Join the Hide community

Get access to live stream, lessons, the post exchange, and chat with other snipers.

Register

Download Gravity Ballistics

Get help to accurately calculate and scope your sniper rifle using real shooting data.

Install the app

How to install the app on iOS

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Inflation.......... ?

- Thread starter Hobo Hilton

- Start date

Don’t let the fake-ass paper price fool you. It has been suppressed for years while theSquid loads up on physical cheaply.I gauge inflation by the price of gold .

They will soon be throwing down for a can of beans.Women of low moral character are asking for gas money now. How rude.

$3.30 a gallon here. I figure those living on a shoestring will start defaulting on shit at around $4.00-$4.50 a gallon. Will scoop up a good used truck and hopefully some good shop equipment and luxury items.

The Leader of TweetTards supports your message

Funny thing.... A old guy on a fixed income $ saw this coming a year ago. These guy's with Billions $ have just woke up.

Twitter CEO Jack Dorsey's dire warning: 'Hyperinflation' will soon 'change everything'

In typical Dorsey style, the social media CEO tweeted out his comment, saying that "it will happen in the US soon, and so the world."

We have witnessed the economic cycles.... When gasoline prices spiked and the shortages occurred the average American family traded off the Suburban or Excursion on a little 4 door economy car. Funny thing the Mexican families could pick up newer a 9 passenger vehicle for nickles on the dollar.... Funny to watch them all show up at an event.... LOL$3.30 a gallon here. I figure those living on a shoestring will start defaulting on shit at around $4.00-$4.50 a gallon. Will scoop up a good used truck and hopefully some good shop equipment and luxury items.

Filled up a gas can yesterday, ethanol-free 91%. Last year's tag was from 11/20 @2.87/gal. New tag is 10/21 @4.17/gal. There are three refineries in my county. What in the actual Brandon is going on? Wait, I answered my own question. Oh, and no onion rings in the store. On a ship off Long Beach?

We have a couple of refineries two counties over and gas is always high in the town where the refineries are than somewhere out of their county. Go figure. And it’s not a recent thing, been that way for as long as I can remember.

It will be transitory until it is not.Is it still transitory? Asking for chode

Merriam- Webster does not tie the meaning down to a specific time. Life itself could be defined as transitory.

Definition of TRANSITORY

of brief duration : temporary; tending to pass away : not persistent… See the full definition

Harbor freight was out of tons of tools. No chisel bits. Guess they break faster than they offload from the ships now.

we have a fuel station south of town ( North Platte, NE) semi's are coming as far away as Utah to fill and haul gas back. Every other semi is from Colorado. They buy it cheap here, and still sell it at their inflated prices back home. I've always said, Colorado could start on fire and all i'd do is throw gas on it

All I know if they run out of Copenhagen I’ll be real pissed

Stock up. Thats what freezers are for.…

Pasta is poised to become the latest staple consumers are forced to pay more for after drought scorched North American production of durum wheat, the high-protein grain that’s milled into semolina flour for spaghetti. Output of durum in Canada, a top exporter, shrunk by nearly half this year and the U.S. harvest is the smallest in 60 years.

ca.finance.yahoo.com

ca.finance.yahoo.com

Your Bowl of Pasta Is Getting More Expensive as Drought Zaps Wheat Fields

(Bloomberg) -- So much for cheap noodles.Most Read from BloombergWhy Americans and Britons Are Rushing to Buy Idyllic Homes in ItalyThe Top Money Maker at Deutsche Bank Reaps Billions From SingaporeOne of California’s Wealthiest Counties Could Run Out of Water Next SummerCities' Answer to...

October 22 – Bloomberg (Thomas Mulier): “Consumers around the world are about to get socked with even higher prices on everyday items, companies from food giant Unilever Plc to lubricant maker WD-40 Co. warned this week as they grapple with supply difficulties. The maker of Dove soap and Magnum ice-cream bars jacked up prices by more than 4% on average last quarter, the biggest jump since 2012, and signaled elevated pricing will continue into next year. A similar refrain came from Nestle SA, Procter & Gamble Co. and Danone SA, whose products dominate supermarket aisles and kitchen cupboards. ‘We’re in for at least another 12 months of inflationary pressures,’ Unilever CEO Alan Jope said… ‘We are in a once-in-two-decades inflationary environment.’”Is it still transitory? Asking for chode

I started last year around June (2020) when every luxury item in the world was sold out and backlogged while the nation had the highest recorded unemployment in history.Prepare.

Nation shut down, businesses shuttered, but Polaris Rzrs were unobtainable unless bought on the used market for the price of a new one. Rolex watches were sold out, but available for 25% premium on the secondary market, and many more luxury items. That was when I saw the writing on the wall. I expected the usual Christmas liquidation due to people selling what they shouldn't have bought. It didn't happen.

With mortgage forbearance, people not paying rent, and increased unemployment, there was just too much money. Now that shit is coming home to roost.

I do not expect a housing crash due to the amount of institutional investments into residential real estate.

Circling back around, summer last year is when I really started laying into stocking the staples. Not just food, but stuff I need to keep all my shit running, wood inventory to keep my hobby running, quality clothing and footwear, etc. Plus, the little things.

Anyone starting now is going to pay significantly more.

Hobo Hilton has been ringing the bell all year, and he/she/they is/are right.

Don't put words in my mouth. What I have said is that the risks of serious inflation and serious economic weakness are pretty balanced, but high. And no, that hasn't really changed at all. Since you probably only know catchphrases for things, the one for that balance with high risk is stagflation.Is it still transitory? Asking for chode

Don't put words in my mouth. What I have said is that the risks of serious inflation and serious economic weakness are pretty balanced, but high. And no, that hasn't really changed at all. Since you probably only know catchphrases for things, the one for that balance with high risk is stagflation.

Image reading what I wrote and understanding it the way you did. It's unfathomable.

Bigfatcock

Some of you older members will understand this bit of personal sarcasm:

I hate being right.

I've got some sort of gene from way back in my blood line. I jokingly say it is my "Viking Gene"... When I perceive a situation developing I visualize the worst possible outcome. I plan accordingly, to the best of my resources.

I hope, in this case, my perception is proven wrong.... For the sake of our Grand Children.

You haven't been right any more than you have been wrong. The food futures you touted are all down 30% or so other than wheat, gold is down for the year etc. As I have said, nothing looks good, but it all looks bad in different directions, and that one major issue is that the fed retains a lot of firepower to fight inflation, and none to fight weakness, so God knows how they decide to use it and how it works out.

When I see situation developing, I just look into the history books, compare syndroms, look for similarities. History repeats itself again and again. So, I learn how it will likely end up, with some small variations, but basics are always the same. The U.S. now looks like the Roman Empire, but at a greatly accelerated pace. If an individual wants to know more, study how all these stories ended many, many years ago. "Inflation" in Rome was kind of different, more along the line of the supply chain issues. Rome never has had unlimited paper money, but Rome did run out of money in general, just like the U.S. at this time. And it was a direct fault of the Rome rulers, who's spent too much. Anyway, all of it contributed to the fall.Bigfatcock

Some of you older members will understand this bit of personal sarcasm:

I hate being right.

I've got some sort of gene from way back in my blood line. I jokingly say it is my "Viking Gene"... When I perceive a situation developing I visualize the worst possible outcome. I plan accordingly, to the best of my resources.

I hope, in this case, my perception is proven wrong.... For the sake of our Grand Children.

Last edited:

You won’t be. It’s coming.I hope, in this case, my perception is proven wrong.... For the sake of our Grand Children.

BIDEN EFFECT: Treasury Secretary Janet Yellen Says Rising Prices will Continue Until "the End of Next Year" (VIDEO) | The Gateway Pundit | by Cristina Laila

Treasury Secretary Janet Yellen on Sunday said rising prices will continue until “the end of next year.” Inflation was up 5.4% year over year in September – the highest rate in 13 years!

Don’t forget the 2 ply condoms!I started last year around June (2020) when every luxury item in the world was sold out and backlogged while the nation had the highest recorded unemployment in history.

Nation shut down, businesses shuttered, but Polaris Rzrs were unobtainable unless bought on the used market for the price of a new one. Rolex watches were sold out, but available for 25% premium on the secondary market, and many more luxury items. That was when I saw the writing on the wall. I expected the usual Christmas liquidation due to people selling what they shouldn't have bought. It didn't happen.

With mortgage forbearance, people not paying rent, and increased unemployment, there was just too much money. Now that shit is coming home to roost.

I do not expect a housing crash due to the amount of institutional investments into residential real estate.

Circling back around, summer last year is when I really started laying into stocking the staples. Not just food, but stuff I need to keep all my shit running, wood inventory to keep my hobby running, quality clothing and footwear, etc. Plus, the little things.

Anyone starting now is going to pay significantly more.

Hobo Hilton has been ringing the bell all year, and he/she/they is/are right.

I always find it interesting who the American people listen to. IDK if she is right or wrong but she is good at "kicking the can down the road" for 2 more years.

BIDEN EFFECT: Treasury Secretary Janet Yellen Says Rising Prices will Continue Until "the End of Next Year" (VIDEO) | The Gateway Pundit | by Cristina Laila

Treasury Secretary Janet Yellen on Sunday said rising prices will continue until “the end of next year.” Inflation was up 5.4% year over year in September – the highest rate in 13 years!www.thegatewaypundit.com

Born: August 13, 1946 (age 75 years)

Janet Yellen’s Net Worth: $16 Million

Confirmed by the Senate, Janet Yellen has a net worth of $16 million, accrued from stock holdings, speaking engagements and various government positions. As she takes office, she will divest holdings in corporations such as Pfizer, Conoco Phillips and AT&T, according to Celebrity Net Worth. Between 2018 and 2020, Yellen earned $7 million from 50 speaking engagementsConsidering at the current pace it's going to take a wheelbarrow full of Benjamins to buy a loaf of bread.... I'd say she's middle class in the near future.

Are you suggesting she is rich or not very rich?

What you said was that it's transitory. You can go back a few months in this thread and read it for yourself. My exact reply to that statement was.... It's temporary until it's not!! Go look it up.Don't put words in my mouth.

Please go ahead and list those tools they have. Besides interest rates what are they going to do? Stop the printing press?the fed retains a lot of firepower to fight inflation,

The Jimmy Carter era is a fine example of the past that's coming up in the near future. Along with the Reagan economy.

The real suck is that it's only taken a few months to dismantle the Trump economy. We could have been on the way to a serious reset of American industrial return. Good thing we have China to rely on. Cough coughWhen I see situation developing, I just look into the history books, compare syndroms, look for similarities. History repeats itself again and again. So, I learn how it will likely end up, with some small variations, but basics are always the same. U.S. now looks as the Roman Empire, but at a greatly accelerate pace. If an individual wants to know more, study how all these stories ended many, many years ago. "Inflation" in Rome was kind of different, more along the line of the supply chain issues. Rome never has had unlimited paper money, but Rome did run out of money in general, just like the U.S. at this time. And it was a direct fault of the Rome rulers, who's spent too much. Anyway, all of it contributed to the fall.

https://www.snipershide.com/shooting/threads/inflation.7066594/page-16#post-9580764 search choid and transitory. This is literally the only post in the thread in which I used that word, and I am not endorsing the view. Don't try to put Biden administration shit in my mouth. What I have said, the entire time, is that the risks were high but balanced. Read my posts.What you said was that it's transitory. You can go back a few months in this thread and read it for yourself. My exact reply to that statement was.... It's temporary until it's not!! Go look it up.

Please go ahead and list those tools they have. Besides interest rates what are they going to do? Stop the printing press?

As for tools, yeah, they can unwind a tone of the printing they have done, they can raise rates, they can increase all sorts of capital requirements. Legislators could raise taxes across the board instead of doling out money. Will they? Maybe a little. But as I said, the main issue is that the economy has major fundamental problems on the other side (risks balanced) and there is no ammunition to fight any economic softness, so they are in a bind. If you watch the employment numbers shit the bed every month, you know this.

Look, my disagreement isn't whether things are good or bad, but that I think they could go bad either way, and I still think that is correct. I think hyperinflation is an almost non existent risk, and I might be wrong there. But also don't paint me as having said crazy shit here, most of my posts have been pointing out how soft the economy is underneath, which I actually think you agree with, if you continue to reference Jimmy Carter.

Dude, they have printed $20 Trillion since 08. There's no unwinding that.

I watch for central banks to takeover. God help us when that's a reality. China is already transitioning to a digital currency and the rest of the world will follow. Those that think crypto is the best path. Bwaahaha, good luck. China just banned it and so will every other central bank. Precious metals? Right! We've been down that road. With the stroke of a pen that shit will be gone too.

It's been done, printing funny money, in many different countries. The outcome is the same in every place that's done it. Somehow the USA is different? Not hardly. The really fucked up part is that when those other places did it there was a stable economy in the rest of the world. Now that is out the window. Every economic power, including China, is in the same boat.https://www.snipershide.com/shooting/threads/inflation.7066594/page-16#post-9580764 search choid and transitory. This is literally the only post in the thread in which I used that word, and I am not endorsing the view. Don't try to put Biden administration shit in my mouth. What I have said, the entire time, is that the risks were high but balanced. Read my posts.

As for tools, yeah, they can unwind a tone of the printing they have done, they can raise rates, they can increase all sorts of capital requirements. Legislators could raise taxes across the board instead of doling out money. Will they? Maybe a little. But as I said, the main issue is that the economy has major fundamental problems on the other side (risks balanced) and there is no ammunition to fight any economic softness, so they are in a bind. If you watch the employment numbers shit the bed every month, you know this.

Look, my disagreement isn't whether things are good or bad, but that I think they could go bad either way, and I still think that is correct. I think hyperinflation is an almost non existent risk, and I might be wrong there. But also don't paint me as having said crazy shit here, most of my posts have been pointing out how soft the economy is underneath, which I actually think you agree with, if you continue to reference Jimmy Carter.

I watch for central banks to takeover. God help us when that's a reality. China is already transitioning to a digital currency and the rest of the world will follow. Those that think crypto is the best path. Bwaahaha, good luck. China just banned it and so will every other central bank. Precious metals? Right! We've been down that road. With the stroke of a pen that shit will be gone too.

So are you admitting I never said it was transitory?Dude, they have printed $20 Trillion since 08. There's no unwinding that.

It's been done, printing funny money, in many different countries. The outcome is the same in every place that's done it. Somehow the USA is different? Not hardly. The really fucked up part is that when those other places did it there was a stable economy in the rest of the world. Now that is out the window. Every economic power, including China, is in the same boat.

I watch for central banks to takeover. God help us when that's a reality. China is already transitioning to a digital currency and the rest of the world will follow. Those that think crypto is the best path. Bwaahaha, good luck. China just banned it and so will every other central bank. Precious metals? Right! We've been down that road. With the stroke of a pen that shit will be gone too.

Anyway, you may be right. Theoretically it can be unwound, but it would be very difficult to do so right now*. I am not super sanguine about it. I completely agree with you about crypto, and I think you will see that has always been my position, exactly because of what you said about precious metals. I still don't agree that hyperinflation is a foregone conclusion. It is a perfect storm scenario. Could that happen? Of course, but I think there are several other likely mitigations that would come because of either economic trends or policy. Again, I just think the risks that we face are in both directions, rather than one. But if I am wrong, or if I change my mind, I will be sure to announce it here first. But I won't be wrong because I thought it was transitory!

*it is not impossible that you are correct in what you implied before that I put too much stake in various theories because I spent too much time in school.

I think that the real issue we have immediately in front of us is the supply chain failures. We are in effect running through our safety stock of most things and once that’s gone the real inflationary and economic problems will ensue. Currently we don’t see it but if nothing corrects we most certainly will experience it on numerous fronts. To deny that this is a problem and a potential economic storm is to be willfully ignorant.

We currently have approximately 50% of the population that doesn't pay taxes and a very large portion of the population that pays taxes but don't produce anything. Included in that are the government employees, city, state and federal, that pay taxes but they are paying taxes on money that was taken from tax payers. So we're in a place where about a third of the population is holding up the other 2/3 of the economy.

Correct, though some of the non federal tax payers are still producers.We currently have approximately 50% of the population that doesn't pay taxes and a very large portion of the population that pays taxes but don't produce anything. Included in that are the government employees, city, state and federal, that pay taxes but they are paying taxes on money that was taken from tax payers. So we're in a place where about a third of the population is holding up the other 2/3 of the economy.

I think it is 61% don't pay federal income taxes. It is looking like we are suckers if you are in the 39% still in the con. Yea, I know, cnbc link and i'll burn for it. Point is, even they are reporting it.

https://www.cnbc.com/2021/08/18/61p...ome-taxes-in-2020-tax-policy-center-says.html

https://www.cnbc.com/2021/08/18/61p...ome-taxes-in-2020-tax-policy-center-says.html

I think their numbers are fairly accurate.... I'm not seeing any kind of "taxing" changes on the horizon. Taxes are playing a bigger part of the "great relocation" than most people realize.....I think it is 61% don't pay federal income taxes. It is looking like we are suckers if you are in the 39% still in the con. Yea, I know, cnbc link and i'll burn for it. Point is, even they are reporting it.

https://www.cnbc.com/2021/08/18/61p...ome-taxes-in-2020-tax-policy-center-says.html

Doesn't matter if they are producers. If they are not paying taxes then the rest of us are pulling their weight.

A flat tax without any exemptions and no more employer deduction for it. Every person must write a check every payday to the Fed. But that's a dream

The pyramid is upside down. You can't fix that. Well it could be fixed except for the fact that the ones that are in the position to won't. The tax system has been bastardized to pander to far to many groups.Correct, though some of the non federal tax payers are still producers.

A flat tax without any exemptions and no more employer deduction for it. Every person must write a check every payday to the Fed. But that's a dream

I agree with your solution, though not your opinion of certain groups of non-taxpayers. If somebody works his ass off and happens to make less money than the cutoff for federal taxes, that isn't his fault, and we are only pulling his weight as far as taxes, not as far as social value. I'm just trying to make a distinction between a hard worker who is low paid and a non worker who smokes dope on the government dime. Sure, on the tax side they are the same, but not on the society side. But whatever, I am all for a flat tax. I have never had a paycheck pullout, always paid quarterlies, so I understand what you are getting at, and understand that it is not the same. But yeah, it is a dream.Doesn't matter if they are producers. If they are not paying taxes then the rest of us are pulling their weight.

The pyramid is upside down. You can't fix that. Well it could be fixed except for the fact that the ones that are in the position to won't. The tax system has been bastardized to pander to far to many groups.

A flat tax without any exemptions and no more employer deduction for it. Every person must write a check every payday to the Fed. But that's a dream

We have the worst tax problem as far as flatness in the developed world.

That is always what i thought sounded fair. How fair is a flat %? Tax code is one sentence. Simplified forms for sure.

@DarnYankeeUSMC makes a good point, or at least it is the point I think he was trying to make. If you just have your taxes withheld weekly from your paycheck, you may be paying taxes, but you don't get the sense of how awful they are as you do when you have to write that check, be it weekly or quarterly. It gives a different perspective on things.

Propane:

The Mont Belvieu Propane Spot Price is the current price at which propane produced in Mont Belvieu, TX is trading in US dollars per gallon. Buyers and sellers in the propane market track the Mont Belvieu propane spot price as it is a strategic geographic location in North America for the production and processing of propane, given its proximity for both onshore and offshore transportation. Historically, the propane spot price peaked during periods of lower national inventory such as the winter of 2014 with a price of 1.695 USD per gallon.

Mont Belvieu Propane Spot Price is at a current level of 1.488, up from 1.483 the previous market day and up from 0.535 one year ago. This is a change of 0.34% from the previous market day and 178.1% from one year ago.

www.wsj.com

www.wsj.com

The Mont Belvieu Propane Spot Price is the current price at which propane produced in Mont Belvieu, TX is trading in US dollars per gallon. Buyers and sellers in the propane market track the Mont Belvieu propane spot price as it is a strategic geographic location in North America for the production and processing of propane, given its proximity for both onshore and offshore transportation. Historically, the propane spot price peaked during periods of lower national inventory such as the winter of 2014 with a price of 1.695 USD per gallon.

Mont Belvieu Propane Spot Price is at a current level of 1.488, up from 1.483 the previous market day and up from 0.535 one year ago. This is a change of 0.34% from the previous market day and 178.1% from one year ago.

Prepare for Propane Sticker Shock

Exports have drained domestic supply ahead of heating season and prices have surged.

Attachments

Last edited:

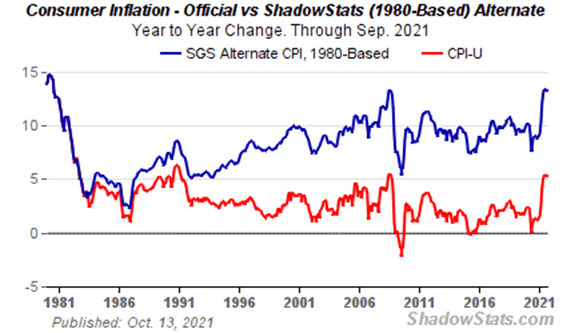

Only thing Transitory is the way they measure inflation. Blue If the inflation was measured by 80's standards

Similar threads

- Replies

- 32

- Views

- 1K

- Replies

- 109

- Views

- 4K

- Replies

- 61

- Views

- 2K