Hang on to your HATS.. It's double speak time.

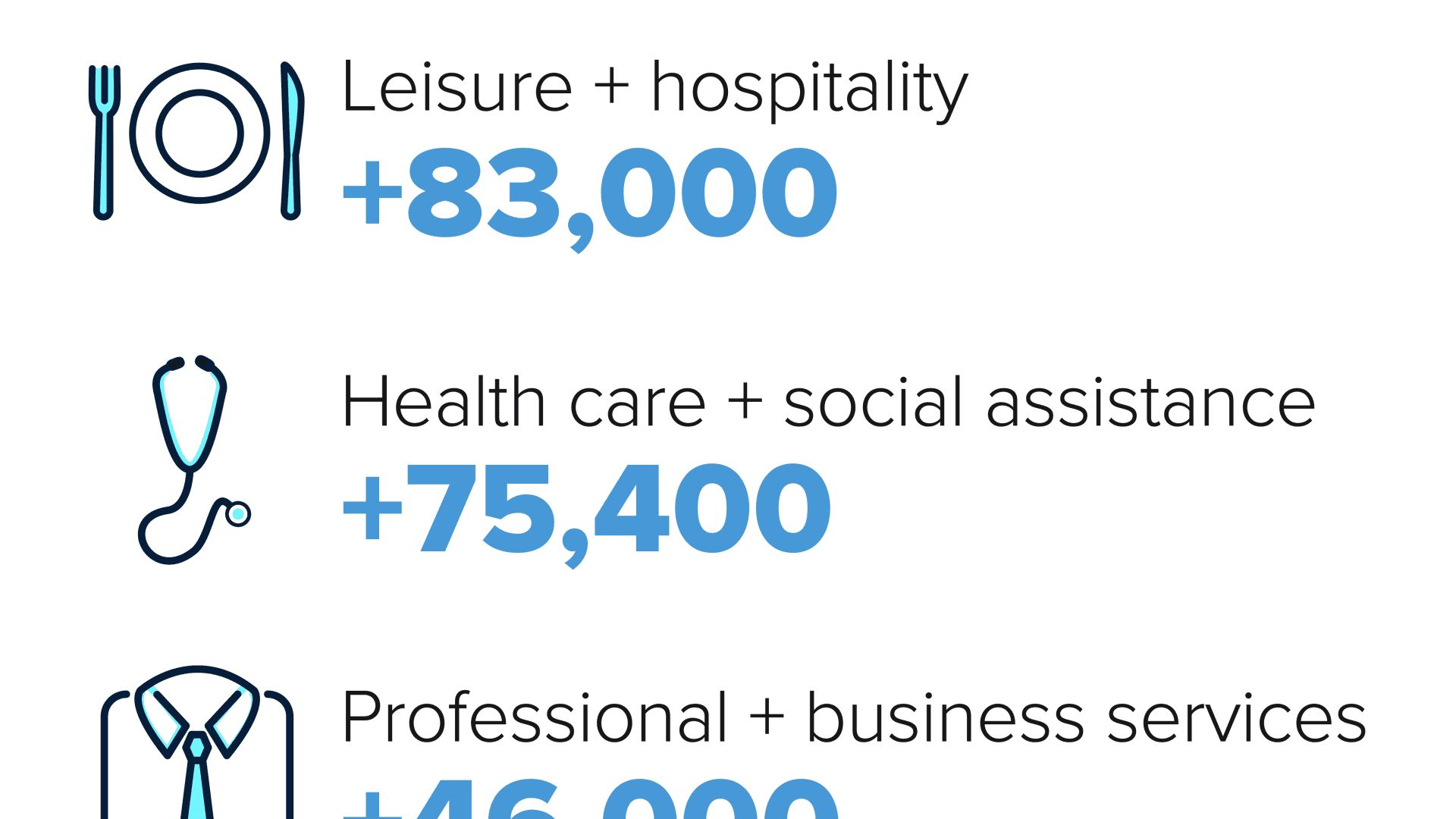

Low Unemployment -

The U.S. Economy Added 263,000 Jobs in September, Unemployment Rate Fell to 3.5%

Economists had expected the economy to add 250,000 jobs and the unemployment rate to hold steady at 3.7 percent. | Economywww.breitbart.com

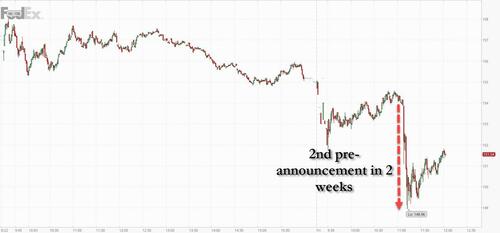

High jobless claims

Labor Participation chart says what?

New U.S. Weekly Jobless Claims in Unexpected Surge

The number of Americans filing fresh claims for jobless benefits jumped by the most in four months last week.www.breitbart.com

U.S. Labor Force Participation Rate (1990-2024)

Labor force participation rate for ages 15-24 is the proportion of the population ages 15-24 that is economically active: all people who supply labor for the production of goods and services during a specified period.www.macrotrends.net

The plan is to keep the rats (We the People) in the maze until we run out of resources (food, water, money,fuel,security, etc)....

Propaganda is their weapon.

:max_bytes(150000):strip_icc()/Bush-56a9a67c5f9b58b7d0fdad35.jpg)