Don’t anticipate this changing any time soon. The current market in the US is around 2 million homes short. Take in consideration that lumber prices are going to continue to climb for at least the next quarter. A lot major builders are watching this like pre 07-08 making sure they are not the ones holding inventory when it goes south.

Join the Hide community

Get access to live stream, lessons, the post exchange, and chat with other snipers.

Register

Download Gravity Ballistics

Get help to accurately calculate and scope your sniper rifle using real shooting data.

Install the app

How to install the app on iOS

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

-

Quick Shot Challenge: What’s the most underrated gear you never leave home without?

Contest ends Wednesday, join now for the chance to win free Hide merch!

Join contest

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Housing shortage.

- Thread starter Jefe's Dope

- Start date

True, but depreciation recapture still applies. You'll pick up whatever depreciation you took on the property over the years as income taxed at ordinary rates up to 25%. If you only rented it two years you'll be alright. The section 121 exclusion only applies to cap gains.I lived in it for 3 years. won't have to pay capital gains tax

To anyone thinking of selling a rental... BEWARE OF DEPRECIATION RECAPTURE.

The longer you rented the property, the worse it gets. If you've rented a residential property for 27.5 years or more, you have zero basis in your property. If you sell without rolling your basis into a new rental through a 1031 exchange you'll pick up the entire sales price of the property as taxable income, with depreciation recapture at up to 25% for whatever you paid for the property, and long term cap gains on the difference between the selling price and your original cost.

For example... lets say you bought a rental for $150k back in 1990 and sell it now for $350k. You pick up the first $150k as ordinary income (~$37,500 @ 25%) and the remaining $200k as long term cap gains (~$30,000 @ 15%) Plus you have state taxes on top of that (another ~$18k+ here in NC @5.25%) That's a $85k tax bill. If you live states like CA or if you're in the top tax bracket it's even worse. The gub'ment could end up taking half your gains.

Selling rentals can get screwy. If you've rented a property out for a long time, I'd consider using it as an estate planning tool instead of unloading it right now... at least as long as stepped up basis is still around. Either that or maybe roll it into a Delaware Statutory Trust.

No shit. Interstate 80 was closed today. It’s a damn wastelandExactly

Mid April and it's still snowing, plus the winds are unrelenting.

Thats too bad sounds almost as shitty as Texas. It is so bad here I would not recommemd even driving through.These people need to realize Wyoming has terrible weather a poor economy and is overall a terrible place to live

The stench of liberals in the big cities and smell of cowshit everywhere else.

Blizzards all winter and tripple digit heat the rest. To top it off we have bow legged women.

Our gun ranges have, flees, ticks, chiggers, rattlesnakes and sand burs.

Nothing to see here, move along.

True, but depreciation recapture still applies. You'll pick up whatever depreciation you took on the property over the years as income taxed at ordinary rates up to 25%. If you only rented it two years you'll be alright. The section 121 exclusion only applies to cap gains.

To anyone thinking of selling a rental... BEWARE OF DEPRECIATION RECAPTURE.

The longer you rented the property, the worse it gets. If you've rented a residential property for 27.5 years or more, you have zero basis in your property. If you sell without rolling your basis into a new rental through a 1031 exchange you'll pick up the entire sales price of the property as taxable income, with depreciation recapture at up to 25% for whatever you paid for the property, and long term cap gains on the difference between the selling price and your original cost.

For example... lets say you bought a rental for $150k back in 1990 and sell it now for $350k. You pick up the first $150k as ordinary income (~$37,500 @ 25%) and the remaining $200k as long term cap gains (~$30,000 @ 15%) Plus you have state taxes on top of that (another ~$18k+ here in NC @5.25%) That's a $85k tax bill. If you live states like CA or if you're in the top tax bracket it's even worse. The gub'ment could end up taking half your gains.

Selling rentals can get screwy. If you've rented a property out for a long time, I'd consider using it as an estate planning tool instead of unloading it right now... at least as long as stepped up basis is still around. Either that or maybe roll it into a Delaware Statutory Trust.

What if you sell your primary, move into your rental and later sell the rental?

Any perks to that?

I’m in NW Florida and the pricing is over inflated, most of the homes are selling higher then their appraisals.

Just sold one there. Was a little slower to sell because it was setup with a MIL quarters, but constant traffic. Turned down two lowballs and got asking no problem.

It was even tougher when we purchased it in 2004. Our realtor told us it was coming on the market (another realtor in her office). We looked at it the first day and made an offer the next. There were three other couples making offers while we were there. We won out because we already had approved financing. It took us two months to find a suitable house that wasn't already under contract.

I’m in south east pa, looking for a farm hose on a few acres... started with a 350k budget. I’ve made 15 offers, 11 of them 390k or higher (30-40k over asking price) no inspections, and I pay the all of the 2% transfer tax. I didn’t get any of them. So my wife and I found a shit box townhouse and bought that. I’m only 29 so no kids or anything, yet. I’m gonna fix it up and then when the market cools and I can buy my farm house I’ll rent it out. I think the mortgage is $875 a month, should rent for $1300 when I’m done with it. I think it’ll end up being a decent move for us

Horrible here in my part of Idaho. Houses selling the day the list for $5000-$50000 above asking price. Clapped out single wides on zero land for $200,000.I live on Zillow watching what's happening and pricing. Today there are 52 agent listing in approx. 30 sq. miles of well developed suburban area in a North suburb of Denver. There are 42 rentals available in the same search area. This amounts to nearly zero inventory.

It's getting worse, not better. I can't believe how little inventory is available and how quickly even the most dilapidated homes sell for.

What's your area look like?

Been watching 2 small subdivisions go in and people are moving in before the exterior is complete.

Id like to get out of the rental market but I'm not paying a premium for a turd of a house. Ill go buy a Mercedes van and live down by the river before that.

I heard Bender is renting.I'm in NW Colorado, small Mountain community, 20+ miles from a small resort town. Since the pandemic started, we first saw an increase in people looking for homes/land, that transitioned to an increase of buying frenzy, to include undesirable homes/land that was sitting on the market for as long as 5-years selling for asking price. Now a year later, we have a shortage of homes under the $1M mark. Last two homes listed in my area under $1M were under contract within a few days. The last one was a 2200-sqft modular, placed on a full concrete basement/garage on 1/2-acre of land down in a hole. It was listed for $675.

I get cards in the mail from realtor's often saying they have buyers ready to buy. So far had two realtors come by to look at the house, and I tell them no listing, no MLS, no lookie loos trampling mud into the house. Bing me a buyer like you said you have. So far crickets.

I'm thinking of doing the FSBO, and putting a full page ad in the newspaper with my house for sale. 3-bd/3-bath 2400-sqft finished, another 1400-sqft partially finished walkout basement, with additional plumbed bath and room to build a fourth bedroom on 8-acres in a private subdivision.

If I can sell it, I'll buy some bare land in Wyoming, put up a yurt, and live in it until things return to semi-normal.

Read the leaseback clauses carefully and if some strong protections for you as a tenant are not present, you should write them in. Do you want your new landlord to be able to bring in heavy machinery and turn your new rented home into a 24/7 construction zone while you are living there? Ask me how I know....This is just crazy, I just got a call from one of those realtors, and she has buyers (another broker), who wants my house sight unseen for $839K, and willing to do a 8 to 9-month leaseback for me. She's emailing me the contract to sign in a few here.

And here I am on this thread talking about it when the realtor calls me. Talk about coincidence?

Folks that had a contract to buy our place couldn't get the loan. That cost us a month. As of yesterday it's back on the market. Don't they check with the bank before flying half way across the country and making an offer on a house? Just damn. Now I'm going to have to cut the grass up there.

I’m in south east pa, looking for a farm hose on a few acres... started with a 350k budget. I’ve made 15 offers, 11 of them 390k or higher (30-40k over asking price) no inspections, and I pay the all of the 2% transfer tax. I didn’t get any of them. So my wife and I found a shit box townhouse and bought that. I’m only 29 so no kids or anything, yet. I’m gonna fix it up and then when the market cools and I can buy my farm house I’ll rent it out. I think the mortgage is $875 a month, should rent for $1300 when I’m done with it. I think it’ll end up being a decent move for us

Come to NE Oklahoma. I can find you what your looking for.

Low income folks can't afford to buy anyway. Look at the average cost of home ownership. The increase in home values alone take many middle income people out of the picture, much less low income families.

Can you imagine the hurt that some of these new home owners will feel when the market tanks and they're upside down on their houses by what could be 30-50%?

I don’t want low income people buying houses where my rentals are. I picked those neighborhoods for a reason. Nice, clean, great school district, jobs, and no poors. If poors get in the neighborhood, I’ll be pissed.

Happened in 2008. Broke small money people who were living above their means lost homes. People who aren’t retarded bought more property, or waited it out on the ones they owned and, and are now super green.Can you imagine the hurt that some of these new home owners will feel when the market tanks and they're upside down on their houses by what could be 30-50%?

As I said above, if I bought today, and took a 30% dive tomorrow, I wouldn’t even be concerned.

right, and that is why they want to move poor renters and section 8 types into the burbs.Low income folks can't afford to buy anyway. Look at the average cost of home ownership. The increase in home values alone take many middle income people out of the picture, much less low income families.

I live in a small town in NE Oregon and prices have gone crazy here also. My son wants to move back from the big city, so I've looked at lots of houses. Most are crap that no one would have messed with a couple of years ago; 100 years old, failing foundations, run down mfg and all selling for crazy prices. I guess people are trying to escape the failing cities. I have a small farm and would like to escape to a free state, but the prices there are even higher than here.

If Obama/Biden had it their way, we'd all be living in govt housing, and receiving food stamps.

Happened in 2008. Broke small money people who were living above their means lost homes. People who aren’t retarded bought more property, or waited it out on the ones they owned and, and are now super green.

As I said above, if I bought today, and took a 30% dive tomorrow, I wouldn’t even be concerned.

Even people who still had good jobs and could make the payments walked from their homes, just because they thought being underwater would be forever.

They had no vison, or spine. Now those homes are worth a lot more than in 2008.

Not sure where you are at, but in nice areas in the suburbs west of St Louis, nice houses don’t last the day or weekend. At the moment, nice homes go for over asking. I could probably sell my house for $100k more today than I bought it at 3 years ago.I tried to buy a house last year....most fucking houses were getting offers the same day they were listed......the same day!

Like are people not even inspecting the homes before plunking down a deposit??

After fucking around with that bullshit for a year we decided to wait and let the market cool down

Last edited:

I remember seeing that too. Short sales were very common.Even people who still had good jobs and could make the payments walked from their homes, just because they thought being underwater would be forever.

They had no vison, or spine. Now those homes are worth a lot more than in 2008.

Then the big ballers came in and swooped up as much physical real estate as possible with the bail out money. That was pretty fucked up, lol.

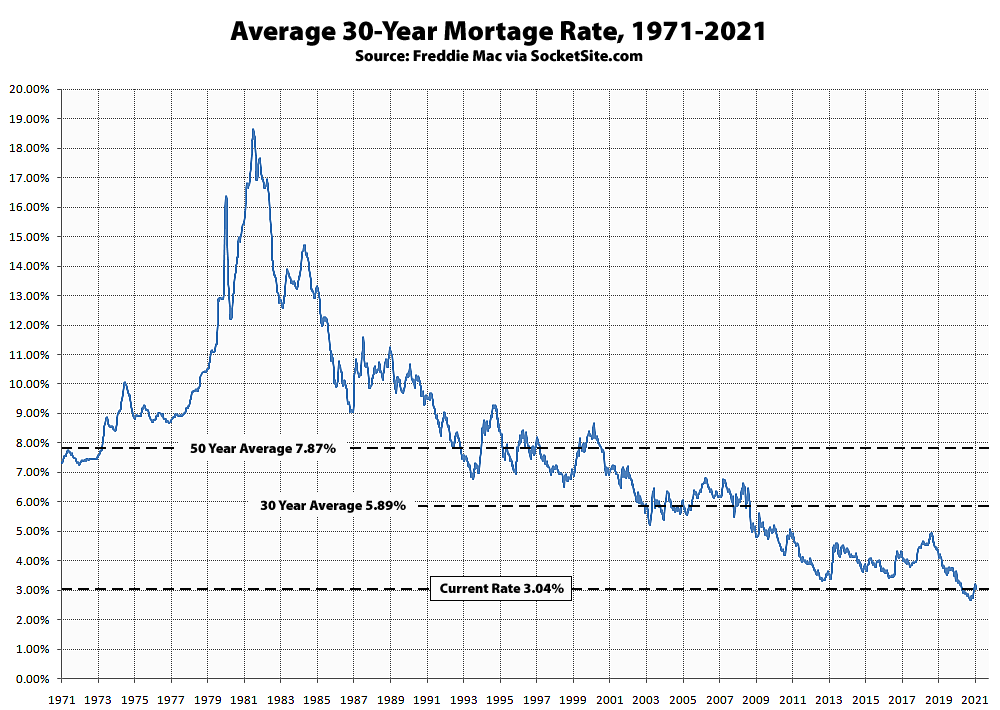

seems to be a trend all over with the interest rates so low, everyone is worried they won't last for long.Not sure where you are at, but in nice areas in the suburbs west of St Louis, nice houses don’t last the day or weekend. At the moment, nice homes go for over asking

A woman who is a friend of a friend bought 40 town houses from 08-10, about an hour north of where I am. Shes trying to sell all 40 for 10 million right now. Gotta risk it for the biscuit.I remember seeing that too. Short sales were very common.

Then the big ballers came in and swooped up as much physical real estate as possible with the bail out money. That was pretty fucked up, lol.

Pix of this, friend of a friend?A woman who is a friend of a friend bought 40 town houses from 08-10, about an hour north of where I am. Shes trying to sell all 40 for 10 million right now. Gotta risk it for the biscuit.

Read an article few weeks ago, can't remember where?? So kinda paraphrasing; big hedge fund co and investment groups are snatching up everything, paying twice the asking price. I found a company last year that you could invest in, that most of what they did was buy apartment buildings.

True, but depreciation recapture still applies. You'll pick up whatever depreciation you took on the property over the years as income taxed at ordinary rates up to 25%. If you only rented it two years you'll be alright. The section 121 exclusion only applies to cap gains.

To anyone thinking of selling a rental... BEWARE OF DEPRECIATION RECAPTURE.

The longer you rented the property, the worse it gets. If you've rented a residential property for 27.5 years or more, you have zero basis in your property. If you sell without rolling your basis into a new rental through a 1031 exchange you'll pick up the entire sales price of the property as taxable income, with depreciation recapture at up to 25% for whatever you paid for the property, and long term cap gains on the difference between the selling price and your original cost.

For example... lets say you bought a rental for $150k back in 1990 and sell it now for $350k. You pick up the first $150k as ordinary income (~$37,500 @ 25%) and the remaining $200k as long term cap gains (~$30,000 @ 15%) Plus you have state taxes on top of that (another ~$18k+ here in NC @5.25%) That's a $85k tax bill. If you live states like CA or if you're in the top tax bracket it's even worse. The gub'ment could end up taking half your gains.

Selling rentals can get screwy. If you've rented a property out for a long time, I'd consider using it as an estate planning tool instead of unloading it right now... at least as long as stepped up basis is still around. Either that or maybe roll it into a Delaware Statutory Trust.

Thanks for that info. I appreciate that!

It actually started after the Great Recession. The assholes we bailed out used that money to buy up a lot of distressed real estate.Read an article few weeks ago, can't remember where?? So kinda paraphrasing; big hedge fund co and investment groups are snatching up everything, paying twice the asking price. I found a company last year that you could invest in, that most of what they did was buy apartment buildings.

Come to NE Oklahoma. I can find you what your looking for.

How about in SW Oklahoma. Looking now and not finding much

Young couple/kids who came to look at the house yesterday are from Oklahoma. I don't understand how people moving from one State to another, can afford, or even mentally accept that the cost of a house is 4x what they're used to?

Hell, If I were looking for a house today, I couldn't afford to buy what I have now, it's just crazy. Where are people getting the money to buy homes close to a $Million or more???

Hell, If I were looking for a house today, I couldn't afford to buy what I have now, it's just crazy. Where are people getting the money to buy homes close to a $Million or more???

No hurt. They will just stop paying their mortgage and/or walk away like they did 2008 through 2012. Five years later, the banks will be wanting to loan them money again.Can you imagine the hurt that some of these new home owners will feel when the market tanks and they're upside down on their houses by what could be 30-50%?

Been hearing a good bit of service members having a tough time with moves as they have to get out of leases or sell, only to move and not be able to find or afford anything on the other end. The lucky ones make $40k+ on their house, but then have to to throw more than that in on the new place.

Insane here. Everyone wants in, houses don’t last a day, often bought sight unseen! Been trying to get my parents here for years. Built mine at just the right time!I live on Zillow watching what's happening and pricing. Today there are 52 agent listing in approx. 30 sq. miles of well developed suburban area in a North suburb of Denver. There are 42 rentals available in the same search area. This amounts to nearly zero inventory.

It's getting worse, not better. I can't believe how little inventory is available and how quickly even the most dilapidated homes sell for.

What's your area look like?

Nope. They aren’t. A shit ton of people from out west are buying houses sight unseen. Try buying anything in MT! The damn Californians are buying that state up like crazy, at insane prices, not even seen. I flew in to look at a place and as soon as we got the door open my agent took a call and said the place was sold to people from CA, not even seen. This happened many other times except the others I was just told on the phone and didn’t go up. I talked to my agent and he said this has been like this like crazy all over MT for quite awhile. People are trying to get out of CA.I tried to buy a house last year....most fucking houses were getting offers the same day they were listed......the same day!

Like are people not even inspecting the homes before plunking down a deposit??

After fucking around with that bullshit for a year we decided to wait and let the market cool down

Mines already gone up 2x in the last 4 years.No doubt the appraisal districts are watching and going to drop the hammer with new assessments.

Don’t sell it unless you know you can buy something cheaper abd make money. Had a friend of mine sell last year. Made some serious money on his place. Had to move in with someone else for over a year to try and find him something. He never could and wound up spending all his hard earned profit from his other house on the new house. Now the kicker. The new house is 1/4 the size of his old one and he paid 3x as much for it as he sold his last one for. So he blew through his profit, had to add to it and got much less house. That was a pretty stupid move imo.I’m in the Denver north ‘burbs and can’t wait to sell my house for double what we paid for it 7yrs ago.

Damn that’s cheap!!Socal is crazy right now. Also, many cities were rezoned so there is a massive influx of LA residents inland, renting now.

A friend sold his 6 acre, 6000 square ft ranch for 900k recently. It was on the market for just over a week. He bought that ranch for 200k in 2001.

We will definitely have a plan to maximize our profitDon’t sell it unless you know you can buy something cheaper abd make money. Had a friend of mine sell last year. Made some serious money on his place. Had to move in with someone else for over a year to try and find him something. He never could and wound up spending all his hard earned profit from his other house on the new house. Now the kicker. The new house is 1/4 the size of his old one and he paid 3x as much for it as he sold his last one for. So he blew through his profit, had to add to it and got much less house. That was a pretty stupid move imo.

I’ll shoot you a PM and see what we can find you.How about in SW Oklahoma. Looking now and not finding much

Realtor called last night to say that we had an offer on the house (we were in negotiations w/ buyer 1, but had nothing in writing). Buyer 2 couldn't come see the house till today & put in a written offer above asking price w/ DD $. I was instructed to electronically sign the offer when I got home to lock in the DD $. I thought about it & decided it just wasn't right to agree to take their $ just because they couldn't see the house till today. Called the realtor back this am & said to tell buyer 2 that it just wasn't right. They needed to see the house & then make a decision w/o putting up the $. Buyer 1 was informed & said they would not raise their offer. That's fine. Buyer 2 & both realtors went to the house today. They love it & stroked the DD check! It's not a done deal yet, but it's looking good.

In the past 3 weeks I've had 2 realtors call me asking if I'm interested in selling the house. They each said they had buyers standing by. How crazy is the market when realtors are calling folks who don't want to sell?

I received a call from my realtor this evening, said the people who looked at it last week, now made an offer. Initially they said they loved the house, but couldn't afford to buy it, because they also wanted to build a detached garage and finish the basement.

Going in to review all the details in the morning.

Going in to review all the details in the morning.

whats ddRealtor called last night to say that we had an offer on the house (we were in negotiations w/ buyer 1, but had nothing in writing). Buyer 2 couldn't come see the house till today & put in a written offer above asking price w/ DD $. I was instructed to electronically sign the offer when I got home to lock in the DD $. I thought about it & decided it just wasn't right to agree to take their $ just because they couldn't see the house till today. Called the realtor back this am & said to tell buyer 2 that it just wasn't right. They needed to see the house & then make a decision w/o putting up the $. Buyer 1 was informed & said they would not raise their offer. That's fine. Buyer 2 & both realtors went to the house today. They love it & stroked the DD check! It's not a done deal yet, but it's looking good.

Just wait. Lumber price will jump another 7-10% next week.In the past 3 weeks I've had 2 realtors call me asking if I'm interested in selling the house. They each said they had buyers standing by. How crazy is the market when realtors are calling folks who don't want to sell?

Just wait. Lumber price will jump another 7-10% next week.

For those of you selling......why sell this week and not wait till next week if there’s money still to be made?

What’s the motivation to sell?

For those of you selling......why sell this week and not wait till next week if there’s money still to be made?

What’s the motivation to sell?

I'm just guessing it could be a scare over increased interest rates. They have ticked up a bit in the last 2 weeks.

Usually when interest rates go up, the price for housing go down.

If the offer is good, sell today, as you don't know what will happen later on. For me, I need a Leaseback in the contract. Most people can't afford to buy a house, and not move into it right away.

I’m not selling lol. Right now it would cost me easily 2x what I currently have in mine to rebuild the same place.For those of you selling......why sell this week and not wait till next week if there’s money still to be made?

What’s the motivation to sell?

Due diligence. Basically a down payment that is only refundable if the seller backs out of the deal.whats dd

We bought a new place and moved already. My goal was to never cut grass at the old house again. We locked in a contract with a buyer, then they couldn't get a loan. I lost 30 days on that. Now I have an extra house, yard and lawn mower. I'm just ready to be done with the old place.For those of you selling......why sell this week and not wait till next week if there’s money still to be made?

What’s the motivation to sell?

My wife and I are currently looking in NC, and just found out about the DD money this past weekend. Never heard of such a thing up here in PA/NJ. I get that it reduces some risk for the seller since it effectively takes the house off the market, but I'm not going to write a check for very much in the event the seller didn't disclose a major flaw they knew or should have easily known (our realtor told us of someone who tried to sue to get that money back after it was found out the house was flooded...judge said no dice...)Due diligence. Basically a down payment that is only refundable if the seller backs out of the deal.

Years ago we made an offer and put down dd. We found bad things during the inspection and got our money back.My wife and I are currently looking in NC, and just found out about the DD money this past weekend. Never heard of such a thing up here in PA/NJ. I get that it reduces some risk for the seller since it effectively takes the house off the market, but I'm not going to write a check for very much in the event the seller didn't disclose a major flaw they knew or should have easily known (our realtor told us of someone who tried to sue to get that money back after it was found out the house was flooded...judge said no dice...)

Similar threads

- Replies

- 63

- Views

- 3K

- Replies

- 129

- Views

- 6K

- Replies

- 9

- Views

- 619