lmao. Other than asserting it, do you have any proof at all?Which they are.

Join the Hide community

Get access to live stream, lessons, the post exchange, and chat with other snipers.

Register

Download Gravity Ballistics

Get help to accurately calculate and scope your sniper rifle using real shooting data.

Install the app

How to install the app on iOS

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

New Ammunition plant to open manufacturing primers

- Thread starter sig2009

- Start date

Just as bad.Vista wasn't going to buy Sportsmans. Great American Outdoors was.

Apparently people have no clue what price fixing means.

Compare prices of each. They are all the same. That's proof enough for me.lmao. Other than asserting it, do you have any proof at all?

Price fixing does occur. I'm not getting into it on a publicly viewable forum, but it does happen.If is doing a lot of work in that sentence, and there is literally zero evidence of price fixing at the current time. If there were to be evidence of such, it would come in the coordinated decrease in production when demand was lower.

The economics of what happened are this: At any given time, primer production numbers are basically fixed. Nobody has added capacity in forever. When Remington went bankrupt, that amount of the supply went off line, so the supply curve, which is vertical in the short term, shifted to the right. Assuming a steady demand curve, you would see price increases, which we did. The amount of those increases would be a factor of demand elasticity. But concurrently the demand curve shifted with the huge influx of new buyers, so the demand curve shifted upward, and probably flattened, so prices went up. When Remington got back on line, which was recent, the supply curve shifted back to normal, but the demand curve had changed. So high prices persisted. That is all literally econ 101. There is nothing in the pricing action that would suggest anything else.

By adding new supply, you will again shift the supply curve to the right, and that will likely lower prices, but the amount will depend of what the demand curve looks like.

As I said, when you would see anti competitive behavior would be supply restriction to keep prices up when demand falls. It is even alluded to in the BIG PRIMERS article above. The problem is that they could have always done that to one degree or another, and they haven't been disciplined enough to be able to. And the almost certainly will not be now. More importantly, ammo is a not a great business, in general. And not great businesses don't become great businesses very often. A great business has pricing power. Primers have pricing power right now, but that is likely very temporary.

Bottom line: you don't need to fix prices if you have significant current excess demand, and there is no way Olin and Vista are going to risk their businesses on price fixing small parts of their business lines. It's ridiculous on its face.

Now how MUCH of that is affecting price is a better question, as well as how you define "price fixing". When an agreement to raise prices on ammunition (whether openly, or just following suit and seeing what the market will bear) due to its scarcity happens, then the components become "more valuable". As in "Why would I sell primers at a lower profit, than I am right now to the ammunition makers?" The cost of materials is only a small factor, scarcity is the real driver along with profits. And an industry that knows there will be lean times like before, is wading in to get all they can get without having cries for anti-trust investigations. Besides, if your competition is making more profits than you, then, well, your stockholders are not going to be happy. And so the prices go up across the board, as industry winks and nods at each other, seeing what they can get from a hot market, each carving up their piece of the pie.

I don't begrudge them so much either, but I do think they are about to cross a line if they don't do something about availability and prices. The emergence of new companies is always a first sign that they are near that line, kind of like the AR craze that occurred not too long ago. How many companies sprung up overnight? Within a year that market crashed.

As people now start buying by cases what they used to buy in boxes, the industry is setting themselves up for the same type of crash. When John Q Public hits a point where they not only have enough, but enough to stretch several business quarters, the house of cards will begin to crumble. And while Joe Lunchbox does have a short memory, he also will have no pressing reason to open up his wallet.

Writing is already on the wall....

Yes, the rising cost of manufacturing and living is here to stay for the foreseeable future. The problem is not isolated to the firearms industry, its pretty much across the board. I work in manufacturing and see the issues from every angle. Labor issues in finding people that want to work and retaining people that are there has driven labor costs up 33% over the last two years, and we still can't get enough people to meet the demand from our customers. There always seems to be another employer desperate enough to offer even more money for labor. Raw material supply has reached a point where you buy as much as you can when its available because there is no telling when you can get it again. Transportation of raw material once you find a source is another problem. Shipping containers that did cost $3000 to rent for a shipment now cost $25000 because of the shortage in containers. Energy cost, Insurance, taxes, I could go on and on. Prices for everything are constantly going up and if you are going to stay in business the price of what you sell is going to go up too. This not isolated to one particular industry, this is everyone on a global scale. On top of that the Fed has just stopped buying mortgage backed securities and is now in the business of selling, driving up interest rates for loans. So where does this end? Who knows, but we are definitely in for a ride of substantial inflation and growing interest rates.not so much price fixing as the reality of raw materials will continue to rise in cost. The cost of manufacturing continues to rise as more and more regualtions have to be adhered to along with the high cost of insurance, utilites, workmans comp, etc. If you've never owned your own business , you don't have a clue. I highly doubt you'll ever see anything much below $75 again. Get used to it. Bitch or shoot, the choice is yours.

A new primer manufacturer is going to have all the same issues listed above, so MAYBE they can effect the supply and the price will come down. However, I think its probable that they are doing this to help steady their own supply for ammunition manufacturing. If there is a surplus from that then we might benefit.

Of course price fixing occurs, if it didn't we wouldn't have a name for it. But what you go on to describe is not price fixing. If two gas stations raise prices over and over in response to each other, it is not price fixing. If the two owners walk across the street and say, "lets restrict the amount of gas we each sell so that we can keep prices high," it is.Price fixing does occur. I'm not getting into it on a publicly viewable forum, but it does happen.

Now how MUCH of that is affecting price is a better question, as well as how you define "price fixing". When an agreement to raise prices on ammunition (whether openly, or just following suit and seeing what the market will bear) due to its scarcity happens, then the components become "more valuable". As in "Why would I sell primers at a lower profit, than I am right now to the ammunition makers?" The cost of materials is only a small factor, scarcity is the real driver along with profits. And an industry that knows there will be lean times like before, is wading in to get all they can get without having cries for anti-trust investigations. Besides, if your competition is making more profits than you, then, well, your stockholders are not going to be happy. And so the prices go up across the board, as industry winks and nods at each other, seeing what they can get from a hot market, each carving up their piece of the pie.

I don't begrudge them so much either, but I do think they are about to cross a line if they don't do something about availability and prices. The emergence of new companies is always a first sign that they are near that line, kind of like the AR craze that occurred not too long ago. How many companies sprung up overnight? Within a year that market crashed.

As people now start buying by cases what they used to buy in boxes, the industry is setting themselves up for the same type of crash. When John Q Public hits a point where they not only have enough, but enough to stretch several business quarters, the house of cards will begin to crumble. And while Joe Lunchbox does have a short memory, he also will have no pressing reason to open up his wallet.

Writing is already on the wall....

Furthermore, there is no indication at all that this is coming from Olin or Vista, who would be the only ones who could truly price fix in the primer markets. I have no idea if wholesale primer prices have even budged, but I am guessing what we are seeing is increased margins at the consumer level. In fact, arguably the impetus for the pricing on the consumer level is the auction market right now, and it is nearly impossible to fix auction prices, they are truly a free market. You can fix auction commissions, like Sotheby's and Christie's did, but fixing auction prices is nearly impossible.

So sure, if you define price fixing by prices gravitating toward the market prices set at public auctions, then you might have price fixing. But if you do, you have literally obliterated any normal use of the term. Again, price fixing in these markets would be more likely during lean times, and not right now. There is no need for it. Everybody can keep raising their prices independently and keep selling all their goods. Why fuck with that?

You guys might mean price gouging when you are saying price fixing, but again, if your price is lower than the auction market price, it is pretty hard to be price gouging.

I do agree with your scenario as to the likely outcome, but that is only possible because the big players in the market are not ever able to control the supply and pricing like people think they can.

why would they have to? if one isn't lowering prices, the other sure as hell isn't . It's win win for both.Which they are.

Just another thought but it should not surprise anybody when undifferentiated commodities sell at similar or the same prices just about everywhere. It's like being surprised that most gas stations in your area are charging about the same rate.

Also, worth noting.

Anyone holding out on buying at 6-10 cent (sometimes more) at this point are only hurting yourselves.

The demand is higher than supply. Which means they will sell no matter what. The only question, will you be the one getting them or not?

Also, while yes, some have doubled in price. However, the cost for the absolute cheapest component is what doubled in price. So, if you’re talking about a singular component like primers, you may have doubled that price, but you didn’t even remotely come close to a substantial increase in the per round cost (again, if only looking at primers independently).

I completely understand the distaste for a component doubling in price. But the fact is, at this point the majority of the primer consumer population has decided the cost is still justified.

Until the majority decide it’s not and stop buying, anyone holding out due to personal distaste, will only be limiting their supplies.

That’s a personal choice. If you have stockpiles or don’t mind shooting less….awesome. If you don’t have a stockpile or you want to continue shooting the volume you are accustomed, the price increase isn’t enough to dissuade that currently.

Anyone holding out on buying at 6-10 cent (sometimes more) at this point are only hurting yourselves.

The demand is higher than supply. Which means they will sell no matter what. The only question, will you be the one getting them or not?

Also, while yes, some have doubled in price. However, the cost for the absolute cheapest component is what doubled in price. So, if you’re talking about a singular component like primers, you may have doubled that price, but you didn’t even remotely come close to a substantial increase in the per round cost (again, if only looking at primers independently).

I completely understand the distaste for a component doubling in price. But the fact is, at this point the majority of the primer consumer population has decided the cost is still justified.

Until the majority decide it’s not and stop buying, anyone holding out due to personal distaste, will only be limiting their supplies.

That’s a personal choice. If you have stockpiles or don’t mind shooting less….awesome. If you don’t have a stockpile or you want to continue shooting the volume you are accustomed, the price increase isn’t enough to dissuade that currently.

But the fact is, at this point the majority of the primer consumer population has decided the cost is still justified.Also, worth noting.

Anyone holding out on buying at 6-10 cent (sometimes more) at this point are only hurting yourselves.

The demand is higher than supply. Which means they will sell no matter what. The only question, will you be the one getting them or not?

Also, while yes, some have doubled in price. However, the cost for the absolute cheapest component is what doubled in price. So, if you’re talking about a singular component like primers, you may have doubled that price, but you didn’t even remotely come close to a substantial increase in the per round cost (again, if only looking at primers independently).

I completely understand the distaste for a component doubling in price. But the fact is, at this point the majority of the primer consumer population has decided the cost is still justified.

Until the majority decide it’s not and stop buying, anyone holding out due to personal distaste, will only be limiting their supplies.

That’s a personal choice. If you have stockpiles or don’t mind shooting less….awesome. If you don’t have a stockpile or you want to continue shooting the volume you are accustomed, the price increase isn’t enough to dissuade that currently.

Any idea who the largest primer consumer would be?

But the fact is, at this point the majority of the primer consumer population has decided the cost is still justified.

Any idea who the largest primer consumer would be?

Doesn’t matter.

If that consumer keeps buying, then individuals personally not buying doesn’t change anything.

All it does is give fuel for complaining online.

Exactly. Submarginal buyers don't matter in any market. It is only those choosing to engage in transactions who count.Doesn’t matter.

If that consumer keeps buying, then individuals personally not buying doesn’t change anything.

All it does is give fuel for complaining online.

I have been buying them locally for 75.00/1000, not that i need them,but they are going to keep going up.

Remember when .22lr went thru the roof?. We used to laugh at the clowns at gun shows and their prices. When the prices came back down they took a real bath.Price fixing does occur. I'm not getting into it on a publicly viewable forum, but it does happen.

Now how MUCH of that is affecting price is a better question, as well as how you define "price fixing". When an agreement to raise prices on ammunition (whether openly, or just following suit and seeing what the market will bear) due to its scarcity happens, then the components become "more valuable". As in "Why would I sell primers at a lower profit, than I am right now to the ammunition makers?" The cost of materials is only a small factor, scarcity is the real driver along with profits. And an industry that knows there will be lean times like before, is wading in to get all they can get without having cries for anti-trust investigations. Besides, if your competition is making more profits than you, then, well, your stockholders are not going to be happy. And so the prices go up across the board, as industry winks and nods at each other, seeing what they can get from a hot market, each carving up their piece of the pie.

I don't begrudge them so much either, but I do think they are about to cross a line if they don't do something about availability and prices. The emergence of new companies is always a first sign that they are near that line, kind of like the AR craze that occurred not too long ago. How many companies sprung up overnight? Within a year that market crashed.

As people now start buying by cases what they used to buy in boxes, the industry is setting themselves up for the same type of crash. When John Q Public hits a point where they not only have enough, but enough to stretch several business quarters, the house of cards will begin to crumble. And while Joe Lunchbox does have a short memory, he also will have no pressing reason to open up his wallet.

Writing is already on the wall....

Did you see that in your magic crystal ball? If so please give out the MEGA MILLIONS Numbers to the rest of us also.I have been buying them locally for 75.00/1000, not that i need them,but they are going to keep going up.

A 7 year old article has no bearing on this discussion. That's the point.Your point ?

LOL, lots of BS here, business have been gouging, fleecing, price fixing goods for centuries.

9to5mac.com

9to5mac.com

The reason primer prices have increased at a higher percentage compared to any other reloading component

is the lack of competition period.

Apple and Amazon price fixing fines levied by antitrust regulator - 9to5Mac

An Italian investigation into alleged Apple and Amazon price fixing in the sale of Beats products has resulted in both companies being ...

9to5mac.com

9to5mac.com

The reason primer prices have increased at a higher percentage compared to any other reloading component

is the lack of competition period.

Last edited:

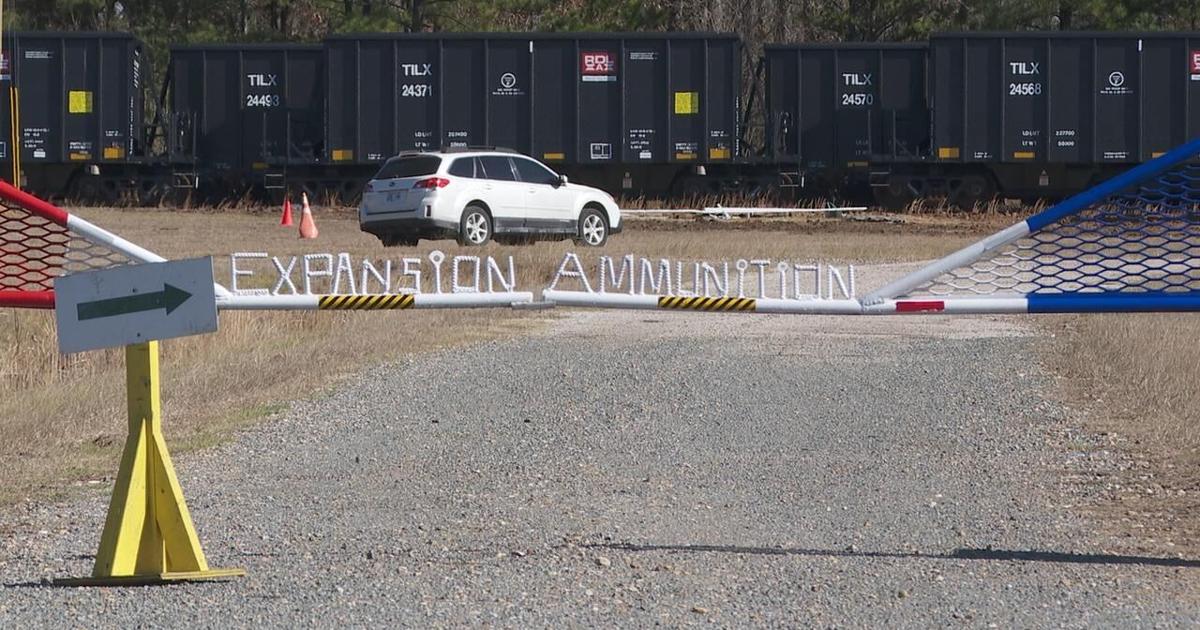

Expansion Ammunition - Produced by Expansion Industries

www.expansion-ammunition.com

www.expansion-ammunition.com

Ammunition plant coming to the Texarkana area

HOOKS, Texas - An ammunition plant is expected to open next year in East Texas, and bring more jobs to the region.

Here is a picture showing exactly what is going on. The short run demand curve changed due to exogenous factors, and supply was reduced due to Remington going off line. That is why you saw E0 (long term equilibrium) move to E2 rather than E1. What you are seeing is literally a text book case, and it requires no conspurrrracies or nefarious doings to understand.

ETA: the short run demand curve likely shifted more vertically than on its axis, but same diff. This is how markets work and how they deal with changes in supply and demand.

Last edited:

economic theory and common sense is forbidden around these parts...watch it you might be banned

Here is a picture showing exactly what is going on. The short run demand curve changed due to exogenous factors, and supply was reduced due to Remington going off line. That is why you saw E0 (long term equilibrium) move to E2 rather than E1. What you are seeing is literally a text book case, and it requires no conspurrrracies or nefarious doings to understand.

ETA: the short run demand curve likely shifted more vertically than on its axis, but same diff. This is how markets work and how they deal with changes in supply and demand.

what id actually like to know is:

primers seem to cause debate with the same ferocity as "legal abortion"

yet if berger 109's go up 4 cents no one even talks about it, and if they do no one cares (same overall price increase per round)

is it because its the cheapest item?

thanks

And that means I won't buy 1k primers for $120 any day.

Enjoy archery then

I just saw this today. great news!

Ammunition plant to open near Texarkana | Texarkana Gazette

HOOKS, Texas -- Expansion Industries, an ammunition manufacturing company whose corporate offices are based out of Carrollton, Texas, is preparing to open a manufacturing facility here.www.texarkanagazette.com

Great news indeedI just saw this today. great news!

Ammunition plant to open near Texarkana | Texarkana Gazette

HOOKS, Texas -- Expansion Industries, an ammunition manufacturing company whose corporate offices are based out of Carrollton, Texas, is preparing to open a manufacturing facility here.www.texarkanagazette.com

Which they are.

LOL

If you know so much, why don't you run to the SEC/DoJ?

Compare prices of each. They are all the same. That's proof enough for me.

LOLOLOLOL

economic theory and common sense is forbidden around these parts...watch it you might be banned

what id actually like to know is:

primers seem to cause debate with the same ferocity as "legal abortion"

yet if berger 109's go up 4 cents no one even talks about it, and if they do no one cares (same overall price increase per round)

is it because its the cheapest item?

thanks

You must not reload for handgun. For a high-volume 9mm handgun reloader using polycoated lead bullets (e.g. BlueBullets), primers are now likely the most expensive component. At 10 cents a piece they're more expensive than either projectiles or processed range brass.

But yeah, for guys who reload rifle it's likely just sticker shock from a price hike of 100-300% depending on where you look.

But the fact is, at this point the majority of the primer consumer population has decided the cost is still justified.

Any idea who the largest primer consumer would be?

We know, the government is buying them all up and burying them at Yucca Flats

Here is a picture showing exactly what is going on. The short run demand curve changed due to exogenous factors, and supply was reduced due to Remington going off line. That is why you saw E0 (long term equilibrium) move to E2 rather than E1. What you are seeing is literally a text book case, and it requires no conspurrrracies or nefarious doings to understand.

ETA: the short run demand curve likely shifted more vertically than on its axis, but same diff. This is how markets work and how they deal with changes in supply and demand.

Stop trying to educate those who can't even comprehend basic math or business 101

You must not reload for handgun. For a high-volume 9mm handgun reloader using polycoated lead bullets (e.g. BlueBullets), primers are now likely the most expensive component. At 10 cents a piece they're more expensive than either projectiles or processed range brass.

Yep

Even if you account for brass as free, primers are the absolute highest % of reloaded pistol ammo cost.

Again, supply and demand. As supply increases “panic demand” decreases, as demand decreases prices decrease.Yeah I get it, they're gonna make hay while the sun shines. But if this new addition to the market means I can buy 1k primers from Midway for $120 everyday instead of 1k/$120 every three days, as far as I'm concerned nothing has been gained.

In other words; People will initially pay $100+/K from a company like this but as people get what they want and supply still remains high they stop buying. When they stop buying prices are forced down. Capitalism works.

Economics 101 has been a historic bench mark. Unfortunately if you dig out that old college text book there is nothing in there that addresses Government's that are running their $ printing presses 24 hours a day and are giving away free money to people so they don't have to go out and get a job............ I appreciate capitalism until it turns into communism.Again, supply and demand. As supply increases “panic demand” decreases, as demand decreases prices decrease.

In other words; People will initially pay $100+/K from a company like this but as people get what they want and supply still remains high they stop buying. When they stop buying prices are forced down. Capitalism works.

The largest consumer of ammunition is the US Government (No, I did not Fact Check)... The man on the street is competing with the Government to procure ammunition and components.... Actually, it's not a big deal and most American's don't know this is happening.

It will become a big deal when the Govenment starts buying up the food supply so it can hand it out to the less fortunate that can't get a job.

Correct, you have to make it all the way to Econ 102 in order to learn about macro issues and the effects of changes in the money supply. Thanks for sharing.Economics 101 has been a historic bench mark. Unfortunately if you dig out that old college text book there is nothing in there that addresses Government's that are running their $ printing presses 24 hours a day and are giving away free money to people so they don't have to go out and get a job............ I appreciate capitalism until it turns into communism.

The largest consumer of ammunition is the US Government (No, I did not Fact Check)... The man on the street is competing with the Government to procure ammunition and components.... Actually, it's not a big deal and most American's don't know this is happening.

It will become a big deal when the Govenment starts buying up the food supply so it can hand it out to the less fortunate that can't get a job.

And by the way, dunderfuck, about 8 billion rounds of ammo are sold every year in the US, and government in total buys about two hundred million of those (price extrapolation) so while they are the single largest consumer of ammo, they are not the dominant consumer of ammo, everyday Americans are. And obviously, given these numbers, commercial ammo production is the largest buyer of primers (also producer) in the US each year.

This is awesome news!I just saw this today. great news!

Ammunition plant to open near Texarkana | Texarkana Gazette

HOOKS, Texas -- Expansion Industries, an ammunition manufacturing company whose corporate offices are based out of Carrollton, Texas, is preparing to open a manufacturing facility here.www.texarkanagazette.com

I'm not arguing with anybody about how this works. It all makes sense. I just don't like it and I have no problem suspending the bulk of my shooting activities till prices come down or I get over my stubbornness.Again, supply and demand. As supply increases “panic demand” decreases, as demand decreases prices decrease.

In other words; People will initially pay $100+/K from a company like this but as people get what they want and supply still remains high they stop buying. When they stop buying prices are forced down. Capitalism works.

One thing everyone is assuming is that this primer plant is going to dedicate any of its production to retail sales.

It might, in the future, once demand for loaded ammunition subsides to the point that there is a production surplus.

Until then........LOLNOPE

This is my thoughts as well. The company is very likely to make the primers for themselves and the industry with no plans for retail sales to the reloading public.

Don't count your Chickens.

No doubt. It is a huge pain in the ass for pistol. I treat them like I suggest that people treat the stock market. Dollar cost average. Just spend the same amount each period on primers. Sometimes you get more, sometimes you get fewer. But you always have primers.You must not reload for handgun. For a high-volume 9mm handgun reloader using polycoated lead bullets (e.g. BlueBullets), primers are now likely the most expensive component. At 10 cents a piece they're more expensive than either projectiles or processed range brass.

But yeah, for guys who reload rifle it's likely just sticker shock from a price hike of 100-300% depending on where you look.

You must not reload for handgun. For a high-volume 9mm handgun reloader using polycoated lead bullets (e.g. BlueBullets), primers are now likely the most expensive component. At 10 cents a piece they're more expensive than either projectiles or processed range brass.

But yeah, for guys who reload rifle it's likely just sticker shock from a price hike of 100-300% depending on where you look.

thanks, makes sense...always something to learn

Besides Tx and 308 who i know shoots high volume pistol

who here is shooting high volume pistol AND only shooting the cheap BlueBullets (because regular FMJ / cup core are more than a primer)

vs

who is shooting rifle where the primer price is irrelevant.

my gut says 99 of 100 on this thread dont reload Blue Bullets

but ive been wrong before

I've reloaded 8k 9mm rounds this week, but that isn't exactly a normal week. I use Precision Delta so it is about .03 more per round than Blue Bullets. The primers are a pain, but it is interesting to note that the people using fewer of them/less of a percentage of cost are complaining most.thanks, makes sense...always something to learn

Besides Tx and 308 who i know shoots high volume pistol

who here is shooting high volume pistol AND only shooting the cheap BlueBullets (because regular FMJ / cup core are more than a primer)

vs

who is shooting rifle where the primer price is irrelevant.

my gut says 99 of 100 on this thread dont reload Blue Bullets

but ive been wrong before

I load/shoot around 10k of 9mm a season, which is relatively low volume among my peers but probably more than most on SH. When buying components for 10-15k at a time my cost was $100-110 per 1000 rounds. I haven't done the math yet but with primers at or above $120/1k that's obviously out the window.thanks, makes sense...always something to learn

Besides Tx and 308 who i know shoots high volume pistol

who here is shooting high volume pistol AND only shooting the cheap BlueBullets (because regular FMJ / cup core are more than a primer)

And I gave an example earlier in this thread about the huge impact this has on my rifle loads as well.

I'm hoping some of you guy's will buy the ammo and give us a review on service and how the product performs.

True. But if they make their own primers and put it in their ammo and put that ammo on the market... They are still adding to the product pool... That could take some of the load off of other producers try to meet demand. Which may free up more primers.This is my thoughts as well. The company is very likely to make the primers for themselves and the industry with no plans for retail sales to the reloading public.

Don't count your Chickens.

If you get enough people pissing in the pool it will overflow eventually.

Mike

According to my conversations with the company president, it sounds like they intend to market primers directly to the consumer. I actually have a job offer from them which is an attractive offer… But I’m skeptical about leaving my current gig for a start up like this in a pretty risky from a regulatory standpoint industry.This is my thoughts as well. The company is very likely to make the primers for themselves and the industry with no plans for retail sales to the reloading public.

Don't count your Chickens.

I wouldn't hesitate.According to my conversations with the company president, it sounds like they intend to market primers directly to the consumer. I actually have a job offer from them which is an attractive offer… But I’m skeptical about leaving my current gig for a start up like this in a pretty risky from a regulatory standpoint industry.

According to my conversations with the company president, it sounds like they intend to market primers directly to the consumer. I actually have a job offer from them which is an attractive offer… But I’m skeptical about leaving my current gig for a start up like this in a pretty risky from a regulatory standpoint industry.

A bird in the hand is worth two in the bush

A bird in the hand is worth two in the bush

Who dares wins

Similar threads

- Replies

- 1

- Views

- 279

- Replies

- 5

- Views

- 418

- Replies

- 0

- Views

- 210