Join the Hide community

Get access to live stream, lessons, the post exchange, and chat with other snipers.

Register

Download Gravity Ballistics

Get help to accurately calculate and scope your sniper rifle using real shooting data.

Install the app

How to install the app on iOS

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Recession - 2022 / 2023 / 2024

- Thread starter Hobo Hilton

- Start date

Outback Steakhouse Parent Company Closes 41 Restaurants

It's starting to settle in.

Starbucks shares sink 12% as coffee chain slashes 2024 forecast amid same-store sales drag

Recession or silent depression?

Neither....... It is "Uncharted Water's" for an entire nation. There are no experts that would bet their farm on their economic forecast.

The market is full of "CNBC Cramer's.

"For the last couple of months, we have talked about what we see as a disconnect between the macro and the microeconomic indicators because, over the last several months, there's been almost a parade of news about how great the economy is," Layton said. "We believe our data digs deeper down, and we don't see a picture as rosy at the microeconomic level as the macroeconomic indicators would suggest. Every day, people on the street still feel the crunch regardless of what some of the financial news is reporting."

www.kitco.com

www.kitco.com

Wall Street is optimistic about the economy, but LegalShield says Main Street is telling a different story

Wall Street is optimistic about the economy, but LegalShield says Main Street is telling a different story

The Kitco News Team brings you the latest news, videos, analysis and opinions regarding Precious Metals, Crypto, Mining, World Markets and Global Economy.

NEW YORK, April 30 (Reuters) - Citigroup (C.N) CEO Jane Fraser told shareholders on Tuesday that U.S. consumers are becoming more cautious with their spending and making smaller purchases.

U.S. borrowers earning lower incomes are increasingly struggling to keep up with loan payments, prompting banks to become more cautious about issuing credit cards and car loans.

"Consumers remain healthy and resilient," Fraser said at the bank's annual meeting on Tuesday. "But we are seeing them more cautious in the U.S. and more discerning in their spending patterns."

U.S. borrowers earning lower incomes are increasingly struggling to keep up with loan payments, prompting banks to become more cautious about issuing credit cards and car loans.

"Consumers remain healthy and resilient," Fraser said at the bank's annual meeting on Tuesday. "But we are seeing them more cautious in the U.S. and more discerning in their spending patterns."

Citi CEO says US consumers are more cautious, emphasizes bank overhaul

My 401k has been performing pretty well for the past couple of years, I checked yesterday and for the last 12 months just shy of 9%! I also finally talked with a financial advisor, he says a reset is inevitable the longer they hold it off the harder it will be. I got caught with my pants down in '08, so I have set in motion the steps to roll a substantial amount into a safe annuity. He says they'll add 18% to my deposit! Should things tank, I plan to get really aggressive, with what I contribute in my 401. I took y'all's advice before when I was debating pulling my money out and instead upped my contributions to 13%, big thanks! My only debt is a truck I financed pre COVID at 3%, that could be paid off this year, I think I could even swing 20% contributions now, maybe...

But I am taking steps to prepare.

But I am taking steps to prepare.

Read the fine print on the annuity contract before you jump in. Financial advisors make big money on annuities - people buying annuities not so much. I invested a small portion of my money in a "safe" annuity and realize it is safe because all the earnings go to someone else. I no longer use that investment advisor.My 401k has been performing pretty well for the past couple of years, I checked yesterday and for the last 12 months just shy of 9%! I also finally talked with a financial advisor, he says a reset is inevitable the longer they hold it off the harder it will be. I got caught with my pants down in '08, so I have set in motion the steps to roll a substantial amount into a safe annuity. He says they'll add 18% to my deposit! Should things tank, I plan to get really aggressive, with what I contribute in my 401. I took y'all's advice before when I was debating pulling my money out and instead upped my contributions to 13%, big thanks! My only debt is a truck I financed pre COVID at 3%, that could be paid off this year, I think I could even swing 20% contributions now, maybe...

But I am taking steps to prepare.

I've definitely changed how I shop! I'm nervous as a whore in church! As an industrial maintenance tech for a company in Alabama that makes automotive parts, we have the UAW setting their sights on the south. We voted no about 6-7 years ago, unbeknownst to us, the owner from Korea had flown in, ready to make an example of us. They have 2 more plants that do the same thing; one in Mexico, another down in S. America. Turning 60 this year, I really didn't want to try and secure a new job, especially after working myself up the tenure/pay scale ladder, I surpassed top out pay 3 years ago, and we're supposed to be getting another substantial raise in May! And we already have all the benefits unions promise. I think they'll probably infiltrate the big final assembly plants, but have a tougher time with the smaller ones, ours anyway. But I feel like the proverbial cat, hanging from a high branch with my claws dug in with the death grip!I figure most know this, but this is a manifestation of what I have been talking about. People are moving down the retail ladder, looking for alternate necessity goods and foregoing non-necessities. This doesn't happen if people are feeling good about their incomes or future. The implications of this drawback is that layoffs will be occurring with greater frequency across all sectors as the decrease in demand slows the economy.

Sincere thanks! I have paperwork coming, I do plan on doing just that! This guy comes highly recommended as an "asset preservation specialist" and does a weekly talk radio show where he makes a lot of sense, especially in his strategies for protecting assets from the IRS. He told me it wasn't high yield but safe, basically investing in an insurance company. I will admit I'm not as savvy as I'd like to be, but I'm no dummy. At my age, and considering I started over late in life, I'm just looking to diversify my little nest egg, that been in the aggressive income and growth basket for the last several years.Read the fine print on the annuity contract before you jump in. Financial advisors make big money on annuities - people buying annuities not so much. I invested a small portion of my money in a "safe" annuity and realize it is safe because all the earnings go to someone else. I no longer use that investment advisor.

Last edited:

Sheeple must be buying them? I know in the last 6 months we've added a few production lines to supply parts for them. We don't have any Ford contracts, but GM, Chrysler, Hyundai & Kia. I'm not a production worker so I really don't pay attention, it's all weather stripping and looks the same to me.The entire EV market is taking a collective dump. Ford lost something like 1.3 BILLION dollars on EVs the first quarter of this year. Even the chinese EVs are stacking up in Europe.

When a man "starts over" the one gift he has is knowledge learned from past experiences.My 401k has been performing pretty well for the past couple of years, I checked yesterday and for the last 12 months just shy of 9%! I also finally talked with a financial advisor, he says a reset is inevitable the longer they hold it off the harder it will be. I got caught with my pants down in '08, so I have set in motion the steps to roll a substantial amount into a safe annuity. He says they'll add 18% to my deposit! Should things tank, I plan to get really aggressive, with what I contribute in my 401. I took y'all's advice before when I was debating pulling my money out and instead upped my contributions to 13%, big thanks! My only debt is a truck I financed pre COVID at 3%, that could be paid off this year, I think I could even swing 20% contributions now, maybe...

But I am taking steps to prepare.

A thought about a 401k. Something I learned long ago after setting up a SEP IRA. The "Government" established the rules for that plan. As time went on and the Government took note of how well the investors were doing........ The government changed the rules. This is why today, few people even know about that plan. With a Government very deep in debt, the politicians are already considering "Robbing the coffer's". Consider buying a 1 ounce Gold Eagle for cash and burying it in the back yard. Keep the Government and their tracking out of your retirement fund, as much as possible.

The game is fast paced and the announcer is Jerome Powell............

He's reporting yesterday's game while today's game speeds on.

Clown show.

He's reporting yesterday's game while today's game speeds on.

Clown show.

Wall Street is confused and divided over how many times the Fed will cut rates this year

The game is fast paced and the announcer is Jerome Powell............

He's reporting yesterday's game while today's game speeds on.

Clown show.

Wall Street is confused and divided over how many times the Fed will cut rates this year

CNBC wants me to create an account. no.

let me spell it out for "Wall Street". The Fed isnt cutting rates this year.

I smell deflation in the air and I am positioning myself to take advantage of it.

I smell deflation in the air and I am positioning myself to take advantage of it.

I would hope so. The challenge to the middle class Americans is how long this, so called, inflation has been going on. I'm not talking about the group that ran up credit card bills. I am talking about those who tightened their spending over the past 3 years and just got by. The fixed income crowd. That group used up savings, continued to drive an older vehicle, put off vacations, down graded the food coming from the grocery store and kept on paying car insurance, home owners insurance and life insurance policies. They put off painting their house that really needed it 3 years ago, the tires on their car need replacing and they have been pulling old clothes out of the back of their closet to get a little more wear out of them. The timing belt on their work vehicle should have been changed last year.......... Even if inflation was licked today... The damage has been done. Deflation would help but the politician's will continue to run up the National Debt to prop up the, so called, strong dollar...I went to the Winco Grocery store (50 mile drive) to save a few dollars over my rural grocery store. Chatted with some older folks wearing faded MAGA hats. They reminded me of a poker player who had a run of bad luck and just pushed the remainder of his chips forward and said "I'm all in". Many are just hanging on till the Presidential vote is counted. The only thing they have is "Hope".I smell deflation in the air and I am positioning myself to take advantage of it.

Sadly hope is dying quickly in the younger generations which is as dangerous to the politicos as the older generations being mad about their retirements being destroyed by inflation.I would hope so. The challenge to the middle class Americans is how long this, so called, inflation has been going on. I'm not talking about the group that ran up credit card bills. I am talking about those who tightened their spending over the past 3 years and just got by. The fixed income crowd. That group used up savings, continued to drive an older vehicle, put off vacations, down graded the food coming from the grocery store and kept on paying car insurance, home owners insurance and life insurance policies. They put off painting their house that really needed it 3 years ago, the tires on their car need replacing and they have been pulling old clothes out of the back of their closet to get a little more wear out of them. The timing belt on their work vehicle should have been changed last year.......... Even if inflation was licked today... The damage has been done. Deflation would help but the politician's will continue to run up the National Debt to prop up the, so called, strong dollar...I went to the Winco Grocery store (50 mile drive) to save a few dollars over my rural grocery store. Chatted with some older folks wearing faded MAGA hats. They reminded me of a poker player who had a run of bad luck and just pushed the remainder of his chips forward and said "I'm all in". Many are just hanging on till the Presidential vote is counted. The only thing they have is "Hope".

View attachment 8409618

In many forums and social media programs across the web a common question you see is “Why even work anymore?”

Of course this is followed by people telling them to pull themselves up by their bootstraps and work harder (very Upton of them). However, I kind of agree with the younger generations. It’s hard out there for the majority of them. 2 jobs plus a roommate still doesn’t leave much for them, if any at all.

The consumer is tapped. The only reason the show keeps running is the banks keep lending money. 10 years ago they would have denied loans, today they give the loans at 20%.

Just some thoughts as I drop a deuce.

Somehow I missed this little, inconspicuous sign less than a mile from my place. The only way people can afford to live here is in a "High Density" apartment complex. Between the cost of buying land and building an apartment the rent is going to have to be $1,400 / month for a shoe box. Wages here will not support that kind of rent.Sadly hope is dying quickly in the younger generations which is as dangerous to the politicos as the older generations being mad about their retirements being destroyed by inflation.

In many forums and social media programs across the web a common question you see is “Why even work anymore?”

Of course this is followed by people telling them to pull themselves up by their bootstraps and work harder (very Upton of them). However, I kind of agree with the younger generations. It’s hard out there for the majority of them. 2 jobs plus a roommate still doesn’t leave much for them, if any at all.

The consumer is tapped. The only reason the show keeps running is the banks keep lending money. 10 years ago they would have denied loans, today they give the loans at 20%.

Just some thoughts as I drop a deuce.

There are several concern citizen groups focusing on all of this high density housing.High density housing === affordable housing === crime

The county Commissioners, city Council and Department heads are all old 4 th generation Montana cattle and logging families.

They have no clue what is staring them in the face. The developers fly in from all over America and slather some snake oil on them and next we have high density.

A recent quote from out High Sheriff:

Holton said that about half the caseload at the Sheriff’s Office is dealing with domestic violence and the caseload is always increasing with an increase in population.

Another observation.... Landlords of small business owner's (about 10 employees) have continued to raise the rent on commercial buildings. It reached the point where many small business owners can now afford to buy land and build a business cheaper than they can continue to pay elevated rent prices. Those building new buildings never lived through a recession. It's going to get messy when business drops off and they can't pay the mortgage.

Life

Don't worry. The Gov will move in migrants and pay their rent. You get the privilege of diversity and cultural enrichment.Somehow I missed this little, inconspicuous sign less than a mile from my place. The only way people can afford to live here is in a "High Density" apartment complex. Between the cost of buying land and building an apartment the rent is going to have to be $1,400 / month for a shoe box. Wages here will not support that kind of rent.

View attachment 8409713

“While the current stance of monetary policy appears to be at a restrictive level, I remain willing to raise the federal funds rate at a future meeting should the incoming data indicate the progress on inflation has stalled or reversed,” Bowman said in remarks prepared for a Massachusetts Bankers Association meeting.

“While the current stance of monetary policy appears to be at a restrictive level, I remain willing to raise the federal funds rate at a future meeting should the incoming data indicate the progress on inflation has stalled or reversed,” Bowman said in remarks prepared for a Massachusetts Bankers Association meeting.

idiot

I agree but I would go for rounds not coins. This is tin foil hat shit but I have made it a point to stay away from anything numismatic that says "The United States of America" and/or has a dollar amount on it. That might imply government ownership and if they pull another gold grab that could work against a person.When a man "starts over" the one gift he has is knowledge learned from past experiences.

A thought about a 401k. Something I learned long ago after setting up a SEP IRA. The "Government" established the rules for that plan. As time went on and the Government took note of how well the investors were doing........ The government changed the rules. This is why today, few people even know about that plan. With a Government very deep in debt, the politicians are already considering "Robbing the coffer's". Consider buying a 1 ounce Gold Eagle for cash and burying it in the back yard. Keep the Government and their tracking out of your retirement fund, as much as possible.

View attachment 8408592

Think in "melt value".I agree but I would go for rounds not coins. This is tin foil hat shit but I have made it a point to stay away from anything numismatic that says "The Untied States of America" and/or has a dollar amount on it. That might imply government ownership and if they pull another gold grab that might work against a person.

Of course they will pull a gold grab, a gun grab, a 401k grab, a real estate grab and even an ammo grab.

You will have nothing if you do not plan ahead. The Deep States plan is printed and in full view for all to see.

Acquire a taste for frogs.

I get that but why spend a 3%-ish premium for the eagle over a round if melting is the end play? Just saying. And I should have "WHEN they pull a gold grab."Think in "melt value".

Of course they will pull a gold grab, a gun grab, a 401k grab, a real estate grab and even an ammo grab.

You will have nothing if you do not plan ahead. The Deep States plan is printed and in full view for all to see.

Acquire a taste for frogs.

View attachment 8410070

Last edited:

Exactly...... Just don't put all your eggs in one basket and have an assortment of colored eggs.I get that but why spend a 3%-ish premium for the eagle if melting is the end play? Just saying. And I should have "WHEN they pull a gold grab."

An old journeyman would talk to me while I had my hood down and welding. I should have had him list all of his words of wisdom 50 years ago.

When I am in my shop welding and drop my hood, I still hear his voice filled with wisdom.

One of my most treasured was : Son, it's not how much you make... It's how much you can hold on to".

Held true in divorce / property settlements, taxes and will hold true when the grab materializes.

100%! Many flavors of catastrophe currency in my basket! I do need to build a root cellar on my place come to think of it.Exactly...... Just don't put all your eggs in one basket and have an assortment of colored eggs.

An old journeyman would talk to me while I had my hood down and welding. I should have had him list all of his words of wisdom 50 years ago.

When I am in my shop welding and drop my hood, I still hear his voice filled with wisdom.

One of my most treasured was : Son, it's not how much you make... It's how much you can hold on to".

Held true in divorce / property settlements, taxes and will hold true when the grab materializes.

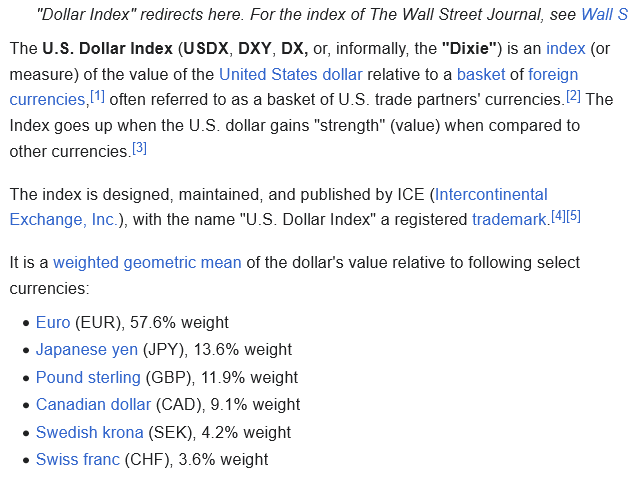

The DXY and the problems. The US Dollar is being kept artificially "strong". It is taking billions to keep it propped up.

One related factor is the Japanese yen.

__________________________________________________

One related factor is the Japanese yen.

__________________________________________________

Japan warns of action over rapid currency moves

Doing some research this morning on a project and looked into what carriers have done. So I used AI to scrounge up the data for the ones that have gone bankrupt or shuttered in 2024 alone:

"Boateng Logistics: A historic freight forwarder company based in Carlsbad, California, permanently closed down and filed for Chapter 7 bankruptcy. The company listed assets up to $50,000 and liabilities ranging from $1 million to $10 million.

Arnold Transportation Services: This 92-year-old trucking company from Grand Prairie, Texas, ceased operations and filed for Chapter 7 bankruptcy liquidation.

True North Freight Solutions: Drivers of this Ontario-based trucking company claimed unpaid wages, leading to financial distress. While the company has not officially filed for bankruptcy, it faced significant challenges.

J.J. & Sons Logistics: This Clint, Texas-based company filed for Chapter 7 liquidation to avoid litigation and a costly judgment. The bankruptcy filing occurred just before a scheduled trial for a wrongful death lawsuit.

Nationwide Cargo Inc.: Although not fully bankrupt, this general freight trucking company filed for Chapter 11 bankruptcy in Illinois to reorganize its business.

Universal Logistics Holdings: While not filing for bankruptcy, this Michigan-based company permanently closed two subsidiaries, resulting in layoffs of 677 employees.

California Intermodal Associates: This family-owned trucking company and brokerage shut down operations but has not yet decided whether to file for bankruptcy. It owes as much as $1.8 million to a lender.

Additionally, U.S. Postal Service contractor Matheson Trucking and its subsidiaries announced plans to wind down operations in January 2024 after six decades in business."

THEN I asked about 2023. The comment at the end of the list showed just how much small businesses are also getting squeezed.

Uber Freight: The Chicago-based freight brokerage arm of ride-sharing giant Uber cut about 150 jobs from its digital brokerage division, representing approximately 3% of its total workforce. CEO Lior Ron attributed the layoffs to headwinds in the logistics market.

Surge Transportation: This digital freight brokerage filed for bankruptcy in July 2023 due to the severe downturn in the industry.

Yellow Freight: As part of the industry challenges, Yellow Freight, the third-largest less-than-truckload operator, closed down operations.

J.J. & Sons Logistics, Meadow Lark, and Boateng Logistics also faced financial difficulties and decided to close their operations.

Additionally, data analyzed by CarrierOK revealed that nearly 88,000 trucking companies closed their doors in 2023, alongside 8,000 freight brokerages4. The rise in trucking bankruptcies can be attributed to factors such as overcapacity, driver shortages, rising fuel costs, regulatory burdens, and economic downturns"

"Boateng Logistics: A historic freight forwarder company based in Carlsbad, California, permanently closed down and filed for Chapter 7 bankruptcy. The company listed assets up to $50,000 and liabilities ranging from $1 million to $10 million.

Arnold Transportation Services: This 92-year-old trucking company from Grand Prairie, Texas, ceased operations and filed for Chapter 7 bankruptcy liquidation.

True North Freight Solutions: Drivers of this Ontario-based trucking company claimed unpaid wages, leading to financial distress. While the company has not officially filed for bankruptcy, it faced significant challenges.

J.J. & Sons Logistics: This Clint, Texas-based company filed for Chapter 7 liquidation to avoid litigation and a costly judgment. The bankruptcy filing occurred just before a scheduled trial for a wrongful death lawsuit.

Nationwide Cargo Inc.: Although not fully bankrupt, this general freight trucking company filed for Chapter 11 bankruptcy in Illinois to reorganize its business.

Universal Logistics Holdings: While not filing for bankruptcy, this Michigan-based company permanently closed two subsidiaries, resulting in layoffs of 677 employees.

California Intermodal Associates: This family-owned trucking company and brokerage shut down operations but has not yet decided whether to file for bankruptcy. It owes as much as $1.8 million to a lender.

Additionally, U.S. Postal Service contractor Matheson Trucking and its subsidiaries announced plans to wind down operations in January 2024 after six decades in business."

THEN I asked about 2023. The comment at the end of the list showed just how much small businesses are also getting squeezed.

Uber Freight: The Chicago-based freight brokerage arm of ride-sharing giant Uber cut about 150 jobs from its digital brokerage division, representing approximately 3% of its total workforce. CEO Lior Ron attributed the layoffs to headwinds in the logistics market.

Surge Transportation: This digital freight brokerage filed for bankruptcy in July 2023 due to the severe downturn in the industry.

Yellow Freight: As part of the industry challenges, Yellow Freight, the third-largest less-than-truckload operator, closed down operations.

J.J. & Sons Logistics, Meadow Lark, and Boateng Logistics also faced financial difficulties and decided to close their operations.

Additionally, data analyzed by CarrierOK revealed that nearly 88,000 trucking companies closed their doors in 2023, alongside 8,000 freight brokerages4. The rise in trucking bankruptcies can be attributed to factors such as overcapacity, driver shortages, rising fuel costs, regulatory burdens, and economic downturns"

“One related factor is the Japanese yen”. Like a child that gets an allowance from parents, and the parents support of the child’s spending above the allowance continually. The Fed gives billions to Japan quietly and regularly to keep the yen looking good. Back in 2022 the US sent them billions that they pissed through in 4-months and they had their hand out looking for more, nothing new.

Collective Action Clauses, from the money in the bank discussion. Ponzi like scam so big it is almost impossible to comprehend.

Collective Action Clauses, from the money in the bank discussion. Ponzi like scam so big it is almost impossible to comprehend.

Last edited:

No surprise in the data you uncovered. There have been a lot of old managers and old families that rode out the 4 recessions during my life time. After looking back at the unrecoverable losses after each recession they concluded it is not worth the suffering to attempt to ride out another market crash. The same can be said for the US farmers, the Mom and Pop hardware stores and the 100's of other small businesses that individuals invested their life time into. My message to American's:Doing some research this morning on a project and looked into what carriers have done. So I used AI to scrounge up the data for the ones that have gone bankrupt or shuttered in 2024 alone:

"Boateng Logistics: A historic freight forwarder company based in Carlsbad, California, permanently closed down and filed for Chapter 7 bankruptcy. The company listed assets up to $50,000 and liabilities ranging from $1 million to $10 million.

Arnold Transportation Services: This 92-year-old trucking company from Grand Prairie, Texas, ceased operations and filed for Chapter 7 bankruptcy liquidation.

True North Freight Solutions: Drivers of this Ontario-based trucking company claimed unpaid wages, leading to financial distress. While the company has not officially filed for bankruptcy, it faced significant challenges.

J.J. & Sons Logistics: This Clint, Texas-based company filed for Chapter 7 liquidation to avoid litigation and a costly judgment. The bankruptcy filing occurred just before a scheduled trial for a wrongful death lawsuit.

Nationwide Cargo Inc.: Although not fully bankrupt, this general freight trucking company filed for Chapter 11 bankruptcy in Illinois to reorganize its business.

Universal Logistics Holdings: While not filing for bankruptcy, this Michigan-based company permanently closed two subsidiaries, resulting in layoffs of 677 employees.

California Intermodal Associates: This family-owned trucking company and brokerage shut down operations but has not yet decided whether to file for bankruptcy. It owes as much as $1.8 million to a lender.

Additionally, U.S. Postal Service contractor Matheson Trucking and its subsidiaries announced plans to wind down operations in January 2024 after six decades in business."

THEN I asked about 2023. The comment at the end of the list showed just how much small businesses are also getting squeezed.

Uber Freight: The Chicago-based freight brokerage arm of ride-sharing giant Uber cut about 150 jobs from its digital brokerage division, representing approximately 3% of its total workforce. CEO Lior Ron attributed the layoffs to headwinds in the logistics market.

Surge Transportation: This digital freight brokerage filed for bankruptcy in July 2023 due to the severe downturn in the industry.

Yellow Freight: As part of the industry challenges, Yellow Freight, the third-largest less-than-truckload operator, closed down operations.

J.J. & Sons Logistics, Meadow Lark, and Boateng Logistics also faced financial difficulties and decided to close their operations.

Additionally, data analyzed by CarrierOK revealed that nearly 88,000 trucking companies closed their doors in 2023, alongside 8,000 freight brokerages4. The rise in trucking bankruptcies can be attributed to factors such as overcapacity, driver shortages, rising fuel costs, regulatory burdens, and economic downturns"

Recession or silent depression?

Deja Vu...... Everything runs in a cycle.

Those young American's who's parents cushioned the lesson's in life are now having to stand on their own two feet.

The suffering has just begun. The new class of "Life 101" is fully enrolled. It will be painful to learn by making mistakes.

Welcome to the adult world.

If people drink less Starbucks then they could afford a $400,000 house on their $20.00 an hour job.Deja Vu...... Everything runs in a cycle.

Those young American's who's parents cushioned the lesson's in life are now having to stand on their own two feet.

The suffering has just begun. The new class of "Life 101" is fully enrolled. It will be painful to learn by making mistakes.

Welcome to the adult world.

View attachment 8412679

When they figure out money can not buy 1) Happiness and 2) Excellent health they will be too old to truly enjoy life.If people drink less Starbucks then they could afford a $400,000 house on their $20.00 an hour job.

Just pull yourself up by your bootstraps and don’t forget to give that lesbian diversity hire whale a firm handshake on your next performance review and then maybe Amazog will raise your wagie salary to 20.25$ to work the wage cage.If people drink less Starbucks then they could afford a $400,000 house on their $20.00 an hour job.

This is the way ahead.Just pull yourself up by your bootstraps and don’t forget to give that lesbian diversity hire whale a firm handshake on your next performance review and then maybe Amazog will raise your wagie salary to 20.25$ to work the wage cage.

On a real note, if you’re a parent with kids under 10 then you need to be socking money away in investments for them just so they can have a chance at a normal life when they turn 20.

It’s hard out there.

LOL, 20X365 = 7600. It's a nice thought, but it won't quite help meet the mortgage on that 400k house.If people drink less Starbucks then they could afford a $400,000 house on their $20.00 an hour job.

I get your point, on conserving $$. Way too many people running that 1500 dollar phone, 130 dollar phone plan, 40 or 50 a month in streaming, don't forget the 150 cable bill.. etc..

I was actually being a smart ass. It’s literally retarded when 80 year olds tell this to 20 year olds on Facebook.LOL, 20X365 = 7600. It's a nice thought, but it won't quite help meet the mortgage on that 400k house.

I get your point, on conserving $$. Way too many people running that 1500 dollar phone, 130 dollar phone plan, 40 or 50 a month in streaming, don't forget the 150 cable bill.. etc..

$20.00 an hour is $41,600 a year without overtime and assuming steady 40 hour work weeks. Literally peanuts. Might be able to get a house in the hood with that money.

25 years ago = I was working lots of OT, Union wage with a good "package". On payday we would all pull out our pay checks and the conversation went something like this "It looks like someone is taking 40% of my money before it gets down to the net take home pay line.LOL, 20X365 = 7600. It's a nice thought, but it won't quite help meet the mortgage on that 400k house.

I get your point, on conserving $$. Way too many people running that 1500 dollar phone, 130 dollar phone plan, 40 or 50 a month in streaming, don't forget the 150 cable bill.. etc..

It's not how much you make, it's how much you hold on to.

That illegal working for $10 / hour under the table is taking home more than the guy making $20 / hour in a service industry job.

Let that sink in.

Yup, cause the illegal is getting Food Stamps and FREE housing, probably living in an all utilities paid for apt complex. All that Cash is just a bonus, so his girl friend (you don't want to get married because you lose benefits) can keep knocking out more kids, and more Food stamps. You hit 3 or 4 kids, and you can push for that FREE section 8 house.25 years ago = I was working lots of OT, Union wage with a good "package". On payday we would all pull out our pay checks and the conversation went something like this "It looks like someone is taking 40% of my money before it gets down to the net take home pay line.

It's not how much you make, it's how much you hold on to.

That illegal working for $10 / hour under the table is taking home more than the guy making $20 / hour in a service industry job.

Let that sink in.

This is the way ahead.

On a real note, if you’re a parent with kids under 10 then you need to be socking money away in investments for them just so they can have a chance at a normal life when they turn 20.

It’s hard out there.

There are few careers out there that will allow you to earn a liveable wage without having to go through communist indoctrination centres. I made it to the major airlines without a degree, Covid clot shot or victim card. It wasn’t easy and it wasn’t cheap but it’s still a career that offer wages that allow you to live decently in some expensive areas, or allows you to live like a king in a remote community at the expense of commuting on your days off.

My goal is to offer the same opportunities to my kids that I had growing up. Regardless of if he’s interested in aviation or not, I think young male kids needs to be actively involved in their youth learning/starting businesses rather than getting drunk and fucking around in college. If you have some capital set aside it’s relatively easy to start a small trade business (HVAC, RV repairs, electrical, flooring, etc)

The hard times are coming hard and with the hordes of millions of foreigners coming in with no end in sight it’ll continue to destroy the labour and housing market and those who will survive will be land owners and business owners.

Land 'Renters'. The gov has proven with taxes and eminent domain, they can take your shit when they want it.There are few careers out there that will allow you to earn a liveable wage without having to go through communist indoctrination centres. I made it to the major airlines without a degree, Covid clot shot or victim card. It wasn’t easy and it wasn’t cheap but it’s still a career that offer wages that allow you to live decently in some expensive areas, or allows you to live like a king in a remote community at the expense of commuting on your days off.

My goal is to offer the same opportunities to my kids that I had growing up. Regardless of if he’s interested in aviation or not, I think young male kids needs to be actively involved in their youth learning/starting businesses rather than getting drunk and fucking around in college. If you have some capital set aside it’s relatively easy to start a small trade business (HVAC, RV repairs, electrical, flooring, etc)

The hard times are coming hard and with the hordes of millions of foreigners coming in with no end in sight it’ll continue to destroy the labour and housing market and those who will survive will be land owners and business owners.

sad

Or a grand parent saving for the grandkidsThis is the way ahead.

On a real note, if you’re a parent with kids under 10 then you need to be socking money away in investments for them just so they can have a chance at a normal life when they turn 20.

It’s hard out there.

This too. I no longer laugh at young adults still living at home. They literally can’t afford to move out, even as new engineers.Or a grand parent saving for the grandkids

Looking at forecasts, I’d be pushing any kids to become plumbers. All the tech people are replaceable with H1B imports. Don’t see trade unions taking too kindly to non-qualified trades people. Carpenters and grass cutters excluded.

Proof the FED Reserve is powerless.

Proof the financial stability of America is floundering.

www.foxbusiness.com

www.foxbusiness.com

Proof the financial stability of America is floundering.

Federal Reserve president says rate cuts may not come in 2024

Minneapolis Federal Reserve President Neel Kashkari said that interest rates may remain elevated for an "extended period" this year until policymakers see more evidence of inflation declining.

Federal Reserve Chair Jerome Powell spoke May 1, trying to project an image of calm optimism. But, very much like the Wizard of Oz, the Fed doesn't want you to pay attention to the real issue behind the curtain: Fed officials are enabling profligate government spending that is driving our economic woes – including the new, weaker-than-expected jobs report and uptick in unemployment.

www.foxbusiness.com

www.foxbusiness.com

Federal Reserve is giving your money away and it could destroy more than your wallet

The Federal Reserve went down a dangerous path after the 2008 financial crisis. It increased its balance sheet and made borrowing cheaper. The result is a $23 trillion spike in debt.

Floundering, again.

www.foxbusiness.com

www.foxbusiness.com

Fed president says next move likely to lower rates, but timing uncertain

Federal Reserve Bank of New York President John Williams said the central bank will likely lower interest rates as its next policy action but that the timing of the shift is unclear.

Similar threads

- Replies

- 84

- Views

- 4K

- Replies

- 26

- Views

- 2K

- Replies

- 39

- Views

- 3K