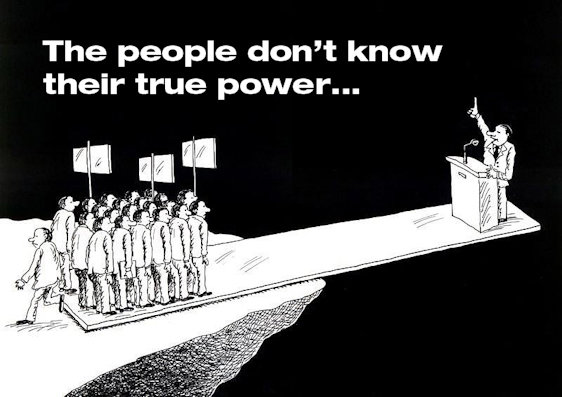

Since 2008? You don't say... <<<<Sarcastic tone

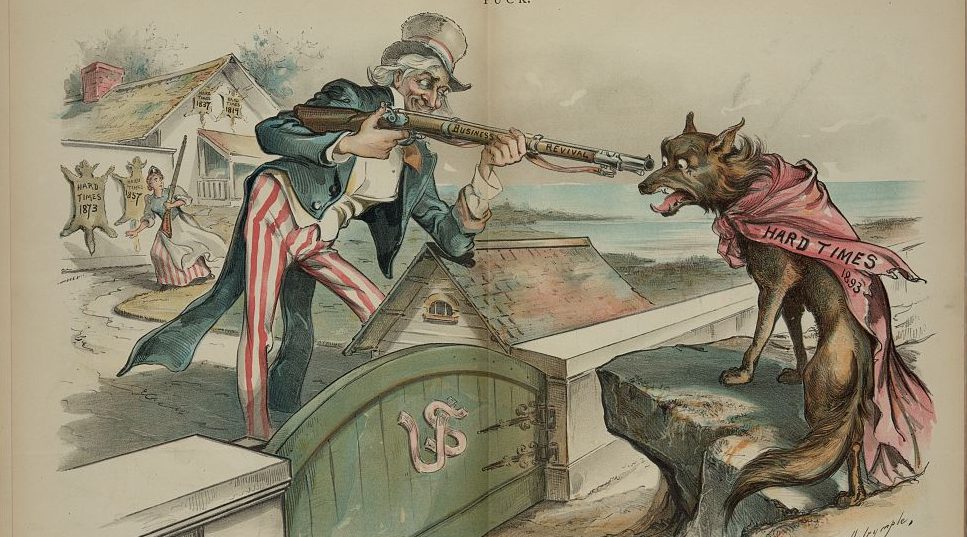

Despite rising costs, oil and gas producers globally are expected to book new records in cash flows and offer the best return on capital employed (ROCE) in 15 years, BMO Capital Markets said in a new report cited by Upstream.

Stronger oil and gas prices will be the key driver of record cash flows in the industry, according to an analysis by BMO Capital Markets of 120 oil and gas firms globally.

Oil And Gas Producers To Break New Cash Flow Records | OilPrice.com

Oil and gas producers are on track to book new records in cash flows this year thanks to high pricesoilprice.com

/GettyImages-1181576432-e75deb478e4e4c199800c1af8502f670.jpg)