Picked up my plans for a barn addition today. I'll get the permit and pour the foundation and slab, unsure if it will get framed this year. I hate buying at the top, hopefully this is the top.

Join the Hide community

Get access to live stream, lessons, the post exchange, and chat with other snipers.

Register

Download Gravity Ballistics

Get help to accurately calculate and scope your sniper rifle using real shooting data.

Install the app

How to install the app on iOS

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Inflation.......... ?

- Thread starter Hobo Hilton

- Start date

Many things are changing in the "Oil Arena"... Ripple effects in all directions... The rest of the world is moving away from the USD for oil trading (Petro Dollar)... The last new refinery was built in America in 1976... Sure, we have oil but can we convert it into fuel ?... Food production / transportation depends on oil.. We can't eat oil.

Can we refine the oil that we produce?

An overly simplistic answer would be, sure. We produce somewhere around 10-11 million barrels a day. We have refining capacity for ~17-18 million barrels a day last I checked.

However, it is more complicated than a simple comparison.

There are particular grades of oil that some refineries prefer, so you would need to look at total capacity by grade, then you'd still need to look at infrastructure capacity to ship those grades to the proper refineries, then again look at existing purchasing contracts from each of the midstream companies to the up and down stream companies. Afterwards, I think you will find localized constrictions but overall a healthy outlook with room to grow our domestic refining production. Though, I'd love to hear from a midstream analyst on that topic.

Evidently we can't refine the jet fuel we need here in America:Can we refine the oil that we produce?

An overly simplistic answer would be, sure. We produce somewhere around 10-11 million barrels a day. We have refining capacity for ~17-18 million barrels a day last I checked.

However, it is more complicated than a simple comparison.

There are particular grades of oil that some refineries prefer, so you would need to look at total capacity by grade, then you'd still need to look at infrastructure capacity to ship those grades to the proper refineries, then again look at existing purchasing contracts from each of the midstream companies to the up and down stream companies. Afterwards, I think you will find localized constrictions but overall a healthy outlook with room to grow our domestic refining production. Though, I'd love to hear from a midstream analyst on that topic.

At least 10 vessels, chartered by companies including Saudi's Aramco Trading, Royal Dutch Shell (RDSa.L), Chevron Corp (CVX.N) and Valero are currently in transit from South Korea to the United States, ship tracking data showed, carrying about 3.3 million barrels of jet fuel for delivery this month.

/cloudfront-us-east-2.images.arcpublishing.com/reuters/7U26BE4CCFMYVG6RVHRS6YRNHI.jpg)

Oil traders ramp up Asian jet fuel exports to U.S., Europe

Global oil trading companies are ramping up jet fuel exports from Asia to Europe and the United States, as widespread anti-coronavirus vaccinations and relatively lower infection rates allow commercial travel to resume faster in Western countries.

I mulled your thoughts over..... I ran across a great quote last week - Hope is not a Plan..... What if today's prices on everything is only half way to the top? We saw this on ammo......... What if "the top" is when a wheel barrow full of $100 USD's will buy one loaf of bread ? I am looking at the needs of my homestead. I have no solar power set up. I need some solar power system as an alternate. Is now the time to start piecing together panels, controller, batteries, shed ?........ IDKPicked up my plans for a barn addition today. I'll get the permit and pour the foundation and slab, unsure if it will get framed this year. I hate buying at the top, hopefully this is the top.

Just finished a DIY project, installing solar panels & related @ the house.

The panels and electronics don’t seem to be showing the effects of inflation too much.

But the Copper wiring, and steel work for the ground mount..the order I placed for 120 ft of schedule 40 galvanized pipe was interesting.

The steel supply place had temporary signs all over “quotes not valid for more than one business day”, and the guy would not take my steel order w/o calling the mill to verify the price at that time.

The panels and electronics don’t seem to be showing the effects of inflation too much.

But the Copper wiring, and steel work for the ground mount..the order I placed for 120 ft of schedule 40 galvanized pipe was interesting.

The steel supply place had temporary signs all over “quotes not valid for more than one business day”, and the guy would not take my steel order w/o calling the mill to verify the price at that time.

Last edited:

Yes Sir..... Understood.... I am dealing with that situation, also. Not too bad around the large cities with industry.... Being in a rural area almost forces us to take a trailer, travel and secure items we need.Just finished a DIY project, installing solar panels & related @ the house.

The panels and electronics don’t seem to be showing the effects of inflation too much.

But the Copper wiring, and steel work for the ground mount..the order I placed to 120 ft of schedule 40 galvanized pipe was interesting.

The steel supply place had temporary signs all over “quotes not valid for more than one business day”, and the guy would not take my steel order w/o calling the mill to verify the price at that time.

Read about what happened during the Weimar Republic. What you are describing are the echos and warnings of hyperinflation. Will it happen here? I don’t know but I can plainly see the warning signs. We are seeing “here and there” pockets of it. When everything goes up, you’ll know it’s too late. Hyperinflation always comes with reduced production capacity. Also remember that Daily price increases are the symptom not the problem.Just finished a DIY project, installing solar panels & related @ the house.

The panels and electronics don’t seem to be showing the effects of inflation too much.

But the Copper wiring, and steel work for the ground mount..the order I placed to 120 ft of schedule 40 galvanized pipe was interesting.

The steel supply place had temporary signs all over “quotes not valid for more than one business day”, and the guy would not take my steel order w/o calling the mill to verify the price at that time.

another always outcome of this: scapegoats. In Germany it was the Jews. It’s rarely the leadership that caused the issue to begin with.

For example: $70-$100 oil isn’t the issue, don’t let them tell you it is. We have had these crude prices before and lumber wasn’t this high, neither was steel. But if I’m right this will be a reason given, not the trillions being printed out of thin air.

The ripple effect...

Sherwin-Williams Co. late Tuesday raised its sales and profit outlook on “strong” demand for paints and other products, but said rising costs for raw materials have led it to raise prices.

newshere.org

newshere.org

Oil Closes Above $70 a Barrel for First Time in Over Two Years

Sherwin-Williams Co. late Tuesday raised its sales and profit outlook on “strong” demand for paints and other products, but said rising costs for raw materials have led it to raise prices.

Sherwin-Williams raises guidance, but flags higher costs for its paints and materials

Sherwin-Williams Co. late Tuesday raised its sales and profit outlook on “strong” demand for paints and other products, but said

Last edited:

Ill put this here on top of the stack.

The issue is that wages always lag behind rises in goods and services. This happens for a number of reasons, not all of them evil. Nobody seems to be talking about that though. The minimum wage is not meant to address this; dont start thinking the politicians are that smart.

The issue is that wages always lag behind rises in goods and services. This happens for a number of reasons, not all of them evil. Nobody seems to be talking about that though. The minimum wage is not meant to address this; dont start thinking the politicians are that smart.

Inflation is the "Elephant in the Room"..... No one wants to talk about it. This morning Campbell's has opened the dialog in the food industry.Ill put this here on top of the stack.

The issue is that wages always lag behind rises in goods and services. This happens for a number of reasons, not all of them evil. Nobody seems to be talking about that though. The minimum wage is not meant to address this; dont start thinking the politicians are that smart.

Campbell Plans to Raise Prices as Higher Costs Cut into Profits

The soup maker’s pandemic boost came to an end, as some customers are returning to restaurants and offices, as inflation and tough year-over-year comparisons weighed on results.

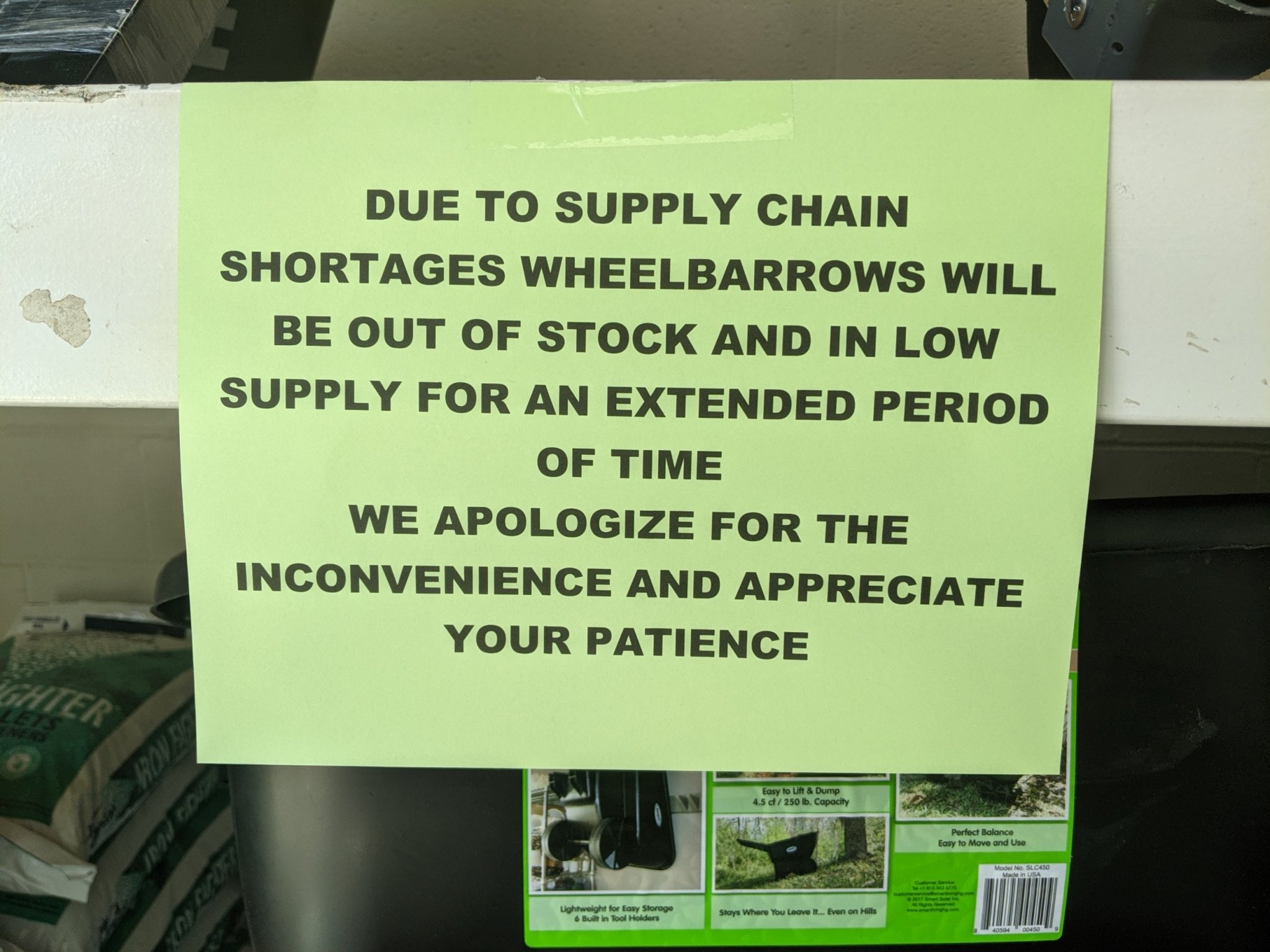

Here is the next hoarding opportunity, courtesy of the local hardware store:

An interesting line of thought:

Now, I think what I find most worrisome is that this closing-of-the-loop that will need to occur to get inflation under control is quite possibly a near-term disaster itself. If we see prices skyrocket, demand will drop, and then we're facing a recession that we will quite simply need to ride out in order to fix the problems that got papered-over the last couple times. That's gonna mean people out of work, asset deflation (a simple increase in mortgage rates to 8% might sink home prices by 35-40% based upon payment affordability, which in turn puts a bunch of homeowners deeply underwater), and probably defaults with the corresponding stress on lenders. Gonna a leader with big balls to ride out that storm.

Now, I think what I find most worrisome is that this closing-of-the-loop that will need to occur to get inflation under control is quite possibly a near-term disaster itself. If we see prices skyrocket, demand will drop, and then we're facing a recession that we will quite simply need to ride out in order to fix the problems that got papered-over the last couple times. That's gonna mean people out of work, asset deflation (a simple increase in mortgage rates to 8% might sink home prices by 35-40% based upon payment affordability, which in turn puts a bunch of homeowners deeply underwater), and probably defaults with the corresponding stress on lenders. Gonna a leader with big balls to ride out that storm.

An interesting line of thought:

Now, I think what I find most worrisome is that this closing-of-the-loop that will need to occur to get inflation under control is quite possibly a near-term disaster itself. If we see prices skyrocket, demand will drop, and then we're facing a recession that we will quite simply need to ride out in order to fix the problems that got papered-over the last couple times. That's gonna mean people out of work, asset deflation (a simple increase in mortgage rates to 8% might sink home prices by 35-40% based upon payment affordability, which in turn puts a bunch of homeowners deeply underwater), and probably defaults with the corresponding stress on lenders. Gonna a leader with big balls to ride out that storm.

BINGO!!!!!!! This price inflation mixed with low interest rates means everyone is about to get fucked. The banking system is going to take it on the chin with the defaults.

BINGO!!!!!!! This price inflation mixed with low interest rates means everyone is about to get fucked. The banking system is going to take it on the chin with the defaults.

... as is anyone who wants to liquidate assets. Gonna be fun selling a house or trading in a late-model pickup when the prospective buyers can only pay whatever the principal is of a loan at 8-10% with whatever monthly payment is affordable on the peanuts they're getting paid post-crash.

Know all those people who bought desirable muscle cars for $500 back in the mid-70s? Yeah, history may not repeat, but it often rhymes.

Or I'm completely wrong and we inflate to the moon.

Is there a way to be fucked regardless of which way this goes? If so, I'm sure I'll find it

Inflation mixed with high interest rates would be much more troubling, non? The point being that there are a lot of tools to deal with inflation starting out low. As I have said a number of times, and as continues to be reflected in just about every report, especially employment, that comes out, risks are balanced but high. Given that rates are already extremely low, the nightmare scenario is extended economic sluggishness, as we currently have no policy tools available to combat that.BINGO!!!!!!! This price inflation mixed with low interest rates means everyone is about to get fucked. The banking system is going to take it on the chin with the defaults.

This thread is really a good example of dog with a bone thinking. Anybody who isn't seeing the other half of the risk equation is blind. I don't know which way it will go, and neither does anybody else, or even if it will go bad, but the monomania in this thread may lead to a lot of really bad investment decisions.

Take it from a long time professional -- don't lose money because of your political beliefs. I promise you it won't hurt Joe Biden if you do, it will only hurt you.

I bought some phyiscal gold.. probably going to buy some more.. then $20K in Ibonds that go up with inflation... (limit per/year)...

Maybe some TIPS.

Maybe some TIPS.

Those bonds may not be the deal you want them to be. it depends on what inflation calculator they are using.I bought some phyiscal gold.. probably going to buy some more.. then $20K in Ibonds that go up with inflation... (limit per/year)...

Maybe some TIPS.

An interesting line of thought:

Now, I think what I find most worrisome is that this closing-of-the-loop that will need to occur to get inflation under control is quite possibly a near-term disaster itself. If we see prices skyrocket, demand will drop, and then we're facing a recession that we will quite simply need to ride out in order to fix the problems that got papered-over the last couple times. That's gonna mean people out of work, asset deflation (a simple increase in mortgage rates to 8% might sink home prices by 35-40% based upon payment affordability, which in turn puts a bunch of homeowners deeply underwater), and probably defaults with the corresponding stress on lenders. Gonna a leader with big balls to ride out that storm.

déjà vu

The Resolution Trust Corporation (RTC) was a U.S. government-owned asset management company run by Lewis William Seidman and charged with liquidating assets, primarily real estate-related assets such as mortgage loans, that had been assets of savings and loan associations (S&Ls) declared insolvent by the Office of Thrift Supervision (OTS) as a consequence of the savings and loan crisis of the 1980s.[1] It also took over the insurance functions of the former Federal Home Loan Bank Board (FHLBB).

Between 1989 and mid-1995, the Resolution Trust Corporation closed or otherwise resolved 747 thrifts with total assets of $394 billion.[2] Its funding was provided by the Resolution Funding Corporation (REFCORP) which still exists to support the debt obligations it created for these functions.

I haven't read all of the posts on this topic, but here are examples of more things to be concerned about with inflation.......hyper-inflation:

https://www.newsmax.com/newsfront/meat-cybersecurity-hack-russia/2021/06/09/id/1024552/

justthenews.com

justthenews.com

Locally, neighbors are trying to get their hands on freezers for beef. At least four months out from what I'm being told. Look for beef/pork to go thru the roof..........

https://www.newsmax.com/newsfront/meat-cybersecurity-hack-russia/2021/06/09/id/1024552/

Food prices climb as trucking companies look for drivers

The shortage began before the COVID-19 pandemic and is getting worse.

Locally, neighbors are trying to get their hands on freezers for beef. At least four months out from what I'm being told. Look for beef/pork to go thru the roof..........

I needed a couple 10-ft sections of 3" schedule 40 PVC pipe to finish up a drain system, and local plumbing supply charged me $47 per. Twice the price of Lowes or Home Depot, but I'm not driving 4-hours to save $40. Time is money. Plus the cost of fuel.

@rady

I have been beating the drums in this thread about hyperinflation, and there are some pretty good analyses in it in here by a number of folks, you should read those. Some of what was discussed is starting to be reported in the media.

The thing we all have to remember at this point is that the biggest lag we personally have is the time between an event starting and us being able to correctly identify it and take appropriate action. The time is shortening to get that action taken.

The initial shot over the bow should have been being able to sell a used car for a damn near new price. While everyone else was discussing that and chearing about the sale they made as individuals we should have been stocking up. Clouds are building and it’s going to rain.

the money being printed was an oh-shit moment in a theoretical sense, but the prices of goods starting to rise drastically should have provided a practical kick in the ass because that’s real activity in the marketplace. Once you add emotional buying and hoarding of goods on top of inflation this will get out of hand. This is especially true now compared to other inflationary periods because people back then didn’t have credit cards (unsecured loans) to finance the high prices and emotional purchases.

I have been beating the drums in this thread about hyperinflation, and there are some pretty good analyses in it in here by a number of folks, you should read those. Some of what was discussed is starting to be reported in the media.

The thing we all have to remember at this point is that the biggest lag we personally have is the time between an event starting and us being able to correctly identify it and take appropriate action. The time is shortening to get that action taken.

The initial shot over the bow should have been being able to sell a used car for a damn near new price. While everyone else was discussing that and chearing about the sale they made as individuals we should have been stocking up. Clouds are building and it’s going to rain.

the money being printed was an oh-shit moment in a theoretical sense, but the prices of goods starting to rise drastically should have provided a practical kick in the ass because that’s real activity in the marketplace. Once you add emotional buying and hoarding of goods on top of inflation this will get out of hand. This is especially true now compared to other inflationary periods because people back then didn’t have credit cards (unsecured loans) to finance the high prices and emotional purchases.

I have alluded to it but I don’t think I have been clear: hyperinflation is not the bogeyman you should be looking at, it’s deflation. Inflation will bite us all first, but it is a picnic with a beauty queen compared to the spectre of deflation.

The central banks are fighting deflation through low interest rates and money printing which is obviously manifesting itself as monetary and price inflation. This is what they want. It’s not true that they are doing this without a reason; they are trying to spur the economy through “easy money”. They fully understand that in a fractional reserve system any decrease in the value of assets will not only crush the financial system it will decimate entire countries. They are fighting to keep the current system going for as long as possible and it appears to be getting away from them - IOW, the planned level of constant inflation has jumped the leash.

hyperinflation is the evil twin of deflation- the two go together. What they are trying to prevent is no joke. But they were the ones who started the fire in the first place.

research deflation and the history of it. It is a complete shit show with generational impacts. If a country lives through it. Don’t get too caught up in the bling of hyperinflation, look over the next terrain feature.

The central banks are fighting deflation through low interest rates and money printing which is obviously manifesting itself as monetary and price inflation. This is what they want. It’s not true that they are doing this without a reason; they are trying to spur the economy through “easy money”. They fully understand that in a fractional reserve system any decrease in the value of assets will not only crush the financial system it will decimate entire countries. They are fighting to keep the current system going for as long as possible and it appears to be getting away from them - IOW, the planned level of constant inflation has jumped the leash.

hyperinflation is the evil twin of deflation- the two go together. What they are trying to prevent is no joke. But they were the ones who started the fire in the first place.

research deflation and the history of it. It is a complete shit show with generational impacts. If a country lives through it. Don’t get too caught up in the bling of hyperinflation, look over the next terrain feature.

This is almost well thought out, but far too doctrinaire. We have too much experience now with fractional reserves to believe in the hard Rothbardian analysis of the system, and certainly too much in developed societies to believe that, minus an extreme external event, hyperinflation is really a characteristic of any modern economy. The problem with your analysis is that it assumes a high likelihood of edge cases, almost a certainty of them, yet there is no historical precedent for that. And don't Venezuela or Pre war Germany me. Those situations were extremely different. Especially Germany, which was struggling under a wholly problematic peace with the Allies.I have alluded to it but I don’t think I have been clear: hyperinflation is not the bogeyman you should be looking at, it’s deflation. Inflation will bite us all first, but it is a picnic with a beauty queen compared to the spectre of deflation.

The central banks are fighting deflation through low interest rates and money printing which is obviously manifesting itself as monetary and price inflation. This is what they want. It’s not true that they are doing this without a reason; they are trying to spur the economy through “easy money”. They fully understand that in a fractional reserve system any decrease in the value of assets will not only crush the financial system it will decimate entire countries. They are fighting to keep the current system going for as long as possible and it appears to be getting away from them - IOW, the planned level of constant inflation has jumped the leash.

hyperinflation is the evil twin of deflation- the two go together. What they are trying to prevent is no joke. But they were the ones who started the fire in the first place.

research deflation and the history of it. It is a complete shit show with generational impacts. If a country lives through it. Don’t get too caught up in the bling of hyperinflation, look over the next terrain feature.

But what you do get right is that we face twin difficulties, and that they are not unlinked. And, I think, you get right the idea that, given the way the tools are currently deployed, a significant slowdown is much more problematic than current inflation levels. The fed has more than enough tools to fight inflation. They have none to fight anything deflationary right now. Which way we tip is very unclear given the languishing job numbers and negative policies of the current administration, and obvious, but slightly overstated, inflationary pressures.

Anyway, your analysis works only if Rothbard and Mises are correct about the absolute unsuitability of the fractional reserve system. For Mises it was an argument that made sense given the history of it up to his time and his post WWI experience. For Rothbard it was more like Old Man Yells at Cloud. It is a simple theory, and has a nice logical simplicity to it, but theories have to be testable, and so far it has basically failed in most every prediction made. The response is always "oh wait, you will see how bad it is," which, not coincidentally, is also the response of all the climate alarmists who make similarly wrong predictions.

History doesn't repeat itself. This isn't Hegel 101. People act or they don't. We don't live in a long story told by the forces of history.lariat

You are bringing up some very good points. History is repeating itself. Time to inventory security, water, food, clothing and shelter. You can't eat paper USD's or Gold Eagles.

LMAOYeh but but but the stimulus bills are just our own tax money given back to us and won’t affect inflation right? Lol

Human nature is unchanged.History doesn't repeat itself. This isn't Hegel 101. People act or they don't. We don't live in a long story told by the forces of history.

People, as a whole, will repeat the same mistakes.

History demonstrates this as a paradigm.

R

Four weeks ago, I was pricing 20-ft one-trip shipping containers (Conex). $4500 delivered locally, which was up from $3600 two years ago. Today, prices are $5000-7000 without delivery.

News reported this morning that Used Car prices are up 29% from this time last year.

News reported this morning that Used Car prices are up 29% from this time last year.

I guess I am the only one who didn't get the communist teachings. History is just a way we write down what humans have chosen to do. It demonstrates nothing, shows nothing. People choose, people do. The particular nature of man, if there is one, which is truly up for debate, is the ability to influence his environment and change his situation. Of all animals he is not a slave to "his nature," and he sure as heck isn't a slave to some rolling wheel of history, as Marx and Hegel would have us believe.Human nature is unchanged.

People, as a whole, will repeat the same mistakes.

History demonstrates this as a paradigm.

R

I know having an education gets a bad rap in these parts. But not having an education past a certain point doesn't allow for you to understand the genealogy of your beliefs. The number of "conservatives" spewing Marxist drivel these days is disconcerting, to say the least.

Those storage containers are showing up in Montana on some rural properties with no services, street addresses or utilities. Going to get interesting.Four weeks ago, I was pricing 20-ft one-trip shipping containers (Conex). $4500 delivered locally, which was up from $3600 two years ago. Today, prices are $5000-7000 without delivery.

News reported this morning that Used Car prices are up 29% from this time last year.

Attachments

Leigh Purvis, the director of health care costs and access at AARP's Public Policy Institute, says the cost of drugs is increasing at more than double the rate of inflation.

www.kpax.com

www.kpax.com

The cost of prescription drugs is rising twice as fast as the rate of inflation, AARP says

Prices for pretty much everything are on the rise at the moment. But there's one critical product where prices continue to rise well above inflation: medication.

Like many "learned" alumni you spend three paragraphs saying nothing of note.I guess I am the only one who didn't get the communist teachings. History is just a way we write down what humans have chosen to do. It demonstrates nothing, shows nothing. People choose, people do. The particular nature of man, if there is one, which is truly up for debate, is the ability to influence his environment and change his situation. Of all animals he is not a slave to "his nature," and he sure as heck isn't a slave to some rolling wheel of history, as Marx and Hegel would have us believe.

I know having an education gets a bad rap in these parts. But not having an education past a certain point doesn't allow for you to understand the genealogy of your beliefs. The number of "conservatives" spewing Marxist drivel these days is disconcerting, to say the least.

As Samuel Clemens said, I never let my schooling get in the way of my education.

Recognizing patterns doesn't have any political lean other than the one you'd impose on it.

R

Deflation or hyperinflation? Which one gets the money changers to leap from tall buildings?

Look before you jump. Landing on some innocent person is truly fucked up.

Look before you jump. Landing on some innocent person is truly fucked up.

Recognizing patterns doesn't, but if you don't understand that historicism is the bedrock foundation for Marxism, continuing on from Hegel, I can't really help you. People don't understand where their ways of thinking come from. That is, the genealogy of their their modes of reasoning. It is actually a very effective way that uneducated people are controlled by the school system. You don't understand that your way of thinking is, at its core, Marxist. You might come to "right wing" conclusions, but the way you get there is all coming up through Hegel. I see it a lot here, and it is really quite amusing.Like many "learned" alumni you spend three paragraphs saying nothing of note.

As Samuel Clemens said, I never let my schooling get in the way of my education.

Recognizing patterns doesn't have any political lean other than the one you'd impose on it.

R

To help you, historicist thinking, in plain terms, believes that history determines events which determines men, in contrast to the strains of the English enlightenment which believes that men determine events which determines history. In the former, to which you and Frodo Hobbit seem to subscribe, history itself is a major player in the events of human existence, whereas for the others, history is simply the chronicling of what happened. Neither has a political lean, but Marxism as an analytic framework doesn't have a political lean either. These frameworks are just how we organize our thoughts.

Also, that isn't how you use the word alumni.

Last edited:

It's cute how often MAGA smells like commie.Deflation or hyperinflation? Which one gets the money changers to leap from tall buildings?

Look before you jump. Landing on some innocent person is truly fucked up.

You could have just written ditto.Recognizing patterns doesn't, but if you don't understand that historicism is the bedrock foundation for Marxism, continuing on from Hegel, I can't really help you. People don't understand where their ways of thinking come from. That is, the genealogy of their their modes of reasoning. It is actually a very effective way that uneducated people are controlled by the school system. You don't understand that your way of thinking is, at its core, Marxist. You might come to "right wing" conclusions, but the way you get there is all coming up through Hegel. I see it a lot here, and it is really quite amusing.

To help you, historicist thinking, in plain terms, believes that history determines events which determines men, in contrast to the strains of the English enlightenment which believes that men determine events which determines history. In the former, to which you and Frodo Hobbit seem to subscribe, history itself is a major player in the events of human existence, whereas for the others, history is simply the chronicling of what happened. Neither has a political lean, but Marxism as an analytic framework doesn't have a political lean either. These frameworks are just how we organize our thoughts.

Also, that isn't how you use the word alumni.

A mental masterbation masterpiece.

If it makes you feel better that you've spent a large sum to be dense congrats.

Alumni, alumnus , neither are the important part of my statement.

R

Well, since I disagreed with everything you wrote, ditto wouldn't cover it. I realize that some things are hard to understand, but that is why we better ourselves through education. And both alumni and alumnus are supposed to point to a particular institution. It doesn't just mean somebody who got him some dergreeee lernin.You could have just written ditto.

A mental masterbation masterpiece.

If it make sure you feel better that you've spent a large sum to be dense congrats.

Alumni, alumnus , neither are the important part of my statement.

R

In fact, according to Forbes “the government has changed the way it calculates inflation more than 20 times” over the past 30 years. The rate of inflation directly affects so many other things in our system, and the government would like to keep that number as low as possible. So they tinkered and tinkered with the formula until they got it just where they wanted it.

According to John Williams of shadowstats.com, if the rate of inflation was still calculated the way that it was back in 1990, it would be above 8 percent right now.

And if the rate of inflation was still calculated the way that it was back in 1980, it would currently be sitting at about 13 percent.

But even with the highly modified formula that they are now using, the rate of inflation still rose at the fastest pace in almost 13 years last month…

According to John Williams of shadowstats.com, if the rate of inflation was still calculated the way that it was back in 1990, it would be above 8 percent right now.

And if the rate of inflation was still calculated the way that it was back in 1980, it would currently be sitting at about 13 percent.

But even with the highly modified formula that they are now using, the rate of inflation still rose at the fastest pace in almost 13 years last month…

I don't know if you can trust Forbes. We need to get that verified by our resident expert.

In fact, according to Forbes “the government has changed the way it calculates inflation more than 20 times” over the past 30 years. The rate of inflation directly affects so many other things in our system, and the government would like to keep that number as low as possible. So they tinkered and tinkered with the formula until they got it just where they wanted it.

According to John Williams of shadowstats.com, if the rate of inflation was still calculated the way that it was back in 1990, it would be above 8 percent right now.

And if the rate of inflation was still calculated the way that it was back in 1980, it would currently be sitting at about 13 percent.

But even with the highly modified formula that they are now using, the rate of inflation still rose at the fastest pace in almost 13 years last month…

Fox had a good article on the proposed tax rate hikes and utility prices... I have all high efficiency furnace / AC / lights but electricity is still one of our larger utility bills.

Full article here... https://www.foxnews.com/politics/biden-corporate-tax-hike-utility-bills

Full article here... https://www.foxnews.com/politics/biden-corporate-tax-hike-utility-bills

I have purchased one thing that has not gone up in price over the past year. Lawn mower blades.

Predator 3 USA Mulching Blades Compatible with Husqvarna 61" Cut

Interesting:

Home Depot is one of the largest importers in the country. Yet with congested ports, container shortages and Covid-19 outbreaks slowing shipments, the company made a decision: It was time to get its own boat.

“We have a ship that’s solely going to be ours and it’s just going to go back and forth with 100% dedicated to Home Depot,” Chief Operating Officer Ted Decker said in an interview. It marks the first time that the company has taken such a step.

Decker said the contracted ship, which will begin running next month, is just one example of the unusual measures that the company is taking as it copes with challenges that have ricocheted across the global supply chain.

One more wake up call in the break down of the supply chain. Of course the cost will be passed on to the customer.

www.cnbc.com

www.cnbc.com

Home Depot is one of the largest importers in the country. Yet with congested ports, container shortages and Covid-19 outbreaks slowing shipments, the company made a decision: It was time to get its own boat.

“We have a ship that’s solely going to be ours and it’s just going to go back and forth with 100% dedicated to Home Depot,” Chief Operating Officer Ted Decker said in an interview. It marks the first time that the company has taken such a step.

Decker said the contracted ship, which will begin running next month, is just one example of the unusual measures that the company is taking as it copes with challenges that have ricocheted across the global supply chain.

One more wake up call in the break down of the supply chain. Of course the cost will be passed on to the customer.

How bad are global shipping snafus? Home Depot contracted its own container ship as a safeguard

The home improvement retailer is one of many companies facing supply chain challenges and trying to find creative solutions to keep merchandise in stock.

Well, here it is. Hearing from a man who puts his money where his mouth is.

_____________Jamie Dimon Stockpiles Cash, Thinks Inflation is Here to Stay

- “We have a lot of cash and capability and we’re going to be very patient, because I think you have a very good chance inflation will be more than transitory,” said Dimon, the longtime JPMorgan CEO.

- “If you look at our balance sheet, we have $500 billion in cash, we’ve actually been effectively stockpiling more and more cash waiting for opportunities to invest at higher rates,” Dimon said. “I do expect to see higher rates and more inflation, and we’re prepared for that.”

Cash is an interesting investment vehicle if you are expecting inflation.Well, here it is. Hearing from a man who puts his money where his mouth is.

_____________

Jamie Dimon Stockpiles Cash, Thinks Inflation is Here to Stay

- “We have a lot of cash and capability and we’re going to be very patient, because I think you have a very good chance inflation will be more than transitory,” said Dimon, the longtime JPMorgan CEO.

- “If you look at our balance sheet, we have $500 billion in cash, we’ve actually been effectively stockpiling more and more cash waiting for opportunities to invest at higher rates,” Dimon said. “I do expect to see higher rates and more inflation, and we’re prepared for that.”

Producer prices as of May rose 6.6% over the past 12 months, the fastest increase on record.

www.cnbc.com

www.cnbc.com

Producer prices climb 6.6% in May on annual basis, largest 12-month increase on record

Month over month, the producer price index increased 0.8%, faster than the 0.5% estimated in a Dow Jones survey.

And retail sales got crushed, which again points to what I have been telling you guys. To wit, high risks, but balanced as to inflation and economic softness.Producer prices as of May rose 6.6% over the past 12 months, the fastest increase on record.

Producer prices climb 6.6% in May on annual basis, largest 12-month increase on record

Month over month, the producer price index increased 0.8%, faster than the 0.5% estimated in a Dow Jones survey.www.cnbc.com

It's like this every week. You get one major report that points to one ill, and another that points to the other. What you aren't getting are many reports that are telling you things are good. But to fixate on only one of the two sides is madness.

Right? I was scratching my head at that one. I call bs.Cash is an interesting investment vehicle if you are expecting inflation.

Similar threads

- Replies

- 32

- Views

- 1K

- Replies

- 109

- Views

- 4K

- Replies

- 61

- Views

- 2K