put it in a foundation like gates, clinton, zuckerberg, or Hylton. Never have to worry about inheritance tax. Your foundation would buy your necessities and not have to worry about EXs coming after a piece of your pie. Ahh, the property, year round hunting, and fishing. nice to dreamLOL... Used to be that a person winning a $1,000,000 was front page news. Now a person has to win $1 billion to get front page billing...

A good gauge of inflation.

Someone in Illinois won the $1.337 billion Mega Millions jackpot—the third-largest lottery prize in U.S. history

Lottery officials say a ticket bought in Illinois matches the winning numbers for the Mega Millions' $1.337 billion jackpot, which ranks among the largest ever.www.cnbc.com

Join the Hide community

Get access to live stream, lessons, the post exchange, and chat with other snipers.

Register

Download Gravity Ballistics

Get help to accurately calculate and scope your sniper rifle using real shooting data.

Install the app

How to install the app on iOS

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Inflation.......... ?

- Thread starter Hobo Hilton

- Start date

Worldwide

Australian power prices go insane

Its taken me a few days to get around to posting this. Unfortunately, the article is behind a pay wall, but the excerpts should give you an idea of the lunacy. All prices are in $A but one $A is about $US68 cents, so to convert to USD reduce all amounts by one third. Also bear in mind that before...

community.oilprice.com

Kiplinger Inflation Outlook: A Tick Up for Services Adds to Fed’s Quandary

Will the modest rise in services inflation prevent the Federal Reserve from cutting interest rates at its next meeting?

www.kiplinger.com

www.kiplinger.com

I'm guessing AZ will increase electrical prices this winter (2022)... Most consumers don't use as much electricity during the wintertime. Higher power costs won't be as noticeable. As soon as summer hits in 2023; BAM!! power company rolls it in $$$$.Worldwide

Australian power prices go insane

Its taken me a few days to get around to posting this. Unfortunately, the article is behind a pay wall, but the excerpts should give you an idea of the lunacy. All prices are in $A but one $A is about $US68 cents, so to convert to USD reduce all amounts by one third. Also bear in mind that before...community.oilprice.com

No refundsWorldwide

Australian power prices go insane

Its taken me a few days to get around to posting this. Unfortunately, the article is behind a pay wall, but the excerpts should give you an idea of the lunacy. All prices are in $A but one $A is about $US68 cents, so to convert to USD reduce all amounts by one third. Also bear in mind that before...community.oilprice.com

I am starting to see a few comments from some really sharp people that are projecting "prices" will never return to pre-pandemic levels on anything. Now, that is a difficult challenge to prepare for if a person is on a fixed income.

Yes. For once I am glad to not be in retirement. I have enough time for things to go either way, but I would be scrambling if I was trying to live off a single retirementI am starting to see a few comments from some really sharp people that are projecting "prices" will never return to pre-pandemic levels on anything. Now, that is a difficult challenge to prepare for if a person is on a fixed income.

One more doubled edge sword. Those of us retired / disabled who bought a house and locked in a 3.5% loan at least will have a roof over our head. Those still working and saving for a house will be like a cat chasing it's tail... Those still working will be spending money to keep a reliable vehicle going. Those retired can just get by with an old beater with minimum insurance, worn tires, cracked windshield that putters around town.Yes. For once I am glad to not be in retirement. I have enough time for things to go either way, but I would be scrambling if I was trying to live off a single retirement

We certainly don't live in that perfect world.

Time to feed the chipmunks.One more doubled edge sword. Those of us retired / disabled who bought a house and locked in a 3.5% loan at least will have a roof over our head. Those still working and saving for a house will be like a cat chasing it's tail... Those still working will be spending money to keep a reliable vehicle going. Those retired can just get by with an old beater with minimum insurance, worn tires, cracked windshield that putters around town.

We certainly don't live in that perfect world.

How do you cook up those chipmunks ? Working on raising a few apple fed deer for this winter.Time to feed the chipmunks.

Attachments

I should have vaccuum sealed and froze those prairie dogs I blasted last week. At least the buzzards got a good meal.

There have been a few of us claiming this fact on this thread for a while now. Everyone else in the world has a huge shock coming when they realize it.I am starting to see a few comments from some really sharp people that are projecting "prices" will never return to pre-pandemic levels on anything. Now, that is a difficult challenge to prepare for if a person is on a fixed income.

Yep. Inflation stopping does not=prices dropping to pre-inflation levels.

It just means they stopped going up.

We need some hardcore deflation. I like deflation.

It just means they stopped going up.

We need some hardcore deflation. I like deflation.

No you don’t. You like stuff on sale, we all do. But you definitely don’t want a deflationary economy. Deflation makes inflation look like a stuffed toy. At least with inflation you can sell your stuff at a profit, and if it is mortgaged at the bank you’re all good because you are able to sell at a price above the mortgage amount. In a deflationary environment there is no recourse - everything just goes down and there is very little liquidity in the assets as no one wants to purchase anything because in many cases they are trying to satisfy contracts that they entered into during a non-deflationary environment and are now going bankrupt along with the economy. True deflation is a total shit show, and we definitely do not have a citizenry that is tough and equally genteel enough to see it through without serious danger to all involved.Yep. Inflation stopping does not=prices dropping to pre-inflation levels.

It just means they stopped going up.

We need some hardcore deflation. I like deflation.

The only way deflation works for a man is if he has no debt and his bank manages to not go under. Or he had his money buried in the back 40.

"True deflation is a total shit show" ???No you don’t. You like stuff on sale, we all do. But you definitely don’t want a deflationary economy. Deflation makes inflation look like a stuffed toy. At least with inflation you can sell your stuff at a profit, and if it is mortgaged at the bank you’re all good because you are able to sell at a price above the mortgage amount. In a deflationary environment there is no recourse - everything just goes down and there is very little liquidity in the assets as no one wants to purchase anything because in many cases they are trying to satisfy contracts that they entered into during a non-deflationary environment and are now going bankrupt along with the economy. True deflation is a total shit show, and we definitely do not have a citizenry that is tough and equally genteel enough to see it through without serious danger to all involved.

The only way deflation works for a man is if he has no debt and his bank manages to not go under. Or he had his money buried in the back 40.

What do you call HYPER inflation?

What do you tell people who's wages can't keep up with the real inflation number of around 50%? It can get worse? Deflation brings your buying power back?

Inflation vs Deflation - are you a bond holder or the one that owes debt

Not picking at you, just at your argument. I tend to disagree about deflation being bad.

Coming soon.. keep up with inflation

I was talking about deflation exclusively."True deflation is a total shit show" ???

What do you call HYPER inflation?

What do you tell people who's wages can't keep up with the real inflation number of around 50%? It can get worse? Deflation brings your buying power back?

Inflation vs Deflation - are you a bond holder or the one that owes debt

Not picking at you, just at your argument. I tend to disagree about deflation being bad.

You havent seen hyperinlfation yet. If you actually think this is hyperinflation you are in for one hell of a shock.

Until your children start playing with money as building blocks and for origami you haven't seen hyperinflation. Nothing we have seen yet compares to the wealth destruction of hyperinflation and deflation. So if you think that this is hyperinflation you need to shore up your finances and get ready, just in case.

Do a study on deflation - the Great Depression as well as the Weimar Republic. It's no joke. The Fed tries at every turn to not go into it for very specific reasons, all of them from very bad experiences and the knowledge that a highly leveraged economy in a deflationary environment WILL crumble, possibly to the point of a failed state, and very likely the end of us as a superpower at a minimum. Nothing monetarily you have saved will rescue you if we go fully down that dark path.

Last edited:

No I didn't say we are currently in HYPER inflation.

I said, if you think True deflation is a shit show, what do you call HYPER inflation.

once again, we need some deflation to bring back the buying power to consumers.

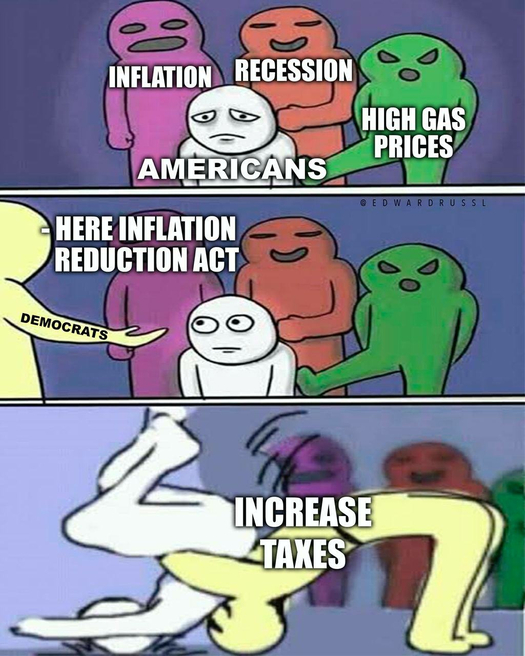

The gov is about ready to shell out almost another TRILLION. More inflation is coming.

I said, if you think True deflation is a shit show, what do you call HYPER inflation.

once again, we need some deflation to bring back the buying power to consumers.

The gov is about ready to shell out almost another TRILLION. More inflation is coming.

"True deflation is a total shit show" ???

What do you call HYPER inflation?

What do you tell people who's wages can't keep up with the real inflation number of around 50%? It can get worse? Deflation brings your buying power back?

Inflation vs Deflation - are you a bond holder or the one that owes debt

Not picking at you, just at your argument. I tend to disagree about deflation being bad.

We are NOT in "hyper inflation" yet, and the real inflation number is more like 15 to 20% per year or so not 50% for your overall budget.

Demand destruction is keeping some things down as it usually does once prices start to rise too quickly.

Very mild deflation will mean a lot of bankruptcies and a lot of unemployment.

Significant ongoing deflation would essentially cause economic collapse.

You might think: "well I'd love significant deflation because I have a bunch of money in cash and I'd like to get good deals as everybody else goes broke."

The problem is, there won't be much of an economy left. How much food will your grocery store stock if deflation means they might be guaranteed to be losing money between when the contracts are signed for delivery and when they sell it?

Is anyone going to bother stocking anything that you want to buy from fuel to equipment, or quoting out services or goods when they know you will pay them less than they had to pay for it?

People will be forced to mark everything up by a huge percentage just to not go broke and long term supply chain operations will grind to a near halt.

Scarcity will be come a real thing and it won't matter much how much money you have, there just won't be much to buy.

Folks with real tangible property and such will probably stop selling while they wait to see how things level off because getting more supplies will be unlikely.

Nobody is going to be able to keep factories running and goods being produced under significant deflation.

You like food? well farmer's aren't going to be able to produce food if there is no chance of them selling the crop for more than it cost them to buy everything to plant the crop and grow the crop.

Like it or not, the best thing for economic stability is around a 1% to 2% continual inflation rate.

The economy can more easily ride out inflation in the 10 to 20 percent year than it can if deflation was to be in the 10 to 20 percent per year.

Chart is a bit outdated.

America needs some deflation. I agree that, in your words, we definitely do not have a citizenry that is tough and equally genteel enough to see it through without serious danger to all involved.

Americans have gotten soft, lazy and expect someone to clean up their messes. I hope American's get a good dose of reality before we have to fight the Chinese.

JMHO

America needs some deflation. I agree that, in your words, we definitely do not have a citizenry that is tough and equally genteel enough to see it through without serious danger to all involved.

Americans have gotten soft, lazy and expect someone to clean up their messes. I hope American's get a good dose of reality before we have to fight the Chinese.

JMHO

I re-read your posts and mine. I’m not trying to be an ass, but it looks kind of like I accomplished it. The point I’m trying to get across is that both hyperinflation and deflation destroy wealth, albeit via different avenues. You don’t want either one. You want responsible politicians and federal officials. We have neither.No I didn't say we are currently in HYPER inflation.

I said, if you think True deflation is a shit show, what do you call HYPER inflation.

once again, we need some deflation to bring back the buying power to consumers.

The gov is about ready to shell out almost another TRILLION. More inflation is coming.

The political class is lining thier pockets on our backs. And in the end, they will still get paid while most of the citizens starve while trying to figure it all out. This is the sad truth.

We are NOT in "hyper inflation" yet, and the real inflation number is more like 15 to 20% per year or so not 50% for your overall budget.

Demand destruction is keeping some things down as it usually does once prices start to rise too quickly.

Very mild deflation will mean a lot of bankruptcies and a lot of unemployment.

Significant ongoing deflation would essentially cause economic collapse.

You might think: "well I'd love significant deflation because I have a bunch of money in cash and I'd like to get good deals as everybody else goes broke."

The problem is, there won't be much of an economy left. How much food will your grocery store stock if deflation means they might be guaranteed to be losing money between when the contracts are signed for delivery and when they sell it?

Is anyone going to bother stocking anything that you want to buy from fuel to equipment, or quoting out services or goods when they know you will pay them less than they had to pay for it?

People will be forced to mark everything up by a huge percentage just to not go broke and long term supply chain operations will grind to a near halt.

Scarcity will be come a real thing and it won't matter much how much money you have, there just won't be much to buy.

Folks with real tangible property and such will probably stop selling while they wait to see how things level off because getting more supplies will be unlikely.

Nobody is going to be able to keep factories running and goods being produced under significant deflation.

You like food? well farmer's aren't going to be able to produce food if there is no chance of them selling the crop for more than it cost them to buy everything to plant the crop and grow the crop.

Like it or not, the best thing for economic stability is around a 1% to 2% continual inflation rate.

The economy can more easily ride out inflation in the 10 to 20 percent year than it can if deflation was to be in the 10 to 20 percent per year.

All depends on who's overall budet you are talking about .

"real inflation number is more like 15 to 20% per year or so not 50% for your overall budget."

My budget consists of GAS and FOOD. Not computers, not buying appliances, not buying semi conductors or any other BASKET of goods that the Gov is using to track CPI. NOPE, just GAS and FOOD and for me.

Now, Breaking down MY budget of GAS and FOOD I have seen this much inflation in the following 'sectors'

so, (ending - begining) / beg = % change

Gas 2.00 to 4.60 a gallon = 130 % increase

Eggs 7.5 dozen 12 to 27.50 = 129 % increase

Steak - 4.99 to 9.99 = 100 % increase

Hamburger 90/10 2.89 a pound (on sale) to on sale price of 4.99 (on sale) = 59% increase

I won't go into MY overall basket of goods, since the numbers are about the same.

But as I stated, I'm experiencing over 50%. I didn't get a 15 - 20% raise, so therefore I'm making less than 2 years ago.

Others might only be feeling it 15 - 20%. I'm happy for all those people. Fixed income people are getting screwed.

News had stated, those that make under 250K a year are feeling the pinch and are starting to live pay check to pay check.

I'm not worried, the government will redefine what inflation is, so, I'll be ok. Maybe, the government will remove a few more items from the CPI, in order to show a lower number. As for me, I know what my inflation rate is.

Some of us are debt free and look forward to deflation.No you don’t. You like stuff on sale, we all do. But you definitely don’t want a deflationary economy. Deflation makes inflation look like a stuffed toy. At least with inflation you can sell your stuff at a profit, and if it is mortgaged at the bank you’re all good because you are able to sell at a price above the mortgage amount. In a deflationary environment there is no recourse - everything just goes down and there is very little liquidity in the assets as no one wants to purchase anything because in many cases they are trying to satisfy contracts that they entered into during a non-deflationary environment and are now going bankrupt along with the economy. True deflation is a total shit show, and we definitely do not have a citizenry that is tough and equally genteel enough to see it through without serious danger to all involved.

The only way deflation works for a man is if he has no debt and his bank manages to not go under. Or he had his money buried in the back 40.

All depends on who's overall budet you are talking about .

"real inflation number is more like 15 to 20% per year or so not 50% for your overall budget."

My budget consists of GAS and FOOD. Not computers, not buying appliances, not buying semi conductors or any other BASKET of goods that the Gov is using to track CPI. NOPE, just GAS and FOOD and for me.

So you don't pay any property taxes?

I'm assuming you don't have to pay any mortgage or rent (just keep in mind the majority of people are paying either mortgage or rent).

You don't have to pay car insurance or home owner's insurance?

You don't have any electricity or Natural Gas bills?

Trash and water and sewer are all free?

You never have to replace or repair equipment?

You never have to make home repairs?

You never have to buy clothes or shoes?

You don't have to pay for tolls, registration / vehicle taxes / inspections?

I'm guessing you have no plans to ever buy another vehicle? (and of course have no car payments)

Don't have to buy tires or do service on your vehicle?

Never have to pay for any medical or vet bills?

You don't have any school aged kids around that need school supplies, school clothes etc?

None of your household appliances ever break down and need repairs / replacement?

If you are one of the rare few that have to pay none of all the above, I'd be very surprised but perhaps it is possible.

In any case your experience of your budget consisting "only" of food and gasoline, is not in any way representative of what the average working class family has to account for in their budgets.

I could just as easily try to claim that there in no inflation because I know somebody that grows all their own food and charges their electric car from solar panels, but that would be just as invalid.

You can't have a proper discussion on macro economic forces such as inflation using only a cherry picked tiny sample to prove your point, you need to go with the mode of what most folks divide their budget into. The government does it's own cherry picking of course by carving out food and fuel, specifically because those are more subject to wild swings which look bad politically.

The fact of the matter is that food and fuel are for MOST working class Americans, only a part of many other things they have to pay for to keep their households and family in operation.

But on your gasoline issue, demand destruction put a limit on it.

For example here, Gasoline rose to be touching the $5 per gallon range, and it became so expensive many people stopped driving when they didn't have to or made other long term changes to their transit situation. Now Gasoline is in the $3.35 / gallon range, and will probably eventually creep up a bit to test where the next demand destruction threshold is.

no worries. pure discussion.I re-read your posts and mine. I’m not trying to be an ass, but it looks kind of like I accomplished it. The point I’m trying to get across is that both hyperinflation and deflation destroy wealth, albeit via different avenues. You don’t want either one. You want responsible politicians and federal officials. We have neither.

The political class is lining thier pockets on our backs. And in the end, they will still get paid while most of the citizens starve while trying to figure it all out. This is the sad truth.

inflation, deflation, money, debt, savings, Finance, and Economics. (debt) is a double edge sword since it cuts both ways.

Depends on who you are and what you are trying to accomplish. Ronald Reagan said, he wished he hired a 1 handed economics advisor.

All depends which side of the fence you are sitting.

I would encourage you to go back and thoughtfully consider what W54/XM-388 said above. Being debt free is VERY good IMO, and well done to you. And it IS a barrier in the initial stages of deflation. Its when it goes on and on that money wont buy as much as the initial glance implies that it will. As he alluded to, taxes wont go down, goods cant be found and utilities will be compromised. Banks have a hard time surviving and runs/holidays are the order of the day. It truly is a bad deal. Hopefully we avoid it, but at times Im not so sure; the spending is so out of control the pendulum is going to swing the other way eventually.Some of us are debt free and look forward to deflation.

You can't compare CPI over time since the government has messed with the 'basket-of-goods' to manipulate it.. unless that graph is adjusted against the current "basket"

When a box of cereal or a loaf of bread are at $5.....we are fucked.

I remember as a kid buying a gallon of milk, a loaf of bread, a dozen eggs and getting change back from a $1 bill.

I'm not all that old.

I remember as a kid buying a gallon of milk, a loaf of bread, a dozen eggs and getting change back from a $1 bill.

I'm not all that old.

Very few numbers the Government has not altered. The rest of the world is finding this out. America is loosing credibility at a high rate of speed.You can't compare CPI over time since the government has messed with the 'basket-of-goods' to manipulate it.. unless that graph is adjusted against the current "basket"

"Poll Numbers" mean nothing.

Those price increases have to be divided by 2.5 years to get annual inflation.All depends on who's overall budet you are talking about .

"real inflation number is more like 15 to 20% per year or so not 50% for your overall budget."

My budget consists of GAS and FOOD. Not computers, not buying appliances, not buying semi conductors or any other BASKET of goods that the Gov is using to track CPI. NOPE, just GAS and FOOD and for me.

Now, Breaking down MY budget of GAS and FOOD I have seen this much inflation in the following 'sectors'

so, (ending - begining) / beg = % change

Gas 2.00 to 4.60 a gallon = 130 % increase

Eggs 7.5 dozen 12 to 27.50 = 129 % increase

Steak - 4.99 to 9.99 = 100 % increase

Hamburger 90/10 2.89 a pound (on sale) to on sale price of 4.99 (on sale) = 59% increase

I won't go into MY overall basket of goods, since the numbers are about the same.

But as I stated, I'm experiencing over 50%. I didn't get a 15 - 20% raise, so therefore I'm making less than 2 years ago.

Others might only be feeling it 15 - 20%. I'm happy for all those people. Fixed income people are getting screwed.

News had stated, those that make under 250K a year are feeling the pinch and are starting to live pay check to pay check.

I'm not worried, the government will redefine what inflation is, so, I'll be ok. Maybe, the government will remove a few more items from the CPI, in order to show a lower number. As for me, I know what my inflation rate is.

Why ?Those price increases have to be divided by 2.5 years to get annual inflation.

The government's number is year over year. Gas was $2.00 two and a half years ago. It is now $4.00. 100% inflation over 2.5 years is around 34% annualizedWhy ?

I understand having money will only be good initially, but I was thinking more long-term of the health of the country. We need a reset, just not the one the central planners are pushing.I would encourage you to go back and thoughtfully consider what W54/XM-388 said above. Being debt free is VERY good IMO, and well done to you. And it IS a barrier in the initial stages of deflation. Its when it goes on and on that money wont buy as much as the initial glance implies that it will. As he alluded to, taxes wont go down, goods cant be found and utilities will be compromised. Banks have a hard time surviving and runs/holidays are the order of the day. It truly is a bad deal. Hopefully we avoid it, but at times Im not so sure; the spending is so out of control the pendulum is going to swing the other way eventually.

Initially those not in debt will have a chance to buy during the fire sale, then things will just disappear from the shelves. I have planned accordingly and tried to take the path of the ants rather than the grasshopper.

My grandparents made it through the great depression and my family prior to that was dead set in the middle of the dust bowl with far fewer resources than we have today. If my family falters and ends up failing it won't be from lack of preparation. I have thought the bad times were coming since the Obama admin, so to say we did not have time to prepare would be a lie. I just hope we are prepared enough.

The 2.5 years is one big fallacy (a mistaken belief, especially one based on unsound argument)Those price increases have to be divided by 2.5 years to get annual inflation.

Jerome Powell designed his "framework" on such unsound belief's. To cover his ass he called the rapid approach of this recession transitional.

Visualize preparing to battle with an opponent that is throwing rocks at you (2.5 years). As he picks up the rock, you have time to adjust your defense or throw a rock at him first.

Now, visualize an opponent getting ready to launch an arrow at you using his bow (2 years). Best take cover and defend yourself.

Escalating the attack, as you walk along a path through a thick forest, a sniper has set up an ambush (1 year). You look down at your chest and see a red dot. The next thing you know, you are on the ground hemorrhaging blood from your chest.

The well seasoned managers of the largest funds are hedged against the sniper of this recession. The man on the street is just now picking up a rock in order to defend himself. Time and time again articles have been written on the "swift approach" of this recession. Historically there has been no other recession that approached this fast.

The FED Reserve and every Administration of countries classed as world leaders have been caught with their pants down.

"We the People" will suffer the consequences.

A good message, thanks for sharing.I understand having money will only be good initially, but I was thinking more long-term of the health of the country. We need a reset, just not the one the central planners are pushing.

Initially those not in debt will have a chance to buy during the fire sale, then things will just disappear from the shelves. I have planned accordingly and tried to take the path of the ants rather than the grasshopper.

My grandparents made it through the great depression and my family prior to that was dead set in the middle of the dust bowl with far fewer resources than we have today. If my family falters and ends up failing it won't be from lack of preparation. I have thought the bad times were coming since the Obama admin, so to say we did not have time to prepare would be a lie. I just hope we are prepared enough.

"The long term health of the country" = My thoughts are the biggest challenge to those prepared is those who are not prepared. America no longer has the resources to save the world. Speaking of the world economy / commerce, the ship is sinking quickly. America is nothing more than a life boat at this time. 80% of the people in the lifeboat can not row or bail water that is splashing in. 20% of the people are bailing and rowing towards a distant shoreline. The 80% are reaching out and trying to pull people into the lifeboat from the ocean. There are sharks in the water and an approaching storm. Well Captain, what do we do?

A little deflation would be great, if it could be accomplished with precision. But since we can't accomplish a little bit of inflation with precision, then we should assume the same would hold true for deflation. Whipsawing from the present position to, say, 25% overshoot in the opposite direction would be a massive distortion in the market with unforeseen consequences (like, everything's fun and games until you find out that various industries like ag, transportation, and energy are desperately dependant on leverage).

But at this point I'm kinda thinking we're overdue for a jubilee anyways, and this would accomplish it.

But at this point I'm kinda thinking we're overdue for a jubilee anyways, and this would accomplish it.

I'd like for my $100 bill to buy the same amount of goods today that it did in 1950... Wishful thinking ?A little deflation would be great, if it could be accomplished with precision. But since we can't accomplish a little bit of inflation with precision, then we should assume the same would hold true for deflation. Whipsawing from the present position to, say, 25% overshoot in the opposite direction would be a massive distortion in the market with unforeseen consequences (like, everything's fun and games until you find out that various industries like ag, transportation, and energy are desperately dependant on leverage).

But at this point I'm kinda thinking we're overdue for a jubilee anyways, and this would accomplish it.

I'd like for my $100 bill to buy the same amount of goods today that it did in 1950... Wishful thinking ?

Would you also be fine with your day of work being paid at the same rate as it did in 1950?

Would you also be fine with your day of work being paid at the same rate as it did in 1950?

Yes, yes I would.

In 1950:

a new house cost $8,450.00

the average income per year was $3,210.00

a gallon of gas was 18 cents

the average cost of new car was $1,510.00

A few more prices from the 50’s and how much things cost

Chrysler New Yorker $4347

1958 Chevrolet Corvette $3631

Men’s All Wool Suits $28.90

Square dance Cotton Check Dress $3.29

Electric Portable Singer Sewing Machine $19.90

Ronson Electric Shaver $28.50

Rib Roast 29 cents per pound

Ritz Crackers 32 cents

Rollaway Beds $14.95

Ring 1 carat Diamond $399.00

Mechanical Adding Machine $3.98

Source: The People History

Ford F-150 Lightning gets big price hike as order book reopens

Ford will begin taking orders for the 2023 F-150 Lightning on August 11, but has increased the base price of the electric pickup by $7,000 for the new model year.

Yes, yes I would.

In 1950:

a new house cost $8,450.00

the average income per year was $3,210.00

a gallon of gas was 18 cents

the average cost of new car was $1,510.00

A few more prices from the 50’s and how much things cost

Chrysler New Yorker $4347

1958 Chevrolet Corvette $3631

Men’s All Wool Suits $28.90

Square dance Cotton Check Dress $3.29

Electric Portable Singer Sewing Machine $19.90

Ronson Electric Shaver $28.50

Rib Roast 29 cents per pound

Ritz Crackers 32 cents

Rollaway Beds $14.95

Ring 1 carat Diamond $399.00

Mechanical Adding Machine $3.98

Source: The People History

If you add an extra 0 to the end of everything including wages and income, you'd find that it's not all that far removed from where things were about 15 to 20 years ago before our current cycle of mega money printing kicked into overdrive. Purchasing power for the average working type based on expenses vs. wages wasn't all that different, with some things being slightly better, some slightly worse.

Up until then purchasing power based on your wages was still reasonable, but then as the mega money printing and huge handouts to wall street and near interest free money to the banks and stock brokers took hold, purchasing power started to show a real decline.

Then the past 3 years of printing more money than ever before, while for the most part wages were rather stagnant, started causing purchasing power to crumble at a steady rate.

I could use up most of my ammo shooting holes in this article:

Rachel Phua is a freelance journalist based in Singapore who has worked for Payday Report, DealStreetAsia, Atlas Obscura, Nikkei, and CNBC International.

www.cnbc.com

www.cnbc.com

Rachel Phua

Rachel Phua is a freelance journalist based in Singapore who has worked for Payday Report, DealStreetAsia, Atlas Obscura, Nikkei, and CNBC International.

Food prices fell sharply in July — but the respite may not last

Global food prices slid in July, but there are doubts over whether the good news will last as, among other things, the Russia-Ukraine grain deal appears shaky.

I'm ready for deflation:

www.cnbc.com

www.cnbc.com

Consumer prices rose 8.5% in July, less than expected as inflation pressures ease a bit

Prices that consumers pay for a variety of goods and services rose 8.5% in July from a year ago, a slowing pace from the previous month.

The U.S. Postal Service filed a notice Wednesday of a temporary price hike for this year’s peak holiday season, which it said would help cover extra handling costs.

The agency said the adjustment was approved by its board of governors and is now pending review by the Postal Regulatory Commission. The price increase would go into effect on Oct. 2 and remain in place until January 22, 2023.

__________________________

Typical... Rather than do a fixed percentage rate increase, the Government has created one more Matrix...... Why ?

The agency said the adjustment was approved by its board of governors and is now pending review by the Postal Regulatory Commission. The price increase would go into effect on Oct. 2 and remain in place until January 22, 2023.

__________________________

Typical... Rather than do a fixed percentage rate increase, the Government has created one more Matrix...... Why ?

Mortgage rates tick back up above 5%, another challenge for first-time home buyers

The 30-year fixed-rate mortgage averaged 5.22% as of August 11, according to data released by Freddie Mac.

I noticed an article where Delta airlines CEO bragging about big donation into Atlanta for some Social Justice excuse. All these big companies are trying to buy a good "Social Justice" score, etc. - wonder how much we as consumers are paying for all these Social Justice outreach by corporate America? How much is this influencing inflation? Seems like almost a "tax" on the consumer.

Start asking a man who is working a 40 hour job just exactly what percent of his gross pay he is taking home with him.I noticed an article where Delta airlines CEO bragging about big donation into Atlanta for some Social Justice excuse. All these big companies are trying to buy a good "Social Justice" score, etc. - wonder how much we as consumers are paying for all these Social Justice outreach by corporate America? How much is this influencing inflation? Seems like almost a "tax" on the consumer.

Like everyone, I have a few items on my "Want List". My needs are fairly well taken care of. I am witnessing some asking prices far above the value of an item. Some ads will say "I really don't need to sell this but I'm testing the water"...

There is a lot of "Water Testing" going on in our country. Politically, Economy, Common Sense and a host of other things never seen in the history of America. I look forward to the passing of this darkest hour.

There is a lot of "Water Testing" going on in our country. Politically, Economy, Common Sense and a host of other things never seen in the history of America. I look forward to the passing of this darkest hour.

Similar threads

- Replies

- 32

- Views

- 1K

- Replies

- 109

- Views

- 4K

- Replies

- 61

- Views

- 2K