Join the Hide community

Get access to live stream, lessons, the post exchange, and chat with other snipers.

Register

Download Gravity Ballistics

Get help to accurately calculate and scope your sniper rifle using real shooting data.

Install the app

How to install the app on iOS

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Filter

Filters

Show only:

Optics WTS: ZCO 5-27 mpct2 $3050 shipped

- By Bravo6niner

- Buy - Sell - Trade

- 10 Replies

Have a nice used ZCO 5-27 with mpct2 reticle for sale.

Locking turrets

Scope caps

Box

Asking $3050.00 shipped in the cont. US. If you want it insured we can discuss that.

Discreet PayPal friends and family

Spuhr mount NOT included.

Locking turrets

Scope caps

Box

Asking $3050.00 shipped in the cont. US. If you want it insured we can discuss that.

Discreet PayPal friends and family

Spuhr mount NOT included.

Attachments

Help with Action value

- By DuneShoot

- Bolt Action Rifles

- 5 Replies

I’m looking at a Defiance action that was made for/from RW Snyder. Done know much about bolts so figured I’d ask here. He’s asking $1350 for the set up. 500 rounds through it. Never heard of the trigger.

Details:

Up for sale is a very lightly used Defiance medium-repeater action w/ a Huber two-stage trigger and 20 MOA mount. 8" twist, 23.5" Krieger barrel chambered in 260 Remington with a Sendero profile. Barrel has been melonited and sports an unusual "fluting" and threaded 5/8x24. RW Snyder contracted with Defiance to build these actions for him so they do not list the name of action.

Based on perusing the Defiance website, the action appears to be the Rebel Hybrid-Port action. The action is butter smooth and was fed using the AICS magazine, I believe other magazines will work depending on your choice of furniture. The action will support the 308 family length of cartridges and others, to include the 6.5 PRC with a bolt change.

Pricing, per current costs.

Action- 1645

Trigger- 300-400

Installed Barrel- 750

Details:

Up for sale is a very lightly used Defiance medium-repeater action w/ a Huber two-stage trigger and 20 MOA mount. 8" twist, 23.5" Krieger barrel chambered in 260 Remington with a Sendero profile. Barrel has been melonited and sports an unusual "fluting" and threaded 5/8x24. RW Snyder contracted with Defiance to build these actions for him so they do not list the name of action.

Based on perusing the Defiance website, the action appears to be the Rebel Hybrid-Port action. The action is butter smooth and was fed using the AICS magazine, I believe other magazines will work depending on your choice of furniture. The action will support the 308 family length of cartridges and others, to include the 6.5 PRC with a bolt change.

Pricing, per current costs.

Action- 1645

Trigger- 300-400

Installed Barrel- 750

Case Prep: What are you using?

- By Amay1234

- Reloading Depot

- 26 Replies

Wondering what everyone uses for case prep. Trimming, chamfering, primer pocket brushes/cleaning, etc. I've been loading pistol ammo for while but just now getting into rifle ammo, especially precision rifle ammo. Starting out with .223 before I work up to something with more expensive calibers. Is something like the Hornady Lock N Load case prep center worth it?

Thanks

Thanks

Accessories WTS MK12 MOD 0/H Full length arca rail

- By dster3

- Buy - Sell - Trade

- 73 Replies

Selling an arca rail for a PRI gen III handguard. Which are the Mod 0 and H from Precision reflex.

Cut to the profile of the tube and utilizes the hole pattern in the tube for mounting. 6061 black anodize.

Comes with mounting hardware and mounting strip. Just remove the picatinny sections and heat shield.

$130 shipped to you.

Cut to the profile of the tube and utilizes the hole pattern in the tube for mounting. 6061 black anodize.

Comes with mounting hardware and mounting strip. Just remove the picatinny sections and heat shield.

$130 shipped to you.

AR10 realistic accuracy expectations

- By Triton225

- Semi-Automatic Rifles

- 75 Replies

So, what is acceptable accuracy out of sub 2k$ ar10's?

Especially interested in the ruger SFAR experiences. Have seen some reviews that 4 moa is being acceptable, maybe I expect too much and comparing to bolt gun experience am I being unfair to think 2 moa is decent and 1moa is standard(AR10s)?

Especially interested in the ruger SFAR experiences. Have seen some reviews that 4 moa is being acceptable, maybe I expect too much and comparing to bolt gun experience am I being unfair to think 2 moa is decent and 1moa is standard(AR10s)?

Firearms LMT MWS 20” 6.5 creed/ 16” 308

- By Troop&Shoot

- Buy - Sell - Trade

- 11 Replies

LMT MWS 20” 6.5 creedmoor for sell. Included is a 16” CL 308 barrel. Less than 200 rounds on the entire system.

Both barrels have a dead air muzzle brake installed. The rifle has been spray painted green/brown and is worn from carrying in hunting season. Shown with geissele SD-E trigger but factory LMT 2 stage will be reinstalled upon sale.

$3000

Both barrels have a dead air muzzle brake installed. The rifle has been spray painted green/brown and is worn from carrying in hunting season. Shown with geissele SD-E trigger but factory LMT 2 stage will be reinstalled upon sale.

$3000

Firearms Accuracy International AT folder for sale

- By FORESTBARBER

- Buy - Sell - Trade

- 2 Replies

One of my PRS rifles with typical rubs, signs of use etc.

Accuracy International AT Folder

AI Competition trigger

Finger adj quick cheek rest adjusters

1 AI magazine

Small firing pin bolt head

New spare firing pin

Harris bipod w quick cant adj lever

RRS Pic rail/Arca bipod mount

APA Fat B###### brake

New (five rounds shot to zero) 26” 6CM barrel chambered by Robert Gradous

Also have 26” 6XC barrel with 500 rounds down tube. Chambered by Robert.

Also have 100 new 6CM Lapua brass. 200 new 6CM Hornady brass for sale.

A bunch of low reload count used 6CM brass or 6XC brass free with rifle.

55” Pelican hard case for the rifle.

Rifle as above $3750 shipped CONUS

Rifle as above with Pelican Case $4000 shipped CONUS.

Accuracy International AT Folder

AI Competition trigger

Finger adj quick cheek rest adjusters

1 AI magazine

Small firing pin bolt head

New spare firing pin

Harris bipod w quick cant adj lever

RRS Pic rail/Arca bipod mount

APA Fat B###### brake

New (five rounds shot to zero) 26” 6CM barrel chambered by Robert Gradous

Also have 26” 6XC barrel with 500 rounds down tube. Chambered by Robert.

Also have 100 new 6CM Lapua brass. 200 new 6CM Hornady brass for sale.

A bunch of low reload count used 6CM brass or 6XC brass free with rifle.

55” Pelican hard case for the rifle.

Rifle as above $3750 shipped CONUS

Rifle as above with Pelican Case $4000 shipped CONUS.

Attachments

-

At1.jpg278.3 KB · Views: 364

At1.jpg278.3 KB · Views: 364 -

At2.jpg251.4 KB · Views: 358

At2.jpg251.4 KB · Views: 358 -

At5.jpg427.5 KB · Views: 339

At5.jpg427.5 KB · Views: 339 -

At4.jpg289.8 KB · Views: 313

At4.jpg289.8 KB · Views: 313 -

At6.jpg306.7 KB · Views: 305

At6.jpg306.7 KB · Views: 305 -

At8.jpg255.1 KB · Views: 266

At8.jpg255.1 KB · Views: 266 -

At9.jpg229 KB · Views: 254

At9.jpg229 KB · Views: 254 -

At10.jpg206.2 KB · Views: 242

At10.jpg206.2 KB · Views: 242 -

At13.jpg424.2 KB · Views: 246

At13.jpg424.2 KB · Views: 246 -

At14.jpg346.5 KB · Views: 249

At14.jpg346.5 KB · Views: 249 -

At16.jpg432.6 KB · Views: 240

At16.jpg432.6 KB · Views: 240 -

At17.jpg398.7 KB · Views: 228

At17.jpg398.7 KB · Views: 228 -

At18s.jpg287.8 KB · Views: 365

At18s.jpg287.8 KB · Views: 365

SOLD MDT HNT 26 for Rem 700 SA - Folding w/ ARCA (Black)

- By aroddc3

- Buy - Sell - Trade

- 9 Replies

Selling my MDT HNT 26 chassis for Rem 700 SA - Folding w/ ARCA (Black). Carbon Fiber grip as it came with. Has one forend screw stripped (front L handguard) but it is cosmetic only and it still attaches the forend to the chassis. I spoke w/ MDT about this and it does not affect accuracy or the handguard connection at all. Because of the screw, I am selling this for steal at $1200 shipped. Otherwise, it is in excellent condition.

Local to DFW. Thanks!

Local to DFW. Thanks!

Former MMA Champ Issues Challenge to the ’10 Toughest Trans Men in the World,’ One Trans Wrestler Agrees to Fight

- By PatMiles

- The Bear Pit

- 11 Replies

Former MMA Champ Issues Challenge to the '10 Toughest Trans Men in the World,' One Trans Wrestler Agrees to Fight

Former MMA champ Jake Shields issued a challenge to fight the "top 10 toughest trans men in the world." One Trans wrestler has stepped up

www.breitbart.com

DYLAN GWINN5 May 2023182

2:31

When thinking back on the mistakes she’s made in her life, Mack Beggs is likely to lament the day she decided to fight Jake Shields.

On Thursday, former MMA champion Jake Shields issued a challenge in which he offered to fight the top 10 toughest trans women in the world without a training camp, and without a break between fights.

For those of you confused (don’t worry, we’re all confused) a transgender man is a female who identifies as a man.Since trans men are real men I would like to challenge the 10 toughest trans men in the world to a fight

I fight them with no training camp and no rest between each fight

— Jake Shields (@jakeshieldsajj) April 20, 2023

Shields wasn’t done provoking the trans crowd, however.

“Alphabet people?” Dang. Well, it appears as though one trans fighter is willing to step up and accept the challenge. Former Texas state wrestling champion Mack Beggs, a female wrestler who identifies as a man, took to Instagram and accepted Shields’ challenge.Let's go, alphabet people get your 10 best and prove me wrong

— Jake Shields (@jakeshieldsajj) April 20, 2023

Beggs took it up a notch by posting a video in which she called it “disrespectful” for Shields to be challenging ten trans men as opposed to doing a 1 v 1.

“We still here, bro,” Beggs said. “We’re still here and we’ve always been here. It’s the fact that you all are so hyper fixated and have some fetish with trans women that you even forget that we are out here.”

Beggs put an exclamation point on her video.

“I’m specifically going to f*ck you up Jake Shields personally,” she asserted.

Beggs may view Shields’ challenge as “disrespectful.” Though, it’s certainly not unprecedented. George Foreman fought and knocked out 5 men in one night in 1975 as he was rebuilding himself following his loss to Muhammad Ali.

Of course, Beggs is 24, and may not be aware of that.

Shields is a former Elite XC, Shooto, and Strikeforce champion. A California native, Shields is 44 years old and hasn’t fought in a cage or ring in two years. But, he is friends with Nate Diaz, which means he’s probably been in more fights outside the cage over the last two years than any active fighters in the cage.

The point of Shields’ tweet was to illustrate the absurdity of women fighting men. A point Shields made when talking to another Twitter user.

When Billie Jean King and Bobby Riggs clashed on the tennis court they called it the “Battle of the Sexes.” I must confess, I’m not sure what to call this one. Shields did acknowledge Beggs’ acceptance of the challenge and details are reportedly being hammered out.As much as I would hate to do it I think easily smashing the women would be the only way to prove my point of how ridiculous This is

When they see them all dropped in seconds they won’t be able to defend trans women in women’s sports

— Jake Shields (@jakeshieldsajj) April 21, 2023

Stay tuned.

Wonder if this will be televised? I'll pay good money to watch it!

What in the serious !@#

- By wvfarrier

- The Bear Pit

- 12 Replies

How does this happen??

www.foxnews.com

www.foxnews.com

Parents protest school after first graders allegedly force girl to perform sex act, record it on iPad

Public school parents in Plainview, Texas, are demanding answers after a 6-year-old girl was allegedly forced by her classmates to perform a sex act while they filmed it.

Don't need, but want a new rifle!

- By CWB4

- Bolt Action Rifles

- 22 Replies

So long story short I am looking for a newer rifle that will mainly see deer in the UP (100 yards max) and an occasional CO trip for Elk that should max out between 200-300 yards. I know a ton of people recommend Tikka, but boy looks like they have tons of options.

I always wanted a lighter rifle in the woods or hiking the land in CO. I completely understand this is an open ended question and everyone is going to have some different thoughts, but I have done enough reading that I want to get a conversation going on this. I would prefer to stay 308 since I don't honestly feel like getting a new caliber stock pile going have enough as it is. I like the idea of a folding stock, but again I don't know if it is necessary and never actually felt a folding stock on a bolt to see how it feels. I am by no means an expert here so truly open to thoughts and suggestions. I would think 20" or under barrel length should be enough for that distance easily.

I would prefer to find someone selling a solid bolt 308 that is set up tried and true as I have done that before from here and worked out very well. I don't need it to be brand new just want it to perform a couple times a year.

Thanks!

I always wanted a lighter rifle in the woods or hiking the land in CO. I completely understand this is an open ended question and everyone is going to have some different thoughts, but I have done enough reading that I want to get a conversation going on this. I would prefer to stay 308 since I don't honestly feel like getting a new caliber stock pile going have enough as it is. I like the idea of a folding stock, but again I don't know if it is necessary and never actually felt a folding stock on a bolt to see how it feels. I am by no means an expert here so truly open to thoughts and suggestions. I would think 20" or under barrel length should be enough for that distance easily.

I would prefer to find someone selling a solid bolt 308 that is set up tried and true as I have done that before from here and worked out very well. I don't need it to be brand new just want it to perform a couple times a year.

Thanks!

Dealing with "Squatter's"......

- By Hobo Hilton

- The Bear Pit

- 64 Replies

A real estate investor who was recently the victim of squatters is using his experience to help other landlords avoid court through a little-known Florida statute.

"I'm more than happy to be the harbinger for other people to be able to find solutions to this kind of terrible, terrible situation that people get into," Sam told Fox News. "If I can help even one person, then it's worth it for me."

www.foxnews.com

www.foxnews.com

"I'm more than happy to be the harbinger for other people to be able to find solutions to this kind of terrible, terrible situation that people get into," Sam told Fox News. "If I can help even one person, then it's worth it for me."

Real estate investor reveals secret to removing Florida squatters without facing expensive legal battles

A Florida landlord was able to avoid bringing the squatters occupying his house to court by using a little-known Florida statute that lets police remove them immediately.

SOLD Staccato P- steel frame/ sale or part trade

- By hitman

- Buy - Sell - Trade

- 3 Replies

I just got this from a guy here on a partial trade. I wanted to try a 2011, but I’m just not into them. I took it to the range one time amd fired 50 rds and not my cup of tea. Comes with what you see, 3 mags and case. In awesome condition. Old owner said it had about 1200-1500 rds on it. In amazing condition. Like new really. Only part trade I’d take would be for a Vudu 1-8 or 1-10

$ 1850 shipped to FFL in lower 48 where legal.

Login to view embedded media

$ 1850 shipped to FFL in lower 48 where legal.

Login to view embedded media

He's baaa-ack

- By Maggot

- The Bear Pit

- 3 Replies

Media company CEO offers Tucker Carlson $100 million deal

American Military News

https://americanmilitarynews.com › 2023/05 › media-...

1 day ago — The CEO of a media company offered Tucker Carlson a whopping $100 million partnership deal on Tuesday in the wake of his sudden departure ...

Third bolt release on AR-15

- Semi-Automatic Rifles

- 28 Replies

I'm stumped. I'm on my third bolt release in two years and less than 5k rounds. Upper/lower are both billet spartan receivers from Joebob Outfitters. The bolt release inlet was a little tight initially, so i lightly filed until the part moved freely with no resistance (save for the spring) after I broke the first one. Both broken bolt releases were from Aero and the third that's going in now in Spikes. They're breaking right below the paddle.

Any ideas? I'm definitely hard on the rifle, but there has to be something else going on here.

Any ideas? I'm definitely hard on the rifle, but there has to be something else going on here.

What triggers you

- By Jgault

- The Bear Pit

- 100 Replies

While I make fun of liberals over getting triggered over everything they see, there are things that trigger us as well. While we obviously don’t melt down like a liberal little bitch, some things just rub us wrong anytime we see it. I’m speaking of a specific image or phrase. I was watching television and I realized the only one that seems to have that reaction for me no matter how many times I see it is the flag of Japan. My father served in the pacific during WWII, and to this day that flag still makes rage and revulsion boil up inside every time I see it. There are lots of symbols or phrases I inherently don’t like, but that is the one that has a visceral reaction for me. So I’m curious, what is yours?

SOLD New Luepold mark5 3.6-18 TMR *price drop*

- By STLSteve86

- Buy - Sell - Trade

- 14 Replies

Leupold mark 5HD 3.6-18x44. Just got this in on trade. New in box never mounted. TMR reticle. Manual, sunshade and caps are all in the box. I shoot moa scopes so this one is a catch and release sale. $1650

Attachments

For the audiopiles...

- By Maggot

- The Bear Pit

- 20 Replies

Bringing American manufacturing home.

I have a quad of the 300B's and they crap on anything coming out of Russia or Chicom land and come with a 5 year warranty.

Wired

https://www.wired.com › Business › inventions

Mar 28, 2023 — Whitener's team devised a way to apply an atom-thick layer of graphene to a vacuum tube's anode to extend its lifespan by improving heat ...

I have a quad of the 300B's and they crap on anything coming out of Russia or Chicom land and come with a 5 year warranty.

One Man's Quest to Revive the Great American Vacuum ...

Wired

https://www.wired.com › Business › inventions

Mar 28, 2023 — Whitener's team devised a way to apply an atom-thick layer of graphene to a vacuum tube's anode to extend its lifespan by improving heat ...

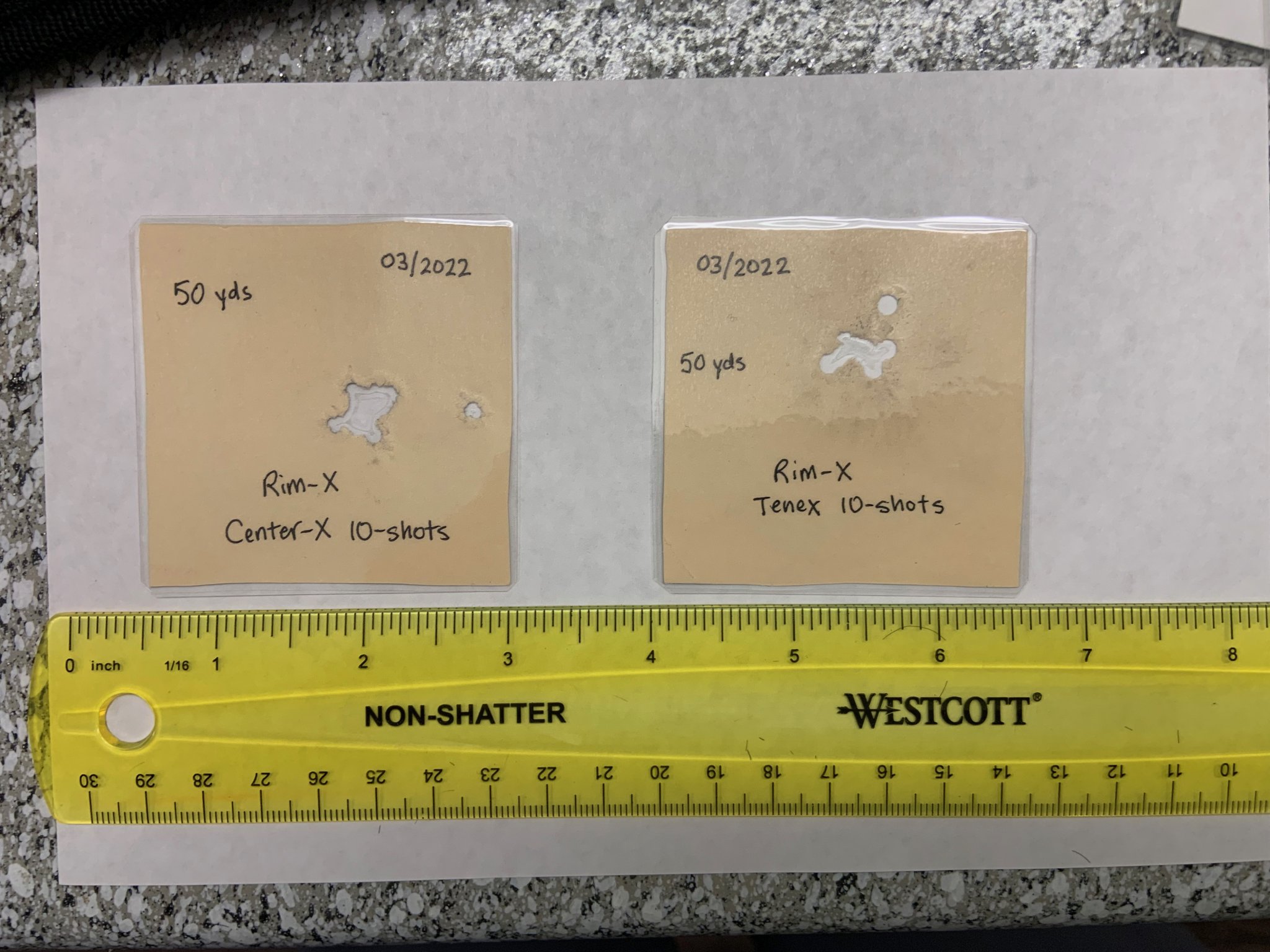

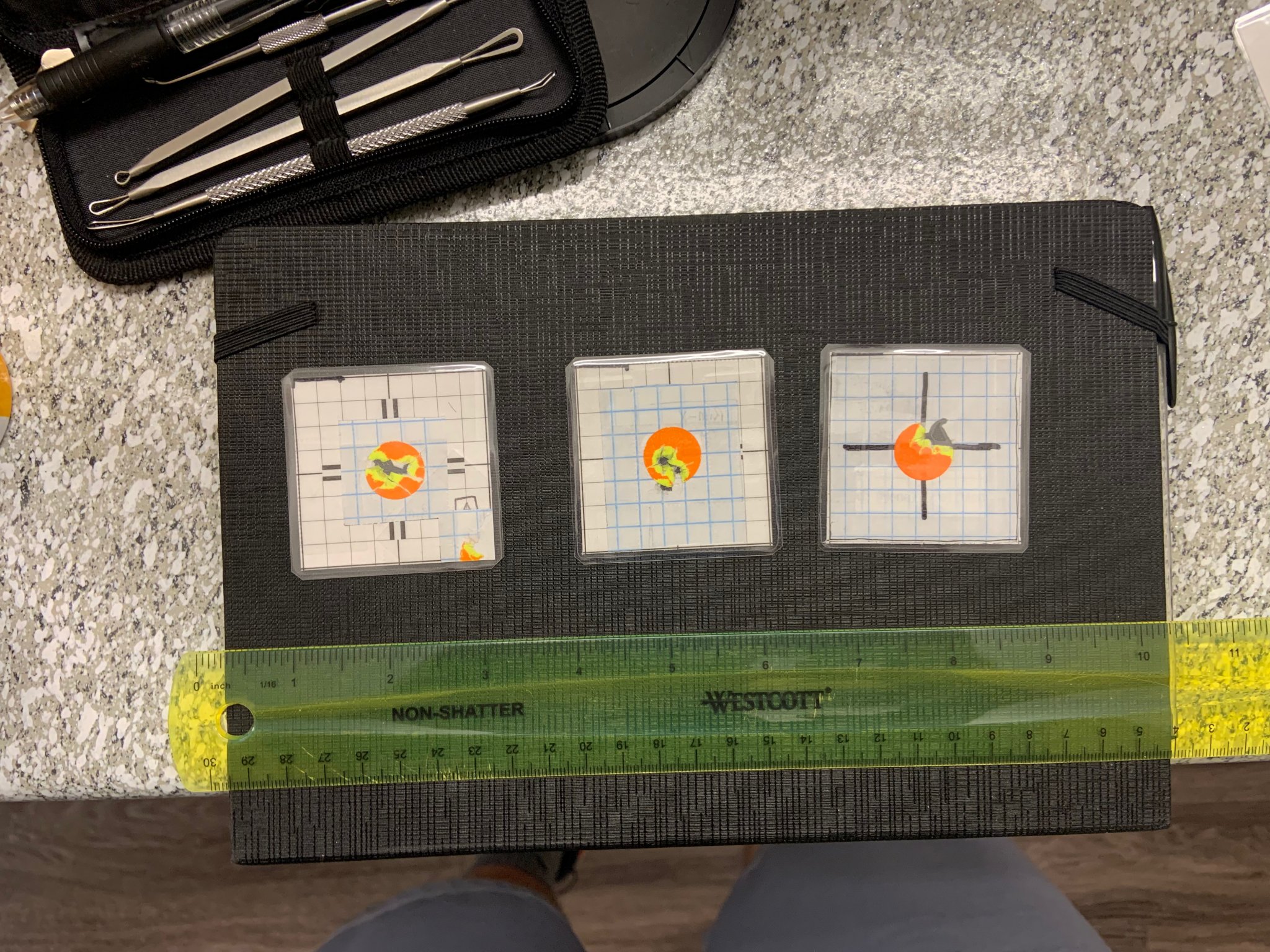

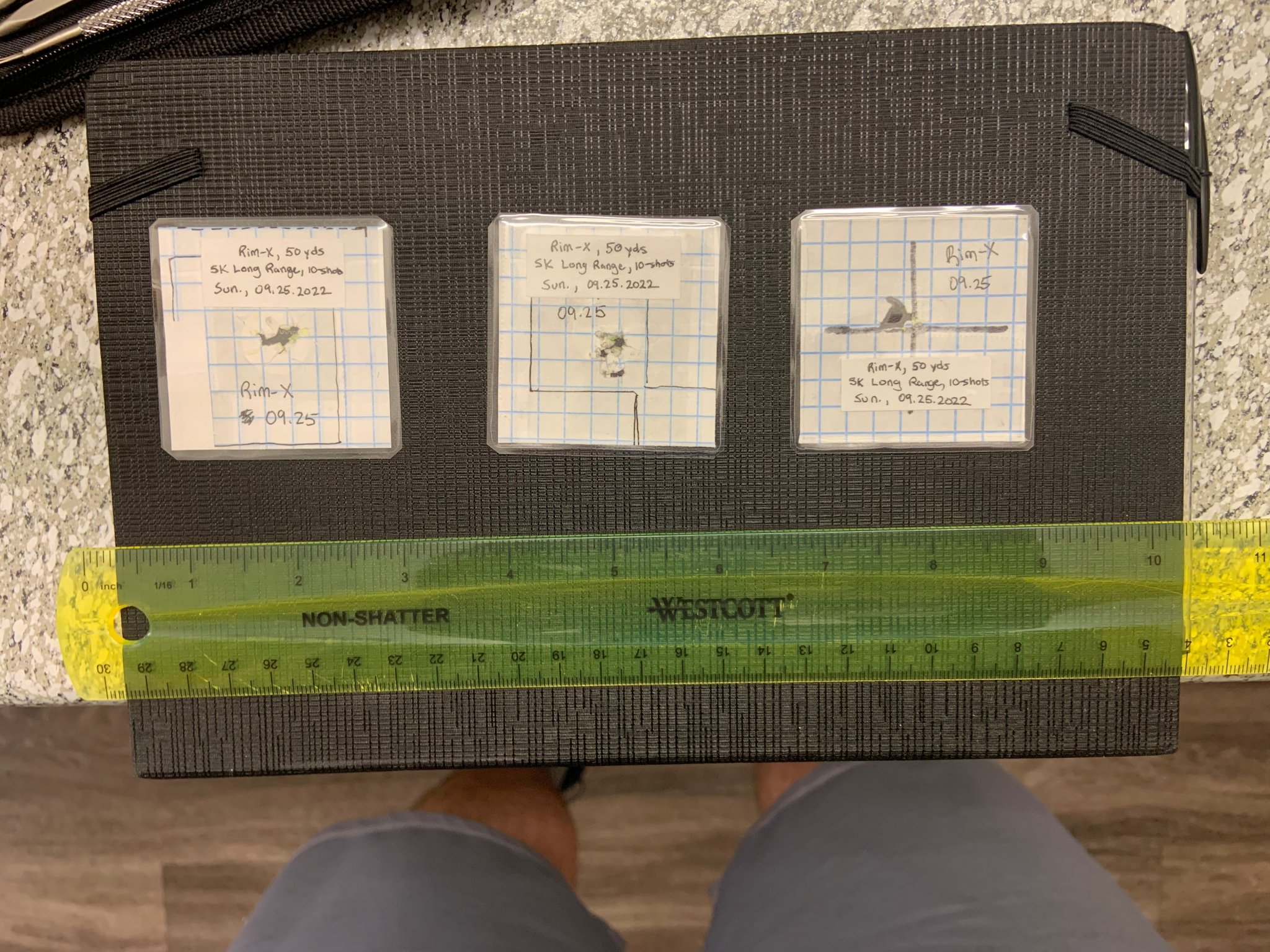

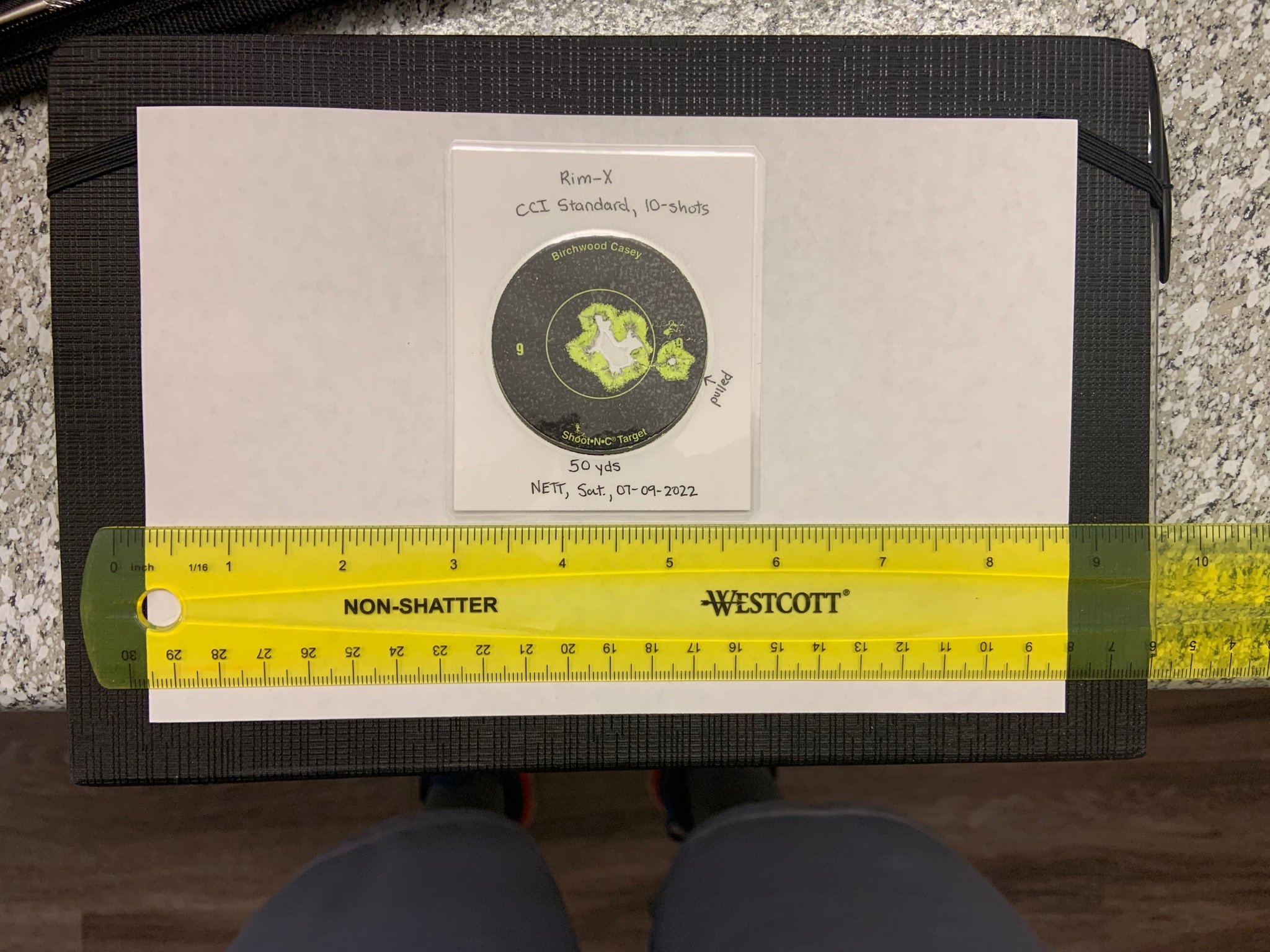

SOLD TS Customs RimX 22LR Package

- By aroddc3

- Buy - Sell - Trade

- 6 Replies

Changing jobs and need some cash. Selling my TS Customs 22LR RimX. This thing hammers and shoots everything well, especially the standard gems: Center-X, SK Long Range and Eley Tenex. Hammers at distance too. Build Sheet attached as well. Only difference is the trigger is a TT special, but I have other triggers if interested. Can include the 360 Precision steel ARCA rail as well if interested. It makes the balance just right. 16.0 lbs.

NET $3,500 to me after whatever shipping and insurance you'd like. Local to DFW. East Dallas. I shoot a bunch of rimfire out here, so I can meet you at a match as well.

Not interested in trades unless it's a ZCO or Tangent.

- Dave

NET $3,500 to me after whatever shipping and insurance you'd like. Local to DFW. East Dallas. I shoot a bunch of rimfire out here, so I can meet you at a match as well.

Not interested in trades unless it's a ZCO or Tangent.

- Dave

Attachments

SOLD Pics Added: ZCO 527 MPCT2 W/SPUHR 6001

- By Familydude

- Buy - Sell - Trade

- 13 Replies

Glass and mechanical function are perfect. Minor rub marks and a small scratch on bell. All shown in pics. Scope comes with box, paperwork, sunshade and Tenebraax covers.

**Pics added: Small scratch on bell is not deep and only noticeable under direct, bright light**

Spuhr 6001 is in great condition.

Scope and mount $3300 shipped to lower 48. PayPalFF or you pick up fees.

Edit: Will sell scope with accessories, no mount, for $2,990.

Does not come with pic rail or red dot.

**Pics added: Small scratch on bell is not deep and only noticeable under direct, bright light**

Spuhr 6001 is in great condition.

Scope and mount $3300 shipped to lower 48. PayPalFF or you pick up fees.

Edit: Will sell scope with accessories, no mount, for $2,990.

Does not come with pic rail or red dot.

Attachments

-

45F811AF-DD78-4940-BEEF-33DC90E750B3.jpeg315.8 KB · Views: 236

45F811AF-DD78-4940-BEEF-33DC90E750B3.jpeg315.8 KB · Views: 236 -

7073E6FC-6557-479B-A987-82160702B9ED.jpeg370.9 KB · Views: 251

7073E6FC-6557-479B-A987-82160702B9ED.jpeg370.9 KB · Views: 251 -

AC1F183C-C375-45B8-B4ED-253303617034.jpeg353.3 KB · Views: 251

AC1F183C-C375-45B8-B4ED-253303617034.jpeg353.3 KB · Views: 251 -

56B4F309-005D-473B-B188-063B14FC1E47.jpeg473 KB · Views: 255

56B4F309-005D-473B-B188-063B14FC1E47.jpeg473 KB · Views: 255 -

9B8C7A6E-B798-41DC-AE40-321E7BA23EEC.jpeg402 KB · Views: 239

9B8C7A6E-B798-41DC-AE40-321E7BA23EEC.jpeg402 KB · Views: 239 -

EEBB001A-50AF-418B-B1E6-8667C3B1F8F1.jpeg417.1 KB · Views: 246

EEBB001A-50AF-418B-B1E6-8667C3B1F8F1.jpeg417.1 KB · Views: 246 -

IMG_9305.jpeg361.8 KB · Views: 63

IMG_9305.jpeg361.8 KB · Views: 63 -

IMG_9306.jpeg383.2 KB · Views: 52

IMG_9306.jpeg383.2 KB · Views: 52

Firearms ARC Nucleus Barreled action SOLD

- By kdawg74

- Buy - Sell - Trade

- 12 Replies

GT barrel sold. Nucleus barreled action 6.5 SAUM. Also have 308 bolt face and action wrench. $1000

Attachments

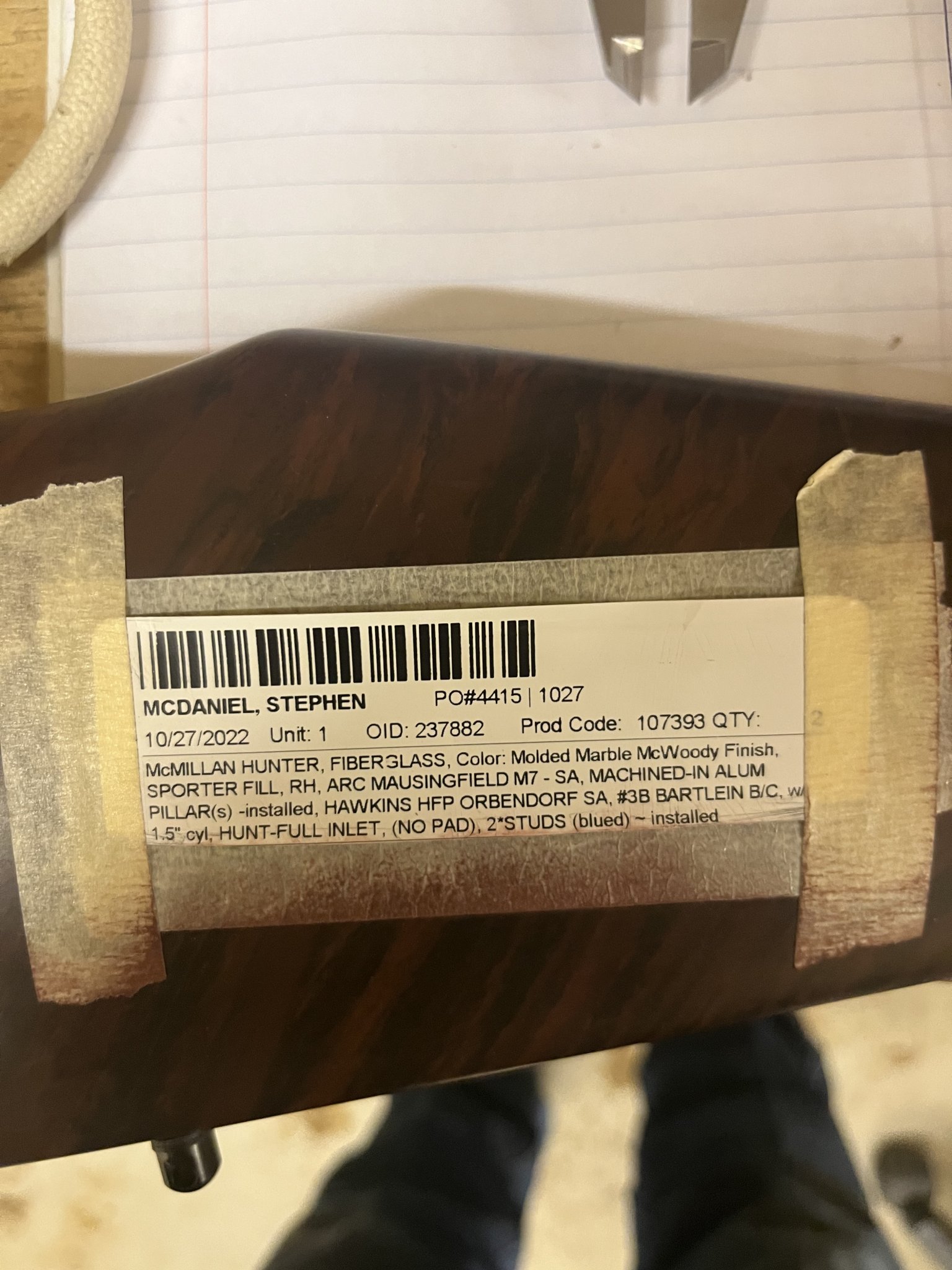

Accessories WTS 2 McMillan stocks $525 each

- By Stevo86

- Buy - Sell - Trade

- 11 Replies

I have for sale… 2 McMillan hunter stocks, inlet for ARC mausingfield actions, bartlien 3b barrels, and Hawkins bdl. I had the butt pads left off so I could have red pachmyar recoil pads installed. One will be included with each stock… you will have to have them installed. These stocks are the molded in McWoody. Asking $650 each shipped. I accept PP F&F OR USPS money order.

Load more