Join the Hide community

Get access to live stream, lessons, the post exchange, and chat with other snipers.

Register

Download Gravity Ballistics

Get help to accurately calculate and scope your sniper rifle using real shooting data.

Install the app

How to install the app on iOS

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Stock Market

- Thread starter pmclaine

- Start date

I hops so as that will kill the green push given the masses depend on oil and gas. I hope they cut by 50%OPEC might be cutting their production.

They learned that from the American's... Next time you have a hospital visit, request an itemized bill and see how much the small things are billed out,I'm sure high level CCP members make loads of money from bribes or embezzlement through the real estate market. If people stop paying mortgages and buying new ghost cities, the party ends for them.

Yes that could affect them. But the reality is the current admin will use that as a justification to push more hard towards green energy.I hops so as that will kill the green push given the masses depend on oil and gas. I hope they cut by 50%

Interesting topic.OPEC might be cutting their production.

The founder of Dubai, Sheikh Rashid, was asked about the future of his country. He replied, "My grandfather rode a camel, my father rode a camel, I ride a Mercedes, my son rides a Land Rover, and my grandson is going to ride a Land Rover…but my great-grandson is going to have to ride a camel again."

______________________

Sobering........ When Rashid's great-grandson is riding a camel I wonder what my great-grandson will be riding.

It could very well be that OPEC (five founding nations) is running their oil production at 100%... Who really knows ? The oil traders are backing away from the futures market due to volatility. Volatility causes fear. Fear creates caution. Caution creates slow movement. Stalking oil or stalking a Grizzly slows movements. Several articles daily on mega businesses moving ahead with caution. No different than mark Twain's river boat navigating in a pea soup fog... Those falling for the propaganda will run full steam ahead into the fog. History repeating.

And now there is OPEC+...

As of 2019, OPEC has a total of 14 Member Countries viz. Iran, Iraq, Kuwait, United Arab Emirates(UAE), Saudi Arabia, Algeria, Libya, Nigeria, Gabon, Equatorial Guinea, Republic of Congo, Angola, Ecuador and Venezuela are members of OPEC.

The 9 newest member countries are weak both financially and politically.... More volatility.

Opec: What is it and what is happening to oil prices?

Saudi Arabia is cutting output by one million barrels a day, and Opec+ is keeping past cuts in place

OPEC might be cutting their production.

I don't think they have a choice.

I'm thinking more that they do have a choice, they'd just rather not stay at current production.I don't think they have a choice.

OPEC's production cuts could push oil prices to $150 a barrel, energy analyst says

"The global supply picture is a mess," energy analyst Paul Sankey said, warning that oil prices could spike to $150 if OPEC+ cuts production.

"It's the battery"........China is going through a serious financial crisis... if/when it does collapse; they will invade Taiwan and bring the world down with them.

Ford hikes price of electric Mustang Mach-E by as much as $8,475 due to ‘significant’ battery cost increases

Ford said the markups are due to "significant material cost increases, continued strain on key supply chains" and market conditions.

And CA is banning sales on gas cars after 2035. So, they don't have enough grid capacity to charge them and they won't be able to afford the cars to begin with. Or, are they going to give a $10K credit to all the poors?"It's the battery"........

Ford hikes price of electric Mustang Mach-E by as much as $8,475 due to ‘significant’ battery cost increases

Ford said the markups are due to "significant material cost increases, continued strain on key supply chains" and market conditions.www.cnbc.com

And CA is banning sales on gas cars after 2035. So, they don't have enough grid capacity to charge them and they won't be able to afford the cars to begin with. Or, are they going to give a $10K credit to all the poors?

The overall goal is to destroy freedom of transportation. Grid being capable is not relevant. They want everyone locked into their block, needing special permission to leave. Of course the chosen ones can move about freely. They know as they continue to enact measures of returning to serfdom that people will flee to somewhere else. Can't have the laborers just drive away.

Hey you military guys.

What are the goals to deny the enemy ??

Freedom of movement

Degrade morale

What else?

What are the goals to deny the enemy ??

Freedom of movement

Degrade morale

What else?

Not even crumbs being invested by the oil companies in new refineries,

_______________

Oil and gas supermajors are on course to repurchase their shares at near-record levels this year thanks to soaring oil and gas prices helping them to deliver bumper profits and boost returns for investors. According to data from Bernstein Research, the seven supermajors–including ExxonMobil (NYSE: XOM), Chevron (NYSE: CVX), BP (NYSE: BP) and Shell (NYSE: SHEL)--are poised to return $38bn to shareholders through buyback programmes this year, with investment bank RBC Capital Markets putting the total figure even higher, at $41bn.

In 2014, when oil was trading over $100/barrel, we only saw $21 billion in buybacks. This year’s figure rivals that of 2008.

oilprice.com

oilprice.com

_______________

Oil and gas supermajors are on course to repurchase their shares at near-record levels this year thanks to soaring oil and gas prices helping them to deliver bumper profits and boost returns for investors. According to data from Bernstein Research, the seven supermajors–including ExxonMobil (NYSE: XOM), Chevron (NYSE: CVX), BP (NYSE: BP) and Shell (NYSE: SHEL)--are poised to return $38bn to shareholders through buyback programmes this year, with investment bank RBC Capital Markets putting the total figure even higher, at $41bn.

In 2014, when oil was trading over $100/barrel, we only saw $21 billion in buybacks. This year’s figure rivals that of 2008.

Big Oil's $41 Billion Buyback Bonanza | OilPrice.com

Oil supermajors are on track for near-record share buckbacks this year as profits soar thanks to high oil and gas prices

Seems to be more battery builders opening plants. The battery is still the weak link in EV's...Numerous companies are addressing this. Your "dead" battery will have a value.

Bosch will invest $200 million to build fuel cells for electric trucks in South Carolina

Bosch will build fuel cells for electric heavy trucks, including Nikola's, in South Carolina starting in 2026.

Toyota pledges up to $5.6 billion for EV battery production, ramps up investment in North Carolina plant

North Carolina facility will manufacture batteries for both plug-in hybrid and battery electric vehicles.

With the uncertainty in the world, I would be uneasy about holding very much over 3 days while the rest of the markets are active.

The open on 9/5/22 is a long way's off.

JMHO

The open on 9/5/22 is a long way's off.

JMHO

When natural gas was "cheap" and abundant a few years ago, lots of heavy industry that produces its own power switched to NG and essentially burned the bridges to using coal and other energy sources - if NG prices go up and becomes less available this will be a huge deal to American (and other) heavy industry.

I agree.... Without a doubt. Politician's killed "The Goose that laid the Golden Eggs" (Coal)............ Someone needs to remind them.When natural gas was "cheap" and abundant a few years ago, lots of heavy industry that produces its own power switched to NG and essentially burned the bridges to using coal and other energy sources - if NG prices go up and becomes less available this will be a huge deal to American (and other) heavy industry.

This is worldwide.When natural gas was "cheap" and abundant a few years ago, lots of heavy industry that produces its own power switched to NG and essentially burned the bridges to using coal and other energy sources - if NG prices go up and becomes less available this will be a huge deal to American (and other) heavy industry.

European Stainless Steel Mills Are Closing Due To Energy Crisis | OilPrice.com

Stainless steel mills across Europe are closing down due to the ongoing energy crisis, adding to current supply woes

Somebody doesn't like BFC prediction of $85 by Christmas.

www.cnbc.com

www.cnbc.com

Oil producer group OPEC+ surprises energy markets with a small production cut

Energy analysts had broadly expected the group to stay the course with its production policy.

An economy stuck in neutral and the threat of recession have prompted companies across all sectors to cut costs by laying off workers, enacting hiring freezes and rescinding job offers. A recent survey of 700 executives revealed that an eye-popping 70% of them are planning layoffs or considering to do so, a number that also applies to hiring freezes. The news isn't all bad: There are about two job openings for every unemployed person and hiring increased by 6.5% in August, the first monthly increase since April.

- The layoffs have ushered in a trend, according to the Wall Street Journal: announcing a job loss on social media to share about the experience and to network with recruiters.

- Tips for navigating your career in uncertain times can be found here.

- T-Mobile laid off an unspecified number of workers in its network-operations and engineering group as part of a restructuring.

- Bed Bath & Beyond cut 20% of its corporate staff, eliminated its chief operating officer and chief stores officer roles, and will close about 150 stores.

- Snap, Snapchat's parent company, laid off 20% of staff – about 1,300 employees – as part of a major restructuring.

- Ford laid off 3,000 salaried and contract workers in the U.S., Canada and India.

- Boston-based Wayfair cut 870 jobs worldwide.

- Apple laid off about 100 contract-based recruiters.

- HBO and HBO Max cut 14% of staff, or 70 employees, after the merger of parent company WarnerMedia and Discovery.

- Peloton Interactive cut nearly 800 employees and announced store closures and price increases.

- Best Buy cut hundreds of store-based jobs.

- Walmart laid off as many as 200 corporate employees.

- Online brokerage Robinhood laid off 23% of its staff in its second round of cuts this year.

- Global software giant Oracle cut an unspecified number of employees in its U.S.

How many of those are people picking up a 2nd job due to inflation?and hiring increased by 6.5% in August, the first monthly increase since April

While US Markets were closed, the foreign markets have not fared well. Germany appears to be the worst.

DEUTSCHE BORSE DAX INDEX

(XETRA AX)

AX)

| 12,760.78 Delayed Data As of 11:55am ET |

Today’s Change | 12,391 Today|||52-Week Range 16,290 | -19.67% Year-to-Date |

| WTI Crude • | 88.82 | +1.95 | +2.24% |

| Brent Crude •3 hours | 95.74 | +2.72 | +2.92% |

One of the trends is "white collar" corporate jobs being cut. Digital transformation activities can replace a lot of corporate jobs - plus, if a job can be done remotely in US it can be done remotely overseas even cheaper.An economy stuck in neutral and the threat of recession have prompted companies across all sectors to cut costs by laying off workers, enacting hiring freezes and rescinding job offers. A recent survey of 700 executives revealed that an eye-popping 70% of them are planning layoffs or considering to do so, a number that also applies to hiring freezes. The news isn't all bad: There are about two job openings for every unemployed person and hiring increased by 6.5% in August, the first monthly increase since April.

High-profile companies making cuts in August:

- The layoffs have ushered in a trend, according to the Wall Street Journal: announcing a job loss on social media to share about the experience and to network with recruiters.

- Tips for navigating your career in uncertain times can be found here.

- T-Mobile laid off an unspecified number of workers in its network-operations and engineering group as part of a restructuring.

- Bed Bath & Beyond cut 20% of its corporate staff, eliminated its chief operating officer and chief stores officer roles, and will close about 150 stores.

- Snap, Snapchat's parent company, laid off 20% of staff – about 1,300 employees – as part of a major restructuring.

- Ford laid off 3,000 salaried and contract workers in the U.S., Canada and India.

- Boston-based Wayfair cut 870 jobs worldwide.

- Apple laid off about 100 contract-based recruiters.

- HBO and HBO Max cut 14% of staff, or 70 employees, after the merger of parent company WarnerMedia and Discovery.

- Peloton Interactive cut nearly 800 employees and announced store closures and price increases.

- Best Buy cut hundreds of store-based jobs.

- Walmart laid off as many as 200 corporate employees.

- Online brokerage Robinhood laid off 23% of its staff in its second round of cuts this year.

- Global software giant Oracle cut an unspecified number of employees in its U.S.

I think Cathie Wood is wrong. No where in her commentary does she address the Billions and Billions of USD's being printed and given away. As long as the printing presses are running the purchasing power of your USD will decline. She notes the declining prices of some commodities... So?

Gasoline went to $5 / gallon in many areas. Now gasoline is back down in the $3 / gallon range. That is hocus pokus. Inflation will be around well into 2023.

Woods is selling snake oil and in need of investors.

www.foxbusiness.com

www.foxbusiness.com

Gasoline went to $5 / gallon in many areas. Now gasoline is back down in the $3 / gallon range. That is hocus pokus. Inflation will be around well into 2023.

Woods is selling snake oil and in need of investors.

Ark Invest's Cathie Wood predicts inflation will see 'major downside surprises' in coming months

Ark Invest CEO and CIO Cathie Wood believes the Fed could get inflation down to 3% in the short-term as commodity prices deflate and the U.S. faces an "inventory recession."

The demand for oil / gas is entering a period of "slack tide".... We are between summer driving demand and winter heating demand... That is why prices are coming down. Refineries will be going into turnaround mode, heaters will be cranking up, the challenges of transporting fuel in the winter will increase, OPEC+ will attempt to keep oil prices up, price of coal is skyrocketing, China's lock down will end and demand there will increase along with the uncertainty of Russia's plans for the winter.Gas is coming down because oil prices are coming down. Oil prices are coming down as world economies slow and head toward recession/depression. OPEC cutting back as they see the signs.

The need for oil will keep the consumer paying a premium..... Even during this recession.

Can OPEC+ Keep Oil Prices Above $90? | OilPrice.com

Crude prices held around $90 per barrel at the beginning of the week after OPEC+ announced a tiny, symbolic output cut

An economy stuck in neutral and the threat of recession have prompted companies across all sectors to cut costs by laying off workers, enacting hiring freezes and rescinding job offers. A recent survey of 700 executives revealed that an eye-popping 70% of them are planning layoffs or considering to do so, a number that also applies to hiring freezes. The news isn't all bad: There are about two job openings for every unemployed person and hiring increased by 6.5% in August, the first monthly increase since April.

High-profile companies making cuts in August:

- The layoffs have ushered in a trend, according to the Wall Street Journal: announcing a job loss on social media to share about the experience and to network with recruiters.

- Tips for navigating your career in uncertain times can be found here.

- T-Mobile laid off an unspecified number of workers in its network-operations and engineering group as part of a restructuring.

- Bed Bath & Beyond cut 20% of its corporate staff, eliminated its chief operating officer and chief stores officer roles, and will close about 150 stores.

- Snap, Snapchat's parent company, laid off 20% of staff – about 1,300 employees – as part of a major restructuring.

- Ford laid off 3,000 salaried and contract workers in the U.S., Canada and India.

- Boston-based Wayfair cut 870 jobs worldwide.

- Apple laid off about 100 contract-based recruiters.

- HBO and HBO Max cut 14% of staff, or 70 employees, after the merger of parent company WarnerMedia and Discovery.

- Peloton Interactive cut nearly 800 employees and announced store closures and price increases.

- Best Buy cut hundreds of store-based jobs.

- Walmart laid off as many as 200 corporate employees.

- Online brokerage Robinhood laid off 23% of its staff in its second round of cuts this year.

- Global software giant Oracle cut an unspecified number of employees in its U.S.

US: Tesla Increased Prices Across The Lineup By $2,000-$6,000

Tesla has just raised the prices of all its electric cars in the US (aside from a few versions) by $2,000 to $6,000.

Tesla Inc. is plotting a potential lithium refinery on the gulf coast of Texas, a move that would bolster the company’s battery-production efforts and further expand its footprint in the state. Construction could begin as soon as the fourth quarter of 2022, but wouldn’t reach commercial production until the fourth quarter of 2024. Tesla has told the state that the facility could be located “anywhere with access to the Gulf Coast shipping channel,” but that the company is evaluating a competing site in Louisiana.

Boy, that really undercuts the mainstream narrative of "the bottom is already in and it's all upside from here".

There is a reason that new petroleum refineries, few nuclear plants, and no new integrated pulp and paper mills since 1980s. Environmental lobbies, EPA, etc. Not sure how the environmental permits can be obtained but wish Tesla well!

Tesla Inc. is plotting a potential lithium refinery on the gulf coast of Texas, a move that would bolster the company’s battery-production efforts and further expand its footprint in the state. Construction could begin as soon as the fourth quarter of 2022, but wouldn’t reach commercial production until the fourth quarter of 2024. Tesla has told the state that the facility could be located “anywhere with access to the Gulf Coast shipping channel,” but that the company is evaluating a competing site in Louisiana.

FJB says America is on the road to recovery

www.cnbc.com

www.cnbc.com

Dow tumbles 1,200 points for worst day since June 2020 after hot inflation report

The stock market came under pressure after the consumer price index report for August showed higher-than-expected inflation.

Don't pull the curtain backBoy, that really undercuts the mainstream narrative of "the bottom is already in and it's all upside from here".

90 day T-Bills are paying a 3.26% annualized coupon rate. 9 months ago it was 0.09%

As America wallows in the mud

ca.finance.yahoo.com

ca.finance.yahoo.com

Rio Signs Deal With China’s Baowu for New Pilbara Iron Mine

(Bloomberg) -- Rio Tinto Group has formed a joint venture with its biggest customer, Chinese state-owned giant China Baowu Steel Group Co., to develop a new iron ore mine in Western Australia’s Pilbara region.Most Read from BloombergUS Inflation Tops Forecasts, Cementing Odds of Big Fed HikeUgly...

Magic today.... Got the markets to finish in the green...... Just barely, like 0.10%...... Makes the index funds look positiveSo what’s with the market suddenly spiking up today? Are they trying to bump this month up before it starts to drop again next month?

Percent Change:

+0.10%

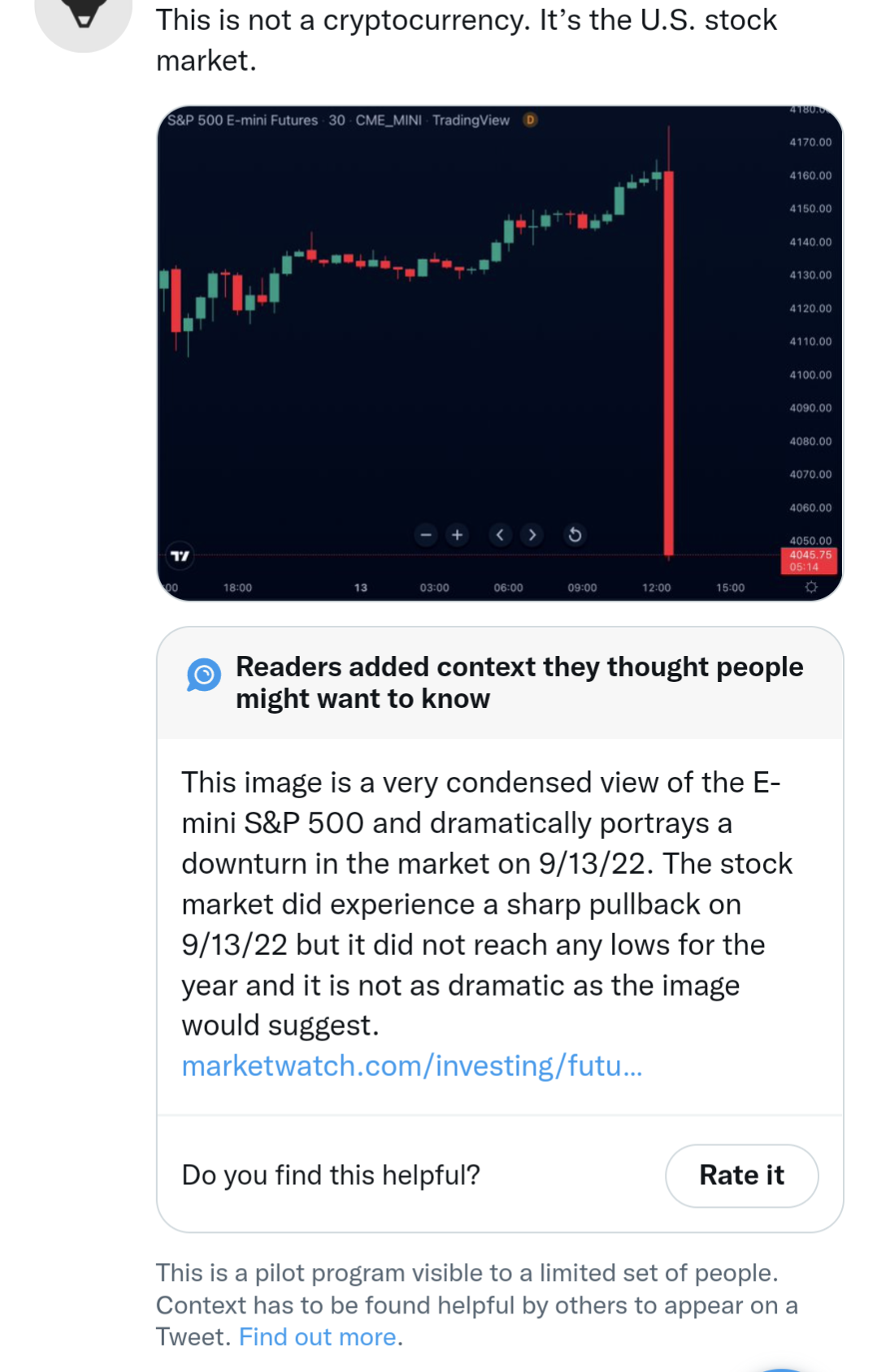

This is an interesting Twitter post:

It's just a simple plot of the S&P over a 24-hour period - but check out that new fact-check which appears to be automatically inserted

Shouldn't be long until people posting negative news about markets or the economy start catching bans for doing so.

It's just a simple plot of the S&P over a 24-hour period - but check out that new fact-check which appears to be automatically inserted

Shouldn't be long until people posting negative news about markets or the economy start catching bans for doing so.

Negativity will soon be eliminated.This is an interesting Twitter post:

View attachment 7956558

It's just a simple plot of the S&P over a 24-hour period - but check out that new fact-check which appears to be automatically inserted

Shouldn't be long until people posting negative news about markets or the economy start catching bans for doing so.

Tesla stops development of battery manufacturing side of Giga Berlin. Rapidly shipping all equipment to build out America's manufacturing and battery development as part to benefit from Inflation Reduction Act.

It's "just business".... Seeing every, worldwide, major corporation making similar moves. Shoring themselves up for a very, very long economic storm.Tesla stops development of battery manufacturing side of Giga Berlin. Rapidly shipping all equipment to build out America's manufacturing and battery development as part to benefit from Inflation Reduction Act.

American's should take note. No place for a slacker.

Hagmann P.I. – Investigator Doug Hagmann

All you do is just listen and be objective.

We shall fine out over the next 30 days if the pans out or not

Tesla stops development of battery manufacturing side of Giga Berlin. Rapidly shipping all equipment to build out America's manufacturing and battery development as part to benefit from Inflation Reduction Act.

Did those two plants use the same technology, or is the equipment from Berlin coming over to replace the stuff in Austin that isn't working?

When a man uses his resources and "prepares for the worst"........ What does he have to lose?Hagmann P.I. – Investigator Doug Hagmann

www.hagmannreport.com

All you do is just listen and be objective.

We shall fine out over the next 30 days if the pans out or not

Are you referring to the 4680 ramp?Did those two plants use the same technology, or is the equipment from Berlin coming over to replace the stuff in Austin that isn't working?

This equipment is to better support the 4860 ramp. Tesla will get it solved in the short-term I believe. But to be honest, I have really haven't been keeping up with any news on any company I own. Happy to continue to owning Tesla and look forward to purchasing more.Yes.

Brutal

FedEx shares FDX, -21.40% fell 21.4% to a two-year closing low of $161.02. The $43.85 price decline shaved about 267 points off the Dow Jones Transportation Average DJT, -5.07%, accounting for more than one-third of the Dow transports’ 685.39-point, or 5.1% drop, to 12,825.34.

www.marketwatch.com

www.marketwatch.com

FedEx shares FDX, -21.40% fell 21.4% to a two-year closing low of $161.02. The $43.85 price decline shaved about 267 points off the Dow Jones Transportation Average DJT, -5.07%, accounting for more than one-third of the Dow transports’ 685.39-point, or 5.1% drop, to 12,825.34.

Why FedEx's stock plunge is so bad for the whole stock market

FedEx Corp.'s profit warning has cast a pall on the broader stock market, as a record plunge in the package delivery giant's stock has helped trigger one...

Similar threads

- Replies

- 13

- Views

- 1K

- Replies

- 141

- Views

- 14K