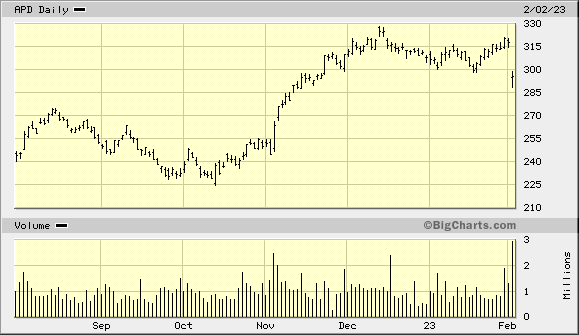

This is how "The Market' rewards a big, old company who's products will be needed to lift America out of this Rabbit Hole. I think all those "indicators" we are seeing this evening are wrong. APD, Down 7.11% for the day. Top rated by the, so called, analysis. This could be read, by some, as the decline will continue long into 2023.

Air Products and Chemicals, Inc. is an American international corporation whose principal business is selling gases and chemicals for industrial uses. Air Products' headquarters is in Allentown, Pennsylvania

S3th

______________________Air Products and Chemicals, Inc. is an American international corporation whose principal business is selling gases and chemicals for industrial uses. Air Products' headquarters is in Allentown, Pennsylvania

Last edited:

:max_bytes(150000):strip_icc()/GettyImages-1148659689-82ec1c80b6df47189af1887b0a890966.jpg)