Fifteen wrongs don’t make a right either.I’m not ignorant of the invisible hand in most things.

Here's a list of industries that the U.S. government has subsidized:

1. Agriculture

2. Energy (including oil, gas, and renewable energy)

3. Transportation (such as aviation, automotive, and public transportation)

4. Healthcare

5. Housing

6. Education

7. Technology (through research and development grants)

8. Defense and aerospace

9. Banking and finance

10. Manufacturing (including automotive and steel)

11. Telecommunications

12. Tourism and hospitality

13. Film and entertainment

14. Mining

15. Fisheries

This is not an exhaustive list. Cope harder.

Join the Hide community

Get access to live stream, lessons, the post exchange, and chat with other snipers.

Register

Download Gravity Ballistics

Get help to accurately calculate and scope your sniper rifle using real shooting data.

Install the app

How to install the app on iOS

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Stock Market

- Thread starter pmclaine

- Start date

So glad they reduced the fuck out of inflation with the Inflation Reduction Act. Crushed it like a boss…

What a fucking joke, and we’re all the butt of it.

Not the honest, limited government our founding fathers envisioned.I’m not ignorant of the invisible hand in most things.

Here's a list of industries that the U.S. government has subsidized:

1. Agriculture

2. Energy (including oil, gas, and renewable energy)

3. Transportation (such as aviation, automotive, and public transportation)

4. Healthcare

5. Housing

6. Education

7. Technology (through research and development grants)

8. Defense and aerospace

9. Banking and finance

10. Manufacturing (including automotive and steel)

11. Telecommunications

12. Tourism and hospitality

13. Film and entertainment

14. Mining

15. Fisheries

This is not an exhaustive list. Cope harder.

Ford Motor Co. slashes price of 2023 Mustang Mach-E by up to $8,100; company reports US sales fell 51% in January after the Mach-E became ineligible for a federal tax credit

Feb 21 (Reuters) - U.S. miner Piedmont Lithium said on Wednesday it would sell its remaining shares in Australian miner Sayona Mining for about A$59.9 million ($39.28 million).

Weakness in lithium prices due to global supply outweighing demand led to Piedmont cutting 27% of its workforce earlier this month as part of a broader cost cutting plan. Larger rival Albemarle cut jobs and halted expansion plans last month.

Weakness in lithium prices due to global supply outweighing demand led to Piedmont cutting 27% of its workforce earlier this month as part of a broader cost cutting plan. Larger rival Albemarle cut jobs and halted expansion plans last month.

Ford halts shipments of new F-150 Lightning EVs

Guess you could hit that rear panel with a scotch brite pad and replace the bumper with one of these for 4K.

Wheels are pretty cool too, might as well upgrade them as well.

Kinda like putting lipstick on a pig though. Yikes

Wheels are pretty cool too, might as well upgrade them as well.

Kinda like putting lipstick on a pig though. Yikes

One more blatant example of how index's are being propped up.

Today's headline:

Uber joins the Dow Transports.

Uber's addition to the Dow Transports on Monday marks the first change to the index since December 7, 2021, when Old Dominion replaced Kansas City Southern. The Dow Transports, unlike the Dow Industrials, are not hitting historic highs, currently almost 7% below the last high reached in November 2021. According to Dow Theory, the Transports should confirm a new high in the Dow Industrials, indicating positive shipping activity. However, there are questions about the relevance of shipping activity as an economic indicator in a service-dominated economy.

Uber's Inclusion in Dow Transports Raises Questions Amid Market Impact

- Uber's addition to the Dow Transports marks a significant shift, reflecting its growth and evolving view of transportation sectors. - Despite initial post-S&P inclusion underperformance, Uber outshone other Transport stocks with a 133% inc

Attachments

Pump and dump. I'm sure the DC insiders did well from their "investments".Intuitive Machines' Moon Mission Nears End, Shares Crash Harder Than Lunar Lander

There will be many more "deals" as things unwind.

Fitch and Moody's are between a rock and a hard place.

(Bloomberg) — New York Community Bancorp’s credit grade was cut to junk by Fitch Ratings, and Moody’s Investors Service lowered its rating even further, a day after the commercial real estate lender said it discovered “material weaknesses” in how it tracks loan risks.

ca.finance.yahoo.com

ca.finance.yahoo.com

(Bloomberg) — New York Community Bancorp’s credit grade was cut to junk by Fitch Ratings, and Moody’s Investors Service lowered its rating even further, a day after the commercial real estate lender said it discovered “material weaknesses” in how it tracks loan risks.

NYCB Downgraded to Junk by Fitch, as Moody’s Goes Even Deeper

(Bloomberg) -- New York Community Bancorp’s credit grade was cut to junk by Fitch Ratings, and Moody’s Investors Service lowered its rating even further, a day after the commercial real estate lender said it discovered “material weaknesses” in how it tracks loan risks.Most Read from...

Taking my question here per a recommendation with regards to 'CZGZF 'in particular. Can anyone explain its rather bizarre price history? The reason I ask is it seems that it remains flat for weeks or in some cases months at a time without even a penny's change in its share price which strikes me as unusual compared to other stocks but figured there's an explanation for it.

-LD

-LD

Are you a buyer at 822.79 ?

Nope.

I was a buyer at $233

But someone else will be.

P

I took a buddy to the Tesla store to test drive a Model Y. He now has a Y Performance on order.

I was lucky to test drive the Highland 3 and am blown away. The Highland Y is going to continue the trend of Tesla taking the #1 spot for years to come.

I was lucky to test drive the Highland 3 and am blown away. The Highland Y is going to continue the trend of Tesla taking the #1 spot for years to come.

Glad you came back. You getting a commission from the sale to your buddy ?I took a buddy to the Tesla store to test drive a Model Y. He now has a Y Performance on order.

I was lucky to test drive the Highland 3 and am blown away. The Highland Y is going to continue the trend of Tesla taking the #1 spot for years to come.

If you sell on a Thursday, how many days until you have the cash in your hand ?Nope.

I was a buyer at $233

But someone else will be.

P

Glad you came back. You getting a commission from the sale to your buddy ?

I've been back! No - only if I had one myself. Which will be “soon” as I likely wait for the Highland Y.

If you sell on a Thursday, how many days until you have the cash in your hand ?

No clue, it’s in my IRA.

Truth be told, I have no idea what you’re talking about.

P

You have a lot to learn.... 3 day settlement, 2 day weekend and your bank may hold funds for another day. Could take 6 - 7 days to get your hands on cash.No clue, it’s in my IRA.

Truth be told, I have no idea what you’re talking about.

P

Being it's in an IRA, depending on the rules, it could take a while.

That's a high flier that will drop like a rock.

Is your stop out set tight ?

Are you going through a financial adviser ?

SAN FRANCISCO, March 4 (Reuters) - Shares in Tesla (TSLA.O) fell more than 7% on Monday after its sales declined in February in China, where it likely faced a slowdown during the Lunar New Year holidays.Tesla is the stock market, bro.

The fall in sales in its key market dimmed the outlook for Tesla's global deliveries, at a time when the top EV maker is battling a decline in demand and rising competition, and is weighed down by a lack of entry-level vehicles and the age of its product line-up.

Tesla sold 60,365 China-made vehicles in February, down 19% from a year earlier and the lowest volume since December 2022, according to data from the China Passenger Car Association. Tesla's Shanghai factory makes Model Y and Model 3 electric cars for the local market, Europe and other countries, and accounted for over half of Tesla's global deliveries last year.

Tesla shares ended down 7.2% on the day at $188.14, a slump of about 24% since the start of the year.

From my experience with businesses in China, there is hardly anything that goes on during February. Now, if March is off too there might be problems.SAN FRANCISCO, March 4 (Reuters) - Shares in Tesla (TSLA.O) fell more than 7% on Monday after its sales declined in February in China, where it likely faced a slowdown during the Lunar New Year holidays.

The fall in sales in its key market dimmed the outlook for Tesla's global deliveries, at a time when the top EV maker is battling a decline in demand and rising competition, and is weighed down by a lack of entry-level vehicles and the age of its product line-up.

Tesla sold 60,365 China-made vehicles in February, down 19% from a year earlier and the lowest volume since December 2022, according to data from the China Passenger Car Association. Tesla's Shanghai factory makes Model Y and Model 3 electric cars for the local market, Europe and other countries, and accounted for over half of Tesla's global deliveries last year.

Tesla shares ended down 7.2% on the day at $188.14, a slump of about 24% since the start of the year.

Nancy got in on that one, up about 25% since then.Palo Alto Networks Inc.... Been a high flyer up until today. The analysis call this a "pivot"... LOL

Looks more like a rock

More to come

View attachment 8354781

Will this effect the Big Bank's bottom line ?

www.cnbc.com

www.cnbc.com

New CFPB rule caps banks' credit card late fees at $8

By cutting late fees to $8 from an average of around $32, more than 45 million card users would save an average of $220 annually, the CFPB said in a release.

Atlas Shrugged: San Sebastian Mines, a new venture by Francisco d'Anconia.

Bill Gates-backed startup confident it can unearth more buried treasure after a historic copper find

Lol.. as they are getting absolutely crushed by 25%+ interest ratesWill this effect the Big Bank's bottom line ?

New CFPB rule caps banks' credit card late fees at $8

By cutting late fees to $8 from an average of around $32, more than 45 million card users would save an average of $220 annually, the CFPB said in a release.www.cnbc.com

(Kitco News) – Gold’s surprising rally to new all-time highs has even seasoned industry professionals scratching their heads as to the true cause.

Gold’s shock rally has analysts grasping for explanations

The Kitco News Team brings you the latest news, videos, analysis and opinions regarding Precious Metals, Crypto, Mining, World Markets and Global Economy.

Don't be enticed by the gold rally, expert says: Investors 'buy gold and hope it doesn't go up'

Gold does well when other assets — and the world, are in trouble. And so even those who join the rally should root against the yellow metal, experts say.

With the every hundred days adding anther trillion n debt, makes it pretty clear for some the dollar is broken.View attachment 8366787

(Kitco News) – Gold’s surprising rally to new all-time highs has even seasoned industry professionals scratching their heads as to the true cause.

Gold’s shock rally has analysts grasping for explanations

The Kitco News Team brings you the latest news, videos, analysis and opinions regarding Precious Metals, Crypto, Mining, World Markets and Global Economy.www.kitco.com

Don't be enticed by the gold rally, expert says: Investors 'buy gold and hope it doesn't go up'

Gold does well when other assets — and the world, are in trouble. And so even those who join the rally should root against the yellow metal, experts say.www.cnbc.com

I think the other countries of the world had put a lot of "Hope" in the financial leaders of America. They have watched the helicopter money and the post pandemic, free money being "stolen" by the mega banks, politicians and investment bankers. None of that money filtered down to the American middle class. Personally, I feel more money is being spent on the "Homeless" than is being spent to shore up the failing infrastructure.With the every hundred days adding anther trillion n debt, makes it pretty clear for some the dollar is broken.

Foreign investors are pulling their money out of America.

Meaningless......

The use of the stock market capitalization-to-GDP ratio increased in prominence after Warren Buffett once commented that it was "probably the best single measure of where valuations stand at any given moment."

In 2000, according to statistics at The World Bank, the market cap to GDP ratio for the U.S. was 153%, again a sign of an overvalued market. With the U.S. market falling sharply after the dotcom bubble burst, this ratio may have some predictive value in signaling peaks in the market.

This is a different market and a different world today than when Warren made his comment. The two elephants in this room today are 1) National Debt and 2) Unchecked inflation.

US Government is propping up the USD with borrowed money. Unsustainable

Meaningless......

By itself agreed.

Whispered in the ears of the gullible through a compliant media it's a siren's song. Like Unemployment Rate.

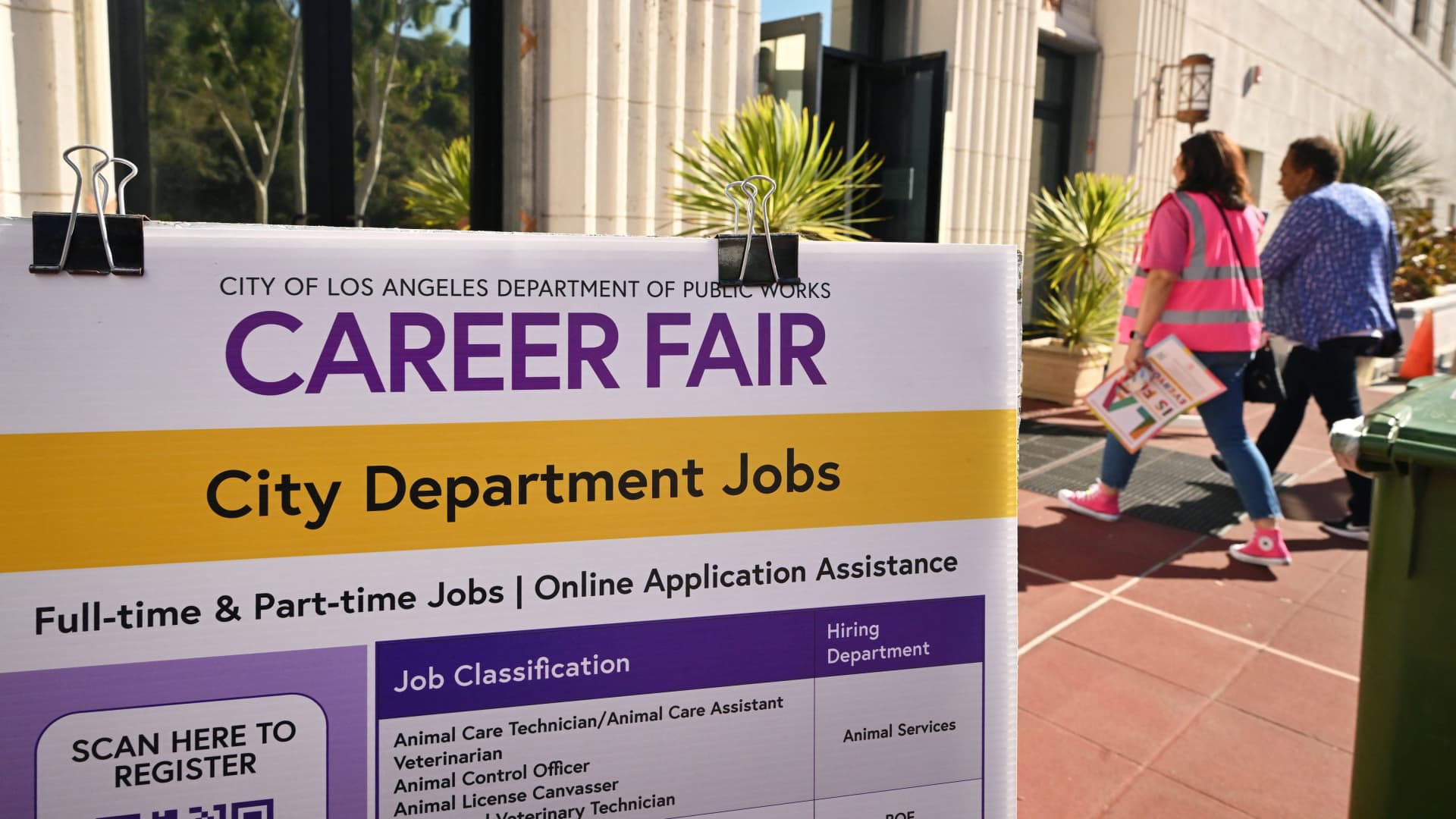

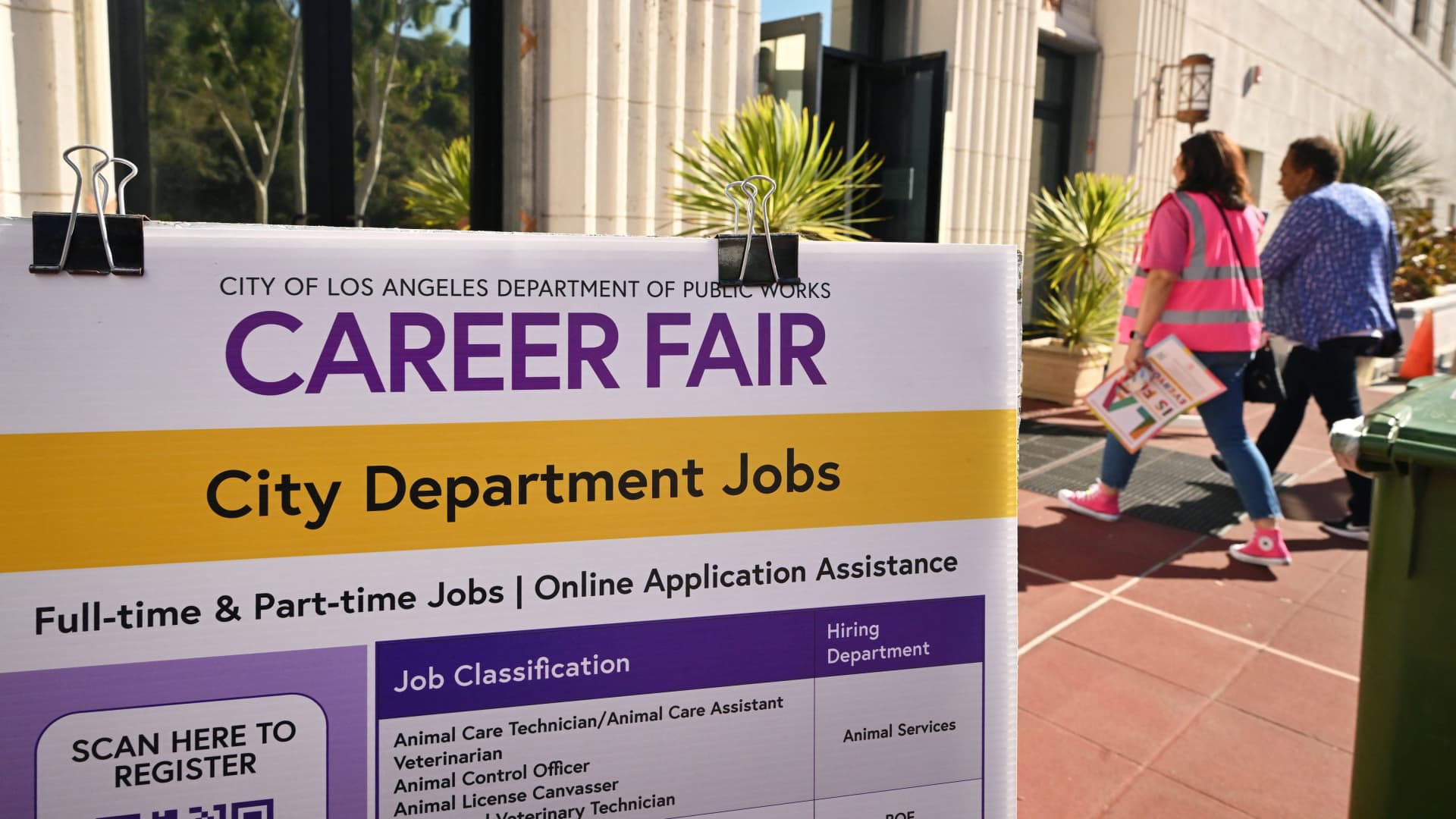

Layoffs rise to the highest for any February since 2009, Challenger says

The total of 84,638 planned cuts showed an increase of 3% from January and 9% from a year ago.

Who fucking cares! Market is en fuego!

A lot of FOMO investing happening, I’m sure the market is in line for a hard correction inside three months once Q1 earnings drop and fail to meet a lot of these lofty expectations.

Layoffs rise to the highest for any February since 2009, Challenger says

The total of 84,638 planned cuts showed an increase of 3% from January and 9% from a year ago.www.cnbc.com

Who fucking cares! Market is en fuego!

Railroads are starting layoffs, what does that tell you about the state of the economy? I’m sure everyone here knows what it says.

Wait until March 11th. I fully expect the FED to kick the can down the road but it could be interesting for some banks.Fitch and Moody's are between a rock and a hard place.

(Bloomberg) — New York Community Bancorp’s credit grade was cut to junk by Fitch Ratings, and Moody’s Investors Service lowered its rating even further, a day after the commercial real estate lender said it discovered “material weaknesses” in how it tracks loan risks.

NYCB Downgraded to Junk by Fitch, as Moody’s Goes Even Deeper

(Bloomberg) -- New York Community Bancorp’s credit grade was cut to junk by Fitch Ratings, and Moody’s Investors Service lowered its rating even further, a day after the commercial real estate lender said it discovered “material weaknesses” in how it tracks loan risks.Most Read from...ca.finance.yahoo.com

Last edited:

JMHO...... The FED's plan appears to be "In order to lick inflation, we need more inflation".... The inflation numbers being reported by the Government are suspicious. My personal finances are seeing at least 20% inflation, depending on the category. I can't cherry pick numbers or leave out food and fuel like they do.Wait until March 11th. I full expect the FED to kick the can down the road but it could be interesting for some banks.

Big Banks have Jerome and the politician's in their back pocket.

Watch how this (below) plays out.

A sobering statement:

“I never used to be concerned about the debt, but it is growing out of control; it’s growing exponentially,” he said. “I will have a granddaughter in about two weeks, and she will be born indebted to the United States government.”

“I never used to be concerned about the debt, but it is growing out of control; it’s growing exponentially,” he said. “I will have a granddaughter in about two weeks, and she will be born indebted to the United States government.”

(Kitco News) – While the weaponization of the dollar is a major issue, U.S. fiscal deficits and the greenback’s weakness down the road are also driving the world’s central banks to accumulate gold, according to Bloomberg macro strategist Simon White.

“Powell might not be overly worried about inflation - with his recent comments reiterating the Federal Reserve is on track to cut rates this year - but other central banks are not so relaxed,” White wrote. “Gold’s new high signals global central banks are likely accumulating the precious metal in an effort to diversify away from the dollar, as persistently large fiscal deficits threaten to further erode its real value and lead to more inflation.”

www.kitco.com

www.kitco.com

“Powell might not be overly worried about inflation - with his recent comments reiterating the Federal Reserve is on track to cut rates this year - but other central banks are not so relaxed,” White wrote. “Gold’s new high signals global central banks are likely accumulating the precious metal in an effort to diversify away from the dollar, as persistently large fiscal deficits threaten to further erode its real value and lead to more inflation.”

Central banks are driving the gold rally as they find new reasons to de-dollarize – Bloomberg strategist Simon White

The Kitco News Team brings you the latest news, videos, analysis and opinions regarding Precious Metals, Crypto, Mining, World Markets and Global Economy.

Tesla

March 11 (Reuters) - Six weeks before the first fatal U.S. accident involving Tesla's Autopilot in 2016, the automaker's president Jon McNeill tried it out in a Model X and emailed feedback to automated-driving chief Sterling Anderson, cc’ing Elon Musk.

The system performed perfectly, McNeill wrote, with the smoothness of a human driver.

"I got so comfortable under Autopilot, that I ended up blowing by exits because I was immersed in emails or calls (I know, I know, not a recommended use)," he wrote in the email dated March 25 that year.

March 11 (Reuters) - Six weeks before the first fatal U.S. accident involving Tesla's Autopilot in 2016, the automaker's president Jon McNeill tried it out in a Model X and emailed feedback to automated-driving chief Sterling Anderson, cc’ing Elon Musk.

The system performed perfectly, McNeill wrote, with the smoothness of a human driver.

"I got so comfortable under Autopilot, that I ended up blowing by exits because I was immersed in emails or calls (I know, I know, not a recommended use)," he wrote in the email dated March 25 that year.

Does it have a reverse lock out ?... Self drive in reverse ?

Angela Chao may have died after accidentally putting her Tesla in reverse, a mistake she made before, WSJ reports

Angela Chao, sister of Elaine Chao, made a mistake while making a three-point turn in her Tesla Model X, The Wall Street Journal reported.

China technology giant Xiaomi starts electric car sales

The launch comes as a cut-throat price war intensifies in the world's biggest car market.

Albemarle Stock Has Over 50% Downside, According to 1 Wall Street Analyst

Lithium prices have plummeted as much as 90% since the beginning of last year.

Jerome and the FED Reserve are quiet.Wait until March 11th. I fully expect the FED to kick the can down the road but it could be interesting for some banks.

They are letting "inflation" do what they should have done 3 years ago. Raise interest rate above inflation rate.

Slow and painful on the American people.

Circling the airport.

Jerome says the FED will never announce a soft landing........ There will never be one.

The Government figures are just numbers pulled out of thin air.

2% inflation has no logic.... Zero inflation is manageable.

Similar threads

- Replies

- 13

- Views

- 2K

- Replies

- 0

- Views

- 213

- Replies

- 142

- Views

- 17K