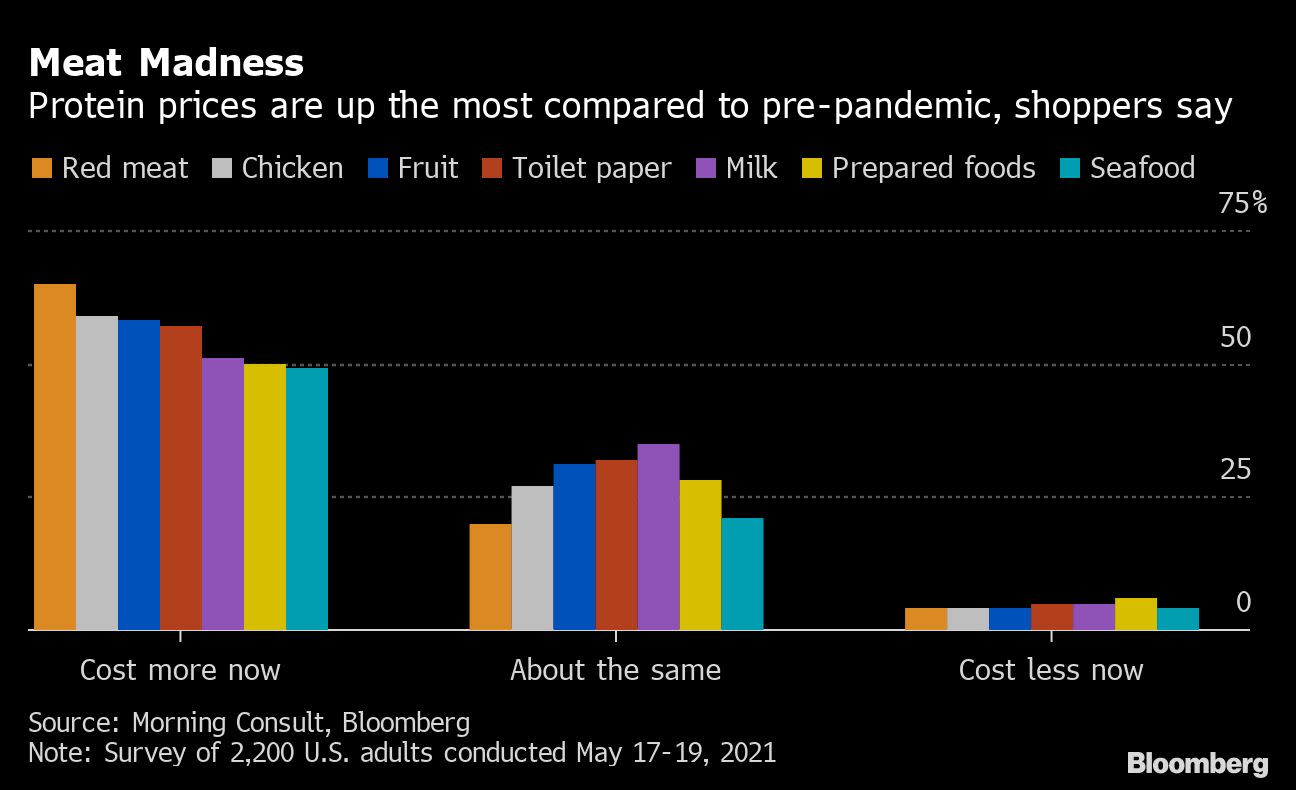

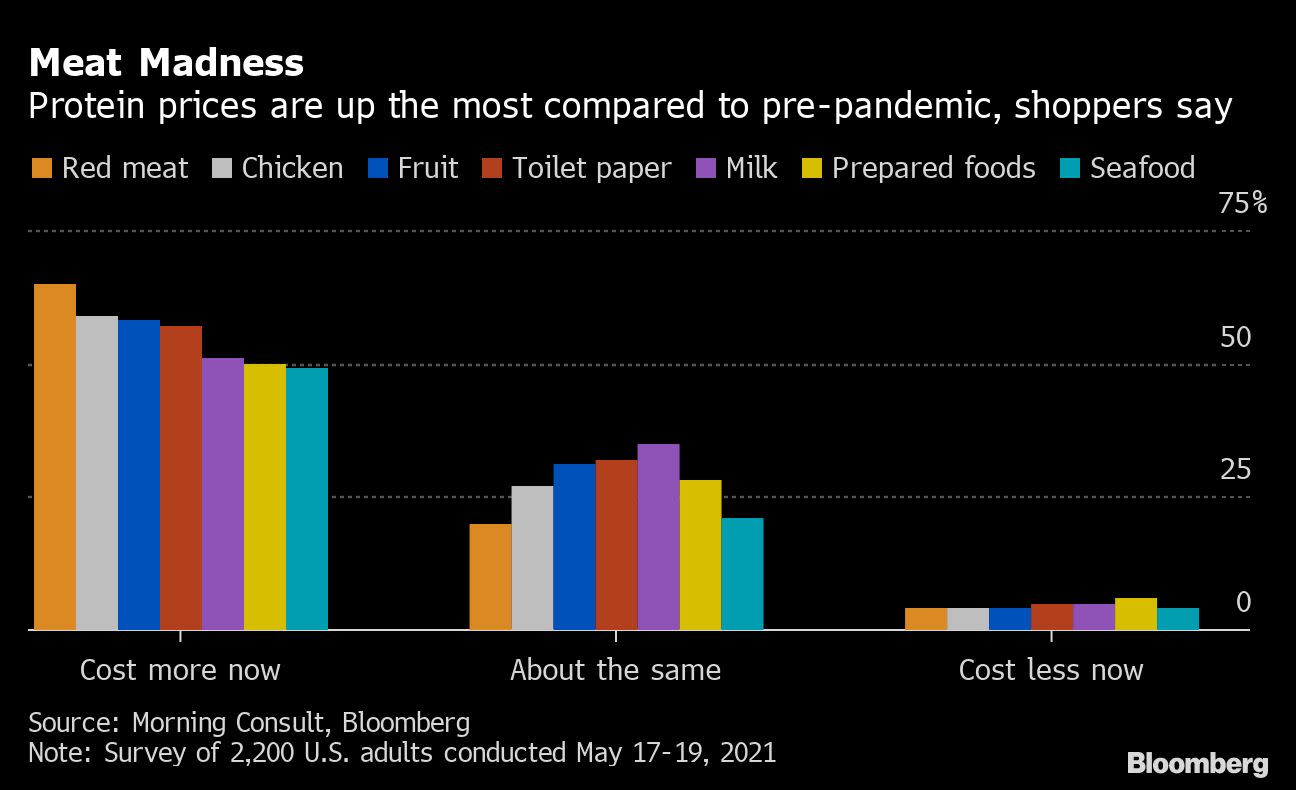

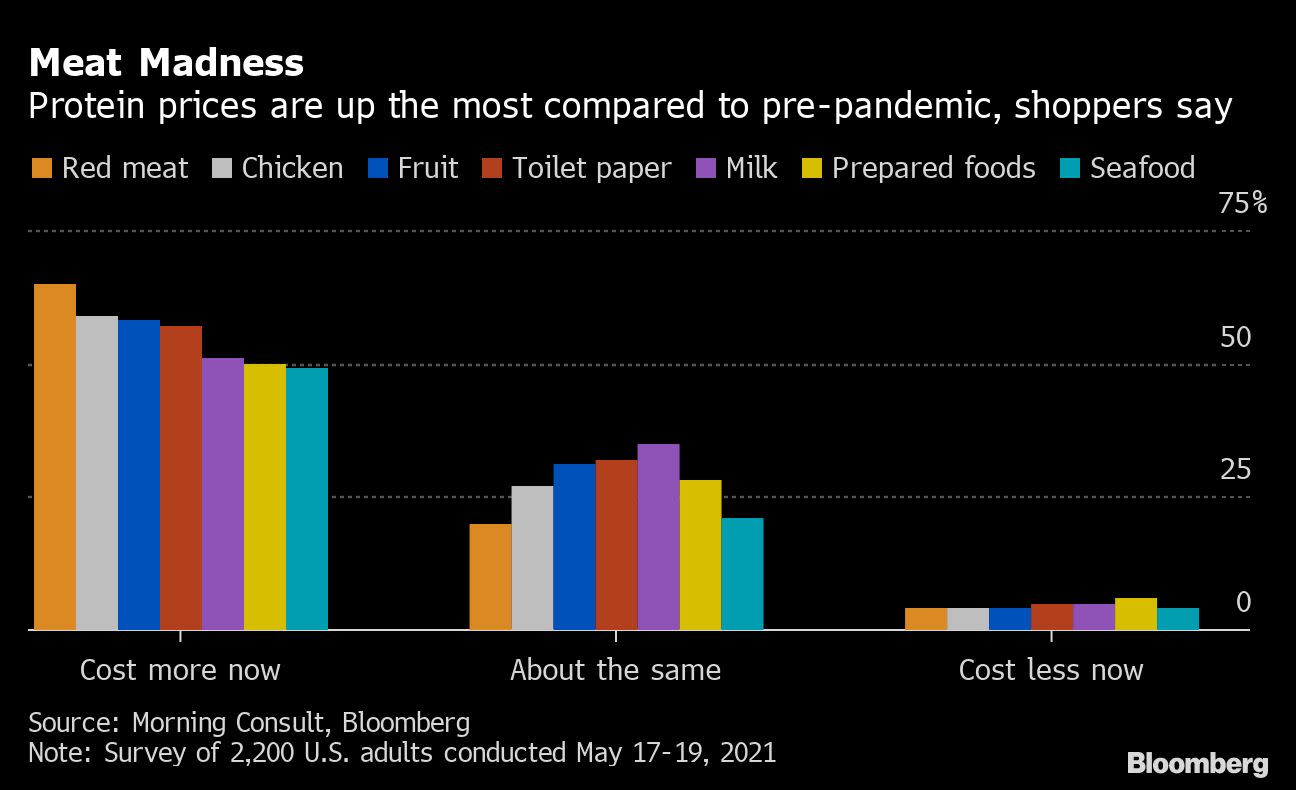

Protein ... Something to plan ahead for

finance.yahoo.com

finance.yahoo.com

Meat Eaters Hit Hardest as Inflation Sweeps U.S. Grocery Aisles

(Bloomberg) -- Inflation is landing in America’s refrigerators -- and it’s hitting meat-eaters most of all.About one in three U.S. adults say they’re spending more on groceries than they were at the start of 2021, according to a Morning Consult survey of 2,200 U.S. adults conducted May 17 to 19...

Beef prices have been going crazy here.Protein ... Something to plan ahead for

Meat Eaters Hit Hardest as Inflation Sweeps U.S. Grocery Aisles

(Bloomberg) -- Inflation is landing in America’s refrigerators -- and it’s hitting meat-eaters most of all.About one in three U.S. adults say they’re spending more on groceries than they were at the start of 2021, according to a Morning Consult survey of 2,200 U.S. adults conducted May 17 to 19...finance.yahoo.com

Kind of almost mimicking the percentage of rise in gas prices.

That leads into all of the propaganda being spread about converting to "plant based" nutrition... You have to consume a lot of tofu to equal a pound of beef.Beef prices have been going crazy here.

Kind of almost mimicking the percentage of rise in gas prices.

I have freezer space, so everytime they have Ribeyes or Tenderloins on sale, and I stock up. I'm lucky that one of the two supermarkets in town actually has Butcher's that know how to cut meat. The other supermarket chain, everything is cut up, processed, and packaged in a central location in Denver, then distributed.

Are you canning any meat or produce ?I have freezer space, so everytime they have Ribeyes or Tenderloins on sale, and I stock up. I'm lucky that one of the two supermarkets in town actually has Butcher's that know how to cut meat. The other supermarket chain, everything is cut up, processed, and packaged in a central location in Denver, then distributed.

Tofu is beans...... soybeans. One reason Bill Gates is buying up farm land and promoting plant based food.Excuse me. Tofu?

Be better off eating beans and mf's.

Your County Agent may can point you in the right direction. I have attended some of the County Farm Service Agency's classes on canning. It's going to be just the basic's but enough info to get you to hot bath canning. From there you go to pressure canning..... Don't get discouraged if your first couple of batches don't come out perfect. It is a learning process... Better to learn from the Old Timers, face to face, than to watch a YouTube video..... LOLNot canning, I need to take time to learn.

Canning is very simple. You just have to make sure you get the item to the necessary temperature and hold it there long enough to kill any spores, particularly botulism. I would suggest not listening to "old timers" because they often can outside of a pressure canner, which is how they learned. It is decidedly unsafe for most foods. Get a good book on it. It's really easy. My wife cans tons of shit, she loves to do it. It's science, not art.

How to Use a Pressure Canner • The Prairie Homestead

Pressure canning isn't as scary as you've been lead to believe! Not only is it a simple skill to learn, it can save you hundreds of dollars each year!

Here, this will get you there.

Tofu unlike beans is a nasty product and soybeans should be used to feed animals not people.

I own a grocery store, and also a liquor store a few miles from the grocery store. All I can say, if you don't have it you better stock up now, it's not going down anytime soon. That is if you can even get it. Inventory has been very sporadic the last year or more.

My main wholesaler is telling us to be very careful on orders and pricing. Stuff is going up daily. Boneless ribeyes have went up $4/lb in a week and a half. Pork and chicken are sky high too

My main wholesaler is telling us to be very careful on orders and pricing. Stuff is going up daily. Boneless ribeyes have went up $4/lb in a week and a half. Pork and chicken are sky high too

Seems like America is setting up to play "Musical Chairs"... Always quite a few players think "There will always be a chair for me".... Until there is none.I own a grocery store, and also a liquor store a few miles from the grocery store. All I can say, if you don't have it you better stock up now, it's not going down anytime soon. That is if you can even get it. Inventory has been very sporadic the last year or more.

My main wholesaler is telling us to be very careful on orders and pricing. Stuff is going up daily. Boneless ribeyes have went up $4/lb in a week and a half. Pork and chicken are sky high too

Nobody really bitched about the trillions being printed, but now that it’s out in the world prices are going up. This is inducing demand destruction through high prices, which will cause more small businesses to go under.I own a grocery store, and also a liquor store a few miles from the grocery store. All I can say, if you don't have it you better stock up now, it's not going down anytime soon. That is if you can even get it. Inventory has been very sporadic the last year or more.

My main wholesaler is telling us to be very careful on orders and pricing. Stuff is going up daily. Boneless ribeyes have went up $4/lb in a week and a half. Pork and chicken are sky high too

alternatives will be sought but everything will be increasing. The paycheck ain’t gonna go as far. I predict that we will start to see repossessions of homes and cars that were bought at these low interest rates soon enough, not necessarily from the increase in monthly payments but from the increase in everything else putting the squeeze in the budget. The inflation genie is out of the bottle and it is not good.

This inflation is also the equivalent of decreasing returns on your 401k. But as long as the stock market goes up it will be invisible to most people.

Last edited:

There's a real problem with canning today....................Canning lids. Very hard to come by, though I see there is a company now forming to produce lids here in the U.S. Expect to pay at least $0.50/lid. They are like primers in respect to supply.Are you canning any meat or produce ?

Stay away from the chinese stuff. They collapse in pressure canners.

Last edited:

We have not been able to get canning lids for a while at our store. We live in a pretty rual area and gardening is pretty common. We even pre ordered them way in advance a while back. Notta.There's a real problem with canning today....................Canning lids. Very hard to come buy, though I see there is a company now forming to produce lids here in the U.S. Expect to pay at least $0.50/lid. They are like primers in respect to supply.

Stay away from the chinese stuff. They collapse in pressure canners.

Similar threads

- Replies

- 32

- Views

- 1K

- Replies

- 109

- Views

- 4K

- Replies

- 61

- Views

- 2K