I think the housing supply vs demand is the issue. Blackrock and other investment organizations are in direct competition for traditional family attempting to buy a limited number of houses thereby reducing supply and driving up demand.The mortgage rates are not the problem. We have dealt with significant higher rates.

https://infogram.com/br-historical-mortgage-rates-1h7j4dv0pkzw94n

What makes the American Dream a nightmare for many is that the increase in house prices and inflation have outpaced by far the measly wage increases.

https://dqydj.com/historical-home-prices/

TLDR: house price have quadrupled since the nineties. Your wages did not.

Join the Hide community

Get access to live stream, lessons, the post exchange, and chat with other snipers.

Register

Download Gravity Ballistics

Get help to accurately calculate and scope your sniper rifle using real shooting data.

Install the app

How to install the app on iOS

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Recession - 2022 / 2023 / 2024

- Thread starter Hobo Hilton

- Start date

Trump announced back when that illegal aliens who are trying to get green cards would be affected negatively for being on welfare...

Suddenly.. 10's of millions of people stopped getting welfare.

Dems stole the election, and now everybody wants to be on it again. Welfare recipients skyrocketed after the stolen election. Much higher than before Trump made his original announcement.

Suddenly.. 10's of millions of people stopped getting welfare.

Dems stole the election, and now everybody wants to be on it again. Welfare recipients skyrocketed after the stolen election. Much higher than before Trump made his original announcement.

Entities like Blackrock and REITs are certainly a factor but I think the low supply right now is primarily caused by nobody selling because most will have to refi to a higher rate. The majority on the market right now is some seriously overpriced stuff that has not moved for 90days+. Any new listing priced very ambitiously but not obscenely high is sold before the week is over.I think the housing supply vs demand is the issue. Blackrock and other investment organizations are in direct competition for traditional family attempting to buy a limited number of houses thereby reducing supply and driving up demand.

Last edited:

Just a reminder:Trump announced back when that illegal aliens who are trying to get green cards would be affected negatively for being on welfare...

Suddenly.. 10's of millions of people stopped getting welfare.

Dems stole the election, and now everybody wants to be on it again. Welfare recipients skyrocketed after the stolen election. Much higher than before Trump made his original announcement.

In fiscal year 2022, the federal government spent $1.19 trillion on more than 80 different welfare programs. That represents almost 20% of total federal spending and a quarter of tax revenues in 2022 or $9,000 spent per American household. (Source)

Jerome Powell is doing what Jerome has always done........ One more politician kicking the can down the road.

Inflation is eating up America.

www.cnbc.com

www.cnbc.com

Inflation is eating up America.

Powell's pivotal speech Friday could see a marked shift from what he's done in the past

Many expect the central bank leader to change his stance so that he hits the ball pretty much down the middle.

If a person scours the history books long enough... They can always find a place in time when "things were worse".

Somewhat of a psychological crutch to get through these dark times.

I'd imagine the final days of The Fall of the Roman empire was worse...

That really has no bearing of where America is today

___________

By some measures, Americans have never been more in the red.

In the second quarter of 2023, total credit card debt surpassed $1 trillion for the first time ever, which helped bring total household debt to $17.06 trillion, also a fresh record, according to the New York Federal Reserve.

But adjusted for inflation, credit card debt was higher when the economy bottomed out in 2008, according to a recent analysis by WalletHub.

Somewhat of a psychological crutch to get through these dark times.

I'd imagine the final days of The Fall of the Roman empire was worse...

That really has no bearing of where America is today

___________

By some measures, Americans have never been more in the red.

In the second quarter of 2023, total credit card debt surpassed $1 trillion for the first time ever, which helped bring total household debt to $17.06 trillion, also a fresh record, according to the New York Federal Reserve.

But adjusted for inflation, credit card debt was higher when the economy bottomed out in 2008, according to a recent analysis by WalletHub.

Container ships are waiting at Asian ports as retailers struggle to shift excess stock

Hopes of a traditional peak season when holiday orders are imported are fading.

People are catchin' on

www.kpax.com

www.kpax.com

Continued wage increases could lead to more interest rate hikes

Continued wage increases could lead to more interest rate hikes

Americans experienced a 3.5% increase in average weekly earnings in the last year. Policymakers say this needs to come down to control inflation.

"This was inevitable. We talked about it six weeks ago, and now you're just starting to see the chips start to fall. The layering is as follows: The regional [banks] don't know yet what their capital requirements are going to be. So, their loan books have closed like a turtle in a shell," he explained during an appearance on "Kudlow."

"This gets worse before it gets better. And what's it doing to small business? Killing them right now," he warned Tuesday.

www.foxbusiness.com

www.foxbusiness.com

"This gets worse before it gets better. And what's it doing to small business? Killing them right now," he warned Tuesday.

'Shark Tank' star Kevin O'Leary warns soaring interest rates will cause 'real chaos' for US economy

"Shark Tank" star and multi-millionaire investor Kevin O'Leary discuss the U.S.'s feeble economy as mortgage rates continue to skyrocket year-over-year.

Never put your retirement nest egg where the politicians can change the rules in their favor:

In effect, this means that higher-income earners wouldn’t receive the same tax break they’ve previously enjoyed once the Secure 2.0 changes are implemented because they wouldn’t be permitted to make pretax catch-up contributions, which reduce the size of the saver’s income subject to tax.

www.foxbusiness.com

www.foxbusiness.com

In effect, this means that higher-income earners wouldn’t receive the same tax break they’ve previously enjoyed once the Secure 2.0 changes are implemented because they wouldn’t be permitted to make pretax catch-up contributions, which reduce the size of the saver’s income subject to tax.

IRS announces changes impacting catch-up contributions

The IRS announced a delay for changes under the Secure 2.0 Act to Americans' catch-up contributions to retirement accounts, allowing those to be made on a pretax basis through 2025.

WASHINGTON — A former White House economist on Tuesday said he thinks the Federal Reserve will hike interest rates again amid rising inflation numbers and energy prices.

“The hiking is coming again,” Kevin Hassett, former chairman of the Council of Economic Advisers under then-President Donald Trump, told CNBC’s “Squawk Box.”

“The inflation numbers are going to surprise on the upside because gas prices have gone up so much and ... we’re looking probably for a top-line (consumer price index) of 0.8 or so,” he added.

______________________

No surprise here. Inflation, over the past few years, has been near 20% / annual.

The Government political machine has been cooking the books.

That can not go on forever.

www.cnbc.com

www.cnbc.com

“The hiking is coming again,” Kevin Hassett, former chairman of the Council of Economic Advisers under then-President Donald Trump, told CNBC’s “Squawk Box.”

“The inflation numbers are going to surprise on the upside because gas prices have gone up so much and ... we’re looking probably for a top-line (consumer price index) of 0.8 or so,” he added.

______________________

No surprise here. Inflation, over the past few years, has been near 20% / annual.

The Government political machine has been cooking the books.

That can not go on forever.

Former White House economic advisor says more Fed hiking is coming

Kevin Hassett, the former chairman of the Council of Economic Advisers, predicts another interest rate hike to lower rising inflation numbers.

"The data finds that consumers living paycheck to paycheck without issues paying bills have average outstanding credit card balances equivalent to 62% of their available savings, while those with issues paying monthly bills carry balances of 157% of their available savings, meaning they would still have a balance even if they emptied their savings accounts."

All income brackets now living paycheck to paycheck: Study

Paycheck-to-paycheck living isn't anything new, but the troubling trend is now impacting more Americans than ever as rising borrowing costs and inflation take a toll.

Charge it........

Sept 1 (Reuters) - See-through backpacks and jean shorts are among the popular last-minute purchases ahead of the new school year, several retailers said, as heat waves sweep the U.S. and security concerns grow at many middle- and high schools.

Though U.S. student debt repayments will resume on Oct. 1, straining many Americans' budgets, 2023 is expected to be the most expensive back-to-school shopping season yet. The National Retail Federation, a retail trade group, predicts spending will surpass $135 billion, an increase of more than $24 billion from last year

/cloudfront-us-east-2.images.arcpublishing.com/reuters/65CBVMR6ANJPRFMUQSAS5ZFQWY.jpg)

www.reuters.com

www.reuters.com

Sept 1 (Reuters) - See-through backpacks and jean shorts are among the popular last-minute purchases ahead of the new school year, several retailers said, as heat waves sweep the U.S. and security concerns grow at many middle- and high schools.

Though U.S. student debt repayments will resume on Oct. 1, straining many Americans' budgets, 2023 is expected to be the most expensive back-to-school shopping season yet. The National Retail Federation, a retail trade group, predicts spending will surpass $135 billion, an increase of more than $24 billion from last year

/cloudfront-us-east-2.images.arcpublishing.com/reuters/65CBVMR6ANJPRFMUQSAS5ZFQWY.jpg)

Back-to-school US spending set to hit record high in 2023

See-through backpacks and jean shorts are among the popular last-minute purchases ahead of the new school year, several retailers said, as heat waves sweep the U.S. and security concerns grow at many middle- and high schools.

BOZEMAN — Members of HRDC say that we are on the precipice of a severe crisis in Montana when it comes to unhoused elderly people. Specifically in Bozeman, HRDC says they've seen an increase in unhoused elderly, and they believe this is mostly due to the high cost of living and their Social Security money isn't enough to live on.

www.kpax.com

www.kpax.com

Number of elderly homeless in Bozeman reaching crisis levels, HRDC says

HRDC says they've seen an increase in unhoused elderly, likely due to the high cost of living that Social Security income can't cover.

Elderly housing, etc. just getting worse. Smaller families (few or no kids to assist) plus so many Americans do not save for retirement. Plus all the Federal Aid going to the illegals.BOZEMAN — Members of HRDC say that we are on the precipice of a severe crisis in Montana when it comes to unhoused elderly people. Specifically in Bozeman, HRDC says they've seen an increase in unhoused elderly, and they believe this is mostly due to the high cost of living and their Social Security money isn't enough to live on.

Number of elderly homeless in Bozeman reaching crisis levels, HRDC says

HRDC says they've seen an increase in unhoused elderly, likely due to the high cost of living that Social Security income can't cover.www.kpax.com

Those that retired 20 years ago +/-..... Were locked into a fixed income number. Remember when a person worked hard to retire at 55 years old with a comfortable fixed income ? If they have lived to 75 years old that fixed income from 20 years ago is just about to be what it takes to scrape by. One big financial Whoops and they are homeless.Elderly housing, etc. just getting worse. Smaller families (few or no kids to assist) plus so many Americans do not save for retirement. Plus all the Federal Aid going to the illegals.

Yes, and that one big financial whoops might just be medical bills. You are correct about retiring on a fixed income that cannot keep up with inflation.Those that retired 20 years ago +/-..... Were locked into a fixed income number. Remember when a person worked hard to retire at 55 years old with a comfortable fixed income ? If they have lived to 75 years old that fixed income from 20 years ago is just about to be what it takes to scrape by. One big financial Whoops and they are homeless.

Add to that the ethos of having very few kids, not instilling family first values, and refusing to get along with each other, means many retirees have found themselves at the end of long life of self absorption facing economic hardship. My family of 5 lives in half the space 3 of the 4 grandparents live in. A bit of cooperation and pooling of resources would change their last years, but they will be dead many decades before their children.Those that retired 20 years ago +/-..... Were locked into a fixed income number. Remember when a person worked hard to retire at 55 years old with a comfortable fixed income ? If they have lived to 75 years old that fixed income from 20 years ago is just about to be what it takes to scrape by. One big financial Whoops and they are homeless.

Assumes you are a member of one or more of the favored groups.Who needs family when you have cradle to grave government welfare?

New orders for manufactured goods in the US decreased by 2.1% from the previous month to $579.4 million in July of 2023, less than market expectations of a 2.5 percent fall and after four consecutive months of increases. It compared with an upwardly revised 2.3 percent rise in June. Demand for transportation equipment, also down following four consecutive monthly increases, drove the decrease, down by $16.5 billion or 14.3 percent to $98.6 billion, mainly due to nondefense aircraft and parts. Demand was also down for primary metals (-0.1 percent vs 0.1 percent in June) and computers and electronic products. On the other hand, demand for nondurable goods increased by $3.1 billion or 1.1 percent to $293.9 billion

Walmart has cut starting pay for new store employees who pick and pack online orders and stock shelves, raising questions of whether companies face a cooling labor market or are adjusting to a return to pre-pandemic shopping habits.

The retailer confirmed that starting wages were reduced in July for personal shoppers and stockers who now join the company. Those workers help prepare orders for curbside pickup or delivery to customers’ homes and replenish store shelves.

www.cnbc.com

www.cnbc.com

The retailer confirmed that starting wages were reduced in July for personal shoppers and stockers who now join the company. Those workers help prepare orders for curbside pickup or delivery to customers’ homes and replenish store shelves.

Walmart cuts starting pay for new hires who prepare online orders, stock shelves

New Walmart employees who join the digital or stocking teams now make about a dollar an hour less than they would have if hired several months ago.

Walmart has cut starting pay for new store employees who pick and pack online orders and stock shelves, raising questions of whether companies face a cooling labor market or are adjusting to a return to pre-pandemic shopping habits.

The retailer confirmed that starting wages were reduced in July for personal shoppers and stockers who now join the company. Those workers help prepare orders for curbside pickup or delivery to customers’ homes and replenish store shelves.

Walmart cuts starting pay for new hires who prepare online orders, stock shelves

New Walmart employees who join the digital or stocking teams now make about a dollar an hour less than they would have if hired several months ago.www.cnbc.com

I know the local grocery store company that my wife works for showed a pretty substantial loss in the last few quarters. They demoted the guy in charge of the two stores and brought in a new guy. I'm sure paying people $16-18 an hour to pull groceries and not charging for it doesn't really help the companies profit margins. At one point shortly after covid bullshit, they were hiring new employees for $1 an hour less than what a full time pharmacy tech made.

I see the local, small town grocery stores starting to "transition". To the non-observant people the shelves look full. To a person like me who goes in for a quart of milk, a loaf of bread and 3 bananas.... There are no quarts of regular milk, only gallons. The bread isle is picked over and the shelves are looking bare. The produce department has goods that are way too green or over ripened. A glitch last week in the check out / IT stuff had over 50 people standing in a line and only two registers working. I had a flash back to the day one register was for "Cash Only" customers.I know the local grocery store company that my wife works for showed a pretty substantial loss in the last few quarters. They demoted the guy in charge of the two stores and brought in a new guy. I'm sure paying people $16-18 an hour to pull groceries and not charging for it doesn't really help the companies profit margins. At one point shortly after covid bullshit, they were hiring new employees for $1 an hour less than what a full time pharmacy tech made.

Real time inventory is plentiful, with high interest rates and additional costs for gas, food, utilities. This is causing people to rethink replacing or

spending needlessly. Car dealers with up charging, zip me fees, and market adjustment increases are soon to be looking for customers.

Example in 2021 I needed a new sub-compact tractor, inventory was nill, talked with the Kubota dealer in my area who's lot was basically empty, he wanted msrp with no guarantee for delivery, today they have so much inventory you can't find parking. Can say the exact same about JD. Now on the flip side grocery stores my observation is disappearing product with delays being replenished, coffee beans the selection keeps shrinking and early Spring was the last time there was a decent sale. There was a posting couple months back about lesser quality ingredients being used to replace more quality ones, you can't get decent bread or rolls from a commercial brand bakery these days ,how soon before saw dust gets added in! Chips and snacks the ever incredible shrinking bag with inflated price, helps me with portion control. Shit storm coming, how to best prepare to avoid getting caught out their. Stop and think about it for a second, what if this Bud Light nonsense was by design to further erode Americans trust in what was a most trusted brand. Enough rant maybe to many Sam Adams tonight

spending needlessly. Car dealers with up charging, zip me fees, and market adjustment increases are soon to be looking for customers.

Example in 2021 I needed a new sub-compact tractor, inventory was nill, talked with the Kubota dealer in my area who's lot was basically empty, he wanted msrp with no guarantee for delivery, today they have so much inventory you can't find parking. Can say the exact same about JD. Now on the flip side grocery stores my observation is disappearing product with delays being replenished, coffee beans the selection keeps shrinking and early Spring was the last time there was a decent sale. There was a posting couple months back about lesser quality ingredients being used to replace more quality ones, you can't get decent bread or rolls from a commercial brand bakery these days ,how soon before saw dust gets added in! Chips and snacks the ever incredible shrinking bag with inflated price, helps me with portion control. Shit storm coming, how to best prepare to avoid getting caught out their. Stop and think about it for a second, what if this Bud Light nonsense was by design to further erode Americans trust in what was a most trusted brand. Enough rant maybe to many Sam Adams tonight

Lots of uncertainty. The American Gold Eagle is looking pretty good at $2,100 +/-... Did not look so good a year ago but the government's plan of "Hope" is dwindling fast.Real time inventory is plentiful, with high interest rates and additional costs for gas, food, utilities. This is causing people to rethink replacing or

spending needlessly. Car dealers with up charging, zip me fees, and market adjustment increases are soon to be looking for customers.

Example in 2021 I needed a new sub-compact tractor, inventory was nill, talked with the Kubota dealer in my area who's lot was basically empty, he wanted msrp with no guarantee for delivery, today they have so much inventory you can't find parking. Can say the exact same about JD. Now on the flip side grocery stores my observation is disappearing product with delays being replenished, coffee beans the selection keeps shrinking and early Spring was the last time there was a decent sale. There was a posting couple months back about lesser quality ingredients being used to replace more quality ones, you can't get decent bread or rolls from a commercial brand bakery these days ,how soon before saw dust gets added in! Chips and snacks the ever incredible shrinking bag with inflated price, helps me with portion control. Shit storm coming, how to best prepare to avoid getting caught out their. Stop and think about it for a second, what if this Bud Light nonsense was by design to further erode Americans trust in what was a most trusted brand. Enough rant maybe to many Sam Adams tonight

We live in the best country and the best of times, right now. Lots of opportunity and rewards for those who work for it.If a person scours the history books long enough... They can always find a place in time when "things were worse".

Somewhat of a psychological crutch to get through these dark times.

I'd imagine the final days of The Fall of the Roman empire was worse...

That really has no bearing of where America is today

___________

By some measures, Americans have never been more in the red.

In the second quarter of 2023, total credit card debt surpassed $1 trillion for the first time ever, which helped bring total household debt to $17.06 trillion, also a fresh record, according to the New York Federal Reserve.

But adjusted for inflation, credit card debt was higher when the economy bottomed out in 2008, according to a recent analysis by WalletHub.

Don’t let the BS get in your way or wreck your day.

Interesting.We live in the best country and the best of times, right now. Lots of opportunity and rewards for those who work for it.

Don’t let the BS get in your way or wreck your day.

Share your perspective.

Pay close attention to the "Grocery Store Arena".... These mergers and deals are being controlled and driven by the politicians and special interest groups .... Not the businessmen.

Connect the dots ......... Food - - - Politician.

________________

The proposed merger of the supermarket operators has faced tough scrutiny from consumer groups and U.S. lawmakers since its announcement last October, over concerns it would reduce competition and drive grocery prices up.

/cloudfront-us-east-2.images.arcpublishing.com/reuters/7VY5RQKA7RI4HLLD6LNUE5JTCA.jpg)

www.reuters.com

www.reuters.com

Connect the dots ......... Food - - - Politician.

________________

The proposed merger of the supermarket operators has faced tough scrutiny from consumer groups and U.S. lawmakers since its announcement last October, over concerns it would reduce competition and drive grocery prices up.

/cloudfront-us-east-2.images.arcpublishing.com/reuters/7VY5RQKA7RI4HLLD6LNUE5JTCA.jpg)

Kroger to divest over 400 stores in bid to close $25 billion Albertsons deal

Kroger said on Friday it would sell over 400 grocery stores to C&S Wholesale Grocers in an effort to get regulatory approval for its nearly $25-billion takeover of smaller rival Albertsons .

Grocery store I went to was out of chicken. Didn’t matter how much money I have, I didn’t get to buy any chicken there.

Hmmm…

Hmmm…

My locally owned grocery store is frequently out of 1/2 gallon of milk. Now, that is the first stop I make when going into the store. No milk and I'm out the door... Next store down the road is an Albertson's. They have always had 1/2 gallon of milk. But their shelves are getting bare on a lot of food items. Full shelves of junk stuff the normal grocery shopper does not buy. The evolving of grocery stores is upon us. I'm sure some guy will chime in and state that the shelves in "his store" have always been fully stocked. The "Regional difference".Grocery store I went to was out of chicken. Didn’t matter how much money I have, I didn’t get to buy any chicken there.

Hmmm…

Last edited:

Best of times? How do you figure? I think we are in the decline as far as cost of living. My father had it better. Sure, we can still plow on, but it is uphill now to be sure.We live in the best country and the best of times, right now. Lots of opportunity and rewards for those who work for it.

Don’t let the BS get in your way or wreck your day.

LOLWe live in the best country and the best of times, right now. Lots of opportunity and rewards for those who work for it.

Don’t let the BS get in your way or wreck your day.

You can always find the chicken littles in every time period.

You will never find a period in time as now, that offers so much for those who work for it. It’s that simple.

Many of us still choose to live well and help others.

There has always been hardship. Get over it.

You will never find a period in time as now, that offers so much for those who work for it. It’s that simple.

Many of us still choose to live well and help others.

There has always been hardship. Get over it.

Let us know where your location is. There are some guy's here wanting to relocate.You can always find the chicken littles in every time period.

You will never find a period in time as now, that offers so much for those who work for it. It’s that simple.

Many of us still choose to live well and help others.

There has always been hardship. Get over it.

Sounds like a good location.

What is your secret to becoming debt free ?

He’s not talking about location. He is talking about mindset. No matter where you are or what you earn, mindset is key. There is worldly wisdom in his post. This is from someone who has seen real hardship in what would be considered damn near “4th world countries”. There just isn’t much that surprises me anymore.Let us know where your location is. There are some guy's here wanting to relocate.

Sounds like a good location.

What is your secret to becoming debt free ?

There is so much money in this world that all you need to do is reach out and get some.

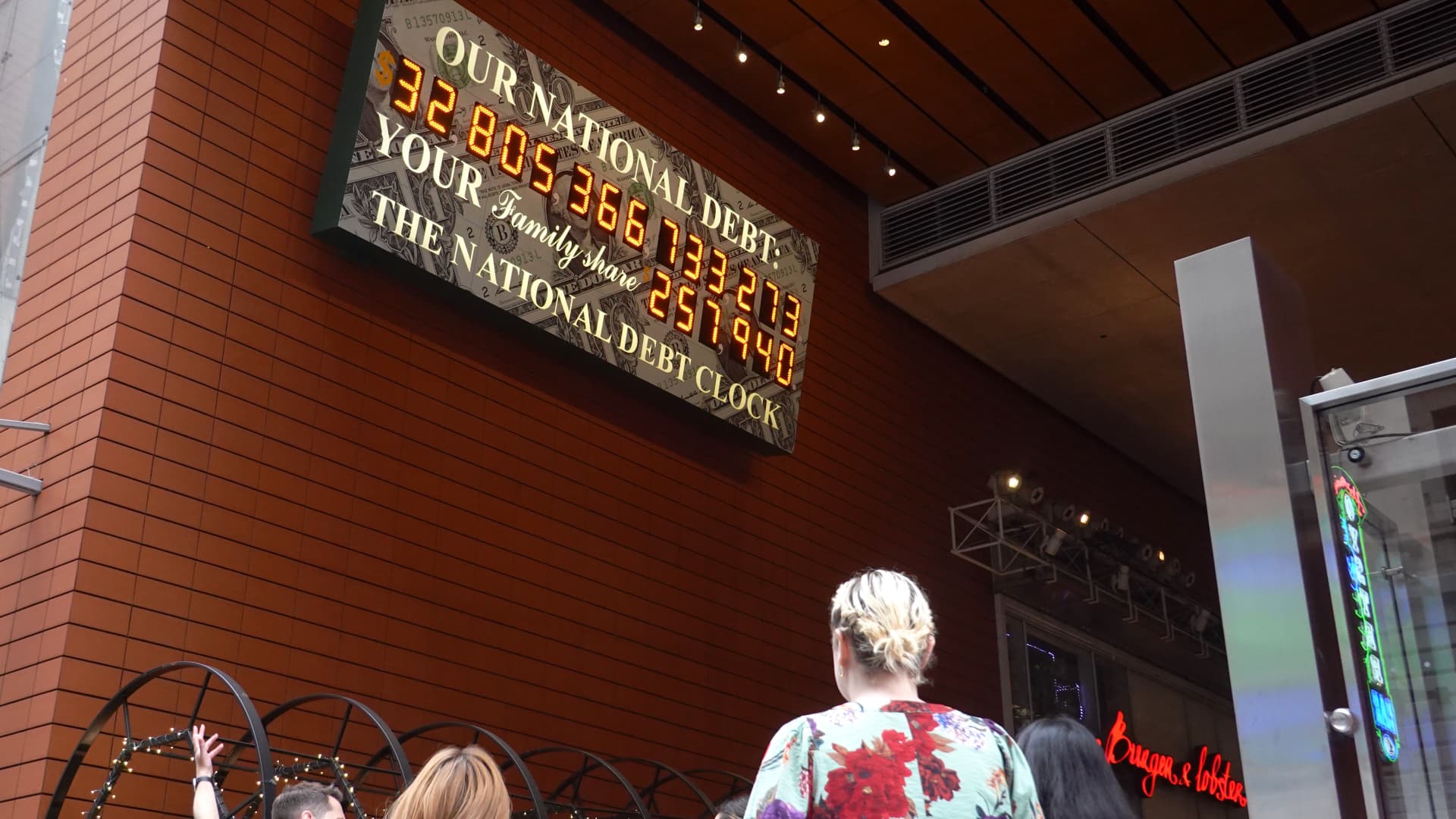

Our government has printed $7T in just the last few years, $100's of billions they just simply lost track of.. so yeah, there a fuck ton of money floating out there. Theis is probably rolling in cash right now.

I have a brother with a degree in Psychology. For the past 50 years, I have listened to him babble similar phrases.He’s not talking about location. He is talking about mindset. No matter where you are or what you earn, mindset is key. There is worldly wisdom in his post. This is from someone who has seen real hardship in what would be considered damn near “4th world countries”. There just isn’t much that surprises me anymore.

So, I am "prejudiced" until I learn about a person's back ground.

Another member here Bigfatcock comes up with some worldly sayings, also full of wisdom.

He shares situations and events that tie him to those sayings.

Mindset theories and philosophy are an avenue to escape the reality of the situation.

My mindset is to meet the challenge head on, The next 12 months will be a challenge for many.

U.S. debt is nearly $33 trillion. But some economists say not all debt is bad.

The U.S. debt sits at nearly $33 trillion and is growing every minute, but not all debt is bad.

Life is funny, and will teach you many things by beating you over the head with a brick. When that happens, and after you recover, retain that lesson!!I have a brother with a degree in Psychology. For the past 50 years, I have listened to him babble similar phrases.

So, I am "prejudiced" until I learn about a person's back ground.

Another member here Bigfatcock comes up with some worldly sayings, also full of wisdom.

He shares situations and events that tie him to those sayings.

Mindset theories and philosophy are an avenue to escape the reality of the situation.

My mindset is to meet the challenge head on, The next 12 months will be a challenge for many.

I look for patterns and anomalies in everything. Watch something long enough, or go far enough back and even anomalies become a pattern. You see this when you talk about the amount of “once in a lifetime” recessions you have personally been through.

That’s what I base a lot of my decisions on along with hard experience. Plus I listen to people who have seen that movie before and know how it ends, lol.

Sounds like something Clyde, said to Bonnie, whilst driving down the road.There is so much money in this world that all you need to do is reach out and get some.

I mean, if he did, he wasn’t wrong. Of course he’d be talking about illegal acts to get money.Sounds like something Clyde, said to Bonnie, while driving down the road.

I’m not. I’m saying it’s so easy to make money that there is zero excuse to be broke. Shit, pan handlers pull in good money and all they do is ask for it.

I was agreeing with @Lug Nut . People are buying everything at stupid prices. There is just so much money being thrown around by everyone.

Start taking note of how many CEO's, Board members, etc are stepping away from businesses and slipping off into obscurity. The idea of 'Take the Money and Run" comes to mind.

BP plc announces that Bernard Looney has notified the Company that he has resigned as Chief Executive Officer with immediate effect.

The Justice Department announced today that two directors of Pinterest Inc. (Pinterest) have resigned their positions on the Board of Directors of Nextdoor Holdings Inc. (Nextdoor) in response to the Antitrust Division’s ongoing enforcement efforts around Section 8 of the Clayton Act. The division's enforcement initiative has led to fifteen interlocking director resignations from eleven boards.

buildremote.co

buildremote.co

BP plc announces that Bernard Looney has notified the Company that he has resigned as Chief Executive Officer with immediate effect.

The Justice Department announced today that two directors of Pinterest Inc. (Pinterest) have resigned their positions on the Board of Directors of Nextdoor Holdings Inc. (Nextdoor) in response to the Antitrust Division’s ongoing enforcement efforts around Section 8 of the Clayton Act. The division's enforcement initiative has led to fifteen interlocking director resignations from eleven boards.

Every Major CEO Stepping Down: 2020-2023 - Buildremote

CEOs are stepping down at record-high rates. When you think about the macro factors applying pressure to companies these days, it makes sense why: As a result of lockdowns, some companies lost all of their revenue while others benefited Employees, en-masse, decided they liked remote work better...

An example of how this recession is different.

www.cnbc.com

www.cnbc.com

Sequoia and Andreessen to take a huge hit on their 2021 Instacart investment, after a 75% plunge in valuation

Venture firms Sequoia and Andreessen Horowitz invested $50 million each in Instacart at the tech market's peak in 2021.

TORONTO, Sept 17 (Reuters) - Bank of Montreal (BMO) (BMO.TO) is winding down its retail auto finance business and shifting focus to other areas in a move that will result in an unspecified number of job losses, Canada's third largest bank said on Saturday.

The move, applicable in Canada and the United States, comes after BMO's bad debt provisions in retail trade surged to C$81 million ($60 million) in the quarter ended July 31 compared with a recovery of C$9 million a year ago, in a sign of growing stress consumers face from a rapid rise in borrowing costs.

/cloudfront-us-east-2.images.arcpublishing.com/reuters/IOWGWBPYTRLPPJQFY3T3Y6YXDE.jpg)

www.reuters.com

www.reuters.com

The move, applicable in Canada and the United States, comes after BMO's bad debt provisions in retail trade surged to C$81 million ($60 million) in the quarter ended July 31 compared with a recovery of C$9 million a year ago, in a sign of growing stress consumers face from a rapid rise in borrowing costs.

/cloudfront-us-east-2.images.arcpublishing.com/reuters/IOWGWBPYTRLPPJQFY3T3Y6YXDE.jpg)

Bank of Montreal to close retail auto finance business, flags job losses

Bank of Montreal (BMO) is winding down its retail auto finance business and shifting focus to other areas in a move that will result in an unspecified number of job losses, Canada's third largest bank said on Saturday.

Deja Vu

For the average household, credit card balances sat at about $10,170 at the end of the second quarter, only $2,242 less than the record set during the fourth quarter of 2007, during the Great Recession.

www.foxbusiness.com

www.foxbusiness.com

For the average household, credit card balances sat at about $10,170 at the end of the second quarter, only $2,242 less than the record set during the fourth quarter of 2007, during the Great Recession.

States with the highest credit card debt

Californians and Texans hold the most credit card debt, according to WalletHub. U.S. consumers nationwide hold more than $1 trillion in credit card debt.

Anybody want to guess at what the real inflation adjustment would be since 2007?Deja Vu

For the average household, credit card balances sat at about $10,170 at the end of the second quarter, only $2,242 less than the record set during the fourth quarter of 2007, during the Great Recession.

States with the highest credit card debt

Californians and Texans hold the most credit card debt, according to WalletHub. U.S. consumers nationwide hold more than $1 trillion in credit card debt.www.foxbusiness.com

Many will go broke while circling the airport hoping for a soft landing.

___________

U.S. homebuilders are feeling pessimistic about their business for the first time in seven months, thanks to stubbornly high mortgage rates.

Builder confidence in the single-family housing market fell 5 points in September to 45 on the National Association of Home Builders/Wells Fargo Housing Market Index. The decrease follows a 6-point drop in August. Anything below 50 is considered negative.

The index’s three components all declined. Current sales conditions fell 6 points to 51, and sales expectations in the next six months also dropped 6 points to 49. Buyer traffic decreased 5 points to 30.

Builders cite weaker affordability due to higher mortgage rates. The average rate on the popular 30-year fixed mortgage has been over 7% since June.

www.cnbc.com

www.cnbc.com

___________

U.S. homebuilders are feeling pessimistic about their business for the first time in seven months, thanks to stubbornly high mortgage rates.

Builder confidence in the single-family housing market fell 5 points in September to 45 on the National Association of Home Builders/Wells Fargo Housing Market Index. The decrease follows a 6-point drop in August. Anything below 50 is considered negative.

The index’s three components all declined. Current sales conditions fell 6 points to 51, and sales expectations in the next six months also dropped 6 points to 49. Buyer traffic decreased 5 points to 30.

Builders cite weaker affordability due to higher mortgage rates. The average rate on the popular 30-year fixed mortgage has been over 7% since June.

Homebuilder sentiment goes negative for the first time in 7 months, thanks to higher mortgage rates

Homebuilder sentiment fell into negative territory as potential buyers struggle to afford new homes in a higher mortgage rate environment.

Similar threads

- Replies

- 82

- Views

- 3K

- Replies

- 26

- Views

- 2K

- Replies

- 39

- Views

- 2K

- Replies

- 7

- Views

- 1K

- Replies

- 9

- Views

- 852