Join the Hide community

Get access to live stream, lessons, the post exchange, and chat with other snipers.

Register

Download Gravity Ballistics

Get help to accurately calculate and scope your sniper rifle using real shooting data.

Install the app

How to install the app on iOS

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Stock Market

- Thread starter pmclaine

- Start date

Tesla has filed an application to offer telecom services in its vehicles in Canada.

Tesla says it'll provide machine-to-machine cellular data service for in-vehicle infotainment access, internet access, & “mobile terminating SMS to wake up vehicles"

Tesla says it'll provide machine-to-machine cellular data service for in-vehicle infotainment access, internet access, & “mobile terminating SMS to wake up vehicles"

So will Twitter be included at no cost for Tesla owners ?Tesla has filed an application to offer telecom services in its vehicles in Canada.

Tesla says it'll provide machine-to-machine cellular data service for in-vehicle infotainment access, internet access, & “mobile terminating SMS to wake up vehicles"

Quick question? Can someone give a good way to invest for my granddaughter’s education besides a 529?

custodial brokerage accountQuick question? Can someone give a good way to invest for my granddaughter’s education besides a 529?

That is a good question. posed to men with varied backgrounds. Doubt we would all do the same.Quick question? Can someone give a good way to invest for my granddaughter’s education besides a 529?

How old is your granddaughter?

Are you going to invest monthly, yearly or a lump sum ? How much ?

Just because you want her well educated, that may not be her plan. Leave some flexibility in your plan so taxes don't kill you if she decides to get married and have a house full of your grandchildren?

ROTH IRA? Pay her to make her bed.Quick question? Can someone give a good way to invest for my granddaughter’s education besides a 529?

I set up a ROTH the first year they were offered... It was a good deal. Then the politicians began changing the rules.. After some changes the deal was not as good. Remember to put your money where the politicians and tax collectors can't get their hands on it. Never put all your eggs on one basket.ROTH IRA? Pay her to make her bed.

This is just one tool but I was specifically referring to an option to save for a grandchild. Other than burying in yard, what savings techniques are safe from government, etc.?I set up a ROTH the first year they were offered... It was a good deal. Then the politicians began changing the rules.. After some changes the deal was not as good. Remember to put your money where the politicians and tax collectors can't get their hands on it. Never put all your eggs on one basket.

Great question that will require a lot of research.. We are all different. Think outside the box. What's right for me would not be right for you.This is just one tool but I was specifically referring to an option to save for a grandchild. Other than burying in yard, what savings techniques are safe from government, etc.?

Grandpa could buy a plot of land and leave it to Graddaughter in his will... She can sell it and pay of the student loans, if any.

Grandpa could just save the money and gift it to her in small amounts while in school so she can pay for education.

Grandpa could just give her an envelope full of $100's every Christmas.

Look at some annuity advantages.

When you dig into any of these plans like 529... Google in "disadvantages of 529" and look at the disadvantages

Face it, the Government and the investment experts are running the odds against Grandpa. They are well hedged.

A bit off topic. My Dad had a term he used frequently.. "Ruling from the Grave". Parents and Grand parents want to stipulate the where, when and how their money will be used by an heir. It's a control thing. Again, this line of reasoning will end up being the worst option of all.

I would be interested in your thoughts on "annuity advantages" for grandchildren. Not a fan of 529 plans anyway.Great question that will require a lot of research.. We are all different. Think outside the box. What's right for me would not be right for you.

Grandpa could buy a plot of land and leave it to Graddaughter in his will... She can sell it and pay of the student loans, if any.

Grandpa could just save the money and gift it to her in small amounts while in school so she can pay for education.

Grandpa could just give her an envelope full of $100's every Christmas.

Look at some annuity advantages.

When you dig into any of these plans like 529... Google in "disadvantages of 529" and look at the disadvantages

Face it, the Government and the investment experts are running the odds against Grandpa. They are well hedged.

A bit off topic. My Dad had a term he used frequently.. "Ruling from the Grave". Parents and Grand parents want to stipulate the where, when and how their money will be used by an heir. It's a control thing. Again, this line of reasoning will end up being the worst option of all.

My understanding is that you can use your own IRA or 401K to pay for education for child or grandchild. 529 had the advantage of locking in credits for current state school costs but what if she doesn't go?

What if college is free in 10years?

Perhaps gold or silver. Tax free, doesn't usually lose value. Coming massive inflation proof. Looks pretty to keep if she doesn't go to school. Easy to bury. Just tell somebody first.

Lots of these stories.

www.wesh.com

www.wesh.com

What if college is free in 10years?

Perhaps gold or silver. Tax free, doesn't usually lose value. Coming massive inflation proof. Looks pretty to keep if she doesn't go to school. Easy to bury. Just tell somebody first.

Lots of these stories.

St. Cloud workers find 2,000 silver coins during home demolition

Workers in St. Cloud were shocked to find 2,000 silver coins in the walls of a home they were demolishing.

An annuity is a contract between you and an insurance company in which you make a lump-sum payment or series of payments and, in return, receive regular disbursements, beginning either immediately or at some point in the future.I would be interested in your thoughts on "annuity advantages" for grandchildren. Not a fan of 529 plans anyway.

I will often swap the term "annuity" with "life insurance"... Let's don't squabble over the fine points.

Here is a "what if" situation. Depending on the age of Grandpa and Granddaughter. Grandpa could take out an annuity / life insurance policy on himself and have it payable to his Granddaughter when he dies. Again, up to her if she wants to apply the payoff to her college debt or something else..

The above are why I suggested a custodial account. It may not be the most tax-advantageous but my parents did it for me and it worked out. They purchased ~5-10 shares of Home Depot as a new born and by the time I graduated I had over 100 shares due to splits and DRIP. So even if your grandchild doesn't use it for student loans either because they are free, she has a scholarship, or other... she can use the funds to purchase a vehicle (or to pay for a Tesla robotaxi), down payment on house, etc.

I agree on physical gold. Just don't leave it in a safe deposit box. I have to think a bit on gold ADR's. That is a control issue. If I was putting something aside for a grandson, the possibility of collector grade guns would be on my radar. Again. leave the collection (guns, gold, investment trade collectables) to him in my will. Never underestimate the power of a properly recorded will... A lot of trust funds are set up... Another control issue that must be properly dealt with.My understanding is that you can use your own IRA or 401K to pay for education for child or grandchild. 529 had the advantage of locking in credits for current state school costs but what if she doesn't go?

What if college is free in 10years?

Perhaps gold or silver. Tax free, doesn't usually lose value. Coming massive inflation proof. Looks pretty to keep if she doesn't go to school. Easy to bury. Just tell somebody first.

Lots of these stories.

St. Cloud workers find 2,000 silver coins during home demolition

Workers in St. Cloud were shocked to find 2,000 silver coins in the walls of a home they were demolishing.www.wesh.com

Another option is a DRIP account set up directly with the company and not a brokerage outfit. I did that for my daughter. she is still holding it and it is still adding shares... She is in Louisiana and made straight A's in high school and the state of Louisiana paid her tutition at LSU where she left with a Masters Degree.... Again we don't have a crystal ball as to the situation of a child 18 years from now...

I used custodial account for my two kids - both in 30s now. Started right as they were born. One used for college and other used for down payment on first house. I agree on the flexibility vs "pure" college savings instrumentsThe above are why I suggested a custodial account. It may not be the most tax-advantageous but my parents did it for me and it worked out. They purchased ~5-10 shares of Home Depot as a new born and by the time I graduated I had over 100 shares due to splits and DRIP. So even if your grandchild doesn't use it for student loans either because they are free, she has a scholarship, or other... she can use the funds to purchase a vehicle (or to pay for a Tesla robotaxi), down payment on house, etc.

An interesting phenomenon... Investors continuing to hold stock in companies that are buying back stock as the price per share falls.

Comments ?

_______________

Berkshire spent $1.05 billion in share repurchases during the quarter, bringing the nine-month total to $5.25 billion. The pace of buyback was in line with the $1 billion purchased in the second quarter. Repurchases were well below CFRA’s expectation as its analyst estimated it would be similar to the $3.2 billion total in the first quarter.

www.cnbc.com

www.cnbc.com

Comments ?

_______________

Berkshire spent $1.05 billion in share repurchases during the quarter, bringing the nine-month total to $5.25 billion. The pace of buyback was in line with the $1 billion purchased in the second quarter. Repurchases were well below CFRA’s expectation as its analyst estimated it would be similar to the $3.2 billion total in the first quarter.

Berkshire Hathaway's operating earnings jump 20%, conglomerate buys back another $1 billion in stock

Berkshire Hathaway posted a solid gain in operating profits during the third quarter despite rising recession fears.

Read those tea leaves for those of us who enjoy your forecast.

Looks like the bottom for the SPX will be 2500 by 2024.

Nothing has really changed with my forecast or short-term outlook. I purchased more Tesla today at $202. To think, Tesla is trading at a 2023 PE of 35x is mind blowing to me and I’m happy to add. The most difficult question I have found myself in recently is “Do I diversify into other stocks which are priced well or do I just keep consolidating into Tesla?”.Read those tea leaves for those of us who enjoy your forecast.

Looks like the bottom for the SPX will be 2500 by 2024.

View attachment 7993583

I’m curious if Tesla will join all other auto’s in having a financing arm. It wouldn’t be a bad move at their current cash position and would likely add to margins due to the securitization model.

(I also wouldn’t be shocked to find out tomorrow that Elon has been selling shares since Thursday.)

Last edited:

Your question is Deja Vu:Nothing has really changed with my forecast or short-term outlook. I purchased more Tesla today at $202. To think, Tesla is trading at a 2023 PE of 35x is mind blowing to me and I’m happy to add. The most difficult question I have found myself in recently is “Do I diversify into other stocks which are priced well or do I just keep consolidating into Tesla?”.

I’m curious if Tesla will join all other auto’s in having a financing arm. It wouldn’t be a bad move at their current cash position and would likely add to margins due to the securitization model.

(I also wouldn’t be shocked to find out tomorrow that Elon has been selling shares since Thursday.)

“Do I diversify into other stocks which are priced well or do I just keep consolidating into Tesla?”.

Over the year's I have had friends who spent many years working for big corporations and faithfully adding the "company stock" to their holdings. They asked that same question. Some held steadfast through the good times and bad times. Others grew impatient and diversified.

Those that stayed with the company long term and purchased regularly came out nice when they retired. Perhaps they had a more conservative philosophy... IDK... In all fairness a lot of faithful employees lost their entire retirement.. Enron, the Great Atlantic & Pacific Tea Company and others.

No doubt. Very risky and a complete loss would set me back.Your question is Deja Vu:

“Do I diversify into other stocks which are priced well or do I just keep consolidating into Tesla?”.

Over the year's I have had friends who spent many years working for big corporations and faithfully adding the "company stock" to their holdings. They asked that same question. Some held steadfast through the good times and bad times. Others grew impatient and diversified.

Those that stayed with the company long term and purchased regularly came out nice when they retired. Perhaps they had a more conservative philosophy... IDK... In all fairness a lot of faithful employees lost their entire retirement.. Enron, the Great Atlantic & Pacific Tea Company and others.

Look at it this way.No doubt. Very risky and a complete loss would set me back.

You are still a young man. You have accumulated a wealth of knowledge in the past few years.

If you "lost it all" you would come back much stronger.

History has proven that time and time again.

More of the blind leading the blind.

I like gold (Up 2% today )... I don't like a headline like this:

Gold to rally by a double-digit percentage in 2023, UBS says 17 Hours Ago CNBC.com

I like gold (Up 2% today )... I don't like a headline like this:

Gold to rally by a double-digit percentage in 2023, UBS says 17 Hours Ago CNBC.com

Elon sold Tesla shares on the 4th so maybe more will be disclosed over the coming days. ~$2B.

12/8 of 2021 ?Two other forms released. He sold 11/7 and 12/8. In total ~$3.5B.

Added to Tesla today and will be purchasing Tesla with all my available cash in my ROTH tomorrow. Hell, even my father, who has been admittedly against my bullishness, opened a position today.

i wonder if some people were propping up the market for the dems, and gave up after the election?

I think it was markets pricing in gridlock and that doesn't appear to be happening.i wonder if some people were propping up the market for the dems, and gave up after the election?

Quick question? Can someone give a good way to invest for my granddaughter’s education besides a 529?

HOME-SCHOOL !!!!!!!!!!!!!!!!!

It's the only fair chance she will have .

Buy more belt feds

What greater compliment could a man give his son ?Added to Tesla today and will be purchasing Tesla with all my available cash in my ROTH tomorrow. Hell, even my father, who has been admittedly against my bullishness, opened a position today.

Quick question? Can someone give a good way to invest for my granddaughter’s education besides a 529?

5 best alternatives to 529 plans that can help you save for college | Bankrate

A 529 plan doesn't fit everyone. Here are some alternatives when a college savings plan isn't the best option.

www.bankrate.com

I’m still shorting crude.

I’d also like to thank big tech laying off a ton of people to cure inflation.

My SPY calls straight ripping. Going to take those shares away.

I’d also like to thank big tech laying off a ton of people to cure inflation.

My SPY calls straight ripping. Going to take those shares away.

Elon Musk now only second to Trump in liberal hate. Calls to investigate Musk by Democrats. How will that impact Tesla?

If they can't find something they will invent it....he is on an egg timer for some level of beat down from Dems. How about Cathie Wood she must be thrilled with today's bump as her 5 year return finally went back to positive at 3.8% today although still down 63% YTD.Elon Musk now only second to Trump in liberal hate. Calls to investigate Musk by Democrats. How will that impact Tesla?

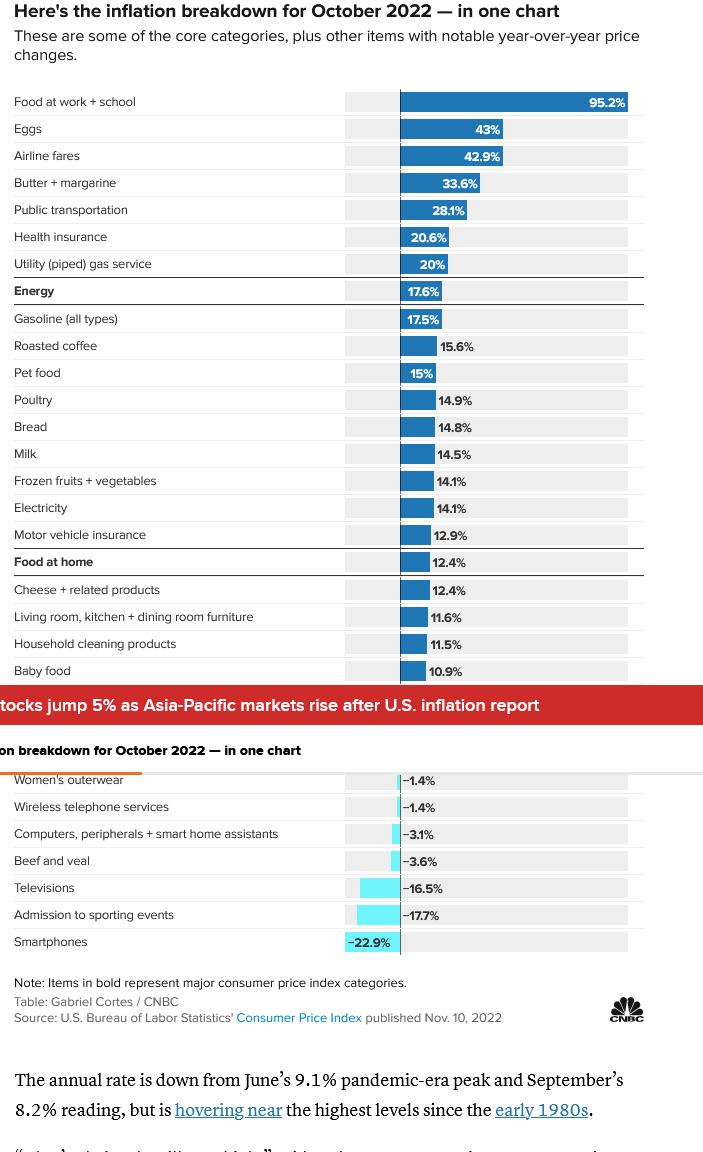

Stock Markets all over the World are taking their biggest jump they have seen in the past 2 years.. Why ?.. Because the headlines are saying inflation is cooling. Getting down into the numbers, here is what the bottom line is:

Inflation was cooler than expected in October, although household staples such as shelter, food and energy remained among the largest contributors to consumer prices still rising at a historically fast pace, the U.S. Bureau of Labor Statistics said Thursday.

www.cnbc.com

www.cnbc.com

Inflation was cooler than expected in October, although household staples such as shelter, food and energy remained among the largest contributors to consumer prices still rising at a historically fast pace, the U.S. Bureau of Labor Statistics said Thursday.

Here’s the inflation breakdown for October 2022 — in one chart

Inflation rose less than expected in October, but consumer prices are still rising quickly for staples such as energy, food and shelter.

Don’t believe the hype. Inflation being “cooler” than expected doesn’t mean inflation isn’t still actively inflating. It only means that it is slightly less inflated than the inflation they were expecting.Stock Markets all over the World are taking their biggest jump they have seen in the past 2 years.. Why ?.. Because the headlines are saying inflation is cooling. Getting down into the numbers, here is what the bottom line is:

Inflation was cooler than expected in October, although household staples such as shelter, food and energy remained among the largest contributors to consumer prices still rising at a historically fast pace, the U.S. Bureau of Labor Statistics said Thursday.

View attachment 7996390

Here’s the inflation breakdown for October 2022 — in one chart

Inflation rose less than expected in October, but consumer prices are still rising quickly for staples such as energy, food and shelter.www.cnbc.com

IOW, your savings are still wasting away. Don’t let them bullshit you.

Today jump was due to CPI coming in better than expectations. But more importantly, jobless claims came in higher than expected. This all points towards lower inflation going forward and likely a lower terminal fed rate. You even see this turn to risk on in the FX market by the USD weakening.

In other news… the new color(s) and painting techniques coming out of Giga Berlin look fantastic.

And TSLA up big today, Elon’s stoking next months jobless claims with Twitter layoffs, killing two birds with one stoneToday jump was due to CPI coming in better than expectations. But more importantly, jobless claims came in higher than expected. This all points towards lower inflation going forward and likely a lower terminal fed rate. You even see this turn to risk on in the FX market by the USD weakening.

.... better than expectations......Today jump was due to CPI coming in better than expectations. But more importantly, jobless claims came in higher than expected. This all points towards lower inflation going forward and likely a lower terminal fed rate. You even see this turn to risk on in the FX market by the USD weakening.

Who are these people who publish their "expectations"..... Locating them is like finding a ghost. They put out this info and magically the so called "official" numbers come in better than expectations. With very little digging it becomes obvious, in this case, inflation is active and well.

The moves today on the markets (worldwide) certainly knocked the "stop outs" for a loop.

Comments ?

Only in 2022 could the stock market be spinning a 7.7% number as "good". That's still showing that inflation is ripping, just not quite as badly as last month. It's also still 5.7% higher than the Fed's target, which has not yet been revised upward (at least not publicly).

But man, not a great day for anyone caught in a short position

But man, not a great day for anyone caught in a short position

Similar threads

- Replies

- 13

- Views

- 2K

- Replies

- 0

- Views

- 214

- Replies

- 142

- Views

- 17K