Even though this is Black History Month... A Tesla will never replace the Cadillac.

Join the Hide community

Get access to live stream, lessons, the post exchange, and chat with other snipers.

Register

Download Gravity Ballistics

Get help to accurately calculate and scope your sniper rifle using real shooting data.

Install the app

How to install the app on iOS

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Stock Market

- Thread starter pmclaine

- Start date

It looks great until you see the rear, lol. Tesla Model 3/Y only comes second to a RS5/RS6.

Caterpillar's shares hit record high on profit beat, robust demand

The majority of countries in the world are deep in debt. The cracks in the financial world are showing up.

America is deep in debt but is still not as bad off as the countries making up the "Market Basket".

So, the DXY is being propped up by the US Government / FED Reserve / etc.

Example:

:max_bytes(150000):strip_icc()/usdx.asp-Final-dbfcb4e1ff8648a4b3d52fc26ce797b8.jpg)

www.investopedia.com

www.investopedia.com

America is deep in debt but is still not as bad off as the countries making up the "Market Basket".

So, the DXY is being propped up by the US Government / FED Reserve / etc.

Example:

:max_bytes(150000):strip_icc()/usdx.asp-Final-dbfcb4e1ff8648a4b3d52fc26ce797b8.jpg)

What Is the U.S. Dollar Index (USDX) and How to Trade It

The U.S. dollar index (USDX) is a measure of the U.S. dollar's value relative to the majority of its most significant trading partners.

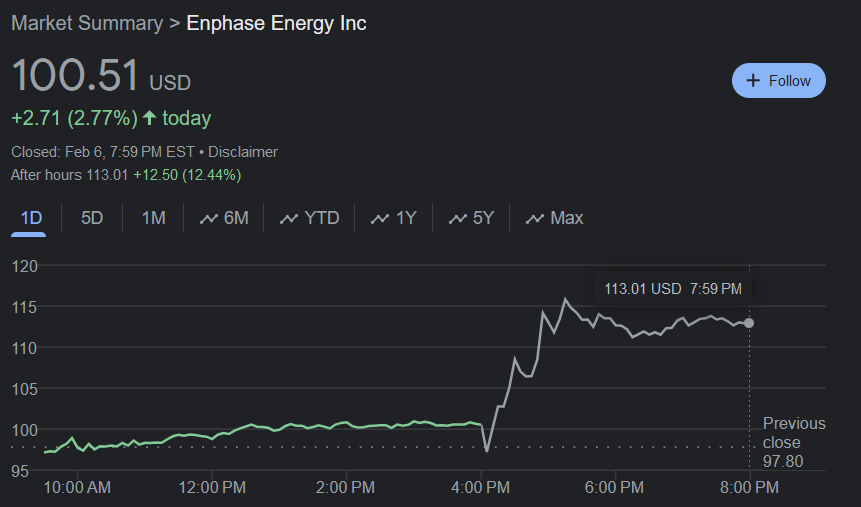

This is a financial report from Enphase Energy, Inc. for the fourth quarter of 2023, including a summary from its President and CEO, Badri Kothandaraman.

Here are the key points:

Financial Highlights for Q4 2023:

Here are the key points:

Financial Highlights for Q4 2023:

- Quarterly revenue: $302.6 million

- GAAP gross margin: 48.5%; Non-GAAP gross margin: 50.3%

- GAAP operating loss: $10.2 million; Non-GAAP operating income: $65.6 million

- GAAP net income: $20.9 million; Non-GAAP net income: $73.5 million

- GAAP diluted earnings per share: $0.15; Non-GAAP diluted earnings per share: $0.54

- Free cash flow: $15.4 million; Ending cash, cash equivalents, and marketable securities: $1.70 billion

- Total revenue for Q4 2023: $302.6 million, compared to $551.1 million in Q3 2023.

- Revenue in the United States decreased by approximately 35%, and in Europe by approximately 70% compared to Q3 2023.

- Shipped 1,595,677 microinverters and 80.7 megawatt hours of IQ® Batteries.

- Introduced new products like IQ8P™ Microinverters and IQ8X™ microinverter in various markets.

- Share repurchase program initiated, with $100.0 million spent on repurchasing 1,183,246 shares in Q4 2023.

- Various product launches and expansions in different countries.

- Continued development and release of features in Solargraf℠, the company's cloud-based design and proposal software platform.

- Revenue expected to be within a range of $260.0 million to $300.0 million.

- GAAP gross margin within a range of 42.0% to 45.0%; Non-GAAP gross margin within a range of 44.0% to 47.0%.

- Net IRA benefit estimated within a range of $12.0 to $14.0 million.

Canadian Solar Inc.’s stock led gains among four solar power companies in the spotlight on Tuesday as it disclosed a $500 million investment from BlackRock Inc. into its Recurrent Energy unit.This is a financial report from Enphase Energy, Inc. for the fourth quarter of 2023, including a summary from its President and CEO, Badri Kothandaraman.

Here are the key points:

Financial Highlights for Q4 2023:

Comparisons:

- Quarterly revenue: $302.6 million

- GAAP gross margin: 48.5%; Non-GAAP gross margin: 50.3%

- GAAP operating loss: $10.2 million; Non-GAAP operating income: $65.6 million

- GAAP net income: $20.9 million; Non-GAAP net income: $73.5 million

- GAAP diluted earnings per share: $0.15; Non-GAAP diluted earnings per share: $0.54

- Free cash flow: $15.4 million; Ending cash, cash equivalents, and marketable securities: $1.70 billion

Operational Highlights:

- Total revenue for Q4 2023: $302.6 million, compared to $551.1 million in Q3 2023.

- Revenue in the United States decreased by approximately 35%, and in Europe by approximately 70% compared to Q3 2023.

Business Highlights:

- Shipped 1,595,677 microinverters and 80.7 megawatt hours of IQ® Batteries.

- Introduced new products like IQ8P™ Microinverters and IQ8X™ microinverter in various markets.

- Share repurchase program initiated, with $100.0 million spent on repurchasing 1,183,246 shares in Q4 2023.

Financial Outlook for Q1 2024:

- Various product launches and expansions in different countries.

- Continued development and release of features in Solargraf℠, the company's cloud-based design and proposal software platform.

View attachment 8343046

- Revenue expected to be within a range of $260.0 million to $300.0 million.

- GAAP gross margin within a range of 42.0% to 45.0%; Non-GAAP gross margin within a range of 44.0% to 47.0%.

- Net IRA benefit estimated within a range of $12.0 to $14.0 million.

At best, ENHP will be bought out by Canadian Solar or SunRun. The worst would be to go broke due to the cheap Chinese panels and related equipment. As the countries of the world deal with "debt" the tariff's will be removed and the cheap panels will flood the market.

Again, ENPH does not make panel.

Also ENPH has a market cap of $14B. Significantly more than Canadian solar and Sun Run combined.

Also ENPH has a market cap of $14B. Significantly more than Canadian solar and Sun Run combined.

Pump and Dump ... Repeat

@ 118... Right where it was in the fall of 2020

www.cnbc.com

www.cnbc.com

@ 118... Right where it was in the fall of 2020

S3th

Enphase CEO says solar industry poised to rebound on falling interest rates and rising utility costs

Enphase CEO Badri Kothandaraman has called a bottom in the first quarter and sees falling interest rates and rising utility costs providing tailwinds.

KFC, Taco Bell and Pizza Hut all posted weaker-than-expected sales.

They blame it on the middle east conflict. Funny they don't blame it on inflation in America and the $18 hamburger.

www.cnbc.com

www.cnbc.com

They blame it on the middle east conflict. Funny they don't blame it on inflation in America and the $18 hamburger.

Yum Brands disappoints as Middle East conflict weighs on sales growth

Yum is the third global restaurant giant to report disappointing revenue for the last three months of 2023.

They had a beat on all YOY numbers, just didn’t hit “analyst” estimates. Who really failed here? Weathermen have a higher accuracy rating.KFC, Taco Bell and Pizza Hut all posted weaker-than-expected sales.

They blame it on the middle east conflict. Funny they don't blame it on inflation in America and the $18 hamburger.

Yum Brands disappoints as Middle East conflict weighs on sales growth

Yum is the third global restaurant giant to report disappointing revenue for the last three months of 2023.www.cnbc.com

They are all trying to "pump up the balloon".........They had a beat on all YOY numbers, just didn’t hit “analyst” estimates. Who really failed here? Weathermen have a higher accuracy rating.

In my Heavy Industrial World, the saying was "Money talks and bull shit walks"......

Nothing has changed.

KFC, Taco Bell and Pizza Hut all posted weaker-than-expected sales.

They blame it on the middle east conflict. Funny they don't blame it on inflation in America and the $18 hamburger.

Yum Brands disappoints as Middle East conflict weighs on sales growth

Yum is the third global restaurant giant to report disappointing revenue for the last three months of 2023.www.cnbc.com

I drive past fast food places at dinner time. They use to have lines in the drive thru that would extend past the parking lot into the street and impede traffic night after night after night

Not anymore. Even chik fil a (bigfatcock garbage) has 4 cars in the drive thru at 5:30pm

Raising Cane's (competitor garbage) same way, lines from the drive thru used to block traffic at dinner time, not anymore

I don't mean just one night, I mean night after night.

When the poors are not eating fast food, what do they eat? Kraft mac-n-cheese? I know some downgrade to 7-11 convenience store food hot dogs and pizza and gas station food, like Sheetz and Wawa also both seem busier than normal at dinner time.

Absolutely the analysts are trying to be overzealous to spur on the bulls, and as much as they have gotten shit wrong in the last few years, I see the present to be no different that they're still going to end up wrong.They are all trying to "pump up the balloon".........

In my Heavy Industrial World, the saying was "Money talks and bull shit walks"......

Nothing has changed.

They "predicted" for two years there was going to be a negative GDP and a full blown enduring recession, all in hopes of influencing increased caution into the FED, and they were all wrong. They "predicted" there jsut had be a slow buildup of FED rates or companies would all retract and start layoffs, and they were all wrong. They recently "predicted" the FED would start dropping rates to start the year because "inflation is over", and again, they were all wrong. It's like they take the basis for all their predictions from Jim Cramer and Cathie Wood.

I do not believe we're ready for the record highs we're seeing just yet, and do not believe they will hold. Doesn't mean I'm not going to continue buying, I'm always buying and rarely selling as I'm in the long game and not day trading, but I see no reason to believe they have gotten a single thing right yet.

I like the way Elon is heading with Tesla but I am still waiting for the stock marekt to go much lower under 3000 some time soon so that I could buy a few stocks.

Last edited:

Wait and miss out.I like the way Elon is heading with Tesla but I am still waiting for the stock marekt to go much lower under 3000 some time soon so that I could buy a few stocks.

Worldwide

Feb 12 (Reuters) - Glencore (GLEN.L), said on Monday it will sell its stake in Koniambo Nickel SAS (KNS) in New Caledonia and that production at KNS's processing plant will be halted for six months while a new investor is sought for the loss-making business.

The plant's furnaces will remain hot to maintain the viability of the site and all local KNS employees will be retained, it said.

Feb 12 (Reuters) - Glencore (GLEN.L), said on Monday it will sell its stake in Koniambo Nickel SAS (KNS) in New Caledonia and that production at KNS's processing plant will be halted for six months while a new investor is sought for the loss-making business.

The plant's furnaces will remain hot to maintain the viability of the site and all local KNS employees will be retained, it said.

Higher prices blowing up the balloon.

www.cnbc.com

www.cnbc.com

Coca-Cola sales beat estimates, helped by higher prices

Coca-Cola sales beat estimates, helped by higher prices

Coca-Cola sales rose as higher prices helped the beverage giant overcome lower volume in North America.

I made the cartons for Coke and Pepsi - both companies worry that one day the American consumer will say no to high priced sugar water.Higher prices blowing up the balloon.

Coca-Cola sales beat estimates, helped by higher prices

Coca-Cola sales beat estimates, helped by higher prices

Coca-Cola sales rose as higher prices helped the beverage giant overcome lower volume in North America.www.cnbc.com

Consumers will curtail spending this year. Why ? Inflation has nibbled away at their buying power. The propaganda lead them to believe this was all "temporary" so they used the charge card more and more. Inflation is not transitional. The bubble will burst.I made the cartons for Coke and Pepsi - both companies worry that one day the American consumer will say no to high priced sugar water.

Inflation rises faster than expected in January as high prices persist

The Labor Department released the closely watched January consumer price index report Tuesday, revealing just how hot inflation was running last month.

Piedmont Lithium - $PLL

Corporate

Piedmont finished 2023 with $72 million in cash and currently holds approximately $38 million in marketable securities. The Company intends to reduce its capital spending in 2024 and control operating expenses through expense management that the Company views as prudent, including a recently completed 27% reduction in force. The Company expects to complete the majority of its cost savings initiatives by the end of Q1’24 and is targeting approximately $10 million in annual run rate savings.

“These cost reduction actions, while difficult, are necessary to position the Company for the long-term. Lithium prices have fallen sharply, and the market consensus is currently negative. However, lithium has been a cyclical business over the past decade with trough markets in pricing generally followed by new record highs,” commented Mr. Phillips. “As they say in the mining business, ‘the solution to low prices is low prices,’ and announcements of capacity curtailments and new project deferrals have recently become commonplace with more likely to come. At today’s lithium prices and equity valuations, new project development is expected to be challenging for all, and if EV markets continue to grow, then another period of lithium shortages appears likely to follow.”

“We believe we are extremely well-positioned as a partner in North America’s only producing spodumene mine and in an exceptional low-capex development project in Africa, with tactical optionality to build downstream businesses in two locations in the United States. We have taken a series of measures we believe are judicious to protect shareholder value in this downturn, while remaining strategically positioned for the lithium market recovery that we foresee,” said Mr. Phillips.

Corporate

Piedmont finished 2023 with $72 million in cash and currently holds approximately $38 million in marketable securities. The Company intends to reduce its capital spending in 2024 and control operating expenses through expense management that the Company views as prudent, including a recently completed 27% reduction in force. The Company expects to complete the majority of its cost savings initiatives by the end of Q1’24 and is targeting approximately $10 million in annual run rate savings.

“These cost reduction actions, while difficult, are necessary to position the Company for the long-term. Lithium prices have fallen sharply, and the market consensus is currently negative. However, lithium has been a cyclical business over the past decade with trough markets in pricing generally followed by new record highs,” commented Mr. Phillips. “As they say in the mining business, ‘the solution to low prices is low prices,’ and announcements of capacity curtailments and new project deferrals have recently become commonplace with more likely to come. At today’s lithium prices and equity valuations, new project development is expected to be challenging for all, and if EV markets continue to grow, then another period of lithium shortages appears likely to follow.”

“We believe we are extremely well-positioned as a partner in North America’s only producing spodumene mine and in an exceptional low-capex development project in Africa, with tactical optionality to build downstream businesses in two locations in the United States. We have taken a series of measures we believe are judicious to protect shareholder value in this downturn, while remaining strategically positioned for the lithium market recovery that we foresee,” said Mr. Phillips.

LONDON, Feb 13 (Reuters Breakingviews) - Something is amiss in American financial markets. U.S. stocks hit new highs last week, propelled in part by the belief the country will vanquish inflation and avoid a recession. At the same time, though, derivatives traders are betting that the Federal Reserve will slash interest rates. That will not happen unless the central bank is seriously worried about growth. One of the two camps is destined to be wrong.

These companies are "just throwing numbers out"... Good number gets a one day bump. Take the money and run. Not one agency enforcing the penalties... They learned from the Government.

www.cnbc.com

www.cnbc.com

www.cnbc.com

www.cnbc.com

www.cnbc.com

www.cnbc.com

Shake Shack stock surges 26% on fourth-quarter profit, strong 2024 outlook

For 2024, Shake Shack expects to grow total revenue by 11% to 15% and open 80 new restaurants.

Arm shares jump 29% as post-earnings rally extends to second week

Arm's strong growth forecast has led investors to declare it an artificial intelligence darling.

DraftKings posts 44% revenue growth and narrowing losses, but falls short of estimates

DraftKings missed Wall Street's expectations on Thursday after the bell but increased its year-over-year revenue by 44%.

Last edited:

Feb 15 (Reuters) - Deere & Co cut its 2024 profit forecast on Thursday as farmers remained hesitant about big-ticket equipment purchases due to high borrowing rates and falling crop prices, even as its first-quarter sales and profit topped Wall Street estimates.

Shares of the world's largest farm equipment maker were down 5.4% in early trading as the manufacturer has seemingly passed its peak for robust demand.

With farmers reassessing expenses, particularly for compact tractors, Deere said it now expects net income for fiscal 2024 of $7.50 billion to $7.75 billion. This is below its prior forecast of $7.75 billion to $8.25 billion and below analysts predictions of $7.93 billion, which already marked a decline from the prior quarter.

Shares of the world's largest farm equipment maker were down 5.4% in early trading as the manufacturer has seemingly passed its peak for robust demand.

With farmers reassessing expenses, particularly for compact tractors, Deere said it now expects net income for fiscal 2024 of $7.50 billion to $7.75 billion. This is below its prior forecast of $7.75 billion to $8.25 billion and below analysts predictions of $7.93 billion, which already marked a decline from the prior quarter.

All built on the backs of the taxpayers, not because it’s an independently viable industry.

Why act like this is new? The US subsidizes many industries with oil and gas being one of them.All built on the backs of the taxpayers, not because it’s an independently viable industry.

I don't agree with those either and have called them out often. But O&G can still stand on its own without it, plus has massive national security implications involved if it were to fall. EV industry is propped up by .gov on the basis of the false prophet climate scare, not because it has actual basis for viability in comparison to ICE or hybrid technology for the majority of American drivers.Why act like this is new? The US subsidizes many industries with oil and gas being one of them.

But remember, I love those Wyoming coal and NG burning Teslas. Sounds like money in my pocket...

Yeah, sometimes it is hard to see the forest through the trees...I don't agree with those either and have called them out often. But O&G can still stand on its own without it, plus has massive national security implications involved if it were to fall. EV industry is propped up by .gov on the basis of the false prophet climate scare, not because it has actual basis for viability in comparison to ICE or hybrid technology for the majority of American drivers.

But remember, I love those Wyoming coal and NG burning Teslas. Sounds like money in my pocket...

That's one way to hide the rust spots. A good coat of paint and clear coat.

Tesla Cybertruck owners complain their new vehicles are rusting

The EV's stainless-steel exterior is seemingly incompatible with common outdoor elements, some owners say.

I've done a lot of stainless steel piping. When fabricating stainless (pipe, sheets, etc) it either has to be insulated from the carbon steel forming dies, the wire brushes on the buffing machines must be the same grade of stainless or there will be contamination of the stainless surface and rust will show up. If one carbon steel screw rust it will contaminate the entire area around in a stainless containment.

It shows up often in the off shore marine world.

It shows up often in the off shore marine world.

Investors are being duped, again. They put their money in a fund and just because a fund, supposedly, does well... It does not mean the individual is doing well. Like putting up 75% to buy into a business and only getting 5% of the profit.

How much dumber can American's get ?

ALB

Albemarle Corp. should have stayed with the industries they knew so well.

14 months of disaster with no relief in sight.

Albemarle Corp. should have stayed with the industries they knew so well.

14 months of disaster with no relief in sight.

I worked in heavy US industry. Traveled all over Europe looking for Innovation ideas. Quickly realized that all the interesting things being done in Europe only worked when heavily subsidized by taxpayers through government mandates. None of those “good ideas” work in a free market economy. Maybe move to Europe? I suggest Sweden.

I worked in heavy US industry. Traveled all over Europe looking for Innovation ideas. Quickly realized that all the interesting things being done in Europe only worked when heavily subsidized by taxpayers through government mandates. None of those “good ideas” work in a free market economy. Maybe move to Europe? I suggest Sweden.

Much like any emerging technology, there are heavy subsidies provided by the government to support infrastructure and research. Think the internet.

Cat Cracking is old technology... Before computers... Again, branching off into the unknown in America. Government rules and regulations will slow them down. Chinese will take the ball and run with it. Deja VuEnergy storage is multiples of Specialities and Ketjen which is why ALB is highly correlated to lithium spot price. To suggest the peak in commodity pricing to trough lows is somehow related to not understanding the industry or is a corporate disaster highlights a lack of understanding.

The US Government is broke, financially. If / When Trump takes over look out. He is a business man with a big mess on his hands. New ventures by the government won't happen. Look at the EV industry in America.Much like any emerging technology, there are heavy subsidies provided by the government to support infrastructure and research. Think the internet.

Think about debt !

The US Government is broke, financially. If / When Trump takes over look out. He is a business man with a big mess on his hands. New ventures by the government won't happen. Look at the EV industry in America.

Think about debt !

I don’t know why people have this view if Trump takes office. You think he’s going to end subsidies on reshoring of jobs and bringing manufacturing of chips, EVs, and batteries to America?

IMHO.... IF Trump takes office his focus will be Boarder, Debt, Corruption, Enforcing existing laws (LEO's , Drugs, corruption)... Ukraine and Israel will have to fight their own battles, NATO will become a bad memory.I don’t know why people have this view if Trump takes office. You think he’s going to end subsidies on reshoring of jobs and bringing manufacturing of chips, EVs, and batteries to America?

If he's not president we can kiss all these pipe dreams good by due to the Revolution.

No middle ground. There can't be... Collapse of the USD and the House of cards falls.

And, this is how you keep the "INDEXES" up..........

www.cnbc.com

www.cnbc.com

Amazon to replace Walgreens in Dow Industrial Average next week

The change will give investors greater exposure to consumer retail, as well as cloud infrastructure and advertising.

The struggling European residential solar market should bottom in first quarter and improve afterward, Lando said. In the U.S., the residential market is not expected to improve until interest rates come down, according to the CEO.

www.cnbc.com

www.cnbc.com

SolarEdge tumbles on weak first-quarter guidance

The solar stock took a spill in after-hours trading on Tuesday.

Norway has a population about 5.5 million people. That is less than metro Atlanta (not counting the Atlanta suburbs, etc.). Norway is a northern Europe utopia kind of place with all kinds of "egalitarian" medical, retirement, etc. benefits funded by high taxes plus state owned industries. Ironically, at the same time Norway is bragging about EV adoption, their main source of income is petroleum exports. Much easier to solve a "national" issue when the nation is smaller than many US cities. Same with Sweden, Finland, and so on.Much like any emerging technology, there are heavy subsidies provided by the government to support infrastructure and research. Think the internet.

S3th - have you spent much time in Norway, Sweden, Finland or similar to get first hand experience with their utopias?

If not, I suggest you visit quickly as Norway is letting in immigrants at 800,000+ already with more coming to enjoy all those freebies.

Issue is that "egalitarian" utopia assumes that the majority of able citizens are putting into the system with few just taking from the system. That utopian European model is coming apart now.

"The Plan" is working. Worldwide.Norway has a population about 5.5 million people. That is less than metro Atlanta (not counting the Atlanta suburbs, etc.). Norway is a northern Europe utopia kind of place with all kinds of "egalitarian" medical, retirement, etc. benefits funded by high taxes plus state owned industries. Ironically, at the same time Norway is bragging about EV adoption, their main source of income is petroleum exports. Much easier to solve a "national" issue when the nation is smaller than many US cities. Same with Sweden, Finland, and so on.

S3th - have you spent much time in Norway, Sweden, Finland or similar to get first hand experience with their utopias?

If not, I suggest you visit quickly as Norway is letting in immigrants at 800,000+ already with more coming to enjoy all those freebies.

Issue is that "egalitarian" utopia assumes that the majority of able citizens are putting into the system with few just taking from the system. That utopian European model is coming apart now.

It's a fact that for most, they see no problem in government funding so long as they are getting something out of it. It's what decays a full democracy, the ability of voting money into your own pocket. Our shambles of a remaining Republic is cratering under this power. Actual constitutionalists are rare and laughed at for being idealists; how dare they demand small government and personal accountability? They see them as fools.

Subsidy fans thumb their nose at capitalism, and scoff at the notion that their pet industry should be expected to stand on its own. The environmentalists are very socialist in their actions and beliefs, demanding the government hinder at every corner with the objective to destroy industries they oppose, and to use the state's treasure to prop up those industries they support. Those in the state will always deny their own involvement in making money in the shadows, clamoring about being a humble servant and nothing more, but they always are and as they control the investigators, they control the investigations and will never be "caught". They scream "EQUITY!!!" and shame those who oppose them or dare raise questions of their motives, true intents or blatant hypocrisies.

Some deny supporting these people. But then, if it makes them money, they shamelessly turn a blind eye to it and counter with "But Jimmy got ice cream, so I should too!!!" arguments. How quick one will sell their principles down the river for a buck. Or maybe it never was their principle in the first place. Only they can answer that.

Two wrongs don't make a right, but they do make for $33T in debt when you do it for long enough.

Subsidy fans thumb their nose at capitalism, and scoff at the notion that their pet industry should be expected to stand on its own. The environmentalists are very socialist in their actions and beliefs, demanding the government hinder at every corner with the objective to destroy industries they oppose, and to use the state's treasure to prop up those industries they support. Those in the state will always deny their own involvement in making money in the shadows, clamoring about being a humble servant and nothing more, but they always are and as they control the investigators, they control the investigations and will never be "caught". They scream "EQUITY!!!" and shame those who oppose them or dare raise questions of their motives, true intents or blatant hypocrisies.

Some deny supporting these people. But then, if it makes them money, they shamelessly turn a blind eye to it and counter with "But Jimmy got ice cream, so I should too!!!" arguments. How quick one will sell their principles down the river for a buck. Or maybe it never was their principle in the first place. Only they can answer that.

Two wrongs don't make a right, but they do make for $33T in debt when you do it for long enough.

You are making our point - all these projects driven by government funding, subsidies, handouts, and so on

You are making our point - all these projects driven by government funding, subsidies, handouts, and so on

I’m not ignorant of the invisible hand in most things.

Here's a list of industries that the U.S. government has subsidized:

1. Agriculture

2. Energy (including oil, gas, and renewable energy)

3. Transportation (such as aviation, automotive, and public transportation)

4. Healthcare

5. Housing

6. Education

7. Technology (through research and development grants)

8. Defense and aerospace

9. Banking and finance

10. Manufacturing (including automotive and steel)

11. Telecommunications

12. Tourism and hospitality

13. Film and entertainment

14. Mining

15. Fisheries

This is not an exhaustive list. Cope harder.

Similar threads

- Replies

- 13

- Views

- 2K

- Replies

- 0

- Views

- 220

- Replies

- 142

- Views

- 17K