I think the macro risk factors are changing.The hilarious thing is that there's nothing new in the macro conditions. The Fed is still saying what it's been saying. Inflation "eased" somewhat but is still positive, so things are getting worse but just not as quickly. Oil never got truly cheap and is back to being downright expensive, and with a near-empty SPR to boot. Republicans did nothing to curb federal spending despite two shutdown showdowns. The labor market is still ultra-tight because we had a generational shift (Boomer retirement) accelerated by the pandemic.

The last six months of what Greenspan would have termed "irrational exuberance" is the fault of traders, not the Fed or even fed.gov. I think everyone got a bit too clever in trying to front-run the Fed's eventual decision to cut rates. So we'll see what happens. Maybe it rips again because why not have triple-digit PEs alongside a 5.25 Fed target rate.

Join the Hide community

Get access to live stream, lessons, the post exchange, and chat with other snipers.

Register

Download Gravity Ballistics

Get help to accurately calculate and scope your sniper rifle using real shooting data.

Install the app

How to install the app on iOS

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Stock Market

- Thread starter pmclaine

- Start date

So, in other words, mortgage rates are normalizing again, getting away from the free money stimulus of the past few years that contributed to rapid increases in real estate prices in western Montana.

Mortgage rate races toward 8% after hitting a high not seen since late 2000

Mortgage rates follow loosely the yield on the 10-year Treasury, which has been climbing this week.www.cnbc.com

Mortgage Rates Chart | Historical and Current Rate Trends

Current and historical mortgage rate charts showing average 30-year mortgage rates over time. See today's rates in context.

Exactly.Bricknoses look cool, but trust me when I say that very few buyers want a truck like that. OEs have played around with stripped trim levels and the only one who bites are municipalities.

A large portion of the truck market consists if people who would have bought a German sedan 20 years ago or a Cadillac 50 years ago. Blame many factors, but Corporate Average Fuel Economy (CAFE) is right at the top of that list. It's been a huge distortion in the market, as government programs tend to be.

I know a lawyer, a dentist, and a bunch of other office worker commuters who drive modern fancy trucks. It is basically a status symbol for men now, like the others you presented from years past. Truck buyers are not ranchers, in spite of the ads that connect trucks to working on a ranch or getting a large load of something put into the bed on a muddy construction site. That has to be less than 1% of the individual buyers. And these are expensive trucks. The attorneys I know with pickups are driving very expensive trucks and are quite proud of them.

Lol. Anyways, the whole mortgage rates are historically low is correct. But it is disingenuous as QE changed everything. You are braindead if you think the global economy can function on major countries' rates being north of 12%.

Nobody said anything about north of 12%, which is high historically.

But 7-8% is not high, historically. There is nothing "disingenuous" about what I posted, QE or no QE. QE contributed to the lower rates in the name of stimulus.

I do not know how old you are, but my first mortgage was at 9.5%. (1990s). It was normal, and I had good credit. If mortgage rates hit 9.5% before the end of the year, everybody would panic, but that is only because they have grown accustomed to artificially low stimulus rates.

I took advantage of them myself. My current mortgage is 2.00%, so I am not going to be refinancing anytime soon.

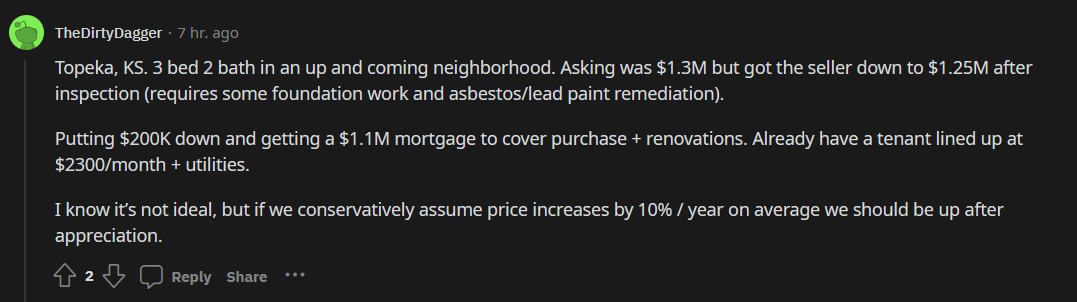

LOL at the TheDirtyDagger quote you posted. I hope he was creating a farce or satire for others to laugh at, and the writing is not his actual business plan. His monthly payment would be (I say would be because that has to be hypothetical satire) almost 8 grand a month. The "not ideal" and "conservatively" language makes me think it is a joke.

But 7-8% is not high, historically. There is nothing "disingenuous" about what I posted, QE or no QE. QE contributed to the lower rates in the name of stimulus.

I do not know how old you are, but my first mortgage was at 9.5%. (1990s). It was normal, and I had good credit. If mortgage rates hit 9.5% before the end of the year, everybody would panic, but that is only because they have grown accustomed to artificially low stimulus rates.

I took advantage of them myself. My current mortgage is 2.00%, so I am not going to be refinancing anytime soon.

LOL at the TheDirtyDagger quote you posted. I hope he was creating a farce or satire for others to laugh at, and the writing is not his actual business plan. His monthly payment would be (I say would be because that has to be hypothetical satire) almost 8 grand a month. The "not ideal" and "conservatively" language makes me think it is a joke.

Nothing in the financial arena is "normalizing". And, if anything was normalizing we would not know it for at least 3 years.So, in other words, mortgage rates are normalizing again, getting away from the free money stimulus of the past few years that contributed to rapid increases in real estate prices in western Montana.

Mortgage Rates Chart | Historical and Current Rate Trends

Current and historical mortgage rate charts showing average 30-year mortgage rates over time. See today's rates in context.themortgagereports.com

I think the macro risk factors are changing.

I don't think the macro risk factors have changed substantially since March when we learned that incremental increases in bond rates completely blows up the balance sheets of mid-size banks. Rather, it feels that Wall Street chose to take a vacation from considering those factors when pricing stocks.

Might not be a meaningful difference in terms of where we're going.

So today bonds selling, yields dip, and stocks move up.

It would tire me out following the day to day vagaries of the market. I just buy on schedule, as usual. Money comes in, a set amount gets invested, and that is that.

It would tire me out following the day to day vagaries of the market. I just buy on schedule, as usual. Money comes in, a set amount gets invested, and that is that.

So many ways to skin the cat. Just about to breach 65% preferred/baby bond/bond allocation which is probably about as high as I will take it. I waited 15 years for yields like this and still picking off a few names here and there when on sale, but more or less like you on a schedule. Ain't sexy and it ain't hard....it's simply delayed gratification and consistency.So today bonds selling, yields dip, and stocks move up.

It would tire me out following the day to day vagaries of the market. I just buy on schedule, as usual. Money comes in, a set amount gets invested, and that is that.

Another one

Torsten Muller-Otvos, the Rolls-Royce CEO who turned an aging brand into a coveted badge of success for pop stars, athletes and young entrepreneurs, is retiring after 14 years.

Rolls-Royce announced Thursday that Muller-Otvos, 63, the longest serving CEO of Rolls-Royce in nearly a century, will retire on December 1. He will be replaced by Chris Brownridge, currently chief executive officer of BMW UK.

www.cnbc.com

www.cnbc.com

Torsten Muller-Otvos, the Rolls-Royce CEO who turned an aging brand into a coveted badge of success for pop stars, athletes and young entrepreneurs, is retiring after 14 years.

Rolls-Royce announced Thursday that Muller-Otvos, 63, the longest serving CEO of Rolls-Royce in nearly a century, will retire on December 1. He will be replaced by Chris Brownridge, currently chief executive officer of BMW UK.

Rolls-Royce CEO Torsten Muller-Otvos retires after boosting sales six-fold

Muller-Otvos brought new shine to the Rolls-Royce brand and became a leader in the luxury world by attracting a new generation of wealthy buyers.

Time to invest in "Lipstick"... A steady stream of the tactic of "Putting lipstick on a pig".... Always before a recession.

Oct 5 (Reuters) - Dell Technologies (DELL.N) said on Thursday it expects compounded annual revenue growth of 3-4% over the long term and boosted its share buyback plan by $5 billion.

Dell also said it would raise its quarterly dividend by 10% or more every year through fiscal 2028, as it plans to return more than 80% of adjusted free cash flow to shareholders through a combination of share buybacks and dividends.

Shares of the company were down more than 2% in premarket trading.

/cloudfront-us-east-2.images.arcpublishing.com/reuters/MHHVMQIVCBIRLI6JHLHO36XCHQ.jpg)

www.reuters.com

www.reuters.com

Oct 5 (Reuters) - Dell Technologies (DELL.N) said on Thursday it expects compounded annual revenue growth of 3-4% over the long term and boosted its share buyback plan by $5 billion.

Dell also said it would raise its quarterly dividend by 10% or more every year through fiscal 2028, as it plans to return more than 80% of adjusted free cash flow to shareholders through a combination of share buybacks and dividends.

Shares of the company were down more than 2% in premarket trading.

/cloudfront-us-east-2.images.arcpublishing.com/reuters/MHHVMQIVCBIRLI6JHLHO36XCHQ.jpg)

Dell forecasts 3-4% compounded annual revenue growth over long term

Dell Technologies said on Thursday it expects compounded annual revenue growth of 3-4% over the long term and boosted its share buyback plan by $5 billion.

I agree - fancy 4 door pickups are the high performance 4 door sedan nowBricknoses look cool, but trust me when I say that very few buyers want a truck like that. OEs have played around with stripped trim levels and the only one who bites are municipalities.

A large portion of the truck market consists if people who would have bought a German sedan 20 years ago or a Cadillac 50 years ago. Blame many factors, but Corporate Average Fuel Economy (CAFE) is right at the top of that list. It's been a huge distortion in the market, as government programs tend to be.

Remember people buying overpriced homes with balloon notes, variable mortgages, etc. right before the 2008 crashLol. Anyways, the whole mortgage rates are historically low is correct. But it is disingenuous as QE changed everything. You are braindead if you think the global economy can function on major countries' rates being north of 12%.

View attachment 8241440

Yep... A lot of that old terminology from that period has been forgotten. The young people have been "riding the wave".Remember people buying overpriced homes with balloon notes, variable mortgages, etc. right before the 2008 crash

Some terms I remember:

Balloon in 5 (My how quickly 5 years passed as the recession took hold)

Indexed off of the 11th district funds (Never saw an index rise so rapidly)

The county of Orange County, California has declared bankruptcy

Resolution Trust company just sold Wells Fargo a "Package of 100 houses". (FED's were forcing big banks to buy those packages... or else)

You have 60 days to enroll in COBRA once your employer-sponsored benefits end. (Man, that shit was EXPENSIVE for a guy with no job)

That list is long... and, sobering.

Last edited:

“You have equities falling like it’s a recession, rates climbing like growth has no bounds, gold selling off like inflation is dead,” said Benjamin Dunn, a former hedge fund chief risk officer who now runs consultancy Alpha Theory Advisors. “None of it makes sense.”′

www.cnbc.com

www.cnbc.com

Why borrowing costs for nearly everything are surging, and what it means for you

Violent moves in bonds have hammered investors and renewed fears of an impending recession, as well as concerns about housing, banks and the U.S. deficit.

Prepare for “stalling and divergent” global growth next year, according to a new forecast issued by the United Nations.

Global economic growth will rise slightly, from 2.4% in 2023 to 2.5% in 2024, according to the UN’s Trade and Development Report, but the world economy is in a precarious position, Richard Kozul-Wright, UNCTAD, Director, Division on Globalization and Development Strategies Division, tells CNBC.

“The global economy is pretty weak and I consider the projection to be an optimistic call,” he said.

Global economic growth will rise slightly, from 2.4% in 2023 to 2.5% in 2024, according to the UN’s Trade and Development Report, but the world economy is in a precarious position, Richard Kozul-Wright, UNCTAD, Director, Division on Globalization and Development Strategies Division, tells CNBC.

“The global economy is pretty weak and I consider the projection to be an optimistic call,” he said.

Jeffrey A. Tucker Saved the best for the last line.

5 Financial Storms on the Horizon

www.theepochtimes.com

Buckle up. It’s going to be a bumpy ride.

Here is an example I spoke of.So today bonds selling, yields dip, and stocks move up.

It would tire me out following the day to day vagaries of the market. I just buy on schedule, as usual. Money comes in, a set amount gets invested, and that is that.

Two days of the NASDAQ where it was in the tank at 11 am. The big players / insiders moved the numbers way up for a close that did not draw attention.

They will not be able to prop up the indexes very much longer. going to be an interesting game to watch.

FOMC Rate Hike Market Probabilities:

November - 24.3%

December - 39.8%

January - 31.5%

FOMC Rate Hike Market Probabilities: after JOBS report.

November - 32.6%

December - 49.6%

January - 49.5%

So........... From your "perspective" is this good... or ... bad ? What does your crystal ball say ?FOMC Rate Hike Market Probabilities: after JOBS report.

November - 32.6%

December - 49.6%

January - 49.5%

Violent moves in the bond market this week have hammered investors and renewed fears of a recession, as well as concerns about housing, banks and even the fiscal sustainability of the U.S. government.

At the center of the storm is the 10-year Treasury yield, one of the most influential numbers in finance. The yield, which represents borrowing costs for issuers of bonds, has climbed steadily in recent weeks and reached 4.88% on Tuesday, a level last seen just before the 2008 financial crisis.

The relentless rise in borrowing costs has blown past forecasters’ predictions and has Wall Street casting about for explanations. While the Federal Reserve has been raising its benchmark rate for 18 months, that hasn’t impacted longer-dated Treasurys like the 10-year until recently as investors believed rate cuts were likely coming in the near term.

www.cnbc.com

www.cnbc.com

At the center of the storm is the 10-year Treasury yield, one of the most influential numbers in finance. The yield, which represents borrowing costs for issuers of bonds, has climbed steadily in recent weeks and reached 4.88% on Tuesday, a level last seen just before the 2008 financial crisis.

The relentless rise in borrowing costs has blown past forecasters’ predictions and has Wall Street casting about for explanations. While the Federal Reserve has been raising its benchmark rate for 18 months, that hasn’t impacted longer-dated Treasurys like the 10-year until recently as investors believed rate cuts were likely coming in the near term.

Why borrowing costs for nearly everything are surging, and what it means for you

Violent moves in bonds have hammered investors and renewed fears of an impending recession, as well as concerns about housing, banks and the U.S. deficit.

So........... From your "perspective" is this good... or ... bad ? What does your crystal ball say ?

The global economy needs higher rate shock but will bode poorly for most people. Rates will continue to go higher until unemployment ticks up. Once we start seeing unemployment and job starts decreasing, I intend to buy TLT.

The global economy needs higher rate shock but will bode poorly for most people. Rates will continue to go higher until unemployment ticks up. Once we start seeing unemployment and job starts decreasing, I intend to buy TLT.

Understood. It could be a long wait to see unemployment and job starts change much. We are "leap frogging" inflation / wage increase / inflation / wage increase...

If you bought TLT today and the changes took place this year, it will still take you 4 years to double your money. Maybe 2 years to buy a house.

Last edited:

Understood. It could be a long wait to see unemployment and job starts change much. We are "leap frogging" inflation / wage increase / inflation / wage increase...

If you bought TLT today and the changes took place this year, it will still take you 4 years to double your money. Maybe 2 years to buy a house.

View attachment 8242868

Wages aren’t spiraling up as many have thought. Wage growth continues to decelerate MoM. The trade behind TLT is focused on two events: timing peak rates and the FED cutting.

Spent some time today (4hrs) driving to and from the range. I wanted to dive deeper into Enphase as it does not get the daily coverage Tesla does. With that said, I decided to listen to videos/podcasts led by the solar installer industry vs. your typical Wall Street analysis.

Found this to be insightful.

I am working on updating my investment portfolio as I no longer believe many of the stocks I own, should hold a sit. Two examples would be Apple and Google; both great blue chips, which is why I have them as individual positions. But I will have enough exposure to them through QQQM and they do not fit my thesis around direct exposure.

Right now, my ROTH and Rollover IRA are positioned to rebalance to 65% QQQM, 20% TSLA, and 15% ENPH . Currently, around 60% is in SGOV.

. Currently, around 60% is in SGOV.

Found this to be insightful.

I am working on updating my investment portfolio as I no longer believe many of the stocks I own, should hold a sit. Two examples would be Apple and Google; both great blue chips, which is why I have them as individual positions. But I will have enough exposure to them through QQQM and they do not fit my thesis around direct exposure.

Right now, my ROTH and Rollover IRA are positioned to rebalance to 65% QQQM, 20% TSLA, and 15% ENPH

Last edited:

Spent some time today (4hrs) driving to and from the range. I wanted to dive deeper into Enphase as it does not get the daily coverage Tesla does. With that said, I decided to listen to videos/podcasts led by the solar installer industry vs. your typical Wall Street analysis.

Found this to be insightful.

I am working on updating my investment portfolio as I no longer believe many of the stocks I own, should hold a sit. Two examples would be Apple and Google; both great blue chips, which is why I have them as individual positions. But I will have enough exposure to them through QQQM and they do not fit my thesis around direct exposure.

Right now, my ROTH and Rollover IRA are positioned to rebalance to 65% QQQM, 20% TSLA, and 15% ENPH. Currently, around 60% is in SGOV.

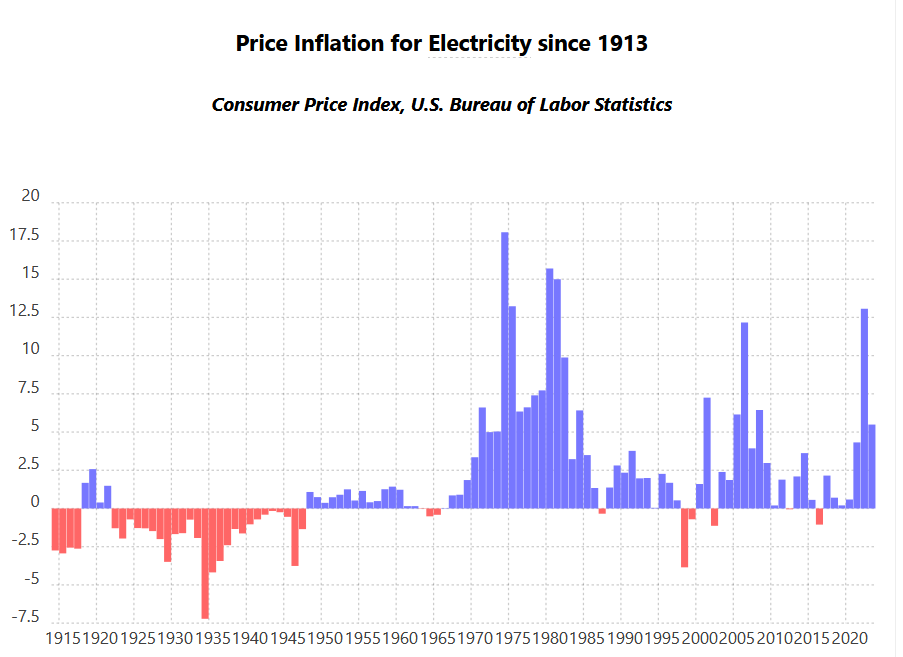

There are reason's the trend line looks like this.

It's still just a battery.

That battery will go dead "At the worst possible moment"... Murphy's Law.

In all fairness a Generac generator will probably go out at that same moment.

Short seller's ethics charges against Enphase 'blatantly false' – CEO

A report and lawsuit alleged that Enphase executives inflated the company's financial performance. The company's share price took a big hit on the report's release, but it recovered to an all-time high Aug. 5 after Enphase posted strong earnings.

Enphase vs Generac

A race to the bottom.

Let's hope they get those neighborhood nukes on line soon.

A race to the bottom.

Let's hope they get those neighborhood nukes on line soon.

The trend looks like that because financing costs have/are rising globally and have risen at the fastest pace in history within the US. This is expected as most people finance solar power installations and equities are discounted to a higher degree (which we have not really seen hit large caps). This does not change the long-term trend or my thesis on electrification. The breakeven period is continuing to decline with sunshine states being able to break even as quickly as 5 years. At that point, you are no longer subjected to inflation and volatility in pricing and will actually earn income by engaging in arbitrage.

We all understand your distaste for equities but your fascination with stock price movement obscures me. Stock goes up, down, flat, you are bearish in all axis. As I have said before, on numerous occasions. I would rather Enphase and Tesla be trading all ATL so I can accumulate more at a discount. I believe both have more to fall but are ultimately well below their long-term intrinsic value.

We all understand your distaste for equities but your fascination with stock price movement obscures me. Stock goes up, down, flat, you are bearish in all axis. As I have said before, on numerous occasions. I would rather Enphase and Tesla be trading all ATL so I can accumulate more at a discount. I believe both have more to fall but are ultimately well below their long-term intrinsic value.

EDIT: Added some other self storage companies to my list. SELF, NSA, CUBE, EXR

Bearish because I have made more money going short than long.

If I were backed in a corner and had to make a pick today. to short, it would be PSA, Public Storage (NYS)

Stock price movement is like running an operation with a committee. For the most part those committee members have skin in the game.

Unlike the analysist, fund managers and financial advisor's.

We are coming upon a time when people will take a critical look at their "junk" and how much it cost them to hang onto it.

Bearish because I have made more money going short than long.

If I were backed in a corner and had to make a pick today. to short, it would be PSA, Public Storage (NYS)

Stock price movement is like running an operation with a committee. For the most part those committee members have skin in the game.

Unlike the analysist, fund managers and financial advisor's.

We are coming upon a time when people will take a critical look at their "junk" and how much it cost them to hang onto it.

Last edited:

One more CEO leaving the building.

Unity CEO John Riccitiello is retiring from the gaming software company following a controversial pricing change that frustrated numerous developers.

Riccitiello, who has been running Unity for nine years, will also step down as chairman and is leaving the board, the company said Monday.

James Whitehurst, former CEO of Red Hat, will become Unity’s interim CEO. Sequoia Capital’s Roelof Botha, the lead independent director of Unity’s Board, will become the company’s chairman.

www.cnbc.com

www.cnbc.com

www.gurufocus.com

www.gurufocus.com

Unity CEO John Riccitiello is retiring from the gaming software company following a controversial pricing change that frustrated numerous developers.

Riccitiello, who has been running Unity for nine years, will also step down as chairman and is leaving the board, the company said Monday.

James Whitehurst, former CEO of Red Hat, will become Unity’s interim CEO. Sequoia Capital’s Roelof Botha, the lead independent director of Unity’s Board, will become the company’s chairman.

Unity CEO John Riccitiello is retiring from gaming software company after controversial pricing change

Unity CEO John Riccitiello is retiring after nine years at the video game technology company and will be replaced on an interim basis by James Whitehurst.

John S. Riccitiello Net Worth (2023) - GuruFocus.com

John S. Riccitiello Net Worth 2023 and insider trades. Provides CEO, CFO, Director and Chief Executives trade reports, independent equity research, and stock screening.

Presented by Nicholas Wealth Management

The market, jobs, economy and the FedMarkets continued to slump last week as bond rates hit levels we haven’t seen in 16 years. Suddenly, a five-year treasury yielding 4.7% isn’t so bad when compared to the volatility of the stock market.

Whether we like it or not, much of the market is based on feelings; sure, they give it fancy terms like “market sentiment,” but that’s saying the same as mood — and the current mood seems to be bad. People are on strike, from auto workers we rely on to make the cars we use to get around, to health care workers we rely on to keep us healthy and actors we rely on to entertain us. So why should markets be in a better mood? If we don’t feel well, can’t get around or lack entertainment, why shouldn’t we be cranky?

Lots of people have exhausted their savings and run up their credit cards, so they can’t even get satisfaction from buying something they don’t really need. It all feels off. The economy is still moving along, but for how long? In general, interest rates are grinding things down, personal debt is climbing, wages aren’t keeping up with inflation and hours are being cut back.

The ADP® employment report added a measly 89,000 jobs in September, far short of the consensus estimate and nearly 100,000 less than the revised August number. But on Friday, the Bureau of Labor Statistics (BLS) employment situation report (also known as non-farm payrolls) for September came in at 336,000, blowing away the consensus estimate and significantly higher than August. Meanwhile, the unemployment rate stayed at 3.8%.

Will these numbers stay the Federal Reserve’s hand at their next meeting? Or will it give them the green light to continue to dither and possibly drive us into a recession, reversing a promising year? Perversely, markets finished the week up, even as the treasury yields that caused concerns in prior weeks rose as well. It will take a few days for markets to fully digest the recent jobs data, but it feels like we’re watching a trainwreck developing in front of our eyes in slow motion.

Burning down the house

Ever wonder why Congress has such a low approval rating? According to Gallup, only 17% of respondents said they approved of the way Congress is handling its job in September. Granted, that was last month when the government was on the verge of a shutdown, so maybe that explains the dismal approval rating. But the problem with that logic is that the last time Congress had a favorability rating of 50% was June 2003 — 20 years ago!

Last week, a small group of Republicans seemed to blow up the House of Representatives and throw the government into a new state of turmoil when they forced a vote to remove Speaker Kevin McCarthy over the budget dust-up — the first time ever a House speaker has been booted from the position.

We’ve previously said there would probably be fewer (or lower) hurdles to jump in the second half of 2023 and that markets would likely push higher, but these self-inflicted wounds seem to be getting to be too much. These mind-boggling miscues are coupled with the Fed fixated on lowering inflation. Higher rates are giving people options they didn’t have in a zero-rate environment, which is coming at the expense of equities. As long as rates remain at these levels, the cost of doing business will remain higher and earnings will suffer. Plus, the market will likely limp instead of roar into the year-end and a promising year will have been frittered away.

The government also should stop spending; we have added over $10 trillion to the deficit since 2019, without any tangible benefits. We spent money we did not have on things we did not need. The solution seems to be simple: Curtail government spending, which will help lower inflation and allow the Fed to back off. That, however, would require leadership, not politics.

Throwing money at the "pandemic" for 3 years dug a deep hole.Presented by Nicholas Wealth Management

The market, jobs, economy and the Fed

Markets continued to slump last week as bond rates hit levels we haven’t seen in 16 years. Suddenly, a five-year treasury yielding 4.7% isn’t so bad when compared to the volatility of the stock market.

Whether we like it or not, much of the market is based on feelings; sure, they give it fancy terms like “market sentiment,” but that’s saying the same as mood — and the current mood seems to be bad. People are on strike, from auto workers we rely on to make the cars we use to get around, to health care workers we rely on to keep us healthy and actors we rely on to entertain us. So why should markets be in a better mood? If we don’t feel well, can’t get around or lack entertainment, why shouldn’t we be cranky?

Lots of people have exhausted their savings and run up their credit cards, so they can’t even get satisfaction from buying something they don’t really need. It all feels off. The economy is still moving along, but for how long? In general, interest rates are grinding things down, personal debt is climbing, wages aren’t keeping up with inflation and hours are being cut back.

The ADP® employment report added a measly 89,000 jobs in September, far short of the consensus estimate and nearly 100,000 less than the revised August number. But on Friday, the Bureau of Labor Statistics (BLS) employment situation report (also known as non-farm payrolls) for September came in at 336,000, blowing away the consensus estimate and significantly higher than August. Meanwhile, the unemployment rate stayed at 3.8%.

Will these numbers stay the Federal Reserve’s hand at their next meeting? Or will it give them the green light to continue to dither and possibly drive us into a recession, reversing a promising year? Perversely, markets finished the week up, even as the treasury yields that caused concerns in prior weeks rose as well. It will take a few days for markets to fully digest the recent jobs data, but it feels like we’re watching a trainwreck developing in front of our eyes in slow motion.

Burning down the house

Ever wonder why Congress has such a low approval rating? According to Gallup, only 17% of respondents said they approved of the way Congress is handling its job in September. Granted, that was last month when the government was on the verge of a shutdown, so maybe that explains the dismal approval rating. But the problem with that logic is that the last time Congress had a favorability rating of 50% was June 2003 — 20 years ago!

Last week, a small group of Republicans seemed to blow up the House of Representatives and throw the government into a new state of turmoil when they forced a vote to remove Speaker Kevin McCarthy over the budget dust-up — the first time ever a House speaker has been booted from the position.

We’ve previously said there would probably be fewer (or lower) hurdles to jump in the second half of 2023 and that markets would likely push higher, but these self-inflicted wounds seem to be getting to be too much. These mind-boggling miscues are coupled with the Fed fixated on lowering inflation. Higher rates are giving people options they didn’t have in a zero-rate environment, which is coming at the expense of equities. As long as rates remain at these levels, the cost of doing business will remain higher and earnings will suffer. Plus, the market will likely limp instead of roar into the year-end and a promising year will have been frittered away.

The government also should stop spending; we have added over $10 trillion to the deficit since 2019, without any tangible benefits. We spent money we did not have on things we did not need. The solution seems to be simple: Curtail government spending, which will help lower inflation and allow the Fed to back off. That, however, would require leadership, not politics.

It would take a charismatic leader (or a small charismatic group) to bring American's together.

If that would take place today, it will take 3 years to dig out of this hole.

Those leaders would have to have the ability to deflect all of the "wedges" being driven between American's.

Without leadership, things will continue to deteriorate.

Biden job reports used by stock market all fake

www.theepochtimes.com

www.theepochtimes.com

Yes, It’s Another Fake Jobs Report

A question for you stock market guys:

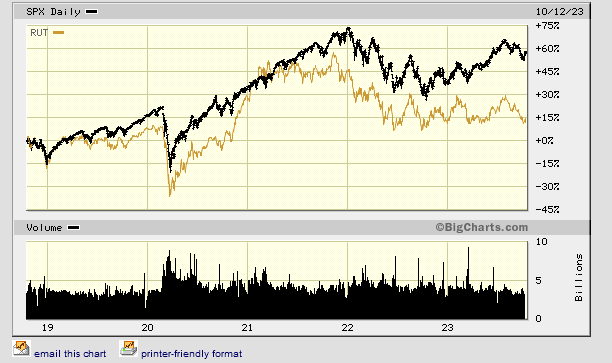

Been some discussions here, recently, about people investing in index funds. I have been comparing a few. This one sort of sticks out.

Historically the Russell 2000 has tracked right along with the S&P 500 until mid 2021.

Seems there is more rotating in and out of the SPX than the RUT. Interesting,

Thoughts ?

www.forbes.com

www.forbes.com

Been some discussions here, recently, about people investing in index funds. I have been comparing a few. This one sort of sticks out.

Historically the Russell 2000 has tracked right along with the S&P 500 until mid 2021.

Seems there is more rotating in and out of the SPX than the RUT. Interesting,

Thoughts ?

2023 Russell Rebalancing: What You Need To Know

On June 23, the popular Russell indexes will get their annual refresh, an event that has historically triggered major market volatility in dozens of impacted stocks. Every year on the fourth Friday of June, the Russell 1000, Russell 2000, Russell 3000 and other Russell indexes are reconstituted.

What Drives S&P 500 Rebalance Turnover? – Indexology® Blog | S&P Dow Jones Indices

Get insights on trending investment themes from industry thought leaders on the Indexology® blog from S&P Dow Jones Indices.

www.indexologyblog.com

Last edited:

Small caps (Russell 2000) suffer when cheap loans dry up and profit margains become more difficult to maintain. You're looking at the beginning of the inflation period when investors knew interest rates and input costs would start to climb, and began moving to safer bets.

As for index funds like S&P 500 types, I'm heavy into it on my own 401k because the fee is 0.012%, and it flat out performs as well or better than a majority of managed funds with much higher fees. That's a predicted $24 in fees with speculated annual return of 9%, per $10k invested per ten years. I can't get that from anywhere else with the lone exception of the zero percent fees on my company stock that tracks at or better than S&P, which I'm also maxed out allowable invested.

I look at it like credit cards: It's not the cash back and rewards you need to watch for, it's the interest and fees they charge.

As for index funds like S&P 500 types, I'm heavy into it on my own 401k because the fee is 0.012%, and it flat out performs as well or better than a majority of managed funds with much higher fees. That's a predicted $24 in fees with speculated annual return of 9%, per $10k invested per ten years. I can't get that from anywhere else with the lone exception of the zero percent fees on my company stock that tracks at or better than S&P, which I'm also maxed out allowable invested.

I look at it like credit cards: It's not the cash back and rewards you need to watch for, it's the interest and fees they charge.

About the only equities that are performing right now are the Big 7 or whatever we're supposed to call them today - Apple, Microsoft, Google, Meta, Tesla, Nvidia, and Amazon. The rest of the S&P, collectively, is in the hole for 2023. That's the basic investment trend which is hurting the Russell small-cap index.

A worthwhile read IMO:

The tl;dr is that Marks sees a rotation out of equities and into debt, i.e. bonds. But it's how he gets there that is enlightening.

The tl;dr is that Marks sees a rotation out of equities and into debt, i.e. bonds. But it's how he gets there that is enlightening.

A worthwhile read IMO:

ChatGPT summary:

The memo discusses a potential "sea change" in the investment environment. It reflects on how the historically low-interest rates and accommodative monetary policy that characterized the period from 2009 to 2021 might be coming to an end. The author suggests that the current economic climate, marked by inflation concerns, rising interest rates, and changing market dynamics, may necessitate a shift in investment strategies. They highlight the following key points:

- The historically low-interest rates allowed for easy money and favorable conditions for asset owners, borrowers, and leveraged investment strategies.

- The recent rise in inflation has prompted central banks to change their accommodative stance and raise interest rates, signaling a shift in the investment landscape.

- The author argues that the investment environment might be fundamentally changing, and investors should not assume that the strategies that worked in the past will continue to yield the same results.

- The author suggests that credit instruments, such as high-yield bonds and loans, now offer competitive returns similar to historical equity returns with less uncertainty.

- Investors may need to consider reallocating their capital away from ownership and leverage and toward lending, particularly in the credit market.

- The memo emphasizes the importance of being prepared for surprises in the changing investment landscape and the need for a more cautious approach.

My opinion is that you should stay far away from HYB. Credit spreads are continuing to widen and junk bonds will widen at a much faster pace than IG. Given what I believe has yet to come and will start showing up in earnings in addition to refinancing risk - HYB market will have to turn away from DCM and Bonds and look at equity and alternative financing to support operations and their maturing debt tranches. At some point, the credit event pushes equities and bonds lower and treasuries higher as a flight to safety.

Banks are continuing to favor shorter-term loans between 1 and 5 years for refinancings or M&A - not new money. IG bond market continues to have excess demand with overbookings being a factor of 3+. I do not follow the HYB market but a credit event would start there first.

I may or may not have ordered this

BlackRock Clients Pull $13 Billion From Long-Term Funds

(Bloomberg) -- BlackRock Inc. clients pulled a net $13 billion from long-term investment funds, the first outflows since the onset of the pandemic in 2020. Most Read from BloombergTop House Republican Wants Help From Democrats to Pick a SpeakerIsrael Latest: Rallies Grow as Army Calls for...

You can get good returns on other things besides stonks now.

BlackRock Clients Pull $13 Billion From Long-Term Funds

(Bloomberg) -- BlackRock Inc. clients pulled a net $13 billion from long-term investment funds, the first outflows since the onset of the pandemic in 2020. Most Read from BloombergTop House Republican Wants Help From Democrats to Pick a SpeakerIsrael Latest: Rallies Grow as Army Calls for...finance.yahoo.com

Similar threads

- Replies

- 13

- Views

- 1K

- Replies

- 141

- Views

- 14K