Invest in rail carsall the continuous buttsex that you did NOT want, until you die.

Don't worry, the US gov doesn't use lube, too expensive.

Not just fixed income either, but yes, those get hit hard.

Join the Hide community

Get access to live stream, lessons, the post exchange, and chat with other snipers.

Register

Download Gravity Ballistics

Get help to accurately calculate and scope your sniper rifle using real shooting data.

Install the app

How to install the app on iOS

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Stock Market

- Thread starter pmclaine

- Start date

Short covering

Tesla jumps 16% after passing key hurdle to roll out advanced driver-assistance tech in China

Last edited:

They need FSD. Asian people can't drive worth a shit.Short covering

Tesla jumps 16% after passing key hurdle to roll out advanced driver-assistance tech in China

If Tesla can get their cars through this.. It will succeed in the West.They need FSD. Asian people can't drive worth a shit.

There is nothing in it for any of us quasi middle class folks.That is a realistic generalization.

As an elderly retired person on a fixed income, I have to ask ? What's in it for me ?

Nothing

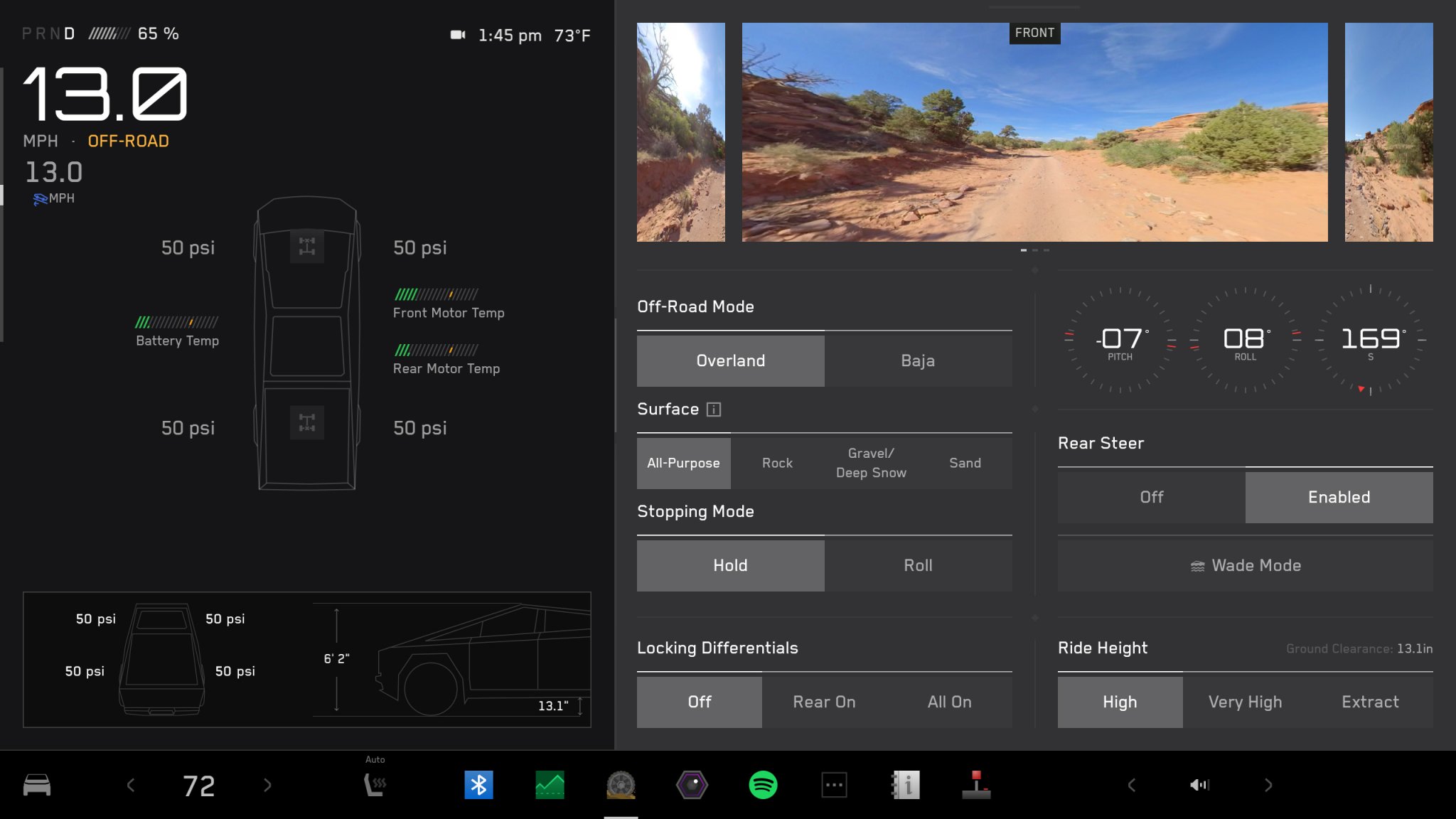

Off-Road Mode and more updates rolling out soon

Here’s what’s coming...

–

Off-Road Mode

Overland Mode – More consistent handling & better overall traction while driving on rock, gravel, deep snow, or sand.

Baja Mode – Vehicle balance is improved & the vehicle handles more freely when Stability Assist is set to Minimal.

Locking Differentials (Dual Motor AWD) | Off-Road Mode

On uneven or slippery terrain, if a wheel has limited or no traction, Cybertruck can direct that torque to the opposite wheel.

In Off-Road Mode, choose from Locking Differentials options on the vehicle status area or in the Off-Road app.

Front Locking Differential (Cyberbeast Tri Motor) | Off-Road Mode

Go to Off-Road Mode > Overland to enable Locking Differential feature. Cyberbeast tri motor has a virtual rear locked differential which is always working in overland mode.

Trail Assist | Off-Road Mode

It’s like cruise control, but for off-roading. Trail Assist helps maintain a set cruising speed so you can focus on steering. Trail Assist works as both a hill ascent and descent control helping to keep the wheels from slipping.

Off-Road Mode > Trail Assist

Slippery Surface | On-Road

Better traction control on snowy, icy, wet, or slick roads to distribute traction evenly across all tires.

Dynamics > Slippery Surface

Dynamics > Engage Rear Locking Differential for increased traction (should be used temporarily only)

Ride and Handling with a Load | On-Road

Adaptive suspension now estimates payload more accurately & automatically adjusts damping to deliver a more comfortable ride & more consistent, confident handling.

CyberTent Mode

Levels the suspension so you can sleep comfortably on a flat surface in your CyberTent ️.

️.

Also keeps the tonneau cover open to accommodate your tent. Lights, AC & outlets will stay on as well if enabled.

Here’s what’s coming...

–

Off-Road Mode

Overland Mode – More consistent handling & better overall traction while driving on rock, gravel, deep snow, or sand.

Baja Mode – Vehicle balance is improved & the vehicle handles more freely when Stability Assist is set to Minimal.

Locking Differentials (Dual Motor AWD) | Off-Road Mode

On uneven or slippery terrain, if a wheel has limited or no traction, Cybertruck can direct that torque to the opposite wheel.

In Off-Road Mode, choose from Locking Differentials options on the vehicle status area or in the Off-Road app.

Front Locking Differential (Cyberbeast Tri Motor) | Off-Road Mode

Go to Off-Road Mode > Overland to enable Locking Differential feature. Cyberbeast tri motor has a virtual rear locked differential which is always working in overland mode.

Trail Assist | Off-Road Mode

It’s like cruise control, but for off-roading. Trail Assist helps maintain a set cruising speed so you can focus on steering. Trail Assist works as both a hill ascent and descent control helping to keep the wheels from slipping.

Off-Road Mode > Trail Assist

Slippery Surface | On-Road

Better traction control on snowy, icy, wet, or slick roads to distribute traction evenly across all tires.

Dynamics > Slippery Surface

Dynamics > Engage Rear Locking Differential for increased traction (should be used temporarily only)

Ride and Handling with a Load | On-Road

Adaptive suspension now estimates payload more accurately & automatically adjusts damping to deliver a more comfortable ride & more consistent, confident handling.

CyberTent Mode

Levels the suspension so you can sleep comfortably on a flat surface in your CyberTent

Also keeps the tonneau cover open to accommodate your tent. Lights, AC & outlets will stay on as well if enabled.

Will we see it in the "1000" ?Off-Road Mode and more updates rolling out soon

Here’s what’s coming...

–

Off-Road Mode

Overland Mode – More consistent handling & better overall traction while driving on rock, gravel, deep snow, or sand.

Baja Mode – Vehicle balance is improved & the vehicle handles more freely when Stability Assist is set to Minimal.

Locking Differentials (Dual Motor AWD) | Off-Road Mode

On uneven or slippery terrain, if a wheel has limited or no traction, Cybertruck can direct that torque to the opposite wheel.

In Off-Road Mode, choose from Locking Differentials options on the vehicle status area or in the Off-Road app.

Front Locking Differential (Cyberbeast Tri Motor) | Off-Road Mode

Go to Off-Road Mode > Overland to enable Locking Differential feature. Cyberbeast tri motor has a virtual rear locked differential which is always working in overland mode.

Trail Assist | Off-Road Mode

It’s like cruise control, but for off-roading. Trail Assist helps maintain a set cruising speed so you can focus on steering. Trail Assist works as both a hill ascent and descent control helping to keep the wheels from slipping.

Off-Road Mode > Trail Assist

Slippery Surface | On-Road

Better traction control on snowy, icy, wet, or slick roads to distribute traction evenly across all tires.

Dynamics > Slippery Surface

Dynamics > Engage Rear Locking Differential for increased traction (should be used temporarily only)

Ride and Handling with a Load | On-Road

Adaptive suspension now estimates payload more accurately & automatically adjusts damping to deliver a more comfortable ride & more consistent, confident handling.

CyberTent Mode

Levels the suspension so you can sleep comfortably on a flat surface in your CyberTent️.

Also keeps the tonneau cover open to accommodate your tent. Lights, AC & outlets will stay on as well if enabled.

View attachment 8407300View attachment 8407301

If Tesla can get their cars through this.. It will succeed in the West.

Here is my "curiosity" about the advanced driver assist. For the past 60 years, the Chinese procure one item from America, disassemble it, copy the components, produce the components, assemble it and sell it back to the Americans for less than the one item they procured.

Does Elon think for one minute they will not copy and produce his system ?

Here is my "curiosity" about the advanced driver assist. For the past 60 years, the Chinese procure one item from America, disassemble it, copy the components, produce the components, assemble it and sell it back to the Americans for less than the one item they procured.

Does Elon think for one minute they will not copy and produce his system ?

What is the system they will copy and produce?

That was my first thought - Chines will steal all the TESLA tech then incorporate into weapons. We will have Chinese FSD equipped drones patrolling US soon.Here is my "curiosity" about the advanced driver assist. For the past 60 years, the Chinese procure one item from America, disassemble it, copy the components, produce the components, assemble it and sell it back to the Americans for less than the one item they procured.

Does Elon think for one minute they will not copy and produce his system ?

All of themWhat is the system they will copy and produce?

Can't wait for the day my reservation is going to be filled.Off-Road Mode and more updates rolling out soon

Here’s what’s coming...

–

Off-Road Mode

Overland Mode – More consistent handling & better overall traction while driving on rock, gravel, deep snow, or sand.

Baja Mode – Vehicle balance is improved & the vehicle handles more freely when Stability Assist is set to Minimal.

Locking Differentials (Dual Motor AWD) | Off-Road Mode

On uneven or slippery terrain, if a wheel has limited or no traction, Cybertruck can direct that torque to the opposite wheel.

In Off-Road Mode, choose from Locking Differentials options on the vehicle status area or in the Off-Road app.

Front Locking Differential (Cyberbeast Tri Motor) | Off-Road Mode

Go to Off-Road Mode > Overland to enable Locking Differential feature. Cyberbeast tri motor has a virtual rear locked differential which is always working in overland mode.

Trail Assist | Off-Road Mode

It’s like cruise control, but for off-roading. Trail Assist helps maintain a set cruising speed so you can focus on steering. Trail Assist works as both a hill ascent and descent control helping to keep the wheels from slipping.

Off-Road Mode > Trail Assist

Slippery Surface | On-Road

Better traction control on snowy, icy, wet, or slick roads to distribute traction evenly across all tires.

Dynamics > Slippery Surface

Dynamics > Engage Rear Locking Differential for increased traction (should be used temporarily only)

Ride and Handling with a Load | On-Road

Adaptive suspension now estimates payload more accurately & automatically adjusts damping to deliver a more comfortable ride & more consistent, confident handling.

CyberTent Mode

Levels the suspension so you can sleep comfortably on a flat surface in your CyberTent️.

Also keeps the tonneau cover open to accommodate your tent. Lights, AC & outlets will stay on as well if enabled.

View attachment 8407300View attachment 8407301

Got to sell a lot more Snake Oil to raise that trend line.Tesla stock is no longer about cars, market, etc. - it is now about Elon and his leaning to the Right. Tesla will be punished for the sins of Elon.

No expert, but I have been following this closely as it is the reason that you have bank failures that have occurred and there will be a lot more.

What happened is that the fed had easy policy going to banks. The banks loaned a lot of money out, especially to the commercial real estate markets at low interest rates. Then the fed went and upped the interest rates. Many lenders are facing losses on older securities and loans, which pay relatively low interest rates compared with newer securities.

Problem is, a lot of commercial real estate loans have gone south with huge hair cuts that you may have heard about with office buildings being sold. Vacancies are way up, and the borrowers can't pay up. Now many regional banks are going to close and have to be bought up by larger banks.........It happened in Pennsylvania with first republic this weekend.

Eventually the domino's will cascade and very few regionals will survive if they have heavy commercial real estate exposure. I fear that this will lead to the CBDC..........What is even scarier is that it looks like the fed bailed out even the uninsured depositors at first republic. You know.....Too big to fail.

What happened is that the fed had easy policy going to banks. The banks loaned a lot of money out, especially to the commercial real estate markets at low interest rates. Then the fed went and upped the interest rates. Many lenders are facing losses on older securities and loans, which pay relatively low interest rates compared with newer securities.

Problem is, a lot of commercial real estate loans have gone south with huge hair cuts that you may have heard about with office buildings being sold. Vacancies are way up, and the borrowers can't pay up. Now many regional banks are going to close and have to be bought up by larger banks.........It happened in Pennsylvania with first republic this weekend.

Eventually the domino's will cascade and very few regionals will survive if they have heavy commercial real estate exposure. I fear that this will lead to the CBDC..........What is even scarier is that it looks like the fed bailed out even the uninsured depositors at first republic. You know.....Too big to fail.

I'm no expert, either. From the looks of the FED and the Market, in general.... There are no experts there. What's there are investment bankers who have members of Congress in their back pocket. Congress passes laws that benefit the big players. Those players feed insider info back to members of Congress. The entire process is "insulated" from all of the 3 letter government agencies.No expert, but I have been following this closely as it is the reason that you have bank failures that have occurred and there will be a lot more.

What happened is that the fed had easy policy going to banks. The banks loaned a lot of money out, especially to the commercial real estate markets at low interest rates. Then the fed went and upped the interest rates. Many lenders are facing losses on older securities and loans, which pay relatively low interest rates compared with newer securities.

Problem is, a lot of commercial real estate loans have gone south with huge hair cuts that you may have heard about with office buildings being sold. Vacancies are way up, and the borrowers can't pay up. Now many regional banks are going to close and have to be bought up by larger banks.........It happened in Pennsylvania with first republic this weekend.

Eventually the domino's will cascade and very few regionals will survive if they have heavy commercial real estate exposure. I fear that this will lead to the CBDC..........What is even scarier is that it looks like the fed bailed out even the uninsured depositors at first republic. You know.....Too big to fail.

The three branches of the U.S. government are the legislative, executive and judicial branches. According to the doctrine of separation of powers, the U.S. Constitution distributed the power of the federal government among these three branches, and built a system of checks and balances to ensure that no one branch could become too powerful.

Over time, the the lines between "separation" of power have been blurred. There are no checks and balances. We have a President writing blank checks and forgiving loans. He really does not have the authority to do these things.

The entire system is heading for a collapse. You are attempting to define the root cause. Basically you are rearranging the deck chairs on the Titanic.

I can only hope I am wrong and you guy's will pile on and shout "Hobo was wrong". I'd much rather be wrong than face the suffering of the future.

This is what happens when traders "Bet" on the Jockey and not the Horse.

Tesla shares fell nearly 6% on Tuesday following news that CEO Elon Musk was pressing ahead with more job cuts at Tesla, impacting an estimated 500 employees in its Supercharger team.

The stock closed at $183.28 and is now down 26% for the year.

Tesla shares fell nearly 6% on Tuesday following news that CEO Elon Musk was pressing ahead with more job cuts at Tesla, impacting an estimated 500 employees in its Supercharger team.

The stock closed at $183.28 and is now down 26% for the year.

Last edited:

Having a decent supercharger network is pretty much what makes Tesla a car folks buy for anything other than a toy.

Firing that whole division seems pretty short sighted.

Firing that whole division seems pretty short sighted.

Unless it's a mature technology and you don't need overstaffed division to simply expand existing chargers.Having a decent supercharger network is pretty much what makes Tesla a car folks buy for anything other than a toy.

Firing that whole division seems pretty short sighted.

And who will fund "The Rebuilding" after the Middle East wars end ?

Asset manager BlackRock will launch an investment platform in Riyadh with the help of a $5 billion anchor investment from Saudi Arabia’s Public Investment Fund (PIF), the kingdom’s sovereign wealth fund.

The announcement Tuesday followed the signing of a memorandum of understanding between BlackRock’s Saudi division and the PIF with the aim of spurring capital markets growth in the oil-rich Gulf country.

BlackRock, the world’s largest asset manager with $10 trillion in assets under management, will “launch investment strategies across asset classes for the Saudi market, including both public and private markets, managed by a Riyadh-based investment team,” a joint press release from the firm and the PIF read.

The new platform will be called BlackRock Riyadh Investment Management, or BRIM

Asset manager BlackRock will launch an investment platform in Riyadh with the help of a $5 billion anchor investment from Saudi Arabia’s Public Investment Fund (PIF), the kingdom’s sovereign wealth fund.

The announcement Tuesday followed the signing of a memorandum of understanding between BlackRock’s Saudi division and the PIF with the aim of spurring capital markets growth in the oil-rich Gulf country.

BlackRock, the world’s largest asset manager with $10 trillion in assets under management, will “launch investment strategies across asset classes for the Saudi market, including both public and private markets, managed by a Riyadh-based investment team,” a joint press release from the firm and the PIF read.

The new platform will be called BlackRock Riyadh Investment Management, or BRIM

Tesla Inc. 'BBB' Ratings Affirmed Despite Pressure On Margins And Cash Flows; Outlook Stable

We expect Tesla Inc. to maintain an adequate ratings cushion relative to investment-grade peers in 2024 and 2025 amid downward pressure on its historically strong EBITDA margins and cash flows.

As a result, we affirmed all our ratings on Tesla, including our 'BBB' issuer credit and issue-level ratings.

The stable outlook reflects our expectation that Tesla will maintain low debt as it defends its strong market share, profitability, and liquidity in an increasingly competitive environment for electric vehicle (EV) sales.

NEW YORK (S&P Global Ratings) May 1, 2024--S&P Global Ratings today took the rating actions listed above.

Despite price cuts to combat weakening affordability in a high interest rate environment, we expect Tesla's EBITDA margin to remain strong over the next two years.We expect rising competition and further pricing pressure will lead to more volatility in Tesla's results in 2024 and 2025. In the first quarter of 2024, the company's EBITDA margins fell slightly below our full-year expectations of 14%, mostly due to lower pricing and some supply chain headwinds. Tesla appears likely to stem further declines for the remainder of 2024 with better manufacturing efficiency across facilities, higher capacity utilization, and ongoing cost reduction efforts (including announced headcount reduction).

We also expect modest benefits from supercharger partnerships with several large automakers, sales of regulatory credits, and licensing its full self-driving technology to other automakers. All of these will be critical to largely offset incremental pricing pressure and higher research and development expenses for its planned product and technology roadmap. To sustain recent strong growth, hold its first-mover advantage, and improve market share, Tesla will need to make the total cost of EV ownership more affordable, including financing, insurance, and service costs. The timing for its goals to improve the affordability of its vehicles will be an important consideration for our market share assumptions and our assessment of its competitive advantage beyond 2024.

Tesla's strong liquidity provides it sufficient financial flexibility, though we still expect free operating cash flow (FOCF) to decline over the next two years relative to 2022 and 2023 levels. Per our estimates, Tesla's FOCF to sales ratio will likely be 3%-6% over the next two years, modestly lower than our prior forecasts. We assume capital expenditures will exceed $10 billion in 2024 to fund production ramp-ups at its factories and high investments related to autonomous driving and the introduction of its next-generation vehicles.

Despite this decline, Tesla's cash flow adequacy metrics will remain better than most investment-grade automakers through 2025. In addition, its access to capital markets bolsters its financial flexibility and minimizes downside risks related to slowing macroeconomic conditions or the pursuit of aggressive growth-related investments. With nearly $27 billion in cash, cash equivalents, and investments as of March 31, 2024, and with our estimates for positive cash flow for the remainder of 2024 and solid access to the asset-back securities markets, we believe Tesla will maintain strong liquidity.

The company's cash balances remain well above our established thresholds (roughly 15% of sales) for Ford and GM (two peers that contend with higher industry cyclicality). With more cash on its balance sheet than total debt, Tesla has a sufficient buffer to fund its global expansion while navigating uncertain macroeconomic conditions globally, including slow growth in North America and Europe with volatile market conditions in China.

We revised our management and governance (M&G) score to moderately negative from neutral. The downward revision reflects a variety of factors that indicate risks to future creditworthiness related to lack of board effectiveness, key-man risk, and exposure to an uncommonly high level of contingent liabilities or lawsuits relative to the company's size and industry peers. Despite corporate governance reforms following the resolution of the take-private investigation by the Securities and Exchange Commission, which was closed with a settlement in September 2018, we continue to view key-person risk as very high given Elon Musk's dominant role.

To substantiate this, the Delaware court ruling from Jan. 30, 2024, cited lack of board independence among other factors as it invalidated Tesla's 2018 equity compensation plan. In our view, to mitigate this risk, Tesla will need to significantly enhance the independence of its board and/or nominate new independent directors who do not have strong ties to Musk. Though none of these the lawsuits or investigations so far have had any material impact on Tesla's brand or strong financial condition, in our view, the company remains overexposed relative to peers from regulatory scrutiny around its direct-to-consumer sales model, autopilot, full self-driving features, and data protection.

The stable outlook reflects our expectation that Tesla will maintain low debt as it sustains solid market share, profitability, and strong liquidity amid an increasingly competitive environment for EV sales.

We could lower our ratings if:

Tesla adopts a more aggressive financial policy that materially reduces its financial cushion due to shareholder distributions, the expansion of its captive finance operations or other business segments, and acquisitions; or

It cannot sustain solid FOCF due to slowing growth or higher-than-expected spending.

We could raise our ratings if:

Tesla sustains its first-mover advantage as EV demand expands and competition intensifies such that it appears likely its global light-vehicle market share will exceed 5%;

We believe it will likely sustain its recent FOCF beyond 2024; and

It remains committed to a prudent financial policy in line with a higher rating.

We expect Tesla Inc. to maintain an adequate ratings cushion relative to investment-grade peers in 2024 and 2025 amid downward pressure on its historically strong EBITDA margins and cash flows.

As a result, we affirmed all our ratings on Tesla, including our 'BBB' issuer credit and issue-level ratings.

The stable outlook reflects our expectation that Tesla will maintain low debt as it defends its strong market share, profitability, and liquidity in an increasingly competitive environment for electric vehicle (EV) sales.

NEW YORK (S&P Global Ratings) May 1, 2024--S&P Global Ratings today took the rating actions listed above.

Despite price cuts to combat weakening affordability in a high interest rate environment, we expect Tesla's EBITDA margin to remain strong over the next two years.We expect rising competition and further pricing pressure will lead to more volatility in Tesla's results in 2024 and 2025. In the first quarter of 2024, the company's EBITDA margins fell slightly below our full-year expectations of 14%, mostly due to lower pricing and some supply chain headwinds. Tesla appears likely to stem further declines for the remainder of 2024 with better manufacturing efficiency across facilities, higher capacity utilization, and ongoing cost reduction efforts (including announced headcount reduction).

We also expect modest benefits from supercharger partnerships with several large automakers, sales of regulatory credits, and licensing its full self-driving technology to other automakers. All of these will be critical to largely offset incremental pricing pressure and higher research and development expenses for its planned product and technology roadmap. To sustain recent strong growth, hold its first-mover advantage, and improve market share, Tesla will need to make the total cost of EV ownership more affordable, including financing, insurance, and service costs. The timing for its goals to improve the affordability of its vehicles will be an important consideration for our market share assumptions and our assessment of its competitive advantage beyond 2024.

Tesla's strong liquidity provides it sufficient financial flexibility, though we still expect free operating cash flow (FOCF) to decline over the next two years relative to 2022 and 2023 levels. Per our estimates, Tesla's FOCF to sales ratio will likely be 3%-6% over the next two years, modestly lower than our prior forecasts. We assume capital expenditures will exceed $10 billion in 2024 to fund production ramp-ups at its factories and high investments related to autonomous driving and the introduction of its next-generation vehicles.

Despite this decline, Tesla's cash flow adequacy metrics will remain better than most investment-grade automakers through 2025. In addition, its access to capital markets bolsters its financial flexibility and minimizes downside risks related to slowing macroeconomic conditions or the pursuit of aggressive growth-related investments. With nearly $27 billion in cash, cash equivalents, and investments as of March 31, 2024, and with our estimates for positive cash flow for the remainder of 2024 and solid access to the asset-back securities markets, we believe Tesla will maintain strong liquidity.

The company's cash balances remain well above our established thresholds (roughly 15% of sales) for Ford and GM (two peers that contend with higher industry cyclicality). With more cash on its balance sheet than total debt, Tesla has a sufficient buffer to fund its global expansion while navigating uncertain macroeconomic conditions globally, including slow growth in North America and Europe with volatile market conditions in China.

We revised our management and governance (M&G) score to moderately negative from neutral. The downward revision reflects a variety of factors that indicate risks to future creditworthiness related to lack of board effectiveness, key-man risk, and exposure to an uncommonly high level of contingent liabilities or lawsuits relative to the company's size and industry peers. Despite corporate governance reforms following the resolution of the take-private investigation by the Securities and Exchange Commission, which was closed with a settlement in September 2018, we continue to view key-person risk as very high given Elon Musk's dominant role.

To substantiate this, the Delaware court ruling from Jan. 30, 2024, cited lack of board independence among other factors as it invalidated Tesla's 2018 equity compensation plan. In our view, to mitigate this risk, Tesla will need to significantly enhance the independence of its board and/or nominate new independent directors who do not have strong ties to Musk. Though none of these the lawsuits or investigations so far have had any material impact on Tesla's brand or strong financial condition, in our view, the company remains overexposed relative to peers from regulatory scrutiny around its direct-to-consumer sales model, autopilot, full self-driving features, and data protection.

The stable outlook reflects our expectation that Tesla will maintain low debt as it sustains solid market share, profitability, and strong liquidity amid an increasingly competitive environment for EV sales.

We could lower our ratings if:

Tesla adopts a more aggressive financial policy that materially reduces its financial cushion due to shareholder distributions, the expansion of its captive finance operations or other business segments, and acquisitions; or

It cannot sustain solid FOCF due to slowing growth or higher-than-expected spending.

We could raise our ratings if:

Tesla sustains its first-mover advantage as EV demand expands and competition intensifies such that it appears likely its global light-vehicle market share will exceed 5%;

We believe it will likely sustain its recent FOCF beyond 2024; and

It remains committed to a prudent financial policy in line with a higher rating.

And in China, EVs actually make sense. First, their residential electricity costs are about half that of the west. They're actually building coal fired power generation plants, by the fist full. Gasoline prices are higher than ours, about $4/gal. Smog and other particulate pollution is absolutely horrendous there, their gassers usually don't even have cats and their industrial production is a filthy as 1800s London. Average miles per year in China are about half the US, and their commuting distance is far less as well. They have a high speed rail system that is inexpensive and efficient, relatively, for long distance travel. All in all, it's the best economical decision for someone to move to EV when updating their existing vehicle. Same reason why it doesn't make the best economical sense to move to an EV in the US. Carville said it best in 1992.

China is also dumping billions upon billions into subsidies to promote EVs, it makes it very easy to buy one. But, just like their real estate market, they're over producing demand and the Chinese EV market is chancing the same ending. Artificial inflation of a market is only sustainable to a point, eventually the taxpayers start demanding something else get subsidized, and contrary to most politicians' thoughts, there really is a limited amount of other people's money.

China is also dumping billions upon billions into subsidies to promote EVs, it makes it very easy to buy one. But, just like their real estate market, they're over producing demand and the Chinese EV market is chancing the same ending. Artificial inflation of a market is only sustainable to a point, eventually the taxpayers start demanding something else get subsidized, and contrary to most politicians' thoughts, there really is a limited amount of other people's money.

glad i got all out of the market and paid off mortgage. i know my pension is totally market dependent like all are . same with soc sec in that if the market really crashes,the banks will follow and soc sec will go down too. current workers can only be taxed so much. they shouldn't be further punished for the government's rape of soc sec and it's fear of revenge by the electorate. they will come up with some way to nationalize 401s,pensions and savings. purchasing power would the drop to 30s german levels and civil war to follow.

Boeing Mafia strikes again

www.seattletimes.com

www.seattletimes.com

Whistleblower Josh Dean of Boeing supplier Spirit AeroSystems has died

Joshua Dean, one of the first whistleblowers to allege Spirit AeroSystems execs had ignored manufacturing defects on the 737 MAX, died after a sudden illness.

I traveled the world looking at other companies looking for innovation ideas for an American company. All the "success stories" out of Europe, Chine, etc. were driven by government regulation or subsidies. You cannot look at what China, Germany, Sweden, etc. are doing and say "that is what US should do" without pulling back some curtains. A lot of the "good ideas" overseas are downright stupid but they make sense if the government boxes you out of options with regulations or they subsidize until it makes sense.And in China, EVs actually make sense. First, their residential electricity costs are about half that of the west. They're actually building coal fired power generation plants, by the fist full. Gasoline prices are higher than ours, about $4/gal. Smog and other particulate pollution is absolutely horrendous there, their gassers usually don't even have cats and their industrial production is a filthy as 1800s London. Average miles per year in China are about half the US, and their commuting distance is far less as well. They have a high speed rail system that is inexpensive and efficient, relatively, for long distance travel. All in all, it's the best economical decision for someone to move to EV when updating their existing vehicle. Same reason why it doesn't make the best economical sense to move to an EV in the US. Carville said it best in 1992.

China is also dumping billions upon billions into subsidies to promote EVs, it makes it very easy to buy one. But, just like their real estate market, they're over producing demand and the Chinese EV market is chancing the same ending. Artificial inflation of a market is only sustainable to a point, eventually the taxpayers start demanding something else get subsidized, and contrary to most politicians' thoughts, there really is a limited amount of other people's money.

PropagandaThe EV transition is dying out. View attachment 8409303

Mission - About - IEA

Reminds me of

China for the win

Hmmmm...

History shows investors can miss out on locking in higher yields if they wait for an answer on Fed rate cuts, a new BlackRock report says. Investors with cash on the sidelines may want to start moving some of that money into bonds, according to a new report from BlackRock. The bond market has seen some volatility amid the uncertainty around interest rates and the Federal Reserve's monetary policy. On Friday, the 10-year Treasury yield briefly tumbled below 4.5% after weaker-than-expected jobs growth for April and a surprise tick higher in the unemployment.

BlackRock says now is the time to lock in higher yields and move cash into bonds

History shows investors can miss out on locking in higher yields if they wait for an answer on Fed rate cuts, a new BlackRock report says. Investors with cash on the sidelines may want to start moving some of that money into bonds, according to a new report from BlackRock. The bond market has seen some volatility amid the uncertainty around interest rates and the Federal Reserve's monetary policy. On Friday, the 10-year Treasury yield briefly tumbled below 4.5% after weaker-than-expected jobs growth for April and a surprise tick higher in the unemployment.

Eventually the world is going to figure out the FED Reserve is helpless.

LONDON/SINGAPORE, May 6 (Reuters) - Global stocks ticked higher on renewed bets that the Federal Reserve would likely ease interest rates this year, while the yen weakened after a strong surge last week from Tokyo's suspected currency intervention.

LONDON/SINGAPORE, May 6 (Reuters) - Global stocks ticked higher on renewed bets that the Federal Reserve would likely ease interest rates this year, while the yen weakened after a strong surge last week from Tokyo's suspected currency intervention.

Money must be tight, credit cards maxed out; people not buying as much Starbucks

Trouble at Starbucks (SBUX) has prompted former Starbucks chief Howard Schultz to weigh in on the situation. "I've emphasized that the company's fix needs to begin at home: U.S. operations are the primary reason for the company's fall from grace," he wrote on LinkedIn, adding that the coffee giant needs to refocus on the customer experience after Q2 earnings "significantly" missed expectations. SBUX has declined 17% since then after slashing its guidance.

Trouble at Starbucks (SBUX) has prompted former Starbucks chief Howard Schultz to weigh in on the situation. "I've emphasized that the company's fix needs to begin at home: U.S. operations are the primary reason for the company's fall from grace," he wrote on LinkedIn, adding that the coffee giant needs to refocus on the customer experience after Q2 earnings "significantly" missed expectations. SBUX has declined 17% since then after slashing its guidance.

The "Stock Buy Back" epidemic by giant American corporations is putting another nail in the coffin of America.Money must be tight, credit cards maxed out; people not buying as much Starbucks

Trouble at Starbucks (SBUX) has prompted former Starbucks chief Howard Schultz to weigh in on the situation. "I've emphasized that the company's fix needs to begin at home: U.S. operations are the primary reason for the company's fall from grace," he wrote on LinkedIn, adding that the coffee giant needs to refocus on the customer experience after Q2 earnings "significantly" missed expectations. SBUX has declined 17% since then after slashing its guidance.

Buy Backs are simply a vote of NO CONFIDENCE in the very companies these people work for.

They should take a page from Heineken's play book:

Heineken is to spend £39m on reopening about 60 UK pubs and sprucing up “tired” locals in suburban areas in an effort to attract more consumers working from home.

The firm, which has 2,400 pubs through its Star pubs and bars arm, plans to reopen 62 long-term-closed venues this year and upgrade 612 outlets, with 94 of these earmarked for makeovers of about £200,000.

It said it would concentrate its major refurbishments on suburban pubs, turning them into “premium locals” to take advantage of the shift away from office working since the Covid crisis, as well targeting people looking to save money on travel by drinking near to home.

The latest investment will create an estimated 1,075 new jobs and broaden each pub’s use, and comes amid signs of rising consumer confidence as inflation and the cost of living crisis ease.

Heineken to pump £39m into reopening and revamping UK pubs

Firm aims to upgrade 612 outlets and reopen 62 this year amid signs of rising consumer confidence

The U.K. will be under Sharia law within the next 10 years. Isn't alcohol banned under that law? This doesn't seem to be a forward looking investment.Heineken is to spend £39m on reopening about 60 UK pubs and sprucing up “tired” locals in suburban areas in an effort to attract more consumers working from home.

My crystal ball is not showing 10 years into the future. Kind of like installing solar panels and waiting for them to pay for themselves or buying a Tesla.The U.K. will be under Sharia law within the next 10 years. Isn't alcohol banned under that law? This doesn't seem to be a forward looking investment.

yea,, so blackrock can dump their crap on you..Hmmmm...

BlackRock says now is the time to lock in higher yields and move cash into bonds

History shows investors can miss out on locking in higher yields if they wait for an answer on Fed rate cuts, a new BlackRock report says. Investors with cash on the sidelines may want to start moving some of that money into bonds, according to a new report from BlackRock. The bond market has seen some volatility amid the uncertainty around interest rates and the Federal Reserve's monetary policy. On Friday, the 10-year Treasury yield briefly tumbled below 4.5% after weaker-than-expected jobs growth for April and a surprise tick higher in the unemployment.

I vote no.

I am bullish on MSFT... the integration of CoPilot is amazing and further builds Microsoft's moat.Liking it now

Something for you "Traders".

Starting on May 28, 2024, the settlement period for most securities traded on U.S. exchanges or over the counter will shorten from two business days (T+2) to one business day (T+1). For most investors, this event may have little or no impact.

Starting on May 28, 2024, the settlement period for most securities traded on U.S. exchanges or over the counter will shorten from two business days (T+2) to one business day (T+1). For most investors, this event may have little or no impact.

"capitalists will sell you the rope, you will use to hang them" - Stalin

I'm bullish on MSFT, but, the AI they are developing will be used against Americans

I'm bullish on MSFT, but, the AI they are developing will be used against Americans

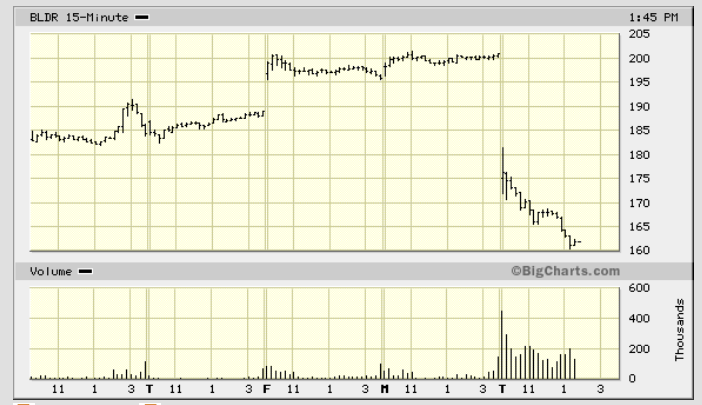

Red Flag

BLDR Builders FirstSource Inc. (NYS)

www.bldr.com

www.bldr.com

BLDR Builders FirstSource Inc. (NYS)

Building Supplies & Materials | Builders FirstSource

Welcome to Builders FirstSource, the nation’s largest supplier of building products, components and services. Find a store near you or request a quote online!

Exclusive: In Tesla Autopilot probe, US prosecutors focus on securities, wire fraud

Similar threads

- Replies

- 13

- Views

- 1K

- Replies

- 141

- Views

- 14K